Professional Documents

Culture Documents

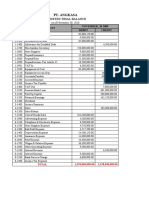

Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015

Uploaded by

Doan Chan PhongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015

Uploaded by

Doan Chan PhongCopyright:

Available Formats

Chapter 8

Exercise 8.1

a Newtown Plumbing: Cash budget for month ending 31 August 2015

Estimated receipts $ $

Cash fees 6000

Receipts from debtors 1000

GST received 600 7600

less Estimated payments

Wages 400

Advertisin

g 600

Office expenses 1200

Rent 2000

Payments to creditors 3600

GST paid 380 8180

Excess of receipts over payments (580)

Bank balance as at 1-Aug-15 850

Estimated bank balance as at 31-Aug-15 270

b Comment on firm’s cash position:

Although the business has $850 at the start of August, the cash budget shows that the

cash is expected to almost run out by the end of the month. The budget in this case acts

as a warning to the owner that a liquidity problem may be looming in the near future.

c Two practical steps to improve the situation:

1 Inject additional cash into the business (capital).

2 If possible, delay the cash payments to creditors.

3 Postpone the payment of expenses (perhaps advertising).

4 Offer discounts to debtors for prompt payment.

Permission is granted for this page to be printed by the purchasing institution. 1

Copyright Macmillan Education Australia 2011.

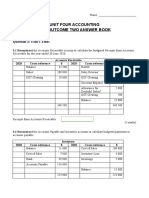

Exercise 8.2

a Mathews Carpentry Services: Cash budget for quarter ending 31 December 2015

October November December

Estimated receipts $ $ $

Cash fees 9000 9500 10000

GST collected 900 950 1000

Total receipts 9900 10450 11000

less Estimated payments

Wages 3000 3200 3200

Advertising 300 400 500

Purchases of timber 2000 2200 2400

Vehicle expenses 300 300 300

Drawings 2200 2200 2200

GST paid 260 290 320

8060 8590 8920

Excess of receipts over payments 1840 1860 2080

Bank balance as at start of month 3200 5040 6900

Estimated bank balance as at end of month 5040 6900 8980

b In which month should she purchase the new equipment?

The cash budget predicts a bank balance of $6900 cash at the end of November.

Therefore, if the equipment was purchased during November, the business would be left

with an overdraft of about $100. It may be wise to wait until December, when the additional

revenue is expected to allow the business to build up a safety margin of cash. This should

then allow the firm to purchase the equipment with less risk of running out of cash.

c Does a cash budget satisfy reliability?

Because cash budgets are based on predictions of future events, they cannot satisfy the

demands of reliability. A cash budget cannot be verified by source documents as a

historical report can be. However, the demands of relevance overrule the demands of

reliability in this case. Budgets are highly relevant reports for management and, although

they cannot satisfy the demands of reliability, they are still relied on to assist the future

planning of the business.

Permission is granted for this page to be printed by the purchasing institution. 2

Copyright Macmillan Education Australia 2011.

Exercise 8.3

a Malvern Tailors: Cash budget for quarter ending 30 September 2015

July August September

Estimated receipts $ $ $

Cash fees 6500 6500 7000

GST received 650 650 700

Total receipts 7150 7150 7700

less Estimated payments

Wages 1200 1500 1500

Cleaning 320 320 320

Office expenses 100 100 100

Payments to suppliers 3250 3250 3500

Insurance 1350

Loan repayments 1600

Drawings 1600 1600 1600

GST payments 367 502 392

8437 8622 7412

Excess of receipts over payments (1287) (1472) 288

Bank balance as at start of month 1600 313 (1159)

Estimated bank balance as at end of

month 313 (1159) (871)

b Report on liquidity situation:

The cash budget reveals that the business is expected to run short of cash in the next

three months. Estimated payments are expected to exceed receipts in both July and

August. During September, the firm is expecting a small excess of receipts. To avoid the

cash shortage anticipated, Joseph should consider reducing the amount of monthly

drawings. Other action to consider would be to postpone the payment of expenses or to

attempt to increase revenue. A review of charges to customers may lead to an increase in

anticipated receipts.

c GST position as at 30 September:

As a total of $2000 in GST is expected to be collected and $1261 is expected to be paid by

the business, a GST liability of $739 is expected to exist at the end of September. This has

serious implications for the business owner, as he must ensure that this amount of cash

will be available when it is due for payment to the Taxation Office. As the budget predicts

an overdrawn bank balance for the end of September, the owner will have to plan carefully

to ensure that he can meet his GST liability.

Exercise 8.4

a Scoresby Landscaping: Breakdown of fees revenue into cash and credit fees

Cash fees

Month Total fees Credit fees

25% 75%

$ $ $

July 20000 5000 15000

August 22000 5500 16500

September 22000 5500 16500

October 24000 6000 18000

November 26000 6500 19500

b Scoresby Landscaping: Schedule of collections from debtors

Permission is granted for this page to be printed by the purchasing institution. 3

Copyright Macmillan Education Australia 2011.

Credit Collections

Month fees in:

September October November

$ $ $

July 15000 6000

August 16500 9900 6600

September 16500 9900 6600

October 18000 10800

November 19500

Total estimated receipts 15900 16500 17400

c Scoresby Landscaping: Cash budget (extract) for quarter ending 30 November 2015

September October November

Estimated receipts $ $ $

Cash fees 5000 5455 5909

Collections from debtors 15900 16500 17400

GST receipts 500 545 591

Total receipts 21400 22500 23900

Exercise 8.5

a E.Z. Painting Services: Breakdown of fees revenue into cash and credit fees

Month Total fees Cash fees Credit fees

70% 30%

$ $ $

January 40000 28000 12000

February 37000 25900 11100

March 35000 24500 10500

April 35000 24500 10500

May 30000 21000 9000

June 25000 17500 7500

b E.Z. Painting Services: Schedule of collections from debtors

Collection

Month Credit fees s in:

April May June

$ $ $

January 12000 1200

February 11100 3330 1110

March 10500 6300 3150 1050

April 10500 6300 3150

May 9000 5400

June 7500

Total estimated receipts 10830 10560 9600

c Calculation of GST collections

Total GST

received receipts Cash fees

Month $ $ $

April 24500 2227 22273

May 21000 1909 19091

June 17500 1591 15909

d E.Z. Painting Services: Schedule of payments to creditors

Permission is granted for this page to be printed by the purchasing institution. 4

Copyright Macmillan Education Australia 2011.

Payments

Month Credit in:

Purchases April May June

$ $ $ $

March 20000 19000

April 18000 17100

May 16000 15200

June 14000

Total estimated

payments 19000 17100 15200

Exercise 8.6

a Green Thumb Gardening: Schedule of collections from debtors

Cash rec.

Credit fees August

Month $ $

June 18000 3600

July 20000 16000

Total est. collections 19600

Green Thumb Gardening: Cash budget for month ending 31 August 2015

Estimated receipts $ $

Cash fees 18000

Collections from debtors 19600

GST collected 1800 39400

less Estimated payments

Cash purchases 1000

Payments to creditors 9900

Advertising 1000

Wages 4000

Drawings 1000

Loan repayments 800

Rates payment 1200

Deposit on truck 2000

GST paid 200 21100

Excess of receipts over payments 18300

Bank balance as at 1-Aug-15 2300

Estimated bank balance as at 31-Aug-15 20600

b Comment on cash position:

The business appears to have an ample cash balance. However, keeping in mind that

Joseph has made a commitment to pay for the truck (another $18000) in September, this

will have a huge impact on his cash balance. It is vital that Joseph prepares budgets for

September and October to get a clearer picture of the liquidity position of his business.

c Recommended type of finance:

1 A short to medium-term loan (over 3–5 years): the business appears to have a

satisfactory cash flow to handle a short- to medium-term loan.

Permission is granted for this page to be printed by the purchasing institution. 5

Copyright Macmillan Education Australia 2011.

2 Leasing: this form of finance avoids a large cash outlay and provides Joseph with a

new, reliable vehicle.

Exercise 8.7

a Abbey’s Electricals: Budget variance report for month ended 30 November 2015

Variance

Budget Actual % F or

$ $ $ $ U

Receipts

Cash fees 12000 13000 1000 8.33% F

Collections from debtors 6000 2400 3600 60.00% U

GST receipts 1200 1300 100 8.33% F

Total receipts 19200 16700 2500 13.02% U

Payments

Wages 5500 2600 2900 52.73% F

Advertising 800 400 400 50.00% F

Rent 2400 2400 0 0.00%

Payments to suppliers 6600 6800 200 3.03% U

Office expenses 400 420 20 5.00% U

Loan repayments 600 700 100 16.67% U

Purchase of computer 0 3000 3000 100.00% U

Drawings 1200 1800 600 50.00% U

GST payments 1020 1302 282 27.65% U

Total payments 18520 19422 902 4.87% U

Excess of receipts over payments 680 (2722)

Bank balance as at 1-Nov-15 1500 1500

Bank balance as at 30-Nov-15 2180 (1222)

b Report on budget:

Significant positive (favourable) variances include:

1 Cash fees were $1000 (8.3%) above budget.

2 Wages were $2900 (53%) below budget. Perhaps casual workers were not used as

expected.

3 Advertising was $400 (50%) below budget. Possibly cut back as a reaction to a

shortage of cash during the month.

Significant negative (unfavourable) variances include:

1 Collections from debtors were $3600 (60%) below budget. This indicates poor

collection of accounts. Remedial action definitely required!

2 Loan repayments were $100 (16.7%) above budget. This may have been due to

external factors such as a change in interest rates. Thus it may not be controllable by

the business.

3 The purchase of a computer was not in the budget at all. This is an example of

unplanned spending. Why was it purchased this month?

4 Drawings were $600 (50%) above budget. Cash may have been required for personal

use, but this has had a serious impact on the cash available for business use.

c Comment on approach to budgeting:

Abbey appears to have followed the ‘set and forget’ approach to budgeting. The spending

in November bears little resemblance to the budget plan and therefore the budget is of

little use. There are too many significant variances for this budget to be seen as

Permission is granted for this page to be printed by the purchasing institution. 6

Copyright Macmillan Education Australia 2011.

successful. The purchase of the computer for $3000 cash when the predicted bank

balance was only $2150 is evidence that the budget plan has been ignored.

Permission is granted for this page to be printed by the purchasing institution. 7

Copyright Macmillan Education Australia 2011.

Exercise 8.8

a Donaldson’s Dry Cleaning

Budget variance report for quarter ended 30 September 2015

Variance

Budget Actual %

$ $ $ $ F or U

Receipts

Cash fees 24000 32000 8000 33.33% F

Collections from debtors 12000 14500 2500 20.83% F

Loan from ABC Finance Co. 5000 0 5000 100.00% U

GST receipts 2400 3200 800 33.33% F

Total

receipts 43400 49700 6300 14.52% F

Payments

Wages 6000 6500 500 8.33% U

Insurance 800 840 40 5.00% U

Suppliers 14000 16400 2400 17.14% U

Postage and telephone 400 380 20 5.00% F

Purchase of new equipment 5000 4600 400 8.00% F

Cleaning of shop 1200 1200 0 0.00%

Drawings 4500 3800 700 15.56% F

GST payments 2140 2342 202 9.44% U

Total

payments 34040 36062 2022 5.94% U

Excess of receipts over payments 9360 13638

Bank balance as at 1-Jul-15 500 500

Bank balance as at 30-Sep-15 9860 14138

b Predicted cash balance was: $9860

c Actual cash balance was : $14138

d Major reasons for difference:

Receipts: Cash sales were $8000 above budget. Collections from debtors were $2500

higher than expected. These unexpected results probably made the loan of $5000

unnecessary. (Note: although the loan is listed as an unfavourable variance, it would

probably be viewed as a positive result!)

Payments: Outflows to suppliers were $2400 over budget. This may have been due to the

higher levels of fees (more business leads to higher purchases of materials). Drawings

were 16% below budget. The equipment was purchased at a much better price than was

expected and helped the firm achieve the pleasing result.

e Quarterly budget period appropriate?

A monthly budget period is usually preferred to a quarterly budget. The problem with a

quarterly period is that shortages may occur in some months before a recovery occurs

within the quarter. A quarterly budget does not reveal the full month-by-month picture and

may therefore not show that liquidity problems may be forthcoming.

Permission is granted for this page to be printed by the purchasing institution. 8

Copyright Macmillan Education Australia 2011.

Exercise 8.9

a Modern Renovations: Cash budget for month ending 31 October 2015

Estimated receipts $ $

Cash fees 16000

Loan NAB 10000

GST receipts 1600 27600

less Estimated payments

Purchases of materials 2300

Rent 9000

Wages 2000

Drawings 2000

GST payments 1130 16430

Excess of receipts over payments 11170

Bank balance as at 1-Oct-15 2700

Estimated bank balance as at 31-Oct-

15 13870

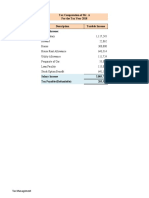

b Modern Renovations: Budgeted income statement for month ending 31 October 2015

Revenue $ $

Cash fees 16000

less Expenses

Materials 2300

Rent 3000

Wages 2000

Advertising 1400 8700

Net profit 7300

c Items included in the cash budget but excluded from the income statement:

Loan—NAB

GST receipts

Drawings

GST payments

d Explanation:

Cash budgets include all anticipated cash inflows and cash outflows. Income statements

only include revenue and expense items. Therefore, GST transactions and other cash

flows that involve assets, liabilities and owner's equity and not revenues and expenses will

not be reported in a budgeted income statement.

Permission is granted for this page to be printed by the purchasing institution. 9

Copyright Macmillan Education Australia 2011.

Exercise 8.10

a Bayside Catering: Cash budget for month ending 30 September 2015

Estimated receipts $ $

Collections from debtors 3000

Cash fees 7800

GST receipts 780 11580

less Estimated payments

Payments to creditors 2900

Cash purchases—food 5400

Wages 2500

Petrol 280

Advertising 400

Insurance 600

Stationery 600

Loan repayments 5000

Drawings 1200

GST settlement 1000

GST payments 188 20068

Excess of receipts over payments (8488)

Bank balance as at 1-Sep-15 (1100)

Estimated bank balance as at 30-Sep-15 (9588)

b Comment on liquidity:

The business will enter September in overdraft and the situation is expected to deteriorate

further during the month. The decision to pay cash for purchases is not wise, as it puts

further pressure on a weak cash position. Michaels should be trying to delay payments,

rather than paying up front. The other problem is the large payment to Fewster Credit. This

business is not in a position to make large repayments at this stage. It may be wise to look

at refinancing the loan to avoid such repayments. Smaller, more regular payments are

preferred to give the firm time to get some cash together. A reworked budget, taking into

account these changes, will reveal that the liquidity of this business is not as bad as it

looks, if it can be better managed.

c Bayside Catering

Budgeted income statement for month ending 30 September 2015

Revenue $ $

Credit fees 2500

Cash fees 7800 10300

less Expenses

Food costs 5400

Wages 2500

Petrol 280

Advertising 400

Stationery expenses 100 8680

Net profit 1620

Permission is granted for this page to be printed by the purchasing institution. 10

Copyright Macmillan Education Australia 2011.

d Comment on the expected profit result:

Despite the predictions of a worrying cash position, the business is expecting to earn a

small profit of about $1600 for the month of September. Depending on the owner's

personal needs, such a small profit may not be sufficient. It is also difficult to make other

comments without additional information such as the usual level of profit for a month or

previous period's results.

e Explanation:

The cash budget is based on cash inflows and cash outflows. On the other hand, the

budgeted income statement is based on revenues earned and expenses incurred. This

fundamental difference helps explain the different results. For example, cash outflows

includes the loan repayments of $5000. As this is not an expense, it is not reported in the

income statement.

Exercise 8.11

a Wizard Window Cleaners: Cash budget for month ending 30 April 2015

Estimated receipts $ $

Cash fees 7500

Collections from debtors 4400

GST receipts 750 12650

les

s Estimated payments

Payments to creditors 1500

Purchase of equipment 2000

Advertising 700

Interest on loan 100

Loan repayments 1000

Wages 2450

Petrol 230

Drawings 1600

GST settlement 1500

GST payments 293 11373

Excess of receipts over payments 1277

Bank balance as at 1-Apr-15 3500

Estimated bank balance as at 30-Apr-15 4777

b Wizard Window Cleaners

Budgeted income statement for month ending 30 April 2015

Revenue $ $

Cash fees 7500

Credit fees 2500 10000

les

s Expenses

Materials 3070

Advertising 500

Interest on loan 100

Wages 2450

Petrol 230 6350

Net profit 3650

c Comment on the budget predictions

Both budgeted statements appear to be positive results for this business. The cash

balance is expected to increase by about $1200 and the projected profit for the month is

Permission is granted for this page to be printed by the purchasing institution. 11

Copyright Macmillan Education Australia 2011.

$3650. Depending on previous period results, the owner is likely to be pleased with both

the expected improvement in the cash position and the estimates of profit performance.

Exercise 8.12

a Con the Concreter

Budget variance report for income statement for month ended 30 June 2015

Variance

Budge

t Actual F or

$ $ $ % U

Revenue

Concreting fees 12000 11000 1000 8.33% U

12000 11000 1000 8.33% U

Expenses

Materials used 3200 3500 300 9.38% U

Petrol 350 400 50 14.29% U

Advertising 300 400 100 33.33% U

Insurance 50 50 0 0.00%

Wages 600 800 200 33.33% U

4500 5150 650 14.44% U

Net profit 7500 5850

b Predicted net profit for June: $7500

c Actual net profit for June: $5850

d Why wasn't the profit achieved?

Major factors include:

1 sales being $1000 less than predicted

2 all expenses (except Insurance) being more than the budget predictions

Exercise 8.13

a Commercial Cleaners

Budgeted income statement for month ending 31 July 2015

Revenue $ $

Cleaning fees 12000

less Expenses

Wages 5000

Cleaning materials 1000

Office expenses 600

Insurance 100 6700

Net profit 5300

Permission is granted for this page to be printed by the purchasing institution. 12

Copyright Macmillan Education Australia 2011.

b Commercial Cleaners

Budget variance report for income statement for month ended 30 July

2015

Variance

Budget Actual F or

$ $ $ % U

Revenue

Cleaning fees 12000 14000 2000 16.67% F

12000 14000 2000 16.67% F

Expenses

Wages 5000 6000 1000 20.00% U

Cleaning materials 1000 1000 0 0.00%

Office expenses 600 500 100 16.67% F

Insurance 100 100 0 0.00%

6700 7600 900 13.43% U

Net profit 5300 6400

c Comment:

The owner has not prepared his budgeted income statement correctly as he has included

several items that are neither revenues or expenses. Loans, drawings and GST

transactions should not be included in an income statement. Once these items are

removed from the report, the business has a predicted net profit of $5300, rather than a

net loss. The actual results are actually better than that predicted by the budget. With

cleaning fees being higher than expected, the actual net profit result was $6400, despite

incurring more wages expense than expected.

Permission is granted for this page to be printed by the purchasing institution. 13

Copyright Macmillan Education Australia 2011.

Case study

a Reservoir Roof Restorations

Cash budget for six months ending 30 June 2015

Jan Feb Mar Apr May Jun

Estimated receipts $ $ $ $ $ $

1310

Cash fees 0 15400 16500 13300 11400 9500

1310

Total receipts 0 15400 16500 13300 11400 9500

Estimated payments

Materials 3275 3850 4125 3325 2850 2375

Wages 4200 4200 5250 3800 3800 4750

Petrol 240 240 240 200 200 200

Service of truck 320

Insurance of truck 640

Registration of truck 540

Advertising 150 150 150 150 150 150

Purchase of equipment 1000 400 400 400 400

Office expenses 100 100 100 100 100 100

Loan repayment 1500 1500

Drawings 2000 2000 2500 2000 2000 2500

Total payments 9965 13360 13405 9975 11000 11015

Excess (deficit) for month 3135 2040 3095 3325 400 -1515

Bank balance start of

month 260 3395 5435 8530 11855 12255

Bank balance end of month 3395 5435 8530 11855 12255 10740

b When should the deposit on the vehicle be paid?

The earliest he should buy the new vehicle is in April. This leaves him with a safety margin of

about $1800. If Fieschi has doubts about this, he should delay the purchase until May. As the

business expects to have a negative cash flow in June, Fieschi may well hold off on his decision so

that the next quarterly budget can be prepared. The fact that the cash position is expected to drop

back to around $10000 by the end of June is a warning that the business may not be able to go

ahead with the purchase of the new vehicle. It should be kept in mind that, once the deposit of

$10000 has been paid, another $15000 still has to be paid in the future. This would put the cash

resources of this business under intense pressure.

Permission is granted for this page to be printed by the purchasing institution. 14

Copyright Macmillan Education Australia 2011.

c Redraft of the cash budget

Reservoir Roof Restorations

Cash budget for six months ending 30 June 2015

Jan Feb Mar Apr May Jun

Estimated receipts $ $ $ $ $ $

1310

Cash fees 0 15400 16500 14364 12312 10260

1310

Total receipts 0 15400 16500 14364 12312 10260

Estimated payments

Materials 3275 3850 4125 3591 3078 2565

Wages 4200 4200 5250 4400 4400 5500

Petrol 240 240 240 200 200 200

Service of truck 320

Insurance of truck 640

Registration of truck 540

Advertising 150 150 150 250 250 250

Purchase of equipment 1000 400 400 400 400

Office expenses 100 100 100 100 100 100

Loan repayment 1500 1500

Drawings 2000 2000 2500 2000 2000 2500

Total payments 9965 13360 13405 10941 11928 12055

Excess (deficit) for month 3135 2040 3095 3423 384 -1795

Bank balance start of

month 260 3395 5435 8530 11953 12337

Bank balance end of month 3395 5435 8530 11953 12337 10542

Comment: At first glance the new advertising strategy appears to be worthwhile. The predicted cash

balance for April increases from $11855 to $11953 (increase of $98). In May the change is from

$12255 to $12337 (increase of $82). However, in June the change is a negative result. Rather than

the expected balance of $10740, the reviewed budget predicts a balance of $10542, a reduction of

$198. This negative change is the result of the increase in wages and the fact that in June there are

5 pay days. The increase of $150 per week leads to an expected increase in wages for June of $750

($150 x 5). This payment eliminates any gains made in the area of revenue and therefore the

advertising plan should not be adopted. An alternative point of view is that the plan should be

adopted because it generates an increase in the market share for the business. The new advertising

is expected to generate new work, meaning that new opportunities will be created for ‘word of

mouth’ advertising. As long as customer satisfaction is high, it may well be that the new plan is just

what the business needs in the slower months of the year. This may well lead to a very busy period

in the following months! It is valid to argue that for around $200 (the net change in the budget) the

business may, in the long run, receive benefits outweighing this cost.

Permission is granted for this page to be printed by the purchasing institution. 15

Copyright Macmillan Education Australia 2011.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentjannatulnisha78No ratings yet

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Tutorial 4 QAsDocument6 pagesTutorial 4 QAsJin HueyNo ratings yet

- Week 3 Lecture Illustrative ExampleDocument2 pagesWeek 3 Lecture Illustrative ExamplewainikitiraculeNo ratings yet

- Assign AcctDocument12 pagesAssign AcctNaeemullah baig100% (1)

- Class Project - SolvedDocument8 pagesClass Project - SolvedMarcoNo ratings yet

- Book 2Document8 pagesBook 2May ManseNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- Adjusted Financial StatementDocument4 pagesAdjusted Financial StatementYousef AL-HAZMINo ratings yet

- Trial balance financial recordsDocument12 pagesTrial balance financial recordsEhtisham Ul HaqNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Financial Statement Analysis of Tie Beauty EnterpriseDocument15 pagesFinancial Statement Analysis of Tie Beauty Enterprisenur anisNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Chapter 4Document35 pagesChapter 4Mohammad Mostafa MostafaNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- Go Green Lawn adjusting entriesDocument2 pagesGo Green Lawn adjusting entriesMd. Rokon KhanNo ratings yet

- Kerja Kelompok PT Angkasa BDocument28 pagesKerja Kelompok PT Angkasa BElisa EndrianiiNo ratings yet

- Adjusting Entry Math LatestDocument4 pagesAdjusting Entry Math LatestOyon Nur newazNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Practice Questions DM112 No 22Document13 pagesPractice Questions DM112 No 22Bianca BenNo ratings yet

- Closing entries for Gray Electronics Repair ServicesDocument1 pageClosing entries for Gray Electronics Repair Serviceswindell arth MercadoNo ratings yet

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- LkhgyDocument2 pagesLkhgyDynNo ratings yet

- Calculate adjustments to trial balance for A Albert and J O'SheaDocument3 pagesCalculate adjustments to trial balance for A Albert and J O'SheaUnais AhmedNo ratings yet

- The Parable of The Talents - 20190714Document6 pagesThe Parable of The Talents - 20190714LynnHanNo ratings yet

- Bfar Chapter 8 Problems 6 7Document9 pagesBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNo ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Class Project - November - HomeworkDocument13 pagesClass Project - November - HomeworkMarcoNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Name Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementDocument9 pagesName Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementHamza IqbalNo ratings yet

- ABM Fundamentals of AccountingDocument3 pagesABM Fundamentals of AccountingtsukiNo ratings yet

- Cheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowDocument4 pagesCheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowHà Anh Đỗ100% (1)

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Completing The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeDocument12 pagesCompleting The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- Trial Balance CompletedDocument1 pageTrial Balance CompletedapachemonoNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Bacc 126 Assignment 1 Aug - Dec 2023Document11 pagesBacc 126 Assignment 1 Aug - Dec 2023TarusengaNo ratings yet

- B&B Repair Services Income StatementDocument22 pagesB&B Repair Services Income Statementrhyayuli0% (1)

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- Journal Entries Trial BalanceDocument3 pagesJournal Entries Trial BalanceLiu CellNo ratings yet

- Compreh Problems - AAA - SolutionDocument28 pagesCompreh Problems - AAA - SolutionNicola NaberNo ratings yet

- Add: Cheque Issued But Not Presented Interest Credited Less: Bank ChargesDocument9 pagesAdd: Cheque Issued But Not Presented Interest Credited Less: Bank ChargesSiddharth RoyNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Document1 pageKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Worksheet SolutionDocument1 pageWorksheet SolutionFahim Ahmed RatulNo ratings yet

- Comprehensive 1 2 Chapters 1-4Document38 pagesComprehensive 1 2 Chapters 1-4api-35603600250% (2)

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Mansa Building Case Financial AnalysisDocument10 pagesMansa Building Case Financial AnalysisSanyam RahejaNo ratings yet

- CHP 6 Partnership Exercise 1-4Document5 pagesCHP 6 Partnership Exercise 1-4jasongojinkai2007No ratings yet

- BBB - Assignment FARDocument23 pagesBBB - Assignment FARcha618717No ratings yet

- 2019 Unit 4 Budgeting SAC Solution BookDocument3 pages2019 Unit 4 Budgeting SAC Solution BookLachlan McFarlandNo ratings yet

- Exercise 2 (Cashflow Statements)Document2 pagesExercise 2 (Cashflow Statements)Prince TshepoNo ratings yet

- Acc 102 Drill No. 1 Answer Key 3Document17 pagesAcc 102 Drill No. 1 Answer Key 3Hanan MacalbeNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Adjust Financial Statements & Prepare ReportsDocument1 pageAdjust Financial Statements & Prepare ReportsalexandraNo ratings yet

- 7 Plus English Paper SampleDocument12 pages7 Plus English Paper SampleDoan Chan PhongNo ratings yet

- 7 Plus Maths Paper SampleDocument14 pages7 Plus Maths Paper SampleDoan Chan PhongNo ratings yet

- 7 Plus English ComprehensionDocument3 pages7 Plus English ComprehensionAlyssa LNo ratings yet

- The Haberdashers' Aske's Boys' School Elstree: Sample PaperDocument3 pagesThe Haberdashers' Aske's Boys' School Elstree: Sample Paperbujjibangaru2012No ratings yet

- 7 Plus English GrammarDocument3 pages7 Plus English Grammarbujjibangaru2012No ratings yet

- Model Theory Lecture Back-and-Forth EquivalenceDocument48 pagesModel Theory Lecture Back-and-Forth EquivalenceDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory Lecture 6: Easy Halves and Unions of ChainsDocument37 pagesMany-Sorted First-Order Model Theory Lecture 6: Easy Halves and Unions of ChainsDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 25 June, 2020Document31 pagesMany-Sorted First-Order Model Theory: 25 June, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory Lecture 11: Homogeneity and ω-categoricityDocument33 pagesMany-Sorted First-Order Model Theory Lecture 11: Homogeneity and ω-categoricityDoan Chan PhongNo ratings yet

- One Two-Hour Lecture A Week: Thursday 16:00-18:00 JST. Zoom Sessions For Practice Classes: To Be Organised On DemandDocument28 pagesOne Two-Hour Lecture A Week: Thursday 16:00-18:00 JST. Zoom Sessions For Practice Classes: To Be Organised On DemandDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 19 June, 2020Document48 pagesMany-Sorted First-Order Model Theory: 19 June, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 2 July, 2020Document37 pagesMany-Sorted First-Order Model Theory: 2 July, 2020Doan Chan PhongNo ratings yet

- Exercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDocument9 pagesExercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory Lecture 3: Presentation Morphisms and Entailment RelationsDocument14 pagesMany-Sorted First-Order Model Theory Lecture 3: Presentation Morphisms and Entailment RelationsDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model TheoryDocument22 pagesMany-Sorted First-Order Model TheoryDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 2 June, 2020Document18 pagesMany-Sorted First-Order Model Theory: 2 June, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory Lecture 5Document56 pagesMany-Sorted First-Order Model Theory Lecture 5Doan Chan PhongNo ratings yet

- Mathematics Test 2Document15 pagesMathematics Test 2annabellehoohNo ratings yet

- Exercise 3.1: A B C D eDocument3 pagesExercise 3.1: A B C D eDoan Chan PhongNo ratings yet

- Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Document12 pagesExercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Doan Chan PhongNo ratings yet

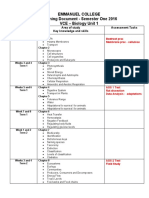

- Emmanuel College Planning Document - Semester One 2016 VCE - Biology Unit 1Document2 pagesEmmanuel College Planning Document - Semester One 2016 VCE - Biology Unit 1Doan Chan PhongNo ratings yet

- Mathstest1 PDFDocument15 pagesMathstest1 PDFManju GalagangodageNo ratings yet

- Selective Schools Sample Test 2Document4 pagesSelective Schools Sample Test 2Doan Chan PhongNo ratings yet

- Selective Schools Sample Test 1Document4 pagesSelective Schools Sample Test 1Doan Chan PhongNo ratings yet

- Selective Schools Sample Test 2 AnswersDocument1 pageSelective Schools Sample Test 2 AnswersDoan Chan PhongNo ratings yet

- Finaflex Main Catalog 2022Document50 pagesFinaflex Main Catalog 2022Benlee Calderón LimaNo ratings yet

- FentonTech Wastewater Ghernaout 2020Document29 pagesFentonTech Wastewater Ghernaout 2020BrankNo ratings yet

- Insertion Mangement Peripheral IVCannulaDocument20 pagesInsertion Mangement Peripheral IVCannulaAadil AadilNo ratings yet

- Final Order in The Matter of M/s Alchemist Capital LTDDocument61 pagesFinal Order in The Matter of M/s Alchemist Capital LTDShyam SunderNo ratings yet

- American SpartansDocument4 pagesAmerican SpartansArya V. VajraNo ratings yet

- Thời gian làm bài: 90 phút (không kể thời gian giao đề)Document8 pagesThời gian làm bài: 90 phút (không kể thời gian giao đề)Nguyễn KiênNo ratings yet

- Letter To Editor NDocument5 pagesLetter To Editor NNavya AgarwalNo ratings yet

- SCC800-B2 SmartSite Management System V100R002C00 Installation GuideDocument190 pagesSCC800-B2 SmartSite Management System V100R002C00 Installation GuideHamza OsamaNo ratings yet

- EthicsDocument10 pagesEthicsEssi Chan100% (4)

- June 10Document16 pagesJune 10rogeliodmngNo ratings yet

- Flamme Rouge - Grand Tour Rules - English-print-V2Document3 pagesFlamme Rouge - Grand Tour Rules - English-print-V2dATCHNo ratings yet

- Isoenzyme ClassifiedDocument33 pagesIsoenzyme Classifiedsayush754No ratings yet

- 03 IoT Technical Sales Training Industrial Wireless Deep DiveDocument35 pages03 IoT Technical Sales Training Industrial Wireless Deep Divechindi.comNo ratings yet

- Sheet-Pan Salmon and Broccoli With Sesame and Ginger: by Lidey HeuckDocument2 pagesSheet-Pan Salmon and Broccoli With Sesame and Ginger: by Lidey HeuckllawNo ratings yet

- Shlokas and BhajansDocument204 pagesShlokas and BhajansCecilie Ramazanova100% (1)

- German Modern Architecture Adn The Modern WomanDocument24 pagesGerman Modern Architecture Adn The Modern WomanUrsula ColemanNo ratings yet

- Post Graduate Dip DermatologyDocument2 pagesPost Graduate Dip DermatologyNooh DinNo ratings yet

- FSN Lullaby Warmer Resus Plus&PrimeDocument4 pagesFSN Lullaby Warmer Resus Plus&PrimemohdkhidirNo ratings yet

- Antianginal Student222Document69 pagesAntianginal Student222MoonAIRNo ratings yet

- Document 3Document5 pagesDocument 3SOLOMON RIANNANo ratings yet

- Armenian Question in Tasvir-İ Efkar Between 1914 and 1918Document152 pagesArmenian Question in Tasvir-İ Efkar Between 1914 and 1918Gültekin ÖNCÜNo ratings yet

- Salman Sahuri - Identification of Deforestation in Protected Forest AreasDocument9 pagesSalman Sahuri - Identification of Deforestation in Protected Forest AreaseditorseajaetNo ratings yet

- Speidel, M. O. (1981) - Stress Corrosion Cracking of Stainless Steels in NaCl Solutions.Document11 pagesSpeidel, M. O. (1981) - Stress Corrosion Cracking of Stainless Steels in NaCl Solutions.oozdemirNo ratings yet

- Exam On Multiculturalism: - Acculturation Process of Immigrants From Central and Eastern Europe in SwedenDocument60 pagesExam On Multiculturalism: - Acculturation Process of Immigrants From Central and Eastern Europe in SwedenMarta santosNo ratings yet

- Christmas Elf NPCDocument4 pagesChristmas Elf NPCDrew CampbellNo ratings yet

- Individual Learning Monitoring PlanDocument2 pagesIndividual Learning Monitoring PlanJohnArgielLaurenteVictorNo ratings yet

- Igbe Religion's 21st Century Syncretic Response to ChristianityDocument30 pagesIgbe Religion's 21st Century Syncretic Response to ChristianityFortune AFATAKPANo ratings yet

- Types of EquityDocument2 pagesTypes of EquityPrasanthNo ratings yet

- CPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionDocument2 pagesCPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionJo KingNo ratings yet

- A Place in Lake County - The Property Owner's Resource GuideDocument16 pagesA Place in Lake County - The Property Owner's Resource GuideMinnesota's Lake Superior Coastal ProgramNo ratings yet