Professional Documents

Culture Documents

Guitar Chords PDF

Uploaded by

Ryan VillamorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guitar Chords PDF

Uploaded by

Ryan VillamorCopyright:

Available Formats

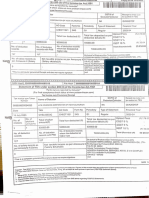

BIR Form No.

2551Q Quarterly Percentage Tax Return

January 2018 (ENCS)

Page 2

TIN Taxpayer's Last Name (if Individual) / Registered Name (if Non-Individual)

241 877 627 000 VILLAMOR, RYAN, GARUPA

Schedule 1 - Computation of Tax (Attach additional sheet/s, if necessary)

Alphanumeric Tax Code (ATC) Taxable Amount Tax Rate Tax Due

1 PT 010 40,000.00 3.0 % 1,200.00

2 - 0.00 0.00 % 0.00

3 - 0.00 0.00 % 0.00

4 - 0.00 0.00 % 0.00

5 - 0.00 0.00 % 0.00

6 - 0.00 0.00 % 0.00

7 Total Tax Due (Sum of Items 1 to 6) (To Part II Item 14) 1,200.00

Table 1 - Alphanumeric Tax Code (ATC)

Tax

ATC Percentage Tax On

Rate

PT 010 Person exempt from VAT under Sec. 109(BB) (Sec. 116) 3%

PT 040 Domestic carriers and keepers of garages (Sec. 117) 3%

PT 041 International Carriers (Sec. 118) 3%

PT 060 Franchises on gas and water utilities (Sec. 119) 2%

PT 070 Franchises on radio/TV broadcasting companies whose annual gross receipts do not exceed P10 M (Sec. 119) 3%

PT 090 Overseas dispatch, message or conversation originating from the Philippines (Sec. 120) 10%

PT 140 Cockpits (Sec. 125) 18%

Tax on amusement places, such as cabarets, night and day clubs, videoke bars, karaoke bars, karaoke television, karaoke boxes, music lounges and other

PT 150 18%

similar establishments (Sec. 125)

PT 160 Boxing Exhibition (Sec. 125) 10%

PT 170 Professional Basketball Games (Sec. 125) 15%

PT 180 Jai-alai and Race Tracks (Sec. 125) 30%

Tax on Banks and Non-Bank Financial Intermediaries Performing Quasi-Banking Functions (Sec. 121)

1) On interest, commisions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from

which such receipts are derived

PT 105 - Maturity period is five (5) years or less 5%

PT 101 - Maturity period is more than five (5) years 1%

PT 102 2) On dividends and equity shares and net income of subsidiaries 0%

PT 103 3) On royalties, rentals of property, real or personal, profits from exchange and all other gross income 7%

PT 104 4) On net trading gains within the taxable year on foreign currency, debt securities, derivatives and other financial instruments 7%

Tax on Other Non-Bank Financial Intermediaries not Performing Quasi-Banking Functions (Sec. 122)

1) On interest, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from

which such receipts are derived

PT 113 - Maturity period is five (5) years or less 5%

PT 114 - Maturity period is more than five (5) years 1%

PT 115 2) From all other items treated as gross income under the code 5%

PT 120 Life Insurance Premiums (Sec. 123) 2%

Agents of Foreign Insurance Companies (Sec. 124)

PT 130 1) Insurance Agents 4%

PT 132 2) Owners of property obtaining insurance directly with foreign insurance companies 5%

You might also like

- 2551Q Quarterly Percentage Tax Return: 947 257 352 000 Lopez, MaricrisDocument1 page2551Q Quarterly Percentage Tax Return: 947 257 352 000 Lopez, MaricrisJmarc JubiladoNo ratings yet

- Page 2 BirDocument1 pagePage 2 BirAce AbeciaNo ratings yet

- Ragasa 2Document1 pageRagasa 2Jam DiolazoNo ratings yet

- Nuay4 PDFDocument1 pageNuay4 PDFCara leizelNo ratings yet

- 2551Q Quarterly Percentage Tax Return: 450 106 598 106 Flores, Joshua, EsguerraDocument2 pages2551Q Quarterly Percentage Tax Return: 450 106 598 106 Flores, Joshua, EsguerraJoshua FloresNo ratings yet

- Bir Form 2550M Value Added Tax: Table 1 - Alphanumeric Tax Code (ATC)Document1 pageBir Form 2550M Value Added Tax: Table 1 - Alphanumeric Tax Code (ATC)Jana Trina LibatiqueNo ratings yet

- RMC 26-2018 Annex ADocument3 pagesRMC 26-2018 Annex APrince PierreNo ratings yet

- Tax Card Global Tax Consultants Tax Year 2019Document3 pagesTax Card Global Tax Consultants Tax Year 2019AqeelAhmadNo ratings yet

- Budget Synopsis Fy 2078-79 - TDSDocument1 pageBudget Synopsis Fy 2078-79 - TDSSahu BhaiNo ratings yet

- Tax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsDocument3 pagesTax Card For The Tax Year 2018-19: Maqbool Haroon Shahid Safdar & Co., Chartered AccountantsThe MaximusNo ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- Bir Form 1600Document3 pagesBir Form 1600Joseph Rod Allan AlanoNo ratings yet

- 2023-24 - Indirect Tax DossierDocument3 pages2023-24 - Indirect Tax DossierCA Manish BasnetNo ratings yet

- RMO No. 3-2004 PDFDocument4 pagesRMO No. 3-2004 PDFlantern san juanNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- Revenue Memorandum Order No. 4-2022 1Document2 pagesRevenue Memorandum Order No. 4-2022 1joy rellosoNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding Taxeskrisha milloNo ratings yet

- Tax Rates For The Tax Year 2020: Amar AssociatesDocument2 pagesTax Rates For The Tax Year 2020: Amar AssociatesZeeshanNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- SHCC Tax Card - Ty 2021Document1 pageSHCC Tax Card - Ty 2021Muhammad AdeelNo ratings yet

- Document PDFDocument2 pagesDocument PDFSamson SeidNo ratings yet

- Withholding Tax Card 2020-21Document3 pagesWithholding Tax Card 2020-21Javed MushtaqNo ratings yet

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgNo ratings yet

- Amount of Tax WithheldDocument1 pageAmount of Tax Withheldinternal audit unit bayambangNo ratings yet

- Tax Rate Card - Ty 2022Document6 pagesTax Rate Card - Ty 2022Abdul Hannan AwanNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding TaxesJimbo ManalastasNo ratings yet

- Tax HomeworkDocument4 pagesTax HomeworkMatthew WittNo ratings yet

- SWHCC Tax Card - Ty 2019Document1 pageSWHCC Tax Card - Ty 2019Muhammad HaseebNo ratings yet

- 2021 Annual Budget Report - Luna, ApayaoDocument40 pages2021 Annual Budget Report - Luna, ApayaoMarvin OlidNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BPatel SumitNo ratings yet

- WHT Rate Card 2018-19Document2 pagesWHT Rate Card 2018-19taqi1122No ratings yet

- TaxRateCard 2022-23Document7 pagesTaxRateCard 2022-23Anas KhanNo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- Workbook CH 7Document6 pagesWorkbook CH 7Perencanaan Itjen KemdikbudNo ratings yet

- BD Budget Analysis 2022-23Document6 pagesBD Budget Analysis 2022-23Tonmoy TanvirNo ratings yet

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailNo ratings yet

- TaxRates2021 22Document2 pagesTaxRates2021 22Amir NazirNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BRidhimaNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- BIR Form No. 1601E - Guidelines and InstructionsDocument4 pagesBIR Form No. 1601E - Guidelines and InstructionsJinefer ButohanNo ratings yet

- GSTR3B - 22-23 MayDocument4 pagesGSTR3B - 22-23 MayLogesh Waran KmlNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- 2307 All Support StaffDocument4 pages2307 All Support StaffReyna Maree GarciaNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Union DT PA 16 2020 Chap 3-0605adc91095086.06897136Document38 pagesUnion DT PA 16 2020 Chap 3-0605adc91095086.06897136SsvashistNo ratings yet

- CS Garments vs. CIRDocument23 pagesCS Garments vs. CIRJoseph Rod Allan AlanoNo ratings yet

- ZFSGDocument1 pageZFSGJeorge VerbaNo ratings yet

- Income Tax ChangesDocument30 pagesIncome Tax ChangesColors of LifeNo ratings yet

- Tax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonDocument2 pagesTax Rate For Individual & Salaried: Reduction For Senior Citizen/Disabled PersonFrantsForum DiscussionNo ratings yet

- Percentage TaxesDocument21 pagesPercentage TaxesMikee TanNo ratings yet

- GSTR3B 29aaifa3562d1zl 022020Document3 pagesGSTR3B 29aaifa3562d1zl 022020HEMANTH kumarNo ratings yet

- WHT Tax Card - 2024Document1 pageWHT Tax Card - 2024shahid100% (1)

- f6vnm 2007 Dec QDocument9 pagesf6vnm 2007 Dec QPhạm Hùng DũngNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Verbal Reasoning 8Document64 pagesVerbal Reasoning 8cyoung360% (1)

- Rise of British Power in India Lec 5Document24 pagesRise of British Power in India Lec 5Akil MohammadNo ratings yet

- EPS For OPAPRU Executives - Ao24jan2024Document3 pagesEPS For OPAPRU Executives - Ao24jan2024rinafenellere.opapruNo ratings yet

- Critical Analysis of The Payment of Wages ActDocument2 pagesCritical Analysis of The Payment of Wages ActVishwesh SinghNo ratings yet

- Altered Ego Todd HermanDocument11 pagesAltered Ego Todd HermanCatherine Guimard-Payen75% (4)

- Bài Tập Tiếng Anh Cho Người Mất GốcDocument8 pagesBài Tập Tiếng Anh Cho Người Mất GốcTrà MyNo ratings yet

- Unconstituted Praxis PDFDocument115 pagesUnconstituted Praxis PDFGerardo AlbatrosNo ratings yet

- Chapter 12 - Bank ReconciliationDocument29 pagesChapter 12 - Bank Reconciliationshemida100% (7)

- Nature of Vat RefundDocument7 pagesNature of Vat RefundRoselyn NaronNo ratings yet

- Revised WHD Quiz 2023 Flyer PDFDocument5 pagesRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalNo ratings yet

- 235 at 2022Document36 pages235 at 2022Miguel FaganelloNo ratings yet

- Bond ValuationDocument49 pagesBond Valuationmehnaz kNo ratings yet

- CRM AssignmentDocument43 pagesCRM Assignmentharshdeep mehta100% (2)

- Scraper SiteDocument3 pagesScraper Sitelinda976No ratings yet

- Indicator - Individual Dietary Diversity ScoreDocument3 pagesIndicator - Individual Dietary Diversity Scorehisbullah smithNo ratings yet

- Introducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingDocument35 pagesIntroducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingkoralbiruNo ratings yet

- Deped Order 36Document22 pagesDeped Order 36Michael Green100% (1)

- Difference Between Workman and Contract LabourDocument4 pagesDifference Between Workman and Contract LabourGaurav mishraNo ratings yet

- X30531Document48 pagesX30531Conrado Pinho Junior50% (2)

- Gladys Ruiz, ResumeDocument2 pagesGladys Ruiz, Resumeapi-284904141No ratings yet

- Little White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Document8 pagesLittle White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Thavam RatnaNo ratings yet

- Cover LetterDocument2 pagesCover LetterGeorgy Khalatov100% (4)

- Pangan v. RamosDocument2 pagesPangan v. RamossuizyyyNo ratings yet

- Criticism of DAT SutherlandDocument2 pagesCriticism of DAT SutherlandBabarNo ratings yet

- JRR Tolkein On The Problem of EvilDocument14 pagesJRR Tolkein On The Problem of EvilmarkworthingNo ratings yet

- Food Product Proposal Letter SampleDocument20 pagesFood Product Proposal Letter Sampleusama100% (1)

- Security System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Document61 pagesSecurity System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Carlos Enrique Huertas FigueroaNo ratings yet

- G.R. No. 113899. October 13, 1999. Great Pacific Life Assurance Corp., Petitioner, vs. Court of Appeals and Medarda V. Leuterio, RespondentsDocument12 pagesG.R. No. 113899. October 13, 1999. Great Pacific Life Assurance Corp., Petitioner, vs. Court of Appeals and Medarda V. Leuterio, RespondentsdanexrainierNo ratings yet

- Annual Barangay Youth Investment ProgramDocument4 pagesAnnual Barangay Youth Investment ProgramBarangay MukasNo ratings yet

- IBM Report Dah SiapDocument31 pagesIBM Report Dah Siapvivek1119No ratings yet