Professional Documents

Culture Documents

Financial Accounting and Reporting: FAR12 Investment Property

Financial Accounting and Reporting: FAR12 Investment Property

Uploaded by

kianamarieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Reporting: FAR12 Investment Property

Financial Accounting and Reporting: FAR12 Investment Property

Uploaded by

kianamarieCopyright:

Available Formats

FINANCIAL ACCOUNTING AND REPORTING

FAR12 Investment Property

12.1. Introduction.................................................................................................................. 1

12.2. Classification ................................................................................................................ 1

12.3. Recognition and Initial Measurement ............................................................... 2

12.4. Subsequent Measurement ...................................................................................... 2

12.4.1. Fair Value Model ......................................................................................... 3

12.4.2. Cost Model ..................................................................................................... 3

12.5. Transfers and Disposals .......................................................................................... 4

12.6. Presentation and Disclosures................................................................................ 5

FAR12 Investment Property

12.1. Introduction

PAS 40 shall be applied in the recognition, measurement and disclosure of investment property. This

standard applies to the measurement in a lessee's (accounted for as finance lease) financial statements of

investment property interests held under a lease and to the measurement in a lessor's (accounted for under

operating lease) financial statements of investment property provided to a lessee. However, all other

aspects relating to leases, their accounting, and their disclosure, are dealt with in PAS 17/PFRS 16.

Additionally, PAS 40 does not apply to:

a. biological assets related to agricultural activity (see PAS 41 and PAS 16); and

b. mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources

(see PFRS 6)

PAS 40 defines investment property as property (land or a building-or part of a building-or both) held

(by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both,

rather than for:

a. use in the production or supply of goods or services or for administrative purposes

b. sale in the ordinary course of business.

On the other hand, owner-occupied property is a property held (by the owner or by the lessee under a

finance lease) for use in the production or supply of goods or services or for administrative purposes.

12.2. Classification

One of the distinguishing characteristics of investment property (compared to owner-occupied property)

is that it generates cash flows that are largely independent from other assets held by an entity. Owner-

occupied property is accounted for under PAS 16.

The following table shows a list of examples of items that are considered investment properties and those

that are not:

Investment Property Not Investment Property

1. Land held for long-term capital appreciation 1. Property held for use in the production or

supply of goods or services or for

administrative purposes (PAS 16)

2. Land held for undecided future use 2. Property held for sale in the ordinary course

of business or in the process of construction

of development for such sale (PAS 2)

3. Building leased out under an operating lease 3. Property being constructed or developed on

behalf of third parties (PAS 11)

4. Vacant building held to be leased out under 4. Property leased to another entity under a

an operating lease finance lease (PAS 17)

5. Property under construction as investment 5. Owner-occupied property, including property

property held for future use as owner-occupied

property, property held for future

development and subsequent use as owner-

occupied property, property occupied by

employees and owner-occupied property

awaiting disposal

The following table summarizes other classification issues related to investment property and the

appropriate treatment of such issues:

A property interest that is held by a lessee under an operating lease may be

classified and accounted for as investment property provided that:

– The rest of the definition of investment property is met

– The operating lease is accounted for as if it were a finance lease in

Property held under

accordance with PAS 17/PFRS 16

operating lease

– The lessee uses the fair value model set out in this Standard for the asset

recognized

– An entity may make the foregoing classification on a property-by-

property basis

– If the portions can be sold or leased out separately, they are accounted

for separately. Therefore, the part that is rented out is investment

property.

Partial own use

– If the portions cannot be sold or leased out separately, the property is

investment property only if the owner-occupied portion is insignificant.

FAR12 INVESTMENT PROPERTY 1

– If those services are a relatively insignificant component of the

arrangement as a whole (for instance, the building owner supplies

security and maintenance services to the lessees), then the enterprise

Ancillary services may treat the property as investment property.

– Where the services provided are more significant (such as in the case of

an owner-managed hotel), the property should be classified as owner-

occupied.

– Not investment property in consolidated financial statements that

include both the lessor and the lessee, because the property is owner-

occupied from the perspective of the group.

Intercompany rentals

– However, such property could qualify as investment property in the

separate financial statements of the lessor, if the definition of investment

property is otherwise met.

Case Study 1

ABC Company and its subsidiaries provided the following properties owned by the group.

Land held for undetermined future use P1,000,000

Vacant building to be leased out under an operating lease 2,000,000

Property held for use in production 4,000,000

Property held by a subsidiary, a real estate firm, in the ordinary course of business 3,000,000

Building owned by subsidiary and for which the subsidiary

provides security and maintenance services to the lessees 2,500,000

Land leased to a subsidiary under an operating lease 1,500,000

Land leased to a subsidiary under a finance lease 2,000,000

Equipment leased out under an operating lease 500,000

Building under construction for use as investment property 3,500,000

Required

In the consolidated statement of financial position of ABC Company and its subsidiaries, what total amount should be

reported as investment property?

12.3. Recognition and Initial Measurement

Recognition principles are similar to those contained in IAS 16. Investment property shall be recognized

as an asset when, and only when:

a. it is probable that the future economic benefits that are associated with the investment property will

flow to the entity; and

b. the cost of the investment property can be measured reliably.

An investment property shall be measured initially at its cost. Transaction costs shall be included in the

initial measurement.

However, property held under an operating lease shall be measured initially using the principles contained

in PAS 17/PFRS 16—at the lower of the fair value and the present value of the minimum lease payments.

The cost of a purchased investment property comprises its purchase price and any directly attributable

expenditure. Directly attributable expenditure includes, for example, professional fees for legal services,

property transfer taxes and other transaction costs.

The cost of an investment property is not increased by:

a. start-up costs (unless they are necessary to bring the property to the condition necessary for it to be

capable of operating in the manner intended by management),

b. operating losses incurred before the investment property achieves the planned level of occupancy,

c. abnormal amounts of wasted material, labor or other resources incurred in constructing or developing

the property.

12.4. Subsequent Measurement

An entity shall select either the cost model or the fair value model for all of its investment property.

There are, however, two exceptions, as follows:

a. If an entity elects to classify property held under an operating lease as investment property, then it

must select the fair value model for all of its investment property.

b. If the entity has investment property backing liabilities that pay a return linked to the fair value of the

assets; if so, regardless of which model is selected for measuring such investment property, the entity

continues to have a choice of models for its other investment property.

Change is permitted only if this results in a more appropriate presentation. PAS 40 notes that this is

highly unlikely for a change from a fair value model to a cost model.

FAR12 INVESTMENT PROPERTY 2

12.4.1. Fair Value Model

After initial recognition, an entity that chooses the fair value model shall measure all of its investment

property at fair value.

A gain or loss arising from a change in the fair value of investment property shall be recognized in profit or

loss for the period in which it arises.

An entity is encouraged, but not required, to measure the fair value of investment property on the basis of

a valuation by an independent valuer who holds a recognized and relevant professional qualification and

has recent experience in the location and category of the investment property being valued.

If, on acquisition, it is not possible to determine fair value reliably on a continuing basis, then the asset shall

be measured using the cost model under IAS 16 until disposal. Residual value shall be assumed to be zero.

Therefore, it is possible for an entity to hold investment property, some of which is measured at fair value

and some under the cost model.

If an entity measures investment property at fair value, it shall continue to do so until disposal, even if

readily available market data become less frequent or less readily available.

12.4.2. Cost Model

After initial recognition, investment property is accounted for in accordance with the cost model as set

out in PAS 16, that is, cost less accumulated depreciation and less accumulated impairment losses.

Investment properties that meet the criteria to be classified as held for sale (or are included in a disposal

group that is classified as held for sale) shall be measured in accordance with PFRS 5.

Case Study 2

Investors Galore Inc., a listed company in Germany, ventured into the construction of a mega shopping mall in south

Asia, which is rated as the largest shopping mall of Asia. The company’s board of directors after market research

decided that instead of selling the shopping mall to a local investor, who had approached them several times during

the construction period with excellent offers, which he progressively increased during the year of construction, the

company would hold this property for the purposes of earning rentals by renting out space in the shopping mall to

tenants. For this purpose it used the services of a real estate company to find an anchor tenant (a major international

retail chain) that then attracted other important retailers locally to rent space in the mega shopping mall, and within

months of the completion of the construction the shopping mall was fully rented out.

The construction of the shopping mall was completed, and the property was placed in service at the end of 2019.

According to the company’s engineering department the computed total cost of the construction of the shopping mall

was P100 million. An independent valuation expert was used by the company to fair value the shopping mall on an

annual basis. According to the fair valuation expert the fair values of the shopping mall at the end of 2019 and at each

subsequent year-end thereafter were:

2019 P100 million

2020 120 million

2021 125 million

2022 115 million

The independent valuation expert was of the opinion that the useful life of the shopping mall was ten years and its

residual value was P10 million.

Required

What would be the impact on the profit and loss account of the company if it decides to treat the shopping mall as an

investment property under PAS 40?

a. Using the fair value model

b. Using the cost model

(Since the rental income for the shopping mall would be the same under both the options, for the purposes of this exercise

do not take into consideration the impact of the rental income from the shopping mall on the net profit or loss for the

period.)

Case Study 3

ABC Company owns three properties, which are classified as investment properties. Details of the properties are as

follows:

Initial cost Fair value, 12/31/19 Fair value, 12/31/20

Property 1 P2,700,000 P3,200,000 P3,500,000

Property 2 3,450,000 3,000,000 2,800,000

Property 3 3,300,000 3,900,000 3,400,000

Each property was acquired in 2014 with a useful life of 50 years. The entity’s accounting policy is to use the fair value

model for investment properties.

Required

a. Determine gain or loss for 2020.

b. Determine the balance of investment property on 2020.

c. Assuming the company is using the cost model for investment properties, how much should be the balance of

investment property on December 31, 2020?

FAR12 INVESTMENT PROPERTY 3

12.5. Transfers and Disposals

Transfers to and from investment property shall be made when and only when there is a change of use

evidenced by:

a. Commencement of owner occupation (transfer from IP to PPE)

b. Commencement of development with a view to sale (transfer from IP to inventories)

c. End of owner occupation (transfer from PPE to IP)

d. Commencement of an operating lease to another party (transfer from inventories or PPE to IP)

The following table summarizes the measurement principles used when there are transfers to or from the

investment property classification:

From To Initial Subsequent

Measurement Measurement

Investment property Property, plant and Cost Cost less

equipment (FV or CA at date of accumulated

transfer) depreciation and

impairment losses

(PAS 16)

Investment property Inventories Cost Lower of cost or net

(FV or CA at date of realizable value

transfer) (PAS 2)

Property, plant and Investment property Fair Value, any Cost model or fair

equipment difference from CA value model

shall be treated as (PAS 40)

revaluation (PAS 16)

Inventories Investment property Fair Value, any Cost model or fair

difference value model

recognized in PL (PAS 40)

(PAS 2)

An investment property shall be derecognized on disposal or at the time that no benefit is expected from

future use or disposal. Any gain or loss is determined as the difference between the net disposal proceeds

and the carrying amount and is recognized in profit or loss.

Compensation from third parties for investment property that was impaired, lost or given up shall be

recognized in profit or loss when the compensation becomes receivable.

Case Study 4

The following are independent situations:

1. Chyna, Inc. completed the construction of a building at the end of 2018 for a total cost of P100 million. The building

is estimated to be economically useful for 25 years. The building was constructed for the purpose of earning rentals

under operating leases. The tenants began occupying the building after its completion. The company opted to use

the fair value model to measure the building. An independent valuation expert was used by the company to

estimate the fair value of the building on an annual basis. According to the expert the fair values of the building at

the end of 2018, 2019 and 2020 were P105 million, P120 million and P118 million, respectively.

The company’s business expanded in 2019. As a result, the company started to use the building in its operations

on January 1, 2020. Because of the change in use, the company reclassified the building from investment property

to property, plant and equipment.

2. Deena, Inc. owns a building purchased on January 1, 2016 for P100 million. The building was used as the

company's head office. The building has an estimated useful life of 25 years. In 2020, the company transferred its

head office and decided to lease out the old building. Tenants began occupying the old building by the end of 2020.

On December 31, 2020, the company reclassified the building as investment property to be carried at fair value.

The fair value on the date of reclassification was P85 million.

3. Ellah Company, a property developer, completed the development of 30 units of office building for sale. Upon

completion, 5 units remain unsold and classified as inventories. The cost of these remaining units is P2,000,000

per unit whilst the net selling price is P2,500,000 per unit. Management subsequently decides to hold the units as

investment property by letting out to tenants.

4. On January 2, 2019, Finnick Company made a test of impairment on one of its buildings carried as plant asset. The

test on impairment revealed a recoverable value of P8,250,000 on that building. The carrying value of this building

as of January 2, 2019 is P12,000,000 with a remaining useful life of 10 years.

On January 1, 2021, Finnick Company decided to convert this building into an investment property that is to be

carried at fair value. The cost of converting the building is insignificant but as a result of the change in the usage,

the fair market value of the building was reliably valued at P10,500,000.

Required

Journalize the above transactions.

FAR12 INVESTMENT PROPERTY 4

12.6. Presentation and Disclosures

Investment properties are aggregated and presented as one line item under the heading “Investment

property” on the face of the statement of financial position. Investment properties are normally classified

as non-current assets. The breakdown of the line item is disclosed in the notes.

The entity shall disclose the following:

a. Whether the fair value or the cost model is used

b. If the fair value model is used, whether property interests held under operating leases are classified

and accounted for as investment property;

c. If classification is difficult, the criteria to distinguish investment property from owner-occupied

property and from property held for sale.

d. The methods and significant assumptions applied in determining the fair value of investment property.

e. The extent to which the fair value of investment property is based on a valuation by a qualified

independent valuer; if there has been no such valuation, that fact must be disclosed.

f. The amounts recognized in profit or loss for:

– Rental income from investment property;

– Direct operating expenses (including repairs and maintenance) arising from investment property

that generated rental income during the period; and

– Direct operating expenses (including repairs and maintenance) arising from investment property

that did not generate rental income during the period.

g. Restrictions on the realizability of investment property or the remittance of income and proceeds of

disposal.

h. Contractual obligations to purchase, construct, or develop investment property or for repairs,

maintenance or enhancements.

Quizzer – Problem 1

1. Akie Company purchases a landed property at a cost of P100,000,000. In the sale and purchase agreement,

P20,000,000 of the purchase price is attributed to the land portion. The building consists of 10 floors of equal space.

Two floors are used for administrative purposes and the balance are let out to tenants. Akie also incurs the following

costs in connection with the purchase of the property: Legal and agency fees, P3,000,000; Soft launching cost to

market for tenants, P500,000; Feng Shui costs for re-arrangements of interiors, P300,000; and administrative

expenses, P200,000. At what amount should the investment property be initially recognized?

A. P82,400,000

B. P82,800,000

C. P83,200,000

D. P103,000,000

2. Billie Company leases an entire shopping complex from Complex Company under a 20-year operating lease. Under

the lease agreement, Billie would manage and take the risks of operating the shopping complex for 20 years. It pays

a yearly rental of P40,000,000 to Complex Company. Billie uses 20% of the floor area for its own operations. The

rest of the floor area is sub-leased to other tenants. Billie Company expects rental income from the sublease to be

about P35,000,000 per year for 20 years. The borrowing costs of Billie Company is 8% per year. The cost of

constructing the complex incurred by Complex Company is P480,000,000, transaction and other incidental costs

amount to P20,000,000. If Billie Company elects to treat its interest in the shopping complex as an investment

property, being its interest in the underlying asset, at what amount should the investment property be initially

recognized by Billie Company?

A. None

B. P343,640,000

C. P400,000,000

D. P500,000,000

3. At the beginning of the year 2019, Dory Company has an investment property, acquired at cost of P1,000,000.

Depreciation of P50,000 is recognized annually and periodic continuing repair costs of P5,000 per year as well as

property tax of P5,000 are incurred by the company on an annual basis. As of December 31, 2019, the property has

no determinable fair value. What should be the carrying value of the investment property on December 31, 2019?

A. None

B. P900,000

C. P940,000

D. P950,000

4. On January 2, 2019, Frankie Company’s investment property has a carrying value of P3,600,000 under the fair value

model. On December 31, 2019, the property has a fair value of P3,000,000, what amount of gain or loss should

Frankie continue to recognize if Frankie would shift to cost model?

A. Gain of P600,000 reported in other comprehensive income

B. Loss of P600,000 reported in the profit or loss

C. Loss of P600,000 reported in equity as decrease in revaluation surplus

D. Zero

FAR12 INVESTMENT PROPERTY 5

5. On July 1, 2019, Eevy Company purchases an investment property at a cost of P50,000,000 including transaction

costs. On October 1, 2019, the fair value of the property increases to P52,000,000. At December 31, 2019, the fair

value of the property is P51,500,000. The rental income received per quarter is P1,000,000. The property has a

useful life of 50 years.

Question 1: If the company uses the cost model, what is the net effect on the profit or loss for the six months ended

December 31, 2019 in relation to the investment property?

A. P(500,000)

B. P1,000,000

C. P1,500,000

D. P2,000,000

Question 2: If the company uses the fair value model, what is the net effect on the profit or loss for the six months

ended December 31, 2019 in relation to the investment property?

A. P1,000,000

B. P1,500,000

C. P2,000,000

D. P3,500,000

6. On January 1, 2019, Gellie Company which uses the fair value model, purchases an investment property at a cost of

P50,000,000. At December 31, 2019, the market value of the property is P60,000,000. The fair market value of the

property on December 31, 2020 is P55,000,000. On January 1, 2021, the property was reclassified to property, plant

and equipment. At what amount should the property, plant and equipment be initially recorded?

A. Zero

B. P50,000,000

C. P55,000,000

D. P60,000,000

7. Honey Company has a plant asset with a carrying value of P1,200,000 as of December 31, 2019. On January 1, 2020,

the company decided to convert the plant asset to investment property. The fair value at date of conversion is

P900,000. The conversion would result to

A. P300,000 loss on conversion reported as other comprehensive income

B. P300,000 loss on conversion reported in profit or loss

C. P900,000 increase in investment property

D. P1,200,000 decrease in plant assets

8. Ikea Company, a property developer, completed the development of 30 units of office building for sale. Upon

completion, 5 units remain unsold and classified as inventories. The cost of these remaining units is P2,000,000 per

unit whilst the net selling price is P2,500,000 per unit. Management subsequently decides to hold the units as

investment property by letting out to tenants. What amount of gain or loss should Ikea Company recognize on the

transfer of inventories to investment property?

A. None

B. P500,000

C. P2,000,000

D. P2,500,000

9. On January 2, 2019, Jillian Company made a test of impairment on one of its buildings carried as plant asset. The

test on impairment revealed a recoverable value of P5,500,000 on that building. The carrying value of this building

as of January 2, 2019 is P8,000,000 with a remaining useful life of 10 years.

On January 1, 2021, Jillian Company decided to convert this building into an investment property that is to be

carried at fair value. The cost of converting the building is insignificant but as a result of the change in the usage,

the fair market value of the building was reliably valued at P7,000,000. What amount of revaluation surplus should

Jillian Company disclose in the shareholders’ equity as of December 31, 2021?

A. None

B. P525,000

C. P600,000

D. P2,000,000

Quizzer – Theory 1

1. PAS 40 defines this property as land or building or part of building or both held by an owner or finance lessee to

earn rentals or for capital appreciation or both.

A. Investment property C. Owner-occupied property

B. Mining property D. Rental property

2. The following properties fall under the definition of investment property, except

A. Land held for long-term capital appreciation

B. Property occupied by an employee paying market rent

C. Land held for a currently undetermined use

D. A building owned by an entity and leased out under an operating lease

FAR12 INVESTMENT PROPERTY 6

3. Which of the following statements best describes owner-occupied property?

A. Property held for sale in the ordinary course of business

B. Property held for use in the production and supply of goods or services and property held for administrative

purposes

C. Property held to earn rentals

D. Property held for capital appreciation

4. An investment property shall be measured initially at

A. Cost

B. Cost less accumulated impairment losses

C. Depreciable cost less accumulated impairment losses

D. Fair value less accumulated impairment losses

5. Subsequent to initial recognition, investment property shall be measured at

A. Fair value

B. Cost less accumulated depreciation and any accumulated impairment losses

C. Either fair value or cost less accumulated depreciation and any accumulated impairment losses.

D. Either fair value or cost.

6. In case of property held under an operating lease and classified as investment property

A. The entity has to account for the investment property under the cost model only.

B. The entity has to use the fair value model only

C. The entity has a choice between the cost model and fair value model.

D. The entity needs only to disclose the fair value and can use the cost model.

7. Which statement is incorrect in determining the fair value of an investment property?

A. An entity shall determine the fair value of investment property after deduction for transaction costs that may

be incurred upon disposal.

B. If an office is leased on a furnished basis, the fair value of the office generally includes the fair value of the

furniture because the rental income relates to the furnished office.

C. The fair value of investment property excludes prepaid or accrued operating lease income.

D. Equipment such as lift, or air-conditioning is often an integral part of a building and is generally included in the

fair value of the investment property rather than recognized separately as property, plant and equipment.

8. Transfers from investment property to property, plant and equipment are appropriate

A. When there is change of use.

B. Based on the entity’s discretion.

C. Only when the entity adopts the fair value model.

D. The entity can never transfer property into another classification once it is classified as investment property.

9. When the entity uses the cost model, transfer between investment property, owner-occupied property and

inventory shall be accounted for at

A. Carrying amount C. Fair value

B. Either at fair value or carrying amount D. Neither at fair value nor carrying amount

10. A transfer from investment property carried at fair value to owner-occupied property shall be accounted for at

A. Fair value which becomes the deemed cost C. Historical cost

B. Appraised value D. Assessed value

11. If inventory is transferred to investment property that is to be carried at fair value, the difference between carrying

amount and fair value shall be included in

A. Other comprehensive income

B. Retained earnings

C. Profit or loss

D. Either other comprehensive income or profit or loss

12. An investment property is derecognized when

A. It is disposed to a third party.

B. It is permanently withdrawn from use.

C. No future economic benefits are expected from its disposal.

D. In all of the above cases.

FAR12 INVESTMENT PROPERTY 2

You might also like

- FarDocument14 pagesFarKenneth Robledo100% (1)

- Intacc PpeDocument32 pagesIntacc PpeIris MnemosyneNo ratings yet

- Accounting For Investments - Test BankDocument21 pagesAccounting For Investments - Test BankIsh Selin100% (1)

- Investment Property (Pas 40)Document2 pagesInvestment Property (Pas 40)Ron Gumapac100% (1)

- Lecture Notes - IAS 40Document5 pagesLecture Notes - IAS 40Muhammed NaqiNo ratings yet

- p1 & AP - IntangiblesDocument13 pagesp1 & AP - IntangiblesJolina Mancera100% (3)

- Intangible AssetsDocument4 pagesIntangible Assetsbrooke100% (1)

- FAR11 Intangibles - With AnsDocument18 pagesFAR11 Intangibles - With AnsAJ Cresmundo100% (1)

- FAR11 Intangibles - With AnsDocument18 pagesFAR11 Intangibles - With AnsAJ Cresmundo100% (1)

- Interm Acctng ReviewerDocument34 pagesInterm Acctng Reviewershaylieee67% (9)

- Income Statement Practice ProblemsDocument6 pagesIncome Statement Practice ProblemsmikeNo ratings yet

- InvestmentDocument25 pagesInvestmentCris Joy Biabas100% (3)

- Investment Property and NCAHFS - OdtDocument5 pagesInvestment Property and NCAHFS - OdtAndrea AtendidoNo ratings yet

- La Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceDocument3 pagesLa Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceChristal Jam LaureNo ratings yet

- Chapter 22 - Investment Property and Cash Surrender Value PDFDocument16 pagesChapter 22 - Investment Property and Cash Surrender Value PDFTurksNo ratings yet

- Reviewer - Intangible AssetsDocument7 pagesReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- IAS 16 - Property, Plant & Equipment (PPE)Document63 pagesIAS 16 - Property, Plant & Equipment (PPE)ali muzamilNo ratings yet

- Business Proposal PolRem Company PhilippinesDocument54 pagesBusiness Proposal PolRem Company PhilippinesAlfredo Jr FortuNo ratings yet

- Financial Asset at Amortized CostDocument14 pagesFinancial Asset at Amortized CostLorenzo Diaz DipadNo ratings yet

- Investment in Debt Securities Exercises IacDocument5 pagesInvestment in Debt Securities Exercises Iacpamela50% (2)

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- Acctg 201A Midterm Exam 1st Sem 20-21 QuestionsDocument10 pagesAcctg 201A Midterm Exam 1st Sem 20-21 QuestionsYameteKudasaiNo ratings yet

- Module 12 - Investment PropertyDocument15 pagesModule 12 - Investment PropertyJehPoyNo ratings yet

- Case 1 - Computations of GW or IFADocument3 pagesCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- Wasting AssetsDocument4 pagesWasting AssetsAnn Lorraine Mamales0% (1)

- Investment QuizDocument7 pagesInvestment Quizshek100% (2)

- D. in Any of TheseDocument3 pagesD. in Any of TheseAlrac Garcia100% (1)

- Far 09 Government GrantsDocument9 pagesFar 09 Government GrantsJoshua UmaliNo ratings yet

- Non Profit AccountingDocument50 pagesNon Profit AccountingcooolzzzguyNo ratings yet

- FAR - Biological Assets and Agricultural ProduceDocument2 pagesFAR - Biological Assets and Agricultural ProduceMariella Catacutan67% (3)

- Chapter 19 Financial Statement Analysis AnswerDocument53 pagesChapter 19 Financial Statement Analysis AnswerHằngNo ratings yet

- FAR16 Share Capital Transactions - For PrintDocument9 pagesFAR16 Share Capital Transactions - For PrintAJ CresmundoNo ratings yet

- Audit of InvestmentsDocument9 pagesAudit of InvestmentsGirlie SisonNo ratings yet

- AP-5903 - PPE & IntangiblesDocument10 pagesAP-5903 - PPE & Intangiblesxxxxxxxxx100% (1)

- Module 2: Investment PropertyDocument8 pagesModule 2: Investment PropertyThe Brain Dump PH100% (1)

- PFR Cases San BedaDocument37 pagesPFR Cases San BedaAJ CresmundoNo ratings yet

- Acquisition of Property 1 1Document50 pagesAcquisition of Property 1 1Jefferson Penino100% (1)

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- Wasting AssetsDocument4 pagesWasting AssetsjomelNo ratings yet

- FAR17 Dividends - With AnsDocument7 pagesFAR17 Dividends - With AnsAJ CresmundoNo ratings yet

- ch13 PDFDocument83 pagesch13 PDFCoita Dewi100% (1)

- Pas 38Document8 pagesPas 38AngelicaNo ratings yet

- DocxDocument15 pagesDocxjhouvanNo ratings yet

- FAR09 Biological Assets - With AnswerDocument9 pagesFAR09 Biological Assets - With AnswerAJ Cresmundo50% (4)

- 50cb2fca 1597910723873pdf PDF FreeDocument10 pages50cb2fca 1597910723873pdf PDF FreefarandiNo ratings yet

- FAR - Investment Property - StudentDocument3 pagesFAR - Investment Property - StudentEdel Kristen BarcarseNo ratings yet

- Investment in Equity Securities 1Document11 pagesInvestment in Equity Securities 1dfsdfdsfNo ratings yet

- FAR14 Financial Liabilities - With AnsDocument9 pagesFAR14 Financial Liabilities - With AnsAJ CresmundoNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Audit of Inventory and Production Cycle Part 2Document10 pagesAudit of Inventory and Production Cycle Part 2AJ Cresmundo100% (1)

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- AnswerQuiz - Module 7Document3 pagesAnswerQuiz - Module 7Alyanna AlcantaraNo ratings yet

- 17 - Land, Building & MachineryDocument3 pages17 - Land, Building & Machineryjaymark canayaNo ratings yet

- CH 17Document37 pagesCH 17Claire Anne Sulam0% (1)

- CPM - PDF 1Document44 pagesCPM - PDF 1LokeshNo ratings yet

- Chapter 22 - Intangible AssetsDocument9 pagesChapter 22 - Intangible AssetsXiena100% (1)

- Strategic Planning and Capital BudgetingDocument32 pagesStrategic Planning and Capital BudgetingKeeiiiyyttt Joie100% (5)

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- CONFRACS - Module 7 - Non-Current Assets Held For SaleDocument14 pagesCONFRACS - Module 7 - Non-Current Assets Held For SaleMatth FlorezNo ratings yet

- Pisodira PDFDocument46 pagesPisodira PDFjhouvanNo ratings yet

- P1.110 Investment Property.Document1 pageP1.110 Investment Property.aleish0301100% (1)

- Cui Vs Arellano University, 112 Phil 135: ST STDocument14 pagesCui Vs Arellano University, 112 Phil 135: ST STAJ CresmundoNo ratings yet

- 12th Commerce HSC Book Keeping Accountancy SolutionsDocument12 pages12th Commerce HSC Book Keeping Accountancy SolutionsShraddha Pawar100% (1)

- Ict 2 Finals Exam Besa Bsa2aDocument4 pagesIct 2 Finals Exam Besa Bsa2aJoyce Ann Cortez100% (1)

- FAR13 Noncurrent Assets Held For Sale - With AnsDocument10 pagesFAR13 Noncurrent Assets Held For Sale - With AnsAJ Cresmundo67% (3)

- Solutions-IAS 40Document7 pagesSolutions-IAS 40Blitz KaizerNo ratings yet

- Borrowing CostsDocument19 pagesBorrowing CostsIrfan100% (20)

- Equity Instruments Include All of The Following, ExceptDocument5 pagesEquity Instruments Include All of The Following, ExceptEzra Mae SangcoNo ratings yet

- Related Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - TheoryDocument6 pagesRelated Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - Theorymae cruzNo ratings yet

- Exercise InvestmentsDocument14 pagesExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Financial Asset at Fair ValueDocument38 pagesFinancial Asset at Fair ValueShiela Marie SolisNo ratings yet

- BFJPIA Cup 1 - Theory of AccountsDocument7 pagesBFJPIA Cup 1 - Theory of AccountsAnne Lorrheine CasanosNo ratings yet

- PPE Problem SetDocument18 pagesPPE Problem SetJustz LimNo ratings yet

- Investment PropertyDocument2 pagesInvestment Propertytopnotcher2011No ratings yet

- D15Document12 pagesD15neo14No ratings yet

- 2 Impairment LossDocument2 pages2 Impairment LossNeighvestNo ratings yet

- MODULE 5 - Investment Property: 3.1.1 Definition & NatureDocument12 pagesMODULE 5 - Investment Property: 3.1.1 Definition & NatureCj BarrettoNo ratings yet

- Combined Revision FileDocument79 pagesCombined Revision Filestreakof happinesssNo ratings yet

- Audit of Investment PropertyDocument5 pagesAudit of Investment PropertyzennongraeNo ratings yet

- PAS 40 ScannedDocument17 pagesPAS 40 ScannedMae PandoraNo ratings yet

- Pas 40Document5 pagesPas 40Carmel Therese100% (1)

- Case Number: 10 Title: Barretto (Plaintiff) vs. Gonzalez (Defendant) G.R. Number: G.R. No. L-37048 Date: March 7, 1933Document9 pagesCase Number: 10 Title: Barretto (Plaintiff) vs. Gonzalez (Defendant) G.R. Number: G.R. No. L-37048 Date: March 7, 1933AJ CresmundoNo ratings yet

- Case No: 5 TITTLE: People Vs Bitdu G.R. No.: L-38230 DATE: November 21, 1933Document7 pagesCase No: 5 TITTLE: People Vs Bitdu G.R. No.: L-38230 DATE: November 21, 1933AJ CresmundoNo ratings yet

- The Law Where The Property Is SituatedDocument8 pagesThe Law Where The Property Is SituatedAJ CresmundoNo ratings yet

- 55 Herminia Borja Manzano VS Judge Roque R. SanchezDocument1 page55 Herminia Borja Manzano VS Judge Roque R. SanchezAJ CresmundoNo ratings yet

- Case Number: 9 TITLE: Juan Miciano V Andre Brimo CITATION: GR No.22595, November 1, 1927 - 50 Phil 867 FactsDocument5 pagesCase Number: 9 TITLE: Juan Miciano V Andre Brimo CITATION: GR No.22595, November 1, 1927 - 50 Phil 867 FactsAJ CresmundoNo ratings yet

- Garcia Vs Receio, G.R No. 138322Document2 pagesGarcia Vs Receio, G.R No. 138322AJ CresmundoNo ratings yet

- Nikko Hotel Manila Garden and Ruby Lim vs. Roberto Reyes, A.K.A. "Amay Bisaya" G.R. No. 154259 February 28, 2005 FactsDocument5 pagesNikko Hotel Manila Garden and Ruby Lim vs. Roberto Reyes, A.K.A. "Amay Bisaya" G.R. No. 154259 February 28, 2005 FactsAJ CresmundoNo ratings yet

- 16 EtcDocument13 pages16 EtcAJ CresmundoNo ratings yet

- Non Excusat". Without Publication, The People Have No Means of Knowing What P.DDocument9 pagesNon Excusat". Without Publication, The People Have No Means of Knowing What P.DAJ CresmundoNo ratings yet

- Descriptive Analytics SpssDocument104 pagesDescriptive Analytics SpssAJ CresmundoNo ratings yet

- Case No: 3 Title: Philippine International Trading Corporation v. Ho. Judge Zosimo Z. Angeles G.R. No. 108461 Date: October 21, 1996 FactsDocument12 pagesCase No: 3 Title: Philippine International Trading Corporation v. Ho. Judge Zosimo Z. Angeles G.R. No. 108461 Date: October 21, 1996 FactsAJ CresmundoNo ratings yet

- Financial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."Document19 pagesFinancial Reporting For School Organizations: "Learning How To Prepare Your Financial Reports The Proper Way."AJ CresmundoNo ratings yet

- Far 01Document27 pagesFar 01AJ CresmundoNo ratings yet

- PFR Cases 4Document27 pagesPFR Cases 4AJ CresmundoNo ratings yet

- Sum of Years' Digit (SYD)Document2 pagesSum of Years' Digit (SYD)Queenie ValleNo ratings yet

- MSQ-08 Capital BudgetingDocument15 pagesMSQ-08 Capital BudgetingElin SaldañaNo ratings yet

- 01 Value and Capital Budgeting SlidesDocument164 pages01 Value and Capital Budgeting SlidesFernandoNo ratings yet

- Principle Course Outline AGRICALTUREDocument7 pagesPrinciple Course Outline AGRICALTUREHussen Abdulkadir100% (1)

- 6804 - Statement of Comprehensive IncomeDocument2 pages6804 - Statement of Comprehensive IncomeAins M. BantuasNo ratings yet

- HDFC Financial Reports AnalysisDocument7 pagesHDFC Financial Reports Analysissanskritibharti8No ratings yet

- Non-Current AssetsDocument6 pagesNon-Current AssetsMaryam EhsanNo ratings yet

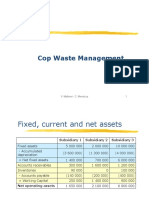

- Cop Waste Management SolutionDocument5 pagesCop Waste Management SolutionPaul GhanimehNo ratings yet

- Redisgn by Srwa Hidayat PDFDocument149 pagesRedisgn by Srwa Hidayat PDFmahnazNo ratings yet

- What Is A Plant AssetDocument23 pagesWhat Is A Plant AssetMiton AlamNo ratings yet

- Chapter 19 IAS 41 AgriculturalDocument10 pagesChapter 19 IAS 41 AgriculturalKelvin Chu JYNo ratings yet

- Ms04 Cost Behavior and Cost ClassificationDocument7 pagesMs04 Cost Behavior and Cost ClassificationAshley BrevaNo ratings yet

- Midterm Examination 2Document4 pagesMidterm Examination 2Nhật Anh OfficialNo ratings yet

- AFN0005Document4 pagesAFN0005AiDLoNo ratings yet

- Final RequirementDocument46 pagesFinal RequirementJosie Marie Daragosa ParameNo ratings yet

- Forex Good PDFDocument80 pagesForex Good PDFsudheeraryaNo ratings yet

- Finals P.O.ADocument8 pagesFinals P.O.AKennneth TamondongNo ratings yet

- Individual Assignment - 03 June 2020 - AFE3691Document11 pagesIndividual Assignment - 03 June 2020 - AFE3691Nambahu PinehasNo ratings yet

- Pre Test Dan Quiz 1 2Document9 pagesPre Test Dan Quiz 1 2Devenda Kartika RoffandiNo ratings yet

- AC2101 SemGrp4 Team2 UpdatedDocument38 pagesAC2101 SemGrp4 Team2 UpdatedKwang Yi JuinNo ratings yet