Professional Documents

Culture Documents

ELSS - Effective Way of Tax Planning & Creation of Wealth

Uploaded by

SINGH SAABOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ELSS - Effective Way of Tax Planning & Creation of Wealth

Uploaded by

SINGH SAABCopyright:

Available Formats

ELSS - Effective way of Tax planning & creation of Wealth

PPF vs ELSS

PPF (Return = 8.83%) SBI Magnum Taxgain Scheme (Return = 17.58%)

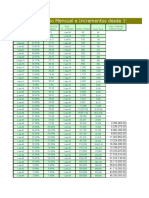

Investment Investment Interest Investment Investment NAV (`) Units

Dates Amount (`) Rate Dates Amount (`)

Mar-1993 1,50,000 12% Mar-1993 1,50,000 10.0000 15000.00

Mar-1994 1,50,000 12% Mar-1994 1,50,000 14.2800 10504.20

Mar-1995 1,50,000 12% Mar-1995 1,50,000 13.8500 10830.32

Mar-1995 15.0500 2414.25

Mar-1996 1,50,000 12% Mar-1996 1,50,000 10.4300 14381.59

Mar-1996 10.4200 4079.11

Mar-1997 1,50,000 12% Mar-1997 1,50,000 9.1989 16306.30

Mar-1998 1,50,000 12% Mar-1998 1,50,000 10.1050 14844.14

Mar-1999 1,50,000 12% Mar-1999 1,50,000 16.1027 9315.21

Dec-1999 36.2324 6739.49

Mar-2000 1,50,000 From 01.04.1999 to 14.01.2000 - 12% Mar-2000 1,50,000 52.7151 2845.48

From 15.01.2000 to 31.03.2000 - 11%

Mar-2001 1,50,000 From 01.04.2000 to 28.02.2001 - 11% Mar-2001 1,50,000 14.3400 10460.25

From 01.03.2001 to 31.03.2001 - 9.5%

Mar-2002 1,50,000 From 01.04.2001 to 28.02.2002 - 9.5% Mar-2002 1,50,000 13.1000 11450.38

From 01.03.2002 to 31.03.2002 - 9%

Mar-2003 1,50,000 From 01.04.2002 to 28.02.2003 - 9% Mar-2003 1,50,000 10.6700 14058.11

From 01.03.2003 to 31.03.2003 - 8%

Sep-2003 17.2300 12469.14

Jan-2004 25.8900 9020.74

Mar-2004 22.0300 11215.53

Mar-2004 1,50,000 8% Mar-2004 1,50,000 22.3100 6723.44

Nov-2004 26.4800 18624.46

Mar-2005 1,50,000 8% Mar-2005 1,50,000 38.5700 3889.03

Jun-2005 37.1800 56286.87

Mar-2006 44.3700 88390.15

Mar-2006 1,50,000 8% Mar-2006 1,50,000 46.0700 3255.91

Mar-2007 42.5500 91284.26

Mar-2007 1,50,000 8% Mar-2007 1,50,000 42.4200 3536.07

Feb-2008 47.7800 103121.99

Mar-2008 1,50,000 8% Mar-2008 1,50,000 41.5000 3614.46

Mar-2009 1,50,000 8% Mar-2009 1,50,000 25.1200 5971.34

May-2009 34.6600 45290.54

Mar-2010 38.7900 62482.37

Mar-2010 1,50,000 8% Mar-2010 1,50,000 39.4000 3807.11

Mar-2011 34.2600 78483.62

Mar-2011 1,50,000 8% Mar-2011 1,50,000 36.6700 4090.54

Mar-2012 31.5200 83811.94

Mar-2012 1,50,000 From 01.04.2011 to 30.11.2011 - 8%, Mar-2012 1,50,000 32.0500 4680.19

From 01.12.2011 to 31.03.2012 - 8.6%

Mar-2013 30.8878 95554.71

Mar-2013 1,50,000 8.80% Mar-2013 1,50,000 30.8836 4856.95

Mar-2014 34.5688 95546.15

Mar-2014 1,50,000 8.70% Mar-2014 1,50,000 34.6545 4328.44

Mar-2015 51.8907 110609.54

Mar-2015 1,50,000 8.70% Mar-2015 1,50,000 45.6143 3288.44

Mar-2016 36.4523 127011.22

Mar-2016 1,50,000 8.70% Mar-2016 1,50,000 37.7949 3968.79

Mar-2017 41.1004 125394.67

Mar-2017 1,50,000 7.90% Mar-2017 1,50,000 41.5127 3613.35

Mar-2018 41.3443 137136.27

Mar-2018 1,50,000 From 01.04.2017 to 30.06.2017 - 7.9%, Mar-2018 1,50,000 40.9647 3661.69

From 01.07.2011 to 31.12.2017 - 7.8%,

From 01.01.2018 to 31.03.2018 - 7.6%

Amount Invested: `39 lakhs Amount Invested: `39 lakhs

Value: `1.44 crores Fund Value: `6.33 crores

Data as on: 30th November, 2018.

Note: Cumulative units given above has been adjusted for dividend reinvestment. For simplicity, we have assumed a yearly investment of `1.5 lakh per year. In reality, the PPF limit was different for different

years, ranging from `60,000 to `1.5 lakh.

SSK_DEC_2018_SBI MUTUAL FUND_11086330_ELSS VS_ PPF Comparison Leaflet_21 W X 29.7 H_CM.

Dividend Reinvested

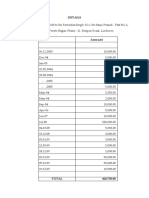

Record Date % of Dividend Record Date % of Dividend

31-Mar-1995 10 29-May-2009 28

31-Mar-1996 8 05-Mar-2010 40

15-Dec-1999 25 18-Mar-2011 40

29-Sep-2003 15 22-Mar-2012 35

01-Jan-2004 15 28-Mar-2013 35

29-Mar-2004 15 28-Mar-2014 35

01-Nov-2004 27 27-Mar-2015 55

13-Jun-2005 102 11-Mar-2016 40

13-Mar-2006 150 17-Mar-2017 40

02-Mar-2007 110 09-Mar-2018 40

15-Feb-2008 110

Highlights Low Lock-in Period of Tax Saving Investment:

Compared to traditional tax saving instruments like PPF,

• Tax benefit on investments up to `1.5 lakh NSC and Bank FDs; the lock-in period of an ELSS scheme

under Section 80 C of Income Tax Act, 1961 is much lower.

• 3 years lock-in period

Lock-in Period

• Available in SIP and Lump sum investment Investment Option (years)

options Public Provident Fund (PPF) 15

National Savings Certificate (NSC) 6

Bank Fixed Deposits 5

Equity Linked Savings Scheme 3

PPF: Partial withdrawals are allowed from the 6th financial year, however the full amount can be

withdrawn after 15 years.

Top 10 Holdings in Top 10 Sectors Exposure in

SBI Magnum Taxgain Scheme SBI Magnum Taxgain Scheme

Stock Name % of Total AUM Industry (%) of AUM

ICICI BANK LTD. 5.73 FINANCIAL SERVICES 27.53

CONSUMER GOODS 12.29

INFOSYS LTD. 4.92

IT 9.38

ITC LTD. 4.66 PHARMA 8.46

HDFC BANK LTD. 4.12 ENERGY 6.85

AUTOMOBILE 6.36

RELIANCE INDUSTRIES LTD. 4.02

CONSTRUCTION 4.75

LARSEN & TOUBRO LTD. 3.57 CEMENT & CEMENT PRODUCTS 4.04

INDUSTRIAL MANUFACTURING 3.34

AXIS BANK LTD. 3.27

TELECOM 3.07

STATE BANK OF INDIA 3.26

AMBUJA CEMENTS LTD. 3.21

HCL TECHNOLOGIES LTD. 3.12

Grand Total 39.90

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You might also like

- How ELSS funds can help with tax planning and wealth creationDocument2 pagesHow ELSS funds can help with tax planning and wealth creationLoknath AgarwallaNo ratings yet

- ELSS Tax Planning Wealth CreationDocument1 pageELSS Tax Planning Wealth CreationmukeshNo ratings yet

- "Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiDocument17 pages"Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiPrakash SharmaNo ratings yet

- Easymeat DataDocument1 pageEasymeat DataFaraz AliNo ratings yet

- Dmr Bt-1ipuw-4ms-Tkp Siklus 2 ( 3april2024 )Document1 pageDmr Bt-1ipuw-4ms-Tkp Siklus 2 ( 3april2024 )Ahmad irfan ArifinNo ratings yet

- Merck TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMerck TBK.: Company Report: January 2019 As of 31 January 2019hudaNo ratings yet

- Lecture 10. The Great ModerationDocument41 pagesLecture 10. The Great Moderation100331798No ratings yet

- HDFC Updated Elss Vs PPF 28th Feb 2017Document31 pagesHDFC Updated Elss Vs PPF 28th Feb 2017Mukesh KumarNo ratings yet

- Refined Projections For UnemploymentDocument4 pagesRefined Projections For Unemploymentkettle1No ratings yet

- RLC net income growth 40Document2 pagesRLC net income growth 40Louis PatNo ratings yet

- Small Scale Industries by Anas AhamadDocument17 pagesSmall Scale Industries by Anas AhamadMd Anas Ahmed AnasNo ratings yet

- Avg - Ori Failure %Document15 pagesAvg - Ori Failure %narendraiit2003No ratings yet

- Rainfall Analysis For The Month of January in Tuguegarao, CagayanDocument10 pagesRainfall Analysis For The Month of January in Tuguegarao, CagayanDianne Abigail CatliNo ratings yet

- SA Revenue Service Interest Rates GuideDocument2 pagesSA Revenue Service Interest Rates GuidelarisagavrilaNo ratings yet

- Quantitative Techniques For Management ApplicationsDocument8 pagesQuantitative Techniques For Management ApplicationsLakshaya KaushalNo ratings yet

- Años 1996 1997 1998 1999 2000 Liquidez CorrienteDocument5 pagesAños 1996 1997 1998 1999 2000 Liquidez CorrienteRafael MirandaNo ratings yet

- Daryvel ArdimerDocument6 pagesDaryvel ArdimerAubrey DacerNo ratings yet

- Backtesting Name: Profits and LossesDocument4 pagesBacktesting Name: Profits and LossesPaul BertotNo ratings yet

- Cigarette Industry Financial AnalysisDocument12 pagesCigarette Industry Financial AnalysispavanNo ratings yet

- Sensex Vs FD PPF Gold Silver 1981 2018Document1 pageSensex Vs FD PPF Gold Silver 1981 2018SaiSudheerreddy AnnareddyNo ratings yet

- Copia de PRACTICA 2 CALCULO DE MORA E INTERES INDEMNIZATORIODocument2 pagesCopia de PRACTICA 2 CALCULO DE MORA E INTERES INDEMNIZATORIOebuttenNo ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet

- Delta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesDelta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- Case 51 Palamon Capital Partners Team System SPADocument10 pagesCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- SPREADSHEET - When To Buy Stocks (TIMING THE MARKET PERFECTLY)Document24 pagesSPREADSHEET - When To Buy Stocks (TIMING THE MARKET PERFECTLY)Barrie GoenawiNo ratings yet

- South Suburban - EastDocument1 pageSouth Suburban - EastpsobaniaNo ratings yet

- UnitPrice EdibleOils MostUsed BiodieselProdDocument7 pagesUnitPrice EdibleOils MostUsed BiodieselProdomarNo ratings yet

- Analyze 5-Year Stock Data for Dow Jones Industrial AverageDocument103 pagesAnalyze 5-Year Stock Data for Dow Jones Industrial AveragePoorni ShivaramNo ratings yet

- Ekadharma International Tbk. (S)Document3 pagesEkadharma International Tbk. (S)RomziNo ratings yet

- Petroleum Update For DistributionDocument2 pagesPetroleum Update For Distributionmwirishscot2100% (4)

- Commodity Research Report 12 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 12 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- LAPD Pub IRT 2012 01 Interest Rate Table 1Document3 pagesLAPD Pub IRT 2012 01 Interest Rate Table 1Natasha Fouche-RoetsNo ratings yet

- Petroleum Historical DataDocument4 pagesPetroleum Historical Datamwirishscot2100% (2)

- Palm oil vs Palm Kernel Oil price and ROC comparisonDocument14 pagesPalm oil vs Palm Kernel Oil price and ROC comparisonAndika WijayaNo ratings yet

- Saving TrackerDocument2 pagesSaving TrackerDanica Marie DanielNo ratings yet

- Saving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDocument2 pagesSaving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDanica Marie DanielNo ratings yet

- Financial Calculation of Ratios Of: By:-Awish Mirza Baig 9202155Document20 pagesFinancial Calculation of Ratios Of: By:-Awish Mirza Baig 9202155awishmirzaNo ratings yet

- ACT HISTÓRICO SMM y CuantíasDocument9 pagesACT HISTÓRICO SMM y CuantíasJose BustamanteNo ratings yet

- 02-Apr-20 Early Bird ReportDocument2 pages02-Apr-20 Early Bird ReportAdiltufail AdilNo ratings yet

- Historical NSS Interest Rate-FinalDocument2 pagesHistorical NSS Interest Rate-FinalSohel RanaNo ratings yet

- Capital Market Development in Sri Lanka from 2003-2018Document32 pagesCapital Market Development in Sri Lanka from 2003-2018asha peirisNo ratings yet

- Share PriceDocument1 pageShare PricetmagicNo ratings yet

- LAPD Pub IRT 2012 01 Interest Rate Table 1Document2 pagesLAPD Pub IRT 2012 01 Interest Rate Table 1Gila TobiasNo ratings yet

- Dmr Bt-1ipuw-4ms-Tkp Siklus 2 ( 1april2024 )Document1 pageDmr Bt-1ipuw-4ms-Tkp Siklus 2 ( 1april2024 )Ahmad irfan ArifinNo ratings yet

- DLTADocument3 pagesDLTArenieNo ratings yet

- Gizelle Aliposa Jemina Apostol Cedric Beraquit Reigh Franz BiacoloDocument31 pagesGizelle Aliposa Jemina Apostol Cedric Beraquit Reigh Franz BiacoloReigh FrNo ratings yet

- Asgr PDFDocument3 pagesAsgr PDFyohannestampubolonNo ratings yet

- Asuransi Ramayana TBKDocument3 pagesAsuransi Ramayana TBKSanesNo ratings yet

- Market Year Imports Unit of Measure Growth Rate: SourceDocument9 pagesMarket Year Imports Unit of Measure Growth Rate: SourceNikita AroraNo ratings yet

- DetailsDocument1 pageDetailsPerumandla LaxminarayanaNo ratings yet

- Excel Safety Stock AbcSupplyChain enDocument16 pagesExcel Safety Stock AbcSupplyChain enSameh RadwanNo ratings yet

- Menghitung Variance PortofolioDocument11 pagesMenghitung Variance PortofolioSteve MedhurstNo ratings yet

- Commodity Research Report 06 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 06 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Group Assignment 2: Country Selected: ItalyDocument2 pagesGroup Assignment 2: Country Selected: ItalyAbhijitNo ratings yet

- How to maximize your retirement savings in EcuadorDocument9 pagesHow to maximize your retirement savings in EcuadorTania Apaza MarquezNo ratings yet

- Hidrologia Anggi-1Document230 pagesHidrologia Anggi-1LUIS FERNANDO BARRIOS MUÑOZNo ratings yet

- Reducing Unsystematic Risk Through Industry Diversification: Company TickersDocument12 pagesReducing Unsystematic Risk Through Industry Diversification: Company TickersAnchal jainNo ratings yet

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- Wurgler Baker Investor SentimentDocument23 pagesWurgler Baker Investor SentimentJohnathan WangNo ratings yet

- Lecture 9 - Pricing - Understanding and Capturing Customer ValueDocument22 pagesLecture 9 - Pricing - Understanding and Capturing Customer ValueBridivaNo ratings yet

- Level III of CFA Program Mock Exam 1 - Questions (PM)Document32 pagesLevel III of CFA Program Mock Exam 1 - Questions (PM)Lê Chấn Phong100% (1)

- Financial Management:: Prof .Ritu SapraDocument34 pagesFinancial Management:: Prof .Ritu SapraGitanshiNo ratings yet

- 4th Sem SyllabusDocument3 pages4th Sem SyllabusAnil ChaurasiaNo ratings yet

- Online Trading in India: A Project Report on Emergence and Operations of E-BrokingDocument68 pagesOnline Trading in India: A Project Report on Emergence and Operations of E-BrokingSatvinder Tiwana100% (1)

- Introduction To Financial Derivatives: Presented by Arjun Parthasarathy 28 June 2006Document39 pagesIntroduction To Financial Derivatives: Presented by Arjun Parthasarathy 28 June 2006Harsh ShahNo ratings yet

- Gulf Venture Capital Association - Private Equity in The Middle East 2007Document100 pagesGulf Venture Capital Association - Private Equity in The Middle East 2007Qamar Zaman100% (5)

- Paper - The P-E RatioDocument10 pagesPaper - The P-E RatioAngsumanMitraNo ratings yet

- Engulfing Candlestick Trading StrategyDocument20 pagesEngulfing Candlestick Trading StrategyAaron AlibiNo ratings yet

- Week 2 Customer ExperienceDocument15 pagesWeek 2 Customer ExperienceHussein MubasshirNo ratings yet

- Investing in Stocks vs Bonds and Mutual FundsDocument36 pagesInvesting in Stocks vs Bonds and Mutual FundsGiselle Bronda CastañedaNo ratings yet

- Exhibit 5 KEXUAN YAO FRAUDLENT LEGAL OpinionDocument8 pagesExhibit 5 KEXUAN YAO FRAUDLENT LEGAL OpinionAdam LemboNo ratings yet

- Chapter 16 (Dilutive and Earning Per Share)Document2 pagesChapter 16 (Dilutive and Earning Per Share)dinar100% (1)

- If - Review MT - CompressedDocument24 pagesIf - Review MT - CompressedPhương AnhNo ratings yet

- FM423 - 2020 ExamDocument7 pagesFM423 - 2020 ExamSimon GalvizNo ratings yet

- Internal assignment on mutual fund law, fees, worth and ethical concernsDocument3 pagesInternal assignment on mutual fund law, fees, worth and ethical concernsShashwat ShuklaNo ratings yet

- Petrobras Bond Issue (A)Document10 pagesPetrobras Bond Issue (A)Andres Emeric ARNo ratings yet

- Derivatives and Risk Management: What Does Forward Contract MeanDocument9 pagesDerivatives and Risk Management: What Does Forward Contract MeanMd Hafizul HaqueNo ratings yet

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoNo ratings yet

- ACCT 302 Financial Reporting II Lecture 7Document63 pagesACCT 302 Financial Reporting II Lecture 7Jesse NelsonNo ratings yet

- Long Call Butterfly: Montréal ExchangeDocument2 pagesLong Call Butterfly: Montréal ExchangepkkothariNo ratings yet

- CekaDocument3 pagesCekaChitra DwiNo ratings yet

- MKT1713 Group-AssignmentDocument11 pagesMKT1713 Group-AssignmentLe Tran Duy Khanh (K17 HCM)No ratings yet

- Quiz Lesson 5 Inflation ProtectionDocument5 pagesQuiz Lesson 5 Inflation ProtectionAKNo ratings yet

- Advanced Accounting: Stock Investments - Investor Accounting and ReportingDocument40 pagesAdvanced Accounting: Stock Investments - Investor Accounting and Reporting19-Geby Agnes LG100% (2)

- Accounting Summary Session 1 - Tilburg University (Entrepreneurship and Business Innovation)Document2 pagesAccounting Summary Session 1 - Tilburg University (Entrepreneurship and Business Innovation)harald d'oultremontNo ratings yet

- Geethendar KumarDocument11 pagesGeethendar KumarkhayyumNo ratings yet

- The Complete Guide To Breakout Trading PDFDocument45 pagesThe Complete Guide To Breakout Trading PDFJithin Raaj100% (8)

- Trading Parameters FWBDocument1 pageTrading Parameters FWBJesu JesuNo ratings yet