Professional Documents

Culture Documents

Dividend Reinvested Record Date % of Dividend

Uploaded by

mukesh0 ratings0% found this document useful (0 votes)

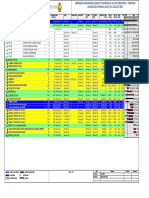

5 views1 pageThis document compares the performance of investments in SBI Magnum Taxgain Scheme, a tax saving FD, and PPF over multiple years from 1993 to 2014. It shows the annual investment amounts, NAV/interest rates, dividends/bonuses earned, and ending units/balances for each investment option over this period. The SBI equity fund provided the highest returns, followed by PPF and the tax saving FD. This highlights that ELSS funds can be an effective way for tax planning and wealth creation compared to other savings instruments.

Original Description:

Original Title

ELSS 150000

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document compares the performance of investments in SBI Magnum Taxgain Scheme, a tax saving FD, and PPF over multiple years from 1993 to 2014. It shows the annual investment amounts, NAV/interest rates, dividends/bonuses earned, and ending units/balances for each investment option over this period. The SBI equity fund provided the highest returns, followed by PPF and the tax saving FD. This highlights that ELSS funds can be an effective way for tax planning and wealth creation compared to other savings instruments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageDividend Reinvested Record Date % of Dividend

Uploaded by

mukeshThis document compares the performance of investments in SBI Magnum Taxgain Scheme, a tax saving FD, and PPF over multiple years from 1993 to 2014. It shows the annual investment amounts, NAV/interest rates, dividends/bonuses earned, and ending units/balances for each investment option over this period. The SBI equity fund provided the highest returns, followed by PPF and the tax saving FD. This highlights that ELSS funds can be an effective way for tax planning and wealth creation compared to other savings instruments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

ELSS - Effective way of Tax planning & creation of Wealth

SBI Magnum Taxgain Scheme Tax saving FD PPF

Investment Investment Dividend/ Investment Investment Investment Investment Interest Rate

NAV (Rs.) Units Interest Rate

Dates Amount (Rs.) Bonus Dates Amount (Rs.) Dates Amount (Rs.)

Mar-93 1,50,000 10.00 15000.00 -- Mar-93 1,50,000 11.00% Mar-93 1,50,000 12%

Mar-94 1,50,000 14.28 10504.20 -- Mar-94 1,50,000 10.00% Mar-94 1,50,000 12%

Mar-95 1,50,000 13.85 10830.32 -- Mar-95 1,50,000 11.00% Mar-95 1,50,000 12%

31-Mar-95 -- 15.05 2414.25 10 -- -- -- -- -- --

Mar-96 1,50,000 10.43 14381.59 -- Mar-96 1,50,000 13.00% Mar-96 1,50,000 12%

31-Mar-96 -- 10.42 4079.11 8 -- -- -- -- -- --

Mar-97 1,50,000 9.20 16306.30 -- Mar-97 1,50,000 13.00% Mar-97 1,50,000 12%

Mar-98 1,50,000 10.11 14844.14 -- Mar-98 1,50,000 12.00% Mar-98 1,50,000 12%

Mar-99 1,50,000 16.10 9315.21 -- Mar-99 1,50,000 11.50% Mar-99 1,50,000 12%

15-Dec-99 -- 36.2324 6739.49 25 -- -- -- -- -- --

Mar-00 1,50,000 52.72 2845.48 -- Mar-00 1,50,000 10.50% Mar-00 1,50,000 From 01.04.1999 to 14.01.2000

- 12%, From 15.01.2000 to

31.03.2000 - 11%

Mar-01 1,50,000 14.34 10460.25 -- Mar-01 1,50,000 10.00% Mar-01 1,50,000 From 01.04.2000 to 28.02.2001

- 11%, From 01.03.2001 to

31.03.2001 - 9.5%

Mar-02 1,50,000 13.10 11450.38 -- Mar-02 1,50,000 8.50% Mar-02 1,50,000 From 01.04.2001 to 28.02.2002

- 9.5%, From 01.03.2002 to

31.03.2002 - 9%

Mar-03 1,50,000 10.67 14058.11 -- Mar-03 1,50,000 6.25% Mar-03 1,50,000 From 01.04.2002 to 28.02.2003

- 9%, From 01.03.2003 to

31.03.2003 - 8%

29-Sep-03 -- 17.23 12469.14 15 -- -- -- -- -- --

01-Jan-04 -- 25.89 9020.74 15 -- -- -- -- -- --

29-Mar-04 -- 22.03 11215.53 15 -- -- -- -- -- --

Mar-04 1,50,000 22.31 6723.44 -- Mar-04 1,50,000 5.50% Mar-04 1,50,000 8%

01-Nov-04 -- 26.48 18624.46 27 -- -- -- -- -- --

Mar-05 1,50,000 38.57 3889.03 -- Mar-05 1,50,000 6.25% Mar-05 1,50,000 8%

13-Jun-05 -- 37.18 56286.87 102 -- -- -- -- -- --

13-Mar-06 -- 44.37 88390.15 150 -- -- -- -- -- --

Mar-06 1,50,000 46.07 3255.91 -- Mar-06 1,50,000 7.00% Mar-06 1,50,000 8%

02-Mar-07 -- 42.55 91284.26 110 -- -- -- -- -- --

Mar-07 1,50,000 42.42 3536.07 -- Mar-07 1,50,000 9.50% Mar-07 1,50,000 8%

15-Feb-08 -- 47.78 103121.99 110 -- -- -- -- -- --

Mar-08 1,50,000 41.50 3614.46 -- Mar-08 1,50,000 8.75% Mar-08 1,50,000 8%

Mar-09 1,50,000 25.12 5971.34 -- Mar-09 1,50,000 8.50% Mar-09 1,50,000 8%

29-May-09 -- 34.66 45290.54 28 -- -- -- -- -- --

05-Mar-10 -- 38.79 62482.37 40 -- -- -- -- -- --

Mar-10 1,50,000 39.40 3807.11 -- Mar-10 1,50,000 7.50% Mar-10 1,50,000 8%

18-Mar-11 -- 34.26 78483.62 40 -- -- -- -- -- --

Mar-11 1,50,000 36.67 4090.54 -- Mar-11 1,50,000 8.75% Mar-11 1,50,000 8%

22-Mar-12 -- 31.52 83811.94 35 -- -- -- -- -- --

Mar-12 1,50,000 32.05 4680.19 -- Mar-12 1,50,000 9.25% Mar-12 1,50,000 From 01.04.2011 to 30.11.2011

- 8%, From 01.12.2011 to

31.03.2012 - 8.6%

28-Mar-13 -- 30.89 95554.71 35 -- -- -- -- -- --

Mar-13 1,50,000 30.88 4856.95 -- Mar-13 1,50,000 9.00% Mar-13 1,50,000 8.80%

28-Mar-14 -- 34.57 95546.15 35 -- -- -- -- -- --

Mar-14 1,50,000 34.65 4328.44 Mar-14 1,50,000 8.50% Mar-14 1,50,000 8.70%

27-Mar-15 -- 51.89 110609.54 55 -- -- -- -- -- --

Mar-15 1,50,000 45.61 3288.44 Mar-15 1,50,000 8.50% Mar-15 1,50,000 8.70%

11-Mar-16 -- 36.45 127011.22 40 -- -- -- -- -- --

Mar-16 1,50,000 37.79 3968.79 Mar-16 1,50,000 7.00% Mar-16 1,50,000 8.70%

Amount Invested: Rs. 36,00,000 Amount Invested: Rs. 36,00,000 Amount Invested: Rs. 36,00,000

Installment Amount: Rs 1,50,000 P.A Installment Amount: Rs 1,50,000 P.A Installment Amount: Rs 1,50,000 P.A

No Of Installments: 24 No Of Installments: 24 No Of Installments: 24

Total Units - 12,88,442.77

NAV as on 30 - Sep - 2016 = 43.4613 Fund Value (As on 30-Sep-2016): Rs. 1,17,15,290 Fund Value (As on 30-Sep-2016): Rs. 1,19,95,666

Fund Value(As on 30-Sep-2016): Rs 5,59,97,398

Return = 19.08% Return = 8.81% Return = 8.97%

Calculations is done for dividend option assuming dividend declared has been reivested at the prevailing NAV

Cumulative units given above has been adjusted for dividend reinvestment

Mutual Fund investment are subject to Market Risk. Past Performance is no guarantee of future results.

For FD, interest rates are for 5 year FD. It has been assumed that maturity value of the FD has been reinvested at the prevailing FD interest rates on 5 year rolling basis.

Deduction under section 80 C for FD has been strated from 2006 only.

Interest rate source: RBI & SBI

This is for internal circulation only.

Dividend Reinvested

Record Date % of dividend

31-Mar-95 10

31-Mar-96 8

15-Dec-99 25

29-Sep-03 15

01-Jan-04 15

29-Mar-04 15

01-Nov-04 27

13-Jun-05 102

13-Mar-06 150

02-Mar-07 110

15-Feb-08 110

29-May-09 28

05-Mar-10 40

18-Mar-11 40

22-Mar-12 35

28-Mar-13 35

28-Mar-14 35

27-Mar-15 55

11-Mar-16 40

You might also like

- The Complete Guide To Donchian Channel Indicator PDFDocument19 pagesThe Complete Guide To Donchian Channel Indicator PDFDiky Arifin100% (7)

- ELSS - Effective Way of Tax Planning & Creation of WealthDocument2 pagesELSS - Effective Way of Tax Planning & Creation of WealthLoknath AgarwallaNo ratings yet

- ELSS - Effective Way of Tax Planning & Creation of WealthDocument2 pagesELSS - Effective Way of Tax Planning & Creation of WealthSINGH SAABNo ratings yet

- Historical NSS Interest Rate-FinalDocument2 pagesHistorical NSS Interest Rate-FinalSohel RanaNo ratings yet

- South Suburban - EastDocument1 pageSouth Suburban - EastpsobaniaNo ratings yet

- Ibs Temerloh Nor Aiman Hakim Bin Zulkifli No 23 Jalan 16/1, Taman Setia Jasa 28000 TEMERLOH, TEMERLOH, 28000, PAHANG MYS 1 31/12/2021 156057633742Document1 pageIbs Temerloh Nor Aiman Hakim Bin Zulkifli No 23 Jalan 16/1, Taman Setia Jasa 28000 TEMERLOH, TEMERLOH, 28000, PAHANG MYS 1 31/12/2021 156057633742aiman hakimNo ratings yet

- PostOfficeSavingSchemes InterestRatesDocument11 pagesPostOfficeSavingSchemes InterestRatesbanstalaNo ratings yet

- "Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiDocument17 pages"Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiPrakash SharmaNo ratings yet

- Thanjavur JL-6Document1 pageThanjavur JL-6dummycircle43No ratings yet

- InterestRatesTable2April2010Document2 pagesInterestRatesTable2April2010larisagavrilaNo ratings yet

- MSCI Frontier Markets Small Cap Index (USD)Document3 pagesMSCI Frontier Markets Small Cap Index (USD)Cường KhuấtNo ratings yet

- Rekapitulasi RevDocument8 pagesRekapitulasi RevSeptian Yudha AgungNo ratings yet

- Share PriceDocument1 pageShare PricetmagicNo ratings yet

- Global Hedge Fund Secondary Market IndexDocument1 pageGlobal Hedge Fund Secondary Market IndexZerohedgeNo ratings yet

- Growth of $1.00: Using Randomized Returns: Dates DjiDocument16 pagesGrowth of $1.00: Using Randomized Returns: Dates DjiPoorni ShivaramNo ratings yet

- HDFC Updated Elss Vs PPF 28th Feb 2017Document31 pagesHDFC Updated Elss Vs PPF 28th Feb 2017Mukesh KumarNo ratings yet

- Thanjavur JL-3Document2 pagesThanjavur JL-3dummycircle43No ratings yet

- Hedgebay Index - July 2010Document2 pagesHedgebay Index - July 2010economicburnNo ratings yet

- ACT HISTÓRICO SMM y CuantíasDocument9 pagesACT HISTÓRICO SMM y CuantíasJose BustamanteNo ratings yet

- Petroleum Historical DataDocument4 pagesPetroleum Historical Datamwirishscot2100% (2)

- LAPD Pub IRT 2012 01 Interest Rate Table 1Document3 pagesLAPD Pub IRT 2012 01 Interest Rate Table 1Natasha Fouche-RoetsNo ratings yet

- Date Price Open High Low Ange %Document35 pagesDate Price Open High Low Ange %DewaniNo ratings yet

- Copy (2) of Monthly & Halfly Crop StatementDocument9 pagesCopy (2) of Monthly & Halfly Crop StatementwaniedNo ratings yet

- Ata 9 - DC9Document59 pagesAta 9 - DC9TomasNo ratings yet

- Calculo de Intereses Legales LaboralesDocument2 pagesCalculo de Intereses Legales LaboralesJoel sNo ratings yet

- Future PricingDocument16 pagesFuture PricingShraman SinglaNo ratings yet

- DMR Bt-1ipuw-4ms-Tkp Siklus 2 (3april2024)Document1 pageDMR Bt-1ipuw-4ms-Tkp Siklus 2 (3april2024)Ahmad irfan ArifinNo ratings yet

- Velocity of MoneyDocument1 pageVelocity of MoneyGood Myrmidon100% (1)

- Answer Sheet v2Document4 pagesAnswer Sheet v2wflflNo ratings yet

- Mini Project - Rain GaugesDocument11 pagesMini Project - Rain Gaugesamin shukriNo ratings yet

- DividendhistoryDocument1 pageDividendhistorydevansh kakkarNo ratings yet

- Thanjavur JL-2Document2 pagesThanjavur JL-2dummycircle43No ratings yet

- FMDQ Daily Quotations List 1-Jul-21: Confidential - MSGDocument4 pagesFMDQ Daily Quotations List 1-Jul-21: Confidential - MSGDareNo ratings yet

- 115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii NeteDocument9 pages115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii Netemircea_ghitescuNo ratings yet

- Saving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDocument2 pagesSaving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDanica Marie DanielNo ratings yet

- Saving TrackerDocument2 pagesSaving TrackerDanica Marie DanielNo ratings yet

- Ibs Kuala Terengganu Muhammad Al Amin Bin Yanto 4039 Kampung Teluk Menara Manir 21200 Kuala Terengganu 1 31/12/2021 163019853119Document2 pagesIbs Kuala Terengganu Muhammad Al Amin Bin Yanto 4039 Kampung Teluk Menara Manir 21200 Kuala Terengganu 1 31/12/2021 163019853119Yanto Al AminNo ratings yet

- Small Scale Industries by Anas AhamadDocument17 pagesSmall Scale Industries by Anas AhamadMd Anas Ahmed AnasNo ratings yet

- Pemberlakuan Stop Selling SO NDS & RO (FID3) April 2023Document9 pagesPemberlakuan Stop Selling SO NDS & RO (FID3) April 2023kholilNo ratings yet

- LAPD Pub IRT 2012 01 Interest Rate Table 1Document2 pagesLAPD Pub IRT 2012 01 Interest Rate Table 1Gila TobiasNo ratings yet

- Cash Disbursement Jan 2020Document60 pagesCash Disbursement Jan 2020Jomar DomingoNo ratings yet

- Position-Sizing-Calculator RupeesDocument36 pagesPosition-Sizing-Calculator RupeesJoy MasseyNo ratings yet

- Document Informativ CNPP - Ro: Informatii Din Carnetul de MuncaDocument3 pagesDocument Informativ CNPP - Ro: Informatii Din Carnetul de MuncaMarin TotirliciNo ratings yet

- ITC LTD.: Presented ByDocument12 pagesITC LTD.: Presented BypavanNo ratings yet

- Lynx Fund Performance SummaryDocument2 pagesLynx Fund Performance Summarymrobertson3890No ratings yet

- Dividend StatDocument1 pageDividend StatPrajapati MeetNo ratings yet

- Data Aras NewDocument27 pagesData Aras NewJobar LoNo ratings yet

- Uneven Cash Flow CalculatorDocument5 pagesUneven Cash Flow CalculatorGomv ConsNo ratings yet

- Fiscal FactDocument6 pagesFiscal FactlakecountyohNo ratings yet

- 1 Liq. Pesos 305Document4 pages1 Liq. Pesos 305Danilo Acosta PerezNo ratings yet

- Intro 01 DesarrolladoDocument15 pagesIntro 01 DesarrolladoOscar Villafuerte InocenteNo ratings yet

- Denver Metro - OverallDocument1 pageDenver Metro - OverallpsobaniaNo ratings yet

- Cálculo - Valores AtrasadosDocument1 pageCálculo - Valores AtrasadosCristiane SouzaNo ratings yet

- Remedial Measure Remedial Measures Against Flooding in Al JouDocument1 pageRemedial Measure Remedial Measures Against Flooding in Al JouamjuNo ratings yet

- Latest Home Loan History of Interest Rate31032018Document8 pagesLatest Home Loan History of Interest Rate31032018Koti SNo ratings yet

- EUR YearsDocument8 pagesEUR YearsVesa ZeqirajNo ratings yet

- Control Relleno-CarreterasDocument10 pagesControl Relleno-CarreterasHenry QmNo ratings yet

- Net Rate 250121Document3 pagesNet Rate 250121Am BornNo ratings yet

- Balanced Fund NewDocument2 pagesBalanced Fund NewmukeshNo ratings yet

- Housing Loan Vs SipDocument1 pageHousing Loan Vs SipmukeshNo ratings yet

- MF SchemesDocument1 pageMF SchemesmukeshNo ratings yet

- Bank FD Vs Balanced FundsDocument1 pageBank FD Vs Balanced FundsmukeshNo ratings yet

- Gujarat Technological University: Syllabus For New MBA Program Effective From Academic Year 2011-12Document23 pagesGujarat Technological University: Syllabus For New MBA Program Effective From Academic Year 2011-12poojaNo ratings yet

- 4.3.c-Technology and IndustrializationDocument23 pages4.3.c-Technology and Industrializationjjamppong09No ratings yet

- Tata Case SolutionDocument10 pagesTata Case Solutionshantanu_malviya_1100% (1)

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating ActivitiesIrfan MansoorNo ratings yet

- Tgs Minggu 3 (Problem 3-2,3-5,3-7)Document7 pagesTgs Minggu 3 (Problem 3-2,3-5,3-7)Ca AdaNo ratings yet

- New Microsoft Office Word DocumentDocument13 pagesNew Microsoft Office Word DocumentKhushboo AgrawalNo ratings yet

- Understanding The Gold Silver RatioDocument7 pagesUnderstanding The Gold Silver RatioVIKAS ARORANo ratings yet

- Account Statement/Confirmation of Transactions: Settled Position(s)Document1 pageAccount Statement/Confirmation of Transactions: Settled Position(s)mohammad qadafiNo ratings yet

- Topic 1Document5 pagesTopic 1fazlinhashimNo ratings yet

- Blackbook Project On Credit Rating SystemDocument88 pagesBlackbook Project On Credit Rating SystemAnkit Chheda0% (1)

- A Study On Analysis of Relationship Between Risk and Return of Reliance Mutual FundDocument24 pagesA Study On Analysis of Relationship Between Risk and Return of Reliance Mutual FundsharathambaNo ratings yet

- Investment Analysis & Portfolio Theory: Mba-IiDocument117 pagesInvestment Analysis & Portfolio Theory: Mba-IiSiidraa TahirNo ratings yet

- Chapter 7 - Q&ADocument16 pagesChapter 7 - Q&APro TenNo ratings yet

- Essentials To ICTDocument19 pagesEssentials To ICTTS100% (9)

- Notes - You Can Be A Stock Market GeniusDocument2 pagesNotes - You Can Be A Stock Market GeniusRyan ReitzNo ratings yet

- You Have Been Recently Hired As A Financial Analyst WhenDocument1 pageYou Have Been Recently Hired As A Financial Analyst WhenHassan JanNo ratings yet

- 2.26 Sample Recent MBA Grad in Banking PDFDocument2 pages2.26 Sample Recent MBA Grad in Banking PDFD7mey XNo ratings yet

- Advisorkhoj LIC Mutual Fund ArticleDocument6 pagesAdvisorkhoj LIC Mutual Fund ArticleHariprasad ManchiNo ratings yet

- OCDE Toolkit de ConstrucciónDocument54 pagesOCDE Toolkit de ConstrucciónALBERTO GUAJARDO MENESESNo ratings yet

- Audit ProbDocument2 pagesAudit ProbZvioule Ma Fuentes0% (1)

- PE Ecosystem - PAI PartnersDocument4 pagesPE Ecosystem - PAI PartnersLeopold TikvicNo ratings yet

- Assignment BM014 3.5 3 DMKGDocument7 pagesAssignment BM014 3.5 3 DMKGDavid CarolNo ratings yet

- Econ 252 Spring 2011 Problem Set 6Document6 pagesEcon 252 Spring 2011 Problem Set 6Tu ShirotaNo ratings yet

- Image Image Image Image: Takeover Buybacks DelistingDocument5 pagesImage Image Image Image: Takeover Buybacks DelistingBhavin SagarNo ratings yet

- Glossary FinancialDocument2 pagesGlossary FinancialJULIETTE MISHELLE OSUNA BASTIDASNo ratings yet

- Basel IIIDocument6 pagesBasel IIIgauravgoluNo ratings yet

- Overview of Non-Bank Financial Institute of BangladeshDocument7 pagesOverview of Non-Bank Financial Institute of BangladeshSakib AhmedNo ratings yet

- 12 Accountancy - Goodwill - Nature and Valuation-Notes and Video LinkDocument10 pages12 Accountancy - Goodwill - Nature and Valuation-Notes and Video LinkEshan KotteNo ratings yet

- Transaction Request For Purchase / Switch / Redemption: Key Partner / Distributor InformationDocument1 pageTransaction Request For Purchase / Switch / Redemption: Key Partner / Distributor Informationvinodmapari105No ratings yet