Professional Documents

Culture Documents

Security Market Indices: Company ABC Closed at $20, and Company XYZ Closed at $60

Uploaded by

David PromiseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Security Market Indices: Company ABC Closed at $20, and Company XYZ Closed at $60

Uploaded by

David PromiseCopyright:

Available Formats

Security market indices

1(a) Examples of:

(1) Price weighted index it is an arithmetic average of the prices of the securities included in the

index. The divisor of a price-weighted index is adjusted for stock splits and changes in the

composition of the index when securities are added or deleted, such that the index value is

unaffected by such changes.

Example

Lets assume the market close on day 1, company ABC closed at $20, and company XYZ closed at $60 .

The value of a price-weighted index of these two stocks is ($20+$60) / 2 = 40 at the close of trading

If company XYZ incurred a 2-for-1 split the day after you computed your average, you would divide

$60 by 2 to get a split price of $30 .

The new denominator will be;

Add this new price to the other stock prices ($30+$20=$50)

Divide this value by the price-weighted average, computed on the day immediately before the stock

split $50/$40 =1.25 the new divisor. (C. Taylor, 2018)

By: C. Taylor

Reviewed by: Ryan Cockerham, CISI Capital Markets and Corporate Finance

Updated November 21, 2018

(ii) Equally weighted index it is calculated as the arithmetic average return of the index stocks.

Example

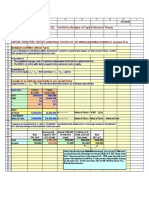

Let us assume there are four stocks in the equal-weighted index, Stock A, Stock B, Stock C, Stock D.

Prices of each stock are as follows:

STOCKS PRICE IN ($) WEIGHT PRODUCT

(100/4) (price*weig

ht)

A 100.00 25% 25

B 95.00 25% 23.75

C 115.00 25% 28.75

D 50.00 25% 12.50

Equally weighted =25+23.75+28.75.12.50 = 90

(iii) Market capitalization-weighted index is a capital market index in which the constituent

securities are weighted based on their market capitalization, which equals the product of its

price per share and total number of common shares outstanding. The weight of each security is

calculated by the ratio of its market capitalization to the sum of market capitalization of all

constituent securities.

Example

Work out the index value on 1 Jan 2017 and 31 Dec 2017 based on the following data:

Stock Price Market Capitalization

Shares

31 Dec

Stock Outstanding 1 Jan 2017 31 Dec 2017 1 Jan 2017

2017

(Q) (P0) (P1) (Q×P0)

(Q×P1)

A 25,000 $15 $20 $375,000 $500,000

B 50,000 $34 $40 $1,700,000 $2,000,000

C 100,000 $52 $60 $5,200,000 $6,000,000

D 50,000 $120 $100 $6,000,000 $5,000,000

Sum 225,000 $13,275,000 $13,500,000

Assuming the divisor is 1, weight will be worked as follows

$375,000

wA (1 Jan 2017) = = 2.82%

$13,275,000

Similarly, we work out that weights of Stock B, C and D are 12.81%, 39.17% and 45.20% respectively.

The weights for Stock A, B, C and D as on 31 Dec 2017 are 3.77%, 15.07%, 45.20% and 37.66%

respectively.

You can see that weights have increased where the stock price has increased and vice versa.

Index as at 1 Jan 2017

= 2.82%×$15 + 12.81%×$34 + 39.17%×$52 + 45.20%×$120

= 79.38

In the same fashion, we find out that the index value as at 31 Dec 2017 is 71.56. The biggest drag on the

index is the decline in price of Stock D because it has the highest weight

By Obaidullah Jan, ACA, CFA and last modified on May 23, 2019

Studying for CFA® Program? Access notes and question bank for CFA ® Level 1 authored by me

at AlphaBetaPrep.com

(iv) Commodity indices

You might also like

- Chapter 4 Security Market Indexes and Index FundsDocument9 pagesChapter 4 Security Market Indexes and Index FundsJilly AceNo ratings yet

- CH 5 Security Market IndexesDocument12 pagesCH 5 Security Market IndexesMoin khanNo ratings yet

- Stock MKT IndexesDocument14 pagesStock MKT IndexesRubab ButtNo ratings yet

- Chapter 5Document7 pagesChapter 5Mohammad AnikNo ratings yet

- Problem Set SolutioDocument5 pagesProblem Set SolutiosajedulNo ratings yet

- ECON 247 Practice Midterm Examination KeyDocument5 pagesECON 247 Practice Midterm Examination KeyRobyn ShirvanNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- PatelDivya-Week 3 AssignmentDocument9 pagesPatelDivya-Week 3 AssignmentDivya PatelNo ratings yet

- Break-Even AnalysisDocument3 pagesBreak-Even AnalysisFryda GarciaNo ratings yet

- Paper T7 Planning Control and Performance Management: Sample Multiple Choice Questions - June 2009Document6 pagesPaper T7 Planning Control and Performance Management: Sample Multiple Choice Questions - June 2009595580No ratings yet

- Quiz 1Document7 pagesQuiz 1qwertyuiopNo ratings yet

- FIN 435 Exam 1 SlidesDocument122 pagesFIN 435 Exam 1 SlidesMd. Mehedi HasanNo ratings yet

- Entrep. Module 7... Grade 12 BezosDocument8 pagesEntrep. Module 7... Grade 12 Bezosadrian lozano100% (5)

- Variance Analysi1Document2 pagesVariance Analysi1Elliot RichardNo ratings yet

- FIN 435 - Exam 1 SlidesDocument122 pagesFIN 435 - Exam 1 SlidesshifatNo ratings yet

- Depreciation CH 10Document5 pagesDepreciation CH 10Bitta Saha HridoyNo ratings yet

- Entrep Module7Document5 pagesEntrep Module7Justine BenitezNo ratings yet

- Ch27 Tool KitADocument4 pagesCh27 Tool KitARoy HemenwayNo ratings yet

- Chapter 2 Questions and AnswersDocument11 pagesChapter 2 Questions and AnswersNoor TaherNo ratings yet

- Tugas Kelompok: Ramadion W.J Berly Berlian Stanley Ihsan F Mihamaf Farhan Josef LDocument4 pagesTugas Kelompok: Ramadion W.J Berly Berlian Stanley Ihsan F Mihamaf Farhan Josef LJulius StanleyNo ratings yet

- Bản Sao Math-Chap-3Document18 pagesBản Sao Math-Chap-3youngandbeautifull666No ratings yet

- Final TestDocument9 pagesFinal TestIqtidar KhanNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- BKM9e-Answers-Chap003-Margin and Short Extra QuestionsDocument3 pagesBKM9e-Answers-Chap003-Margin and Short Extra QuestionsLê Chấn PhongNo ratings yet

- CVP2 MarkupsDocument19 pagesCVP2 MarkupsWaleed J.No ratings yet

- Intro To Re ExcelDocument16 pagesIntro To Re Excelnina9121No ratings yet

- Peer Review Form: Only Have Less People in Your Team)Document7 pagesPeer Review Form: Only Have Less People in Your Team)dangkhanhhuyen294No ratings yet

- WEEK 2 - FNSACC503A - Budgeting - WORKED EXAMPLES PDFDocument7 pagesWEEK 2 - FNSACC503A - Budgeting - WORKED EXAMPLES PDFgrandoverallNo ratings yet

- Security AnalysisDocument6 pagesSecurity AnalysisNicole LabbaoNo ratings yet

- Topic 5 Securities Market IndicesDocument21 pagesTopic 5 Securities Market IndicesOne AshleyNo ratings yet

- Chapter 9 Depreciation, Amortization and DepletionDocument11 pagesChapter 9 Depreciation, Amortization and DepletionKrissa Mae Longos100% (1)

- PPE - Part - 2. CHAPTER16Document36 pagesPPE - Part - 2. CHAPTER16Ms Vampire100% (1)

- Mid-Term Exam, Semester A, 2018-2019Document10 pagesMid-Term Exam, Semester A, 2018-2019李晶晶No ratings yet

- EPS Calculations (AutoRecovered)Document3 pagesEPS Calculations (AutoRecovered)ernest mwandihiNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- CH # 8 (By Product)Document10 pagesCH # 8 (By Product)Rooh Ullah KhanNo ratings yet

- Quantic MBA Accounting Project - Class of Sept 2024 Group 58Document7 pagesQuantic MBA Accounting Project - Class of Sept 2024 Group 58Eng Chee Liang100% (1)

- Diluted EPS TutorialDocument3 pagesDiluted EPS TutorialRawan YasserNo ratings yet

- Leverage: 1) Operating Leverage (Associated With Operating Risk) - 2) Financial Leverage (Associated With Financial Risk)Document18 pagesLeverage: 1) Operating Leverage (Associated With Operating Risk) - 2) Financial Leverage (Associated With Financial Risk)ShashankNo ratings yet

- Assignment 7 - Fiyan Wahyu Setyandi - 2002413001 - Manufaktur Lanjutan 2ADocument11 pagesAssignment 7 - Fiyan Wahyu Setyandi - 2002413001 - Manufaktur Lanjutan 2Alucu dan kerenNo ratings yet

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDocument15 pagesChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNo ratings yet

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocument11 pagesChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANo ratings yet

- Calculating Index Values and PerformanceDocument5 pagesCalculating Index Values and Performancemuneebmateen01No ratings yet

- JeromeWorswick9e SSM CH04Document14 pagesJeromeWorswick9e SSM CH04ivonneNo ratings yet

- Chap 3 M4B TT 1Document10 pagesChap 3 M4B TT 1Mai Phương AnhNo ratings yet

- Kami Export - What Is Stock?Document6 pagesKami Export - What Is Stock?Sama NazimiNo ratings yet

- LeverageDocument19 pagesLeverageAnu Srii IngarsalNo ratings yet

- How To Compile An INDEX Like The CPI: Step 1Document2 pagesHow To Compile An INDEX Like The CPI: Step 1OlebogengPNo ratings yet

- MolinaDiannaLynn A220 Chapter 16 Problem 3Document4 pagesMolinaDiannaLynn A220 Chapter 16 Problem 3Dianna Lynn MolinaNo ratings yet

- Final Exam: Cpa Exam Questions & Additional ExercisesDocument24 pagesFinal Exam: Cpa Exam Questions & Additional Exercisessino akoNo ratings yet

- Revision Sheet Dr. SaraDocument17 pagesRevision Sheet Dr. SaraSeif HishamNo ratings yet

- Si-5161 Manajemen Infrastruktur: Tugas 2Document5 pagesSi-5161 Manajemen Infrastruktur: Tugas 2radenroro28No ratings yet

- Cost of Capital WorksheetDocument11 pagesCost of Capital WorksheetNatalie Godgotme RoseNo ratings yet

- Tugas Kelompok Akmen 2Document4 pagesTugas Kelompok Akmen 2Vanni Lim100% (1)

- Security Market Indexes Chapter 5 PDFDocument18 pagesSecurity Market Indexes Chapter 5 PDFShihabHasanNo ratings yet

- Full Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full Chapterhomelingcomposedvqve100% (18)

- Chapter 8Document3 pagesChapter 8Yasmeen YoussefNo ratings yet

- DepreciationDocument4 pagesDepreciationMùhammad TàhaNo ratings yet

- Assignement - QTM (Quantitive Techique MGT)Document23 pagesAssignement - QTM (Quantitive Techique MGT)Nimit Gupta100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tinynet (Mytyvm) : Creating Virtual MachinesDocument38 pagesTinynet (Mytyvm) : Creating Virtual MachinesSayyam ChNo ratings yet

- Assignment 2 DC Machines-SolutionsDocument6 pagesAssignment 2 DC Machines-SolutionsBRUNO TUMBANANo ratings yet

- Weidner - Fulcanelli's Final RevelationDocument22 pagesWeidner - Fulcanelli's Final Revelationjosnup100% (3)

- Science, Technoloy and Society Prelim ExamDocument14 pagesScience, Technoloy and Society Prelim ExamIman Official (Em-J)No ratings yet

- STT Tecnica QuirúrgicaDocument5 pagesSTT Tecnica QuirúrgicaNathaly GuevaraNo ratings yet

- This Study Resource Was: Management Consultancy June Dane Yuri D. Abieras BSA-5Document5 pagesThis Study Resource Was: Management Consultancy June Dane Yuri D. Abieras BSA-5Jicell FerrerNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2JOSHUA GABATERONo ratings yet

- Brochure PerformanceDocument11 pagesBrochure PerformanceprabumnNo ratings yet

- Amigurumi Angel FishDocument3 pagesAmigurumi Angel FishcapricorntranNo ratings yet

- BKS IyengarDocument2 pagesBKS IyengarArvindChauhanNo ratings yet

- Unit 7 Idioms Are ImportantDocument8 pagesUnit 7 Idioms Are ImportantKaja HrabarNo ratings yet

- Hammer Group SeptDec 2023Document5 pagesHammer Group SeptDec 2023Adilah AzamNo ratings yet

- Ucsp LM PDFDocument124 pagesUcsp LM PDFAivonny Peñaranda CorbitaNo ratings yet

- Tugas DMD GROUP 01Document8 pagesTugas DMD GROUP 01ulviqhj354No ratings yet

- My Mother at SixtysixDocument18 pagesMy Mother at SixtysixAnoushka RaiNo ratings yet

- Tarc Acc t2Document4 pagesTarc Acc t2Shirley VunNo ratings yet

- ARUBA 303 SERIES DatasheetDocument7 pagesARUBA 303 SERIES DatasheethendraNo ratings yet

- LG Neon2Document4 pagesLG Neon2LorenzoNo ratings yet

- 3rd Quarter DLP 20 MODULE 2Document4 pages3rd Quarter DLP 20 MODULE 2Jim Alesther LapinaNo ratings yet

- Ukraine - A History PDFDocument887 pagesUkraine - A History PDFFidel Trejo Orozco100% (9)

- Moxa Iologik E1200 Series Manual v15.2Document129 pagesMoxa Iologik E1200 Series Manual v15.2yeng menNo ratings yet

- Ramesh Patel Resume (Civil) 02Document4 pagesRamesh Patel Resume (Civil) 02RameshNo ratings yet

- (Computer Science and Engineering) : University of Engineering & Management (UEM), JaipurDocument35 pages(Computer Science and Engineering) : University of Engineering & Management (UEM), JaipurDeepanshu SharmaNo ratings yet

- Pathorchur Coleus Aromaticus A Review of The MedicDocument9 pagesPathorchur Coleus Aromaticus A Review of The MedicDung NguyenNo ratings yet

- Guide in The Preparation of Manual of OperationDocument3 pagesGuide in The Preparation of Manual of Operationerickson_villeta50% (2)

- Tlacaelel's Descendants and The Authorship of The Historia Mexicana (Stephen A. Colston)Document4 pagesTlacaelel's Descendants and The Authorship of The Historia Mexicana (Stephen A. Colston)sakeke87No ratings yet

- One Pager by Capgemini Mechanical Design and Simulation ServicesDocument4 pagesOne Pager by Capgemini Mechanical Design and Simulation ServicesSmita GadreNo ratings yet

- Assignment On Rules of InferenceDocument1 pageAssignment On Rules of InferenceAlone100% (1)

- L 8 UniDocument3 pagesL 8 Unidaina AaAaNo ratings yet

- AP Macroeconomics Review Sheet 2013Document7 pagesAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)