Professional Documents

Culture Documents

Financial Statements and Adjusting Entries

Uploaded by

ALI ZAFAR� LIAQAT UnknownOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements and Adjusting Entries

Uploaded by

ALI ZAFAR� LIAQAT UnknownCopyright:

Available Formats

FINANCIAL STATEMENTS AND ADJUSTING ENTRIES

FINANCIAL STATEMENTS:

Financial statements are summaries of financial activities. Financial statements are prepared on a

regular basis at the end of an accounting period and are used to communicate important

accounting information.

ACCOUNTING PERIOD:

An accounting period is the time frame for which a business prepares its financial statements

and reports its financial performance and position to external stakeholders. This could be after

three, six or twelve months. The accounting period usually coincides with the business'

fiscal year.

INCOME STATEMENT:

A summary of business revenue and expenses for a specific period of time, such as month or a

year.

STATEMENT OF OWNERS EQUITY:

A summary of the changes that have occurred in owner’s equity during a specific period of time,

such as a month or a year.

BALANCE SHEET:

A listing of a firm’s assets, liabilities and owners equity at a specific point in time, such as the

last day of a month or the last day of year.

GUIDE FOR FINANCIAL STAEMENTS PREPERATIONS:

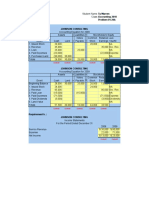

NEW COMB COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2020

Revenue:

Service revenue $100,000,00

Expenses:

Salaries expense $300,000

Rent expense 200,000

Utilities expense 100,000

Total expenses 600,000

Net income $400,000

NEW COMB COMPANY

STATEMENT OF OWNERS EQUITY

FOR THE YEAR ENDED DECEMBER 31, 2020

Todd Newcomb,Capital,January 1,2020 $900,000

Net income for period $400,000

Less: Withdrawls 200,000

Increase in Capital $200,000

Todd Newcomb,Capital,December 31,2020 $11,00,000

NEW COMB COMPANY

BALANCE SHEET

DECEMBER 31, 2020

ASSETS

Cash $300,000

Accounts receivable 200,000

Supplies 100,000

Equipment 600,000

Total Assets $12,00,000

LIABILITIES

Accounts payable $100,000

OWNERS EQUITY

Todd Newcomb Capital $11,00,000

Total liabilities and owners equity $12,00,000

PRACTICE QUESTION:

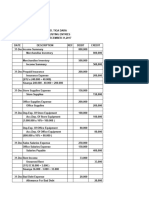

Marilyn Johnson, Attorney at Law

Trial Balance

July 31, 1990

ACCOUNTS TITLE DEBIT CREDIT

Cash 1375000

Account receivable 20000

Supplies 200000

Equipment 3000000

Account payable 2500000

Marilyn Johnson Capital 2000000

Drawings 70000

Legal fees earned 400000

Salaries expense 150000

Rent expense 60000

Utility expense 25000

Totals 4900000 4900000

SOLUTION:

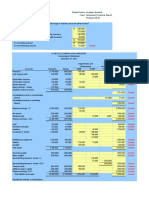

MARILYN JOHNSON ATTORNEY AT LAW

INCOME STATEMENT

FOR THE MONTH ENDED JULY 31, 1990

Revenue:

Legal fees earned $4,000,00

Expenses:

Salaries expense $150,000

Rent expense 60,000

Utilities expense 25,000

Total expenses 235,000

Net income $165,000

MARILYN JOHNSON ATTORNEY AT LAW

STATEMENT OF OWNERS EQUITY

FOR THE MONTH ENDED JULY 31, 1990

Marilyn, Johnson,Capital,July 1,2020 $200,0000

Net income for the month $165,000

Less: Withdrawls 70,000

Increase in Capital $95,000

Marilyn, Johnson,Capital,July 31,2020 $20,95,000

MARILYN JOHNSON ATTORNEY AT LAW

BALANCE SHEET

JULY 31, 1990

ASSETS

Cash $1375,000

Accounts receivable 20,000

Supplies 200,000

Equipment 3000,000

Total Assets $45,95,000

LIABILITIES

Accounts payable $25,00,000

OWNERS EQUITY

Marilyn Johnson Capital $20,95,000

Total liabilities and owners equity $45,95,000

You might also like

- Problem 01-29A Requirement A.: Johnson Consulting: Acct. Title/RE NADocument5 pagesProblem 01-29A Requirement A.: Johnson Consulting: Acct. Title/RE NATDUB003No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Corporate Finance Practice ProblemsDocument9 pagesCorporate Finance Practice ProblemsEunice NanaNo ratings yet

- AFA Questions - Students HandoutDocument51 pagesAFA Questions - Students HandoutDusabamahoro JoniveNo ratings yet

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Mrs. O'Donnell BAT4M0Document5 pagesMrs. O'Donnell BAT4M0Alene AmsaluNo ratings yet

- ACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDocument24 pagesACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDewdrop Mae RafananNo ratings yet

- Drill Corporate LiquidationDocument3 pagesDrill Corporate LiquidationElizabeth DumawalNo ratings yet

- IFRS 3 Practical CasesDocument8 pagesIFRS 3 Practical CasesScribdTranslationsNo ratings yet

- Razon Financiera Ch06-9Document4 pagesRazon Financiera Ch06-9Jorge Latuya0% (1)

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- BUSI 1004 B - Week 2Document3 pagesBUSI 1004 B - Week 2AlexNo ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- AaaaaDocument2 pagesAaaaaMondays AndNo ratings yet

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (1)

- Partnership Distribution ScheduleDocument7 pagesPartnership Distribution ScheduleMagdy KamelNo ratings yet

- Dilemma Company Financial Statement 2020Document1 pageDilemma Company Financial Statement 2020Tish ViennaNo ratings yet

- Mid term examDocument6 pagesMid term examWaizin KyawNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet

- Week 2 Requirement: Name: Puray, Ma. Lorraine M - Course: BSA-1 Class Schedule: M-F (7:00-8:50 Am)Document10 pagesWeek 2 Requirement: Name: Puray, Ma. Lorraine M - Course: BSA-1 Class Schedule: M-F (7:00-8:50 Am)Lorraine Millama PurayNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- ACCT 1005 Financial Accounting Worksheet SolutionsDocument2 pagesACCT 1005 Financial Accounting Worksheet SolutionsChan SynergisticNo ratings yet

- Ferna CompanyDocument2 pagesFerna CompanyAngeliePanerioGonzaga100% (1)

- ACC136_MODULE_GUIDE_-_CopyDocument36 pagesACC136_MODULE_GUIDE_-_Copymcskelta8No ratings yet

- Asset: TOTAL: 1,560,000 Liabilities Current LiabilitiesDocument2 pagesAsset: TOTAL: 1,560,000 Liabilities Current LiabilitiesKchess myNo ratings yet

- Cap 8 SolutDocument11 pagesCap 8 Solutpedroza676904No ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Advance Accounting AssigmentDocument16 pagesAdvance Accounting AssigmentAsfawosen DingamaNo ratings yet

- FABM2 (QUIZ 2) November 09, 2020 Ian BregueraDocument2 pagesFABM2 (QUIZ 2) November 09, 2020 Ian Breguerafennie ilinah molinaNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Accounting Cycle Chapter 4 Class ActivityDocument13 pagesAccounting Cycle Chapter 4 Class ActivitykhanNo ratings yet

- Problem 2-2: InstructionsDocument6 pagesProblem 2-2: InstructionsMohd ZuhairNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- Marcus Enterprises Statement of Profit and Loss For The Year Ended December 31, 201xDocument4 pagesMarcus Enterprises Statement of Profit and Loss For The Year Ended December 31, 201xJasmine ActaNo ratings yet

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- 2018-Spring-Fin - Acct.-Final ALTERNATE Exam-1Document6 pages2018-Spring-Fin - Acct.-Final ALTERNATE Exam-1RealGenius (Carl)No ratings yet

- Accounting for margin of safety, break-even pointDocument5 pagesAccounting for margin of safety, break-even pointRheu ReyesNo ratings yet

- Assessment Task 1 Marcus EnterpriseDocument3 pagesAssessment Task 1 Marcus EnterpriseChristian Paul LloverasNo ratings yet

- Solution Tutorial 1Document2 pagesSolution Tutorial 1KHANH Du NgocNo ratings yet

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Problem 2-3 Financial Statements Income Statement Retained Earnings Balance Sheet Cash FlowsDocument3 pagesProblem 2-3 Financial Statements Income Statement Retained Earnings Balance Sheet Cash FlowsGenivy SalidoNo ratings yet

- Accounting Assignment CHP 1-1Document11 pagesAccounting Assignment CHP 1-1MUHAMMAD AMMAD ARSHADNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Single/Multiple Step Income Statements, Owners Equity Statements, Classified Balance SheetsDocument11 pagesSingle/Multiple Step Income Statements, Owners Equity Statements, Classified Balance SheetsShuvro Chakravorty100% (1)

- S. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BDocument3 pagesS. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BALI ZAFAR� LIAQAT UnknownNo ratings yet

- Accouting Equation HandoutDocument5 pagesAccouting Equation HandoutALI ZAFAR� LIAQAT UnknownNo ratings yet

- Assignment:: (I) (Ii) (Iii) (Iv) (V) (Vi) (Vii)Document3 pagesAssignment:: (I) (Ii) (Iii) (Iv) (V) (Vi) (Vii)ALI ZAFAR� LIAQAT Unknown100% (1)

- Accounting Is An Art of RecordingDocument2 pagesAccounting Is An Art of RecordingALI ZAFAR� LIAQAT UnknownNo ratings yet

- EC Assignment 1Document9 pagesEC Assignment 1Shubhankar BansalNo ratings yet

- FIN5FMA Tutorial 2 SolutionsDocument7 pagesFIN5FMA Tutorial 2 SolutionsSanthiya MogenNo ratings yet

- Hilton SamplechapterDocument41 pagesHilton SamplechapterNinikKurniatyNo ratings yet

- SLFI610-Project Appraisal & FinanceDocument2 pagesSLFI610-Project Appraisal & FinanceVivek GujralNo ratings yet

- Understanding Corporation AccountingDocument19 pagesUnderstanding Corporation AccountingMellanie Serrano100% (3)

- Punjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Document18 pagesPunjab National Bank Vs Mithilanchal Industries PvGJ202001092015405363COM765549Sakshi ShettyNo ratings yet

- Futures and Options: Merits and Demerits: An Assignment By: PUROO SONI (15907)Document15 pagesFutures and Options: Merits and Demerits: An Assignment By: PUROO SONI (15907)Puroo SoniNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sanchita KunwerNo ratings yet

- Words Related With Business AdministrationDocument181 pagesWords Related With Business AdministrationRamazan MaçinNo ratings yet

- Annual Report 2012 Al Arafa BankDocument150 pagesAnnual Report 2012 Al Arafa BankWasik Abdullah MomitNo ratings yet

- KPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The BasicsDocument40 pagesKPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The Basicshui7411No ratings yet

- A Study On Finacial Advisor For Mutual Fund InvestorsDocument53 pagesA Study On Finacial Advisor For Mutual Fund InvestorsPrasanna Belligatti100% (1)

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- Illustration - 2022-11-03T115112.732Document3 pagesIllustration - 2022-11-03T115112.732BLOODY ASHHERNo ratings yet

- CH 03Document47 pagesCH 03api-3804982No ratings yet

- CEO Compesation: Presentation OnDocument11 pagesCEO Compesation: Presentation OnEra ChaudharyNo ratings yet

- FIN622 Online Quiz - PdfaDocument531 pagesFIN622 Online Quiz - Pdfazahidwahla1100% (3)

- Todd Combs Transcript Art of Investing 10 Oct 2023Document22 pagesTodd Combs Transcript Art of Investing 10 Oct 2023ACasey101No ratings yet

- Horngren Ima16 Tif 17 GEDocument53 pagesHorngren Ima16 Tif 17 GEasem shabanNo ratings yet

- Vista Equity Partners - 2017 Analyst PositionDocument4 pagesVista Equity Partners - 2017 Analyst PositionJonathan StewartNo ratings yet

- Accountancy NotesDocument23 pagesAccountancy NotesAlbana QemaliNo ratings yet

- Estmt - 2023 02 17Document6 pagesEstmt - 2023 02 17allan tu50% (2)

- TOLES Higher Paper 2 - p02-20Document19 pagesTOLES Higher Paper 2 - p02-20имя фамилияNo ratings yet

- Public Private PartnershipsDocument14 pagesPublic Private PartnershipsCharu ModiNo ratings yet

- Essay DraftDocument2 pagesEssay DraftWidodo MohammadNo ratings yet

- Zerodha Profit CalculatorDocument4 pagesZerodha Profit CalculatorvvpvarunNo ratings yet

- Basic Finance FormulasDocument1 pageBasic Finance Formulasmafe moraNo ratings yet

- Consumers' Perceptions of Reliance Life Insurance Health PlansDocument105 pagesConsumers' Perceptions of Reliance Life Insurance Health Plans2014rajpointNo ratings yet

- SWOT Analysis SummaryDocument16 pagesSWOT Analysis SummaryMaricres BiandoNo ratings yet

- Candle Anomaly Volume WarningDocument55 pagesCandle Anomaly Volume Warningsuresh100% (2)