Professional Documents

Culture Documents

Order Block Theory Private Study Notes Extracted From Various Entities

Order Block Theory Private Study Notes Extracted From Various Entities

Uploaded by

Arun kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Order Block Theory Private Study Notes Extracted From Various Entities

Order Block Theory Private Study Notes Extracted From Various Entities

Uploaded by

Arun kumarCopyright:

Available Formats

Order Block Theory private study notes extracted from various entities

Trading using ICT’S Institutional ORDER BLOCK Theory

1. Identify OBs using a Higher TFs i.e. start from the Daily TF then H4 TF. Determine your

order flow (Institutional Trend) using the D1 & H4 TFs.

2. Now that you have the Long Term directional/institutional bias, proceed to construct the

OBs in lower TFs i.e. H1 and M15. M15 being the Entry TF and Entries have to be in line

with the HIGHER TF Order Flow/Institutional bias because that’s where the real trend is

going.

3. When price breaks a previous OB (i.e. Closes above or Below an OB), we should wait for

an RTO (Return to Order Block), before Entry. Price should retest the OB after breaking it.

This Pattern is known as the Last Step Broken + Retest (LSB + Retest). You can trade the

break without waiting for a retest, however you must watch out for a possible return to

the broken OB.

With this Order Block Concept, we look forward to take trades from Source to Source.

i.e. taking a trade from PEAK to PEAK. That’s the aim.

4. H4 I M15 Integration.

Monthly Chart= Bearish.

Weekly Chart= Bearish.

Daily Chart= Bearish

it means the Lower TFs/Intraday charts H4, H1 and M15 will be Correcting/Retracing

Higher (i.e. making Lower Highs). This is where you Expect the price to enter into a

Premium (50+% bullish Retracement) and seek buy side liquidity to sell to.

Monthly Chart = Bullish

Weekly Chart = Bullish

Daily Chart = Bullish

It means intraday Charts 4 Hour and less will be Correcting or Retracing Lower (i.e.

making Higher Lows). This is where you anticipate the market to enter a Discount

(50+% bearish Retracement) and seek Sell Side Liquidity to Buy from.

L. TENGA WhatsApp +263779729280

1

Order Block Theory private study notes extracted from various entities

ICT INSTITUTIONAL ORDER BLOCK THEORY

What is an OB?

Institutions trade using order blocks.

The Order Block is a specific price range or candle where institutions will be buying or selling

against the retail trend/dump money.

Institutions leave order blocks for themselves to trade at a later stage.

They will reverse the price to a previous order and then driving the price hard in the direction of

the trend (The real institutional trend).

These order blocks we can also call them specific levels of either going Long or Short.

If an order block is violated or broken, it now qualifies as a Breaker, meaning Price will retest back

to that order block. Sometimes we call it a failed order block.

NB: YOU DON’T TRADE ORDER BLOCKS STRAIGHT AWAY, YOU WAIT FOR PRICE TO COME BACK

TO THAT ORDER BLOCK THEN YOU TAKE A TRADE.

L. TENGA WhatsApp +263779729280

2

Order Block Theory private study notes extracted from various entities

Types of OBs:

i. Bullish Order Block (BUB)

ii. Bearish Order Block (BEB)

The Order of OBs

1. Source OB

2. Breaker OB

3. Continuation OB (Traditional/Basic OB)

Bullish Source OB is the Lowest Candle or Price Bar with a Down Close that has the most range

between Open to Close and is near a “Support” level. The support level can be YL, WL, ML, ADR

Low…this is a Trend Reversal Order Block. It the last candle creating a Peak Formation Low I.e.

Lowest price point on the chart. Hence a Bullish SOB indicates a shift in Market Structure from

Bearish to Bullish.

L. TENGA WhatsApp +263779729280

3

Order Block Theory private study notes extracted from various entities

Validation of a Bullish SOB: When the High of the Lowest Down Close Candle or Price Bar is

traded through/surpassed by a later formed Candle or Price Bar.

L. TENGA WhatsApp +263779729280

4

Order Block Theory private study notes extracted from various entities

Entry Techniques: When Price trades Higher away from the Bullish Order Block and then Returns

to the Bullish Order Block Candle or Price Bar High – This is Bullish i.e. you wait for price to Return

to Order Block or Return to Origin (RTO) then you enter. THE AIM IS TO TAKE A TRADE FROM

SOURCE TO SOURCE.

L. TENGA WhatsApp +263779729280

5

Order Block Theory private study notes extracted from various entities

Defining Risk: The Low of the Bullish Order Block is the location of a relatively safe Stop Loss

placement. Just below the 50% of the Order Block total range is also considered to be a good

location to raise the Stop Loss after Price runs away from the Bullish Order Block to reduce Risk

when applicable.

L. TENGA WhatsApp +263779729280

6

Order Block Theory private study notes extracted from various entities

Bullish Order Block (BUB) - a Down Close candle in the most recent swing high which has the most

range between the open and close. This is an area where institutions will be taking profits i.e.

selling against the trend and new market makers entering to resume the original bullish trend.

Specifically, a BUB is the previous Bearish candle to an upward movement. The BUB is a series of bullish orders

(purchases) made by institutional as the price was falling (institutional buy when the market falls).

L. TENGA WhatsApp +263779729280

7

Order Block Theory private study notes extracted from various entities

Bullish Breaker Block is a bullish range or Up Close Candle in the most recent Swing High prior

to an Old Low being violated. The Sellers that sold this Low and later see this same Swing High

violated – will look to mitigate the loss. When Price returns back to the Swing High – this is a

Bullish Trade Setup worth considering.

L. TENGA WhatsApp +263779729280

8

Order Block Theory private study notes extracted from various entities

Bearish Source Order Block it is the Highest Candle or price bar with an Up-close that has the

most range between open to close and is near Resistance Level. The resistance level can be YH,

WH, MH, ADR High…this is a Trend Reversal Order Block. It is the last candle creating Peak

Formation High i.e. the Highest Price Point on the chart. A bearish SOB indicates a Shift in Market

Structure (SMS) from being Bullish to Bearish.

Validation of a Bearish SOB: When the Low of the Highest Up Close Candle or Price Bar is traded

through/surpassed by a later formed Candle or Price Bar.

Entry Techniques: When Price trades Lower away from the Bearish Order Block and then Returns

to the Bearish Order Block Candle or Price Bar High – This is Bearish, wait for price to Return to

the Bearish Source Order Block (RTO-Return to Order Block/Origin) then you Enter. THE AIM IS

TO TAKE A TRADE FROM SOURCE TO SOURCE.

Defining Risk: The High of the Bearish Source Order Block is the location of a relatively safe Stop

Loss placement. Just above the 50% of the Order Block total range is also considered to be a good

location to raise the Stop Loss after Price runs away from the Bearish Order Block to reduce Risk

when applicable.

L. TENGA WhatsApp +263779729280

9

Order Block Theory private study notes extracted from various entities

Bearish OB (BEB) is a Bullish Range or Up-Close Candle in the most recent Swing Low which has

the most range between open and close.

Specifically, a BEB is a Bullish or a series of Bullish candles after a bearish movement, it is the last

bullish candle in a down trend.

The BEB is a series of bearish orders (sells) made by institutions as the price was going up

(institutional sell when the market rises).

L. TENGA WhatsApp +263779729280

10

Order Block Theory private study notes extracted from various entities

Bearish Breaker Block is a bearish range or Down Close Candle in the most recent Swing Low

prior to an Old High being violated. The Buyers that buy this Low and later see this same Swing

Low violated – will look to mitigate the loss. When Price returns back to the Swing Low – this is a

Bearish Trade Setup worth considering.

L. TENGA WhatsApp +263779729280

11

Order Block Theory private study notes extracted from various entities

CREDITS

MICHAEL J. HUDDLESTON-December 2016 ICT Study Notes.

BISHOPRAJ-Simply Pips.

BHEKI MPANGANE- Bfx Strategy Training.

LUIS RIESCO- Market Makers Method (Order Blocks)

L. TENGA WhatsApp +263779729280

12

You might also like

- The Market Maker's MatrixDocument73 pagesThe Market Maker's MatrixZul Airel96% (82)

- Market Structure and Powerful Setups - Wade FX SetupsDocument153 pagesMarket Structure and Powerful Setups - Wade FX Setupspg_hardikar97% (39)

- ICT MethodsDocument66 pagesICT MethodsMohammed Nizam95% (78)

- Test Bank For Macroeconomics 10th Edition N Gregory MankiwDocument29 pagesTest Bank For Macroeconomics 10th Edition N Gregory MankiwDianeBoyerqmjs100% (40)

- .ICT Mastery - 1614680538000Document36 pages.ICT Mastery - 1614680538000Laston Kingston94% (17)

- Market Makers Method (Order Blocks) English PDFDocument165 pagesMarket Makers Method (Order Blocks) English PDFFibo Forex86% (72)

- Inner Circle Trader - Precision Trading Volume 2Document3 pagesInner Circle Trader - Precision Trading Volume 2Steve Smith94% (17)

- LTI Smart MoneyDocument26 pagesLTI Smart Moneyy6bt25096% (51)

- Summary of Al Brooks's Trading Price Action TrendsFrom EverandSummary of Al Brooks's Trading Price Action TrendsRating: 5 out of 5 stars5/5 (1)

- Beat Market Maker PDFDocument15 pagesBeat Market Maker PDFdorin0victor0vasile67% (3)

- Smart Money Entry TypesDocument15 pagesSmart Money Entry TypesEyad Qarqash95% (44)

- Festus Omoemu - BTMMvsICTDocument20 pagesFestus Omoemu - BTMMvsICTjcarlm201790% (20)

- SMART MONEY ORDE BLOC EditedDocument9 pagesSMART MONEY ORDE BLOC Editedtawhid anam86% (7)

- Macro Examples For Everything by EconplusDalDocument6 pagesMacro Examples For Everything by EconplusDalMukmin ShukriNo ratings yet

- FX ORDER BLOCKS - Journey To A MillionDocument32 pagesFX ORDER BLOCKS - Journey To A MillionDave Library94% (18)

- FNC Knowledge FXDocument5 pagesFNC Knowledge FXCherif Bensaid100% (1)

- Welcome To Lig Africa TrainingDocument31 pagesWelcome To Lig Africa TrainingIjumba Steve83% (6)

- ICT Material ReferenceDocument102 pagesICT Material ReferenceStephen ShekwonuDuza HoSea91% (11)

- Supply & Demand Trading Bible for Day Trading BeginnersFrom EverandSupply & Demand Trading Bible for Day Trading BeginnersRating: 3.5 out of 5 stars3.5/5 (6)

- Order Blocks: Supply & DemandDocument5 pagesOrder Blocks: Supply & DemandTradewith Dev100% (1)

- Inner Circle Trader - London Open TacticDocument3 pagesInner Circle Trader - London Open TacticMuhammad RandaNo ratings yet

- Inner Circle Trader - Search & Destroy ProfileDocument4 pagesInner Circle Trader - Search & Destroy ProfileEyad QarqashNo ratings yet

- How The Large Instituions Operate in The Forex Market PDFDocument48 pagesHow The Large Instituions Operate in The Forex Market PDFRyan100% (6)

- MMM Hacks PDFDocument65 pagesMMM Hacks PDFRyan100% (2)

- StopHunt Mastery PDFDocument115 pagesStopHunt Mastery PDFoli100% (10)

- Stop-Loss Hunt: Quantum Stone CapitalDocument5 pagesStop-Loss Hunt: Quantum Stone CapitalCapRa Xubo100% (1)

- The Nasdaq100 Index Subtle Alchemy: Let's smash it together, #1From EverandThe Nasdaq100 Index Subtle Alchemy: Let's smash it together, #1Rating: 4 out of 5 stars4/5 (1)

- The Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeFrom EverandThe Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeRating: 2.5 out of 5 stars2.5/5 (3)

- Locked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)From EverandLocked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)Rating: 1 out of 5 stars1/5 (1)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Inner Circle Trader - The Judas SwingDocument1 pageInner Circle Trader - The Judas SwingTalha darNo ratings yet

- ICT SummaryDocument35 pagesICT Summaryrerer100% (3)

- Little Leaf's Microgreens Price Calculator 2021Document26 pagesLittle Leaf's Microgreens Price Calculator 2021Carl RodríguezNo ratings yet

- TWFX Forex Ict MMM Notes COMPLETODocument110 pagesTWFX Forex Ict MMM Notes COMPLETOJHON CONTRERAS0% (1)

- Rule Based TradingDocument3 pagesRule Based TradingAlex Almeida100% (2)

- ++inner Circle Trader - Trading The FigureDocument2 pages++inner Circle Trader - Trading The FigureCr Ht100% (1)

- Beat The MarketDocument12 pagesBeat The Marketjayjonbeach75% (4)

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerFrom EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerRating: 4 out of 5 stars4/5 (3)

- Supply & Demand Day Trading for Futures: Brand New ETF's,Forex, Futures, Stocks Day Trader Series, #2From EverandSupply & Demand Day Trading for Futures: Brand New ETF's,Forex, Futures, Stocks Day Trader Series, #2No ratings yet

- Hero Moto Corp Power Point PresentationDocument12 pagesHero Moto Corp Power Point PresentationSandeep Kumar Deora78% (9)

- Chapter 5 and 6 Business QuestionsDocument10 pagesChapter 5 and 6 Business QuestionsHibah AamirNo ratings yet

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Inner Circle Trader - Sniper Course, Range FindingDocument5 pagesInner Circle Trader - Sniper Course, Range Findingtracie senjee100% (2)

- Tactical Trading Concepts Liquidity Pools and Stop OrdersDocument13 pagesTactical Trading Concepts Liquidity Pools and Stop OrdersHi27069333% (3)

- Elements of A Trade SetupDocument22 pagesElements of A Trade SetupGuy Surrey100% (1)

- 4 5949794731742463536 PDFDocument22 pages4 5949794731742463536 PDFAnastasia Nikoláyevna100% (12)

- ICT Models Incluye KILLZONES INDEX y FOREX PDFDocument9 pagesICT Models Incluye KILLZONES INDEX y FOREX PDFferuz qazaqov100% (1)

- Ict Strategy With Fibonacci ApplicationDocument22 pagesIct Strategy With Fibonacci ApplicationEmmanuel olayemi100% (1)

- Institutional Trading, VolumeDocument29 pagesInstitutional Trading, VolumeAnand Shankaran0% (2)

- Precision Based Trading King. D Boateng IG@kingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@kingboatengofficialnicholasNo ratings yet

- Market Maker TrapsDocument109 pagesMarket Maker TrapsFarid Taufiq93% (14)

- ICT - 21 GigaDocument18 pagesICT - 21 GigaTri Nur DayaNo ratings yet

- Order BlocksDocument8 pagesOrder Blocksdaniel75% (4)

- Market Structure 1Document5 pagesMarket Structure 1aasdasdf50% (2)

- Learning To Trade The Order Block' Forex Strategy Forex AcademyDocument6 pagesLearning To Trade The Order Block' Forex Strategy Forex Academycaviru100% (2)

- Bible of Supply & Demand Trading for complete BeginnersFrom EverandBible of Supply & Demand Trading for complete BeginnersRating: 1 out of 5 stars1/5 (2)

- KFD - Safari Savings AccountDocument4 pagesKFD - Safari Savings AccountBwambale RonaldNo ratings yet

- Business Ethics - Chapter 4Document9 pagesBusiness Ethics - Chapter 4Kunawathe KesavanNo ratings yet

- CC 62 - EPIA Capital Improvement PlanDocument26 pagesCC 62 - EPIA Capital Improvement PlanErika EsquivelNo ratings yet

- Abbott Labs (ABT) : Company DescriptionDocument2 pagesAbbott Labs (ABT) : Company DescriptionHernan DiazNo ratings yet

- March 20 Oct 20 PDFDocument40 pagesMarch 20 Oct 20 PDFMalik MuzafferNo ratings yet

- MEED SaudiArabia2019 Report Linked CompressedDocument27 pagesMEED SaudiArabia2019 Report Linked CompressedRejith Muralee100% (1)

- SWOT AnalysisDocument16 pagesSWOT AnalysispadmaNo ratings yet

- Review Topic 8 PowerPoint IIDocument17 pagesReview Topic 8 PowerPoint IIValeria L. GiliNo ratings yet

- DBQ ManchesterDocument3 pagesDBQ ManchesterAnish Navada50% (2)

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluNo ratings yet

- BSMA 1A Quiz 3 Cost Accounting CycleDocument5 pagesBSMA 1A Quiz 3 Cost Accounting CycleMaeca Angela SerranoNo ratings yet

- Al ShaheerDocument5 pagesAl ShaheerMuhammad AdilNo ratings yet

- Test 022Document3 pagesTest 022Quỳnh TrươngNo ratings yet

- Vias Publicas Vol 57 PDFDocument60 pagesVias Publicas Vol 57 PDFAngel SoteldoNo ratings yet

- ECO3203 Test #1 Study GuideDocument14 pagesECO3203 Test #1 Study GuideGrace, FindleyNo ratings yet

- Chapter 4 The Theory of Individual BehaviorDocument16 pagesChapter 4 The Theory of Individual BehaviorYayandi Hasnul100% (1)

- Contemporary Module - SemiFinal and FinalDocument36 pagesContemporary Module - SemiFinal and FinalAJ Grean EscobidoNo ratings yet

- Managerial Accounting - BADM 2010 F18 Assignment 7 Chapter 12Document3 pagesManagerial Accounting - BADM 2010 F18 Assignment 7 Chapter 12Judy1928No ratings yet

- To To Job 112. of FromDocument4 pagesTo To Job 112. of Fromhoang trinhNo ratings yet

- Unit 1Document19 pagesUnit 1Røhãñ PãrdëshîNo ratings yet

- Dr. Parik Patel, BA, CFA, ACCA Esq. ? (@ParikPatelCFA) TwitterDocument1 pageDr. Parik Patel, BA, CFA, ACCA Esq. ? (@ParikPatelCFA) TwitterlukaskoubeNo ratings yet

- Public Finance in Canada Canadian 5th Edition Rosen Test BankDocument11 pagesPublic Finance in Canada Canadian 5th Edition Rosen Test Bankmrsnataliegriffinbpoacydzim100% (29)

- Sfsar Staat Hmrer Fees: Indian Oil Corporation LimitedDocument1 pageSfsar Staat Hmrer Fees: Indian Oil Corporation LimitedkhalandarNo ratings yet

- Indonesia Electric Vehicle Outlook 2023Document44 pagesIndonesia Electric Vehicle Outlook 2023BigardNo ratings yet

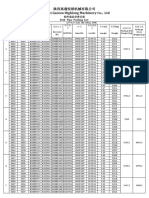

- Shaanxi Gaoton Highlong Machinery Co., LTD: Drill Pipe Packing ListDocument2 pagesShaanxi Gaoton Highlong Machinery Co., LTD: Drill Pipe Packing ListHưng Lê TrungNo ratings yet