Professional Documents

Culture Documents

Preweek Practical Accounting 2-18

Uploaded by

adssdasdsadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preweek Practical Accounting 2-18

Uploaded by

adssdasdsadCopyright:

Available Formats

,..

.·

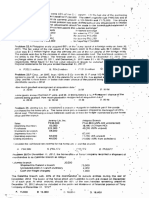

Problem 9. On

Novembe r 1 . Naga Company entered into a firm commitme

nt to acquire- ·a

.

be on =ebruary at the price of $ 1 2 ,000

machinery Delivery and passage of title would 28, 20 1 3

Singapore dollars. On the same date, to hedge agai11st unfavora ble changes .11n the exchange

S1flgapor e dollars .

rate. S entered into a 1 20-day · forward contract with China bank for $ 1 2,000 '

Exchange rate were as follows:

Spot Rate • ForvVa rd Rate

Nov 01 . 20 1 2 P36.25 P34.30

Dec. 3 1 , 2 0 1 2 37.40 36.70

Feb. 28, 20 1 3 39.50 • 39.50

How much is the forex gain or Joss recognized by the S company on the firm commitment ..

on December31, 2012?

)

,.

.· A P13,800 gain

E. P28,800 loss

C.

"

P1 3,800 loss

D. P28,800 gain

I Problem 1 0.011 October 2, .20 1 3 , KO Inc. ordered a custom built d e li very truck from a Japannse

firm. The purchase order is non-cancellable. The pU"" chase price 1s 1 million yen with delivery

a nd payment to be made 0n March 3 1 , io·14. On October 2, 201 3, KO Inc. entered int<> .a

brward contract to buy 1 r 1 illion yen on Ma rc h 3 1 , 2014 for P0.57. On March 3 1 , 2 0 1 4 , the

customer build delivery truck was delivered.

1 0/02.' 1 3 · ; 2/3 1 / 1 :; 3/3 1 / 1 '1

Spot rate P0.50 P0. 9 6 • I P0.57

For.Yard rate 0.53 0.58 0.57

As a f;:iir value hedge, the December 3 1 , 20.1 3 p rofit and loss statement forex gain or loss on the

hedging instrument amounted to?

A P50,000 loss B. P50,000 gain C P60, 000 loss D . P60,000 gain

the Dec e mbe r 3 1 , 201 3 profit e nd loss statement forex gain or loss-on

°

As a cash flow hedge,

tne hedging instrument amounted to?

A P50,000 P/L gain B. P50,000 OCI gain C P60,000 OCI los s D . P60,000 P/Lgain

Problem 1 1 .Clippers Company operates a branch operation in a foreign country. Although this

branch deals i n foreign cummcy (FC), the peso is viewed as its functional currency. Thus, a re

measurement !S necessary is necessary to oroduce financial information for external reporti�g

purposes. The branch began the year witn 1 00,000 FCs in cash and no other assets or

liabilities. However, the bra11ch immediately _used 60, )00 FCs to acquire equipment. On May 1,

ii p u rch ase d inventory cost111g 30,000 FCs ror cash < ind 1t sold o n July 1 for 50,000 FCs cash.

Tile branch transferred 1 0,000 FCs to the parent on ( •ctober 1 ;;ind recorded depreciation on the

.;: qu1pment of 6 , 000 FCs for tile year. C u rrency ex:11a.1�e rat�s !or I F!; fP.lj�ws.

Janu�ry 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P0. 1 6 = 1 FC

•

May 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . P0. 1 8

L . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 0 . 20 ·

.iuly

•

Octob er 1 . . .. .. . . . . . . . . . . . . . . . . . P0 . 2 1

Dece mber 1 . . . .

. . . . . . . . . . . . . . . . . . . . . . P0 . 22

Aver age for the year. . . . .. .. . . . . . . PO. 1 9

or loss to be r·3Cognized i n the comb ined i ncom e

What is the forex re-me asure ment gain

s ta tem en t?

B. P2,400 C P2,700 D. 3,000

A. P2, 1 00

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Law On Obligations and Contracts Quiz Bee Round 1 EasyDocument6 pagesLaw On Obligations and Contracts Quiz Bee Round 1 EasyadssdasdsadNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Issuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleDocument6 pagesIssuance Vested in "Higher Court.'' - The Issuance of The Writ Is Expressly Vested by ArticleadssdasdsadNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Reviewer For 2nd Eval Auditing Theory Answer KeyDocument11 pagesReviewer For 2nd Eval Auditing Theory Answer KeyadssdasdsadNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 10576-Article Text-41055-3-10-20191228 PDFDocument9 pages10576-Article Text-41055-3-10-20191228 PDFadssdasdsadNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Impact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyDocument11 pagesImpact of An Excise Tax On The Consumption of Sugar-Sweetened Beverages in Young People Living in Poorer Neighbourhoods of Catalonia, Spain: A Difference in Differences StudyadssdasdsadNo ratings yet

- The Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityDocument15 pagesThe Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityadssdasdsadNo ratings yet

- Activity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)Document23 pagesActivity Ratio Influence On Profitability (At The Mining Company Listed in Indonesia Stock Exchange Period 2010-2013)adssdasdsadNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Preweek Practical Accounting 2-24Document1 pagePreweek Practical Accounting 2-24adssdasdsadNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Virginia Wanjiku Mwangi Mba 2019Document87 pagesVirginia Wanjiku Mwangi Mba 2019adssdasdsadNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- An Initial Look at The TRAIN Law Are WeDocument20 pagesAn Initial Look at The TRAIN Law Are WeadssdasdsadNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Preweek Practical Accounting 2-21Document1 pagePreweek Practical Accounting 2-21adssdasdsadNo ratings yet

- Preweek Practical Accounting 2-22Document1 pagePreweek Practical Accounting 2-22adssdasdsadNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Chapter 1 To 4-1Document1 pageChapter 1 To 4-1adssdasdsadNo ratings yet

- Chapter 1 To 4-3Document1 pageChapter 1 To 4-3adssdasdsadNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Preweek Practical Accounting 2-20Document1 pagePreweek Practical Accounting 2-20adssdasdsadNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- COE by Sir OcampoDocument22 pagesCOE by Sir OcampoadssdasdsadNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 9) Montefalcon v. Vasquez PDFDocument5 pages9) Montefalcon v. Vasquez PDFEffy SantosNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Pre-Trial Locus Visit Distinguished From Post Trial Locus VisitDocument2 pagesPre-Trial Locus Visit Distinguished From Post Trial Locus VisitLDC Online Resources100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Service Bulletin: © Honeywell International Inc. Do Not Copy Without Express Permission of HoneywellDocument29 pagesService Bulletin: © Honeywell International Inc. Do Not Copy Without Express Permission of HoneywellJuan Ruben GarciaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fidic Red Yellow Silver BooksDocument11 pagesFidic Red Yellow Silver Bookssilence_10007No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Islamic LawDocument1 pageIslamic LawAnonymous OGuQXU8vDNo ratings yet

- False ImprisonmentDocument33 pagesFalse ImprisonmentKajal SinghNo ratings yet

- Adobe Scan Aug 23, 2023Document1 pageAdobe Scan Aug 23, 2023gomsha200No ratings yet

- Warm Up and StretchingDocument2 pagesWarm Up and StretchingRaffaeleSalapeteNo ratings yet

- Legal Ethics Case DigestsssDocument13 pagesLegal Ethics Case Digestssswins lynNo ratings yet

- APY Subscriber-Details Modification FormDocument3 pagesAPY Subscriber-Details Modification FormManoj GoyalNo ratings yet

- Bersamin v. People - G.R. No. 239957Document6 pagesBersamin v. People - G.R. No. 239957Ash SatoshiNo ratings yet

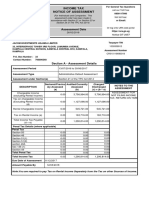

- Assessment Date: Income Tax Notice of AssessmentDocument2 pagesAssessment Date: Income Tax Notice of AssessmentBwana KuubwaNo ratings yet

- CALAMBA NegoSale Batch 47110 012023Document18 pagesCALAMBA NegoSale Batch 47110 012023Dodie PelausaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Kenya Gazette: TitlmtDocument48 pagesThe Kenya Gazette: Titlmtnjenga koigiNo ratings yet

- GC Dalton Industries vs. Equitable PCI BankDocument5 pagesGC Dalton Industries vs. Equitable PCI BankJoshua CuentoNo ratings yet

- Fort Bonifacio Development Corporation vs. Fong 754 SCRA 544, March 25, 2015Document8 pagesFort Bonifacio Development Corporation vs. Fong 754 SCRA 544, March 25, 2015Eunice AmbrocioNo ratings yet

- Loyola International School Al-Nasr CampusDocument1 pageLoyola International School Al-Nasr CampusamirNo ratings yet

- CASE DIGESTS by KSY Legal WritingDocument3 pagesCASE DIGESTS by KSY Legal WritingKrizzaShayneRamosArqueroNo ratings yet

- Application FormDocument2 pagesApplication FormMurari JhaNo ratings yet

- Wordly Wise Online: Lesson 4Document3 pagesWordly Wise Online: Lesson 4YongJun LiuNo ratings yet

- Val02 Module Chapter 6 - DeontologyDocument14 pagesVal02 Module Chapter 6 - DeontologyKaye Joy TendenciaNo ratings yet

- Assessment 7 - SJD1501Document9 pagesAssessment 7 - SJD1501Chun LiNo ratings yet

- Damnum Sine Injuria & Injuria Sine DamnumDocument4 pagesDamnum Sine Injuria & Injuria Sine DamnumSesa GillNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Application For Population CertificateDocument1 pageApplication For Population Certificatepradip_kumar40% (5)

- Versoza v. People20210501-12-1i0u1ooDocument46 pagesVersoza v. People20210501-12-1i0u1ooLi-an RodrigazoNo ratings yet

- Performance of ContractDocument6 pagesPerformance of ContractUser1No ratings yet

- Ip İp Contract 28 October 17 25BDocument19 pagesIp İp Contract 28 October 17 25B17 ChnSad100% (1)

- Republic of The Philippines vs. Meralco, G.R. 14314, November 15, 2002 TDocument11 pagesRepublic of The Philippines vs. Meralco, G.R. 14314, November 15, 2002 TRaineir Pabiran100% (1)

- HSSLiVE-XI-Maths - CH-3 - TRIGONOMETRYDocument11 pagesHSSLiVE-XI-Maths - CH-3 - TRIGONOMETRYsingh vijayNo ratings yet

- Spouses Avelina Rivera-Nolasco and Eduardo A. Nolasco, vs. Rural Bank of Pandi, Inc.Document3 pagesSpouses Avelina Rivera-Nolasco and Eduardo A. Nolasco, vs. Rural Bank of Pandi, Inc.Athina Maricar CabaseNo ratings yet