Professional Documents

Culture Documents

Calculation of Taxable Income For Nancy As at 31 October 2020

Uploaded by

Danisa Ndhlovu0 ratings0% found this document useful (0 votes)

17 views8 pagesNancy has $24,000 in taxable rental income from a block of flats she was granted life usufruct of. Samson has no taxable income as the block of flats is under Nancy's life usufruct. Kathy has no taxable income as the shares from the Tomana Trust can only be transferred and taxed upon her 21st birthday. The Deceased Estate has $19,000 in taxable income after exemptions and deductions. The Tomana Trust has $30,000 in taxable dividend income.

Original Description:

Original Title

solution 12

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNancy has $24,000 in taxable rental income from a block of flats she was granted life usufruct of. Samson has no taxable income as the block of flats is under Nancy's life usufruct. Kathy has no taxable income as the shares from the Tomana Trust can only be transferred and taxed upon her 21st birthday. The Deceased Estate has $19,000 in taxable income after exemptions and deductions. The Tomana Trust has $30,000 in taxable dividend income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views8 pagesCalculation of Taxable Income For Nancy As at 31 October 2020

Uploaded by

Danisa NdhlovuNancy has $24,000 in taxable rental income from a block of flats she was granted life usufruct of. Samson has no taxable income as the block of flats is under Nancy's life usufruct. Kathy has no taxable income as the shares from the Tomana Trust can only be transferred and taxed upon her 21st birthday. The Deceased Estate has $19,000 in taxable income after exemptions and deductions. The Tomana Trust has $30,000 in taxable dividend income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

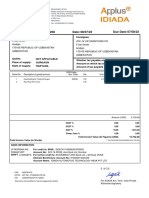

Calculation of taxable income for

Nancy as at 31 October 2020

The sum of $40000

Nancy is an ascertained beneficiary with

respect to $40 000, however the amount is

not taxable in hands of Nancy because its

income of Capital nature.

Block of flats

Samson is the ascertained beneficiary of the block

of flats.

A block of flats is not income but an asset. Income

accruing from rental block of flats is taxable.

Nancy was granted life usufruct in respect to

block of flats therefore she is liable for the post –

death income as from 1 May to 31 October 2020

that will be

=4000*6 months =$24 000

Calculation of taxable income for

Nancy as at 31 October 2020

$

Gross income

Rental from block of 24 000

flats(4000*6)

Taxable income 24 000

ii.Samson

In terms of section 11 of Income tax act Samson

had no any taxable income u up to 31 Oct 2020,

since he was bequeathed to a block of flats with

a life usufruct on Nancy. Therefore the monthly

rentals should be taxed in the hands of Nancy.

iii.Kathy

Tomana Trust is the ascertained beneficiary of the

shares.

The share were to be transferred to Kathy upon

meeting the condition of reaching her 21st birthday

(contingent right) . .

Therefore Kathy has the right to income from the

shares upon her 21 st birthday and only the

distributed income to Kathy will be taxed .Therefore

no taxable income in the hands of Kathy.

The retained income will be taxed in the hands of

Tomana trust.

Iv )Deceased Estate

Calculation of taxable income for Deceased

Estate as at 31 October 2020.

Gross income $

Cash of lieu of leave 24 000

Gratuity in the form of a salary for the -

month of April 2020(no right to income)

Bonus 20 000

Total gross income 44 000

Calculation of taxable income for

Deceased Estate as at 31 October 2020.

Less Exemptions $

Bonus (20 000)

Less Allowable deductions

Executor fees (5000)

Taxable income 19 000

v.Calculation of taxable income for

Tomana Trusts as at 31 October 2020

According to Section 12(2) of Income tax,

dividend received by Tomana Trust is deemed to

be income generated in Zimbabwe.

$

Dividend from Vulgate 30 000

Electronics

Taxable income 30 000

You might also like

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- The Difference in Future Taxable AmountsDocument2 pagesThe Difference in Future Taxable AmountsThư LuyệnNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Mini Exercise Accounting Equation and JEDocument2 pagesMini Exercise Accounting Equation and JEKaren TumabiniNo ratings yet

- Acc 496 Chapter 6Document2 pagesAcc 496 Chapter 6Abdul HassonNo ratings yet

- TAX RefExamDocument16 pagesTAX RefExamjeralyn juditNo ratings yet

- MajDocument3 pagesMajdougconway1No ratings yet

- Problem 2Document2 pagesProblem 2Rio De LeonNo ratings yet

- Practice Final PB PartialDocument25 pagesPractice Final PB PartialBenedict BoacNo ratings yet

- Taxation 2nd PreboardDocument17 pagesTaxation 2nd PreboardJaneNo ratings yet

- Donor's TaxDocument5 pagesDonor's TaxVernnNo ratings yet

- Tax 1st Drills Answer KeyDocument18 pagesTax 1st Drills Answer KeyJerma Dela Cruz100% (1)

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- H05.FA2-01 Trade & Other Payables - HernandezDocument5 pagesH05.FA2-01 Trade & Other Payables - HernandezBea GarciaNo ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- Tax Planning and Compliance: Page 1 of 5Document5 pagesTax Planning and Compliance: Page 1 of 5Srikrishna DharNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- IAS 12 - Promotianal Assesment 2024Document2 pagesIAS 12 - Promotianal Assesment 2024abraham johannesNo ratings yet

- Co Accg 1 - Tut QN - Oct 2022Document10 pagesCo Accg 1 - Tut QN - Oct 2022Xuan Hui LohNo ratings yet

- AYB320 0122 TrustsTutorialDocument20 pagesAYB320 0122 TrustsTutorialLinh ĐanNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- TH THDocument12 pagesTH THmariyha PalangganaNo ratings yet

- Taxation of Estates and TrustsDocument42 pagesTaxation of Estates and TrustsAngelica Joyce DyNo ratings yet

- IRA No. 4 Estate Trust Co-OwnDocument2 pagesIRA No. 4 Estate Trust Co-OwnProlen AcantoNo ratings yet

- GoodwillDocument7 pagesGoodwillAdam KhanNo ratings yet

- BT 211 Module 05 1Document12 pagesBT 211 Module 05 1Franz PampolinaNo ratings yet

- Orca Share Media1532355060231Document18 pagesOrca Share Media1532355060231Let it beNo ratings yet

- Contest TaxDocument31 pagesContest TaxTerence Jeff TamondongNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- Quiz For Business TaxDocument5 pagesQuiz For Business TaxAngela WaganNo ratings yet

- Week 3 Tutorial Solutions - Fiancial AcountingDocument13 pagesWeek 3 Tutorial Solutions - Fiancial AcountingMi ThaiNo ratings yet

- Lecture 5 (1) - Estates Under AdministrationDocument21 pagesLecture 5 (1) - Estates Under AdministrationYanPing AngNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Module 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxDocument2 pagesModule 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxZeyad El-sayedNo ratings yet

- Donor's Tax TRAIN LAWDocument4 pagesDonor's Tax TRAIN LAWJenMarlon Corpuz Aquino100% (1)

- ReSA B45 TAX Final PB Exam Questions, Answers & SolutionsDocument13 pagesReSA B45 TAX Final PB Exam Questions, Answers & SolutionsjoyhhazelNo ratings yet

- Accounting For Income Tax QuizDocument5 pagesAccounting For Income Tax QuizTorico BryanNo ratings yet

- Donor's Tax Post QuizDocument12 pagesDonor's Tax Post QuizMichael Aquino0% (1)

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Chapter 37-Presentation of FsDocument8 pagesChapter 37-Presentation of FsEmma Mariz GarciaNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- Assignment 4Document2 pagesAssignment 4Nate LoNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - ND-2022 - QuestionsajedulNo ratings yet

- Trust TutorialDocument3 pagesTrust TutorialpremsuwaatiiNo ratings yet

- B326: Advanced Financial Accounting: Take Home Exam For Final Assignment 2020-2021/spring (V1)Document6 pagesB326: Advanced Financial Accounting: Take Home Exam For Final Assignment 2020-2021/spring (V1)Abdulaziz Reda BinshihoonNo ratings yet

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Demo TeachingDocument2 pagesDemo TeachingPrincess Jane SuatNo ratings yet

- Lecture 5 - Ss Q1 Q2 Q3Document4 pagesLecture 5 - Ss Q1 Q2 Q3Esther FanNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- 1 Ha Potatoes - 12 March 2014Document2 pages1 Ha Potatoes - 12 March 2014Danisa NdhlovuNo ratings yet

- 1 Ha Onions - 13 March 2014Document2 pages1 Ha Onions - 13 March 2014Danisa NdhlovuNo ratings yet

- Afrostain Farmtech Magazine September EditionDocument12 pagesAfrostain Farmtech Magazine September EditionDanisa NdhlovuNo ratings yet

- January DiseaseDocument2 pagesJanuary DiseaseDanisa NdhlovuNo ratings yet

- Goat ManagementDocument18 pagesGoat ManagementDanisa NdhlovuNo ratings yet

- Auditing TutorialDocument20 pagesAuditing TutorialDanisa NdhlovuNo ratings yet

- Planning Your FarmDocument3 pagesPlanning Your FarmDanisa NdhlovuNo ratings yet

- Name Surname Reg #: Bridget R Shawn Grace N Tapiwanashe Rudadiso Danisa Osward S T Vimbai Natalie Brandy T CephasDocument11 pagesName Surname Reg #: Bridget R Shawn Grace N Tapiwanashe Rudadiso Danisa Osward S T Vimbai Natalie Brandy T CephasDanisa NdhlovuNo ratings yet

- Advanced Taxation Practice Question QuestionDocument8 pagesAdvanced Taxation Practice Question QuestionDanisa NdhlovuNo ratings yet

- Financial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDocument11 pagesFinancial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDanisa NdhlovuNo ratings yet

- Tax Presentation (Hire Purchase)Document4 pagesTax Presentation (Hire Purchase)Danisa NdhlovuNo ratings yet

- QPDsDocument4 pagesQPDsDanisa NdhlovuNo ratings yet

- Auditing TutorialDocument13 pagesAuditing TutorialDanisa NdhlovuNo ratings yet

- Grain and Feed Annual Pretoria Zimbabwe 6-15-2018Document7 pagesGrain and Feed Annual Pretoria Zimbabwe 6-15-2018Danisa NdhlovuNo ratings yet

- Chapter 5 Limiting Factors and Throughput Accounting: 1. ObjectivesDocument15 pagesChapter 5 Limiting Factors and Throughput Accounting: 1. ObjectivesDanisa NdhlovuNo ratings yet

- Tax Chargeable (200 000-5 000) 20%Document2 pagesTax Chargeable (200 000-5 000) 20%Danisa NdhlovuNo ratings yet

- Grain Feeds 1Document4 pagesGrain Feeds 1Danisa NdhlovuNo ratings yet

- Small-Scale Broiler Farming at Rural Households With or Without Management Intervention During WinterDocument8 pagesSmall-Scale Broiler Farming at Rural Households With or Without Management Intervention During WinterDanisa NdhlovuNo ratings yet

- Grain and Feed Annual Report - Pretoria - Zimbabwe - 7!26!2017Document8 pagesGrain and Feed Annual Report - Pretoria - Zimbabwe - 7!26!2017Danisa NdhlovuNo ratings yet

- Chapter 4 Data PresentationDocument17 pagesChapter 4 Data PresentationDanisa NdhlovuNo ratings yet

- Chinhoyi University of Technology: School of Business Sciences and ManagementDocument8 pagesChinhoyi University of Technology: School of Business Sciences and ManagementDanisa NdhlovuNo ratings yet

- Module Cuac 413Document93 pagesModule Cuac 413Danisa NdhlovuNo ratings yet

- Minicase 246Document2 pagesMinicase 246Ngọc Minh Nguyễn100% (1)

- Master Budget QuizDocument1 pageMaster Budget QuizAbegail RafolsNo ratings yet

- Research Paper On Tax Evasion in IndiaDocument7 pagesResearch Paper On Tax Evasion in Indiahjuzvzwgf100% (1)

- Income Tax 1Document31 pagesIncome Tax 1Barbie EboniaNo ratings yet

- IINP222300238 JSC JV Homologation - 220714 - 110521Document1 pageIINP222300238 JSC JV Homologation - 220714 - 110521Gayrat KarimovNo ratings yet

- Accounting Exercises (Management Accounting)Document2 pagesAccounting Exercises (Management Accounting)arvin sibayan100% (1)

- Invoice 458608Document1 pageInvoice 458608mi fokkoNo ratings yet

- Advertising Associates v. CADocument1 pageAdvertising Associates v. CACristelle Elaine Collera100% (1)

- IncomeTax Banggawan2019 Ch14Document12 pagesIncomeTax Banggawan2019 Ch14Noreen Ledda0% (1)

- Tally ERP 9 With GST Notes: Mr. Rahul K PathakDocument12 pagesTally ERP 9 With GST Notes: Mr. Rahul K PathakAkash RoyNo ratings yet

- Chapter 9 Acctng For LaborDocument4 pagesChapter 9 Acctng For LaborJoan Tanto MagdalenoNo ratings yet

- Money Makes The World Go Round: Arguing About The PriceDocument3 pagesMoney Makes The World Go Round: Arguing About The Priceira silyutinaNo ratings yet

- 2010 Federal Income Tax OutlineDocument38 pages2010 Federal Income Tax OutlineJohnny Emm100% (2)

- MInimum Tax and Turnover - M. M. Akram Reported Judgements - THE COMMISSIONER-IR, ZONE-1, LTU, KARACHI Vs M - S. KASB BANK LIMITED, KARACHIDocument10 pagesMInimum Tax and Turnover - M. M. Akram Reported Judgements - THE COMMISSIONER-IR, ZONE-1, LTU, KARACHI Vs M - S. KASB BANK LIMITED, KARACHIAns usmaniNo ratings yet

- MFG 006 Rev 0 FAPL Festo India Purchase Order Dated 04062020 PDFDocument1 pageMFG 006 Rev 0 FAPL Festo India Purchase Order Dated 04062020 PDFvenkatraman JNo ratings yet

- Pocket Films RevenueDocument1 pagePocket Films RevenueAkshay HamandNo ratings yet

- rc339 Fill 23eDocument5 pagesrc339 Fill 23esalimpublicNo ratings yet

- Nepal Budget 2070 Tax Prespective: NBSM & AssociatesDocument9 pagesNepal Budget 2070 Tax Prespective: NBSM & AssociatesrameshneupaneNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Tackling Global Tax Havens ShaxonDocument5 pagesTackling Global Tax Havens Shaxonoskar pipejerNo ratings yet

- Tuitionfees 2 NdtermDocument3 pagesTuitionfees 2 NdtermBhaskhar AnnaswamyNo ratings yet

- Advanced Taxation Novmock2019 PDFDocument13 pagesAdvanced Taxation Novmock2019 PDFAndy AsanteNo ratings yet

- Investment Declaration From 12BB 22-23Document3 pagesInvestment Declaration From 12BB 22-23Kewal GuglaniNo ratings yet

- Taco 0228931021300043Document1 pageTaco 0228931021300043securitas ncrNo ratings yet

- Learning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's SuitDocument12 pagesLearning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's Suitjoan mziNo ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- Flipkart Clothes - 27823Document1 pageFlipkart Clothes - 27823raghuveer9303No ratings yet

- Donor's Tax Assignment March 5Document4 pagesDonor's Tax Assignment March 5Sherine VizcondeNo ratings yet

- Income Tax 1 FinalDocument50 pagesIncome Tax 1 FinalGracee MedinaNo ratings yet

- تقرير فحص ضريبيDocument3 pagesتقرير فحص ضريبيSmart Certified Translation ServicesNo ratings yet