Professional Documents

Culture Documents

Central Banking 3

Uploaded by

polmulitriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banking 3

Uploaded by

polmulitriCopyright:

Available Formats

Principles of Banking: Reading 3

Central Bank and Central Banking

[Monetary Policy Authority and Banking Sector Regulators]

The bank which governs banking system and money market is Central Bank. The primary function of a central bank

is to assist Government in formulating economic policy, in controlling and conducting money-market and also

controlling bank‟ credit. Some specialized Bankers, Economists and thinkers have given different definitions:

“ A central bank is a bank whose essential duty is to maintain stability of the monetary standard. In the words

of Decock, “ The central bank is a banking system in which a single bank has either a complete or a residuary

monopoly of note issue.” Professor Hatley says, “Central Bank is the lender of the last resort.” Functions of

Central Bank: The functions of central bank are different from other banks. The following functions of

central bank are stated below:

Traditional or general functions:

Issue of notes and coins:

The first and foremost function of central bank is to issue notes and coins as per needs of the public and

requirement of business and commerce. As per rules, notes are issued against gold, silver and foreign

currency.

Government Bank:

Central Bank acts as banker and economic adviser of the Government. The central bank conducts and

maintains Government accounts for all Government receipts and payments.

Banker’s Bank:

Central Bank acts as banker‟s bank. As a rule, all scheduled and commercial banks have to maintain

Statutory Liquidity Reserve (SLR) 18% with Bangladesh Bank(CRR: 5% and Bonds & Securities 13%).

Lender of the last Resort:

In case of financial crisis of the commercial banks, central bank acts as a lender of the last resort through

lending against first class securities, bill of exchange etc.

Reservoir of foreign currency:

Central Bank maintains Foreign Currency Reserve. For the purpose of control of foreign currency, the

following factors are responsible: For issuance of notes; For payments of liabilities; For payments of debt

Clearing House:

Central Bank acts as a Clearing House for settlement of interbank transactions.

Credit Control:

Credit Control is one of the major functions of central bank. The following are the ways of controlling credit:

(a) Change in bank rates

(b) Open market operation

(c) Change ( increase or decrease) in reserve- ratio

(d) Selective credit

(e) Direct influence

(f) Moral suasion

(g) Propaganda.

1

Purposeful functions:

Control Money Supply

Stabilize Exchange Rate

Maintain Gold Reserve

Help Stabilizing Price-Level

Stabilize business activities

Expansion and Development Functions:

-Development of Agriculture Sector:Central Bank formulates policy for expansion of Agri-sector for the purpose

of economic upliftments in the country.

-Development of Industry Sector:

-Development of natural resources: Central Bank plays vital role for tapping natural resources which may lead to

economic growth.

Distinguish between Central Bank and Commercial Bank:

Central Bank and Commercial Bank are both financial institutions. But they have got distinguishing features. Central

Bank is meant for national welfare and Commercial Bank is meant for earning profits. The following points

of distinction between central bank and commercial bank:

Points of Central Commercial Bank

distinction Bank

Formation Central Bank is the sole banking Institution Commercial Bank is formed on the basis of

which is established through ordinance or Banking Company Laws.

special law of the Government.

Establishment Central Bank is established under Commercial Bank is established under

Government ownership. both govt. and private initiatives

Purpose To earn profit is not the main purpose of The main purpose of commercial bank is

central bank. Its main purpose is to control to earn profit. Recovery of loan is the main

credit system and money market. stay for generation of profit.

Number In a country there is only one Central Bank. In a country there may be more number of

commercial banks.

Control Central bank is conducted exclusively under Commercial Bank is conducted under

Government control. central bank‟s control.

Government Government has direct influence on Central Government has indirect influence On

Influence Bank. Commercial Bank through Central Bank.

Currency Central Bank organizes, controls and Commercial Banks are the members of the

Market administers currency market. currency market.

Competition Central Bank does not compete with other Commercial Bank has to face to face lot of

banks. competition.

Representative Central Bank represents the country or state. Commerci al Bank represents the

customer.

2

Foreign Central Bank has no branch abroad. Commercial Bank may have many

Branch Branches abroad.

Note issue Note issue is the primary function of central Commercial Bank cannot issue notes.

bank.

Credit control Central Bank controls credit. Commercial Bank assists central bank in

controlling credit.

Clearing Central Bank acts as a clearing house for Commercial banks are the members of the

House settlement of inter-bank transactions. clearing house. They settle transactions

through clearing house.

Lender of last In case of any crisis, central bank Last resort Commercial Bank gets assistance from

resort lends commercial bank as a last resort. central bank in case of need.

Nature Of Central bank is not engaged in general Commercial bank is engaged in receiving

work banking activities i.e. to receive deposits, to deposits, paying money, creating loan etc.

lend, to create loan etc.

Foreign Central Bank controls foreign exchange. Commercial bank helps central bank in

Exchange controlling foreign exchange.

Investments Central bank does not Make any investment for Commercial bank makes investments in

profitability purpose. various sectors for the purpose of

profitability.

Refinance Central bank refinances commercial bank. Commercial bank takes refinance facility

Facility from the central bank.

Development Central Bank formulates policy on Commercial bank participates

work development Work.

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Chapter 07 Futures and OptiDocument68 pagesChapter 07 Futures and OptiLia100% (1)

- The Best American History Essays 2006Document306 pagesThe Best American History Essays 2006polmulitri100% (1)

- Central Bank and Its FunctionsDocument4 pagesCentral Bank and Its FunctionsHassan Sardar Khattak100% (4)

- Role of Central BankDocument32 pagesRole of Central BankAsadul Hoque100% (3)

- The Best American History Essays 2007Document289 pagesThe Best American History Essays 2007polmulitri100% (1)

- The Science of SexDocument55 pagesThe Science of SexpolmulitriNo ratings yet

- CarrieJi TOEFL Speaking TemplateDocument2 pagesCarrieJi TOEFL Speaking Templatepolmulitri50% (2)

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- NISM Series XXII Fixed Income Securities Workbook May 2021Document182 pagesNISM Series XXII Fixed Income Securities Workbook May 2021Karthick S Nair100% (1)

- IUJ Math Aptitude Test - Sample 4Document7 pagesIUJ Math Aptitude Test - Sample 4Tigist TayeNo ratings yet

- The Best American Science and Nature Writing 2002Document333 pagesThe Best American Science and Nature Writing 2002polmulitri100% (1)

- Banks and Banking System-1Document13 pagesBanks and Banking System-1polmulitriNo ratings yet

- Banks and Banking System-1Document13 pagesBanks and Banking System-1polmulitriNo ratings yet

- Comparative Study of Financial Statement Reports of Canara Bank and Comparative BankDocument41 pagesComparative Study of Financial Statement Reports of Canara Bank and Comparative Bankparamjeet kourNo ratings yet

- Huang vs. Atty. ZambranoDocument2 pagesHuang vs. Atty. ZambranoRob100% (2)

- Role of Central Banks and Credit CreationDocument44 pagesRole of Central Banks and Credit Creationdua tanveerNo ratings yet

- Central Banking - BMDocument15 pagesCentral Banking - BMsfarhanemonNo ratings yet

- Central BankDocument6 pagesCentral BankMd Shahbub Alam SonyNo ratings yet

- Central Bank: Presented By: Zara (1711332) Bba - 5BDocument14 pagesCentral Bank: Presented By: Zara (1711332) Bba - 5BWajeeha RizwanNo ratings yet

- Banking - FoundationDocument153 pagesBanking - Foundationvineet kumarNo ratings yet

- Chap 6 Commercial BanksDocument28 pagesChap 6 Commercial BanksRashed MahmudNo ratings yet

- A Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionDocument14 pagesA Central Bank or Reserve Bank, or Monetary Authority Is An InstitutionVEDANT BASNYATNo ratings yet

- Central and Commercial BanksDocument10 pagesCentral and Commercial BanksHsfhrhfhfcu N3jddjejfjfrjNo ratings yet

- BankingDocument168 pagesBankingVaishnav Kumar100% (1)

- Central Bank FunctionsDocument3 pagesCentral Bank FunctionsPrithi Agarwal50% (2)

- Banking Notes The Primary Function of A Central BankDocument4 pagesBanking Notes The Primary Function of A Central Banknatafilip10No ratings yet

- Central Bank's FunctionsDocument14 pagesCentral Bank's FunctionsH-Sam PatoliNo ratings yet

- Central Bank (2 Files Merged)Document8 pagesCentral Bank (2 Files Merged)Atika ParvazNo ratings yet

- Central BankingDocument3 pagesCentral BankingVenkat IyerNo ratings yet

- BankingDocument5 pagesBankingSahanaNo ratings yet

- Eco - Banking - 5Document9 pagesEco - Banking - 5C.s TanyaNo ratings yet

- Functions of Central Bank PDFDocument27 pagesFunctions of Central Bank PDFPuja BhardwajNo ratings yet

- Functions and Role of RBIDocument7 pagesFunctions and Role of RBICharu Saxena16No ratings yet

- BANKING (Complete)Document10 pagesBANKING (Complete)Kushal OberoiNo ratings yet

- Central Bank vs Commercial Bank: Key DifferencesDocument8 pagesCentral Bank vs Commercial Bank: Key DifferencesSushilNo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Unit 5 - Central BankDocument21 pagesUnit 5 - Central Banktempacc9322No ratings yet

- Differences Between Central and Commercial BanksDocument2 pagesDifferences Between Central and Commercial BanksTannu GuptaNo ratings yet

- Reserve Bank of IndiaDocument25 pagesReserve Bank of IndiaUdayan SamirNo ratings yet

- Bangladesh Bank Report (Final)Document14 pagesBangladesh Bank Report (Final)chatterjee1987100% (4)

- Unit2 EeimDocument12 pagesUnit2 Eeimcasanova cheemsNo ratings yet

- PPB (CT)Document10 pagesPPB (CT)tahsinahmed9462No ratings yet

- Central Bank Functions ExplainedDocument7 pagesCentral Bank Functions ExplainedTilahun MikiasNo ratings yet

- Banks and Their ClassificationDocument9 pagesBanks and Their ClassificationRodica CebanNo ratings yet

- Central Banking Functions and ObjectivesDocument50 pagesCentral Banking Functions and ObjectivesRubiya KajamydeenNo ratings yet

- Definition of A BankDocument123 pagesDefinition of A BankMANAN KHANDELWAL 1850419No ratings yet

- Functions of A Central BankDocument2 pagesFunctions of A Central BankKishor MahmudNo ratings yet

- Foreign Remittance of DBBLDocument55 pagesForeign Remittance of DBBLMd Khaled NoorNo ratings yet

- Central Bank Functions and Role as Financial Institution RegulatorDocument22 pagesCentral Bank Functions and Role as Financial Institution RegulatorMd Rabbi KhanNo ratings yet

- Central Bank of BangladeshDocument7 pagesCentral Bank of BangladeshTawfeeq HasanNo ratings yet

- Functions of CBDocument33 pagesFunctions of CBpareshNo ratings yet

- Money & Banking Unit - Key ConceptsDocument39 pagesMoney & Banking Unit - Key ConceptsVijay ARNo ratings yet

- Chapter Two-Central BankDocument7 pagesChapter Two-Central BankTanmoy SahaNo ratings yet

- Central Bank: Chapter # 5Document17 pagesCentral Bank: Chapter # 5Sarfraz 'Drogba' ShaikhNo ratings yet

- Ch. 5 Banking: The Central BankDocument9 pagesCh. 5 Banking: The Central BankAneshak KhandelwalNo ratings yet

- Role of Central BankDocument6 pagesRole of Central BankWajeeha RizwanNo ratings yet

- Bangladesh University of Business and Technology On Bangladesh Bank and Its ActivityDocument11 pagesBangladesh University of Business and Technology On Bangladesh Bank and Its ActivitymostafizurNo ratings yet

- Module 1Document5 pagesModule 1Prajwal VasukiNo ratings yet

- Functions of Central Bank in PakistanDocument3 pagesFunctions of Central Bank in PakistanMehran MumtazNo ratings yet

- Central Bank Role ExplainedDocument5 pagesCentral Bank Role Explainedሔርሞን ይድነቃቸውNo ratings yet

- Good Morning All,: Welcome To Grade-XII Online Economic SessionDocument19 pagesGood Morning All,: Welcome To Grade-XII Online Economic SessionPrabin KhanalNo ratings yet

- Laws and Practice of General Banking (English) - LMPDocument35 pagesLaws and Practice of General Banking (English) - LMPAshfia ZamanNo ratings yet

- Lesson 5 - Central Vs Commercial BanksDocument4 pagesLesson 5 - Central Vs Commercial BanksHamna RazaNo ratings yet

- Central Banking Functions and Credit ControlDocument25 pagesCentral Banking Functions and Credit ControlOnindya MitraNo ratings yet

- Commercial Bank ManagementDocument8 pagesCommercial Bank ManagementShilpika ShettyNo ratings yet

- Class 12 Economics Project FileDocument19 pagesClass 12 Economics Project FiletusharNo ratings yet

- Central Banking: ObjectivesDocument11 pagesCentral Banking: ObjectivesRishi mehtaNo ratings yet

- Central Bank Functions and ResponsibilitiesDocument16 pagesCentral Bank Functions and ResponsibilitiesAyesha Parvin RubyNo ratings yet

- Central Bank Functions and ResponsibilitiesDocument13 pagesCentral Bank Functions and ResponsibilitiesmanikaNo ratings yet

- MACRO 3 Money and BankingDocument11 pagesMACRO 3 Money and BankingRashinaNo ratings yet

- CH 6 - BankingDocument17 pagesCH 6 - BankingPrachi SanklechaNo ratings yet

- Journal of International: Academic Research For MultidisciplinaryDocument12 pagesJournal of International: Academic Research For MultidisciplinarypolmulitriNo ratings yet

- The Best American Science & Nature Writing 2001Document291 pagesThe Best American Science & Nature Writing 2001polmulitriNo ratings yet

- My 2021 Goals: Reading WritingDocument1 pageMy 2021 Goals: Reading Writingchintu chaudharyNo ratings yet

- SEO-Optimized title for document on Indian financial markets reformsDocument486 pagesSEO-Optimized title for document on Indian financial markets reformspolmulitriNo ratings yet

- AnswerDocument10 pagesAnswerpolmulitriNo ratings yet

- Assignment New 1pDocument2 pagesAssignment New 1ppolmulitriNo ratings yet

- GrapevineDocument1 pageGrapevinepolmulitriNo ratings yet

- QuestionDocument3 pagesQuestionpolmulitriNo ratings yet

- Eligibility and Selection CriteriaDocument1 pageEligibility and Selection CriteriapolmulitriNo ratings yet

- My 2021 Goals: Reading WritingDocument1 pageMy 2021 Goals: Reading Writingchintu chaudharyNo ratings yet

- Grapevine Communication TypesDocument2 pagesGrapevine Communication TypespolmulitriNo ratings yet

- Cave Paintings in Lascaux: Discoveries at Lascaux GrottoDocument3 pagesCave Paintings in Lascaux: Discoveries at Lascaux GrottopolmulitriNo ratings yet

- AnswerDocument10 pagesAnswerpolmulitriNo ratings yet

- GrapevineDocument1 pageGrapevinepolmulitriNo ratings yet

- Fiftieth Year of Bangladesh BankingDocument4 pagesFiftieth Year of Bangladesh BankingpolmulitriNo ratings yet

- Mosler in Bonk (MBM) - Evening: MonogementDocument1 pageMosler in Bonk (MBM) - Evening: MonogementpolmulitriNo ratings yet

- Development & Islamic - 4Document4 pagesDevelopment & Islamic - 4polmulitriNo ratings yet

- Commercial Banking 2Document5 pagesCommercial Banking 2polmulitriNo ratings yet

- Fiftieth Year of Bangladesh BankingDocument4 pagesFiftieth Year of Bangladesh BankingpolmulitriNo ratings yet

- Commercial Banking 2Document5 pagesCommercial Banking 2polmulitriNo ratings yet

- Central Banking 3Document3 pagesCentral Banking 3polmulitriNo ratings yet

- Development & Islamic - 4Document4 pagesDevelopment & Islamic - 4polmulitriNo ratings yet

- Mission 200Document80 pagesMission 200HITESH PurohitNo ratings yet

- Five Keys To Investing SuccessDocument12 pagesFive Keys To Investing Successr.jeyashankar9550No ratings yet

- Acct Statement XX8558 19012023Document18 pagesAcct Statement XX8558 19012023Ankit GairolaNo ratings yet

- MATHINVS - Simple Annuities 3.6Document7 pagesMATHINVS - Simple Annuities 3.6Kathryn SantosNo ratings yet

- PERA FAQsDocument2 pagesPERA FAQsJustine YantoNo ratings yet

- 14 Private Company Case Study Kakao DaumDocument6 pages14 Private Company Case Study Kakao DaumasdfsadfsdfNo ratings yet

- WE - 12 - Exchange Rates and FX MarketsDocument23 pagesWE - 12 - Exchange Rates and FX MarketsKholoud KhaledNo ratings yet

- PNB 2015-AnnualReportDocument162 pagesPNB 2015-AnnualReportMarius AngaraNo ratings yet

- Horngrens Financial and Managerial Accounting 6th Edition Nobles Test BankDocument85 pagesHorngrens Financial and Managerial Accounting 6th Edition Nobles Test Bankmatthewavilawpkrnztjxs100% (29)

- Acca p4 - Advance Investment AppraisalDocument11 pagesAcca p4 - Advance Investment AppraisalkichuNo ratings yet

- Adl Pe Primer Fin r2Document24 pagesAdl Pe Primer Fin r2priyankachopraNo ratings yet

- Money LaunderingDocument24 pagesMoney LaunderingNeha SachdevaNo ratings yet

- ADD QuestionDocument8 pagesADD Questionomkolhe0007No ratings yet

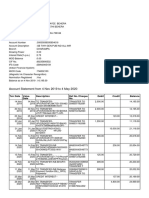

- Account Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChiranjibi Behera ChiruNo ratings yet

- Connecticut Foreclosure EventDocument2 pagesConnecticut Foreclosure EventHelen BennettNo ratings yet

- Investing in Fixed Income SecuritiesDocument16 pagesInvesting in Fixed Income Securitiescao cao100% (1)

- Chapter 3 What Is MoneyDocument19 pagesChapter 3 What Is MoneySamanthaHandNo ratings yet

- SEC Form 10-Q FilingDocument39 pagesSEC Form 10-Q FilingalexandercuongNo ratings yet

- Agriculture For Government AccountingDocument15 pagesAgriculture For Government Accountinganna paulaNo ratings yet

- Booking 1062381456Document2 pagesBooking 1062381456Deni SetiawanNo ratings yet

- 5011 Merchant Banking and Financial Services: Iii Semester/Ii Year BaDocument18 pages5011 Merchant Banking and Financial Services: Iii Semester/Ii Year Bas.muthuNo ratings yet

- Laws On Banks-A4Document16 pagesLaws On Banks-A4Steven OrtizNo ratings yet

- NAB Connect Consolidated File Format Specification - V0.05Document63 pagesNAB Connect Consolidated File Format Specification - V0.05vvijay05No ratings yet

- 2021 129 Taxmann Com 304 Gujarat 2021 282 Taxman 520 Gujarat 19 08 2021 Hitachi HiDocument26 pages2021 129 Taxmann Com 304 Gujarat 2021 282 Taxman 520 Gujarat 19 08 2021 Hitachi Hiashish poddarNo ratings yet