Professional Documents

Culture Documents

China Export Boom

Uploaded by

Kiran AdhikariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China Export Boom

Uploaded by

Kiran AdhikariCopyright:

Available Formats

China’s

Export

Boom

Its export dynamism is revealed

in a sharp move into electronics

and machinery

Mary Amiti and Caroline Freund

O

ver the past 15 years, China’s exports have

jumped more than tenfold, far exceeding the

tripling of world trade that has taken place over

the same period. As a result, in 2004, China over-

took Japan as the world’s third largest exporter, just behind

Germany and the United States. Not surprisingly, this growth

has attracted a lot of attention among media, academia, and The share of consumer electronics in China’s exports has grown since 1992.

policymakers. Insights into the driving forces behind this

growth could help identify how best China and other coun-

tries could benefit. Moreover, countries wishing to emulate tronics and machinery, China’s overall export structure has

China’s success may find lessons worth replicating. become more specialized, not more diversified. And China’s

How has China achieved this phenomenal export growth? growing sophistication of its exports is largely thanks to pro-

Recent studies highlight the sophistication of its exports, the cessing trade—the practice of assembling duty-free interme-

diversification of its product mix, and the growth in new diate inputs.

varieties. Sophistication could be important if these prod-

ucts have higher productivity growth. Diversification might Reallocating across sectors

aid growth by lessening the impact of shocks to specific sec- As a first step, we compare a snapshot of China’s export

tors and by facilitating new export discoveries. Exporting sector in 1992 with one from 2005 by examining how the

new products might allow exports to grow rapidly with less composition of its exports has changed. We find that it has

downward pressure on export prices. undergone a dramatic transformation since 1992. There has

To better understand these mechanisms, we recently been a significant decline in the share of agriculture and soft

undertook a study that decomposes the export growth in manufactures, such as textiles and apparel, with growing

several novel ways. Our findings indicate that, despite a dra- shares in hard manufactures, such as consumer electronics,

matic move out of agriculture, apparel, and textiles into elec- appliances, and computers.

38 Finance & Development September 2007

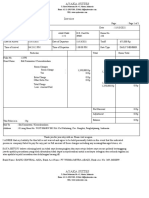

Breaking it down further, we take a We also explore changes in the pattern of China’s

look at changes within the manufactur- imported inputs to see if the increased skill content of pro-

ing sector. In particular, we examine how cessing exports is coming from the foreign or the domestic

trade shares have adjusted in all major stage of production. Comparing the change in the skill con-

sectors, which together comprise about tent of imported manufacturing inputs for processing trade

70 percent of China’s manufacturing with the change in the skill content of imported inputs for

exports. We find that there is a notable nonprocessing trade, we find a much larger increase in the

move out of textiles, apparel, footwear, skill content of processed imports. The results imply that the

and toys and into office machines, elec- increase in skill content in China’s exports is likely because of

trical machinery, and telecommunica- the increase in the skill content of imported inputs embed-

tions (see Chart 1). ded in these exports.

Getting more sophisticated Becoming more specialized

Does this move into electronics and Author:

In recent Amiti

years, — Chart

many 1

governments have begun promoting a

telecommunications mean that China’s Date: 7/26/07

more diversified export structure in hopes of offsetting poten-

manufacturing exports have become tialProof: 1 shocks in major sectors. This approach picks up

negative

more skill intensive? Over the past few

years, several studies (Rodrik, 2006;

Schott, 2006) have highlighted the Chart 1

surprising sophistication of China’s

Toward electronics exports

exports, suggesting that they tend to

Between 1992 and 2005, the makeup of Chinese

look a lot more like industrial country

manufacturing exports moved toward high technology.

exports than would be expected given

(percent of manufacturing exports)

China’s income level. The sophistication

30

of China’s exports in combination with

1992

the country’s robust income growth 2005

leads Rodrik to the conclusion that 20

what a country exports matters for its

future growth. The idea is that produc-

ing high-productivity goods has greater 10

growth benefits than producing other

goods—computer chips are better than

0

potato chips.

iles

ns

chi nic

act ous

chi e

l

ar

chi ial

tals

are

ma Offic

y

g

nes

y

twe

atio

ma str

ner

urin

ma ectro

ner

t

To see whether the skill content of

nuf ne

App

Tex

Me

u

Foo

nic

ma ella

Ind

El

China’s export growth has increased over mu

c

Mis

Author: Amiti — Chart 2

com

the past 15 years, we look at the share

Tele

of export products that are mid to high Date:

Source:7/30/07

China Customs, Beijing.

Note: A sector is defined as major if its share of total trade is above 3 percent in 1992

skill—defined as products that are ranked Proof: 2 Major sectors account for about 70 percent of manufacturing exports.

and/or 2005.

above the bottom 20 percent in terms of

skill intensity. Because industry skill-level

data for China were unavailable, we base Chart 2

the skill intensity ranking on information

Increasing skill content

from Indonesia—another emerging market country that is

likely to have similar technologies. (We also used U.S. data on Much of the higher skill content of China’s exports arises from

imported inputs with higher skill content.

skill rankings and the results are nearly identical.) We find that,

(share of exports from mid- to high-skill industries; percent)

in 1992, 45 percent of exports were in these mid- to high-skill

80

products, but by 2005, the export share of these industries had 1992

risen to 68 percent (see Chart 2, left bars). 2005

60

But, given the large share of processing trade in China, an

increase in the skill content of China’s exports could be due

40

to China importing intermediate inputs with higher skill con-

tent that it then assembles for export. Indeed, when we exclude

20

processing trade (see Chart 2, right bars), the increasing share

of trade in mid- and high-skill industries is much smaller. This

0

result is even stronger at higher skill levels, with processing All goods Excluding processing trade

trade accounting for the entire increase in the share of trade in Source: China Customs, Beijing.

high-skill industries.

Finance & Development September 2007 39

on the thinking of economists such as Hausmann and Rodrik A key concern in using this type of calculation to assess the

(2003), who argue that in the early stage of development, importance of new export varieties is that exports tend to be

more entrepreneurship and potentially greater diversification highly skewed—the smallest two deciles account for the vast

may help producers identify and expand production of new majority of product categories, and thus it is natural to expect

products in which they are globally competitive. Similarly, these two deciles to exhibit high growth. For that reason, we

Imbs and Wacziarg (2003) find that greater diversification evaluate the reallocation in more detail by dividing exports

of production has gone hand in hand with income rising into deciles according to the number of categories of trade

from low levels, suggesting it could be an important stage in 1992. For example, the tenth decile is the top 10 percent

of growth. But traditional theory highlights enhanced spe- of product categories when products are ranked by value.

cialization as the way to benefit from trade: if each country The decline in the share of the top decile shows that there

exports goods in which it has a comparative cost advantage, was a sizable reallocation of trade, but it was not the bottom

world output and welfare should rise. 50 percent of products that gained. Over 80 percent of the

To see whether China has moved in the direction of decline in the trade share of the top decile was accounted for

greater specialization or diversification, we look at the by an increase in the trade share of the four deciles just below

distribution of exports over time. We find that despite an the top (see Chart 3, bottom panel). In sum, the results imply

increase in China’s total number of export products, the that there was a significant reorientation in exports to prod-

degree of specialization has increased slightly. The increase ucts that were in the bottom 20 percent by value but in the

is especially notable in the top-ranked products. The top mid to high range by product rank.

10 export products now account for nearly 25 percent of We also perform more detailed analyses using tariff line

export value, whereas the top 10 in 1992 accounted for just data from the United States, which are far more disaggre-

10 percent of export value. Similarly, the top 100 products gated, with over 16,000 product codes. Our results show that

account for 54 percent of trade compared with 45 percent theAuthor:

majorityAmiti — Chart 4least 80 percent—stemmed from

of growth—at

in 1992. These results imply that, if anything, it is increased Date: 7/26/07

existing products. This implies that export expansion was

specialization that has contributed to export growth, con- Proof:

driven 3

by goods that were already being exported in 1992.

sistent with recent work by di Giovanni and Levchenko

(2007), which finds that increased trade is accompanied by

specialization in a large cross section of countries. Chart 3

Favoring existing products Growth in new goods

Goods in the bottom 20 percent of trade show the most

Is China exporting new products? Recent research shows a

growth . . .

strong correlation between the number of export products

(share of total value in 2005, percent)

and income levels in cross-country data (Hummels and

Klenow, 2005). The evidence suggests that income growth 25

leads to the development of new varieties. This is consis- 20

tent with new trade theory, which shows that the number

of goods produced in an economy increases with the size 15

of the economy. In addition, growth in new product vari- 10

eties is beneficial for exporters because it will likely offset

some of the downward pressure on export prices from an 5

increased world supply of goods. In contrast, traditional 0

theory only allows for an expansion of existing exports as 1 2 3 4 5 6 7 8 9 10

Decile by value, 1992

income expands.

To explore the importance of new products, we decompose . . . but the reshuffling of exports during the expansion occurred

China’s export growth from 1992 to 2005 using international mainly in the middle- and top-ranked products.

product codes, the most detailed level of disaggregation that (share of total value, percent)

80

is comparable over time. Because these data are too aggre- Share of total value, 1992

gated to allow entirely new products to be identified—by Share of total value, 2005

60

1992, China was exporting in more than 90 percent of these

categories—we split exports into deciles by value in 1992

40

and calculate their share of exports in 2005 (as in Kehoe and

Ruhl, 2003). If export growth arose mainly from new product

20

varieties, there would be rapid growth in the bottom deciles,

where trade was negligible in 1992. The data reveal that the 0

categories that accounted for the bottom 20 percent of trade 1 2 3 4 5 6 7 8 9 10

Decile by number of products, 1992

by value more than doubled in 15 years, whereas the catego-

Source: China Customs, Beijing.

ries in the other deciles contracted or remained constant (see Note: HS 6-digit data, containing more than 5,000 product codes.

Chart 3, top panel).

40 Finance & Development September 2007

Declining export prices low China’s lead is that the export sector must be allowed to

As China increases its supply of goods on world markets, change as it grows.

this is likely to put downward pressure on world prices of Second, our results point to an export sector that is tak-

these goods and thus lead to a deterioration in China’s terms ing advantage of China’s large supply of workers and of the

of trade. Since we find that most of China’s export growth increasing fragmentation of production across countries cur-

is from existing goods, this is especially likely to be an issue. rently under way, especially in Asia. The increased amount

Product differentiation could lessen price effects if new prod- of processing trade has enabled China to export increasingly

ucts were not good substitutes for existing goods. sophisticated products by assembling high-quality duty-

Taking the subset of goods that China exported to the free imported inputs. In the process, exports of many goods

United States from 1997 to 2005 (for which reliable price have increased dramatically, leading to enhanced specializa-

data are available), we construct an average export price tion. This is a traditional story consistent with a traditional

index that is a weighted sum of the growth rates of the prices policy recommendation. Lowering trade costs, both tariff

of the various products, where the weights are the products’ and nontariff barriers, and getting prices right are likely to

help resources move to their most productive uses. Indeed,

“The cost of opening a business in China’s average tariff has come down from about 45 percent

in 1992 to 10 percent today, which has surely facilitated the

China is 9.3 percent of average per transformation.

Third, our finding that China’s rapid export growth has

capita income, compared with more been accompanied by falling export prices implies that con-

sumers around the world have benefited from lower prices.

than 40 percent on average in While China’s export and income growth have remained

robust in recent years, growing exports could push prices

Latin America and East Asia and down further, with exporter profits eventually suffering.

Going forward, exporters may have incentives to offset

the Pacific.” declines in export prices by expanding into new products and

differentiating their products from those of competitors. n

shares in total value. We find that the export price index for

China over this period is 0.87, indicating a fall of 13 per- Mary Amiti is a Senior Economist with the U.S. Federal Reserve,

cent in current U.S. dollars. In contrast, the price index for and Caroline Freund is a Senior Economist in the IMF’s Re-

exports of these same products from the rest of the world search Department. The views expressed in this article are those

to the United States is 1.06, indicating a 6 percent increase of the authors and do not necessarily reflect those of the Federal

in prices. Thus, it appears that the rapid export growth has Reserve Bank of New York or the Federal Reserve System.

been associated with a decline in China’s export prices over

the period. References

The export price decline in China is consistent with a Amiti, Mary, and Caroline Freund, 2007, “An Anatomy of China’s

negative terms of trade effect, with increased exports push- Export Growth,” forthcoming in China’s Growing Role in World Trade,

ing down export prices. However, it could also be related to ed. by Robert Feenstra and Shang-Jin Wei (Cambridge, Massachusetts:

improved productivity in China, declining profit margins, National Bureau of Economic Research).

or exchange rate movements. This is an important topic for Di Giovanni, Julian, and Andrei Levchenko, 2007, “Trade Openness

future research. and Volatility” (unpublished; Washington: International Monetary Fund).

Hausmann, Ricardo, and Dani Rodrik, 2003, “Economic Development

Going forward as Self-Discovery,” Journal of Development Economics, Vol. 72

By decomposing China’s spectacular export growth of more (December), pp. 603–33.

than 500 percent since 1992, we were able to tease out a num- Hummels, David, and Peter Klenow, 2005, “The Variety and Quality

ber of findings, some of which may help guide policymakers. of a Nation’s Exports,” American Economic Review, Vol. 95 (June),

First, the dramatic transformation of China’s export struc- pp. 704–23.

ture over the past 15 years implies that its business environ- Imbs, Jean, and Romain Wacziarg, 2003, “Stages of Diversification,”

ment is relatively flexible, enabling it to move in and out of American Economic Review, Vol. 93 (March), pp. 63–86.

different sectors. In terms of the flexibility of employment, Kehoe, Timothy, and Kim Ruhl, 2003, “How Important Is the New

China ranks roughly on a par with East Asia and the Pacific Goods Margin in International Trade?” Research Department Staff Report

and significantly higher than averages from the other regions, No. 324 (Minneapolis: Federal Reserve Bank of Minnesota).

including those that contain industrial countries, according Rodrik, Dani, 2006, “What’s So Special about China’s Exports?” NBER

to the World Bank’s Doing Business 2007 indicators. Further, Working Paper No. 11947 (Cambridge, Massachusetts: National Bureau of

the cost of opening a business in China is 9.3 percent of aver- Economic Research).

age per capita income, compared with more than 40 percent Schott, Peter, 2006, “The Relative Sophistication of Chinese Exports,”

on average in Latin America and East Asia and the Pacific. In NBER Working Paper No. 12173 (Cambridge, Massachusetts: National

light of this experience, a lesson for countries seeking to fol- Bureau of Economic Research).

Finance & Development September 2007 41

You might also like

- Graphs For P 1 and P 2Document5 pagesGraphs For P 1 and P 2Kiran AdhikariNo ratings yet

- China Export BoomDocument4 pagesChina Export BoomKiran AdhikariNo ratings yet

- China Country ProfileDocument13 pagesChina Country ProfileKiran AdhikariNo ratings yet

- 08.0 PP 109 110 The Informational ApproachDocument2 pages08.0 PP 109 110 The Informational ApproachKiran AdhikariNo ratings yet

- Report On ChinaDocument42 pagesReport On ChinaANTHONY BERNALNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- HW8 SolutionsDocument4 pagesHW8 SolutionsKiran AdhikariNo ratings yet

- China Country ProfileDocument13 pagesChina Country ProfileKiran AdhikariNo ratings yet

- Quantum Algorithms For Fixed Qubit ArchitecturesDocument20 pagesQuantum Algorithms For Fixed Qubit ArchitecturesKiran AdhikariNo ratings yet

- Problem Sheet 3, Gauge Theories in Particle Physics: Problem 1: Time Ordering (5 Points)Document2 pagesProblem Sheet 3, Gauge Theories in Particle Physics: Problem 1: Time Ordering (5 Points)Kiran AdhikariNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- HW 1.1 Solution To Exact FormDocument7 pagesHW 1.1 Solution To Exact FormKiran AdhikariNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Quantum approximate optimization of exact-cover problem on superconducting quantum processorDocument9 pagesQuantum approximate optimization of exact-cover problem on superconducting quantum processorKiran AdhikariNo ratings yet

- HW 1.1 Exact SolutionDocument11 pagesHW 1.1 Exact SolutionKiran AdhikariNo ratings yet

- Adiabatic Quantum Algorithms for NP-Complete ProblemsDocument20 pagesAdiabatic Quantum Algorithms for NP-Complete ProblemsJie ChenNo ratings yet

- Tutorial Theory of Relativity and Cosmology: 4.1 Covariant Formulation of ElectrondynamicsDocument2 pagesTutorial Theory of Relativity and Cosmology: 4.1 Covariant Formulation of ElectrondynamicsKiran AdhikariNo ratings yet

- Exercise Sheet 3: Quantum Information - Summer Semester 2020Document2 pagesExercise Sheet 3: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- Sheet 4Document1 pageSheet 4Kiran AdhikariNo ratings yet

- Master Thesis Topics: Felix KahlhoeferDocument10 pagesMaster Thesis Topics: Felix KahlhoeferKiran AdhikariNo ratings yet

- Adhikari, Kiran - 905715 - Assignsubmission - File - HW - qft2Document7 pagesAdhikari, Kiran - 905715 - Assignsubmission - File - HW - qft2Kiran AdhikariNo ratings yet

- Sheet 2Document2 pagesSheet 2Kiran AdhikariNo ratings yet

- Exercise Sheet 1: Quantum Information - Summer Semester 2020Document2 pagesExercise Sheet 1: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- Vortrag MertschDocument12 pagesVortrag MertschKiran AdhikariNo ratings yet

- Exercise Sheet 13: Quantum Information - Summer Semester 2020Document3 pagesExercise Sheet 13: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- Exercise Sheet 2: Quantum Information - Summer Semester 2020Document3 pagesExercise Sheet 2: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- Exercise Sheet 5: Quantum Information - Summer Semester 2020Document3 pagesExercise Sheet 5: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- 2-A - Deutsch AlgorithmDocument9 pages2-A - Deutsch AlgorithmKiran AdhikariNo ratings yet

- Exercise Sheet 9: Quantum Information - Summer Semester 2020Document2 pagesExercise Sheet 9: Quantum Information - Summer Semester 2020Kiran AdhikariNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sirona Invoice 1702366155-93Document1 pageSirona Invoice 1702366155-93mugentsukiyomi31No ratings yet

- Activity-Based Management and Activity-Based Costing: Cost Accounting: Foundations and Evolutions, 8eDocument37 pagesActivity-Based Management and Activity-Based Costing: Cost Accounting: Foundations and Evolutions, 8eErika Dawn BalderasNo ratings yet

- Fiscal Reforms in India Since 1991-Group 5-Sec BDocument20 pagesFiscal Reforms in India Since 1991-Group 5-Sec BPrateek Chaturvedi75% (4)

- Experience authentic Rajasthani flavorsDocument12 pagesExperience authentic Rajasthani flavorsTejasvee Tandon Jaipuria JaipurNo ratings yet

- Contactos Arg-ColombiaDocument40 pagesContactos Arg-ColombiaJuan Angel Gonzalez CamposNo ratings yet

- Ganda-Co. Sassy Mo Beauty SalonDocument35 pagesGanda-Co. Sassy Mo Beauty SalonJonathan SantosNo ratings yet

- Komatsu 27R8-7Document264 pagesKomatsu 27R8-7ВикторNo ratings yet

- Amazon Spain Approves 2019 AccountsDocument78 pagesAmazon Spain Approves 2019 AccountsLaura Gomez SánchezNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jyoti MorkundeNo ratings yet

- Item No. Part No. Name of Part Material No. Reqd DescriptionDocument3 pagesItem No. Part No. Name of Part Material No. Reqd Descriptionmantilla7No ratings yet

- Course Course Code JUNE 2018: Universiti Teknologi Mara Final ExaminationDocument9 pagesCourse Course Code JUNE 2018: Universiti Teknologi Mara Final ExaminationAmiraNo ratings yet

- Reprinted Tax Receipt for Wilson PropertiesDocument2 pagesReprinted Tax Receipt for Wilson PropertiesChelsea KayeNo ratings yet

- Rok Akademicki (Academic Year) 2021/2022 Kierunek:: Foreing Language (Different Than English, UW Offer)Document2 pagesRok Akademicki (Academic Year) 2021/2022 Kierunek:: Foreing Language (Different Than English, UW Offer)amith ashwithiNo ratings yet

- وعده بهشتDocument262 pagesوعده بهشتM.Shahir IsmailzadaNo ratings yet

- Turning Crisis into Opportunity: How Global Institutions Can Address COVID-19, Climate Change and InequalityDocument10 pagesTurning Crisis into Opportunity: How Global Institutions Can Address COVID-19, Climate Change and InequalityyashitaNo ratings yet

- Catalog EGR VOL-StahlDocument9 pagesCatalog EGR VOL-StahlTetroVorinNo ratings yet

- Plant Location and Lay-OutDocument26 pagesPlant Location and Lay-OutJoy Maan De GuzmanNo ratings yet

- Invoice Letter 11 Nov 2021Document8 pagesInvoice Letter 11 Nov 2021Suvi AzkaNo ratings yet

- EquipamentosDocument4 pagesEquipamentosIgor SabreuNo ratings yet

- Manage Your Spirit Airlines Itinerary and Flight DetailsDocument3 pagesManage Your Spirit Airlines Itinerary and Flight DetailsColombian ExoFruitNo ratings yet

- Rate Analysis For DewateringDocument4 pagesRate Analysis For DewateringBabin Saseendran100% (1)

- GuesstimatesDocument5 pagesGuesstimatesHritik LalNo ratings yet

- Financial Accounting First Canadian Edition Canadian 1st Edition Waybright Test Bank DownloadDocument39 pagesFinancial Accounting First Canadian Edition Canadian 1st Edition Waybright Test Bank DownloadSherry Belvin100% (24)

- Garden Rail - N°291 - 2018-11Document64 pagesGarden Rail - N°291 - 2018-11Valery GagichNo ratings yet

- Best Illume Lights Spotlight FeaturesDocument16 pagesBest Illume Lights Spotlight FeaturesgemrisNo ratings yet

- Agreement for Contractual CustomersDocument2 pagesAgreement for Contractual Customerssam yadav100% (1)

- A Yarn Manufacturing Spinning Mill List 2019 v5Document44 pagesA Yarn Manufacturing Spinning Mill List 2019 v5Tabassum RezaNo ratings yet

- Report Cera SanitarywareDocument10 pagesReport Cera SanitarywareShiva SinghNo ratings yet

- New Carens Price List 1-4-2022Document1 pageNew Carens Price List 1-4-2022Toyesh BhardwajNo ratings yet

- Suchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)Document17 pagesSuchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)himeesha dhiliwalNo ratings yet