Professional Documents

Culture Documents

Tax Card 2022

Uploaded by

abdullahsaleem91Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

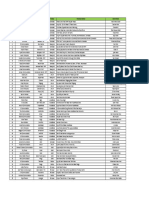

Tax Card 2022

Uploaded by

abdullahsaleem91Copyright:

Available Formats

FOSTERING FINANCIAL EXCELLENCE

TAX RATE CARD - TAX YEAR 2021-22

Descrip on Descrip on U/S Filer Non Filer

U/S Rates of Tax

For Salaried Individuals having Salary Income more than 75% of Taxable Income Immpvable property sale and purchase

Advance tax on buyer 236K 1% 2%

Upto 600,000 0%

Advance tax on seller holding < 4 Y 1% 2%

600,001 - 1,200,000 5% on > 600 K 236C

Advance tax on seller holding > 4 Y 0%

1,200,001 - 1,800,000 30 K plus 10% on > PKR 1.2 M Gain on sale of Immpvable property Gain taxable Gain taxable rate

1,800,001-2,500,000 90 K plus 15% on > PKR 1.8 M Sold within 1 Y 100 % taxable

Upto 5 Mil 3.5%

2,500,001 - 3,500,000 195 K plus 17.5% on > PKR 2.5 M Sold a er 1 Y but not exceeding 2 Y 75 % taxable

Upto 10 Mil 7.5%

3,500,000 - 5,000,000 370 K plus 20% on > PKR 3.5 M Sold a er 2 Y but not exceeding 3 Y 37A 50 % taxable

149 Upto 15 Mil 10%

Sold a er 3 Y but not exceeding 4 Y 25 % taxable

5,000,001 - 8,000,000 670 K plus 22.5% on > PKR 5 M > 15 Mil 15%

Sold a er 4 Y 0 % taxable

8,000,001 - 12,000,000 1.345 M plus 22.5% on > PKR 8 M

12,000,001 - 30,000,000 2.345 M plus 27.5% on > PKR 12 M Descrip on U/S Filer Non Filer

Advance tax on sale by auc on

30,000,001 - 50,000,000 7.295 M plus 30% on > PKR 30 M Sale of immovable property by auc on 5% 10%

50,000,001 - 75,000,000 13.295 M plus 32.5% on > PKR 50 M 236A

Sale of other than immovable property by auc on 10% 20%

Above 75,000,000 21.420 M plus 35% on > PKR 75 M Advance tax charged by local educa onal ins tu on 236I 0% 5%

Other than Salaried Individuals Advance tax on telephone suscriber and internet

Monthly bill upto 1000 0% 0%

Upto 400,000 0

Monthly bill > 1000 236 10% 10%

400,001 - 600,000 5% on > 400 K internet, mobile telephone, prepaid card or telephone 10% 10%

600,001 - 1,200,000 10 K + 10% on > PKR 600 K Dividend

1,200,001-2,400,000 70 K + 15% on > PKR 1.2 M Received from mutual fund, REIT and Others

150

15% 30%

18 Received from Companies 25% 50%

2,400,001 - 3,000,000 250 K + 20% on > PKR 2.4 M

Profit on Debt 151 15% 30%

3,000,001 - 4,000,000 370 K + 25% on > PKR 3 M

Return on investment in sukuks

4,000,001 - 6,000,000 620 K + 30% on > PKR 4 M Received by Company 25% 50%

Above 6,000,000 1.220 M + 35% on > PKR 6 M Received by IND, AOP if profit is < 1M 251 (1A) 10% 20%

Received by IND, AOP if profit is > 1M 12.5% 25%

Companies Individual / AOP Tax at import stage

Descrip on U/S Impor ng goods classified in Part I of the 12th schedule 1% 2%

Filer Non Filer Filer Non Filer Impor ng goods classified in Part II of the 12th schedule 148 2% 4%

GOODS, SERVICES & CONTRACTS U/S 153 Services excluding (Electronic and Print Media Adver sing Services, Contracts, 5.5% 11%

Sportsman and tching, Dying, Prin ng, Embroidery etc.) (if Annual srvices > 30K)

Rice, Co on Seed Oil, Edible Oils (if Annual Supplies > 75K) 1.50% 3% 1.50% 3% Payments to non resident

Other Goods including Toll Manufacturing (if Annual Supplies > 75K) 4% 8% 4.50% 9% Royalty or Fee for Technical Services 152(1) 15% 30%

Construc on and Related Services

153(1)(a)

Distributor, Wholesaler, Retailer, Dealer, and Sub-Dealer of FMCG, Fer lizer, electronics 0.25% 8% 0.25% 9% 152(1A) 7%

excluding mobile phones, sugar, Cement and Edible Oil (if Annual Supplies > 75K) S tching, Dying, Prin ng, Embroidery etc

Traders of Yarn 0.50% 1% 0.50% 1% Media Person Adver sement Services 152(1AAA) 10% 10%

Fee for Offshore Digital Services 152(1C) 5% 5%

Services excluding (Electronic and Print Media Adver sing Services, Contracts,

3% 6% 3% 6% Export other than export comission 152(2) 20% 40%

Sportsman and s tching, Dying, Prin ng, Embroidery etc.) (if Annual services > 30K) 153(1)(b) Sales to distributor, dealer and wholesaler (Other than Fer lizer) 0.1% 0.2%

236G

Electronic and Print Media Adver sing Services 1.50% 3% 1.50% 3% Sales to distributor, dealer and wholesaler of Fer lizer 0.25% 0.70%

Contracts (if Annual Contract > 10K) 6.50% 13% 7% 14% Sale to retailers 236H 0.5% 1.0%

153(1)(c)

Sportsman N/A 10% 20% Descrip on U/S

Companies IND/AOP

S tching, Dying, Prin ng, Embroidery etc. 153(2) 1% 2% 1% 2% Filer Non Filer Filer Non Filer

Supply of Goods 4% 4% 4.5% 4.5%

Exports U/S 154 Services 8% 16% 10% 20%

152(2A)

Contract 7% 14% 7% 14.0%

154

Export other than export commission 1% Sportsman N/A 10% 20%

(1,3,3A,3B,4A)

Export Commission 154(2) 5% Transport Services, Freight Forwarding Services, Air Cargo Services,

Courier Services, Manpower Outsourcing Services, Hotel Services,

Property income Rent U/S 155 Companies Security Guard Services, So ware Development Services, IT Services and

U/S

Filer Non Filer IT Enabled Services, Tracking Services, Adver sing Services (Other than 152(5)(I) 3% 6% 3% 6%

Rent (Companies) 15% 30% Print/Electronic Media), Share Registrar Services, Engineering Services,

(Individual / AOP) Car Rental Services, Building Maintenance Services, Services Rendered by

Pakistan Stock Exchange Limited and Pakistan Mercan le Exchange

Rent (Individual / AOP) Filer Non Filer Limited, Inspec on, Cer fica on, Tes ng, Training Services

<= 300,000 155 Nil Nil

Mimimum tax

300,001 to 600,000 5% on > 300,000 10% on > 300,000

OMC, SSGC and SNGPL when Turnover > 1Billion

600,001 to 2,000,000 15 K + 10% on > 600 K 30 K + 20% on > 600 K 0.75%

PIA and Ppulty Industry

2,000,001 and above 155 K + 25% on > 2 M 310 K + 50% on > 2 M Oil refinary and Motercycle dealers registered under Sales tax act 0.50%

Distributor of pharmacu cal prodcuts, FMCG and Cigare es 0.25%

Companies / Individual / AOP

U/S Petroleum agents and distributor registered under sale taxs act, Rice 113

PRIZE & WINNINGS U/S 156 Filer Non Filer mills and dealers, Flour mills, person running online marketplace clause,

0.25%

Prize Bonds 15% 30% Tire 1 retailer of FMCG, person engaged in sale and purchase of used

156

Prizes, Winning, Lo ery & Raffles 20% 40% vehicle

In all other cases 1.25%

PETROL AND CNG U/S 156A

Petrol & Petroleum Products 156A 12% 24% Super tax Only on Banking Companies @ 4%

FOSTERING FINANCIAL EXCELLENCE

TAX RATE CARD - TAX YEAR 2021-22

Descrip on U/S Rates of Tax Sales Tax Withholding Rate

Sr.

Tax on Builders & Developers (First Schedule) Withholding Agent Supplier Category Rate of Tax to be Withheld

No.

Tax on Builders (a) Federal and Provincial Government departments; autonomous bodies; and public sector organiza ons

1 Registered Persons 1/5th of Sales Tax as shown on invoice

For Commercial Builders (b) Companies as defined in the Income Tax Ordinance, 2001 (i.e.FTN holders)

Karachi, Lahore & Islamabad (a) Federal and Provincial Government departments; autonomous bodies; and public sector organiza ons Persons registered as wholesaler,

2 1/10th of Sales Tax as shown on invoice

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, dealer or distributor

Rs. 210/ Sq Ft (b) Companies as defined in the Income Tax Ordinance, 2001 (i.e.FTN holders)

Peshawar,Mardan, Abbo abad, Que a

Whole of the tax involved or as applicable to supplies on the basis of gross

Urban Areas not specified in above 3 Federal and Provincial Government departments; autonomous bodies; and public sector organiza ons Unregistered Persons

value of supplies

For Residen al Builders 4 Companies as defined in the Income Tax Ordinance, 2001 (XLIX of 2001) Unregistered Persons 5% of gross value of supplies

Rs. 20 per Sq. Ft upto 750 Sq. Ft. Rs. Person providing adver sement

5 Registered persons as recipient of adver sement services Whole of sales tax applicable

Karachi, Lahore & Islamabad 7C 40 per Sq. Ft upto 751 to 1500 Sq. Ft. Rs. services

70 per Sq. Ft on 1501 Sq. Ft. or more 6 Registered persons purchasing cane molasses. Unregistered Persons Whole of sales tax applicable

Rs. 15 per Sq. Ft upto 750 Sq. Ft. Persons supplying any kind of lead

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, under chapter 78 (PCT Headings:

Rs. 35 per Sq. Ft upto 751 to 1500 Sq. Ft. Rs.

Peshawar,Mardan, Abbo abad, Que a 7801.1000, 7801.9100,

55 per Sq. Ft on 1501 Sq. Ft. or more

Rs. 10 per Sq. Ft upto 750 Sq. Ft. 7801.9900, 7802.0000, 78.03,

7 Registered persons manufacturing lead ba eries 7804.1100, 7804.1900, 75% of the sales tax applicable

Urban Areas not specified in above Rs. 25 per Sq. Ft upto 751 to 1500 Sq. Ft.

7804.2000, 78.05, 7806.0010,

Rs. 35 per Sq. Ft on 1501 Sq. Ft. or more

7806.0020, 7806.0090) or scrap

ba eries under chapter 85 (PCT

Tax on Developers Headings: 8548.1010, 8548.1090)

Persons other than ac ve 2% of gross value of supplies Provided that the provisions of this entry

For Commercial Plots 8 Online market place

taxpayers shall be effec ve from the date as no fied by the Board

Karachi, Lahore & Islamabad

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Note

Rs. 210/ Sq Ft

Peshawar,Mardan, Abbo abad, Que a The above men oned sales tax rates for withholding or deduc on by the withholding agents are not applicable to goods and supplies specified below;

Urban Areas not specified in above (i) Electrical energy;

(ii) Natural Gas;

For Residen al Plots (iii) Petroleum Products as supplied by petroleum produc on & explora on companies, oil refineries, oil marke ng companies and dealers of motor spirit and high speed diesel;

Rs. 20 per Sq. yd. upto 120 Sq. yd. (iv) Vegetable ghee and cooking oil;

Karachi, Lahore & Islamabad 7D Rs. 40 per Sq. yd. upto 121 to 200 Sq. yd. Rs. (v) Telecommunica on services;

70 per Sq. yd. on 201 Sq. yd. or more (vi) Goods specified in the Third Schedule to the Sales Tax Act, 1990;

Rs. 15 per Sq. yd. upto 120 Sq. yd. (vii) Supplies made by importers who paid value addi on tax on such goods at the me of import; and

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, (viii) Supplies made by an Ac ve Taxpayer as defined in the Sales Tax Act, 1990 to another registered persons with excep on of adver sement services.

Rs. 35 per Sq. yd. upto 121 to 200 Sq. yd. Rs.

Peshawar,Mardan, Abbo abad, Que a (ix) Supply of sand, stone, gravel/crush and clay to low cost housing schemes sponsored or approved by Naya Pakistan Housing and Development Authority.

55 per Sq. yd. on 201 Sq. yd. or more

Rs. 10 per Sq. yd. upto 120 Sq. yd. (x) Electric vehicles (4 wheelers) CKD kits for small cars/SUVs, with 50 kwh ba ery or below and LCVs with 150 kwh ba ery of below ll 30th June, 2026;

(xi) Electric vehicles (4 wheelers) small cars/SUVs, with 50 kwh ba ery or below and LCVs with 150 kwh ba ery of below in CBU condi on ll 30th June, 2026;

Urban Areas not specified in above Rs. 25 per Sq. yd. upto 121 to 200 Sq. yd.

(xii) Electric vehicles (2-3 wheelers and heavy commercial vehicles) in CBU condi on ll 30th June, 2025; and

Rs. 35 per Sq. yd. on 201 Sq. yd. or more

(xiii) Motor cars of cylinder capacity upto 850cc

Tax on Builders & Developers (Eleventh Schedule)

DISCLAIMER:

Tax on Builders The above tax rates are extracted from the Income Tax Ordinance, 2001 and Finance Act, 2021. Proper due care has been observed while extrac ng the rate , however mistakes could be possible in any tax rate. The

rates are for general guidance purposes only and should not be constructed as legal provision. M/s Iqbal Yasir and Co. (Chartered Accountants) will not take any responsibility for any loss incurred by anyone as a result

For Commercial Builders of any above informa on.

Karachi, Lahore & Islamabad Rs. 250/ Sq Ft

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal,

Rs. 230/ Sq Ft

Peshawar,Mardan, Abbo abad, Que a

Urban Areas not specified in above Rs. 210/ Sq Ft

For Residen al Builders

100D Rs. 80 per Sq. Ft upto 3000 Sq. Ft & Rs. 125 per Sq. Ft for 3001 and

Karachi, Lahore & Islamabad

above Sq. Ft

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Rs. 65 per Sq. Ft upto 3000 Sq. Ft & Rs. 110 per Sq. Ft for 3001 and

Peshawar,Mardan, Abbo abad, Que a above Sq. Ft

Rs. 50 per Sq. Ft upto 3000 Sq. Ft & Rs. 100 per Sq. Ft for 3001 and

Urban Areas not specified in above

above Sq. Ft

Tax on Developers

For En re Project

Karachi, Lahore & Islamabad Rs.150 per Sq. yd

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal,

Rs.130 per Sq. yd

Peshawar,Mardan, Abbo abad, Que a

Urban Areas not specified in above Rs.100 per Sq. yd

100D

For Development of Industrial Area

Karachi, Lahore & Islamabad

Hyderabad, Sukkur, Multan, Faisalabad, Rawalpindi, Gujranwala, Sahiwal, Rs.20 per Sq. yd

Peshawar,Mardan, Abbo abad, Que a

Urban Areas not specified in above Rs.10 per Sq. yd

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- F7 Sir Zubair NotesDocument119 pagesF7 Sir Zubair NotesAli OpNo ratings yet

- Compare investment projects using payback period and ARRDocument24 pagesCompare investment projects using payback period and ARRzaheer shahzadNo ratings yet

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- AUE3701 PACK ASS 2 2022 8m92akDocument38 pagesAUE3701 PACK ASS 2 2022 8m92akMonica DeetlefsNo ratings yet

- Fac 3703Document99 pagesFac 3703Nozipho MpofuNo ratings yet

- IPRO Mock Exam - 2021 - QDocument21 pagesIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- IAS 40 Investment Property SummaryDocument16 pagesIAS 40 Investment Property SummaryPhebieon MukwenhaNo ratings yet

- IFRS 16 Leases: You Might Want To Check That Out HereDocument10 pagesIFRS 16 Leases: You Might Want To Check That Out HerekoshkoshaNo ratings yet

- 06 JUNE AnswersDocument13 pages06 JUNE AnswerskhengmaiNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- Fi Concession April 2023 Application of Financial Management TechniquesDocument12 pagesFi Concession April 2023 Application of Financial Management TechniquesBenineNo ratings yet

- Txzaf 2019 Jun QDocument16 pagesTxzaf 2019 Jun QAyomideNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- NOCLAR FAQs for SAICA MembersDocument17 pagesNOCLAR FAQs for SAICA MembersKarlo Jude AcideraNo ratings yet

- Cost and Pricing MGT For Competitive AdvantageDocument45 pagesCost and Pricing MGT For Competitive Advantageilona gabrielNo ratings yet

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingDocument13 pagesFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidNo ratings yet

- IFRS 15 Mapping Linked To Illustrative Examples - Page 1Document3 pagesIFRS 15 Mapping Linked To Illustrative Examples - Page 1See-Anne RamsuranNo ratings yet

- Lecture 9 M17EFA - Company Valuation 2 1Document48 pagesLecture 9 M17EFA - Company Valuation 2 1822407No ratings yet

- General Fin Reporting 2013 Exam W SolutionsDocument69 pagesGeneral Fin Reporting 2013 Exam W SolutionsTosha Lopez100% (1)

- IAS 29 IllustrationDocument28 pagesIAS 29 Illustrationapi-3828505No ratings yet

- Chapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document40 pagesChapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Acca f7 Course NotesDocument202 pagesAcca f7 Course NotessajedulNo ratings yet

- ACCA SBR Technical ArticlesDocument60 pagesACCA SBR Technical ArticlesReem JavedNo ratings yet

- F7 ACCA June 2013 Exam: BPP AnswersDocument16 pagesF7 ACCA June 2013 Exam: BPP Answerskumassa kenya100% (1)

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- SBR Study Notes - 2018 - FinalDocument293 pagesSBR Study Notes - 2018 - Finalprerana pawar100% (2)

- IFRS Practice Issues Revenue NIIF 15 Sept14Document204 pagesIFRS Practice Issues Revenue NIIF 15 Sept14prof_fids100% (1)

- Thông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Document367 pagesThông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Kent PhamNo ratings yet

- F7 Workbook Q PDFDocument124 pagesF7 Workbook Q PDFLêNgọcTùngNo ratings yet

- FAC1502 Tutorial Letter 102 UNISADocument45 pagesFAC1502 Tutorial Letter 102 UNISAdanNo ratings yet

- William WongDocument3 pagesWilliam WongKashif Mehmood0% (1)

- Tutorial Letter 501/0/2020: Financial StrategyDocument13 pagesTutorial Letter 501/0/2020: Financial StrategydevashneeNo ratings yet

- Ias 12 - Income Taxes DefinitionsDocument4 pagesIas 12 - Income Taxes DefinitionsFurqan ButtNo ratings yet

- The Fall of Enron: Group 1Document20 pagesThe Fall of Enron: Group 1Thiện NhânNo ratings yet

- Ey Applying Ifrs Leases Transitions Disclsosures November2018Document43 pagesEy Applying Ifrs Leases Transitions Disclsosures November2018BT EveraNo ratings yet

- Bamfram PLC Is A Well Established Manufacturer of A SpecializedDocument2 pagesBamfram PLC Is A Well Established Manufacturer of A SpecializedAmit PandeyNo ratings yet

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet

- ACCA F9 Past Paper AnalysisDocument6 pagesACCA F9 Past Paper AnalysisPawan_Vaswani_9863100% (1)

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocument10 pagesWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryNo ratings yet

- 12 SBR Study NotesDocument297 pages12 SBR Study NotesYogesh BhattaraiNo ratings yet

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocument8 pagesMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNo ratings yet

- Acca SBR 204 210 PDFDocument7 pagesAcca SBR 204 210 PDFYudheesh P 1822082No ratings yet

- Financial Reporting Act 2015 - English - Unofficial VersionDocument29 pagesFinancial Reporting Act 2015 - English - Unofficial VersionReefat HasanNo ratings yet

- IFRS Sample Questions PDFDocument90 pagesIFRS Sample Questions PDFSreekanthMylavarapuNo ratings yet

- Acca - Fia - Cat - Dipifr - Abe:: Join Our Exam-Focused Lecturing Team ForDocument2 pagesAcca - Fia - Cat - Dipifr - Abe:: Join Our Exam-Focused Lecturing Team Forshyam48No ratings yet

- F7 Course Note by Mezbah UddinDocument107 pagesF7 Course Note by Mezbah UddinAsim NazirNo ratings yet

- An Overview of SingerBDDocument19 pagesAn Overview of SingerBDEmon Hossain100% (1)

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Part C F5 RevisionDocument20 pagesPart C F5 RevisionMazni HanisahNo ratings yet

- Dec 2007 - AnsDocument10 pagesDec 2007 - AnsHubbak KhanNo ratings yet

- Gagnon Company Reported The Following Sales and Quality Costs ForDocument1 pageGagnon Company Reported The Following Sales and Quality Costs ForAmit PandeyNo ratings yet

- Graded Questions Solutions 2023Document27 pagesGraded Questions Solutions 20232603803No ratings yet

- Fin119 CSG PDFDocument514 pagesFin119 CSG PDFjamesbook100% (1)

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsFrom EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNo ratings yet

- Additional Principal Review PageDocument1 pageAdditional Principal Review Pageabdullahsaleem91No ratings yet

- Awasr Chairman Introduction FinalDocument47 pagesAwasr Chairman Introduction Finalabdullahsaleem91No ratings yet

- REPORT AND PRESENTATION ON INTERVENTION 21 April 2021Document37 pagesREPORT AND PRESENTATION ON INTERVENTION 21 April 2021abdullahsaleem91No ratings yet

- Balance Sheet: CheckDocument1 pageBalance Sheet: Checkabdullahsaleem91No ratings yet

- Analysys Mason - Market Analysis 2019-09-24Document175 pagesAnalysys Mason - Market Analysis 2019-09-24abdullahsaleem91No ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Annual CPD Declaration 2020: X X X X XDocument2 pagesAnnual CPD Declaration 2020: X X X X XBadshahNo ratings yet

- Awasr Valuation at IPO 2023: 4 September, 2021Document3 pagesAwasr Valuation at IPO 2023: 4 September, 2021abdullahsaleem91No ratings yet

- Awasr Oman Partners 2019Document44 pagesAwasr Oman Partners 2019abdullahsaleem91No ratings yet

- Vision Statement Zoom ConsultantDocument1 pageVision Statement Zoom Consultantabdullahsaleem91No ratings yet

- Punjab Procurement Rules 2014 Amended Upto 17-08-2020 (Final)Document45 pagesPunjab Procurement Rules 2014 Amended Upto 17-08-2020 (Final)abdullahsaleem91No ratings yet

- Awasr Valuation at IPO 2023: 4 September, 2021Document3 pagesAwasr Valuation at IPO 2023: 4 September, 2021abdullahsaleem91No ratings yet

- ROI IT StartupDocument49 pagesROI IT Startupabdullahsaleem91No ratings yet

- G10489 EC - Taxation OverviewDocument17 pagesG10489 EC - Taxation Overviewabdullahsaleem91No ratings yet

- Tax Compliance December 2020Document10 pagesTax Compliance December 2020abdullahsaleem91No ratings yet

- ACA training roles guide QPRTs PRTs ATPsDocument2 pagesACA training roles guide QPRTs PRTs ATPsabdullahsaleem91No ratings yet

- Tax Card 2022Document2 pagesTax Card 2022abdullahsaleem91100% (1)

- Risk Matrix Assessment Bank Risk Matrix AssessmentDocument3 pagesRisk Matrix Assessment Bank Risk Matrix Assessmentabdullahsaleem91No ratings yet

- Knowledge for eAudIT: Processes, WCGWs and Controls in Oil and GasDocument10 pagesKnowledge for eAudIT: Processes, WCGWs and Controls in Oil and Gasabdullahsaleem91100% (1)

- Chartered Accountants: Hospitality - Conract SynopsisDocument7 pagesChartered Accountants: Hospitality - Conract Synopsisabdullahsaleem91No ratings yet

- Procurement Process FlowchartDocument1 pageProcurement Process Flowchartabdullahsaleem91No ratings yet

- Rawalpindi Chamber of Commerce & IndustryDocument325 pagesRawalpindi Chamber of Commerce & Industrywinds isbNo ratings yet

- MP CG-2Document6 pagesMP CG-2John RazaNo ratings yet

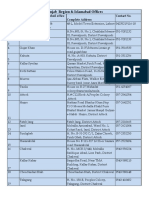

- Regional Offices in Punjab: Name Designation Contact Address Email AddressDocument5 pagesRegional Offices in Punjab: Name Designation Contact Address Email AddressMunir Khan0% (1)

- The Sikh Dilemma: The Partition of Punjab 1947: Busharat Elahi JamilDocument30 pagesThe Sikh Dilemma: The Partition of Punjab 1947: Busharat Elahi JamilKaran KahlonNo ratings yet

- ELECTION LISTDocument6 pagesELECTION LISTSaood AwanNo ratings yet

- List of 3 in 1 Magnetic Data Cable Winners: First Position in InstitutionDocument131 pagesList of 3 in 1 Magnetic Data Cable Winners: First Position in InstitutionCOFFEENo ratings yet

- Recognized Medical & Dental Postgraduate QualificationsDocument132 pagesRecognized Medical & Dental Postgraduate QualificationsMariaLakhaniNo ratings yet

- Certified Hajj Umra Tour OperatorDocument28 pagesCertified Hajj Umra Tour OperatorHameed Bangish100% (1)

- USB Data Cable WinnersDocument67 pagesUSB Data Cable WinnersMujeeb MaqboolNo ratings yet

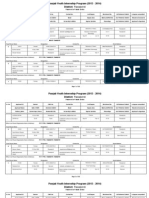

- Punjab Youth Internship Program PlacementsDocument123 pagesPunjab Youth Internship Program PlacementsEngr. Naveed MazharNo ratings yet

- List-of-Certified-Installer-C-3-18-03-2024Document26 pagesList-of-Certified-Installer-C-3-18-03-2024Khalid AminNo ratings yet

- PTCL dividend for non-CNIC shareholders in 2014Document712 pagesPTCL dividend for non-CNIC shareholders in 2014MeeNo ratings yet

- UBL Branch List PDFDocument9 pagesUBL Branch List PDFMuhammad MubashirNo ratings yet

- The RefugeeDocument6 pagesThe Refugeeshwejan rajNo ratings yet

- SFPL-Approved Station List 2019Document7 pagesSFPL-Approved Station List 2019Raheem Ullah KakarNo ratings yet

- FEED Mills in PakistanDocument14 pagesFEED Mills in PakistanCh. Anwarulhaq92% (12)

- Rs. Eight Hundred Twenty-One Only 821: Certificate Issued byDocument1 pageRs. Eight Hundred Twenty-One Only 821: Certificate Issued byMuhammad SajidNo ratings yet

- SVP and Helix Promo Site List ShellDocument3 pagesSVP and Helix Promo Site List Shellمحمد ابوبكرNo ratings yet

- Pak Studies Up To Date clASS 9TH CH 1Document7 pagesPak Studies Up To Date clASS 9TH CH 1SYED salman saeedNo ratings yet

- Panel Hospitals IGI LIFE & GENERAL-20170629-130924400Document10 pagesPanel Hospitals IGI LIFE & GENERAL-20170629-130924400Syed Marwan AmeerNo ratings yet

- Tehsil OfficesDocument22 pagesTehsil OfficesWaqarali ShahNo ratings yet

- Provision of Higher Education Opportunities for Students of Balochistan & FATADocument2 pagesProvision of Higher Education Opportunities for Students of Balochistan & FATAAziz okz100% (1)

- Postal Codes PakistanDocument3 pagesPostal Codes PakistanWaris ArslanNo ratings yet

- List of JR EngDocument9 pagesList of JR EngArslan Jameel MalikNo ratings yet

- List of Intermediaries Companies 2019Document4 pagesList of Intermediaries Companies 2019Ahmed AliNo ratings yet

- CMPak List of Franchisee Faciliation of RegisterationDocument6 pagesCMPak List of Franchisee Faciliation of RegisterationSarfraz RasoolNo ratings yet

- RDA Ringroad PDFDocument19 pagesRDA Ringroad PDFKashif Naeem50% (2)

- Elephantasy by Kausar IqbalDocument24 pagesElephantasy by Kausar IqbalKausar IqbalNo ratings yet

- IPS PRESS Catalogue 2018-19Document20 pagesIPS PRESS Catalogue 2018-19Institute of Policy StudiesNo ratings yet

- Merit List of Candidates Male, Female (All Quotas) Rawalpindi RegionDocument11 pagesMerit List of Candidates Male, Female (All Quotas) Rawalpindi RegionMuhammad shuaibNo ratings yet