Professional Documents

Culture Documents

ACCO 20113 Strategic Cost Management Midterm Slides

ACCO 20113 Strategic Cost Management Midterm Slides

Uploaded by

aj dump0 ratings0% found this document useful (0 votes)

2 views65 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views65 pagesACCO 20113 Strategic Cost Management Midterm Slides

ACCO 20113 Strategic Cost Management Midterm Slides

Uploaded by

aj dumpCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 65

• Maintain professional competence • Confidential information shall not • Avoid conflicts of interest.

• Communicate information fairly

through ongoing development. be disclosed, unless legally • Refrain from doing activities that and objectively.

• Perform professional duties in obligated to do so. might have prejudice in the proper • Fully disclose all relevant

accordance with applicable laws • Inform subordinates regarding carrying out of duties. information that could reasonably

and regulations. confidentiality of information. • Refuse gift or favor that might be expected to influence an

• Prepare complete and clear • Do not use confidential information influence related work. intended user’s understanding of

reports from relevant and reliable for personal advantage. • Refrain from undermining the the reports, comments, and

information. attainment of the organization’s recommendations presented.

objectives.

• Communicate potential

professional constraints that

would preclude responsible

judgment or successful

performance of an activity.

• Communicate both favorable and

unfavorable information and

professional judgments or

opinions.

• Refrain from any activity that

would discredit the profession.

(INPUT) (PROCESS) (OUTPUT)

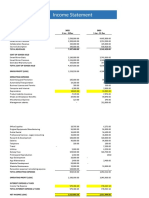

Sales xx,xxx

Less: Cost of goods sold (x,xxx)

Gross profit x,xxx

Less: Operating expenses (x,xxx)

Net income xx,xxx

Sales xx,xxx

Less: Variable costs (x,xxx)

Contribution margin x,xxx

Less: Fixed costs (x,xxx)

Net income xx,xxx

Sales 50,000 x 30 1,500,000

- CGS 50,000 x 14 700,000

Gross profit 800,000

- OpEx 100,000 + (50,000 x 2) 200,000

Net Income 600,000

Sales 50,000 x 30 1,500,000

- VC 50,000 x 12 600,000

CM 900,000

- FC 300,000

Net Income 600,000

Sales 40,000 x 30 1,200,000

- CGS 40,000 x 14 560,000

Gross profit 640,000

- OpEx 100,000 + (40,000 x 2) 180,000

Net Income 460,000

Sales 40,000 x 30 1,200,000

- VC 40,000 x 12 480,000

CM 720,000

- FC 300,000

Net Income 420,000

ACNI 460,000 VCNI 420,000

- FOH (EI) 40,000 + FOH (EI) 40,000

VCNI 420,000 ACNI 460,000

Sales 60,000 x 30 1,800,000

- CGS 60,000 x 14 840,000

Gross profit 960,000

- OpEx 100,000 + (60,000 x 2) 220,000

Net Income 740,000

Sales 60,000 x 30 1,800,000

- VC 60,000 x 12 720,000

CM 1,080,000

- FC 300,000

Net Income 780,000

ACNI 740,000 VCNI 780,000

+ FOH (BI) 80,000 - FOH (BI) 80,000

- FOH (EI) 40,000 + FOH (EI) 40,000

VCNI 780,000 ACNI 740,000

Sales xx,xxx

Less: Variable Costs (x,xxx)

Contribution Margin xx,xxx

Less: Fixed Costs (x,xxx)

Net Income x x ,x x x

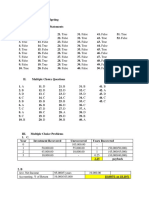

Per unit Units Percentages Amounts

S 120.00 1,250 100% 150,000.00

- VC 48.00 40%

CM 72.00 60% 90,000.00

- FC 90,000.00

NIBT -

- tax

NIAT

Per unit Units Percentages Amounts

S 120.00 2,000 100% 240,000.00

- VC 48.00 2,000 40% 96,000.00

CM 72.00 60% 144,000.00

- FC 90,000.00

NIBT 54,000.00

- tax 30% NIBT 16,200.00

NIAT 37,800.00

Per unit Units Percentages Amounts

S 120.00 1,944 100% 233,333.33

- VC 48.00 40%

CM 72.00 60% 140,000.00

- FC 90,000.00

NIBT 50,000.00

- tax 30% NIBT

NIAT

Per unit Units Percentages Amounts

S 120.00 1,875 100% 225,000.00

- VC 48.00 40%

CM 72.00 60%

- FC 40% 90,000.00

NIBT 20%

- tax

NIAT

Per unit Units Percentages Amounts

S 115.87 1,500 100% 173,809.52

- VC 40%

CM 60% 104,285.71

- FC 90,000.00

NIBT 14,285.71

- tax 30% NIBT

NIAT 10,000.00

A B C

Selling price 150 210 360

VC/unit 90 140 190

CM/unit 60 70 170

SMR 20% 20% 60%

WACM 12 14 102 128

Product A B C Fixed cost 400,000

Divide by: WACM 128

Selling price per P150 P210 P360

Breakeven point in units, whole company 3,125 units

unit

Variable cost per P90 P140 P190 Allocation as to sales mix:

unit A - 3,125 units x 20% 625 units

B - 3,125 units x 20% 625 units

Sales mix 20% 20% 60%

percentage C - 3,125 units x 60% 1,875 units

Expressing BEP in peso sales:

Total Fixed Cost P400,000

A - 625 units x P150 93,750

B - 625 units x P210 131,250

C - 1,875 units x P360 675,000

₱ 111,000.00 ₱ 110,000.00 ₱ 105,000.00 ₱ 125,000.00

₱ 1,000.00 ₱ 5,000.00 ₱ 20,000.00

Unfavorable Spending Variance Unfavorable Efficiency Variance Favorable Volume Variance

₱ 6,000.00 Unfavorable Budget Variance ₱ 20,000.00

Favorable Volume Variance

₱ 14,000.00 Favorable Total Overhead Variance

(Overapplied)

4-way 3-way 2-way 1-way

VOH Spending Variance ₱ 6,000.00 U

VOH Efficiency Variance 5,000.00 U Spending Variance ₱ 1,000.00 U

FOH Spending Variance 5,000.00 F Efficiency Variance 5,000.00 U Budget Variance ₱ 6,000.00 U

FOH Volume Variance 20,000.00 F Volume Variance 20,000.00 F Volume Variance 20,000.00 F Underapplied overhead ₱ 14,000.00 F

Total Overhead Variance ₱ 14,000.00 F Total Overhead Variance ₱ 14,000.00 F Total Overhead Variance ₱ 14,000.00 F Total Overhead Variance ₱ 14,000.00 F

VOH Spending Variance ₱ 6,000.00 U VOH Spending Variance ₱ 6,000.00 U

FOH Spending Variance 5,000.00 F VOH Efficiency Variance 5,000.00 U

Total Spending Variance ₱ 1,000.00 U FOH Spending Variance 5,000.00 F

Toal Budget Variance ₱ 6,000.00 U

You might also like

- Instant Download Ebook PDF Federal Constitutional Law A Contemporary View 5e PDF ScribdDocument40 pagesInstant Download Ebook PDF Federal Constitutional Law A Contemporary View 5e PDF Scribdotis.zahn44898% (46)

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- 2.Hola-Kola - The Capital Budgeting DecisionDocument3 pages2.Hola-Kola - The Capital Budgeting DecisionGautam D50% (2)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibDocument1 pageMatheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibVarun Sharma0% (1)

- 8.01 Bar Manual 104pDocument8 pages8.01 Bar Manual 104porientalhospitality100% (3)

- Theory Based Question (10 Marks) - Decision Making: ACCT 2146 Assignment #2 CVP, Job Costing, Process CostingDocument10 pagesTheory Based Question (10 Marks) - Decision Making: ACCT 2146 Assignment #2 CVP, Job Costing, Process CostingVincentio WritingsNo ratings yet

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- SCM Final Module-Decentralized-Operations-And-Segment-ReportingDocument12 pagesSCM Final Module-Decentralized-Operations-And-Segment-ReportingPrincess BilogNo ratings yet

- Relevant CostingDocument23 pagesRelevant CostingEy GuanlaoNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Case 1 - TaylorDocument5 pagesCase 1 - TaylorEdwin EspirituNo ratings yet

- ExamDocument15 pagesExamSyra Mae PorilloNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- Spring Day Company Statement of Financial Position For 20x1 and 20x2Document2 pagesSpring Day Company Statement of Financial Position For 20x1 and 20x2Printing PandaNo ratings yet

- FINANCIAL ANALYSIS Practice 3Document15 pagesFINANCIAL ANALYSIS Practice 3Hallasgo, Elymar SorianoNo ratings yet

- CVP AnalysisDocument10 pagesCVP AnalysisHarold Beltran DramayoNo ratings yet

- Variable CostingDocument4 pagesVariable CostingKhairul Ikhwan DalimuntheNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Feasibility Studies The M-One Resto & Coffee: Gross SalesDocument2 pagesFeasibility Studies The M-One Resto & Coffee: Gross SalesAntopuntodewoNo ratings yet

- Marketing Plan With TPDocument5 pagesMarketing Plan With TPJanesha KhandelwalNo ratings yet

- Prepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsDocument6 pagesPrepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsMiljane PerdizoNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- Seatwork 4 - Decentralized OperationsDocument3 pagesSeatwork 4 - Decentralized OperationsJessaLyza CordovaNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- TabbelDocument2 pagesTabbelLyra EscosioNo ratings yet

- Group Presentation For Second Class Week Beginning Sept 21Document4 pagesGroup Presentation For Second Class Week Beginning Sept 21Mamata SreenivasNo ratings yet

- Activities 11&12Document6 pagesActivities 11&12MPCINo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- BookDocument3 pagesBookmanalnasnkjfnsdkjndjknxNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- DOL Demonstration Problem 2023Document4 pagesDOL Demonstration Problem 2023Zoltan SzarvasNo ratings yet

- Income Statement TemplateDocument4 pagesIncome Statement Templatesally ngNo ratings yet

- 9 4 CVP Feu 2022Document58 pages9 4 CVP Feu 2022Angelica Jasmine ReyesNo ratings yet

- Summary of Operating Assumptions (For Example)Document5 pagesSummary of Operating Assumptions (For Example)Krishna SharmaNo ratings yet

- Feasibility Study AnalisticDocument4 pagesFeasibility Study AnalisticAntopuntodewoNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Year Sales Volume Sales VC FC DepDocument8 pagesYear Sales Volume Sales VC FC DepMohammad Umair SheraziNo ratings yet

- Ranking P.I. Share Unit Price Rtd. Earnings Net Profit SalesDocument16 pagesRanking P.I. Share Unit Price Rtd. Earnings Net Profit SalesAlexandru EneNo ratings yet

- Break-Even Point (BEP) Waktu Balik ModalDocument2 pagesBreak-Even Point (BEP) Waktu Balik ModalDodik ArviantoNo ratings yet

- Problem 5-19Document5 pagesProblem 5-19Phuong ThaoNo ratings yet

- Jawaban Soal Latihan AKL2 Pertemuan 4Document5 pagesJawaban Soal Latihan AKL2 Pertemuan 4fathan qoriibaNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- SCM Chapter 7Document4 pagesSCM Chapter 7mini moniNo ratings yet

- Balance Sheet of CompanyDocument3 pagesBalance Sheet of Companyshubham jagtapNo ratings yet

- Segment ReportingDocument4 pagesSegment ReportingMurshid IqbalNo ratings yet

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Shahnawaz Inflaction RateDocument4 pagesShahnawaz Inflaction RateshahnawazmotiNo ratings yet

- Assignment 1-1Document19 pagesAssignment 1-1mishal zikriaNo ratings yet

- Slides of Lecture#09 Corporate Finance (FIN-622)Document4 pagesSlides of Lecture#09 Corporate Finance (FIN-622)sukhiesNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- The Strategy Gap: Leveraging Technology to Execute Winning StrategiesFrom EverandThe Strategy Gap: Leveraging Technology to Execute Winning StrategiesNo ratings yet

- CHAPTER 12 - Enterprise Computing-1Document1 pageCHAPTER 12 - Enterprise Computing-1Nadi HoodNo ratings yet

- This Is The Day That The Lord Has Made Stand Up, Stand Up For JesusDocument3 pagesThis Is The Day That The Lord Has Made Stand Up, Stand Up For JesusNadi HoodNo ratings yet

- CHAPTER 12 - Enterprise Computing-3Document1 pageCHAPTER 12 - Enterprise Computing-3Nadi HoodNo ratings yet

- CHAPTER 12 - Enterprise Computing-4Document1 pageCHAPTER 12 - Enterprise Computing-4Nadi HoodNo ratings yet

- CH10 Long Term Decision Payongayong-3Document1 pageCH10 Long Term Decision Payongayong-3Nadi HoodNo ratings yet

- CH10 Long Term Decision Payongayong-1Document1 pageCH10 Long Term Decision Payongayong-1Nadi HoodNo ratings yet

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- ACCO 20123-Financial Management-Financial Planning & Time Value of Money (Theories& Prob) - 1Document1 pageACCO 20123-Financial Management-Financial Planning & Time Value of Money (Theories& Prob) - 1Nadi HoodNo ratings yet

- CH10 Long Term Decision Payongayong-2Document1 pageCH10 Long Term Decision Payongayong-2Nadi HoodNo ratings yet

- Chapter 03. Operations Management and TQMDocument105 pagesChapter 03. Operations Management and TQMNadi HoodNo ratings yet

- A Converted 20Document1 pageA Converted 20Nadi HoodNo ratings yet

- ACCO 20123-Financial Management-Financial Planning & Time Value of Money (Theories& Prob) - 2Document1 pageACCO 20123-Financial Management-Financial Planning & Time Value of Money (Theories& Prob) - 2Nadi HoodNo ratings yet

- Payongayong CH3Document1 pagePayongayong CH3Nadi HoodNo ratings yet

- Document 1 Hoem BranchDocument38 pagesDocument 1 Hoem BranchNadi HoodNo ratings yet

- Intro SCMDocument19 pagesIntro SCMNadi HoodNo ratings yet

- Statistics - Data Collection - Secondary Data - : IdentificationDocument1 pageStatistics - Data Collection - Secondary Data - : IdentificationNadi HoodNo ratings yet

- Assessment: 1. What Is The Significance of Studying Operations Management?Document3 pagesAssessment: 1. What Is The Significance of Studying Operations Management?Nadi HoodNo ratings yet

- Lesson #3Document3 pagesLesson #3Nadi HoodNo ratings yet

- Chapter 15 Test BankDocument31 pagesChapter 15 Test BankNadi HoodNo ratings yet

- TRUE OR FALSE. Write TRUE If The Statement Is True For All Times and FALSE IfDocument1 pageTRUE OR FALSE. Write TRUE If The Statement Is True For All Times and FALSE IfNadi HoodNo ratings yet

- STAT 20053 Problem Set No. 1 Statistical Analysis With Software Application 1st SEM AY: 2021Document1 pageSTAT 20053 Problem Set No. 1 Statistical Analysis With Software Application 1st SEM AY: 2021Nadi HoodNo ratings yet

- SW06Document6 pagesSW06Nadi HoodNo ratings yet

- Discharge of Contract by AgreementDocument11 pagesDischarge of Contract by AgreementAadhitya NarayananNo ratings yet

- It's Going VIRL Guide Cisco VIRL Lab Training - Technet24 PDFDocument196 pagesIt's Going VIRL Guide Cisco VIRL Lab Training - Technet24 PDFanu johnNo ratings yet

- April 6, 2016 G.R. No. 206766 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, EDUARDO YEPES, Accused-Appellant. Decision Perez, J.Document61 pagesApril 6, 2016 G.R. No. 206766 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, EDUARDO YEPES, Accused-Appellant. Decision Perez, J.Iana CleoNo ratings yet

- CLJ 2006 4 129Document66 pagesCLJ 2006 4 129lionheart8888No ratings yet

- Vavediya Rakeshbhai UpDocument1 pageVavediya Rakeshbhai UpANISH SHAIKHNo ratings yet

- Benin Vs Tuazon Case DigestDocument2 pagesBenin Vs Tuazon Case DigestKleyr De Casa AlbeteNo ratings yet

- Assignment and Mid-Tem Test Last Dates & Deadlines (Revised On 29.09.2011)Document7 pagesAssignment and Mid-Tem Test Last Dates & Deadlines (Revised On 29.09.2011)bhumijaNo ratings yet

- Chevron Philippines, Inc., G.R. No. 178759 vs. Commissioner of The Bureau of Customs, Respondent. August 11, 2008 Corona, J.Document8 pagesChevron Philippines, Inc., G.R. No. 178759 vs. Commissioner of The Bureau of Customs, Respondent. August 11, 2008 Corona, J.ellaNo ratings yet

- Update On International Financial Reporting Standards (IFRS)Document29 pagesUpdate On International Financial Reporting Standards (IFRS)Beth Diaz LaurenteNo ratings yet

- LIC's Jeevan Labh (Plan No. 936) : Benefit IllustrationDocument3 pagesLIC's Jeevan Labh (Plan No. 936) : Benefit IllustrationAkash SahuNo ratings yet

- New York Produce Exchange Inter-Club Agreement 1996Document5 pagesNew York Produce Exchange Inter-Club Agreement 1996kzafirasNo ratings yet

- 25 - Cui v. Cui, G.R. No. L-18727, August 31, 1964Document3 pages25 - Cui v. Cui, G.R. No. L-18727, August 31, 1964DAblue ReyNo ratings yet

- Curso Mhawk4Document109 pagesCurso Mhawk4Omar Antonio Araque100% (1)

- Devotional Reflections On Matthew 7Document3 pagesDevotional Reflections On Matthew 7David DeSilvaNo ratings yet

- Model Internal Audit Activity Charter: Mission and Scope of WorkDocument3 pagesModel Internal Audit Activity Charter: Mission and Scope of WorkEva CardozoNo ratings yet

- Chapter # 1: Introduction To AuditingDocument2 pagesChapter # 1: Introduction To AuditingGhalib HussainNo ratings yet

- Alangdeo Vs City Mayor of BaguioDocument8 pagesAlangdeo Vs City Mayor of BaguioMarie Paulene Almazan SorianoNo ratings yet

- H7290a Draft SubaDocument21 pagesH7290a Draft SubaFrank MaradiagaNo ratings yet

- Islām, Īmān, Iḥsān Climbing The Spiritual Mountain - Yaqeen Institute For Islamic ResearchDocument34 pagesIslām, Īmān, Iḥsān Climbing The Spiritual Mountain - Yaqeen Institute For Islamic ResearchAbdourahamane GarbaNo ratings yet

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonDocument17 pagesFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. Houstondas413No ratings yet

- Sample Not For Training Purposes: Student WorkbookDocument20 pagesSample Not For Training Purposes: Student Workbookmeer_123100% (1)

- Paper ID InstructionsDocument6 pagesPaper ID InstructionsDaisy ImbaquingoNo ratings yet

- A Complete Guide To Devops With Aws Deploy Build and Scale Services With Aws Tools and Techniques Osama Mustafa Full ChapterDocument68 pagesA Complete Guide To Devops With Aws Deploy Build and Scale Services With Aws Tools and Techniques Osama Mustafa Full Chapterlouis.cintron696100% (7)

- Case Digest GuidelinesDocument5 pagesCase Digest GuidelinesKeij Ejercito100% (2)

- The State's Pages On 9/11 Through The YearsDocument55 pagesThe State's Pages On 9/11 Through The YearsThe State NewspaperNo ratings yet

- In Re Petition Martin NGDocument2 pagesIn Re Petition Martin NGshirlyn cuyongNo ratings yet

- List of Telugu Movies in LAN 1. 10 ClassDocument30 pagesList of Telugu Movies in LAN 1. 10 ClassGirls TiktokNo ratings yet

- Learner'S Licence: Form 3 (See Rule 3 (A) and 13)Document1 pageLearner'S Licence: Form 3 (See Rule 3 (A) and 13)sshiju367No ratings yet