Professional Documents

Culture Documents

Toaz - Info Valuation Concepts and Methodologies PR

Uploaded by

Kizaru0 ratings0% found this document useful (0 votes)

7 views17 pagesOriginal Title

Toaz.info Valuation Concepts and Methodologies Pr c4baf82373ac8c8891059d2c86ed6f72

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views17 pagesToaz - Info Valuation Concepts and Methodologies PR

Uploaded by

KizaruCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 17

RN el eau

MULTIPLE CHOICE THEORY. Write the letter of the best answer before

the number of the question or statement being answered

1, This has been defined by the industry as transactions that would

yield future economic benefits as a result of past transactions.

a. Asset

b. Equity

c. Net Assets

d. Shares of Stocks

2. These are investments which are already in the going concern

state, as most business are in the optimistic perspective that they

will grow in the future.

a. Green Field Investments

b. Brown Field Investments

c. Blue Field Investment

4d. Black Field Investments

3. These are business opportunities which are those businesses

that has a long term into infinite operational period.

a. Going Concer Business Opportunities

b. Perpetual Business Opportunities

c. Stable Business Opportunities

4. Strategic Business Opportunities

4, The beauty of GCBOs is that we already have a reference for

their performance either on similar nature of business or from its

historical performance. With this, the risk indicators can be identified

easily and therefore can be quantified accordingly. The Committee

of Sponsoring Organization of the Treadway Commission (COSO)

suggests that risk management principles must be observed as well

in doing businesses and determining its value. It was noted in their

report that the benefits of having a sound Enterprise-wide Risk

Management allows for the company as follows, except

’2. decrease the opportunities with risk being managed well

b. facilitates the management and identification of the risk

factors that affect the business

c. improve management and distribution of resources

across the enterprise

d. make the business more resilient to abrupt changes

RT heon esate a suueescesc 4

5. These are the amounts of cash availabe for dstnbution to boy,

debt and equity claim from the business or asset

a. Operating Cash flows

b. Investing Cash flows

c. Financing Cash flows

4d. Net Cash flows

6. There are two levels of net cash flows, these are

and

‘a. (1) Net Cash Flows to the Firm; and (2) Net Cash Flows

to Equity

b. (1) Net Cash Flows to the Firm; and (2) Net Cash Flows

to Creditors,

¢. (1) Net Cash Flows to the Creditors; and (2) Net Cash

Flows to Equity

d. None of the above since there are three levels of net

cash flows.

7. This represents the cash flows which was described in the

preceding paragraph. This is the amount made available to both

debt and equity claims against the company.

a, Net Cash Flows to the Firm

b. Net Cash Flows to Creditors

c. Net Cash Flows to Equity

4. Operating Cash Flows

8. This represents the amount of cash flows made available to the

equity stockholders after deducting the net debt or the outstanding

liabilities to the creditors less available cash balance of the

company.

a. Net Cash Flows to the Firm

b. Net Cash Flows to Creditors

c. Net Cash Flows to Equity

4d. Operating Cash Flows

9. This represents the value of the company in perpetuity or in a

going concern environment

a, Terminal Value

b. Salvage Value

. Perpetuity Value

4. Infinity Value

Re ee ean aureus

10. DCF Analysis is most applicable to use when the following are

available, except

a. Validated Operational and Financial Information

b. Reasonable appropriated cost of capital or required rate

of return

c. Cashflow Pricing Multiples

d. New quantifiable information

11. This is a technique that uses relevant drivers for growth and

performance that can be used as proxy to set a reasonable estimate

for the value of an asset or investment prospective.

a. Comparable Company Analysis

b. DCF Analysis

c. Market Analysis

d. Public Company Analysis

12. In determining the value using comparable company analysis

the following factors must be considered, except,

a. Non quantitative factors must also be considered

b. Period of observation must be comparable

c. Comparators may be at least with the similar company

size even in different industry

d. Variables used in determining the ratios must be the

same

13. This ratio represents the relationship of the market value per

share and the earnings per share. It sends the signal on how much

the market perceives the value of the company as compared to

what it actually eared

a. Price Earnings Ratio

b. Book to Market Ratio

c. Dividend Yield Ratio

d. EBITDA Multiple

14, This is used to determine the appreciation of the market to the

value of the company as oppose to the value it reported under its

Statement of Financial Position.

a. Price Earnings Ratio

b. Book to Market Ratio

¢. Dividend Yield Ratio

RENT keon sake u uae eke]

¢, EBITDA Multiple

15. This describes the relationship between the dividends recg

per share and the appreciation of the market on the price of tne

company,

a, Price Earnings Ratio

b. Book to Market Ratio

c. Dividend Price Ratio

d. EBITDA Multiple

16. This represents for the net amount of revenue after deductin

operating expenses and before deducting financial fixed costs,

taxes and non-cash expenses.

a. Price Earnings Ratio

b. Book to Market Ratio

c. Dividend Price Ratio

4. EBITDA Multiple

17. This is the excess of the earnings after deducting the cost of

capital

a. Net Cash Flow to Equity

b. Economic Value Added

c. Net Income after Interest

4d, EBITDA

18. Once the value of the asset has been established, there are

factors that can be considered to properly value the asset. Which of

the following are not part of the other factors to be considered in

Valuation?

a. earning accretion

b. eaming dilution

cc. equity control premium

d. All of the above

19. These are additional value inputted in the calculation that would

account for the increase in value of the firm due to other quantifiable

attributes like potential growth, increase in prices, and even

‘operating efficiencies.

@. earning accretion

b. earning dilution

c. equity control premium

d. Precedent Transactions

[Sank eee ee

Pe ee eterna

20. This is the amount that is added to the value of the firm in order

to gain control of it,

a. earning accretion

b. earning dilution

¢. equity control premium

d. Precedent Transactions

21. These are experiences, usually similar with the opportunities

available. These transactions are considered risks that may affect

further the ability to realize the projected earnings.

a. earning accretion

b. earning dilution

. equity control premium

4. Precedent Transactions

22. This works differently with accretion. But, this should also be

considered in the sensitivity analysis.

a. earning accretion

b. earning dilution

. equity control premium

4d. Precedent Transactions

23. Which of the following is not a Method under Asset Based

Valuation?

a. Discounted Cash Flow Analysis

b. Economic Value Added

c. Comparable Company Analysis

d. All of the above

24. Which of the following statements is not correct?

a. The beauty of GCBOs is that we already have a reference

for their performance either on similar nature of business

or from its historical performance.

b. Asset has been defined by the industry as transactions

that would yield future economic benefits as a result of

past transactions.

c. Most investors diversify their investment in various

‘opportunities, but the challenge is determining the value

on how much they are willing to acquire it

4. Going concern business opportunities are those

businesses that has a short term into infinite operational

period

x

RUN ken setae nue snese sy

25. Which of the following statements is not correct?

a. The operating cash flows are the amounts of cash avai

for distribution to both debt and equity claim from tne

business or asset.

b. The advantage of EBITDA is that it already excludes |

interest that represents the cost of financing the asse, |

taxes you pay to the government because this should bg |

accounted separately, and depreciation and amortization

Which is part of the capital expenditures which will be

deducted separately as well

c. Since GCBOs is assumed to operates in a long period of

time to almost perpetuity. The risk and returns are inherey

to the opportunity should also be quantified

d. Terminal Value represents the value of the company in

perpetuity or in a going concern environment.

Pe eo ery aoa eciss

MULTIPLE CHOICE PROBLEM. Write the letter of the best answer before

the number of the question or statement being answered.

4. Green Tea Corp. reported the following information: Revenue of Php

32,500, Operating Expenses of Php16,250. Included in the operating

expense are salaries and wages of Php1,450, depreciation of

Php500, and rentals of Php275. The interest expense incurred is

Php200. How much is the EBITDA for the period?

a. Phpt6,750

b. Php16,250

c. Php16,550

d. Php14,025

2. Comerstone Inc. reported revenue for the period amounting to

Php75,200 and EBITDA Margin of 60%. How much is the operating

expenses excluding depreciation?

a. Php75,200

b. Php45,120

c. Php30,080

d. Zero

3. Singapore Ltd. has reported Php125,000 revenue where their

EBITDA Margin is 45%. If the taxes are 30% of the EBITDA. How

much is the Net Cash Flows if the capital expenditure was

purchased at Php1,500?

a. Php37,875

b. Php39,375

c. Php58,250

d. Php46,625

4, Malaysia Inc. purchased a capital expenditure amounting to

Php1,500 and reported revenue of Php125,000 and operating

expenses is Php50,000. The company incurred Php§00 for interest.

If the depreciation is Php§,000, how much is the Net Cash Flows?

Tax Rate is 30%

a, Php75,000

b. Php57,650

cc. Php52,150

4. Php56,150

ROTO rechiesas eau

5. Pawikan Corp. reported the following information:

[Year [Net Cash Flows |

| 1 | Php250

2 Php300.

| See Eps aOR een

How much is the net present value of the Net Cash Flows, us

| it

| discount rate of 10%? a

| a. Php300.12

| b. Php900.85

| c. Php738.17

| d. Php1,000

| 6. Dracaris Inc. purchased an investment and expected to earn:

i ‘Year Net Gash Flows |

| [4] Php2s0 al

| 2 | Php300 ]

| 3 | Php4s0 |

| TV__[ Phps0o

Assuming a 5% discount factor, how much is the net present value

based on the foregoing question?

a. Phpt75.38

b. Php247.81

cc. Php1,500

d. Php1,250

7. Using the data in No. 6, how much is the net present value if the

investment made was done within the year?

a. Php175.38

\ b. Php247.81 |

. Php1,500

d. Php1,250

8. Tres-Martirez Inc, has reported net cash flows amouting

Php625,000. The terminal value is assumed to end at 8 years.

‘Assuming the historical information has 5% growth rate, how much is

the terminal value?

a, Php625,000

b. Php31,000

c. Php12,500

4. Php15,000

SS ee

Del Kee esau users

9. Using the assumptions in No. 8, what is the present value of

Terminal value?

a. Php625

b. Phpt2

c. Php4,086

d. Php38,273

10. Uranus Co. Ltd reported net income of Php2,750 while 8 years ago

net income is at Php2,000 only. How much is the compounded

annualize growth rate?

a. 4.65%

b. 4.56%

c. 5.25%

d. 5.65%

11. Pluto Corp., a listed company, sells its share in the stock market at

Php13.5 per share with EPS of Php 2.5. Based on the foregoing how

much is the PIE Ratio?

a 54

b. 5.0

© 25

4.35

42. If Jupiter Inc.’s market value per share is Php27S Million. The EPS it

generated is Php12.50. What is the P/E ratio?

a. Php 27.5

b. Php 20.0

c. Php32.8

d. Php12.§

13. Sunflower Inc. provided the following information EPS is Php25 per

share while P/E Multiple is 2.0. How much is MVPS?

a. PhpS0

b. Php50.75

cc. Php4s

d. PhpSs

44, Leone Inc., a listed corporation, reported on its Statement of

Financial Position total assets of Php85,000,000. The company

maintain its debt ratio of 70% and have outstanding capital stocks of

1 million. Given their performance and financial stability their stocks

were traded at Pnp30 per share. Based on the foregoing, the book to

market ratio of Leone Ine. is

VALUATION CONCEPTS AND METHODOLOGIES

a 10

b. 0.95

c. 0.90

d. 0.85

15. The management accountant of Yza Belle Inc. has calculated thei,

book value per share at Php 6.25. If Yza Belle shares will be soig

using the average book to market ratio for the industry similar tothe

company of 0.68, the price per share would be atleast

a. 9.19

b. 6.25

4.25

4. 10.00

For 16 to 17. Raphael Marco Corp., a company with outstanding

common shares of 1,000,000 and 10% preferred shares amounting to

Php? ,000,000.

16. Raphael Marco's earnings per share based on its reported net |

income of Php7,250,000 is,

a. Php 7.35

b. Php 7.28

cc. Php7.15

d. Php7.05

17. The firms similar to Raphael Marco is having a P/E Multiple of 4.

Given the earnings per share calculated in No.16, the reasonable

market value per share should be

a. Php29.40

b. Php29.00

cc. Php28.60

4. Php28.20

18. Lucille Inc. declared its dividends at Php1.25/share. The company's

stocks were last traded at Php45 per share. The dividend yield of the

company is

a. 36

b. 0.028

©. 0.28

d. 28

Pe eee ues

19. Uno Corp. declared its dividend consistent with its dividend yield of

0.10 or 10%. This year, Uno Corp's stockholder receives Php0.75 for

every share they have in the company. Based on the foregoing, the

company’s market value per share when the divided was declared

should be

a. Php0.075)

b. Php7.50

c. Php3.s

d. Php0.05

20. Martyne Inc.'s market capitalization is already around Php67,000,

when they had reported their revenue at Php32,500, which is 50% of

the operating expenses. Out of the operating expenses the

company’s cost to depreciate its assets is Php500. The market

capitalization is the basis for the market value per share when

divided into the company's outstanding shares of 1,000. Based on

the foregoing, Martyne’s EBITDA multiple is about

a 4.25

b. 4.12

c. 4.00

d. 2.00

21. JVL Holdings Inc. reported its EBITDA margin at 25% when their

revenues are Php30,000,000. JVL Holdings has outstanding shares

of 1,000,000. The company would like to sell its stocks, upon doing

research the firms similar to JVL Holdings disclosed the following

EBITDA multiple: Dot Corp. @ 8.00; Period Corp. @ 7.5;

Exclamation Inc. @ 6.25. Using the average EBITDA multiple, the

potential market value per share of JVL Holdings is,

a. Phps4.38

b. Php60.52

¢. PhpS0.25

4. Php52.17

For 22 to 23. VMV Corp. is planning to expand and new projects is

expecting to earn an average of Php375,000. If the project requires

for Php5,000,000 investment at 10% cost of capital

22. The Economic Value Added is

a. Php125,000

b. (Php125,000)

cc. Php875,000

d._(Php875,000)

VALUATION CONCEPTS AND METHODOLOGIES

23. VMV Corp recomputed the earings and resulted to an average gy

Php750,000 per year. The economic value added in this Scenario is

Pnp125,000

(Php 125,000)

Php250,000

(Php250,000)

aoce

24. Based on No.22 except that the cost of capital is raised to 15%, the

economic value added to breakeven should be

a. Php125,000

b. Php250,000

cc. Php500,000

¢. Php750,000

28. Victoria Corp. estimated its terminal value on the 5" year of

operations from the time of the valuation to be Php825 Million. Using

the discount rate of 5%, the present value of the terminal value is

Php825.00 Million

Php785.71 Million

Php678.73 Million

Php646.41 Million

aoc

26. BMV Inc. has outstanding stocks of 1,500,000 and market value per

share of Php22.50 with a P/E Ratio of 4. The company has

sustained it net income margin at 25%. The revenue of BMV Inc.

should be

a. Php33,750,000

b. Php22,500,000

cc. Php8,437,000

. Php90,000,000

27. BMV Inc. has outstanding stocks of 1,500,000 and market value per

share of Php22.50 with a P/E Ratio of 4. The company has

sustained it net income margin at 25%. The company's reported

EBITDA Margin is 40%. The EBITDA of BMV Inc, should be

Php33,750,000

Php8,437,000

Php13,500,000

Php20,250,000

Boge

Re Teor uaa

Kwek2 Corp. has 1,000,000 outstanding shares and reported its Earnings

per Share at Php 14.25. Kwek2 Corp. targets to increase its net income by

410% for the succeeding years hence they spent Php20,000,000. The

estimated depreciation is Php500,000 per year starting year 1. The

company's cost of capital is 8%

28. The net cash flows for Year 1 is

Php5,250,000

(Php5,250,000)

Php14,750,000

(Php, 750,000)

aero

29, The net cash flows for Year 2 is

a. Php16,225,000

b. (Php16,225,000)

cc. Php15,675,000

4d. (Php15,675,000)

30. The net present value of the cash flows for 3 years is,

Php23,217,132.17

(Php23,217,132.17)

Php21,802,364.35

(Php21,802,364.35)

OO ee

RT kas esau asus cry

Problem Solving

™

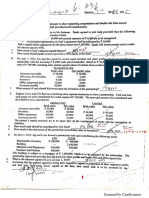

2-1. Frequently Corp has projected that their performance for the

Fextfive i

years will result to the following:

Year Revenue ‘Operating Exp” Taxes

{iced 50.00 30.00 6.00

2 55.00 33.00 6.60

3 60.50 36.30 7.26

4 66.55 39.93 7.99

SeeeaeTS21, 43.92 8.78

A property was purchased at the beginning amounting to Php150 Million

‘The terminal value was assumed based on the growth rate of the cash

flows. The outstanding loans is Php16.62 Million. The required rate of return

for this business is 12%.

How much is the Terminal Value?

How much is the Discounted Net Cash Flows to the Firm?

How much is the Discounted Net Cash Flows to the Equity?

‘Assuming there are no outstanding loans, how much is the

Discounted Net Cash Flows to the Equity?

‘+ Assuming that the required rate of retum is 10%, how much is the

Discounted Net Cash Flows to the Equity?

RENT WEST PEE

”

P2-2. An investor was offered by an existing stockholder to purchase his

shares from Sansrival Corp at Php16.00 per share. The outstanding shares

of the company is 1 Million. the year 1 revenue is PhpS Million and expected |

to constantly grow by 5%. The EBITDA margin remains to be stable at 50%

Taxes are 30% of EBITDA. The required rate of return is 10%. Their

‘outstanding loans is Php17 Million.

+ How much is the value of the stocks? Are you going to accept the

offer?

* How much is the value of the stocks if the there is no loans

outstanding?

* Are you going to accept the offer if the required return is 12%? Why?

P2-3 Casyo Inc. reported an EBITDA of Php12.50 Miilion. After 5 years itis

projected to be Php21.86 Million. The required retum is 8%.

eee etary aan oss

How much is the terminal value?

How much is Net Cash Flows — Firm?

«How much is the Net Cash Flows - Equity?

+ How much is the Net Cash Flows — Equity if the outstanding loans is

Php 100 Million?

2-4. Compute for the price earnings ratio if the earnings per share is

Php5.50:

Market Value per

share

| 27.500

30.250

22.000

47.875

28.875 J

P:E Ratio

er] ||]

P2-5, LMVL Co., a publicly listed company, reported earnings for the year

amounting to Php25 Million with outstanding shares of 1 Million. The market

value per share of LMVL Co. is Php122. What the P/E Ratio of LMVL Co.

(round your answer to the nearest ones)?

Suppose that LMVL Co. sets as the industry leader, LVVL Co. another

player in the same industry is being eyed by an investor. The reported EPS

Of LVVL Co. is Php10. If the investor is aware of the LMVL Co.'s

performance, how much should the investor value LVL Co.?

2.6, Listed Automobile industry players has the following market value and

earnings per share

Player oe Saale Earnings Per | pie Ratio

A 46.50, 5.00

6] meee 603

c | 16.25 2.18

D 26.11 372

E 34.32 4.29

Rye etn eaab aos METHODOLOGIES

(0 the performance of another firm in the same

te

An analyst is looking in sd eamnga of Php tah

industry but is not isted, the company report

share. How much is the value of the firm’

2-7. Bebe Co. declared dividends of Php2 per share for their performanos

last year after the deciaration of dividends the market value per share

increased to Php4s per share. What is the dividend yield ratio of Bebe Co >

P2.8. Lumina Inc’s statement of financial position as of December 31, 2019

reported the following: Asset ~ Php 400 Milion; Liabilities — Php 100 Milion;

Equity ~ Php300 Million with outstanding shares of 10 Million. The Lumina’s

stock is already selling at Php37 per share. How much is the Book-to-

Market Ratio?

‘Assuming Lumina Inc has not available market information, but the industry

Book-to-Market Ratio is 1.2 what is the market value of Lumina?

2.9. Ancient Times Corp., a closed corporation and selling its shares to an

investor. The statement of income of the company for the period ending

December 31, 2019 is as follows:

Ancient Times Corp.

Statement of Income

For the Period Ending December 31, 2019

(ia million pesos)

Revenue 1500

Cost of Sales 900

Gross Profit 600

Operating Expenses 300

Operating Income 300

Interest Expense 75

Net Income 225

‘Ancient Times depreciation is PhpS0 million and is exempted from paying

Corporate income tax. The industry where Ancient Times recognizes the

EBITDA Multiple of 2.75.

Re Nel Keele uma reece

« How much is the EBITDA of Ancient Times for the Period?

« How much is the market value of Ancient Times?

«Ifthe owners is willing to sell 50% of the ownership at Php500

Million, are you going to buy the company's stake?

2.10 Liberated Inc. is exploring an investment that will required Php750

Milion that would yield and annual earnings of Php 185 Million. If the

‘company required rate of return for the company is 12%, how much is the

economic value added?

How much earnings is needed to be realized that will make the EVA

breakeven?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- I - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Document279 pagesI - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Bhosx KimNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- VCMDocument19 pagesVCMBhosx Kim100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Donors TaxDocument29 pagesDonors TaxBhosx Kim100% (3)

- Other Percentage TaxDocument42 pagesOther Percentage TaxBhosx KimNo ratings yet

- Midterm (08-14-16)Document6 pagesMidterm (08-14-16)Bhosx KimNo ratings yet

- Tax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesDocument29 pagesTax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesBhosx KimNo ratings yet

- BOI ForDocument5 pagesBOI ForBhosx KimNo ratings yet

- COVID-19 Community Quarantines in The PhilippinesDocument7 pagesCOVID-19 Community Quarantines in The PhilippinesBhosx KimNo ratings yet

- Effect of Tax Incentives On The Growth of SMEs in RwandaDocument10 pagesEffect of Tax Incentives On The Growth of SMEs in RwandaBhosx KimNo ratings yet

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- Customer Relationship - Business Model CanvasDocument6 pagesCustomer Relationship - Business Model CanvasBhosx KimNo ratings yet

- Idic ModelDocument12 pagesIdic ModelBhosx KimNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationBhosx KimNo ratings yet

- Avoid The Four Perils of CRMDocument14 pagesAvoid The Four Perils of CRMBhosx KimNo ratings yet

- Problem 13Document3 pagesProblem 13Bhosx KimNo ratings yet

- Module 2A - CVP AnalysisDocument5 pagesModule 2A - CVP AnalysisBhosx KimNo ratings yet

- Dokumen - Tips Labor Law Memory AidDocument75 pagesDokumen - Tips Labor Law Memory AidBhosx KimNo ratings yet

- Final Deptal (10-14-18)Document5 pagesFinal Deptal (10-14-18)Bhosx KimNo ratings yet

- Quiz Par. FRM & OpDocument4 pagesQuiz Par. FRM & OpReymart Castillo HamoNo ratings yet

- Advac 1 Final Deptal (10-2-16) PDFDocument12 pagesAdvac 1 Final Deptal (10-2-16) PDFBhosx KimNo ratings yet

- Problem 2-1: Pagador, Janelyne CDocument6 pagesProblem 2-1: Pagador, Janelyne CBhosx KimNo ratings yet

- Lesson 1 1 PDFDocument14 pagesLesson 1 1 PDFBhosx KimNo ratings yet

- Asset Based ValuationDocument13 pagesAsset Based ValuationBhosx KimNo ratings yet

- Intro To Donors Tax BanggawanDocument8 pagesIntro To Donors Tax BanggawanBhosx KimNo ratings yet

- Principles of ValuationDocument20 pagesPrinciples of ValuationBhosx KimNo ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Training and Mentoring: Necessity For Orientation TrainingDocument6 pagesTraining and Mentoring: Necessity For Orientation TrainingBhosx KimNo ratings yet

- Donors TaxDocument15 pagesDonors TaxBhosx KimNo ratings yet

- PFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsDocument7 pagesPFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsBhosx KimNo ratings yet