Professional Documents

Culture Documents

Module 6

Uploaded by

Rachelle Mae NagalesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 6

Uploaded by

Rachelle Mae NagalesCopyright:

Available Formats

MODULE 6. Example 6-2.

COMMON VAT RULES ON SALE OF GOODS, PROPERTIES AND

SERVICES - INPUT TAX ON CAPITAL GOODS AND INPUT TAX

Alpah Co. made acquisitions of fixed assets, VAT not

ALLOCATION included, mentioned below, with journal entries below:

Lesson 1 – Input Tax on Capital Goods Asset 1: June 5, 2019 (life of 6 years) ₱300,000

CAPITAL GOODS Asset 2: June 15, 2019 (life of 2 years) 600,000

- goods with estimated useful life of more than 1 year Asset 3: June 25, 2019 (life of 4 years) 480,000

- subject to depreciation (or amortization) under

income tax law,

- used in the production and sale of taxable goods or June 5

services. Fixed asset 300,000

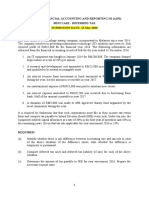

Figure 6-1. Input tax on capital goods. Input taxes 36,000

If the aggregate cost of input tax of each asset will be Cash/Payable 336,000

the capital goods in a allowed in the month of June 15

month does not exceed purchase.

₱1,000,000. Fixed asset 600,000

If the aggregate cost of input tax on each asset will be Input taxes 72,000

the capital goods in a amortized monthly, over its Cash/Payable 672,000

month exceeds life, not exceeding 60 months, June 25

₱1,000,000. or 60 months, whichever is Fixed asset 480,000

shorter.

Input taxes 57,600

Quick Facts:

❖ Consider the aggregate of costs of ALL capital goods

Cash/Payable 537,600

purchased or imported WITHIN THE MONTH: The aggregate costs of all acquisitions during the

If not exceeding ₱1,000,000, input tax on each, upon month exceeded 1M. Input taxes will be amortized.

purchase.

If exceeding 1,000,000, amortize the input taxes.

Example 6-1.

A VAT taxpayer made a purchase on June 2, 2019 of Amort. Of input tax 2019-21 2021-23 2023-25

Asset 1 – 6 yrs. P600 P600 P600

machinery for use in his business:

300k x 12%=36k/60

A. Acquisition cost, VAT not included = ₱500,000

Asset 2 – 2yrs. 3,000 Expired Expired

useful life = 10 years

600kx12%=72k/24

Input tax = 500k x 12% = ₱60,000. Asset 3 – 4 yrs. 1,200 1,200 Expired

B. Acquisition cost, VAT not included = ₱3,000,000 480kx12%=57.6k/48

Useful life = 10 years Amort. Per month P4,800 P1,800 P600

Input tax = 3M x 12% = 360k / 60 months = ₱6,000. Input taxes in June 2019 for acquisitions:

C. Acquisition cost, VAT not included = ₱3,600,000 (₱36,000+₱72,000+₱57,600) 165,000

Useful life = 3 years Less: Amortization, June 2019 (4,800)

Input Tax = 3.6M x 12% = 432k / 36 months = ₱12,000. For Amortization after June 2019 160,800

Journal entry:

June 30, 2019

Deferred input tax 160,800

Input taxes 160,800

When asset with unamortized input tax is retired from

business, it must be closed against the output taxes.

if amortized in July 2019:

Output taxes xxx

Input taxes xxx

Deferred input taxes 160,800

CONSTRUCTION IN PROGRESS (CIP)

- cost of construction which is not yet completed.

- considered a purchase of services.

- Its value will be determined based on progress

billings.

- Its input taxes will be recognized in the month

payment was made on the progress billing.

- In case of a contract for sale of service where

only labor will be supplied by the contractor

and materials will be purchased by the

contractee, input tax on labor will be recognized

in month that payment was made based on

progress billings, while input tax on materials

will be recognized when the materials were VAT business with non-VAT business

purchased.

Example 6-3. Example 6-4.

a. There was a CIP for a depreciable asset for use in

Ceeh Co. has Business No. 1 (subject to VAT), and

business with the following data:

Business No. 2 (not subject to VAT)

- Taxpayer will purchase materials, and the VAT

contractor will furnish labor for a contract price 03/01 Purchases goods from VAT 200,000

of ₱2,000,000, which there would be progress suppliers for VAT business

billings. (VAT not included)

- In a month, taxpayer purchased materials (VAT

03/03 Purchase goods from non-VAT 180,000

not included) of ₱500,000, and paid the

suppliers, for non-VAT business

contractor P400,000 (VAT not included) on the

(VAT not included)

progress billing.

03/15 Purchase supplies from VAT 20,000

On the materials (500k x 12%) 60,000

suppliers, for use of VAT and non-

On the progress billings (400k x 12%) 48,000

VAT business (VAT not included)

Total input taxes 108k

b. Mr. Aopa entered into a contract with a building 03/16 Sales, VAT business, VAT not

contractor. included

- contractor will furnish materials and labor, and 03/25 Sales, non-VAT business, invoice

will pay according to the progress billings of price

contractor. The VAT payable would have been computed as:

- The total contract price was ₱10,000,000.

- For the month of June 2019, Mr. Aopa paid the

contractor ₱2,000,000.

VAT = ₱2,000,000 x 12% = ₱240,000

Quick Fact:

- The rule on CIP will apply even if the total

payments for the month on progress billings

and materials exceeded ₱1,000,000.

Lesson 2 - Input Tax Allocation

IMPORTANT RULE TO REMEMBER: Allocation will be Lesson 3 - 12% rated sales with 0% rated sales

based on sales.

a. When taxpayer with VAT business and non-VAT

business makes a purchase during the month from a

VAT registered person, the input tax will be allocated

between VAT and non-VAT business.

b. When taxpayer with domestic and export sales

makes a purchase during the month from a VAT-

registered person, input tax will be allocated

between the 12% and 0% rated sales. Input tax

allocated to export sales is refundable or creditable

against other internal revenue taxes due.

c. When a VAT-registered person sells goods/

properties /services to the Government, including

GOCCs, (subject to 5% final VAT) the input taxes will

be allocated between sales to public and sales

allocated to Government, etc. The VAT input tax

allocated the latter will be cost or expensed to the

seller.

Example 6-5. For a previously VAT-exempt person who become a VAT

Diego Lalu Co. (VAT taxpayer) sales, and purchases from taxpayer, he will be allowed transitional input taxes on

his inventory on transition date of:

VAT suppliers, VAT not included, in a month:

a. goods,

Sales, domestic 2,000,000

b. materials

Sales, exports 8,000,000

c. supplies

Purchases of goods for domestic sales 600,000 equivalent to 2% of inventory value, or VAT actually

Purchases of goods for export sales 2,400,000 paid on it, whichever is higher.

Purchases of equipment, for

domestic and export sales 900,000 However, no transitional input tax on:

a. services

INPUT TAX ALLOCATION: b. capital goods

c. goods that are VAT exempt under Section 109

of NIRC.

Example 6-7.

Mr. Asev began business as trader, non-VAT

taxpayer.

In first calendar year of operations he was not

subject to VAT.

He became subject to VAT on 1/1/2019.

On 12/31/2018, he had an inventory with

valuation in Financial Position from purchases

from VAT suppliers, VAT included, of ₱5,600.

input tax of ₱374,400 may be refunded separately In January 2019, his gross sales is ₱120,000, and

of VAT payment of ₱146,400, OR purchases of P40,000 from VAT suppliers, VAT

credited against the VAT payable on domestic not included.

sales. VAT payable for January 2019 would have been

VAT payable on domestic sales 146,400 computed thus:

Less: VAT refundable on exports (374,400)

Net VAT refundable (228,000) Output taxes (120k x 12%) 14,400

VAT refundable of ₱374,400 may also offset Less: Input tax on purchases 4,800

against any other internal revenue tax (i.e. income of January (40k x 12%)

tax due). Transitional input tax on December 31, 2018

inventory —

Statutory provision (5k x 2%) 100

Sales to the public with sales to the Government Actually paid (5,600 x 600

Example 6-6. 12/112)

Sales to public 3,000,000 Whichever is higher 600 (5,400)

VAT payable 9,000

Sales to Government 2,000,000

Total 5,000,000 Quarterly Summary List of Sales and Purchases

Purchases 2,400,000 - All persons liable for VAT (manufacturers,

Input tax on purchases of 2,400,000 wholesalers, service providers), are required to

(2,400,000x12%) ₱ 288,000 submit Quarterly Summary List of Sales and

VAT payable on sales to public: Quarterly Summary List of Purchases.

Output taxes (3,000,000 x 12%) 360,000 - It will be submitted through Compact Disk-

Less: Input taxes on sales to public Recordable (CDR) medium. (Rev. Reg. No. Books

(3,000,000/5,000,000 x 288,000) (172,800) of Accounts 1-1012).

Value-added tax payable ₱ 187,200 Books of Accounts

- must be registered with BIR before they are

used.

Lesson 4 - Transitional Input Tax. The Purchases Book and the Sales Book

Transitional input tax. - Purpose of Purchase Book: to have in one book

- When taxpayer who is not subject to the VAT of accounts, clearly classified, in columns, all

becomes subject to VAT because: purchases on account with VAT, the VAT on

a. Gross sale exceeded ₱3,000,000. them, and purchases without VAT.

b. Taxpayer exempted from VAT and opted to be - total input taxes on purchases on account of

registered under VAT system; taxpayer will be any month is shown under the column Input

allowed an input tax on his inventory on the Taxes.

transition date. - Purpose of a Sales Book: to have in one book of

accounts, unmistakably classified, in columns,

all account sales subject to VAT, the output

taxes, and sales not subject to tax.

- Total output taxes on sales on account in a

month is shown under the column Output

Taxes.

- Other books of accounts (i.e., cash receipts

book, cash disbursement book, and general

journal) may also have entries involving the

VAT.

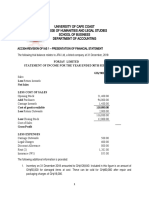

Example 6-8.

Mr. M (VAT taxpayer) had a Purchase Book and a

Sales Book, with entries shown in Figure 6-3 & 4.

VAT payable from cash purchases and sales will

be recorded in General Journal.

Purchase Book shows total input taxes of

₱30,000 and Sales Book shows total output taxes

of ₱84,000.

cash purchases and cash sales in the General

Journal had input taxes of ₱40,000 and output

taxes of ₱100,000.

Output taxes (84k+100k) 184,000

Less: Input taxes (30k + 40k) (70,000)

VAT payable 114,000

You might also like

- Request For ReinvestigationDocument9 pagesRequest For Reinvestigationjoel raz94% (16)

- Nikhil Internship Report PDFDocument24 pagesNikhil Internship Report PDFNikhil Jain56% (9)

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Solved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasDocument1 pageSolved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasAnbu jaromia0% (1)

- Bkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Document4 pagesBkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Rubiatul Adawiyah33% (3)

- BUS345 Midterm 1 NotesDocument31 pagesBUS345 Midterm 1 NotesՄարիա ՄինասեանNo ratings yet

- NIKE INC (Reformulation)Document3 pagesNIKE INC (Reformulation)apuiftekharNo ratings yet

- Taxation 2022 AdvancedDocument3 pagesTaxation 2022 AdvancedNeil CorpuzNo ratings yet

- Npo ARC Review Questions 2Document6 pagesNpo ARC Review Questions 2janineNo ratings yet

- Input Vat On Capital Goods, Transitional Vat, and Presumptive TaxDocument4 pagesInput Vat On Capital Goods, Transitional Vat, and Presumptive Taxyes it's kaiNo ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- 4 - Input Tax Credit (ITC)Document25 pages4 - Input Tax Credit (ITC)ShrutiNo ratings yet

- CAF 6 TAX All Past Papers Upto 2019 CA Study MaterialDocument47 pagesCAF 6 TAX All Past Papers Upto 2019 CA Study MaterialRais AhmedNo ratings yet

- Part 3Document12 pagesPart 3rajeshkandel345No ratings yet

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- Value of SupplyDocument8 pagesValue of SupplyPratham 5hettyNo ratings yet

- Fails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceDocument54 pagesFails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceKrishna Chaitanya DammalapatiNo ratings yet

- Fails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceDocument58 pagesFails To Make Payment To The Supplier Within 180 Days From The Date of Issue of InvoiceGiri SukumarNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- Topic - Availament of Itc: GST - Additional Questions By: CA Vijender AggarwalDocument8 pagesTopic - Availament of Itc: GST - Additional Questions By: CA Vijender AggarwalHimanshu YadavNo ratings yet

- Caf 6 Tax Spring 2019Document5 pagesCaf 6 Tax Spring 2019Raza Ali SoomroNo ratings yet

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- AP Audit of Non-Current Liabilities Part 2Document2 pagesAP Audit of Non-Current Liabilities Part 2bangtansonyeondaNo ratings yet

- 3 Input TaxDocument23 pages3 Input TaxMobile LegendsNo ratings yet

- B-BTAX313 Module 3 (Revenue Cycle) - Case StudyDocument5 pagesB-BTAX313 Module 3 (Revenue Cycle) - Case Studywill passNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Business and Transfer Taxation Chapter 9 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 9 Discussion Questions AnswerKarla Faye LagangNo ratings yet

- Module 12 - Accounting For Income Tax - Leases - Employee BenefitsDocument7 pagesModule 12 - Accounting For Income Tax - Leases - Employee BenefitsMaha Bianca Charisma CastroNo ratings yet

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- 6028 Tax AssignmentDocument8 pages6028 Tax Assignmentpuneetk20No ratings yet

- Acctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxDocument12 pagesAcctg334-Auditing Assurance: Concepts & Applications 2 Quiz-Employee Benefits & Accounting For Income TaxMichale JacomillaNo ratings yet

- Bsa2105 FS2021 Vat Da22414Document4 pagesBsa2105 FS2021 Vat Da22414ela kikay100% (1)

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- 6028-Tax AssignmentDocument6 pages6028-Tax AssignmentFiniti Financials Consultants LLPNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument22 pages© The Institute of Chartered Accountants of IndiaShobhit JalanNo ratings yet

- Accounting LM3Document6 pagesAccounting LM3Nathan Kurt LeeNo ratings yet

- Idt (Old) Icai RTP Nov 2020Document22 pagesIdt (Old) Icai RTP Nov 2020Ram Baran MauryaNo ratings yet

- Problem Quiz On IntermediateDocument3 pagesProblem Quiz On IntermediateReginald ValenciaNo ratings yet

- Tax Planning and Compliance: Page 1 of 5Document5 pagesTax Planning and Compliance: Page 1 of 5Srikrishna DharNo ratings yet

- Written ReportDocument10 pagesWritten ReportSamantha TayoneNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- 05 Input TaxesDocument4 pages05 Input TaxesJaneLayugCabacunganNo ratings yet

- Itc FinalDocument47 pagesItc FinalarshiaNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeWenjunNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandeNo ratings yet

- Chapter-4-13 2021Document66 pagesChapter-4-13 2021Yoshida SomaNo ratings yet

- BAF 306 BAF 4 - VAT Payable or RefundableDocument16 pagesBAF 306 BAF 4 - VAT Payable or Refundableyudamwambafula30No ratings yet

- Taxable Income: Credit", As FollowsDocument13 pagesTaxable Income: Credit", As FollowsSuzette VillalinoNo ratings yet

- Lesson 7 BtaxDocument8 pagesLesson 7 Btaxdin matanguihanNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Imp Que GST by CA Manoj Batra For Nov 20 AttemptDocument261 pagesImp Que GST by CA Manoj Batra For Nov 20 Attemptshri jeetNo ratings yet

- TAX - DrillDocument5 pagesTAX - DrillKriztleKateMontealtoGelogoNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Edith DalidaNo ratings yet

- Output Vat Quiz - HernandezDocument4 pagesOutput Vat Quiz - HernandezDigna HernandezNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- ITC Part I With Practice QuestionsDocument16 pagesITC Part I With Practice QuestionsTushar MadanNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Vat On Sale of Goods or Properties: Shareholders For Their Shares in Profit of VATDocument3 pagesVat On Sale of Goods or Properties: Shareholders For Their Shares in Profit of VATRachelle Mae NagalesNo ratings yet

- Lesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXDocument2 pagesLesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXRachelle Mae NagalesNo ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet

- Module 3. Value-Added Tax On Sale of Services: Lesson 1 - Delineation of ServiceDocument2 pagesModule 3. Value-Added Tax On Sale of Services: Lesson 1 - Delineation of ServiceRachelle Mae NagalesNo ratings yet

- Receipt 2480 1594Document1 pageReceipt 2480 1594FRANK JOSE MARQUEZ GIRONNo ratings yet

- PESCODocument1 pagePESCOkhan67067gmailcomNo ratings yet

- Local Taxation and Real Property Taxation-SummaryDocument1 pageLocal Taxation and Real Property Taxation-SummaryErika Mae LegaspiNo ratings yet

- U.S. Return of Partnership Income: Employer Identification NoDocument16 pagesU.S. Return of Partnership Income: Employer Identification Nosherr jones100% (1)

- Deed of Absolute SaleDocument4 pagesDeed of Absolute SaleNan MallNo ratings yet

- PPV PPT A3 (Group-2)Document28 pagesPPV PPT A3 (Group-2)sahil patel100% (1)

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- Temp Differences FlashcardsDocument11 pagesTemp Differences FlashcardsKatrina EustaceNo ratings yet

- Fin 303 PDFDocument4 pagesFin 303 PDFSimanta KalitaNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Tax InterviewDocument1 pageTax InterviewGhayur HaiderNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- Chapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)Document75 pagesChapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)El jokerNo ratings yet

- Remedies Enhancement ActivityDocument6 pagesRemedies Enhancement ActivityRicka PascualNo ratings yet

- Correction of Errors: Assets Liabilities Equity ProfitDocument4 pagesCorrection of Errors: Assets Liabilities Equity ProfitCharithea NaboNo ratings yet

- Humble Company Has Provided The Following Budget Information For TheDocument2 pagesHumble Company Has Provided The Following Budget Information For TheAmit PandeyNo ratings yet

- Presentaton On Review of LiteratureDocument27 pagesPresentaton On Review of LiteraturearchitNo ratings yet

- Act BillDocument2 pagesAct BillSujith Reddy ThummalaNo ratings yet

- Assessable Spouse Election FormDocument1 pageAssessable Spouse Election FormpetermhanleyNo ratings yet

- Gains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Document11 pagesGains in Dealings of Properties: BAM 127: Income Taxation For BA Module #11Mylene SantiagoNo ratings yet

- Prof. K. S. Jaiswal: Department of CommerceDocument16 pagesProf. K. S. Jaiswal: Department of CommerceR VNo ratings yet

- 433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)Document4 pages433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)douglas jonesNo ratings yet

- Commentary For Fin Act 21-Sec9bDocument13 pagesCommentary For Fin Act 21-Sec9bVedaprakash ManavalanNo ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument1 pageMultan Electric Power Company: Say No To CorruptionArslan RiazNo ratings yet