Professional Documents

Culture Documents

Lesson 7 Btax

Uploaded by

din matanguihan0 ratings0% found this document useful (0 votes)

2 views8 pagesThis document discusses input taxes and allowable input tax deductions under the Philippine value-added tax system. It defines input tax and categories of deductible input tax such as taxes paid on local purchases, presumptive input tax, and transitional input tax. It also outlines sources of creditable input taxes from local purchases or importation of goods, capital goods, and rules for input tax claims for vehicles and construction in progress.

Original Description:

Original Title

LESSON-7-BTAX

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses input taxes and allowable input tax deductions under the Philippine value-added tax system. It defines input tax and categories of deductible input tax such as taxes paid on local purchases, presumptive input tax, and transitional input tax. It also outlines sources of creditable input taxes from local purchases or importation of goods, capital goods, and rules for input tax claims for vehicles and construction in progress.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views8 pagesLesson 7 Btax

Uploaded by

din matanguihanThis document discusses input taxes and allowable input tax deductions under the Philippine value-added tax system. It defines input tax and categories of deductible input tax such as taxes paid on local purchases, presumptive input tax, and transitional input tax. It also outlines sources of creditable input taxes from local purchases or importation of goods, capital goods, and rules for input tax claims for vehicles and construction in progress.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Business Tax: Value-Added Tax (Input Taxes) Input Tax Allowable Input Tax Deductions

Input tax is the value-added tax due from or paid by

VAT-registered person in the course of his trade or business

on importation of goods or local purchase of goods,

properties or services, including lease or use of properties, in

the course of his trade or business. It shall also include the

transitional input tax and the presumptive input tax.

Categories of Deductible Input Tax

1. Value-Added Tax (VAT) paid on local purchases

(passed on by seller) or on importation (passed-on Deductions from Allowable Input Tax Deductions

VAT) 1. Input Tax claimed as tax credit certificate or refund

2. Presumptive Input Tax 2. Input Tax attributed to VAT-Exempt Sales

3. Transitional Input Tax 3. Input Tax attributed to Sales to Government

4. Standard Input Tax Sources of Creditable Input Taxes (Local Purchases or

Persons who can avail of input tax credit from VAT on Importation)

Importation Input tax evidenced by a VAT invoice or official receipts by

1. To the importer upon payment of VAT prior to the a VAT-registered person which shall be valid for 5 years from

release of goods from customs territory the date of permit to use.

2. To the purchaser of the domestic goods or properties a. Purchase or Importation of Goods

upon consummation of the sale 1. For Sale

3. To the purchaser of services or lessee or licensee 2. For conversion into or intended to form part of a

upon payment of the compensation, rental, royalty finished product for sale, including packaging

or fee materials

3. For use as supplies in the course of trade or business

4. For use as raw materials supplied in the sale of pertaining to transactions subject to VAT may be

services recognized for input tax credit computed as follows:

5. For use in trade or business for which deduction for (VAT Sales/total sales x input taxes)

depreciation or amortization is allowed

b. Purchase of real properties for which a VAT has Sources of Creditable Input Taxes (Local Purchases on

actually been paid Capital Goods)

c. Purchase of services in which VAT has actually been Meaning of capital goods or properties:

paid Goods or properties with estimated useful life greater

d. Transactions deemed sale than one (1) year treated as depreciable assets

under Sec. 34(F) of the NIRC; and used directly or

VAT-registered person is also engaged in transactions not indirectly in the production or sale of taxable goods

subject to VAT or services. [Sec. 16, RR 4-2007]

Where the aggregate acquisition cost (exclusive of

A VAT-registered person who is also engaged in VAT) of depreciable capital goods during any

transactions not subject to VAT shall be allowed to calendar month does not exceed P1,000,000

recognize input tax credit on transactions subject to VAT as In this case:

follows: The total input tax is creditable against output tax in

a. All the input taxes that can be directly attributed to the month acquired.

transactions subject to VAT may be recognized for a. If the estimated useful life of a capital good is five (5)

input tax credit. years or more – The input tax shall be spread evenly

b. If any input tax cannot be directly attributed to either over a period of sixty (60) months and the claim for

a VAT taxable or VAT-exempt transaction, the input input tax credit will commence in the calendar

tax shall be pro-rated to the VAT taxable and VAT- month when the capital good is acquired. The total

exempt transactions and only the ratable portion input taxes on purchases or importations of this type

of capital goods shall be divided by 60 and the reclassified and the reclassified asset is capitalized and

quotient will be the amount to be claimed monthly. depreciated

b. If the estimated useful life of a capital good is less Input tax on construction in progress:

than five (5) years – The input tax shall be spread a. CIP is considered, for purposes of claiming input tax,

evenly on a monthly basis by dividing the input tax by as a purchase of service, the value of which shall be

the actual number of months comprising the determined based on the progress billings

estimated useful life of the capital good. The claim for b. Until such time the construction has been completed,

input tax credit shall commence in the calendar it will not qualify as capital goods as define, in which

month that the capital goods were acquired. case, input tax credit on such transaction can be

Sources of Creditable Input Taxes (Local Purchases on recognized in the month the payment was made,

Capital Goods) provided, that an official receipt of payment has

Sale or transfer of depreciable good within a period been issued based on the progress billings

of 5 years or prior to the exhaustion of the amortizable Contract for the sale of service where only the labor will be

input tax. supplied

If the depreciable capital good is sold/transferred In case of contract for the sale of service where only

within 5 years or prior to the exhaustion of the the labor will be supplied by the contractor and

amortizable input tax, the entire unamortized input tax materials will be purchased by the contracted from

can be claimed as input tax credit during the other suppliers, input tax credit on the labor

month/quarter when the sale or transfer was made contracted shall still be recognized on the month the

payment was made based on the progress billings

Meaning of construction in progress (CIP): while input tax on the purchase of materials shall be

CIP is the cost of construction work which is not yet recognized at the time the materials were

completed. CIP is not depreciated util the asset is places purchased.

in service. Normally, upon completion, a CIP is Input tax claimed while the construction is in progress:

Once the input tax has already been claimed while primary agricultural products which are used as

the construction is in progress, no additional input tax inputs to their production.

can be claimed upon completion of the asset when The term “Processing” shall mean pasteurization,

it has been reclassified as a depreciable capital asset canning and activities which through physical or

and depreciated chemical process alter the exterior texture or form or

Rules on allowing input tax credit on vehicles, and other inner substance of a product in such manner as to

expenses incurred. prepare it for special use to which it could not have

a. Purchase of vehicle must be substantiated with been put in its original form or condition (RA 9337).

official receipts or other adequate records; Transitional Input Tax

b. Taxpayer has to prove the direct connection of the A person who becomes liable to value-added tax or

motor vehicle to the business; any person who elects to be a VAT-registered person

c. Only one vehicle for land transport is allowed for the shall, subject to the filing of inventory according to

use of an official/employee with value not exceeding the rules and regulations prescribed by the Secretary

P2.4 million; of Finance, upon recommendation of the

d. No depreciation shall be allowed for yachts, Commissioner, be allowed input tax on his beginning

helicopters, airplanes [Sec. 3, RR 12-2012] inventory of goods, materials and supplies equivalent

Presumptive Input Tax to 2% of the value of such inventory or the actual

Persons or firms engaged in the processing of value-added tax paid on such goods, materials and

sardines, mackerel and milk, an in manufacturing supplies, whichever is higher, which shall be

refined sugar, cooking oil and packed noodle-based creditable against the output tax.

instant meals, shall be allowed a presumptive input Standard Input Tax

tax, creditable against the output tax, equivalent to Input tax attributable to VAT sales to Government not

4% of the gross value in money of their purchases of creditable against output tax on sales to non-

Government entities

Input taxes that can be directly attributable to VAT Difference between the VAT rate and the

taxable sales of goods and services to the withholding VAT rate accounts for the standard input

Government or any of its political subdivisions, tax

instrumentalities or agencies including GOCCs shall The remaining seven percent (7%) effectively

not be credited against output taxes arising from accounts for the standard input VAT for sales of

sales to non-Government entities goods or services to government or any of its political

The government or any of its political subdivisions, subdivisions, instrumentalities or agencies including

instrumentalities or agencies, including GOCCs shall GOCCs, in lieu of the actual input VAT directly

deduct and withhold a final VAT due at the rate of attributable or ratably apportioned to such sales

fiver percent (5%) of the gross payment Should actual input VAT attributable to sale to

Beginning January 1, 2021, the VAT withholding government exceeds seven percent (7%) of gross

system under this Subsection shall shift from final to a payments, the excess may form part of the seller’s

creditable system expense or cost. On the other hand, if actual input

The payor or person in control of the payment shall VAT attributable to sale to government is less than

be considered as the withholding agent seven percent (7%) of gross payment, the difference

Final withholding VAT represent the net VAT payable must be closed to expense or cost.

of the seller. Withholding VAT Rate

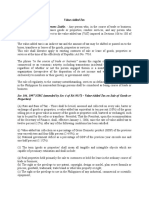

The five percent (5%) final withholding VAT rate shall TAX

TYPE

DESCRIPTION RATE ATC

Applicable to Government Withholding Agent Only

represent the net VAT payable of the seller. WV VAT withholding on Purchase of Goods 5% WV010

WV VAT Withholding on Purchase of Services 5% WV020

Starting January 1, 2022, the 5% final withholding vat WV

Applicable to Both Government and Private Withholding Agents

VAT Withholding from non-residents (Government Withholding Agents) 12% WV040

WV VAT Withholding from non-residents (Private Withholding Agents) 12% WV050

on sale to government is to be considered as WV

VAT Withholding on Purchases of Goods (with waiver of privilege to claim tax credit)

12% WV012

creditable

VAT Withholding on Purchases of Goods (with waiver of privilege to claim input tax credit)

creditable withholding vat. WV

final

12% WV014

VAT Withholding on Purchases of Services (with waiver of privilege to claim input tax

WV 12% WV022

credit) creditable

VAT Withholding on Purchases of Services (with waiver of privilege to claim input tax

WV 12% WV024

credit) final

Remittance of Withholding VAT may, at the option of the owner/seller/taxpayer or

The VAT withheld shall be remitted within ten (10) days importer/miller/taxpayer, be available for the issuance

following the end of the month the withholding was of TCC upon application duly filed with the BIR by the

made seller/owner or importer/miller within two (2) years from

Advance Payment Of VAT the date of filing of the 4th quarter VAT return of the year

Transactions requiring advance payment of VAT: such advance payments were made, or if filed out of

1. Sale of Refined Sugar time, from the last day prescribed by law for filing the

2. Sale of Flour return.

3. Transport of naturally grown and planted timber Advance VAT payment claimed as TCC cannot be carried

products over

4. Sale of Jewelry, gold and other metallic minerals Advance VAT payments which have been the subject

Advance payment of VAT allowed as credit against output of an application for the issuance of TCC shall not be

tax allowed as carry-over nor credited against the output

The advance payments made by the seller/owner of tax of the succeeding quarter/year.

refined sugar, importer or miller of wheat/flour and Issuance of TCC limited to unutilized advance VAT

sellers/owners of naturally grown and planted timber payment

products shall be allowed as credit against their

output tax on the actual gross selling price of refined Issuance of TCC shall be limited to the unutilized

sugar/flour/timber products. advance VAT payment and shall not include excess

Advance payments may be available for issuance of tax input tax.

credit certificate

Advance payments which remains unutilized at the end Issuance of TCC for input tax attributable to zero-rated

of taxpayer’s taxable year where the advance payment sales shall be covered by a separate application for TCC

was made, which is tantamount to excess payment, following applicable rules.

Refund of Input Tax Unused input tax of person who retired or ceased business

Input tax on zero-rated sales of goods or property: A VAT-registered person whose registration has been

A VAT-registered person whose sales of goods, cancelled due to retirement from or cessation of

properties or services are zero-rated or effectively zero- business, or due to changes in or cessation of status

rated may apply for the issuance of a tax credit under Sec. 106 (C) of the Tax Code may, within two (2)

certificate/refund of input tax attributable to such sales. years from the date of cancellation, apply for the

The input tax that may be subject of the claim shall issuance of a tax credit certificate for any unused input

exclude the portion of input tax that has been applied tax which he may use in payment of his other internal

against the output tax. The application should be filed revenue taxes; Provided, however, that he shall be

within two (2) years after the close of the taxable quarter entitled to a refund if he has no internal revenue tax

when such sales were made liabilities against which the tax credit certificate may be

Printing of the word “zero-rate” required: utilized.

The supreme court has ruled in several cases that the Period of refund or tax credit of input tax

printing of the word “zero-rated” is required to be refund or tax credit certificate/refund of input taxes shall

placed on the VAT invoices or receipts covering zero- be made in proper cases, the Commissioner of Internal

rated sales in order to be entitled to claim for tax credit Revenue shall grant a tax credit certificate/refund for

or refund creditable input taxes within ninety (90) days from the

Other documents may be used to prove “zero-rated sale date of submission of complete documents in support of

In another case, failure of the taxpayer to indicate its the application.

zero-rated sales in its VAT returns and in its official receipts Appeal of full or partial denial

is not sufficient reason to deny its claim for tax credit or In case of full or partial denial of the claim for tax credit

refund when there are other documents from which the certificate/refund as decided by the Commissioner of

court can determine the veracity if the taxpayer’s Internal Revenue, the taxpayer may appeal to the Court

claims. of Tax Appeals (CTA) within thirty (30) days from the

receipt of said denial, otherwise the decision shall

become final. However, if no action on the claim for tax

credit certificate/refund has been taken by the

Commissioner of Internal Revenue after the ninety (90)

day shall be punishable under Section 269 of this code.

Manner of giving refunds

Refunds shall be made upon warrants drawn by the

Commissioner of Internal Revenue or by his authorized

representative without the necessity of being

countersigned by the COA Chairman.

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- VAT Input TaxesDocument7 pagesVAT Input TaxesJocelyn Verbo-AyubanNo ratings yet

- 05 Input TaxesDocument4 pages05 Input TaxesJaneLayugCabacunganNo ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- Pretest - OrganizationDocument3 pagesPretest - OrganizationGlaiza Perez100% (1)

- Vat & OptDocument14 pagesVat & OptDaphnie BoloNo ratings yet

- Input Taxes SummaryDocument8 pagesInput Taxes SummaryMichael AquinoNo ratings yet

- Securitization, Shadow Banking, and FinancializationDocument54 pagesSecuritization, Shadow Banking, and FinancializationjoebloggsscribdNo ratings yet

- Value Added Tax - Module ExercisesDocument8 pagesValue Added Tax - Module ExercisesChiarra ArceoNo ratings yet

- 07) CIR V Seagate Tech PhilsDocument3 pages07) CIR V Seagate Tech PhilsAlfonso Miguel LopezNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- Taxation LawDocument10 pagesTaxation LawflorNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Edith DalidaNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesJune Baricanosa AlvarezNo ratings yet

- 38 CIR Vs SEA GATEDocument4 pages38 CIR Vs SEA GATEIshNo ratings yet

- MCQ'S Product Design and DevelopmentDocument14 pagesMCQ'S Product Design and Developmentchiku khade100% (5)

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- What Is The Immediacy TestDocument6 pagesWhat Is The Immediacy TestBo Dist100% (1)

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Bsa2105 FS2021 Vat Da22414Document4 pagesBsa2105 FS2021 Vat Da22414ela kikay100% (1)

- Tax 303 - Input VatDocument7 pagesTax 303 - Input VatiBEAYNo ratings yet

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument12 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesWin TambongNo ratings yet

- Value Added Tax 3Document8 pagesValue Added Tax 3Nerish PlazaNo ratings yet

- 3 Input TaxDocument23 pages3 Input TaxMobile LegendsNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesUbalda AbuboNo ratings yet

- C9 Input VATDocument18 pagesC9 Input VATdraga pinasNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Bustax Chapter 9Document10 pagesBustax Chapter 9Pineda, Paula MarieNo ratings yet

- TAXATION 2 Chapter 13 Input VATDocument2 pagesTAXATION 2 Chapter 13 Input VATKim Cristian MaañoNo ratings yet

- Input VAT ch9 IncompleteDocument3 pagesInput VAT ch9 IncompleteMarionne GNo ratings yet

- 7 Input Tax CreditDocument16 pages7 Input Tax CreditinstainstantuserNo ratings yet

- Value-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayableDocument15 pagesValue-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayablePrimo WilliamsNo ratings yet

- Chapter-5 (Input Tax Credit)Document30 pagesChapter-5 (Input Tax Credit)pronab sarkerNo ratings yet

- Principle of Taxation: Sales Tax Computation QuestionDocument12 pagesPrinciple of Taxation: Sales Tax Computation QuestioniamneonkingNo ratings yet

- Itc GSTDocument27 pagesItc GSTShivam GoelNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDocument22 pagesAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNo ratings yet

- 2020 Bustax - VAT - Part1 - Handouts PDFDocument13 pages2020 Bustax - VAT - Part1 - Handouts PDFMila MercadoNo ratings yet

- Hadee Lutful & Co.: Presented byDocument7 pagesHadee Lutful & Co.: Presented byColors of LifeNo ratings yet

- Input TaxDocument23 pagesInput TaxIana Gonzaga FajardoNo ratings yet

- MIDTERMS Business and Transfer TaxationDocument13 pagesMIDTERMS Business and Transfer Taxationabrylle opinianoNo ratings yet

- UU PPN EnglishDocument32 pagesUU PPN EnglishRizka Hikmatul Maula PutriNo ratings yet

- Uu No 43 THN 2009Document14 pagesUu No 43 THN 2009Gita ChandradewiNo ratings yet

- Answers - Business Taxation - Input Vat (Chapter 9)Document2 pagesAnswers - Business Taxation - Input Vat (Chapter 9)Gino CajoloNo ratings yet

- Value Added Tax (Cap 476)Document15 pagesValue Added Tax (Cap 476)Triila manillaNo ratings yet

- VALUE Added TaxDocument20 pagesVALUE Added TaxMadz Rj MangorobongNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- Value Added TaxDocument44 pagesValue Added TaxDa Yani ChristeeneNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Chapter 10 NotesDocument22 pagesChapter 10 NotesSittie Ainna Acmed UnteNo ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- VAT ModuleDocument50 pagesVAT ModuleRovi Anne IgoyNo ratings yet

- Value Added Tax2Document28 pagesValue Added Tax2biburaNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- Accounting Policies in Bharat ElectronicsDocument4 pagesAccounting Policies in Bharat ElectronicsNafis SiddiquiNo ratings yet

- Lesson 2 AasiDocument1 pageLesson 2 Aasidin matanguihanNo ratings yet

- STCM 04 Ge CVPDocument2 pagesSTCM 04 Ge CVPdin matanguihanNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- Lesson 4 BtaxDocument4 pagesLesson 4 Btaxdin matanguihanNo ratings yet

- Lesson 6 BtaxDocument5 pagesLesson 6 Btaxdin matanguihanNo ratings yet

- SCM - Question and AnswersDocument7 pagesSCM - Question and Answersdr jaimanNo ratings yet

- OkDocument4 pagesOksofhia abassNo ratings yet

- 1.7.marketing Information SystemsDocument21 pages1.7.marketing Information SystemskhushiYNo ratings yet

- Assignment Ratio AnalysisDocument11 pagesAssignment Ratio Analysiscrossbonez93100% (1)

- Future: Classification of Costs For Decision Making and PlanningDocument30 pagesFuture: Classification of Costs For Decision Making and PlanningSarvar PathanNo ratings yet

- Module 3, Day 2Document15 pagesModule 3, Day 2praveshNo ratings yet

- AGRI6 W10dDocument8 pagesAGRI6 W10dJosh FontanillaNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- Planning An Advertising Campaign, Steps Involved in Planning An Advertising CampaignDocument4 pagesPlanning An Advertising Campaign, Steps Involved in Planning An Advertising Campaignshubhangi raneNo ratings yet

- Certification in Integrated Treasury Management SyllabusDocument4 pagesCertification in Integrated Treasury Management Syllabusshubh.icai0090No ratings yet

- The Delta of An Option or Simply The Option DeltaDocument14 pagesThe Delta of An Option or Simply The Option DeltaMehul J VachhaniNo ratings yet

- MessageDocument2 pagesMessageJoaozin ZinhoNo ratings yet

- mkt301 ProjectDocument33 pagesmkt301 ProjectSamira HaqueNo ratings yet

- Communication of Change Management UNIQLODocument16 pagesCommunication of Change Management UNIQLOpalejarmNo ratings yet

- Segmentation TanishqDocument5 pagesSegmentation Tanishqamit singhNo ratings yet

- Sales ManagementDocument4 pagesSales ManagementIlie AkmalNo ratings yet

- Janna Lane Faunillan Yvonne Kate Gapo: Module 6 GroupDocument2 pagesJanna Lane Faunillan Yvonne Kate Gapo: Module 6 GroupJanna Lane FaunillanNo ratings yet

- OpTransactionHistoryTpr02 08 2022Document46 pagesOpTransactionHistoryTpr02 08 2022sanket enterprisesNo ratings yet

- Clique Student Sheet (Manteran Lamo)Document4 pagesClique Student Sheet (Manteran Lamo)Dina Rizkia RachmahNo ratings yet

- Fin701 - Module2 9.17Document6 pagesFin701 - Module2 9.17Krista CataldoNo ratings yet

- 3 DeliverableDocument18 pages3 DeliverableYeison GonzaliasNo ratings yet

- DarzDocument6 pagesDarzMuhammad MudassarNo ratings yet

- Internship Project ReportDocument12 pagesInternship Project ReportShubham ChauhanNo ratings yet

- Case Study - CHEN ONEDocument12 pagesCase Study - CHEN ONEUbed Amjad ShaikhNo ratings yet

- Coefficient of ElasticityDocument1 pageCoefficient of ElasticityAnonymous AKdppszR5MNo ratings yet

- Innovation Management GlobalDocument2 pagesInnovation Management Globalvaksoo vaiNo ratings yet

- CUTE Tutorial - Zoom Training - 11.03.21Document146 pagesCUTE Tutorial - Zoom Training - 11.03.21Hema KrishnanNo ratings yet