Professional Documents

Culture Documents

Principle of Taxation: Sales Tax Computation Question

Uploaded by

iamneonkingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principle of Taxation: Sales Tax Computation Question

Uploaded by

iamneonkingCopyright:

Available Formats

Principle of Taxation

Sale Tax Act 1990

A sales tax is a consumption tax imposed by the government on the sale of goods and services. A

conventional sales tax is levied at the point of sale, collected by the retailer, and passed on to the

government. A business is liable for sales taxes in a given jurisdiction if it has a nexus there, which can be

a brick-and-mortar location, an employee, an affiliate, or some other presence, depending on the laws

in that jurisdiction.

Sales Tax Computation Question

Prepared By Zahid Qavi. FCA

Principle of Taxation

Knowledge Required For Sales Tax Computation Question

1. Conceptually clear understanding of following Definitions

a. Supply

b. Time of Supply

c. Value of Supply

d. Input Tax

e. Output Tax

2. Knowledge of Sec 4, Zero rating, Export, Fifth Schedule items, items which are not deemed to be

zero rated.

3. Understanding of the list of items on which Input Tax could not be claimed(Sce 8(1))

4. Conceptually clear understanding of adjustable Input Tax

90% of Output Tax

Input Tax on Fixed Assets

5. Rules regarding Debit / Credit Notes

6. Rules regarding Missing Invoice, next SIX consecutive tax periods.

7. Understanding of Section 73, Payments through banking instruments within 180 days exceeding

value of FIFTY THOUSANDS excluding utility bills.

8. When a person can claim Input Tax ( Sec 7 )

9. Apportionment of Input Tax

10. Supplies on which Further Tax @ 3% shall not be charged

11. Format of Solution

Zahid Qavi. FCA Join CA Studio at Facebook 1

Principle of Taxation

Supply:

―supply‖ means a sale or transfer of the right to dispose of goods as owner, including sale under a

hire purchase agreement, and also includes -

a) putting to:

private,

business or

non-business

Use of goods produced during taxable activity; [Refer Question-5 at end of this chapter]

b) auction or disposal of goods to satisfy a debt; and

c) possession of taxable goods held immediately before de-registration: [Refer Question-6 at end of

this chapter]

d) in case of manufacture of goods belonging to another person, the transfer or delivery of

such goods to the owner or to a person nominated by him.

The Federal Government may specify other transactions as supply

Time of Supply:

Type of supply Time of supply

(a) A supply of goods Earlier of:

- The time at which the goods are delivered or made

available to the recipient of the supply or

- the time when any payment is received by the supplier in

respect of that supply

(b) A supply of goods under a hire The time at which the agreement is entered into

purchase agreement

(c) Services Time at which the services are rendered or provided

Value of Supply:

‗value of supply‘ means in respect of a taxable supply, the consideration in money (including all Federal

and Provincial duties and taxes) which the supplier receives from the recipient but excluding the amount

of tax:

No. Scenario Value of supply

(i) If consideration for a supply is fully or Open market price of the supply excluding the

partly in kind amount of tax

(ii) If supplier and recipient are associates Open market price of the supply excluding the

and supply is made at no consideration amount of tax

or at a consideration lower than open

market price

(iii) If taxable supply is made to general Open market price of the supply excluding the

public on installment basis (including amount of tax

surcharge)

(iv) In case trade discount is provided The discounted price excluding the amount of

tax. Provided that tax invoice shows the

discounted price and the related tax and the

discount allowed is in conformity with normal

business practices

Zahid Qavi. FCA Join CA Studio at Facebook 2

Principle of Taxation

(v) In case of a special nature of transaction Open market price

where it is difficult to determine value of

supply

(vi) In case of imported goods The value determined under Customs Act

including custom duty and excise duty

charged on it

(vii) If there are sufficient reasons to believe The value determined by the Valuation

that the value Committee comprising representatives of

of a supply has not been correctly trade and the Inland Revenue constituted

declared in the by the Commissioner

invoice

(viii) If goods other than taxable goods Market price of goods excluding the

(exempt goods) are amount of tax

supplied to a registered person for

processing

Input Tax:

―Input tax‖, in relation to a registered person, means—

a) tax levied on supply of goods received by the person;

b) tax levied on goods imported by the person;

c) tax levied under Federal Excise Act in sales tax mode on goods/services acquired by the person,

and

d) Provincial sales tax levied on services rendered or provided to the person:

e) tax levied under the Sales Tax Act, 1990 as adapted in the State of Azad Jammu and Kashmir, on

the supply of goods received by the person;

Output Tax:

―output tax‖, in relation to a registered person, means-

(i) tax levied on a supply of goods made by the person;

(ii) tax charged under Federal Excise Act in sales tax mode on:

production of the goods, or

providing of the services,

by the person;

(iii) Provincial sales tax charged on services provided by the person;

Zahid Qavi. FCA Join CA Studio at Facebook 3

Principle of Taxation

4. Zero rating.

List down the goods which are charged to tax at the rate of zero percent

The following goods shall be charged to tax at the rate of zero per cent:--

a) goods exported or specified in the Fifth Schedule;

b) supply of stores/provisions for consumption aboard a conveyance proceeding to a

destination outside Pakistan

c) goods specified by Federal Government by notification in official gazette

d) goods specified by FBR that are supplied to a registered person engaged in the manufacturing and

supply of zero rated goods.

List the type of exports which are outside the purview of zero rating/Exceptions to above rule

However following goods shall not be charged to tax at the rate of zero per cent:

(i) exports that are intended to be re-imported into Pakistan; or

(ii) goods that have been entered for export but are not exported; or

(iii) goods that have been exported to a country specified by the Federal Government:

The Federal Government may restrict input tax credit for person making a zero-rated supply.

THE FIFTH SCHEDULE (ZERO-RATED SUPPLIES)

1. Sale to diplomats, diplomatic missions, privileged persons.

2. Sales to duty free shops

3. Sales of raw materials, for further manufacture of goods in the Export Processing Zone.

4. Sales of such locally manufactured plant and machinery to the Export Processing Zones

5. Supplies made to exporters under the Duty and Tax Remission Rules

8. Tax credit not allowed

(1) A registered person shall not be entitled to deduct input tax paid on-

a) the goods or services used for any purpose other than for taxable supplies made by him;

b) any other goods or services specified by Federal Government;

c) the goods on which extra amount of tax is paid in addition to normal tax at 17% [under sub-

section (5) of section 3].

ca) the goods/services on which sales tax has not been deposited in Government treasury by the

supplier;

caa) purchases, for which:

a discrepancy is indicated by CREST or

input tax is not verifiable in the supply chain;

d) fake invoices;

e) Purchases made by a registered person who fails to furnish the information required by the Board.

f) goods and services not related to the taxable supplies made by the registered persons:

g) goods and services acquired for personal or non-business consumption:

h) goods used in immovable property, or permanently attached to immovable property, such as

building and construction materials, paints, electrical, pipes, wires and cables, but excluding:

pre-fabricated buildings

good acquired for sales or re-sale

good acquired for direct use in the production of taxable goods;

Zahid Qavi. FCA Join CA Studio at Facebook 4

Principle of Taxation

i) vehicles specified in Customs Act, parts of such vehicles, electrical and gas appliances,

furniture, office equipment (excluding electronic cash registers), but excluding goods acquired for

sale/re-sale.

j) services in respect of which input tax adjustment is barred under the provincial sales tax law;

k) import or purchase of agricultural machinery or equipment subject to sales tax at the rate of 7%;

and

l) such goods and services which, at the time of filing of return by the buyer, have not been declared

by the supplier in his return or he has not paid the tax due as indicated in his return.

m) import of scrap of compressors

8B. Adjustable input tax

(1) A registered person shall not be allowed to adjust input in a tax period exceeding 90% of the

output tax. Excess input tax shall be carried forward to the next tax period, and shall be

considered as input tax for that period. The Board may prescribe the procedure for refund

[(as mentioned in sub-section (2) below]. [S. 10(1)]

Input tax on fixed assets/capital goods shall not be restricted to 90% of output.

The Board may exclude any persons from the ambit of above provision.

(2), (3) Where input tax is restricted up to 90% of output tax an adjustment or refund will be allowed to

a registered person.

For claiming the adjustment/refund the person should fulfill following conditions:–

No. Person Condition applicable

(i) If the registered person‘s account are The person should furnish a statement along

subject to audit under Companies with annual audited accounts certified by the

Ordinance, 1984 auditors

(ii) In case of other persons The person should fulfill the conditions and

restrictions specified by the Board

The adjustment/refund of input tax shall be made on yearly basis in the 2nd month after the end of

the financial year.

(4) The Board may prescribe other limit of input tax adjustment.

(5) An auditor found guilty of misconduct in furnishing the above certificate [mentioned in sub-section

(2)] shall be referred to the Council for disciplinary action under Chartered Accountants Ordinance.

9. Debit and credit note

Where a registered person has issued a tax invoice and due to cancellation or return of goods or a change

in value of supply the amount as per the tax invoice needs to be modified, he may, issue a debit or credit

note.

Rules regarding Missing Invoice, next SIX consecutive tax periods.

Where a registered person did not deduct input tax within the relevant period, he may claim such tax in

the return for any of the 6 succeeding tax periods.

Zahid Qavi. FCA Join CA Studio at Facebook 5

Principle of Taxation

73. Certain transactions not admissible

(1) Payment for a transaction exceeding Rs. 50,000, excluding utility bill, shall be made by a crossed

cheque or other banking channel otherwise input will be disallowed.

(2) The payment for credit transaction should be made within 180 days of issuance of the tax

invoice.

Time of claim of input tax/ Conditions for allowing input

A registered person shall not be entitled to deduct input unless:

Situation Document required

In case of purchases made by him He holds a tax invoice in his name and having

his registration number in respect of such supply:

If the supplier has not declared such supply in his

return or he has not paid amount of tax due as

indicated in his return than input cannot be

recorded.

In case of imports made by him He holds bill of entry or goods declaration in his

name and showing his sales tax registration

number. It should be duly cleared by the Custom

authorities.

In case of goods purchased in auction He holds a treasury challan, in his name and

bearing his registration number, showing payment

of sales tax.

Apportionment of input tax

25. Determination of input tax.

1) Input tax paid on raw material purchased for only taxable supplies shall be admissible.

2) Input tax paid on raw material purchased for only exempt supplies shall not be admissible.

3) ,5) The input tax for both exempt and taxable supplies shall be apportioned according to

following formula:

Residual Input Tax Credit = Value of taxable supplies x Residual input

on taxable supplies (Value of taxable + exempt supplies)

An input tax claimed wrongfully because of incorrect application of formula shall be punishable.

4) Monthly adjustment of input tax shall be treated as provisional adjustment and at the end of

financial year, the registered person shall make final adjustment on basis of taxable and exempt

supplies made during the year.

Zahid Qavi. FCA Join CA Studio at Facebook 6

Principle of Taxation

Supplies on which Further Tax @ 3% shall not be charged

An SRO provides following list of persons on which this further tax of 3% is not chargeable:

(i) Electricity energy supplied to domestic and agricultural consumers.

(ii) Natural gas supplied to domestic consumers.

(iii) Motor oil, diesel oil, jet fuel and fuel oil.

(iv) Goods sold by the retailers to end customers.

(v) Supply of goods directly to end customers including food, beverages, fertilizers and vehicles.

(vi) Items listed in Third Schedule

(vii) Second hand worn clothing and other worn articles falling under PCT heading 6309.0000.

(viii) Fertilizers

(ix) Supplies by steel melters, re-rollers and ship breakers operating under Chapter XI of Sales

Tax Special Procedure Rules, 2007.

(x) Supplies covered under the Fifth Schedule to the Sales Tax Act, 1990.

Zahid Qavi. FCA Join CA Studio at Facebook 7

Principle of Taxation

Mr/Business Name

Computation of Sales Tax

Payable/Refundable Tax Period

Output Tax W-l xxx

Less Input Tax(Lower of)

Actual Input Tax (Actual + b/f) xxx

90% of Output Tax xxx

(xxx)

Add ;Further Tax 3% of Supplies to unregistered Person xxx

Less; Input Tax on Fixed Assets (xxx)

Sales Tax Payable xxx

Input Tax to be carried forward xxx

Sales Tax Refundable against Export xxx

Zahid Qavi. FCA Join CA Studio at Facebook 8

Principle of Taxation

W-1: Calculation of Output Tax

Supplies to registered person- as per question xxx

Supplies to unregistered person- as per question xxx

supplies to Retailers/distributor/whole seller xxx

Add if already not included in supplies/ ignore if already added

Goods putting to private use- Drawings Xxx

Taxable goods used internally Xxx

Taxable goods donated Xxx

Free sample for business promotion. Xxx

Auction or disposal of goods to satisfy a debt Xxx

Advances received against taxable goods Xxx

Goods which are made available to the customers but not Xxx

delivered

Supplies to associates at special rate- differential amount to Xxx

be added

Supplies at special discount rate-differential amount is to be Xxx

added

Goods supplied to cottage industry. Xxx

Supply of 3rd Schedule items- if Sales Tax is not charged at Xxx

retail price

Insurance claim received against destroyed goods -treated as Xxx

supply.

Missing Invoice of last Six tax period Xxx

Debit note issued to increase value of supply. Xxx

Xxx

Less; If already included in taxable supplies otherwise just ignore

Sales return xxx

Sales of goods on markup-Exclude markup value. Xxx

Supply, repair or maintenance to aircraft and ships Xxx

Supply to diplomats, diplomatic missions, privileged persons. Xxx

Credit Note Xxx

Supplies to duty free shops. xxx

Supplies to Export Processing Zone. xxx

Supplies made to Gawadar Special Economic Zone xxx

(xxx)

xxx

Tax @ 17% XXX

Zahid Qavi. FCA Join CA Studio at Facebook 9

Principle of Taxation

W-2: Calculation of Input Tax

Purchases from registered person Xxx

Taxable Goods imported Xxx

Less if already included in Purchases/ Ignore if already not added

Goods not used in making taxable supplies Xxx

extra amount of tax is paid in addition to normal tax at 17% Xxx

Goods/services on which sales tax has not been deposited Xxx

If discrepancy is indicated by CREST Xxx

Input tax is not verifiable in the supply chain Xxx

Fake invoices Xxx

Purchases if supplier is Blacklisted/Suspended Xxx

Supplier fails to furnish the information required by the Xxx

Board

Goods and services acquired for personal or non-business Xxx

consumption

Goods used in immovable property Xxx

Building material Xxx

Pipes Xxx

Cables Xxx

Electrical fittings Xxx

Paint Xxx

Electrical appliances Xxx

Furniture Xxx

Fixture Xxx

Office equipment Xxx

Gass appliances Xxx

Vehicles Xxx

Purchases against which buyer has not declared the supplier Xxx

in his return

Sales tax invoice exceeding Rs 50,000 and paid in cash Xxx

Credit purchases not paid within 180 days through banking Xxx

mode.

Purchases against which sales tax invoice is not received Xxx

Input tax on fixed assets Xxx

Purchases return Xxx

(xxx)

Add if already not included

Missing invoice - last six tax period Xxx

Advance against taxable purchases Xxx

Xxx

xxx

Sales tax @ 17% Xxx

Add Tax on utility bills Xxx

XXX

Zahid Qavi. FCA Join CA Studio at Facebook 10

Principle of Taxation

W-3: Apportionment of Input Tax:

Turnover Common Input Fixed Assets

Taxable Supplies - - -

Zero-Rated Supplies - - -

Exempt Supplies - - -

- - -

Zahid Qavi. FCA Join CA Studio at Facebook 11

You might also like

- Definitions and Terms Reference To Sales Tax Act 1990Document4 pagesDefinitions and Terms Reference To Sales Tax Act 1990Yasir FarooqNo ratings yet

- Lesson 7 BtaxDocument8 pagesLesson 7 Btaxdin matanguihanNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- STX - IiDocument15 pagesSTX - IiWASEEM AKRAMNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Edith DalidaNo ratings yet

- UU PPN EnglishDocument32 pagesUU PPN EnglishRizka Hikmatul Maula PutriNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- The Value Added Tax Act CapDocument80 pagesThe Value Added Tax Act CapEdward BiryetegaNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Chapter 18 Spr. 24Document12 pagesChapter 18 Spr. 24Asad HanifNo ratings yet

- Input Taxes SummaryDocument8 pagesInput Taxes SummaryMichael AquinoNo ratings yet

- Vat HandoutsDocument7 pagesVat HandoutsjulsNo ratings yet

- Value Added Tax - Module ExercisesDocument8 pagesValue Added Tax - Module ExercisesChiarra ArceoNo ratings yet

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeBheki TshimedziNo ratings yet

- Tax 303 - Input VatDocument7 pagesTax 303 - Input VatiBEAYNo ratings yet

- Title Iv Value-Added Tax Imposition of TaxDocument4 pagesTitle Iv Value-Added Tax Imposition of TaxCat SabioNo ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Value Added Tax 3Document8 pagesValue Added Tax 3Nerish PlazaNo ratings yet

- DTREDocument10 pagesDTRESeeraj KhanNo ratings yet

- Lecture 6 - Value-Added TaxDocument7 pagesLecture 6 - Value-Added TaxPiyey LlarenaNo ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- Vat Regulation The Value Added Tax (General) Regulation 1998 CitationDocument9 pagesVat Regulation The Value Added Tax (General) Regulation 1998 CitationERICK MLINGWANo ratings yet

- Refunds: Chapter - 19Document28 pagesRefunds: Chapter - 19Ashma KhanalNo ratings yet

- 05 Input TaxesDocument4 pages05 Input TaxesJaneLayugCabacunganNo ratings yet

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicNo ratings yet

- VAT Input TaxesDocument7 pagesVAT Input TaxesJocelyn Verbo-AyubanNo ratings yet

- GST Itc DetailDocument8 pagesGST Itc DetailAnonymous ikQZphNo ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Lecture 6 - Value-Added TaxDocument6 pagesLecture 6 - Value-Added TaxVic FabeNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- TAX-501: Excise Taxes: - T R S ADocument4 pagesTAX-501: Excise Taxes: - T R S AShiela Marie Sta AnaNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- Input Tax Credit Composition Scheme 1Document19 pagesInput Tax Credit Composition Scheme 1AkshaNo ratings yet

- Assignment 2Document15 pagesAssignment 2Nitish Kumar NaveenNo ratings yet

- Discussion Questions: True True True False True FalseDocument7 pagesDiscussion Questions: True True True False True FalseJustin TempleNo ratings yet

- A New Tax System (Goods and Services Tax) Act 1999Document9 pagesA New Tax System (Goods and Services Tax) Act 1999angelaNo ratings yet

- Ra 8181Document5 pagesRa 8181Cons BaraguirNo ratings yet

- VAT ModuleDocument50 pagesVAT ModuleRovi Anne IgoyNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- GH Vat ActDocument52 pagesGH Vat ActSEGEBUNo ratings yet

- Other Acts Related To ConstructionDocument48 pagesOther Acts Related To ConstructionRatnesh PatelNo ratings yet

- DTRERules Updatedversion Upto12.09.2019Document17 pagesDTRERules Updatedversion Upto12.09.2019abid205No ratings yet

- Uu No 43 THN 2009Document14 pagesUu No 43 THN 2009Gita ChandradewiNo ratings yet

- Title IvDocument9 pagesTitle IvErica Mae GuzmanNo ratings yet

- Unit 3 - ITC-1Document9 pagesUnit 3 - ITC-1Shivani YadavNo ratings yet

- TAX 301 VAT Subject TransactionsDocument9 pagesTAX 301 VAT Subject TransactionsMyrrielNo ratings yet

- TAX 301 VAT Subject Transaction 1Document9 pagesTAX 301 VAT Subject Transaction 1Jeen JeenNo ratings yet

- Imposition of Supplementary DutyDocument7 pagesImposition of Supplementary DutyHarippa23No ratings yet

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- Chapter 8Document7 pagesChapter 8yebegashetNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxMhaybelle JovellanoNo ratings yet

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Document17 pagesRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNo ratings yet

- © Skill Short Edulife Pvt. Ltd. (2020)Document3 pages© Skill Short Edulife Pvt. Ltd. (2020)Animesh Kumar TilakNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument10 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfaniamneonkingNo ratings yet

- Lecture 1 96Document1 pageLecture 1 96iamneonkingNo ratings yet

- Ratios (Short Interpretations)Document2 pagesRatios (Short Interpretations)iamneonkingNo ratings yet

- Lecture 3 98Document1 pageLecture 3 98iamneonkingNo ratings yet

- Lecture 2 97Document1 pageLecture 2 97iamneonkingNo ratings yet

- Chapter 4 Free Consent and Void AgreementsDocument20 pagesChapter 4 Free Consent and Void AgreementsiamneonkingNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationiamneonkingNo ratings yet

- Q-3 Spr-17 SOLUTIONDocument2 pagesQ-3 Spr-17 SOLUTIONiamneonkingNo ratings yet

- Test 2 - Suggested SolutionDocument2 pagesTest 2 - Suggested SolutioniamneonkingNo ratings yet

- Chapter 4 Free Consent and Void Agreements (Vol - 2)Document12 pagesChapter 4 Free Consent and Void Agreements (Vol - 2)iamneonkingNo ratings yet

- QPL Labor Practice (Q A)Document3 pagesQPL Labor Practice (Q A)iamneonkingNo ratings yet

- Labor (Solutions)Document7 pagesLabor (Solutions)iamneonkingNo ratings yet

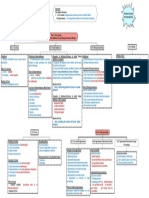

- Chapter 04 MindMapDocument1 pageChapter 04 MindMapiamneonkingNo ratings yet

- Q-6 Aut-12 SOLUTIONDocument1 pageQ-6 Aut-12 SOLUTIONiamneonkingNo ratings yet

- Q-1 Aut-17 SOLUTIONDocument3 pagesQ-1 Aut-17 SOLUTIONiamneonkingNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- Q-3 Aut-16 SOLUTION (Lec#39 HW)Document2 pagesQ-3 Aut-16 SOLUTION (Lec#39 HW)iamneonkingNo ratings yet

- Q-4 Aut-21 SOLUTIONDocument2 pagesQ-4 Aut-21 SOLUTIONiamneonkingNo ratings yet

- Q-3 Spr-10 SOLUTIONDocument3 pagesQ-3 Spr-10 SOLUTIONiamneonkingNo ratings yet

- Q-4 Aut-11 SOLUTIONDocument1 pageQ-4 Aut-11 SOLUTIONiamneonkingNo ratings yet

- Q-5 Spr-20 SOLUTIONDocument2 pagesQ-5 Spr-20 SOLUTIONiamneonkingNo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Test 4 (QP)Document2 pagesTest 4 (QP)iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 06Document3 pagesRise School of Accountancy: Suggested Solution Test 06iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 05Document1 pageRise School of Accountancy: Suggested Solution Test 05iamneonkingNo ratings yet

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 04Document2 pagesRise School of Accountancy: Suggested Solution Test 04iamneonkingNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Chapter 11 NISMDocument12 pagesChapter 11 NISMKiran VidhaniNo ratings yet

- SAP MM Process Flow DocumentDocument36 pagesSAP MM Process Flow Documentganepall100% (2)

- Us CB Future of Retail Metrics PDFDocument16 pagesUs CB Future of Retail Metrics PDFaashmeen25No ratings yet

- AIKBEA & KBOO Cir 9-2022Document4 pagesAIKBEA & KBOO Cir 9-2022Nihar RanjanNo ratings yet

- Project Report On-Marketing Strategies of VodafoneDocument109 pagesProject Report On-Marketing Strategies of Vodafoneridhsi61% (23)

- Liquidation Report: Lyn B. FerranculloDocument5 pagesLiquidation Report: Lyn B. FerranculloJanine FormentoNo ratings yet

- A FrAmework For Successful Hotel DevelopmentsDocument16 pagesA FrAmework For Successful Hotel DevelopmentsMurat KaraNo ratings yet

- Teaching PowerPoint Slides - Chapter 1Document24 pagesTeaching PowerPoint Slides - Chapter 1famin87No ratings yet

- Certified Human Resources Manager Sample MaterialDocument13 pagesCertified Human Resources Manager Sample MaterialAnamika VermaNo ratings yet

- CASE STUDY - Ventiv-WorldpayDocument3 pagesCASE STUDY - Ventiv-WorldpayNeelabhNo ratings yet

- Letter of Invitation - DraftDocument3 pagesLetter of Invitation - DraftAidel BelamideNo ratings yet

- RPA Simp TieDocument2 pagesRPA Simp TieArshiya BegumNo ratings yet

- Himanshu AroraDocument3 pagesHimanshu AroraKiran Kumar PNo ratings yet

- Chapter 3 Case Part 2Document3 pagesChapter 3 Case Part 2graceNo ratings yet

- NPCP Chapter 11 PDFDocument2 pagesNPCP Chapter 11 PDFCristian OmacNo ratings yet

- Contract Drafting BrochureDocument10 pagesContract Drafting BrochureUtkarshini SinhaNo ratings yet

- Russia Global Economic Implications of The Russia-Ukraine War - Economist Intelligence UnitDocument3 pagesRussia Global Economic Implications of The Russia-Ukraine War - Economist Intelligence UnitAsdfgh Jklbhu100% (1)

- Production Control Objectives: ITTS-QMS-PR13-F04Document2 pagesProduction Control Objectives: ITTS-QMS-PR13-F04zainahmedscribdNo ratings yet

- AssignmentDocument2 pagesAssignmentYahya TariqNo ratings yet

- School of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Document12 pagesSchool of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Pramod ShawNo ratings yet

- AB Gustaf Kähr: Has Been Found To Conform To PEFC StandardDocument2 pagesAB Gustaf Kähr: Has Been Found To Conform To PEFC StandardLeenaNo ratings yet

- GM StudentDocument16 pagesGM StudentShuvranil SahaNo ratings yet

- Problem Set 1Document5 pagesProblem Set 1LAWRENCE VIVEK TOPPO PGP 2019-21 BatchNo ratings yet

- Ent300 Assignment 3 Business Plan General Guidelines 2021Document18 pagesEnt300 Assignment 3 Business Plan General Guidelines 2021anisNo ratings yet

- Business and IndustyDocument3 pagesBusiness and IndustysantoshskpurNo ratings yet

- ATS Friendly Smart CV TemplateDocument2 pagesATS Friendly Smart CV TemplateAbdulfatai AbdulrasheedNo ratings yet

- 7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Document2 pages7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Ken MarcaidaNo ratings yet

- Position Paper - GrometesDocument15 pagesPosition Paper - Grometesmaycil ambagNo ratings yet

- Mother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Document14 pagesMother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Lunilyn Ortega100% (1)

- Contract of SaleDocument4 pagesContract of Salecorvinmihai591No ratings yet