Professional Documents

Culture Documents

Rise of Accountancy

Uploaded by

iamneonkingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rise of Accountancy

Uploaded by

iamneonkingCopyright:

Available Formats

Rise School of Accountancy

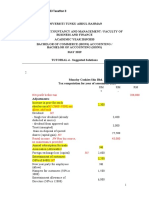

Suggested Solution Test 05

Question 01

Mr. Manto

Computation of income and tax thereon

For TY 2009

Income from salary (W-1) 1,882,030

Income from other source 100,000

Income from capital gain – Gain on sale of shares 25,000 x (62-42) 500,000

(holding period is less than one year)

Taxable income 2,482,030

Tax liability on income under NTR (90,000 + 682,030 x 15%) (2) 192,305

Less: Tax paid by employer [S.12(3)] (102,030)

Payable to Government 90,275

Items which are not considered

(N-1) Lease rentals are not considered when car is acquired on lease, rather fair market value is considered.

(N-2) Interest credited is exempt up to higher of interest calculated @ 16% or 1/3 of salary. Since the rate

atwhich interest has been credited is not given therefore it cannot be compared with 1/3rd of salary.

(N-3) As Mr. Manto is returning expatriate as per section 51(1), therefore Rs. 4,000,000 is exempt.

Workings

(W-1) Income from salary

Basic Salary [S.12(2)(a)] (100,000 x 12) 1,200,000

House rent allowance [S.12(2)(c)] (30,000 x 12) 360,000

Medical allowance (Fully taxable)[S.12(2)(c)] (10,000 x 12) 120,000

Medical facility (Fully exempt because as per terms) [2nd Sch. Clause 139] -

Conveyance provided [S.13(3)] (2,000,000x5%) 100,000

Concessional lunch facility (Exempt because Manto is employee of a hotel)[2nd Sch. Clause 53A(ii)] -

Training course (Not chargeable because for official purpose) [S.12(2)(d)] -

Employer contribution to provident fund (1,200,000 x 10%) 120,000

Less: Exempt up to lower of:

- 10% of basic salary and dearness all. (10% of 1,200,000 = 120,000) or

- 150,000 (120,000) -

Interest credited 48,000

Less: Exempt up to 1/3rd of (basic salary+dearness allowance) (1/3 x 1,200,000) (400,000) -

1,780,000

Add: Tax borne by employer [S.12(3)] (W-2) 102,030

1,882,030

(W-2) Tax borne by employer

Step 1

Salary income 1,780,000

Tax thereon (30,000 + 580,000 x 10%) 88,000

Step 2

Salary income (1,780,000 + 88,000) 1,868,000

Tax thereon (90,000 + 68,000 x 15%) 100,200

Step 3

Salary income (1,780,000 + 100,200) 1,880,200

Tax thereon (90,000 + 80,200 x 15%) 102,030

Page 1 of 1

You might also like

- Income Tax Numericals SolutionsDocument9 pagesIncome Tax Numericals SolutionsBrown BoiNo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Numerical Solution Question 1 To 10Document7 pagesNumerical Solution Question 1 To 10fmayo5402No ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2020Document8 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2020Shamail AsimNo ratings yet

- Tax Calculation and Assessment for Mr. Taqi AhmedDocument3 pagesTax Calculation and Assessment for Mr. Taqi AhmedBablooNo ratings yet

- CAF-6 Mock Solution by SkansDocument6 pagesCAF-6 Mock Solution by SkansMuhammad YahyaNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- CA Inter Taxation Mock Test - 02.08.2018 - Detailed SolutionfDocument14 pagesCA Inter Taxation Mock Test - 02.08.2018 - Detailed SolutionfKaustubhNo ratings yet

- INTER CA DIRECT TAX IMPORTANT POINTSDocument4 pagesINTER CA DIRECT TAX IMPORTANT POINTSDaniel TerstegenNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Solution - Mock Exam - 240120 - 142640Document6 pagesSolution - Mock Exam - 240120 - 142640lebiyacNo ratings yet

- Mittal Commerce Classes Ca Intermediate - Mock TestDocument12 pagesMittal Commerce Classes Ca Intermediate - Mock TestSachin SinghNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Taxation 302Document5 pagesTaxation 302MGCININo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Reviewer TAX - Google DocsDocument3 pagesReviewer TAX - Google DocsAnnabel MendozaNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Solution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheDocument23 pagesSolution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheLucyNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- 2018 Tax2A Test 2 Suggested Solution Question 3Document2 pages2018 Tax2A Test 2 Suggested Solution Question 3molemothekaNo ratings yet

- Financial Management-2Document10 pagesFinancial Management-2BHAKTINo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- R2 TAX ML Solution CMA June 2020 Exam.Document6 pagesR2 TAX ML Solution CMA June 2020 Exam.Pavel DhakaNo ratings yet

- ACC3004H Tax 2 April Test 2015 Suggested Solution Question 2Document3 pagesACC3004H Tax 2 April Test 2015 Suggested Solution Question 2Sibonelo MasukuNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- T2A 20542021 Employment IDocument6 pagesT2A 20542021 Employment IChan Chun HaoNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- Screenshot 2023-02-28 at 4.57.32 PMDocument2 pagesScreenshot 2023-02-28 at 4.57.32 PMTanushree MishraNo ratings yet

- Sol Man Chapter 12 Share Based Payments Part 1 2021 - CompressDocument12 pagesSol Man Chapter 12 Share Based Payments Part 1 2021 - CompressWynne RamosNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- Lamri CoDocument3 pagesLamri CoDavid Jung ThapaNo ratings yet

- ATX T1 Ans. to Q3 (CBAT)Document1 pageATX T1 Ans. to Q3 (CBAT)alvinmono.718No ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- GR10 Accounting Practice Exam Memorandum November Paper 1Document7 pagesGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5No ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Document4 pagesRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanNo ratings yet

- F6mys 2016 Jun A Hybrid PDFDocument9 pagesF6mys 2016 Jun A Hybrid PDFsahrasaqsdNo ratings yet

- Insurance Company AccountsDocument12 pagesInsurance Company AccountsSarfaraz ShaikhNo ratings yet

- Clubbing, Set-Off & Deduction U - C VI-A - SolutionDocument6 pagesClubbing, Set-Off & Deduction U - C VI-A - SolutionBharatbhusan RoutNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationiamneonkingNo ratings yet

- Lecture 3 98Document1 pageLecture 3 98iamneonkingNo ratings yet

- Lecture 2 97Document1 pageLecture 2 97iamneonkingNo ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument10 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfaniamneonkingNo ratings yet

- Ratios explainedDocument2 pagesRatios explainediamneonkingNo ratings yet

- Business Laws MCQ AnswersDocument2 pagesBusiness Laws MCQ AnswersiamneonkingNo ratings yet

- Chapter 4 Free Consent and Void AgreementsDocument20 pagesChapter 4 Free Consent and Void AgreementsiamneonkingNo ratings yet

- Lecture 1 96Document1 pageLecture 1 96iamneonkingNo ratings yet

- Chapter 4 Free Consent and Void Agreements (Vol - 2)Document12 pagesChapter 4 Free Consent and Void Agreements (Vol - 2)iamneonkingNo ratings yet

- Q-3 Aut-16 SOLUTION (Lec#39 HW)Document2 pagesQ-3 Aut-16 SOLUTION (Lec#39 HW)iamneonkingNo ratings yet

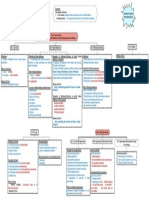

- Chapter 04 MindMapDocument1 pageChapter 04 MindMapiamneonkingNo ratings yet

- QPL Labor Practice (Q A)Document3 pagesQPL Labor Practice (Q A)iamneonkingNo ratings yet

- Labor (Solutions)Document7 pagesLabor (Solutions)iamneonkingNo ratings yet

- Q-3 Spr-17 SOLUTIONDocument2 pagesQ-3 Spr-17 SOLUTIONiamneonkingNo ratings yet

- Q-1 Aut-17 SOLUTIONDocument3 pagesQ-1 Aut-17 SOLUTIONiamneonkingNo ratings yet

- Q-6 Aut-12 SOLUTIONDocument1 pageQ-6 Aut-12 SOLUTIONiamneonkingNo ratings yet

- Q-3 Spr-10 SOLUTIONDocument3 pagesQ-3 Spr-10 SOLUTIONiamneonkingNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Q-5 Spr-20 SOLUTIONDocument2 pagesQ-5 Spr-20 SOLUTIONiamneonkingNo ratings yet

- Q-4 Aut-21 SOLUTIONDocument2 pagesQ-4 Aut-21 SOLUTIONiamneonkingNo ratings yet

- Q-4 Aut-11 SOLUTIONDocument1 pageQ-4 Aut-11 SOLUTIONiamneonkingNo ratings yet

- Depreciation calculation and gain on disposalDocument3 pagesDepreciation calculation and gain on disposaliamneonkingNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Test 4 (QP)Document2 pagesTest 4 (QP)iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 04Document2 pagesRise School of Accountancy: Suggested Solution Test 04iamneonkingNo ratings yet

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Subject Areas For Transactional Business Intelligence in HCMDocument428 pagesSubject Areas For Transactional Business Intelligence in HCMzafar.ccna1178No ratings yet

- Right to Work with Dignity and Effective Collective Bargaining in ZambiaDocument8 pagesRight to Work with Dignity and Effective Collective Bargaining in ZambiaEvangelist Kabaso SydneyNo ratings yet

- Compensation Management: An IntroductionDocument95 pagesCompensation Management: An Introductionharikaviswanatham100% (1)

- Salzer Switch Company Internship ProjectDocument66 pagesSalzer Switch Company Internship ProjectRenu Gopal100% (5)

- Document 13Document3 pagesDocument 13Naman AgrawalNo ratings yet

- Teacher ContractDocument2 pagesTeacher ContractKatrina ShaneNo ratings yet

- Pet Memorial Marketing ObjectivesDocument51 pagesPet Memorial Marketing ObjectivesChristian AribasNo ratings yet

- International Compensation System of Multinational CorporationDocument22 pagesInternational Compensation System of Multinational CorporationRaihan RakibNo ratings yet

- Discussion QuestionsDocument1 pageDiscussion Questionsamer_wahNo ratings yet

- CD - 1. Dreamland vs. JohnsonDocument1 pageCD - 1. Dreamland vs. JohnsonAnonymous 3y1PFJsEthNo ratings yet

- Provident FundDocument9 pagesProvident FundYogesh KandariNo ratings yet

- Wallstreetjournal 20230124 TheWallStreetJournalDocument30 pagesWallstreetjournal 20230124 TheWallStreetJournalMufaddal PittalwalaNo ratings yet

- Staff WelfareDocument93 pagesStaff WelfareSohail Niazi50% (2)

- Project Global Fast FoodsDocument5 pagesProject Global Fast FoodsandreeaNo ratings yet

- Majithia Wage Board Recommendations Notified 11.11Document60 pagesMajithia Wage Board Recommendations Notified 11.11naisalktpNo ratings yet

- Executive - Compensation Unit 5Document22 pagesExecutive - Compensation Unit 5Priya SonuNo ratings yet

- Managerial Accounting 16th Ed Textbook Solutions Manual Chapter 01Document92 pagesManagerial Accounting 16th Ed Textbook Solutions Manual Chapter 01Tiến AnhNo ratings yet

- Grade Matrix ProjectDocument10 pagesGrade Matrix ProjectRajesh InsbNo ratings yet

- ACI Employee Benefits Package AnalysisDocument35 pagesACI Employee Benefits Package AnalysisMonzurul Kadir ShakeelNo ratings yet

- Oracle E-Business Suite R12.x HRMS - A Functionality Guide - Sample ChapterDocument22 pagesOracle E-Business Suite R12.x HRMS - A Functionality Guide - Sample ChapterPackt PublishingNo ratings yet

- Avc-Ii-B (HRM) Week-1 Functions of Human Resource ManagementDocument12 pagesAvc-Ii-B (HRM) Week-1 Functions of Human Resource ManagementcecilNo ratings yet

- COST - Rulebook - 15-19 4.19.16Document112 pagesCOST - Rulebook - 15-19 4.19.16Jeremy Joseph EhlingerNo ratings yet

- Joy at Work by Dennis Bakke (Summary)Document15 pagesJoy at Work by Dennis Bakke (Summary)Pear Press100% (1)

- DO Annex 1 Voucher Application Form VAF 1Document4 pagesDO Annex 1 Voucher Application Form VAF 1Radian LacuestaNo ratings yet

- Faysal Bank Car Leasing ReportDocument21 pagesFaysal Bank Car Leasing ReportShehrozAyazNo ratings yet

- Organizational and HR Study OverviewDocument18 pagesOrganizational and HR Study OverviewMervidelleNo ratings yet

- Career Opportunities in EventsDocument5 pagesCareer Opportunities in EventsTruc TThanhNo ratings yet

- Five Experts Respond To Five Questions About Five Trends in Compensation and Bene Fits Over The Next 5 YearsDocument18 pagesFive Experts Respond To Five Questions About Five Trends in Compensation and Bene Fits Over The Next 5 YearsJULIO TORREJON CASTILLONo ratings yet

- Workday Compensation OverviewDocument11 pagesWorkday Compensation OverviewHaritha100% (1)

- Leave RuleDocument52 pagesLeave RulePriyanka PatelNo ratings yet