Professional Documents

Culture Documents

Ratios (Short Interpretations)

Uploaded by

iamneonking0 ratings0% found this document useful (0 votes)

8 views2 pagesThe document discusses various financial ratios and provides possible reasons for high or low ratios. It analyzes ratios such as return on capital employed (ROCE), return on equity (ROE), return on assets (ROA), asset turnover, gross profit ratio, net profit ratio, debtor days, creditor days, inventory days, working capital cycle, current ratio, quick ratio, gearing ratio, and interest cover. For each ratio, it outlines what the ratio measures and possible factors that could lead to a high or low measurement of that ratio.

Original Description:

Original Title

Ratios (Short interpretations)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses various financial ratios and provides possible reasons for high or low ratios. It analyzes ratios such as return on capital employed (ROCE), return on equity (ROE), return on assets (ROA), asset turnover, gross profit ratio, net profit ratio, debtor days, creditor days, inventory days, working capital cycle, current ratio, quick ratio, gearing ratio, and interest cover. For each ratio, it outlines what the ratio measures and possible factors that could lead to a high or low measurement of that ratio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesRatios (Short Interpretations)

Uploaded by

iamneonkingThe document discusses various financial ratios and provides possible reasons for high or low ratios. It analyzes ratios such as return on capital employed (ROCE), return on equity (ROE), return on assets (ROA), asset turnover, gross profit ratio, net profit ratio, debtor days, creditor days, inventory days, working capital cycle, current ratio, quick ratio, gearing ratio, and interest cover. For each ratio, it outlines what the ratio measures and possible factors that could lead to a high or low measurement of that ratio.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

CAF-01 (FAR-1) Ratios

Some possible reasons of variations in different ratios

Ratio High ratio Low ratio

name

ROCE This ratio tells us that • Higher profitability • Lower profitability

company is earning Rs. __ • Efficient funds management • Inefficient funds management

per Rs. 100 invested in

business / capital

employed.

ROE This ratio tells us that • Higher profitability • Lower profitability

company is earning Rs. __ • Efficient funds management • Inefficient funds management

per Rs. 100 invested in • Reduction in tax rates. • Increase in tax rates.

ordinary share capital / • Reduction in interest rates. • Increase in interest rates

by shareholders. • Decrease in equity which • Increase in equity which

might be due to buyback of might be due to issuance of

shares. new shares

• Decrease in equity which

may be due to Distribution

of profits as dividend.

ROA This ratio tells us that • Higher profitability • Lower profitability

company is earning Rs. __ • Efficient asset management • Inefficient asset management

per Rs. 100 invested in

total assets.

Asset This ratio tells us that • Efficient utilization of asset • Inefficient use of asset

turnover company is earning Rs. __ • High productivity of asset • Low productivity

of sale per Re. 1 invested

in business / capital

employed.

Gross This ratio tells us that • Increase in selling price • Deliberate decrease in selling

profit company is earning Rs. ___ • Reduction in Raw material price

ratio gross profit per Rs. 100 of purchase or production costs • Increase in Raw material prices

sales. • Economies of scale obtained • Higher production costs due to

• Undervaluation of opening inefficiencies

stock or overvaluation of • Inability to obtain economies of

closing stock scale

• Overvaluation of opening stock

or

undervaluation of closing stock

Net This ratio tells us that • Tight control over operating

company is earning Rs. ___ • Uncontrolled expenses

profit expenses

net profit per Rs. 100 of • Decrease in other income

ratio • Increase in other income

sales. • High finance cost

• Low finance cost

• Higher gross profit margin

• Higher gross profit margin

Debtor This ratio tells us that the • Inefficient collection • Efficient collection

days debtors of company are • Longer credit periods given • Shorter credit periods

converted into cash in ___ • Less discounts offered

days. • More discounts offered

Creditor This ratio tells us that the • Late payments to supplier • Timely payments to supplier

days creditors of company are • Less credit worthiness • Credit worthiness

paid in ___ days. • Less discounts availed • More discounts availed

Inventory This ratio tells us that the • Inefficient inventory

days inventory of company is management • Efficient inventory management

converted into sales in ___ • Lower sales • Higher sales

days.

Umair Sheraz Utra, ACA Page 1

CAF-01 (FAR-1) Ratios

Working This ratio tells us the length • Lower inventory turnover / • High inventory turnover / better

capital of time between company’s poor inventory management inventory management

cycle payment for purchases and • Higher credit days to debtors • Lower credit days to debtors /

receipt of cash from / poor control over debtors better control over debtors

debtors. • Failure to obtain extended • Extended credit limit obtained

credit limits / timely from creditors / late payments

payments to suppliers to suppliers

Current This ratio tells us that to • Larger inventories which

• Running finance facility

ratio pay Re. 1 current liability, may be indicative of slow

obtained to fund operations

company has Rs. ___ moving or obsolete stock

current assets available. • Long term loan payment might

• Increase in credit period of have become due in the next 12

debtors which may be months (current portion)

indicative of difficulty in

• Better inventory management

recovery and bad / doubtful

debts • Reduction in credit period of

debtors

• Less credit purchase /

reduction in credit period • Extended credit period allowed

allowed by the creditors by creditors

Quick This ratio tells us that to • Better liquidity position

ratio pay Re. 1 current liability, • Longer debtors credit period • Financial difficulty

company has Rs. ___ quick • Lower inventories

assets* available. • Shorter debtors credit period

*QA = CA – Invent. – Prep.

Gearing This ratio tells us the • Higher debts than equity

ratio dependence of company on • Further debt obtained during • Lower debts than equity /

external debt as compared the period difficulty in raising long term

to the equity of company. • Decrease in equity which loans from banks

might be due to buyback of • Debt repaid during the period

shares. • Increase in equity which might

• Decrease in equity which be due to issuance of new

may be due to Distribution shares

of profits as dividend.

Interest This ratio tells us that to • Higher profitability • Lower profitability

cover pay Re. 1 interest, company • Less use of debts • More use of debts

has Rs. ___ of interest • Ability to take further debts

available. • Less credit worthiness

Umair Sheraz Utra, ACA Page 2

You might also like

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- Far.1 Revision Class Notes 1Document2 pagesFar.1 Revision Class Notes 1Anila NawazNo ratings yet

- Sources of Business Finance (Hanith Forman)Document5 pagesSources of Business Finance (Hanith Forman)Hanith Adam FormanNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Introduction To Financial Management: Lecture 2b - Obtaining and Managing Working CapitalDocument45 pagesIntroduction To Financial Management: Lecture 2b - Obtaining and Managing Working CapitalAmbreen RabbaniNo ratings yet

- Internal - Financing Final MBA 22Document17 pagesInternal - Financing Final MBA 22suparshva99iimNo ratings yet

- Financial Statements and Ratio AnalysisDocument6 pagesFinancial Statements and Ratio AnalysisWilda Bedar BalisoroNo ratings yet

- Interpretation of Accounts.: Analysis of Financial Statements Ratio Analysis Cash Flow Statement FRS-1Document7 pagesInterpretation of Accounts.: Analysis of Financial Statements Ratio Analysis Cash Flow Statement FRS-1zulpukarovaNo ratings yet

- 3-Analysis of Financial StatementsDocument69 pages3-Analysis of Financial StatementsAlperen KaragozNo ratings yet

- sch1620 - The Capital Structure DecisionDocument145 pagessch1620 - The Capital Structure DecisionApril N. AlfonsoNo ratings yet

- Topic 2.0 Evaluation of Financial PerformanceDocument49 pagesTopic 2.0 Evaluation of Financial PerformanceNur ZahirahNo ratings yet

- Overtrading Overcapitalization-FinalDocument23 pagesOvertrading Overcapitalization-FinalShsvz SvzuvsvzNo ratings yet

- Sources of Finance: Different Ways A Business Can Obtain MoneyDocument19 pagesSources of Finance: Different Ways A Business Can Obtain MoneyJayaNo ratings yet

- Chapter 3 - Financial Ratio and AnalysisDocument28 pagesChapter 3 - Financial Ratio and AnalysisSarifah SaidsaripudinNo ratings yet

- Financial RatiosDocument46 pagesFinancial RatiosSheila Marie Ann Magcalas-GaluraNo ratings yet

- Accounting Ratios - Class NotesDocument8 pagesAccounting Ratios - Class NotesAbdullahSaqibNo ratings yet

- Unit Outcomes: Subject: Accounting Grade 12 Chapter: Companies Lesson: Analysis and Interpretation-RatiosDocument8 pagesUnit Outcomes: Subject: Accounting Grade 12 Chapter: Companies Lesson: Analysis and Interpretation-Ratios903712594No ratings yet

- Chapter 2 Principles of Working Capital ManagementDocument72 pagesChapter 2 Principles of Working Capital ManagementhabtamuNo ratings yet

- Sources of FinanceDocument37 pagesSources of FinanceIfaz Mohammed Islam 1921237030No ratings yet

- Business Math ReviewerDocument3 pagesBusiness Math ReviewerYngvild ArrNo ratings yet

- Session 9 DividendDocument15 pagesSession 9 DividendEmilyNo ratings yet

- Lec 10Document27 pagesLec 10Ritik KumarNo ratings yet

- 03 Gilbert Lumber CompanyDocument36 pages03 Gilbert Lumber CompanyEkta Derwal PGP 2022-24 BatchNo ratings yet

- Lecture Notes 2 PDFDocument16 pagesLecture Notes 2 PDFRaveesh HurhangeeNo ratings yet

- Project Financing Project Financing: Presented By:-Shasmita, SudhansuDocument17 pagesProject Financing Project Financing: Presented By:-Shasmita, SudhansuSabita ChhetryNo ratings yet

- S.Chapter 5. WCM and FAMDocument101 pagesS.Chapter 5. WCM and FAMPassionNo ratings yet

- Management of Short Term Assets and Liabilities by P.rai87@gmailDocument22 pagesManagement of Short Term Assets and Liabilities by P.rai87@gmailPRAVEEN RAI100% (4)

- Corporate Finance: Lecture Note Packet 2 Capital Structure, Dividend Policy & ValuationDocument246 pagesCorporate Finance: Lecture Note Packet 2 Capital Structure, Dividend Policy & ValuationKanchan VarshneyNo ratings yet

- Analysis and InterpretationDocument22 pagesAnalysis and InterpretationSteven RaintungNo ratings yet

- BA2088 - Lecture 3 Corporate Credit II - Corporate Credit Analysis Using Financial Statements & RatiosDocument52 pagesBA2088 - Lecture 3 Corporate Credit II - Corporate Credit Analysis Using Financial Statements & RatioskeuqNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisPhuoc TruongNo ratings yet

- Receivables ManagementDocument37 pagesReceivables Managementchanky_kool8782% (11)

- Working Capital Lecture 2a - Student VersionDocument32 pagesWorking Capital Lecture 2a - Student VersionAmbreen RabbaniNo ratings yet

- Week 02 - Ratios - SDocument6 pagesWeek 02 - Ratios - STeresa ManNo ratings yet

- Activity RatiosDocument9 pagesActivity RatiosBookbuzzNo ratings yet

- MF Working CapitalDocument81 pagesMF Working CapitalJansen Alonzo BordeyNo ratings yet

- Interpretation of Fin StatementsDocument22 pagesInterpretation of Fin StatementstinashekuzangaNo ratings yet

- Classification of Accounting RatiosDocument7 pagesClassification of Accounting RatioskipkuruisethNo ratings yet

- Receivables Management: "Any Fool Can Lend Money, But It TakesDocument37 pagesReceivables Management: "Any Fool Can Lend Money, But It Takesjai262418No ratings yet

- Working Capital ManagementDocument10 pagesWorking Capital ManagementHarshit GoyalNo ratings yet

- Main Accounting Standards - Tutor SummaryDocument3 pagesMain Accounting Standards - Tutor SummaryReem JavedNo ratings yet

- PDF Financial Analysis, Ratios and InterpretationDocument7 pagesPDF Financial Analysis, Ratios and InterpretationAaliyah AndreaNo ratings yet

- 29 Business FinanceDocument26 pages29 Business Financeayza.aftab24No ratings yet

- T5 - Financial Analysis TechniquesDocument33 pagesT5 - Financial Analysis TechniquesJhonatan Perez VillanuevaNo ratings yet

- Working CapitalDocument56 pagesWorking CapitalJuan CarlosNo ratings yet

- Analysis of Financial Statements Reading # 07 Financial Analysis Techniques (Supplement)Document44 pagesAnalysis of Financial Statements Reading # 07 Financial Analysis Techniques (Supplement)Yasir ShaikhNo ratings yet

- Cash Flows and Life Cycle of FirmDocument6 pagesCash Flows and Life Cycle of FirmSharath ChandraNo ratings yet

- Dividend Discount Model: by Harpreet Kaur Sehgal (Intern, AR Finance Room)Document14 pagesDividend Discount Model: by Harpreet Kaur Sehgal (Intern, AR Finance Room)Tapas SamNo ratings yet

- Pyq Flashcards Ratios&APDocument4 pagesPyq Flashcards Ratios&APkala1975No ratings yet

- Chapter # 4 Foundations of Ratio and Financial AnalysisDocument49 pagesChapter # 4 Foundations of Ratio and Financial AnalysisAnna MahmudNo ratings yet

- Receivables Management: Dr.K.P.Malathi ShiriDocument19 pagesReceivables Management: Dr.K.P.Malathi ShiriSruthy KrishnaNo ratings yet

- f3 Fin RatioDocument5 pagesf3 Fin RatioErza Scarlet ÜNo ratings yet

- Damodaran On Cap StructureDocument145 pagesDamodaran On Cap Structuregioro_miNo ratings yet

- FFM1-Ch 1. Working Capital ManagementDocument38 pagesFFM1-Ch 1. Working Capital ManagementQuỳnhNo ratings yet

- Working Capital ManagementDocument72 pagesWorking Capital ManagementKING KARTHIKNo ratings yet

- 2023 Analyzing Firm PerformanceDocument29 pages2023 Analyzing Firm PerformanceNguyễn Xuân HoaNo ratings yet

- Chapter - Business Finance Needs and SourcesDocument26 pagesChapter - Business Finance Needs and SourcesBlack arab GaladimaNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementMariell PenaroyoNo ratings yet

- Manajemen Produksi & Operasi: Konsep Finance Dalam Galangan KapalDocument53 pagesManajemen Produksi & Operasi: Konsep Finance Dalam Galangan KapalRizal RachmanNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationiamneonkingNo ratings yet

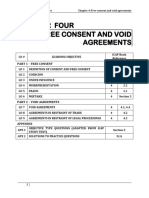

- Chapter 4 Free Consent and Void AgreementsDocument20 pagesChapter 4 Free Consent and Void AgreementsiamneonkingNo ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument10 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfaniamneonkingNo ratings yet

- Test 4 (QP)Document2 pagesTest 4 (QP)iamneonkingNo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- QPL Labor Practice (Q A)Document3 pagesQPL Labor Practice (Q A)iamneonkingNo ratings yet

- Test 2 - Suggested SolutionDocument2 pagesTest 2 - Suggested SolutioniamneonkingNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Labor (Solutions)Document7 pagesLabor (Solutions)iamneonkingNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Test-7 (Sol.)Document4 pagesTest-7 (Sol.)iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 05Document1 pageRise School of Accountancy: Suggested Solution Test 05iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 06Document3 pagesRise School of Accountancy: Suggested Solution Test 06iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 04Document2 pagesRise School of Accountancy: Suggested Solution Test 04iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Test 7 (QP)Document2 pagesTest 7 (QP)iamneonkingNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Sales Tax PDFDocument19 pagesSales Tax PDFiamneonkingNo ratings yet

- Test 8 (QP)Document5 pagesTest 8 (QP)iamneonkingNo ratings yet

- EEE-121 Electric Circuit Analysis I: Experimental Verification of Ohm's Law, Simulation Software (LTSPICE/circuit Maker)Document16 pagesEEE-121 Electric Circuit Analysis I: Experimental Verification of Ohm's Law, Simulation Software (LTSPICE/circuit Maker)iamneonkingNo ratings yet

- Principle of Taxation: Sales Tax Computation QuestionDocument12 pagesPrinciple of Taxation: Sales Tax Computation QuestioniamneonkingNo ratings yet

- CSC 141 Icp Lab ManualDocument87 pagesCSC 141 Icp Lab ManualiamneonkingNo ratings yet

- Sales Tax pdf-1Document42 pagesSales Tax pdf-1iamneonkingNo ratings yet

- IEF Test 4 - Solution Aut-2020Document5 pagesIEF Test 4 - Solution Aut-2020iamneonkingNo ratings yet

- Sales Tax PDFDocument15 pagesSales Tax PDFiamneonkingNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsWindie SisodNo ratings yet

- Balancesheet - Maruti Suzuki India LTDDocument2 pagesBalancesheet - Maruti Suzuki India LTDAnonymous ty7mAZNo ratings yet

- Bkash Limited 2015 (Signed Financials)Document40 pagesBkash Limited 2015 (Signed Financials)Onamika AktherNo ratings yet

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusNo ratings yet

- Alternative Investments - PPT 1Document53 pagesAlternative Investments - PPT 1Mahesh VommiNo ratings yet

- Corporate Gov en StartUps PymesDocument6 pagesCorporate Gov en StartUps Pymesmahmoud lasheenNo ratings yet

- Day Trading StrategiesDocument3 pagesDay Trading Strategiesjango2018No ratings yet

- Mutual FundsDocument18 pagesMutual FundsAyushi Singh. 214 - BNo ratings yet

- A Comparative Analysis of Public and Private Sector MutualDocument17 pagesA Comparative Analysis of Public and Private Sector Mutualprincess100% (1)

- VCVDocument5 pagesVCVMustafi MorganNo ratings yet

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelShiv Deep Sharma 20mmb087No ratings yet

- Bartrop FullDocument635 pagesBartrop FullDavid Esteban Meneses RendicNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalRefat DedarNo ratings yet

- SE Penalities - Jan 22, 2020Document12 pagesSE Penalities - Jan 22, 2020G V KrishnakanthNo ratings yet

- Activity 2 Accounting Standards-Setting Body-AnskDocument2 pagesActivity 2 Accounting Standards-Setting Body-AnskGennesse Marshelle Villacorte GalvezNo ratings yet

- Case Study in Deep WaterDocument13 pagesCase Study in Deep WaterReza Margana50% (2)

- Walt Disney Company CaseDocument12 pagesWalt Disney Company Caserobertatoscano7450% (2)

- CAPE AccountingDocument35 pagesCAPE Accountingget thosebooksNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- M9A TextDocument126 pagesM9A TextMalvin TanNo ratings yet

- Group Assignment 1Document2 pagesGroup Assignment 1Adis TsegayNo ratings yet

- Retail Service Station OpportunitiesDocument10 pagesRetail Service Station Opportunitiesvelaphi_nhlapo2936No ratings yet

- AlShaheer Quarterly Report 2016Document35 pagesAlShaheer Quarterly Report 2016faiqsattar1637No ratings yet

- Brigham Chapter 21 Solution ManualDocument12 pagesBrigham Chapter 21 Solution Manualprimadonna03100% (3)

- Financial AnalysisDocument12 pagesFinancial AnalysisTrisha Lane AtienzaNo ratings yet

- Chap 12 - Cost of Capital - EditedDocument17 pagesChap 12 - Cost of Capital - EditedRusselle Therese Daitol100% (1)

- Chapter 9Document76 pagesChapter 9Mohammed S. ZughoulNo ratings yet

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilNo ratings yet

- DSSM - Business Maths & Finance Day 1Document49 pagesDSSM - Business Maths & Finance Day 1Nadeera WijebandaraNo ratings yet

- MGT402 Assignment NO1Document3 pagesMGT402 Assignment NO1Muhammad AsifNo ratings yet