Professional Documents

Culture Documents

Test-7 (Sol.)

Uploaded by

iamneonking0 ratings0% found this document useful (0 votes)

12 views4 pagesOriginal Title

18. Test-7 (Sol.)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views4 pagesTest-7 (Sol.)

Uploaded by

iamneonkingCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Rise School of Accountancy

Suggested Solution - Test -7

Question 01

“Depreciable asset” means any tangible movable property, immovable property (other than

unimproved land), or structural improvement on immovable property, owned by a person that –

(a) has a normal useful life exceeding 1 year;

(b) is likely to lose value as a result of normal wear and tear, or obsolescence; and

(c) is used wholly or partly in deriving income from business,

but shall not include any property for which full cost of asset is allowed as deduction in the year of purchase; and

“structural improvement” in relation to immovable property, includes any building, road, driveway, car park,

railway line, bridge, tunnel, airport runway, canal, fence, water or sewerage pipes, drainage, landscaping or

dam.

In case a depreciable asset is jointly owned by a taxpayer and an Islamic financial institution licensed by the SBP

or SECP due to an arrangement of Musharika financing (or diminishing Musharika financing), the asset is

considered as wholly owned by the taxpayer.

Rise School of Accountancy

Suggested Solution - Test -7

Question 02

Mr. Wheels

Taxable Income and Tax Thereon

Tax year 2007

Income from business Rs.

Accounting profit 20,000,000

Add: Accounting depreciation 6,000,000

Donation to a relief fund [S.61(1)(b)] (Note 3) 700,000

Additions to plant wrongly included in expenses [S.21(n)] 300,000

Plant installation wrongly included in expenses [S.21(n)] 500,000

Unpaid liability [S.34(5)] (Note 4) 400,000

Unpaid liability – repair *S.34(5)+ 1,000,000

Tax profit on the sale of the building [S.22(13)(d)] (Note 5) 3,000,000

11,900,000

Less: Accounting profit on the sale of the building 6,095,000

Recovery of a debt previously written off (Note 6) 175,000

Tax Depreciation and initial allowance (Note 7) 3,629,250

(9,899,250)

Taxable income 22,000,750

Items not included in the computation of taxable income

Note 1

Principal amount of loan of Rs.2,600,000(3,000,000-400,000) will have no impact because only those

unpaid liabilities are added to income which were previously

allowed as deduction. [S.34(5)]

Note 2

An advance received by a person from another person which is not paid by a crossed

cheque or through a banking channel from a person holding a national tax number, is

treated as the income chargeable under the head ‘Income from other sources’ *s.39(3)+.

However, the provisions of s.39(3) does not apply to an advance payment for the sale of goods or

supply of services [s.39(4)].

No adjustment is, therefore, required in the computation of income for the

Rs. 4,000,000 received in cash from Carsales Associates as an advance payment for the

sale of cars.

Note 3

Rs. 700,000 paid as a donation is not deductible but Mr. Wheels is entitled to a tax

credit calculated under a prescribed formula [s.61(1)(b)].

Note 4

The unpaid amount of Rs. 400,000 for profit on debt (included in sundry creditors) was

allowed as a deduction in the tax year 2003 (accounting year ended 30 June 2003).

As the amount has remained unpaid for 3 years from the end of the tax year in which

the deduction was allowed, the Rs. 400,000 is chargeable to tax in the tax year 2007

(i.e. the first tax year following the end of the said three years).[S.34(5)]

Note 5

Where the consideration received on the disposal of immovable property exceeds its cost, the

consideration received is to be treated as the cost.

The tax profit on the disposal of the building is worked out as under

Rs.

Sale consideration 15,000,000

Less: Tax written down value

Deemed cost 15,000,000

Depreciation allowed (10,000,000 – 7,000,000) (3,000,000) (12,000,000)

Tax profit on disposal 3,000,000

Note 6

As the debt of Rs. 175,000 written off in the tax year 2006, was not allowed as deduction,

the receipt of the Rs. 175,000 is not income chargeable to tax. [S. 70]

Note 7

Depreciation

Plant and Buildings Motor Furniture Total

Machinery

Rate of depreciation 15% 10% 15% 15%

Written down value 2,700,000 13,800,000 2,500,000 1,570,000

Disposal - (7,000,000) - -

2,700,000 6,800,000 2,500,000 1,570,000

Depreciation 405,000 680,000 375,000 235,500 1,695,500

Additions 4,300,000 - 2,500,000 -

Initial allowance (1,075,000) - - - 1,075,000

Written down value 3,225,000 - 2,500,000 -

Depreciation 483,750 - 375,000 - 858,750

3,629,250

The cost of vehicle is restricted to Rs. 2,500,000.

It is sum of Rs. 300,000 minor additions and Rs. 4,000,000 (3,500,000 + 500,000)

Rise School of Accountancy

Suggested Solution - Test -7

Question 03

a) The cost of new purchased machine shall be the sum of following amounts:

(a) The total amount given for asset, including FMV of consideration in kind determined at the time the

asset is acquired.

(b) Any incidental expenditure paid in acquiring and disposing of asset.

(c) Expenditure paid to alter or improve the asset. For example, the cooling equipment purchased here.

b)

As per S.76 (3) if a personal asset is put to business use, its cost will be the fair market

value on the date it is put to business use and as per S.76 (2) (c), the cost shall include

expenditure paid to alter or improve the asset. Therefore, the cost of personal computer shall be

sum of FMV on 1st July, 2015 and cost of up gradation.

c)

As per S.76 (4) the cost of self-constructed furnace shall be the total cost incurred in

producing or constructing the asset plus any incidental expenditure paid to alter or

improve the asset.

You might also like

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (1)

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Document5 pagesDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- 67721bos54327 Fnew P7aDocument11 pages67721bos54327 Fnew P7aPriyanshu TomarNo ratings yet

- Suggested Anser CAP II ITVATDocument14 pagesSuggested Anser CAP II ITVATNirmal ShresthaNo ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- F6PKN 2015 Jun A PDFDocument10 pagesF6PKN 2015 Jun A PDFabby bendarasNo ratings yet

- MTP 3 20 Answers 1681284184Document13 pagesMTP 3 20 Answers 1681284184Sunil YadavNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasNo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Direct Tax or Indirect TaxDocument14 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- (' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaDocument12 pages(' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- QuizDocument4 pagesQuizRinconada Benori ReynalynNo ratings yet

- Income Tax June 2023-Dec 2020Document116 pagesIncome Tax June 2023-Dec 2020binuNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- 6167f0c20cf2c12cd8917628 OriginalDocument34 pages6167f0c20cf2c12cd8917628 OriginalTM GamingNo ratings yet

- F6PKN 2014 Jun ADocument14 pagesF6PKN 2014 Jun ARihamNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Fund Flow Statement ExplainedDocument21 pagesFund Flow Statement ExplainedPGNo ratings yet

- Ilovepdf MergedDocument84 pagesIlovepdf MergedVinay DugarNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- 11 A) Discuss About The Objectives of Management Accounting. (OR) B) Explain The Nature and Scope of Management AccountingDocument4 pages11 A) Discuss About The Objectives of Management Accounting. (OR) B) Explain The Nature and Scope of Management AccountingSwathi SwathiNo ratings yet

- Taxation Mid 2 Solution NUBDocument4 pagesTaxation Mid 2 Solution NUBNiizamUddinBhuiyanNo ratings yet

- INclass 2&3-2013a-1Document4 pagesINclass 2&3-2013a-1Ferdnance ChekaiNo ratings yet

- Tax implications of share listing for investment holding companyDocument15 pagesTax implications of share listing for investment holding companyFakhrul Azman NawiNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Super 30 Questions for CA Inter MAY - 24 ExamsDocument63 pagesSuper 30 Questions for CA Inter MAY - 24 Examsmmukund1632No ratings yet

- DT MT AnsDocument13 pagesDT MT AnsRaghavanNo ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- SS Project January 2023Document2 pagesSS Project January 2023NUR AFFIDAH LEENo ratings yet

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Document4 pagesRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanNo ratings yet

- Tax Planning for New BusinessDocument11 pagesTax Planning for New BusinessmandyNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Detailed SolutionfDocument14 pagesCA Inter Taxation Mock Test - 02.08.2018 - Detailed SolutionfKaustubhNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Winter Exam Questions on Accounting and Performance MeasurementDocument29 pagesWinter Exam Questions on Accounting and Performance Measurementfareha riazNo ratings yet

- Alpa Bravo 123Document16 pagesAlpa Bravo 123adnan khanNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- 13. INCOMPLETE RECORDSDocument32 pages13. INCOMPLETE RECORDSSunil KumarNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- 69769bos280322 P7aDocument14 pages69769bos280322 P7aharitaNo ratings yet

- Accounting for Managers: Cash Budget and Financial StatementsDocument4 pagesAccounting for Managers: Cash Budget and Financial StatementsyogeshgharpureNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Depreciation calculation and gain on disposalDocument3 pagesDepreciation calculation and gain on disposaliamneonkingNo ratings yet

- ACCT500 (16) Answers To Seminar 6Document5 pagesACCT500 (16) Answers To Seminar 6rashid rahmanzada100% (1)

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- Compiler Additional Questions For Nov 22 ExamsDocument18 pagesCompiler Additional Questions For Nov 22 ExamsRobertNo ratings yet

- Chapter 4 Free Consent and Void AgreementsDocument20 pagesChapter 4 Free Consent and Void AgreementsiamneonkingNo ratings yet

- Lecture 2 97Document1 pageLecture 2 97iamneonkingNo ratings yet

- Lecture 3 98Document1 pageLecture 3 98iamneonkingNo ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument10 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfaniamneonkingNo ratings yet

- Lecture 1 96Document1 pageLecture 1 96iamneonkingNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationiamneonkingNo ratings yet

- QPL Labor Practice (Q A)Document3 pagesQPL Labor Practice (Q A)iamneonkingNo ratings yet

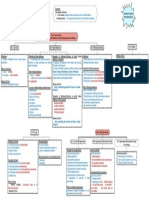

- Chapter 04 MindMapDocument1 pageChapter 04 MindMapiamneonkingNo ratings yet

- Ratios explainedDocument2 pagesRatios explainediamneonkingNo ratings yet

- Business Laws MCQ AnswersDocument2 pagesBusiness Laws MCQ AnswersiamneonkingNo ratings yet

- Q-3 Spr-17 SOLUTIONDocument2 pagesQ-3 Spr-17 SOLUTIONiamneonkingNo ratings yet

- Chapter 4 Free Consent and Void Agreements (Vol - 2)Document12 pagesChapter 4 Free Consent and Void Agreements (Vol - 2)iamneonkingNo ratings yet

- Q-3 Spr-10 SOLUTIONDocument3 pagesQ-3 Spr-10 SOLUTIONiamneonkingNo ratings yet

- Labor (Solutions)Document7 pagesLabor (Solutions)iamneonkingNo ratings yet

- Q-1 Aut-17 SOLUTIONDocument3 pagesQ-1 Aut-17 SOLUTIONiamneonkingNo ratings yet

- Q-5 Spr-20 SOLUTIONDocument2 pagesQ-5 Spr-20 SOLUTIONiamneonkingNo ratings yet

- Depreciation calculation and gain on disposalDocument3 pagesDepreciation calculation and gain on disposaliamneonkingNo ratings yet

- Q-6 Aut-12 SOLUTIONDocument1 pageQ-6 Aut-12 SOLUTIONiamneonkingNo ratings yet

- Q-4 Aut-11 SOLUTIONDocument1 pageQ-4 Aut-11 SOLUTIONiamneonkingNo ratings yet

- Q-4 Aut-21 SOLUTIONDocument2 pagesQ-4 Aut-21 SOLUTIONiamneonkingNo ratings yet

- Q-3 Aut-16 SOLUTION (Lec#39 HW)Document2 pagesQ-3 Aut-16 SOLUTION (Lec#39 HW)iamneonkingNo ratings yet

- Rise of AccountancyDocument1 pageRise of AccountancyiamneonkingNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- Test 4 (QP)Document2 pagesTest 4 (QP)iamneonkingNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 04Document2 pagesRise School of Accountancy: Suggested Solution Test 04iamneonkingNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- Suggested Solution Assessment Test 01: Rise School of AccountancyDocument3 pagesSuggested Solution Assessment Test 01: Rise School of AccountancyiamneonkingNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- For Sir Red - 20 MCQs - TAXATIONDocument5 pagesFor Sir Red - 20 MCQs - TAXATIONRed Christian PalustreNo ratings yet

- BIR Ruling 293-2015 - Productivity Incentive (De Minimis)Document5 pagesBIR Ruling 293-2015 - Productivity Incentive (De Minimis)Jerwin DaveNo ratings yet

- CIR Vs Filinvest DigestDocument3 pagesCIR Vs Filinvest DigestSharon BakerNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Assignment 2 Midterm MacatangayC3SDocument3 pagesAssignment 2 Midterm MacatangayC3Schad macatangayNo ratings yet

- Tax Knowledge Impacts Tax ComplianceDocument6 pagesTax Knowledge Impacts Tax ComplianceMajane TognoNo ratings yet

- GST Tax Invoice FormatDocument1 pageGST Tax Invoice FormatsuchjazzNo ratings yet

- ACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021Document3 pagesACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021TashaNo ratings yet

- Employee Pay SlipDocument1 pageEmployee Pay Slippriyankapriyanka90856No ratings yet

- 23101800173405ICIC ChallanStatementDocument2 pages23101800173405ICIC ChallanStatementshikhar guptaNo ratings yet

- Spencer Ogden Key Information Document: Compliances & Contractor ServicesDocument1 pageSpencer Ogden Key Information Document: Compliances & Contractor Servicescristiano soaresNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- Engineering Economy Exam SolutionsDocument6 pagesEngineering Economy Exam SolutionsValadez28No ratings yet

- Expansionary & Contractionary Fiscal PolicyDocument4 pagesExpansionary & Contractionary Fiscal PolicyShwetabh SrivastavaNo ratings yet

- Entries On Construction in ProgressDocument8 pagesEntries On Construction in ProgressRomyleen WennaNo ratings yet

- CPD 02Document35 pagesCPD 02ARCHANA KUMARI100% (1)

- TdsDocument4 pagesTdsshanikaNo ratings yet

- Rationale For Introduction of GSTDocument7 pagesRationale For Introduction of GSTAnirban DasNo ratings yet

- Request Letter For Compromise - KbindustrialDocument1 pageRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorNo ratings yet

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Document1 pageSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck AtienzaNo ratings yet

- Concepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1Document73 pagesConcepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1hiedi100% (34)

- 2550m April 2019 - LGSLDocument3 pages2550m April 2019 - LGSLexergyNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Proforma Invoice: Tera Software LimitedDocument1 pageProforma Invoice: Tera Software LimitedSigitek Software ServicesNo ratings yet

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

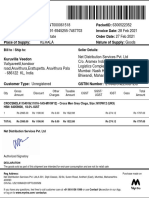

- Bill To / Ship To: Seller DetailsDocument1 pageBill To / Ship To: Seller DetailsErick MathewNo ratings yet

- 1936 (CTH) Does Not Define The Term Resides', Therefore Its Ordinary Meaning FromDocument8 pages1936 (CTH) Does Not Define The Term Resides', Therefore Its Ordinary Meaning FromDessiree ChenNo ratings yet

- Taxation and Income TaxationDocument71 pagesTaxation and Income TaxationPortly RespirationNo ratings yet