Professional Documents

Culture Documents

Taxi Aggregator Market

Uploaded by

vishesh jainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxi Aggregator Market

Uploaded by

vishesh jainCopyright:

Available Formats

--------- Taxi

Taxi Aggregator

Aggregator Market

Market ---------

The cab rental services has witnessed phenomenal growth over the past 6-7 years and

has become one of the important business in India. They are usually referred to as Taxi

Aggregators, Cab Aggregators or Radio Taxi. Taxi aggregators are not the

owners of the cabs which provide service to you, but they simply organise different cab

operators to provide service under their name using the technology like GPS / GPRS

(Global Positioning System / General Packet Radio Service). The Indian radio taxi

market alone is pegged anywhere between $6-$9 billion by different

estimates, and is forecasted to grow at 17-20% annually.

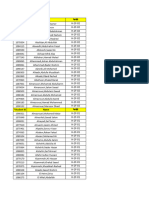

Taxi Market (*As of 2016)

Taxi Market ($12 billion)*

Organised Market Unorganised Market

($1.2 billion)* ($10.8 billion)

Owners Affiliates Aggregators

• Easy Cabs • Savaari • Meru Cabs

Individual Owners Small Operators Taxi Stands Prepaid Taxi

• Mega Cabs •

• Taxi Guide OLA

• TAB Cabs • Uber

• Cab 24 × 7 • Book My Cab

• taxipixi • Taxi for Sure

Market Size

India Radio Taxi Services Market Size, By Volume (Thousand Units) 2011-2015

400

300

288.8

200

170.0

100

90.0

64.0

28.5

0

2011 2012 2013 2014 2015

Source: TechSci Research

Major Players in the Taxi Market

The key players in the Indian market are as follows:

Overview of the top Indian Taxi Aggregators

Mega Cabs CARZONRENT Meru Ola Uber

(Easy Cabs)

Founder Founder Founder Founder Founder

Kunal Lalani Rajiv K. Vij Neeraj Gupta Bhavish Aggarwal, Travis Kalanick and

Ankit Bhati Garrett Camp

Launch Year Launch Year Launch Year Launch Year Launch Year

2001 2000 2007 2010 2009, Entered India in

2013

Current Fleet Size Current Fleet Size Current Fleet Size Current Fleet Size Current Fleet Size

2500 6500 20000+ 700000 -

Headquartered Headquartered Headquartered Headquartered Headquartered

Delhi New Delhi Mumbai Bangalore US, San Francisco

Provides services in Provides services in Provides services in Provides services in Provides services in

Delhi, Kolkata, Delhi, Mumbai, Mumbai, Delhi, Bangalore, Delhi NCR, Bangalore, Delhi,

Bengaluru, Chandigarh, Bengaluru & Hyderabad Hyderabad, Jaipur & Mumbai, Pune, Mumbai, Kolkata,

Pune and Amritsar Ahmedabad, Chennai, Bengaluru Chennai & Goa Hyderabad, Chennai,

Gurgaon, Jaipur, Pune, Jaipur,

Kolkata, Noida, Pune, Chandigarh,

Ghaziabad & Faridabad Ahmedabad, Kochi,

Ajmer, Udaipur,

Jodhpur, Surat,

Vadodara,

Bhubaneshwar,

Guwahati, Coimbatore,

Indore, Mysore, Nagpur,

Vishakhapatnam, Nashik,

Thiruvananthapuram,

Mangalore, Bhopal,

Ludhiana, Lucknow

No of cities No of cities No of cities No of cities No of cities

7 4 24 110 29

Taxi booking through Taxi booking through Taxi booking through Taxi booking through Taxi booking through

App, Website & Phone Website, Phone App, Website, Facebook, App, Website, Phone, App, Website, Phone,

Google Maps & Phone Google Map Google Map

Market Share of Top Cab Aggregators

As of July As of June

2015 2017

Market Market

Composition Composition

80% 4% 4% 12% 4.50% 4% 44.20% 1.30%

Ola + TFS Others Uber Meru ixigo Cabs Uber Ola Meru

Business Flow for Online Cab Booking

Customer Downloads app

Selects pick up

& drop location

Selects Cab type

Driver accepts Customer confirms

the trip booking

Chooses

payment method

Details are sent Cab details are

Start ride

to driver sent to customer

End ride

Commission to

admin

Payment

SWOT Analysis

Strength Weakness

• Well trained drivers • Lack of suitable and educated

• Clean and air-conditioned cabs drivers

• Ageing cabs

• Ease of booking

• High cab maintenance costs

• GPRS and GPS enabled vehicles

• Reasonable fares

• Easy availability and reliability

SWOT

Threats Opportunities

• Varying government regulations • Growing urban population

• Ceiling on the number of permits • Increase in disposable incomes

• Rising competition • Increased influx of tourists

• Price wars • Increasing internet penetration &

smart phone users

Acquisition Deals

OlaCabs Bought TaxiForSure for about $200 Million

2015

Wings Travels Acquires Bookmycab for an Undisclosed Amount

2016

Decimal View

The radio taxi market is growing at very rapid pace and has a huge headroom for growth. Given the rising demand for taxi services across the country, the

market is forecast to grow at a CAGR of over 17.0% during 2016-2021. Further, revenues of the radio taxi services market are projected to grow at a CAGR of

over 25% during the period of 2014-2019. Also, there has been huge investor activity in the segment, which has helped the service providers to upgrade their

technology as well as their footprint across the country.

5A, B- Wing, Trade Star Building, J B Nagar, Andheri - Kurla Road, Andheri East, Mumbai - 400059, Maharashtra, India.

Ph: +91 22300 15200 | Email: indo@decimalpointanalytics.com | Web: www.decimalpointanalytics.com

You might also like

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- RadioTaxi Market PDFDocument26 pagesRadioTaxi Market PDFMohammad MHNo ratings yet

- Tab CAB v3 0Document34 pagesTab CAB v3 0nikhil bajajNo ratings yet

- Tab CAB v3 0Document34 pagesTab CAB v3 0vimalNo ratings yet

- Financial Analysis of Tata MotorsDocument45 pagesFinancial Analysis of Tata MotorsSourish DuttaNo ratings yet

- Tata Motors - A Peek Into Its Globalization Process, Journey and Challenges Faced This Brief Report Will Cover The FollowingDocument9 pagesTata Motors - A Peek Into Its Globalization Process, Journey and Challenges Faced This Brief Report Will Cover The FollowingKumar VibhavNo ratings yet

- Bharti 2airtel 1227851581611151 8Document49 pagesBharti 2airtel 1227851581611151 8mayankvohraNo ratings yet

- Urbantransportationmarketinindia 110910043746 Phpapp02Document39 pagesUrbantransportationmarketinindia 110910043746 Phpapp02Masri Ahmad ArippinNo ratings yet

- OLA Service IndustryDocument10 pagesOLA Service IndustryKashish SehgalNo ratings yet

- Tata MotorsDocument31 pagesTata MotorsRishabhJaysawalNo ratings yet

- Accenture Strategy Driving Digitization Auto Industry 1Document7 pagesAccenture Strategy Driving Digitization Auto Industry 1Emre ÇağlarNo ratings yet

- OlaDocument5 pagesOlaNabeel HazariNo ratings yet

- Auto Parts PDFDocument36 pagesAuto Parts PDFNitin ShenoyNo ratings yet

- Annual Report of Airtel: - A.VinaykumarDocument49 pagesAnnual Report of Airtel: - A.VinaykumarVinay KumarNo ratings yet

- Comprehensive Mobility Plan ChennaiDocument17 pagesComprehensive Mobility Plan Chennaiakash0% (1)

- Elegant PPMDocument12 pagesElegant PPMAnkit SinghNo ratings yet

- Automobile AnalysisDocument6 pagesAutomobile AnalysisGouthamAmudhalaNo ratings yet

- Automobile IndustryDocument12 pagesAutomobile Industrykhushi13sepNo ratings yet

- Choice IntroductionDocument22 pagesChoice IntroductionMonu SinghNo ratings yet

- An Industry Analysis of The Taxi AggregaDocument28 pagesAn Industry Analysis of The Taxi AggregaPurva TayadeNo ratings yet

- Automobile IndustryDocument12 pagesAutomobile Industrykhushi13sepNo ratings yet

- The Indian Automotive Industry A PerspectiveDocument52 pagesThe Indian Automotive Industry A PerspectiveRees JohnsonNo ratings yet

- Bharti 2airtel 1227851581611151 8Document49 pagesBharti 2airtel 1227851581611151 8Ramendra SinghNo ratings yet

- MEP Company Profile January 2021 UIDocument33 pagesMEP Company Profile January 2021 UIGuzila HuNo ratings yet

- Boletin Sector en Cifras 46 Resumen en InglesDocument15 pagesBoletin Sector en Cifras 46 Resumen en InglesCësaricardo Muñoz EspínNo ratings yet

- Asset 1Document1 pageAsset 1rohit sharmaNo ratings yet

- Tata Nano Harvard Case AnalysisDocument16 pagesTata Nano Harvard Case AnalysiskopiNo ratings yet

- Comparative Analysis of Radio Taxi SectorDocument26 pagesComparative Analysis of Radio Taxi SectorsajalNo ratings yet

- Market Analysis: Type SizeDocument3 pagesMarket Analysis: Type SizeanujdeshmukhNo ratings yet

- AIRTELDocument49 pagesAIRTELSaroj MuduliNo ratings yet

- Ola ProjectDocument32 pagesOla Projectgirish pilse61% (28)

- Tata Motors Group 4 v1Document9 pagesTata Motors Group 4 v1Kumar VibhavNo ratings yet

- Applied Theory in Strategy and Competition: Group B6Document17 pagesApplied Theory in Strategy and Competition: Group B6sumitNo ratings yet

- Leading The Future: Sep. - Oct., 2003Document40 pagesLeading The Future: Sep. - Oct., 2003trustno_11No ratings yet

- SOS Auto - Natia ShubitidzeDocument13 pagesSOS Auto - Natia ShubitidzeNatia ShubitidzeNo ratings yet

- Presentation On Landscape of Automobile Industry in India: Consulting ClubDocument8 pagesPresentation On Landscape of Automobile Industry in India: Consulting Clubankit7714No ratings yet

- Presentation On Landscape of Automobile Industry in India: Consulting ClubDocument8 pagesPresentation On Landscape of Automobile Industry in India: Consulting ClubBiswaroop ChoudhuryNo ratings yet

- Presentation On Landscape of Automobile Industry in India: Consulting ClubDocument8 pagesPresentation On Landscape of Automobile Industry in India: Consulting ClubAnonymous rkZNo8No ratings yet

- Presentation On Landscape of Automobile Industry in India: Consulting ClubDocument8 pagesPresentation On Landscape of Automobile Industry in India: Consulting Club123456karthikNo ratings yet

- Tataacesolution 160408184239 PDFDocument8 pagesTataacesolution 160408184239 PDFHimanshu SethNo ratings yet

- STP of Tata MotorsDocument3 pagesSTP of Tata Motorslekha pmNo ratings yet

- End Term - MGV - Team FlipkartDocument23 pagesEnd Term - MGV - Team Flipkartmillenium sankhlaNo ratings yet

- AI Business Update 30 MarchDocument26 pagesAI Business Update 30 MarchJonathan CruiseNo ratings yet

- OlaDocument13 pagesOlaRavi PareekNo ratings yet

- Tata NANO - The LakhTakiya'Document12 pagesTata NANO - The LakhTakiya'Amit KapoorNo ratings yet

- 1.conceptual Understanding of StrategyDocument13 pages1.conceptual Understanding of StrategyNatani Sai KrishnaNo ratings yet

- Communication Skills: Presentation On: Industry Report (Automobiles)Document14 pagesCommunication Skills: Presentation On: Industry Report (Automobiles)Satyam TiwariNo ratings yet

- 3 Retail Scenario in IndiaDocument75 pages3 Retail Scenario in IndiaHimanshu MaanNo ratings yet

- Industan Otors: Truggle OR UrvivalDocument32 pagesIndustan Otors: Truggle OR UrvivalpcmanjulaNo ratings yet

- Tracxn Feed Report FinTech India 29 Jul 2021 FINDocument98 pagesTracxn Feed Report FinTech India 29 Jul 2021 FINastropragya11No ratings yet

- Revamp of Toyota'S After Sales Services: Experiential Learning Project - IBADocument41 pagesRevamp of Toyota'S After Sales Services: Experiential Learning Project - IBAHafsa MarufNo ratings yet

- Business Lines Product Lines: Important Information About The CompanyDocument1 pageBusiness Lines Product Lines: Important Information About The CompanyASHISHNo ratings yet

- The Indian Automotive Industry A PerspectiveDocument52 pagesThe Indian Automotive Industry A PerspectivePawan DhanwariaNo ratings yet

- The Indian Automotive Industry A PerspectiveDocument52 pagesThe Indian Automotive Industry A PerspectiveRuchi ShahNo ratings yet

- The Indian Automotive Industry A PerspectiveDocument52 pagesThe Indian Automotive Industry A PerspectiveSystole ConsultancyNo ratings yet

- Final Project SMDocument22 pagesFinal Project SMRida IjazNo ratings yet

- Amit 1Document22 pagesAmit 1Sankalp GahlotNo ratings yet

- Compendium of Best Practices in Road Asset ManagementFrom EverandCompendium of Best Practices in Road Asset ManagementNo ratings yet

- The Beauty of Discomfort: How What We Avoid Is What We NeedFrom EverandThe Beauty of Discomfort: How What We Avoid Is What We NeedRating: 2 out of 5 stars2/5 (4)

- Introduction To Business EthicsDocument8 pagesIntroduction To Business Ethicsvishesh jainNo ratings yet

- 6051d50f2c869 CaseNova CaseDocument4 pages6051d50f2c869 CaseNova Casevishesh jainNo ratings yet

- Plagiarism Comparison Scan Report: File File FM End Term Answer Sheet - Docx PC20200479 - Vishesh Jain - FM ET - SafeDocument3 pagesPlagiarism Comparison Scan Report: File File FM End Term Answer Sheet - Docx PC20200479 - Vishesh Jain - FM ET - Safevishesh jainNo ratings yet

- OPJEMS Brochure-2020 PDFDocument2 pagesOPJEMS Brochure-2020 PDFvishesh jainNo ratings yet

- The DealMaker CaseDocument5 pagesThe DealMaker Casevishesh jainNo ratings yet

- Round 1Document4 pagesRound 1vishesh jainNo ratings yet

- Mphasis Annual Report 2020Document208 pagesMphasis Annual Report 2020vishesh jainNo ratings yet

- Online Case Study Challenge - LearnousDocument3 pagesOnline Case Study Challenge - Learnousvishesh jainNo ratings yet

- 57th Annual Report - 2018-19 - Webe4d2Document208 pages57th Annual Report - 2018-19 - Webe4d2vishesh jainNo ratings yet

- International Business CIA 1B Geocentric Approach: By, Anjana Parvathy S 1723146 BbahbDocument3 pagesInternational Business CIA 1B Geocentric Approach: By, Anjana Parvathy S 1723146 BbahbAnjanaNo ratings yet

- Urbanization in Pakistan: A Governance Perspective: Monument, Decentralization, Human DevelopmentDocument10 pagesUrbanization in Pakistan: A Governance Perspective: Monument, Decentralization, Human DevelopmentSehrish ChNo ratings yet

- RQM Best PracticesDocument52 pagesRQM Best PracticesOlalekan FagbemiroNo ratings yet

- Pinocchio "Geppetto's Puppet" Answer The Following QuestionsDocument5 pagesPinocchio "Geppetto's Puppet" Answer The Following QuestionsAbdelrahman ElhossinyNo ratings yet

- Child Marriage - Addressing The Challenges and Obstacles in The Po PDFDocument36 pagesChild Marriage - Addressing The Challenges and Obstacles in The Po PDFvibhayNo ratings yet

- Article 1475Document2 pagesArticle 1475Sintas Ng SapatosNo ratings yet

- Ethics SyllabusDocument6 pagesEthics SyllabusVishnu ChandrikadharanNo ratings yet

- Econ 1Bb3: Introductory Macroeconomics Sections C01, C02 Mcmaster University Fall, 2015Document6 pagesEcon 1Bb3: Introductory Macroeconomics Sections C01, C02 Mcmaster University Fall, 2015Labeeb HossainNo ratings yet

- Indian Literature S in English TranslationDocument12 pagesIndian Literature S in English TranslationRawats002No ratings yet

- (Muhammad Ashraf & Muqeem Ul Islam) : Media Activism and Its Impacts On The Psychology of Pakistani Society'Document30 pages(Muhammad Ashraf & Muqeem Ul Islam) : Media Activism and Its Impacts On The Psychology of Pakistani Society'naweedahmedNo ratings yet

- Humanistic Theories: Abraham Maslow's TheoryDocument3 pagesHumanistic Theories: Abraham Maslow's TheoryShiba TatsuyaNo ratings yet

- ISL100 Sec2266Document2 pagesISL100 Sec2266alhati63No ratings yet

- Analele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2009Document186 pagesAnalele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2009emilmaneaNo ratings yet

- Salary Request LetterDocument5 pagesSalary Request LetterFearless HeroNo ratings yet

- Varikkasery ManaDocument2 pagesVarikkasery ManaLakshmi Pillai50% (2)

- Instant Download Ebook PDF Speak Up An Illustrated Guide To Public Speaking 4th Edition PDF FREEDocument32 pagesInstant Download Ebook PDF Speak Up An Illustrated Guide To Public Speaking 4th Edition PDF FREEgeorge.wang839No ratings yet

- PEP Web - Ernst Simmel and Freudian PhilosophyDocument3 pagesPEP Web - Ernst Simmel and Freudian Philosophyrogne100% (1)

- PDF Document 2Document11 pagesPDF Document 2rizzacasipong413No ratings yet

- Tendernotice - 1 (4) 638043623175233354Document5 pagesTendernotice - 1 (4) 638043623175233354Ar Shubham KumarNo ratings yet

- MenuDocument2 pagesMenuKaye AguarinNo ratings yet

- Nicomachean Ethics AristotleDocument14 pagesNicomachean Ethics AristotleNathaniel BaldevinoNo ratings yet

- CAN Vs COULDDocument5 pagesCAN Vs COULDE'lena EremenkoNo ratings yet

- Target Market and Marketing MixDocument2 pagesTarget Market and Marketing MixGwen TevessNo ratings yet

- 3862 Tha Watchkeeper Brochure 2013Document5 pages3862 Tha Watchkeeper Brochure 2013ThinkDefenceNo ratings yet

- Instant DiscussionsDocument97 pagesInstant DiscussionsFlávia Machado100% (1)

- Ponce Vs Legaspi GR 79184Document2 pagesPonce Vs Legaspi GR 79184Angelee Therese AlayonNo ratings yet

- 2022 KOICA SP Fellows GuidebookDocument34 pages2022 KOICA SP Fellows Guidebookhamzah0303No ratings yet

- Program Administration ManualDocument62 pagesProgram Administration ManualNuno DuarteNo ratings yet

- DatanomicsDocument3 pagesDatanomicsOscar JaraNo ratings yet

- Computer Forensics - An: Jau-Hwang Wang Central Police University Tao-Yuan, TaiwanDocument27 pagesComputer Forensics - An: Jau-Hwang Wang Central Police University Tao-Yuan, TaiwanDESTROYERNo ratings yet