Professional Documents

Culture Documents

Worksheet in FMChap4

Uploaded by

Nguyên ThảoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet in FMChap4

Uploaded by

Nguyên ThảoCopyright:

Available Formats

Capital Budgeting

Example 1

Mai Linh is a fashion chain. It is considering introducing a new line of African fashion in its

Mai Linh paid Tuan Bach $0.5mn to research the market. The results suggest that custome

Expected annual sales $30 mn. Purchasing from suppliers in Africa costs $10 mn.

Upfront R&D and marketing expenses $10 mn. No upfront investment needed. No new sh

Additional R&D, advertising, selling, advertising and general costs $5 mn each year.

Annual expenses to operate the current European shops $100 mn. Total current annual sa

African fashion to be trendy in 4 years. Then noone will buy thus Mai Linh will stop selling.

Corporate tax rate 40%. Debt-Equity ratio 1:1. Costs of equity and pre-tax debt are 10% an

Debt-equity ratio to remain constant.

a) Evaluate the project.

b) Suppose that African fashion sales will continue forever after year 4. Evaluate the proje

Evaluation of the Project

STEP 1: ESTIMATE FREE CASH FLOW

a) Estimation of Free cash flows figures in $ mn

Year 0 1 2 3 4

Sales 30 30 30 30

less Costs of Sales 10 10 10 10

Gross Profit 20 20 20 20

less Operating expenses 10 5 5 5 5

EBIT -10 15 15 15 15

less Income tax @40% 0 6 6 6 6

Unlevered Net Income -10 9 9 9 9

Free Cash Flow -10 9 9 9 9

0.111

STEP 2: ESTIMATE THE COST OF CAPITAL PB=1+0.111=1.111year

WACC = 0.5*10+0.5*6*(1-0.4) 8.427

= 6.8 % 7.8904 0.1994

PB=1.1994

STEP 3: CALCULATE NPV

b) NPV = -10+9/1.068+9/1.068^2+9/1.068^3+9/1.068^4

= 19.854

IRR= 81%

PI= 2.9854 298%

PB=

African fashion in its European shops.

suggest that customers like African fashion.

osts $10 mn.

nt needed. No new shops.

mn each year.

otal current annual sales $500 mn.

i Linh will stop selling.

e-tax debt are 10% and 6% respectively.

4. Evaluate the project.

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Revised List of Maharashtra HospitalsDocument16 pagesRevised List of Maharashtra Hospitalsdummy data100% (1)

- CRM McDonalds ScribdDocument9 pagesCRM McDonalds ScribdArun SanalNo ratings yet

- 04 - Capital Budgeting Cash FlowDocument19 pages04 - Capital Budgeting Cash FlowRodrigo RamosNo ratings yet

- LectureDocument34 pagesLectureAshish MalhotraNo ratings yet

- Making Capital Investment Decisions: Mcgraw-Hill/IrwinDocument23 pagesMaking Capital Investment Decisions: Mcgraw-Hill/IrwinMSA-ACCA100% (2)

- Lecture 28Document34 pagesLecture 28Riaz Baloch NotezaiNo ratings yet

- Year Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeDocument6 pagesYear Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeSpandana AchantaNo ratings yet

- Capital Investment Decisions: Prof. Liu Bin (Ph. D) Dalian Maritime UniversityDocument48 pagesCapital Investment Decisions: Prof. Liu Bin (Ph. D) Dalian Maritime UniversitymarkkenNo ratings yet

- Chapter 10 - Making Capital Investment DecisionsDocument30 pagesChapter 10 - Making Capital Investment Decisionsفيصل ابراهيمNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 WipDocument24 pagesAdv Issues in CapBud - Gr2 9-02 WipHimanshu GuptaNo ratings yet

- Assignment 2: Business Value Management: Show Detailed Calculations in The Spaces ProvidedDocument4 pagesAssignment 2: Business Value Management: Show Detailed Calculations in The Spaces Providedelmin mammadovNo ratings yet

- Exercise 4 SolutionDocument3 pagesExercise 4 SolutioneyNo ratings yet

- Capital Investment Appraisal For Long-Term DecisionsDocument39 pagesCapital Investment Appraisal For Long-Term DecisionsDevon PhamNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- Chapter 3 - Chapter 3: Financial Forecasting and PlanningDocument35 pagesChapter 3 - Chapter 3: Financial Forecasting and PlanningAhmad Ridhuwan AbdullahNo ratings yet

- Appendix - Inv Appraisal ExamplesDocument13 pagesAppendix - Inv Appraisal ExamplesYougal MalikNo ratings yet

- Corporate Finance Tutorial 4 - SolutionsDocument22 pagesCorporate Finance Tutorial 4 - Solutionsandy033003No ratings yet

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skNo ratings yet

- Chap010 - Student EditionDocument20 pagesChap010 - Student EditionSmile2000No ratings yet

- Capital Budgeting ExampleDocument5 pagesCapital Budgeting ExampleVô ThườngNo ratings yet

- Paper LBO Model Example - Street of WallsDocument6 pagesPaper LBO Model Example - Street of WallsAndrewNo ratings yet

- Finance 2 - Chapter 3Document68 pagesFinance 2 - Chapter 3Ayoub Ben AissaNo ratings yet

- LBO Valuation Model 1 ProtectedDocument14 pagesLBO Valuation Model 1 ProtectedYap Thiah HuatNo ratings yet

- Cash Flows and Other Topics in Capital BudgetingDocument63 pagesCash Flows and Other Topics in Capital BudgetingShaina Rosewell M. VillarazoNo ratings yet

- Chapter 12Document33 pagesChapter 12phuphong777No ratings yet

- ch6 IM 1EDocument20 pagesch6 IM 1EJoan MaryNo ratings yet

- Project Analysis Discounted Cash Flow Analysis: Managerial Finance FINA 6335 Ronald F. SingerDocument29 pagesProject Analysis Discounted Cash Flow Analysis: Managerial Finance FINA 6335 Ronald F. SingermanduramNo ratings yet

- KKJJHHHGGDocument40 pagesKKJJHHHGGJuan SanguinetiNo ratings yet

- Finc361 - Lecture - 11 - Capital Budgeting PDFDocument57 pagesFinc361 - Lecture - 11 - Capital Budgeting PDFLondonFencer2012No ratings yet

- Capital Budgeting-FinalDocument38 pagesCapital Budgeting-FinalRohit Rajesh RathiNo ratings yet

- P10-3 Choosing Between Two Projects With Acceptable Payback Periods Conad, An ItalianDocument3 pagesP10-3 Choosing Between Two Projects With Acceptable Payback Periods Conad, An ItalianSakibul Islam SifatNo ratings yet

- Future Value of 1 Sample Problem: SolutionDocument9 pagesFuture Value of 1 Sample Problem: Solutioncris_magno08No ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Chapter 10 Solutions - Foundations of Finance 8th Edition - CheggDocument14 pagesChapter 10 Solutions - Foundations of Finance 8th Edition - ChegghshshdhdNo ratings yet

- Ins3007 S4 SVDocument32 pagesIns3007 S4 SVnguyễnthùy dươngNo ratings yet

- Ty SPM L7Document15 pagesTy SPM L7sanilNo ratings yet

- Chapter 3 - Project SelectionDocument49 pagesChapter 3 - Project SelectionRavi VarmanNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- Chapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Document11 pagesChapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Meghana ErapagaNo ratings yet

- Week 9: Interpretation of Financial StatementsDocument47 pagesWeek 9: Interpretation of Financial StatementsUmair AshrafNo ratings yet

- CIMA F3 Workbook Q PDFDocument67 pagesCIMA F3 Workbook Q PDFjjNo ratings yet

- Business Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeDocument4 pagesBusiness Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeViem AnhNo ratings yet

- Business Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeDocument4 pagesBusiness Modeling Lab Room Activities Lab03 - Model Design Activity 1 - Management FeeViem AnhNo ratings yet

- Chapter 6: Making Capital Investment Decisions: Corporate FinanceDocument36 pagesChapter 6: Making Capital Investment Decisions: Corporate FinanceAsif Abdullah KhanNo ratings yet

- Module 4 Problems FMDocument29 pagesModule 4 Problems FMZaid Ismail ShahNo ratings yet

- BU7300 - Corporate Finance Capital Budgeting Week 1Document21 pagesBU7300 - Corporate Finance Capital Budgeting Week 1Moony TamimiNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- 319 HW3-1Document14 pages319 HW3-1Hiếu Nguyễn Minh HoàngNo ratings yet

- Principles of Corporate Finance Concise 2nd Edition Brealey Test BankDocument47 pagesPrinciples of Corporate Finance Concise 2nd Edition Brealey Test Bankhoadieps44ki100% (33)

- Principles of Corporate Finance Concise 2Nd Edition Brealey Test Bank Full Chapter PDFDocument48 pagesPrinciples of Corporate Finance Concise 2Nd Edition Brealey Test Bank Full Chapter PDFmirabeltuyenwzp6f100% (10)

- CB and Cash Flow (FM Keown10e Chap10Document70 pagesCB and Cash Flow (FM Keown10e Chap10Hasrul HashomNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingDorianne BorgNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- Chapter 2. Understanding The Income Statement A. QuestionsDocument3 pagesChapter 2. Understanding The Income Statement A. QuestionsThị Kim TrầnNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- PracticeQuestions-Qbank-Part I-FM-IIDocument7 pagesPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaNo ratings yet

- Final Mock1 - AnswerDocument7 pagesFinal Mock1 - AnswerK58 Hà Phương LinhNo ratings yet

- Project Evaluation PrinciplesDocument3 pagesProject Evaluation PrinciplesMalik BilalNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- China Case Study - Currency ManipulationDocument10 pagesChina Case Study - Currency ManipulationNguyên ThảoNo ratings yet

- The Process of Importing Machinery Spare Parts: Chapter 1 Introduction To Muratec Machinery Co., LTDDocument1 pageThe Process of Importing Machinery Spare Parts: Chapter 1 Introduction To Muratec Machinery Co., LTDNguyên ThảoNo ratings yet

- (IT) IMPORTING FCL - Group 1Document40 pages(IT) IMPORTING FCL - Group 1Nguyên ThảoNo ratings yet

- UEL - Inut Platform SlideDocument28 pagesUEL - Inut Platform SlideNguyên ThảoNo ratings yet

- Southwest Airlines Closing CaseDocument2 pagesSouthwest Airlines Closing CaseNguyên ThảoNo ratings yet

- Exercise Risk Management and InsuranceDocument3 pagesExercise Risk Management and InsuranceNguyên ThảoNo ratings yet

- So sánh Công ước biển quốc tếDocument8 pagesSo sánh Công ước biển quốc tếNguyên ThảoNo ratings yet

- Use The Information in Exhibit 1 and Exhibit 2 To Answer Question 7 To 12Document1 pageUse The Information in Exhibit 1 and Exhibit 2 To Answer Question 7 To 12Nguyên ThảoNo ratings yet

- (GDTMQT) Advantages or Disadvantages of IMPORT FCL (Compared With LCL)Document4 pages(GDTMQT) Advantages or Disadvantages of IMPORT FCL (Compared With LCL)Nguyên ThảoNo ratings yet

- Pet 402Document1 pagePet 402quoctuanNo ratings yet

- 1 Nitanshi Singh Full WorkDocument9 pages1 Nitanshi Singh Full WorkNitanshi SinghNo ratings yet

- SET 2022 Gstr1Document1 pageSET 2022 Gstr1birpal singhNo ratings yet

- PaintballDocument44 pagesPaintballGmsnm Usp MpNo ratings yet

- ResearchDocument13 pagesResearchCHOYSON RIVERALNo ratings yet

- Variable Compression Ratio Engines A Literature Review: December 2018Document15 pagesVariable Compression Ratio Engines A Literature Review: December 2018Er Samkit ShahNo ratings yet

- Cape 2 Biology - Homeostasis &excretionDocument9 pagesCape 2 Biology - Homeostasis &excretionTamicka BonnickNo ratings yet

- Seven-Year Financial Pro Jection: ProblemDocument10 pagesSeven-Year Financial Pro Jection: Problemnyashadzashe munyatiNo ratings yet

- Reading Assignment Nuclear ChemistryDocument2 pagesReading Assignment Nuclear Chemistryapi-249441006No ratings yet

- NSTP1 MODULE 3 Disaster Awareness Preparedness and ManagementDocument16 pagesNSTP1 MODULE 3 Disaster Awareness Preparedness and Managementrenz dave100% (2)

- Science 9-Quarter 2-Module-3Document28 pagesScience 9-Quarter 2-Module-3Mon DyNo ratings yet

- CPhI Japan InformationDocument22 pagesCPhI Japan InformationctyvteNo ratings yet

- 45096Document12 pages45096Halusan MaybeNo ratings yet

- FRM Valuation & Risk Models Dowd, Chapter 2: - Hosted by David Harper Cfa, FRM, Cipm - Published April 22, 2012Document19 pagesFRM Valuation & Risk Models Dowd, Chapter 2: - Hosted by David Harper Cfa, FRM, Cipm - Published April 22, 2012BeastNo ratings yet

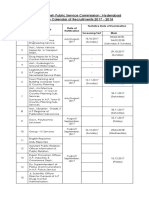

- APPSC Calender Year Final-2017Document3 pagesAPPSC Calender Year Final-2017Krishna MurthyNo ratings yet

- Quarterly Progress Report FormatDocument7 pagesQuarterly Progress Report FormatDegnesh AssefaNo ratings yet

- Equine Anesthesia Course NotesDocument15 pagesEquine Anesthesia Course NotesSam Bot100% (1)

- API 614-Chapter 4 DATA SHEET Dry Gas Seal Module Si Units: System Responsibility: (2.1.2)Document10 pagesAPI 614-Chapter 4 DATA SHEET Dry Gas Seal Module Si Units: System Responsibility: (2.1.2)tutuionutNo ratings yet

- TelfastDocument3 pagesTelfastjbahalkehNo ratings yet

- Polikanov 2019-05-14 Curriculum Vitae YuryDocument6 pagesPolikanov 2019-05-14 Curriculum Vitae Yuryapi-460295531No ratings yet

- INTELLECTUAL DISABILITY NotesDocument6 pagesINTELLECTUAL DISABILITY Notesshai gestNo ratings yet

- Readers Digest November 2021 PDF RD 2021 PDF EnglishDocument172 pagesReaders Digest November 2021 PDF RD 2021 PDF EnglishIslam Gold100% (1)

- 2 Effective Manufacturing ERP MESDocument17 pages2 Effective Manufacturing ERP MESm_trang2005100% (2)

- Chapter 11-15Document172 pagesChapter 11-15Mansoor AhmadNo ratings yet

- SUPERHERO Suspension Training ManualDocument11 pagesSUPERHERO Suspension Training ManualCaleb Leadingham100% (5)

- Capacity Requirement PlanningDocument17 pagesCapacity Requirement PlanningvamsibuNo ratings yet

- February 2019Document4 pagesFebruary 2019sagar manghwaniNo ratings yet

- Earth As A PlanetDocument60 pagesEarth As A PlanetR AmravatiwalaNo ratings yet