Professional Documents

Culture Documents

Sample 35 1MLife With 500T AccCIB

Uploaded by

Ron CatalanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample 35 1MLife With 500T AccCIB

Uploaded by

Ron CatalanCopyright:

Available Formats

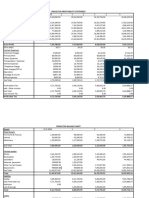

ILLUSTRATION OF BENEFITS

Name : VALUED CLIENT, . . Plan : ENHANCE Annual Premium : 13,535.00

Age : 35 Currency : PHP Basic Premium : 10,000.00

Gender : Female Rider/s AccCIB:1.0 - 500,000.00 Semi Annual Premium : 6,767.50

: Quarterly Premium : 3,383.75

Fund Allocation

100.00% Equity Fund Monthly Premium : 1,127.92

Substandard/Extra Ratings: A

Policy Amount : 1,000,000.00

1,000,000.00 Projected Benefits

Pol Att. Annual 4% 8% 10 %

Top Ups Withdrawals

Year Age Premium Living Benefit Death Benefit Living Benefit Death Benefit Living Benefit Death Benefit

1 36 13,535.00 0.00 0.00 1,381.12 1,001,381.12 1,526.01 1,001,526.01 1,597.81 1,001,597.81

2 37 13,535.00 0.00 0.00 4,567.79 1,004,567.79 5,037.86 1,005,037.86 5,277.22 1,005,277.22

3 38 13,535.00 0.00 0.00 9,352.54 1,009,352.54 10,359.41 1,010,359.41 10,882.40 1,010,882.40

4 39 13,535.00 0.00 0.00 14,737.30 1,014,737.30 16,523.81 1,016,523.81 17,469.44 1,017,469.44

5 40 13,535.00 0.00 0.00 20,209.76 1,020,209.76 23,051.01 1,023,051.01 24,583.52 1,024,583.52

6 41 13,535.00 0.00 0.00 28,843.73 1,028,843.73 33,122.65 1,033,122.65 35,470.92 1,035,470.92

7 42 13,535.00 0.00 0.00 37,657.06 1,037,657.06 43,830.56 1,043,830.56 47,275.89 1,047,275.89

8 43 13,535.00 0.00 0.00 46,631.38 1,046,631.38 55,199.57 1,055,199.57 60,063.85 1,060,063.85

9 44 13,535.00 0.00 0.00 55,747.60 1,055,747.60 67,256.51 1,067,256.51 73,906.76 1,073,906.76

10 45 13,535.00 0.00 0.00 65,971.77 1,065,971.77 81,176.39 1,081,176.39 90,121.01 1,090,121.01

11 46 13,535.00 0.00 0.00 75,909.14 1,075,909.14 95,369.16 1,095,369.16 107,032.45 1,107,032.45

12 47 13,535.00 0.00 0.00 85,975.86 1,085,975.86 110,423.62 1,110,423.62 125,358.52 1,125,358.52

13 48 13,535.00 0.00 0.00 96,151.55 1,096,151.55 126,382.62 1,126,382.62 145,214.35 1,145,214.35

14 49 13,535.00 0.00 0.00 106,427.81 1,106,427.81 143,305.49 1,143,305.49 166,739.75 1,166,739.75

15 50 13,535.00 0.00 0.00 118,739.25 1,118,739.25 163,767.14 1,163,767.14 192,952.83 1,192,952.83

16 51 13,535.00 0.00 0.00 129,229.48 1,129,229.48 182,976.87 1,182,976.87 218,541.05 1,218,541.05

17 52 13,535.00 0.00 0.00 139,769.01 1,139,769.01 203,345.35 1,203,345.35 246,306.24 1,246,306.24

18 53 13,535.00 0.00 0.00 150,308.74 1,150,308.74 224,913.15 1,224,913.15 276,413.43 1,276,413.43

19 54 13,535.00 0.00 0.00 160,810.37 1,160,810.37 247,737.10 1,247,737.10 309,057.32 1,309,057.32

20 55 13,535.00 0.00 0.00 174,229.11 1,174,229.11 276,287.64 1,276,287.64 349,835.25 1,349,835.25

21 56 13,535.00 0.00 0.00 184,551.09 1,184,551.09 302,061.41 1,302,061.41 388,649.44 1,388,649.44

25 60 13,535.00 0.00 0.00 226,501.83 1,226,501.83 426,317.73 1,426,317.73 587,633.30 1,587,633.30

30 65 13,535.00 0.00 0.00 265,830.67 1,265,830.67 622,485.42 1,622,485.42 947,433.13 1,947,433.13

35 70 10,000.00 0.00 0.00 273,073.81 1,273,073.81 869,650.02 1,869,650.02 1,487,923.85 2,487,923.85

64 99 10,000.00 0.00 0.00 0.00 0.00 1,597,969.88 2,597,969.88 16,273,499.95 17,273,499.95

TOTAL ANNUAL PREMIUM AND TOP UPS : 746,050.00

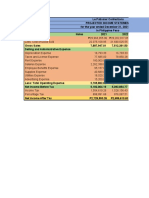

The rates of return shown above are for illustration purposes only. The projected values are NOT GUARANTEED and will depend on the actual performance of the

fund/s selected.

The above demonstrates possible benefits assuming an 8% rate of return. This is for illustration only and is not a guarantee of future results.

The projected values are net of the following:

1. An Insurance Charge that is imposed in respect of the Death Benefit starting on the 1st policy year and in respect of any Rider benefit upon its effectivity. For

the 1st deduction of Insurance Charge, units of the relevant Fund/s will be cancelled on the Valuation Date immediately after the Policy Date. The Due Dates for

succeeding Insurance Charges are on every Monthly Anniversary.

2. A Premium Charge of 72% on the 1st year, 30% on the 2nd year, 15% on the 3rd year until the 5th year and 5% on the 6th year until the 10th year will be applied

on the Regular Premium less any Rider Premium and 5.0 % on every Top-up Premium thereafter. Monthly Periodic Charge of 25% on the 2nd & 3rd year, 20% on the

4th & 5th year applied on the Regular Premium less any Rider premium will be deducted from the fund.

3. A Fund Management Charge of 2% of the Fund Value for the Equity Fund. It is deducted in the calculation of the Net Asset Value (NAV) of Equity Fund in

accordance with the Valuation Provision.

The above charges are subject to change. The Insurer reserves the right to adjust any charges in this plan at any time.

Notes:

1. All payments and benefits shown are in Philippine Peso. Payments are accepted in Philippine Peso only.

2. The Annual Contribution includes Regular Premium and other additional benefit charges. Regular Premium includes any extra premium, any Rider Premium,

initial deposit to the fund and all charges enumerated above.

3. The Living Benefits reflected above are the projected Total Fund Value. The projected values of the fund/s are based on assumed annual returns of 4%, 8%

and 10%. These are hypothetical figures and are not meant to represent or be indicative of the actual returns of the fund/s. The Total Fund Value may be less

than the amount invested. The investment risks associated with this policy are to be borne solely by the Policyowner.

4. The assumed annual rates of return above are based on your selected fund/s. This illustration shows that 100.00% of your Initial Fund Deposit is deposited to

the Equity Fund.

5. The illustration summary relates to your ENHANCE.

6. A Loyalty Bonus may be credited to each of the Policyowner's Fund/s at the end of the 10th policy year and each 5th policy year thereon while the policy is in

force. The amount of Loyalty Bonus is determined by multiplying the loyalty bonus percentage, as determined by the Insurer from time to time, with the average

monthly Total Fund Value at the end of each policy month for the previous five years. The Loyalty Bonus is not guaranteed and will depend on the actual

7. If you decide that this plan is not suited to your needs, simply return the policy to Pioneer Life Inc. within 15 days from the date you received it. The amount

refundable shall be the sum of the Insurance Charges, and the Premium Charges paid from the Policy Date plus the Total Fund Value.

8. This Illustration of Benefits shall form part of the insurance contract once your variable life policy is issued.

. . VALUED CLIENT

Proposed Owner's Name and Signature

Pioneer Life Inc.

Pioneer House Makati, 108 Paseo de Roxas, Legaspi Village, Makati City 1229

Runtime : 10.09.54 PM Version : 03.31.2021

Tel: +632 8812 7777 Fax: +632 8817 1461 www.pioneer.com.ph

Insured's Name : . . VALUED CLIENT

Policyowner's Name : . . VALUED CLIENT

Agent's Name : RONALD CATALAN FFSI, ASRI, ALMI, ACS

POLICYOWNER ACKNOWLEDGMENTS

ACKNOWLEDGMENT OF VARIABILITY

I acknowledge that:

I have applied with Pioneer Life Inc. for a Variable Unit Linked(VUL) Policy, and have

reviewed the illustration/s that shows how a VUL policy performs using the Insurer’s

assumptions and based on the Insurance Commission’s guidelines on interest rates.

I understand that since the fund performance may vary, the values of my units are not

guaranteed and will depend on the actual performance at that given period and that the

value of my policy could be less than the capital invested. The unit values of my VUL are

periodically published.

I understand that the investment risks under the VUL Policy are borne solely by me, as the

Policyowner.

. . VALUED CLIENT

Proposed Owner's Name Proposed Owner's Signature Date Agent's Signature

Pioneer Life Inc.

Pioneer House Makati, 108 Paseo de Roxas, Legaspi Village, Makati City 1229

Runtime : 10.09.54 PM Version : 03.31.2021

Tel: +632 8812 7777 Fax: +632 8817 1461 www.pioneer.com.ph

You might also like

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Amalia Ferrer - 1M CoverDocument2 pagesAmalia Ferrer - 1M CoverRon CatalanNo ratings yet

- Valued Client Female 25yoDocument2 pagesValued Client Female 25yoRon CatalanNo ratings yet

- BENEFITS ILLUSTRATIONDocument2 pagesBENEFITS ILLUSTRATIONRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- BENEFITS_ILLUSTRATIONDocument2 pagesBENEFITS_ILLUSTRATIONRon CatalanNo ratings yet

- BENEFITS ILLUSTRATIONDocument2 pagesBENEFITS ILLUSTRATIONRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Maximizing Life Insurance BenefitsDocument2 pagesMaximizing Life Insurance BenefitsRon CatalanNo ratings yet

- 3 Junie Delute IIDocument2 pages3 Junie Delute IIJune Delfino DeluteNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Age 29 Male - 50T Premium InvDocument2 pagesAge 29 Male - 50T Premium InvRon CatalanNo ratings yet

- Illustration of Benefits Showing Projected Returns up to 10Document2 pagesIllustration of Benefits Showing Projected Returns up to 10Ron CatalanNo ratings yet

- Daisy Basic 1T Premium Per MonthDocument2 pagesDaisy Basic 1T Premium Per MonthRon CatalanNo ratings yet

- SimuladorCR AHDocument7 pagesSimuladorCR AHNohelia Tito ZelaNo ratings yet

- CPSC - TruckingDocument32 pagesCPSC - TruckingSari Sari Store VideoNo ratings yet

- Company Finance Profit & Loss Consolidated (Rs in CRS.)Document4 pagesCompany Finance Profit & Loss Consolidated (Rs in CRS.)rohanNo ratings yet

- Pro Forma Balance Sheet: Year 0 1 2 AssetsDocument39 pagesPro Forma Balance Sheet: Year 0 1 2 AssetsLala ReyesNo ratings yet

- Crystal Report ViewerDocument6 pagesCrystal Report Viewercontabilidad01No ratings yet

- ACCELSA 1T 2020 EstadosFinancierosDocument18 pagesACCELSA 1T 2020 EstadosFinancierosYamis VillegasNo ratings yet

- KjasbflksnfDocument18 pagesKjasbflksnfCristopher IanNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- Financial AspectDocument56 pagesFinancial AspectAngela LaurillaNo ratings yet

- 06 22Document18 pages06 22MustaminNo ratings yet

- Sachin DaneshwariDocument2 pagesSachin DaneshwariADARSH PATTARNo ratings yet

- 07 Extra-Payment-CalculatorDocument10 pages07 Extra-Payment-Calculatorvijay sainiNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Wells Fargo employee pay history 2021Document1 pageWells Fargo employee pay history 2021Sourabh PunshiNo ratings yet

- Diamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Document9 pagesDiamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Alabi OlamideNo ratings yet

- Financial Statement Summary for Chaccochollo Urban Community ProjectDocument1 pageFinancial Statement Summary for Chaccochollo Urban Community ProjectLizbeth Yomira Ramos MamaniNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Installment Shandya 1506305117Document3 pagesInstallment Shandya 1506305117Shandya MaharaniNo ratings yet

- UID Sales Perfomance Report09112022Document3 pagesUID Sales Perfomance Report09112022nurkha.crhNo ratings yet

- FinamDocument12 pagesFinammybotsdriveNo ratings yet

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocument33 pagesComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Projected Financial StatementsDocument46 pagesProjected Financial Statementsvictorious xtremeNo ratings yet

- Final Cookies FsDocument8 pagesFinal Cookies FsDanah Jane GarciaNo ratings yet

- Shree Cement DCF ValuationDocument71 pagesShree Cement DCF ValuationPrabhdeep DadyalNo ratings yet

- Group Project KHT Fall 20Document23 pagesGroup Project KHT Fall 20SAKIB MD SHAFIUDDINNo ratings yet

- Tedros Genene Bakery Income Statement For The Year 2013 - 2018Document30 pagesTedros Genene Bakery Income Statement For The Year 2013 - 2018Samuel GirmaNo ratings yet

- 2ND Mandatory-Deduction-For-2023Document2 pages2ND Mandatory-Deduction-For-2023EgieMae GarcesNo ratings yet

- Hindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Projected Income: Annual Sales Twister Smoothies/power Booster SmoothiesDocument56 pagesProjected Income: Annual Sales Twister Smoothies/power Booster SmoothiesDominic AlimNo ratings yet

- I Aktiva Lancar: NO Rekening 2015 2016Document12 pagesI Aktiva Lancar: NO Rekening 2015 2016dimasNo ratings yet

- I Aktiva Lancar: NO Rekening 2015 2016Document12 pagesI Aktiva Lancar: NO Rekening 2015 2016dimasNo ratings yet

- Infosys Sources of FinanceDocument6 pagesInfosys Sources of FinanceyargyalNo ratings yet

- Disney (DIS) FY 2014 Financial ResultsDocument115 pagesDisney (DIS) FY 2014 Financial ResultsJaime Vara De ReyNo ratings yet

- Resumen Del Estado Financiero: N.E. Snip 249898 Tres de Ancohaqui PNSR ProcoesDocument3 pagesResumen Del Estado Financiero: N.E. Snip 249898 Tres de Ancohaqui PNSR ProcoesLizbeth Yomira Ramos MamaniNo ratings yet

- Cronograma Interes SimpleDocument12 pagesCronograma Interes SimpleCristian L Mendoza AsenciosNo ratings yet

- B127-Aragon-A No 4Document6 pagesB127-Aragon-A No 4Shaina AragonNo ratings yet

- Wholesale Distributor Balance SheetDocument1 pageWholesale Distributor Balance SheetWei Song ChenNo ratings yet

- Makauno Co.: Semi-Monthly Payroll August 1-15, 2020Document11 pagesMakauno Co.: Semi-Monthly Payroll August 1-15, 2020Chincel G. ANINo ratings yet

- Exercise 16 Problem 1 Problem 2Document4 pagesExercise 16 Problem 1 Problem 2Christian SantosNo ratings yet

- AmortizationDocument11 pagesAmortizationJoen SinamagNo ratings yet

- Daisy Basic 1T Premium Per MonthDocument2 pagesDaisy Basic 1T Premium Per MonthRon CatalanNo ratings yet

- Illustration: End of Pol Year Attained Age Annual PremiumDocument1 pageIllustration: End of Pol Year Attained Age Annual PremiumRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- BENEFITS ILLUSTRATIONDocument2 pagesBENEFITS ILLUSTRATIONRon CatalanNo ratings yet

- Daisy Basic 1T Premium Per MonthDocument2 pagesDaisy Basic 1T Premium Per MonthRon CatalanNo ratings yet

- Illustration: End of Pol Year Attained Age Annual PremiumDocument1 pageIllustration: End of Pol Year Attained Age Annual PremiumRon CatalanNo ratings yet

- Daisy Basic 1T Premium Per MonthDocument2 pagesDaisy Basic 1T Premium Per MonthRon CatalanNo ratings yet

- Daisy Basic 1T Premium Per MonthDocument2 pagesDaisy Basic 1T Premium Per MonthRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Sample 35 1MLife With 500T AccCIBDocument2 pagesSample 35 1MLife With 500T AccCIBRon CatalanNo ratings yet

- 5 Ways To Double Sales in 90 Days PDFDocument24 pages5 Ways To Double Sales in 90 Days PDFSahran HussnineNo ratings yet

- 5 Things The Super Successful Do Online - King KongDocument39 pages5 Things The Super Successful Do Online - King KongSahran Hussnine100% (2)

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Sample Investment 1M On Age 50Document2 pagesSample Investment 1M On Age 50Ron CatalanNo ratings yet

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- Age 29 Male - 50T Premium InvDocument2 pagesAge 29 Male - 50T Premium InvRon CatalanNo ratings yet

- 5 Things The Super Successful Do Online - King KongDocument39 pages5 Things The Super Successful Do Online - King KongSahran Hussnine100% (2)

- Age30 Below-1m SampleDocument2 pagesAge30 Below-1m SampleRon CatalanNo ratings yet

- 3 Step To Creating A Killer Content StrategyDocument13 pages3 Step To Creating A Killer Content StrategySahran HussnineNo ratings yet

- Embrace 100T With Top UpDocument2 pagesEmbrace 100T With Top UpRon CatalanNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- 3 Step To Creating A Killer Content StrategyDocument13 pages3 Step To Creating A Killer Content StrategySahran HussnineNo ratings yet

- Market Equilibrium PDFDocument8 pagesMarket Equilibrium PDFHasan RabyNo ratings yet

- Tax Invoice: INVOICE NO. B2320473 21.12.2022 Invoice / Issue DateDocument1 pageTax Invoice: INVOICE NO. B2320473 21.12.2022 Invoice / Issue DateRanjith PatelNo ratings yet

- NPO Accounting Activity May 26 2021Document5 pagesNPO Accounting Activity May 26 2021Cassie PeiaNo ratings yet

- Contractors ListDocument38 pagesContractors Listelias_el9002100% (3)

- ISO14327 2004resistanceweldingDocument20 pagesISO14327 2004resistanceweldingEdNo ratings yet

- Geography PDFDocument4 pagesGeography PDFworksatyajeetNo ratings yet

- Government Initiatives, Agricultural Reforms and Rural DevelopmentDocument205 pagesGovernment Initiatives, Agricultural Reforms and Rural DevelopmentMansiNo ratings yet

- How To Build A Simple Top Bar HiveDocument42 pagesHow To Build A Simple Top Bar HivePhil Chandler98% (47)

- Penawaran Harga Seragam SATPAMDocument2 pagesPenawaran Harga Seragam SATPAMIndra WardanaNo ratings yet

- AA 5-Exercise 3 Page 91Document8 pagesAA 5-Exercise 3 Page 91Gil Diane AlcontinNo ratings yet

- Forecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixDocument9 pagesForecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixMathew UsfNo ratings yet

- Factor of Production QuizDocument4 pagesFactor of Production QuizRonnel Pardos100% (1)

- ValuationDocument227 pagesValuationmohammad sadegh movahedifarNo ratings yet

- Ten Principles of EconomicsDocument3 pagesTen Principles of EconomicsYannah HidalgoNo ratings yet

- Primary Maths Worksheet (Coins in My Piggy Bank)Document2 pagesPrimary Maths Worksheet (Coins in My Piggy Bank)AstraX EducationNo ratings yet

- Cash Disbursement JournalDocument1 pageCash Disbursement JournalRhea Mikylla ConchasNo ratings yet

- Website QuotationDocument1 pageWebsite QuotationBalaji DNo ratings yet

- 01 Pojmy Filmove Teorie 3Document10 pages01 Pojmy Filmove Teorie 3Maki DefaceNo ratings yet

- Offer N AcceptanceDocument21 pagesOffer N Acceptancearsheedbashir9No ratings yet

- CDC Halves Social Distance Guidance For K-12 Classrooms: Divisive Meetings Test U.S. Ties To BeijingDocument52 pagesCDC Halves Social Distance Guidance For K-12 Classrooms: Divisive Meetings Test U.S. Ties To BeijingRomel Gamboa SanchezNo ratings yet

- Closingrates 202306junDocument20 pagesClosingrates 202306junTabrez IrfanNo ratings yet

- Full Payment Acknowledgment Receipt: Hundred Seventy Three Thousand Pesos (P8,973,000,00), inDocument1 pageFull Payment Acknowledgment Receipt: Hundred Seventy Three Thousand Pesos (P8,973,000,00), inMark Rainer Yongis LozaresNo ratings yet

- ECO201 CheatsheetThe title "TITLE ECO201 Cheatsheet" is concise and SEO-optimized as it contains the relevant keywords "ECO201" and "CheatsheetDocument5 pagesECO201 CheatsheetThe title "TITLE ECO201 Cheatsheet" is concise and SEO-optimized as it contains the relevant keywords "ECO201" and "Cheatsheetwasif ahmedNo ratings yet

- CC-102 EconomicsDocument8 pagesCC-102 Economicswehoxak452No ratings yet

- MCQ Entrepreneurship 5Document3 pagesMCQ Entrepreneurship 5Dgcc Information technology deprtmentNo ratings yet

- Jati, Journal Manager, Nazery Khalid - PLANNING OF MARITIME ECONOMIC ACTIVITIES IN MALAYSIA TOWARDS THE PRACTICE OF SUSTAINABLE DEVELOPMENT-1Document12 pagesJati, Journal Manager, Nazery Khalid - PLANNING OF MARITIME ECONOMIC ACTIVITIES IN MALAYSIA TOWARDS THE PRACTICE OF SUSTAINABLE DEVELOPMENT-1Best scoreNo ratings yet

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- UNIT 17 and UNIT 18Document7 pagesUNIT 17 and UNIT 18Nere RetwaNo ratings yet

- Scope and Importance EUnitDocument5 pagesScope and Importance EUnitNikhil AmbhoreNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet