0% found this document useful (0 votes)

757 views2 pagesLabor Accounting and Incentive Plans

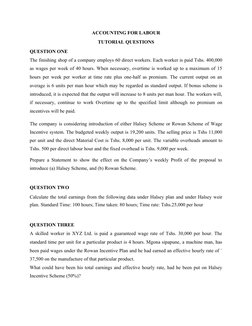

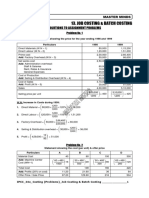

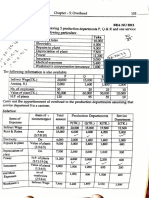

This document contains 6 questions related to accounting for labor costs. Question 1 provides data on direct labor hours, wages, overtime rates and output for a company considering implementing either a Halsey or Rowan incentive scheme. It asks to calculate the effect on weekly profit of each scheme. Question 2 asks to calculate total earnings under Halsey and Halsey Weir plans given standard and actual time data. Question 3 provides data on a worker's guaranteed wage rate and earnings under Rowan to calculate potential earnings under Halsey. The remaining questions cover definitions of overtime premium, journal entries for various labor costs, and preparation of a payroll register.

Uploaded by

Elias DeusCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

757 views2 pagesLabor Accounting and Incentive Plans

This document contains 6 questions related to accounting for labor costs. Question 1 provides data on direct labor hours, wages, overtime rates and output for a company considering implementing either a Halsey or Rowan incentive scheme. It asks to calculate the effect on weekly profit of each scheme. Question 2 asks to calculate total earnings under Halsey and Halsey Weir plans given standard and actual time data. Question 3 provides data on a worker's guaranteed wage rate and earnings under Rowan to calculate potential earnings under Halsey. The remaining questions cover definitions of overtime premium, journal entries for various labor costs, and preparation of a payroll register.

Uploaded by

Elias DeusCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Question Two

- Question One

- Question Five

- Question Four

- Question Six