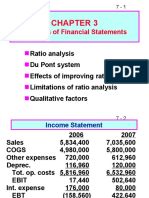

Professional Documents

Culture Documents

Performance As of October 31, 2020 Holdings by Company Size: Institutional Class

Uploaded by

Ljubisa Matic0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

TCF_EQ_ar-page15

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional Class

Uploaded by

Ljubisa MaticCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

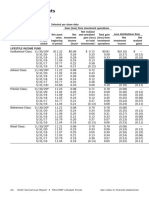

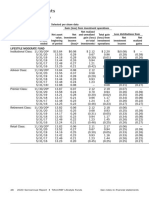

Performance as of October 31, 2020 Holdings by company size

Large-Cap Value Fund Average annual Annual operating % of equity investments

Total return total return expenses* Market capitalization as of 10/31/2020

Inception More than $50 billion 71.1

date 1 year 5 years 10 years gross net More than $15 billion–$50 billion 22.8

Institutional Class 10/1/02 –7.51% 4.56% 8.20% 0.41% 0.41% More than $2 billion–$15 billion 6.1

Advisor Class 12/4/15 –7.60 4.50† 8.17† 0.49 0.49 Total 100.0

Premier Class 9/30/09 –7.65 4.41 8.03 0.56 0.56

Retirement Class 10/1/02 –7.80 4.30 7.93 0.66 0.66

Retail Class 10/1/02 –7.81 4.24 7.86 0.72 0.72 Fund profile

Class W 9/28/18 –7.19 4.72† 8.29† 0.41 0.00

as of 10/31/2020

Russell 1000® Value Index — –7.57 5.82 9.48 — —

Net assets $4.77 billion

The returns in this report show past performance, which is no guarantee of future results. The returns do

not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares. Returns Portfolio turnover rate 26%

and the principal value of your investment will fluctuate. Current performance may be higher or lower than Number of holdings 85

that shown, and you may have a gain or a loss when you redeem your shares. For current performance Weighted median market

information, including performance to the most recent month-end, please visit TIAA.org. Performance capitalization $88.68 billion

may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement Price/earnings ratio (weighted

arrangements, performance would be lower. 12-month trailing average)† 25.0

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. †

Price/earnings ratio is the price of a stock divided by

its earnings per share for the past twelve-month period.

* The gross and net annual operating expenses are taken from the Fund’s prospectus. The net annual operating

expenses may at times reflect a contractual reimbursement of various expenses. The expense reimbursement

will continue through at least February 28, 2021, unless changed with the approval of the Board of Trustees.

Without these reimbursements, expenses would be higher and returns lower.

†

The performance shown for the Advisor Class and Class W that is prior to their respective inception dates is

based on the performance of the Institutional Class. The performance for these periods has not been restated to

reflect the actual expenses of the Advisor Class and Class W. If these actual expenses had been reflected, the

performance of these two classes shown for these periods would have been different because the Advisor Class

and Class W have different expenses than the Institutional Class.

$10,000 over 10 years

Institutional Class

$40,000

30,000

20,000

10,000

0

Oct 10 Oct 11 Oct 12 Oct 13 Oct 14 Oct 15 Oct 16 Oct 17 Oct 18 Oct 19 Oct 20

Large-Cap Value Fund $21,991

Russell 1000® Value Index $24,732

Ending amounts are as of October 31, 2020. For the purpose of comparison,

the graph also shows the change in the value of the Fund’s benchmark during

the same period. The performance of the other share classes varies due to

differences in expense charges.

TIAA-CREF Funds: Equity Funds 2020 Annual Report 15

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Legg Mason Value Fund - Dec 2022 PDFDocument2 pagesLegg Mason Value Fund - Dec 2022 PDFJeanmarNo ratings yet

- CSD - Invesco S&P Spin-Off ETF Fact SheetDocument2 pagesCSD - Invesco S&P Spin-Off ETF Fact SheetSack ValperNo ratings yet

- PBW - Invesco WilderHill Clean Energy ETF Fact SheetDocument2 pagesPBW - Invesco WilderHill Clean Energy ETF Fact SheetRahul SalveNo ratings yet

- HSBC Global Investment Funds - US Dollar BondDocument2 pagesHSBC Global Investment Funds - US Dollar BondMay LeungNo ratings yet

- Invesco QQQ Trust: Growth of $10,000Document2 pagesInvesco QQQ Trust: Growth of $10,000TotoNo ratings yet

- Factsheet - Premia China Property ETFDocument2 pagesFactsheet - Premia China Property ETFkwongyuan88_11867164No ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- RWC Global Emerging Equity Fund: 30th June 2020Document2 pagesRWC Global Emerging Equity Fund: 30th June 2020Nat BanyatpiyaphodNo ratings yet

- QQQ 2Document2 pagesQQQ 2Dominic angelNo ratings yet

- Factsheet For Fidelity Mutual FundDocument2 pagesFactsheet For Fidelity Mutual FundewaidaebaaNo ratings yet

- USAA Cornerstone Equity Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Equity Fund 2022 - 1Qag rNo ratings yet

- USAA Cornerstone Moderately Aggressive Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderately Aggressive Fund 2022 - 1Qag rNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4A RNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3A RNo ratings yet

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Document3 pagesInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinNo ratings yet

- USAA Small Cap Stock Fund Fact Sheet 2022 - 4QDocument2 pagesUSAA Small Cap Stock Fund Fact Sheet 2022 - 4QAgreyes33124No ratings yet

- Parametric Custom Core SP 500Document4 pagesParametric Custom Core SP 500Sangeeta SinghalNo ratings yet

- Putnam Dynamic Asset Allocation Balanced Fund: (Pabyx)Document2 pagesPutnam Dynamic Asset Allocation Balanced Fund: (Pabyx)sigit sutokoNo ratings yet

- USAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017Document4 pagesUSAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017anthonymaioranoNo ratings yet

- Invesco DB Oil Fund: Growth of $10,000Document2 pagesInvesco DB Oil Fund: Growth of $10,000Rutvik BNo ratings yet

- Vanguard VEADocument114 pagesVanguard VEARaka AryawanNo ratings yet

- USAA Precious Metals and Mineral Fund - USAGX - 4Q 2022Document2 pagesUSAA Precious Metals and Mineral Fund - USAGX - 4Q 2022ag rNo ratings yet

- Real Estate - StepStoneDocument96 pagesReal Estate - StepStonesanjiv30No ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2A RNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- SR Research SVCDocument8 pagesSR Research SVCshNo ratings yet

- SCHW - ZackDocument10 pagesSCHW - ZackJessyNo ratings yet

- Fact Sheet - ICON Flexible Bond Fund (IOBZX)Document2 pagesFact Sheet - ICON Flexible Bond Fund (IOBZX)acie600No ratings yet

- Financial Opportunities 2Q 2022Document3 pagesFinancial Opportunities 2Q 2022ag rNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- Etf FCT BshyallDocument14 pagesEtf FCT Bshyallemirav2No ratings yet

- AAM - High 50 Dividend Strategy 2019-3QDocument4 pagesAAM - High 50 Dividend Strategy 2019-3Qag rNo ratings yet

- CohenSteers Convertible Inc 2019-4 FCDocument2 pagesCohenSteers Convertible Inc 2019-4 FCA RNo ratings yet

- USAA Cornerstone Moderate Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderate Fund 2022 - 1Qag rNo ratings yet

- CFP SDL UK Buffettology Fund Factsheet June 2021Document2 pagesCFP SDL UK Buffettology Fund Factsheet June 2021sky22blueNo ratings yet

- Mrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5Document2 pagesMrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5emirav2No ratings yet

- USAA Tax Exempt Intermediate-Term Fund 2Q '22Document2 pagesUSAA Tax Exempt Intermediate-Term Fund 2Q '22ag rNo ratings yet

- SAW Fact Sheet FINAL 3-31-08Document2 pagesSAW Fact Sheet FINAL 3-31-08MattNo ratings yet

- Vanguard Extended Duration Treasury Index FundDocument10 pagesVanguard Extended Duration Treasury Index FundneiskerNo ratings yet

- Balanced Portfolio 2020-1 FCDocument3 pagesBalanced Portfolio 2020-1 FCA RNo ratings yet

- USAA Income Stock Fund - 1Q 2022Document2 pagesUSAA Income Stock Fund - 1Q 2022ag rNo ratings yet

- Vanguard Capital Opportunity Fund: Supplement To The Prospectus and Summary ProspectusDocument9 pagesVanguard Capital Opportunity Fund: Supplement To The Prospectus and Summary Prospectus76132No ratings yet

- Barings Global Senior Secured Bond FundDocument4 pagesBarings Global Senior Secured Bond FundFrancis MejiaNo ratings yet

- CohenSteers PreferredIncome 2020-2FCDocument3 pagesCohenSteers PreferredIncome 2020-2FCag rNo ratings yet

- Wells FargoDocument11 pagesWells FargoRafa BorgesNo ratings yet

- U.S. Equity Index Fund (TDAM) : As at June 30, 2021Document1 pageU.S. Equity Index Fund (TDAM) : As at June 30, 2021Tony ParkNo ratings yet

- TROW Q1 2022 Earnings ReleaseDocument15 pagesTROW Q1 2022 Earnings ReleaseKevin ParkerNo ratings yet

- MF Classic Value Investor Fact Sheet JhiDocument2 pagesMF Classic Value Investor Fact Sheet JhiJosé JoseNo ratings yet

- Cambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Emerging Shareholder Yield ETF: Strategy Overview Fund DetailsJexNo ratings yet

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementsJim GohNo ratings yet

- Uupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotesDocument3 pagesUupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotessailfurtherNo ratings yet

- P Smallcap Ar EngDocument43 pagesP Smallcap Ar EngKuanChau YapNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- Cohen & Steets - Dynamic Income 2020-1Document3 pagesCohen & Steets - Dynamic Income 2020-1ag rNo ratings yet

- Statements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedDocument1 pageStatements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedLjubisa MaticNo ratings yet

- See Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Document1 pageSee Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Ljubisa MaticNo ratings yet

- Financial Highlights: TIAA-CREF Lifestyle FundsDocument1 pageFinancial Highlights: TIAA-CREF Lifestyle FundsLjubisa MaticNo ratings yet

- LS Sar Page48Document1 pageLS Sar Page48Ljubisa MaticNo ratings yet

- LS Sar Page47Document1 pageLS Sar Page47Ljubisa MaticNo ratings yet

- LS Sar Page49Document1 pageLS Sar Page49Ljubisa MaticNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- LS Sar Page51Document1 pageLS Sar Page51Ljubisa MaticNo ratings yet

- Adobe Scan Apr 12, 2023Document4 pagesAdobe Scan Apr 12, 2023Ashok SalhotraNo ratings yet

- Quiz 5 KeyDocument13 pagesQuiz 5 KeyLedayl MaralitNo ratings yet

- Cbe Joining Instruction For Diploma 1 September Intake 2023-2024 Jif2Document10 pagesCbe Joining Instruction For Diploma 1 September Intake 2023-2024 Jif2Daniel EudesNo ratings yet

- Fifa 23 TutorialDocument2 pagesFifa 23 TutorialDrazi YTBNo ratings yet

- Tvlrcai Bot Meeting FTM January 2024Document83 pagesTvlrcai Bot Meeting FTM January 2024Keds MikaelaNo ratings yet

- 1330 Sarevsh Shinde Pptx. HRM IIDocument9 pages1330 Sarevsh Shinde Pptx. HRM IIsarvesh shindeNo ratings yet

- CYBERPRENEURSHIPDocument13 pagesCYBERPRENEURSHIPMash ScarvesNo ratings yet

- Open DEED OF ABSOLUTE SALE (Motor Vehicle - Bunye - Ferrer)Document2 pagesOpen DEED OF ABSOLUTE SALE (Motor Vehicle - Bunye - Ferrer)Arkim llovitNo ratings yet

- Essentials of Economics 9Th Edition John Sloman Full ChapterDocument67 pagesEssentials of Economics 9Th Edition John Sloman Full Chapterpeter.voit454100% (5)

- Subject: Revised DPWH Program On Awards And: Ou - Tl.UeDocument15 pagesSubject: Revised DPWH Program On Awards And: Ou - Tl.Uebrian paul ragudoNo ratings yet

- Development in Legal Issues of Corporate Governance in Islamic Finance PDFDocument25 pagesDevelopment in Legal Issues of Corporate Governance in Islamic Finance PDFDwiki ChyoNo ratings yet

- Fap Turbo GuideDocument71 pagesFap Turbo GuideUchiha AzuranNo ratings yet

- Financial Statement Analysis of Suzuki MotorsDocument21 pagesFinancial Statement Analysis of Suzuki MotorsMuhammad AliNo ratings yet

- DPWH Related CircularsDocument31 pagesDPWH Related CircularsCarina Jane TolentinoNo ratings yet

- Notice Inviting Applications (NIA) 2021 - 1Document174 pagesNotice Inviting Applications (NIA) 2021 - 1Abhishek GunawatNo ratings yet

- Solutions Manual: Accounting: Building Business SkillsDocument31 pagesSolutions Manual: Accounting: Building Business SkillsNicole HungNo ratings yet

- Qualified Institutional Placement: Presented by - Sandeep Singh 09-II-247 Shyamu Pandey 09-II-250Document11 pagesQualified Institutional Placement: Presented by - Sandeep Singh 09-II-247 Shyamu Pandey 09-II-250sandeep-bhatia-911No ratings yet

- Online Business (E-Commerce) in Indonesia TaxationDocument12 pagesOnline Business (E-Commerce) in Indonesia TaxationIndah NovitasariNo ratings yet

- Mooe School Forms 2020Document48 pagesMooe School Forms 2020KrisPaulineSantuaNo ratings yet

- Conceptual Model of Internet Banking Adoption With Perceived Risk and Trust FactorsDocument7 pagesConceptual Model of Internet Banking Adoption With Perceived Risk and Trust FactorsTELKOMNIKANo ratings yet

- Past Year Question Group 6Document9 pagesPast Year Question Group 6Its AnnaNo ratings yet

- CFA Level 3 - Formula Sheet (NO PRINT)Document35 pagesCFA Level 3 - Formula Sheet (NO PRINT)Denis DikarevNo ratings yet

- Canada Office and Industrial - CBRE - Q4 2019Document34 pagesCanada Office and Industrial - CBRE - Q4 2019JP & PANo ratings yet

- RFP For Solar Photovoltaic Microgrid Project, City of GoletaDocument53 pagesRFP For Solar Photovoltaic Microgrid Project, City of GoletaNhacaNo ratings yet

- Avsharn Bachoo FNB Optimizes Retail Banking Product Offers Using Real-Time Propensity Models Rules and EventsDocument28 pagesAvsharn Bachoo FNB Optimizes Retail Banking Product Offers Using Real-Time Propensity Models Rules and EventsAvsharnNo ratings yet

- ZENITH Fábrica en ShangháiDocument24 pagesZENITH Fábrica en ShangháiJoseIsaacRamirezNo ratings yet

- Sms TemplatesDocument83 pagesSms TemplatesSee ThaNo ratings yet

- Conceptual Framework ReviewerDocument4 pagesConceptual Framework ReviewerMA. MIGUELA MACABALESNo ratings yet

- Questionnaire: S.K.School of Business Management, Hemchandracharya North Gujarat UniversityDocument4 pagesQuestionnaire: S.K.School of Business Management, Hemchandracharya North Gujarat UniversityDhavalNo ratings yet

- Redesign Your IT Organizational StructureDocument118 pagesRedesign Your IT Organizational StructureOscar Franco100% (3)