Professional Documents

Culture Documents

The Representation of Financial Statements in Compliance With The Indian Accounting Standards For

Uploaded by

RAJARSHI ROY CHOUDHURY0 ratings0% found this document useful (0 votes)

6 views3 pagesThe document analyzes and compares the representation of financial statements of Maruti Suzuki, Infosys, and Interglobe Aviation according to various Indian accounting standards. While the companies operate in different sectors (automobile, IT, aviation), their financial statements comply with standards for balance sheets, income statements, statements of changes in equity, cash flows, and notes. The revenue recognition methods and inventory items differ between the companies according to their respective industries and services. However, there are some similarities in how they account for assets according to accounting standards for property, plant, and equipment.

Original Description:

Original Title

FamaLatestReport

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document analyzes and compares the representation of financial statements of Maruti Suzuki, Infosys, and Interglobe Aviation according to various Indian accounting standards. While the companies operate in different sectors (automobile, IT, aviation), their financial statements comply with standards for balance sheets, income statements, statements of changes in equity, cash flows, and notes. The revenue recognition methods and inventory items differ between the companies according to their respective industries and services. However, there are some similarities in how they account for assets according to accounting standards for property, plant, and equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesThe Representation of Financial Statements in Compliance With The Indian Accounting Standards For

Uploaded by

RAJARSHI ROY CHOUDHURYThe document analyzes and compares the representation of financial statements of Maruti Suzuki, Infosys, and Interglobe Aviation according to various Indian accounting standards. While the companies operate in different sectors (automobile, IT, aviation), their financial statements comply with standards for balance sheets, income statements, statements of changes in equity, cash flows, and notes. The revenue recognition methods and inventory items differ between the companies according to their respective industries and services. However, there are some similarities in how they account for assets according to accounting standards for property, plant, and equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

The representation of Financial Statements in compliance with the Indian accounting standards for

Maruti Suzuki, Infosys and Interglobe Aviation which belong to Automobile, Information

Technology and Aviation Sector respectively have been studied in detail. Since the companies

are from different sectors the revenue recognition methods and inventories of the three

companies are dissimilar. However there is some similarity between the assets possessed by the

three companies.

Paramete Maruti Suzuki Infosys Interglobe Analysis

r Aviation

Ind-AS 1 The latest Annual Report of The latest Annual Report The latest Annual The representation

the company consists of the of the company Report of the company of the financial

complete set of Financial comprises of the incorporates the statements of the

Statements- balance sheet, complete set of Financial complete set of three companies

profit and loss, change in Statements- balance Financial Statements- are in line with

equity, cash flows and notes. sheet, profit and loss, balance sheet, profit Ind-AS 1.

The financial statements change in equity, cash and loss, change in

have been prepared in flows and notes. The equity, cash flows and

congruence with the going financial statements have notes. . The financial

concern principle and been prepared in statements have been

accrual basis. accordance with prepared in conformity

historical cost, going with the going

concern principle and concern principle and

accrual basis. accrual basis.

Ind-AS 115 Revenue for domestic and Straight-Line basis is Earnings from The revenue

export sales of vehicles, applied to realize bookings are recognition

spare parts and other acknowledged as method of the

revenue for fixed price

accessories is realized when revenue after the three companies

maintenance and customer boards the

the company passes on the depends upon the

percentage of flight. Additionally

control to customers. services they

Revenue collected for the completion method is fees charged for provide.

delivery of technical services employed for cancellation of flight For Maruti it is

contracts that are tickets is also

is acknowledged only after related to the

considered as revenue.

they have been provided to discontinuous in sale of vehicles

Revenue recognition

the customer. Royalty nature. Effective April 1, policy is in conformity whereas for

Earnings and returns from 2018, the Group has with Ind-AS 115. Indigo it mainly

investments are also adopted focuses on the

considered as income for Ind AS 115. passenger service

the company. Effective April and ticket

1, 2018, the Group adopted cancellation

Ind AS 115. Amounts procedure. In

disclosed as revenue are net case of Infosys it

of returns, discounts, sales is about delivering

incentives, goods & service products and

tax. The Group has material services.

uncertain tax positions

including matters under

disputes relating to Income

Taxes. The Company also

has matters under litigation

relating to Excise duty.

Ind-AS 2 Inventories comprise of The business of the Inventories consist of There are some

vehicles, vehicle spares and company is providing stores and spares, similarities

components, loose tools. software services and it loose tools and in- between the

Costs are assigned to does not have any flight inventories. inventory items of

individual items of inventory physical inventories. So, Costs are allocated to Maruti and

on the weighted average reporting under clause individual items of Indigo. The

cost basis. Inventories are 3(ii) of the Order is not inventory on the annual reports of

computed at the lower of applicable for the weighted average cost the above

cost and net realizable value. basis. Inventories are mentioned

Company.

estimated at the lower companies have

of cost and net specified the sub-

realizable value. categories that

should come

under cost of

inventory such as

cost of purchase,

conversion cost

and transportation

cost.

Ind-AS 16 Property, Plant and Property, Plant and Property, Plant and According to Ind-

Equipment include freehold Equipment include Equipment include AS 16, for the

and leasehold land, Freehold and leasehold Owned Aircraft and analysis of

buildings, plant and land, Buildings, spare engines, Leased property, plant

machinery, furniture, Computers,Office Aircrafts, Computers, and equipment

fixtures, office appliances Equipment etc. PPE are Furniture and fixtures, four steps to be

etc. Land irrespective of valued at cost less less Ground Support followed are

being freehold or leasehold accumulated depreciation Equipment, etc. recognition of

are not amortised. and impairment. PPE are Provided that PPE,

Depreciation is accounted depreciated over their significant parts of an measurement at

for all the other components estimated functional lives item of property, plant and after

of PPE. Straight line method using the straight line and equipment have recognition,

is used to calculate method. The functional different useful lives, depreciation,

depreciation on a pro-rata lives and residual values then they are impairment and

basis from the month in of the assets are reviewed accounted for as derecognition.

which each asset is put to periodically. separate component of The three

use to allocate their cost, net PPE. Depreciation on companies

of their residual values, over PPE, excluding owned comply with IND-

their estimated useful lives. aircraft and spare AS and

engine, rotables and derecognise the

non-aircraft assets once they

equipment, leasehold do not reap any

improvements and future economic

leasehold benefits.

improvements -

aircraft, is calculated

on written down value

method. Depreciation

for the above

mentioned items are

computed based on the

straight line method.

Ind-AS 7 Indirect method has been Indirect method has been Indirect method has The three

used to prepare the used to prepare the been used to prepare companies use

consolidated cash flow consolidated cash flow the consolidated cash indirect method to

statement. It complies with statement which has been flow statement. prepare the

Ind-AS 7. segregated into consolidated Cash

Operating, Financing and Flow statement.

Investing activities. The Consolidated

Cash Flow

Statement of the

three companies is

segregated into

Operating,

Financing and

Investing

activities. Since

the three

companies belong

to three different

sectors, their

Operating,

Financing and

Investing

activities are

different.

You might also like

- FAMA OldDocument4 pagesFAMA OldVarun RNo ratings yet

- Individual Assignment (Financial Accounting Module)Document4 pagesIndividual Assignment (Financial Accounting Module)Heisenberg008No ratings yet

- CIA-1 Financial AccountingDocument10 pagesCIA-1 Financial AccountingAkshat MauryaNo ratings yet

- Stage 2 Accounting Standard Adopted by Maruti Suzuki India Ltd.Document2 pagesStage 2 Accounting Standard Adopted by Maruti Suzuki India Ltd.Nave2n adventurism & art works.No ratings yet

- Individual Project: Financial and Managerial Accounting Assignment Submitted By: Gaurav Pal, A037Document3 pagesIndividual Project: Financial and Managerial Accounting Assignment Submitted By: Gaurav Pal, A037gauravpalgarimapalNo ratings yet

- Accounting Standard Summary Notes Group IDocument15 pagesAccounting Standard Summary Notes Group ISrinivasprasadNo ratings yet

- Diff CA Vs FADocument2 pagesDiff CA Vs FAks2699100No ratings yet

- Notes Forming Part of Financial StatementsDocument58 pagesNotes Forming Part of Financial StatementsAndrew StarkNo ratings yet

- Annual Report of IOCL 91Document1 pageAnnual Report of IOCL 91Nikunj ParmarNo ratings yet

- Chapter-13 Preparation of Final Accounts of Sole Proprietors PDFDocument20 pagesChapter-13 Preparation of Final Accounts of Sole Proprietors PDFTarushi Yadav , 51BNo ratings yet

- COGS Beginning Inventory + Purchases During The Period - Ending InventoryDocument4 pagesCOGS Beginning Inventory + Purchases During The Period - Ending InventoryGopali AoshieaneNo ratings yet

- Stand Alone NotesDocument62 pagesStand Alone NotesMadhu MohanNo ratings yet

- A Primer On Financial StatementsDocument9 pagesA Primer On Financial StatementsKarol WeberNo ratings yet

- Firstnotes Leases Standard Ind As 116 Notified McaDocument7 pagesFirstnotes Leases Standard Ind As 116 Notified McaAkshay VoraNo ratings yet

- Analysis of Financial Statements: International Financial Reporting StandardsDocument22 pagesAnalysis of Financial Statements: International Financial Reporting Standardsvvs176975No ratings yet

- Financial Ratios - Insurance SectorDocument4 pagesFinancial Ratios - Insurance SectorMubeenNo ratings yet

- Financial Accounting and Management Accounting: Individual Assignment (Ind AS)Document6 pagesFinancial Accounting and Management Accounting: Individual Assignment (Ind AS)gauravpalgarimapalNo ratings yet

- With Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18Document2 pagesWith Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18Allyssa Camille Arcangel100% (2)

- Accounting Basics Flashcards SsDocument7 pagesAccounting Basics Flashcards SsKyle Ruzzel SuyuNo ratings yet

- Annual Report of IOCL 162Document1 pageAnnual Report of IOCL 162Nikunj ParmarNo ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- FAR 1st Discusssion NoteDocument5 pagesFAR 1st Discusssion NoteApril GumiranNo ratings yet

- Ia3 Midterm ExamDocument7 pagesIa3 Midterm ExamJalyn Jalando-onNo ratings yet

- Mid Term Assignment: Submitted BY Mohammad Adil CHDocument10 pagesMid Term Assignment: Submitted BY Mohammad Adil CHMohammad Adil ChoudharyNo ratings yet

- TataDocument56 pagesTataAndreea GeorgianaNo ratings yet

- 74601bos60479 FND cp1 U3Document13 pages74601bos60479 FND cp1 U3kingdksNo ratings yet

- Annual Report of IOCL 95Document1 pageAnnual Report of IOCL 95Nikunj ParmarNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- Jet Airways Case - Group7Document2 pagesJet Airways Case - Group7NIDHIKA KADELA 24No ratings yet

- FRA - Accounting PoliciesDocument4 pagesFRA - Accounting PoliciesGarima SharmaNo ratings yet

- Inter Globe Aviation LTDDocument84 pagesInter Globe Aviation LTDTANISHA JAY RAVALNo ratings yet

- Annual Report of IOCL 158Document1 pageAnnual Report of IOCL 158Nikunj ParmarNo ratings yet

- Accountancy For Managers (DONE)Document10 pagesAccountancy For Managers (DONE)Gouri mattadNo ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- A FABM 2 Guide Week 1 To 10Document11 pagesA FABM 2 Guide Week 1 To 10Efren Grenias JrNo ratings yet

- Ratios - Financial SectorDocument10 pagesRatios - Financial SectorAnish ShahNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Accounting Measures & Firm Performance: Ratio CalculationDocument7 pagesAccounting Measures & Firm Performance: Ratio CalculationVítor Gularte de OliveiraNo ratings yet

- The Asset Liability Approach For Recording Future Income Taxes Is An PDFDocument1 pageThe Asset Liability Approach For Recording Future Income Taxes Is An PDFFreelance WorkerNo ratings yet

- Accounting Principles For Engineers-CAPEX Vs OPEXDocument7 pagesAccounting Principles For Engineers-CAPEX Vs OPEXRaymund GatocNo ratings yet

- Narsee Monjee Institute of Management StudiesDocument7 pagesNarsee Monjee Institute of Management StudiesRishabh MishraNo ratings yet

- ACTG240 - Ch01Document44 pagesACTG240 - Ch01xxmbetaNo ratings yet

- ACC ASSIGNMENT - Abhilash ChaudharyDocument17 pagesACC ASSIGNMENT - Abhilash ChaudharyAbhilash ChaudharyNo ratings yet

- Accounting Standard 9Document13 pagesAccounting Standard 9MANJEET PANGHALNo ratings yet

- Chapter 6 Variable Absortion Cost STDDocument14 pagesChapter 6 Variable Absortion Cost STDjacks ocNo ratings yet

- Unit: IV Final Accounts of Sole TradersDocument16 pagesUnit: IV Final Accounts of Sole TradersAnbe SivamNo ratings yet

- Lesson 4Document10 pagesLesson 4PoonamNo ratings yet

- Ca - Unit 1Document22 pagesCa - Unit 1SHANMUGHA SHETTY S SNo ratings yet

- Capital and Revenue ExpenditureDocument31 pagesCapital and Revenue ExpenditureHari Purwadi100% (1)

- Capital and Revenue ExpenditureDocument31 pagesCapital and Revenue ExpenditureHari Purwadi100% (1)

- Germany - General InsuranceDocument12 pagesGermany - General InsurancedpandeNo ratings yet

- CostaccDocument6 pagesCostaccKassandra Mari LucesNo ratings yet

- FAMA IndividualAssignmentDocument5 pagesFAMA IndividualAssignmentSRINIVAS BALIGANo ratings yet

- FAR2 NotesDocument132 pagesFAR2 NotesCarlito DiamononNo ratings yet

- CFAS - Chapter 6: IdentificationDocument1 pageCFAS - Chapter 6: Identificationagm25100% (1)

- Final AccountsDocument40 pagesFinal AccountsCA Deepak EhnNo ratings yet

- EMEA Group2 EgyptDocument11 pagesEMEA Group2 EgyptRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group5 BangladeshDocument19 pagesEMEA Group5 BangladeshRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group11 MexicoDocument21 pagesEMEA Group11 MexicoRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group7 ChinaDocument26 pagesEMEA Group7 ChinaRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group09 IndonesiaDocument13 pagesEMEA Group09 IndonesiaRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group1 GuyanaDocument13 pagesEMEA Group1 GuyanaRAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group4 RussiaDocument26 pagesEMEA Group4 RussiaRAJARSHI ROY CHOUDHURYNo ratings yet

- Machine Learning, Robotic Process Automation, Edge Computing, Cybersecurity, Blockchain. Etc...Document1 pageMachine Learning, Robotic Process Automation, Edge Computing, Cybersecurity, Blockchain. Etc...RAJARSHI ROY CHOUDHURYNo ratings yet

- Work From Home and Virtual Team Project Phase 2Document6 pagesWork From Home and Virtual Team Project Phase 2RAJARSHI ROY CHOUDHURYNo ratings yet

- EMEA Group8 IndiaDocument15 pagesEMEA Group8 IndiaRAJARSHI ROY CHOUDHURYNo ratings yet

- Gig Economy in IndiaDocument15 pagesGig Economy in IndiaRAJARSHI ROY CHOUDHURYNo ratings yet

- Ethical Issues in Management Assignment - D010 - RajarshiRoyChoudhuryDocument7 pagesEthical Issues in Management Assignment - D010 - RajarshiRoyChoudhuryRAJARSHI ROY CHOUDHURYNo ratings yet

- Chapter 5 Estimation of Doubtful AccountsDocument13 pagesChapter 5 Estimation of Doubtful AccountsAngelie LaxaNo ratings yet

- Answers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalDocument220 pagesAnswers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalJoel Christian MascariñaNo ratings yet

- Simulation of The Preparation of The Work Unit (Satker) Financial StatementsDocument23 pagesSimulation of The Preparation of The Work Unit (Satker) Financial StatementskarismaNo ratings yet

- Blaine KitchenwareDocument15 pagesBlaine KitchenwareZainab MahmoodNo ratings yet

- ACC401-Basic Conso-Basic QuestionsDocument5 pagesACC401-Basic Conso-Basic Questionsisaacbediako82No ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Handout ReceivablesDocument4 pagesHandout ReceivablesTsukishima KeiNo ratings yet

- Answers Lease 1Document10 pagesAnswers Lease 1els emsNo ratings yet

- Dividend Policy MCQDocument2 pagesDividend Policy MCQYasser Maamoun50% (2)

- Financial Report On Civil BankDocument38 pagesFinancial Report On Civil BankSrijana BhusalNo ratings yet

- EOQ & Reorder Point ActivityDocument2 pagesEOQ & Reorder Point ActivityCatherine OrdoNo ratings yet

- Live: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionDocument5 pagesLive: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionsandiekaysNo ratings yet

- Fabm2-3 Statement of Changes in EquityDocument24 pagesFabm2-3 Statement of Changes in EquityJacel GadonNo ratings yet

- Breakeven ActivityDocument3 pagesBreakeven ActivityMarian100% (1)

- Sba SemDocument9 pagesSba SemChelsa Mae AntonioNo ratings yet

- FM Quiz ch1-3Document7 pagesFM Quiz ch1-3Noor SyuhaidaNo ratings yet

- 01Document14 pages01NarinderNo ratings yet

- BookkeepingDocument2 pagesBookkeepingSido Angel Mae BarbonNo ratings yet

- Resa Afar 2205 Quiz 2Document14 pagesResa Afar 2205 Quiz 2Rafael Bautista100% (1)

- Cost Analysis NotesDocument7 pagesCost Analysis NotesAli AshhabNo ratings yet

- SP Term 1 XII - AcctsDocument14 pagesSP Term 1 XII - AcctsSakshi NagotkarNo ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Cost ClassificationDocument91 pagesCost ClassificationJack PayneNo ratings yet

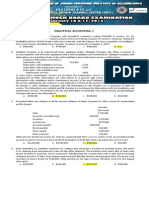

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- Financial Statement AnalysisDocument34 pagesFinancial Statement AnalysisanshumanNo ratings yet

- CVP LectureDocument9 pagesCVP Lecturejohanna mapilotNo ratings yet

- BU127 Midterm 2 Winter 2017 Final Version Including SolutionsDocument10 pagesBU127 Midterm 2 Winter 2017 Final Version Including SolutionsAdams BruinsNo ratings yet

- Case: Big Boy: Levarage Various Ratios and TheirDocument24 pagesCase: Big Boy: Levarage Various Ratios and TheirShagun SetiaNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet