Professional Documents

Culture Documents

13

Uploaded by

WSLeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

13

Uploaded by

WSLeeCopyright:

Available Formats

society and then easily spread from human to human (Sapian, et al., 2010).

In late April 2009,

a major outbreak originated in Mexico causing a huge number of deaths which surprised the

world (Christopher, 2009). On April 24, 2009, the World Health Organization, WHO

declared Pandemic Alert Phase 4 Swine Influenza A (H1N1) which afterward indicate as

Influenza A (H1N1) as a result of existing diverse genes presence such as the North

American’s avian, swine and human and also the Eurasian swine. Then, on June 11, 2009, it

climbed to Phase 6. As of October 11, there were a total of 199 countries affected with a

confirmed case by the 399,232 laboratory resulting in 4,735 deaths (Sapian, et al., 2010).

Clinically, the 2009 H1N1 pandemic infection is similar to seasonal influenza. Most patients

suffer from fever, sore throat, difficulty in breathing, cough, headache and muscle aches, and

some suffer from vomiting and diarrhea. Mild in most cases. Deaths are rare, mainly due to

severe pneumonia. About half of the people were previously healthy. The rest suffer from

underlying diseases such as lung and cardiovascular disease, pregnancy, diabetes, obesity and

immunosuppression (Abu Bakar & Sam, 2009).

On the 15th May 2009, Malaysia discovered it first case when a student from the United

States came back to Malaysia. Since then, multiple clusters have appeared in schools, all of

which have been accompanied by a resurgence of infection cases from abroad. As of July 14,

2009, the Ministry of Health had confirmed 804 cases, of which 69% were imported cases

and 31% were involved in local infection. The number of cases involving local transmissions

is expected to continue to grow significantly. By the beginning of July, it became clear that

local transmission had been established within the country and that they had taken a step

toward mitigation (Christopher, 2009).

Wealth Management is a broad topic. (Opolski & Potocki, 2011) stated that in the process of

wealth management, time may be the most important variable in planning strategic

investment. With a clearly defined time frame, wealth management consultants can determine

investment choice strategies and customer-determined rates of return. Goal definition, their

priorities and timetable are an integral part of the wealth management process. In fact, this is

the basis for success in the future. According to the Malaysian Financial Planning Council

MFPC (2004), a typical method of personal financial planning is to effectively use savings to

accumulate wealth, and then devalue the value and such wealth to prevent loss. This includes

careful preservation of the individual’s current status and such plans, the individual’s current

activity status and the individual’s credit and cash management, tax planning, and eventual

wealth distribution at a later stage. It reflects how to gradually develop and build the ability to

manage financial needs related to insurance and risk management, investment, and retirement

and real estate planning. Individuals must participate in a comprehensive and thorough

financial plan by self-managing or appointing qualified personnel of the financial plan

holding company (Tan, Hoe, & Hung, 2011). People are effectively investing their assets and

personal income to ensure financial security not only during work but also after retirement.

The gradual increase in the elderly population and the extension of life expectancy indicate

the need and importance of a carefully planned personal financial plan (Lai & Tan, 2009).

You might also like

- 1.7 Chapter LayoutDocument2 pages1.7 Chapter LayoutWSLeeNo ratings yet

- 14Document1 page14WSLeeNo ratings yet

- 2.1.2 Income ShockDocument1 page2.1.2 Income ShockWSLeeNo ratings yet

- 18Document2 pages18WSLeeNo ratings yet

- 2.1.1 Household Consumption Decision MakingDocument1 page2.1.1 Household Consumption Decision MakingWSLeeNo ratings yet

- 2.1.3 Wealth ShockDocument2 pages2.1.3 Wealth ShockWSLeeNo ratings yet

- So-Eco 204 - Sem3 - 2020Document13 pagesSo-Eco 204 - Sem3 - 2020WSLeeNo ratings yet

- FINAL EXAM ITC101 s32020Document8 pagesFINAL EXAM ITC101 s32020WSLeeNo ratings yet

- 15Document1 page15WSLeeNo ratings yet

- Jan 2005 Income Statement for Variable and Absorption CostingDocument4 pagesJan 2005 Income Statement for Variable and Absorption CostingWSLeeNo ratings yet

- The 5 Step Consumer Purchase Decision Making ProcessDocument1 pageThe 5 Step Consumer Purchase Decision Making ProcessWSLeeNo ratings yet

- 1.8 Chapter SummaryDocument2 pages1.8 Chapter SummaryWSLeeNo ratings yet

- TVM Tutorial Explained in 40 CharactersDocument2 pagesTVM Tutorial Explained in 40 CharactersWSLeeNo ratings yet

- ECO204 Individual Assignment Critically Discusses GlobalizationDocument12 pagesECO204 Individual Assignment Critically Discusses GlobalizationWSLeeNo ratings yet

- Assignment Cover Sheet: Lee Wei Shan B1103003Document14 pagesAssignment Cover Sheet: Lee Wei Shan B1103003WSLeeNo ratings yet

- What Is GlobalizationDocument16 pagesWhat Is GlobalizationWSLeeNo ratings yet

- B1103003eco204sem3 2020 QUIZDocument4 pagesB1103003eco204sem3 2020 QUIZWSLeeNo ratings yet

- UnemploymentDocument9 pagesUnemploymentWSLeeNo ratings yet

- ACC103 Assign Sem 1, 2020 PDFDocument9 pagesACC103 Assign Sem 1, 2020 PDFWSLee0% (1)

- MGT 204 Business PlanDocument8 pagesMGT 204 Business PlanWSLeeNo ratings yet

- Process Costing in SequentialDocument8 pagesProcess Costing in SequentialSarfaraz HeranjaNo ratings yet

- Stationery Business Plan Final PDFDocument14 pagesStationery Business Plan Final PDFWSLee75% (4)

- Question 2eDocument2 pagesQuestion 2eWSLeeNo ratings yet

- Maybank FinalDocument2 pagesMaybank FinalWSLeeNo ratings yet

- The Execution of A GST Could Raise Boundaries To Upward Social Portability For Lower Wage Family UnitsDocument1 pageThe Execution of A GST Could Raise Boundaries To Upward Social Portability For Lower Wage Family UnitsWSLeeNo ratings yet

- The Execution of A GST Could Raise Boundaries To Upward Social Portability For Lower Wage Family UnitsDocument1 pageThe Execution of A GST Could Raise Boundaries To Upward Social Portability For Lower Wage Family UnitsWSLeeNo ratings yet

- Law 101Document17 pagesLaw 101WSLeeNo ratings yet

- Market For Resendtial Property in MalaysiaDocument12 pagesMarket For Resendtial Property in MalaysiaWSLeeNo ratings yet

- ECO 101 Help University Assignment Feedback SheetDocument5 pagesECO 101 Help University Assignment Feedback SheetWSLeeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Evbox Ultroniq V2: High Power Charging SolutionDocument6 pagesEvbox Ultroniq V2: High Power Charging SolutionGGNo ratings yet

- Anxiety, Depression and Self-Esteem in Children With Well-Controlled AsthmaDocument6 pagesAnxiety, Depression and Self-Esteem in Children With Well-Controlled AsthmaAbdallah H. KamelNo ratings yet

- The Control of Building Motion by Friction Dampers: Cedric MARSHDocument6 pagesThe Control of Building Motion by Friction Dampers: Cedric MARSHAlam Mohammad Parvez SaifiNo ratings yet

- Sop For FatDocument6 pagesSop For Fatahmed ismailNo ratings yet

- Reaction Order and Rate Law Expression Worksheet KeyDocument5 pagesReaction Order and Rate Law Expression Worksheet KeyLyra GurimbaoNo ratings yet

- THC124 - Lesson 1. The Impacts of TourismDocument50 pagesTHC124 - Lesson 1. The Impacts of TourismAnne Letrondo Bajarias100% (1)

- Examining The Structural Relationships of Destination Image, Tourist Satisfaction PDFDocument13 pagesExamining The Structural Relationships of Destination Image, Tourist Satisfaction PDFAndreea JecuNo ratings yet

- OYO Case Study SolutionDocument4 pagesOYO Case Study SolutionVIKASH GARGNo ratings yet

- Exam Unit 1 Out and About 1º BachilleratoDocument5 pagesExam Unit 1 Out and About 1º Bachilleratolisikratis1980No ratings yet

- 25 Mosquito Facts and TriviaDocument3 pages25 Mosquito Facts and Triviamara_hahaNo ratings yet

- Guidelines SLCM BWDocument60 pagesGuidelines SLCM BWpnaarayanNo ratings yet

- New Balance Case StudyDocument3 pagesNew Balance Case StudyDimas AdityaNo ratings yet

- Agile Spotify - Team - HomeworkDocument8 pagesAgile Spotify - Team - Homeworksp76rjm7dhNo ratings yet

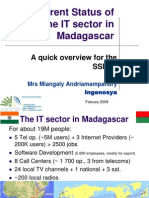

- Madagascar SslevMg v2Document11 pagesMadagascar SslevMg v2Thyan AndrianiainaNo ratings yet

- G.raju Reddy Resume (PDF1) PDFDocument3 pagesG.raju Reddy Resume (PDF1) PDFanon_708469687No ratings yet

- Economics Principles and Policy 13th Edition Baumol Solutions ManualDocument2 pagesEconomics Principles and Policy 13th Edition Baumol Solutions ManualCraigGonzalezaxzgd100% (17)

- STAR GLASS - D66f5e - PDFDocument126 pagesSTAR GLASS - D66f5e - PDFJessie O.BechaydaNo ratings yet

- Template Project Approach QuestionnaireDocument1 pageTemplate Project Approach QuestionnaireSara AliNo ratings yet

- Managerial Economics L4 Consumer BehaviourDocument50 pagesManagerial Economics L4 Consumer BehaviourRifat al haque DhruboNo ratings yet

- The Korean MiracleDocument20 pagesThe Korean MiracleDivya GirishNo ratings yet

- DissertationDocument15 pagesDissertationNicole BradyNo ratings yet

- COSMETOLOGY-9 Q1 W3 Mod2Document15 pagesCOSMETOLOGY-9 Q1 W3 Mod2Christian Elliot DuatinNo ratings yet

- Using Previous Years AlmanacDocument1 pageUsing Previous Years AlmanacbhabhasunilNo ratings yet

- Training Programme EvaluationDocument14 pagesTraining Programme Evaluationthanhloan1902No ratings yet

- Group ActDocument3 pagesGroup ActRey Visitacion MolinaNo ratings yet

- Conditions For The Emergence of Life On The Early Earth: Summary and ReflectionsDocument15 pagesConditions For The Emergence of Life On The Early Earth: Summary and Reflectionsapi-3713202No ratings yet

- TL 496 DatasheetDocument7 pagesTL 496 DatasheetAnonymous vKD3FG6RkNo ratings yet

- Mutual FundDocument2 pagesMutual Fundkum_praNo ratings yet

- Labconco-3905503 Rev e Purifier Hepa Filtered and Class I Filtered Enclosures User ManualDocument77 pagesLabconco-3905503 Rev e Purifier Hepa Filtered and Class I Filtered Enclosures User ManualCalixto GrajalesNo ratings yet