Professional Documents

Culture Documents

CHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 Edition

Uploaded by

Meljenice Closa PoloniaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 Edition

Uploaded by

Meljenice Closa PoloniaCopyright:

Available Formats

CHAPTER 17: BORROWING COSTS

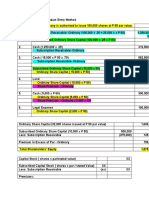

PROBLEMS

17-1 (IFRS)CHAPTER 17 Borrowing Cost Problem 17-2 CFAS 2020

Edition

Ans: B. 6,470,000

Solution:

Construction cost on January 1, 2020 P 6,000,000

Interest (6,000,000 x 10% x 11/12) 550,000

Interest Income ( 80,000)

Total Cost of plant P 6,470,000

===========

17-2 (IFRS)

Ans: D. 1,800,000

Solution:

Interest incurred (24,000,000 x 10%/12) P 2,000,000

Interest income ( 200,000)

Capitalizable borrowing cost P 1,800,000

===========

17-3 (AICPA Adapted)

1. B. 516, 000

Solution: Principal Interest

8% note payable (8% x 6,000,000) 6,000,000 480,000

9% note payable (9% x 9,000,000) 9,000,000 810,000

Total 15,000,000 1,290,000

Average interest rate (1,290,000/15,000,000) 8.60%

Average expenditures (12,000,000/2) 6,000,000

Capitalizable interest (6,000,000 x 8.6) 516,000

2. C. 774,000

Solution:

Total interest incurred 1,290,000

Capitalizable interest (516,000)

Interest expense for the year 774,000

17-4 (IAA)

Ans: C. 490,000

Solution:

Specific borrowing (4,000,000 x 10%) P 400,000

General borrowing (750,000 x 12%) 90,000

Capitalized interest P 490,000

========

17-5 (IAA)

Ans: C. 247,000

Solution:

Specific borrowing (2,2000,000 x 10%) 220,000

Interest revenue (45,000)

General borrowing (800,000 x 9%) 72,000

Average Expenditures 3,000,000

Specific borrowing (2,200,000)

General borrowing 800,000

Capitalized interest 247,000

======

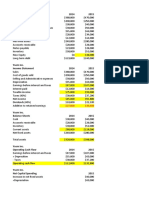

17-6 (AICPA Adapted)

Ans: B. 1,450,000

Solution:

Interest on specific borrowing (10,000,000 x 10%) 1,000,000

Interest income related to specific borrowing (100,00)

Interest on general borrowing (5,000,000 x 11%) 550,000

Total capitalizable interest 1,450,000

17-7 (IAA)

1. C. 280,000

Weighted Average Accumulated Expense

= 1,000,000 x 12/12 = 1,000,000

2,000,000 x 6/12 = 1,000,000

3,000,000 x 2/12 = 500,000

= 2,500,000

Capitalizable Borrowing Cost

= 1,000,000 X 10% + (2,500,000 – 1,000,000) 12%

= 100,000 + 180,000

Capitalizable Borrowing Cost = 280,000

========

2. B. 6,280,000

Solution:

Cost of the New Building

= (1,000,000 + 2,000,000 + 3,000,000) + 280,000

= 6,000,000 + 280,000

Cost of the New Building = 6,280,000

==========

3. A. 2,220,000

Interest Expense for 2020

= (1,000,000 X 10% + 20,000,000 X 12%) – 280,000

= 100,000 + 2,400,000 – 280,000

Interest Expense for 2020 = 2,220,000

=========

Problem 17-8 Multiple Choice

1. D

2. C

3. D

4. C

5. A

6. C

7. C

8. D

9. A

10. C

P ro b le m 1 7 -9

1. C

2. B

3. C

4. A

5. B

6. C

7. A

8. A

9. B

10. B

You might also like

- VALIX - IA 1 (2020 Ver.) Government GrantDocument9 pagesVALIX - IA 1 (2020 Ver.) Government GrantAriean Joy DequiñaNo ratings yet

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietNo ratings yet

- 4-6 Dahlia CompanyDocument1 page4-6 Dahlia CompanyyayayaNo ratings yet

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Diamond CompanyDocument1 pageDiamond CompanyKillua ZOLDYNo ratings yet

- CFAS - Chapter 6: IdentificationDocument1 pageCFAS - Chapter 6: Identificationagm25100% (1)

- Chapter 8 CFAS Problem 8-1 Page 162Document6 pagesChapter 8 CFAS Problem 8-1 Page 162Rhoda Claire M. GansobinNo ratings yet

- MiyawwDocument9 pagesMiyawwjessa mae zerdaNo ratings yet

- c2 Premium Liability Lets Get It PDFDocument15 pagesc2 Premium Liability Lets Get It PDFCris VillarNo ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- CFAS Suggested AnswersDocument12 pagesCFAS Suggested AnswersPaul De Pedro100% (1)

- Chapter 15 Financial Asset at Fair ValueDocument7 pagesChapter 15 Financial Asset at Fair ValueRujean Salar Altejar100% (1)

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementMiafe B. AlmendralejoNo ratings yet

- PAS 33-Earnings Per Share PAS 33-Earnings Per ShareDocument27 pagesPAS 33-Earnings Per Share PAS 33-Earnings Per ShareHazel PachecoNo ratings yet

- REVIEW FINANCIAL ACCOUNTING & REPORTING EXAMDocument21 pagesREVIEW FINANCIAL ACCOUNTING & REPORTING EXAMClene DoconteNo ratings yet

- Chapter 18 20Document11 pagesChapter 18 20jessa mae zerdaNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- ACC123 InventoryCostFlowDocument3 pagesACC123 InventoryCostFlowkhryzellia lagurinNo ratings yet

- Cash & Receivables ManagementDocument5 pagesCash & Receivables ManagementAlexandra Nicole IsaacNo ratings yet

- Financial Accounting Reviewer - Chapter 64Document11 pagesFinancial Accounting Reviewer - Chapter 64Coursehero PremiumNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Problem6 Ppe-P2Document19 pagesProblem6 Ppe-P2Angela RuedasNo ratings yet

- Standard CostingDocument11 pagesStandard CostingAbigail Dela Cruz Manggas100% (1)

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- Chapter 15 - Financial Asset at Fair ValueDocument1 pageChapter 15 - Financial Asset at Fair ValueRaymina CNo ratings yet

- Subject Activity 002 (Sa002) : Cost Accounting and ControlDocument6 pagesSubject Activity 002 (Sa002) : Cost Accounting and ControlaltaNo ratings yet

- Accounts ReceivableDocument34 pagesAccounts ReceivableRose Aubrey A Cordova100% (1)

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- IA Valix 2020 (Problem 4-2 Answer Key)Document6 pagesIA Valix 2020 (Problem 4-2 Answer Key)Baby MushroomNo ratings yet

- Law 1Document3 pagesLaw 1Amethyst Jordan60% (5)

- Problem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Document2 pagesProblem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Katrina Dela Cruz100% (1)

- IA Activity 6 AssDocument6 pagesIA Activity 6 AssWeStan LegendsNo ratings yet

- Answers On Government GrantDocument12 pagesAnswers On Government GrantGabrielle Joshebed Abarico100% (1)

- Inventory Cost Formulas LCNRV Fs DisclosuresDocument15 pagesInventory Cost Formulas LCNRV Fs DisclosuresKawhileonard LeonardNo ratings yet

- Machete Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageMachete Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Ia Chapter 11-12Document4 pagesIa Chapter 11-12Marinella LosaNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Borrowing Cost Problem SolutionsDocument17 pagesBorrowing Cost Problem SolutionsNicole ConcepcionNo ratings yet

- Problem 12 27Document4 pagesProblem 12 27Bella RonahNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- IA 1 Valix 2020 Ver. Problem 27-1 - Problem 27-2Document5 pagesIA 1 Valix 2020 Ver. Problem 27-1 - Problem 27-2Ariean Joy Dequiña100% (1)

- Financial Asset at Fair Value Question 31-1 What Are The Classifications of Financial Assets?Document12 pagesFinancial Asset at Fair Value Question 31-1 What Are The Classifications of Financial Assets?jsemlpzNo ratings yet

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- MILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BDocument4 pagesMILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BZhaira Kim CantosNo ratings yet

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Document11 pages1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahNo ratings yet

- 20-1 To 20-13Document16 pages20-1 To 20-13Jesica Vargas0% (2)

- Revenue Cycle Trade DiscountsDocument50 pagesRevenue Cycle Trade DiscountsJean MaeNo ratings yet

- Picarra, Sherilyn - PROBLEM 8-4Document2 pagesPicarra, Sherilyn - PROBLEM 8-4Sherilyn PicarraNo ratings yet

- CFAS - Chapter 6: Multiple ChoiceDocument4 pagesCFAS - Chapter 6: Multiple Choiceagm250% (1)

- Factors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationDocument2 pagesFactors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationJin HandsomeNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Abcede, Borrowing CostsDocument2 pagesAbcede, Borrowing CostsCindy BartolayNo ratings yet

- P1. PRO O.L Solution CMA September 2022 ExaminationDocument6 pagesP1. PRO O.L Solution CMA September 2022 ExaminationAwal ShekNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- Investments Problems SolvedDocument8 pagesInvestments Problems SolvedAce LimpinNo ratings yet

- Go CompanyDocument3 pagesGo CompanyMaui100% (2)

- CHAPTER 17 Borrowing Cost Problem 17-9 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-9 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-5 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-5 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-8 CFAS 2020 EditionDocument2 pagesCHAPTER 17 Borrowing Cost Problem 17-8 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-6 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-6 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-5 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-5 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-9 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-9 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-8 CFAS 2020 EditionDocument2 pagesCHAPTER 17 Borrowing Cost Problem 17-8 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-6 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-6 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 EditionDocument4 pagesCHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- Advanced Financial Accounting Canadian Canadian 7Th Edition Beechy Test Bank Full Chapter PDFDocument36 pagesAdvanced Financial Accounting Canadian Canadian 7Th Edition Beechy Test Bank Full Chapter PDFpaul.colapietro194100% (14)

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriestaurusNo ratings yet

- Group-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011Document71 pagesGroup-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011pkaul1No ratings yet

- WSCSS Schedule 2023 01 01Document13 pagesWSCSS Schedule 2023 01 01mom2asherloveNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Qualifying ExamDocument60 pagesQualifying ExamMARK ANGELO PANGILINANNo ratings yet

- Agroha Enterprises Balance Sheet and Ratio AnalysisDocument13 pagesAgroha Enterprises Balance Sheet and Ratio AnalysisAfzalNo ratings yet

- DepreciationDocument17 pagesDepreciationDr Sarbesh Mishra100% (1)

- Financial Reporting and Analysis 7th Edition Gibson Test BankDocument23 pagesFinancial Reporting and Analysis 7th Edition Gibson Test Bankmrsbrianajonesmdkgzxyiatoq100% (31)

- Far 1 Past PapersDocument327 pagesFar 1 Past PapersTooba MaqboolNo ratings yet

- TVS Motor - Taxmann VersionDocument19 pagesTVS Motor - Taxmann VersionSripal JainNo ratings yet

- Cash Flows and Financial Statements at YsomDocument4 pagesCash Flows and Financial Statements at YsomKrishna Sharma0% (1)

- RFA Masters SRS 16-2-15Document33 pagesRFA Masters SRS 16-2-15Ramesh NathanNo ratings yet

- RMIT FR Week 3 Solutions PDFDocument115 pagesRMIT FR Week 3 Solutions PDFKiabu ParindaliNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- Accounting Standard 12Document11 pagesAccounting Standard 12api-3828505100% (1)

- Ratio Analysis of Mahindra N Mahindra LTDDocument15 pagesRatio Analysis of Mahindra N Mahindra LTDMamta60% (5)

- Qualifying Exam ReviewerDocument11 pagesQualifying Exam ReviewerJohn Oliver OcampoNo ratings yet

- Federal Taxation I - W AnswersDocument8 pagesFederal Taxation I - W AnswersGracie Ortuoste0% (1)

- Question No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamDocument6 pagesQuestion No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamBernadette PanicanNo ratings yet

- Assignment and Case Studies of AccountsDocument2 pagesAssignment and Case Studies of AccountsSachin ThakurNo ratings yet

- What is a Real Estate Investment Trust? (REITDocument45 pagesWhat is a Real Estate Investment Trust? (REITkoosNo ratings yet

- Pak Leather Crafts Limited Financial Statements AnalysisDocument30 pagesPak Leather Crafts Limited Financial Statements AnalysisShah JehanNo ratings yet

- 4.-Financial-Statement-Analysis-1 in FabmDocument46 pages4.-Financial-Statement-Analysis-1 in FabmJodalyn CasibangNo ratings yet

- Tutorial Chapter 1 (Semester March - August 2023)Document3 pagesTutorial Chapter 1 (Semester March - August 2023)Hasif IrfanNo ratings yet

- Total Income DTDocument54 pagesTotal Income DTJay jainNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- ThesisDocument76 pagesThesisMareeya AnnaNo ratings yet

- Executive Director Leadership ProposalDocument7 pagesExecutive Director Leadership ProposalLogeswariy SelvarajuNo ratings yet

- SPPRA Rules Amended 2010 (Amended Uptodate)Document52 pagesSPPRA Rules Amended 2010 (Amended Uptodate)Hammad ShamsNo ratings yet