Professional Documents

Culture Documents

WRKNGCP Eng

WRKNGCP Eng

Uploaded by

Лена КиселеваOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WRKNGCP Eng

WRKNGCP Eng

Uploaded by

Лена КиселеваCopyright:

Available Formats

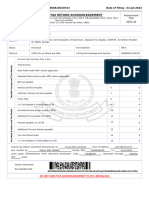

Goods and Services Tax / Harmonized Sales Tax (GST/HST) Return Working Copy

Do not use this working copy to file your return or to make payments at your financial institution.

Name Business number

R T

Reporting period Year Month Day Year Month Day Due date Year Month Day

From to

Working copy (for your records)

Copy your Business number, the reporting period, and the amounts from the highlighted line numbers in this worksheet to the

▼

corresponding boxes in your GST/HST return.

Enter your total sales and other revenue. Do not include provincial sales tax, GST

101 00

or HST. If you are using the Quick Method of accounting, include the GST or HST.

Net tax calculation

Enter the total of all GST and HST amounts that you collected or that became collectible

by you in the reporting period. 103

Enter the total amount of adjustments to be added to the net tax for the reporting period

(for example, the GST/HST obtained from the recovery of a bad debt). 104

Total GST/HST and adjustments for period (add lines 103 and 104) 105

Enter the GST/HST you paid or that is payable by you on qualifying expenses (input tax

credits – ITCs) for the current period and any eligible unclaimed ITCs from a previous period. 106

Enter the total amount of adjustments to be deducted when determining the net tax for the

reporting period (for example, the GST/HST included in a bad debt). 107

Total ITCs and adjustments (add lines 106 and 107) 108

Net tax (subtract line 108 from line 105) 109

Other credits if applicable

Do not complete line 111 until you have read the instructions.

Enter any instalment and other annual filer payments you made for the reporting period.

If the due date of your return is June 15, see the instructions. 110

Enter the total amount of the GST/HST rebates, only if the rebate form indicates that you

can claim the amount on this line. For filing, information, see instructions. 111

Total other credits (add lines 110 and 111) 112

Balance (subtract line 112 from line 109) 113 A

Other debits if applicable

Do not complete line 205 or line 405 until you have read the instructions.

Enter the total amount of the GST/HST due on the acquisition of taxable real property. 205

Enter the total amount of other GST/HST to be self-assessed. 405

Total other debits (add lines 205 and 405) 113 B

Balance (add lines 113 A and 113 B) 113 C

▼ ▼

Line 114 and line 115: If the result entered on line 113 C is a negative amount, enter the Refund claimed Payment enclosed

amount of the refund you are claiming on line 114. If the result entered on line 113 C is a

positive amount, enter the amount of your payment on line 115. 114 115

Instructions

Line 110

Annual filer with a June 15 due date: If you are an individual with business income for income tax purposes and have a December 31 fiscal year-end,

the due date of your return is June 15. However, any GST/HST you owe is payable by April 30. This payment should be reported on line 110 of your

GST/HST Tax Return.

Line 111: Some rebates can reduce or offset your amount owing. Those rebate forms contain a question asking you if you want to claim the rebate amount on

line 111 of your GST/HST Tax Return. Tick yes on the rebate form(s) if you are claiming the rebate(s) on line 111 of your GST/HST Tax Return. If you file your

return electronically, send the rebate application by mail to the Prince Edward Island Tax Centre.

Line 205: Complete this line only if you purchased taxable real property for use or supply primarily (more than 50%) in your commercial activities and you are

a GST/HST registrant (other than an individual who purchases a residential complex) or you purchased the property from a non-resident. If you qualify for an

input tax credit on the purchase, include this amount on line 108.

Line 405: Complete this line only if you are a GST/HST registrant who has to self-assess GST/HST on an imported taxable supply or who has to self-assess

the provincial part of HST.

Personal information is collected under the Excise Tax Act to administer tax, rebates, and elections. It may also be used for any purpose related to the administration or enforcement of the Act such as audit,

compliance and the payment of debts owed to the Crown. It may be shared or verified with other federal, provincial/territorial government institutions to the extent authorized by law. Failure to provide this

information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right to access their personal information and request correction if there are errors or

omissions. Refer to Info Source at cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng.html, Personal Information Bank CRA PPU 241.

You might also like

- Ebook Company Accounting Australia New Zealand 5Th Edition Jubb Solutions Manual Full Chapter PDFDocument67 pagesEbook Company Accounting Australia New Zealand 5Th Edition Jubb Solutions Manual Full Chapter PDFJenniferLeexdte100% (12)

- Ghana Revenue Authority: Monthly Vat & Nhil Flat Rate ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Flat Rate Returnokatakyie1990No ratings yet

- PRINT WHITE - F2016 - GST Return TemplateDocument1 pagePRINT WHITE - F2016 - GST Return Templateyourtypicaljay417No ratings yet

- DT 0107 Monthly Paye Deductions Return Form v1 2 PDFDocument2 pagesDT 0107 Monthly Paye Deductions Return Form v1 2 PDFpapapetroNo ratings yet

- Wa0005Document86 pagesWa0005Deepu DeepNo ratings yet

- Withholding Return SampleDocument15 pagesWithholding Return Sampleoyesigye DennisNo ratings yet

- Mat - PPT FinalDocument18 pagesMat - PPT FinalAkash PatelNo ratings yet

- GETFund NHIL VERSION 218AUG 2018Document2 pagesGETFund NHIL VERSION 218AUG 2018joseph borketeyNo ratings yet

- GST Advance Receipts: Advance Receipts If Turnover Is Less Than Rs. 1.5 CroresDocument29 pagesGST Advance Receipts: Advance Receipts If Turnover Is Less Than Rs. 1.5 CroresVidyadhara HegdeNo ratings yet

- Form PDF 152576390250324Document8 pagesForm PDF 152576390250324karthik narayanNo ratings yet

- GST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Document1 pageGST/HST NETFILE - Confirmation: Your Confirmation Number Is: 769194Tadeusz ZajacNo ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- Instructions For PIT Form V5Document1 pageInstructions For PIT Form V5awlachewNo ratings yet

- Form PDF 914796000060123Document70 pagesForm PDF 914796000060123itie anejaNo ratings yet

- Year End STP Finalisation: Process ManualDocument5 pagesYear End STP Finalisation: Process ManualJaycee RamonesNo ratings yet

- Deferred TaxDocument5 pagesDeferred TaxRAKSHIT CHAUHANNo ratings yet

- PDF 372591110310722Document1 pagePDF 372591110310722santy309No ratings yet

- Sahib Itr A y 21-22 - 050530Document8 pagesSahib Itr A y 21-22 - 050530Sahib SandhuNo ratings yet

- Columbia WHTDocument7 pagesColumbia WHTAnilNo ratings yet

- ImmovableDocument5 pagesImmovableMacho GuyNo ratings yet

- Value Added Tax Returns Form 002Document5 pagesValue Added Tax Returns Form 002JUDY OSUSUNo ratings yet

- Companies Income Tax Returns Form 001: This Returns Covers Beginning EndingDocument2 pagesCompanies Income Tax Returns Form 001: This Returns Covers Beginning EndingAbraham BlackNo ratings yet

- VAT FormDocument2 pagesVAT FormGbenga Ogunsakin67% (3)

- Form PDF 525292250230922Document12 pagesForm PDF 525292250230922Vikash KumarNo ratings yet

- Report RFKKXXDFTP Transfer Posting in FI PDFDocument3 pagesReport RFKKXXDFTP Transfer Posting in FI PDFAnand SharmaNo ratings yet

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510No ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- Accounting For Taxes On IncomeDocument25 pagesAccounting For Taxes On IncomeSUMANSHU_PATELNo ratings yet

- T2short Fill 19eDocument4 pagesT2short Fill 19enh nNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Withholding Tax BestDocument14 pagesWithholding Tax Bestsoumya singhNo ratings yet

- US Internal Revenue Service: f1120sh - 1993Document2 pagesUS Internal Revenue Service: f1120sh - 1993IRSNo ratings yet

- As - 22 Accounting For Taxes On IncomeDocument21 pagesAs - 22 Accounting For Taxes On IncomeTACS & CO.No ratings yet

- RifiuDocument5 pagesRifiuFairTax SolutionsNo ratings yet

- T2short 19eDocument4 pagesT2short 19eryderbishop05No ratings yet

- WHVAT ReturnDocument6 pagesWHVAT ReturnbatuchemNo ratings yet

- PDF 176195070160424Document12 pagesPDF 176195070160424pandey.bishwajeet482No ratings yet

- AMT - Know About Alternative Minimum Tax Applicability, Exemptions, Credits & MoreDocument8 pagesAMT - Know About Alternative Minimum Tax Applicability, Exemptions, Credits & MoreRudrin DasNo ratings yet

- PDF 108908510310723Document1 pagePDF 108908510310723sowmya.bNo ratings yet

- US Internal Revenue Service: F940ez - 1991Document4 pagesUS Internal Revenue Service: F940ez - 1991IRSNo ratings yet

- Ias 12Document32 pagesIas 12Cat ValentineNo ratings yet

- File GSTR-9: Getting Details For Annual ReturnsDocument30 pagesFile GSTR-9: Getting Details For Annual ReturnsHarendra KumarNo ratings yet

- VAT Return GuideDocument3 pagesVAT Return GuideiatfirmforyouNo ratings yet

- Itr Ay 2022-23 Kanta SinghalDocument1 pageItr Ay 2022-23 Kanta Singhalprateek gangwaniNo ratings yet

- Return Review Letter 2019 11 14 09 07 35 944Document3 pagesReturn Review Letter 2019 11 14 09 07 35 944Waqar Alam KhanNo ratings yet

- VAT ReturnsDocument39 pagesVAT ReturnsTaha AhmedNo ratings yet

- PDF 160233240300324Document12 pagesPDF 160233240300324sometimes for your timepassNo ratings yet

- Document From Adhu-6 PDFDocument19 pagesDocument From Adhu-6 PDFBasavaraj S PNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearHarshit PandeyNo ratings yet

- Final Version Core Funding Template (2) CavanDocument2,392 pagesFinal Version Core Funding Template (2) CavanberniemcvNo ratings yet

- Accounting Standard (As) 22Document12 pagesAccounting Standard (As) 22Sahil GangwaniNo ratings yet

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment Formokatakyie1990No ratings yet

- 8024 Topper 21 101 503 551 10614 Adjustments in Preparation of Financial Statements Up201905031252 1556868156 99Document11 pages8024 Topper 21 101 503 551 10614 Adjustments in Preparation of Financial Statements Up201905031252 1556868156 99jency.ijaNo ratings yet

- SK-PST FormDocument1 pageSK-PST FormOsama JavaidNo ratings yet

- New Features in Tally 9: Release 1.0Document4 pagesNew Features in Tally 9: Release 1.0rishikesh08100% (2)

- Accounting Standard - 22Document25 pagesAccounting Standard - 22themeditator100% (1)

- Pewofozo LubukejonexDocument2 pagesPewofozo LubukejonexAsjsjsjsNo ratings yet

- Continue: TSRTC Student Bus Pass Application Form PDFDocument3 pagesContinue: TSRTC Student Bus Pass Application Form PDFAsjsjsjsNo ratings yet

- Last First Middle InitialDocument3 pagesLast First Middle InitialAsjsjsjsNo ratings yet

- Nanak Institutions: Bus Pass Application FormDocument2 pagesNanak Institutions: Bus Pass Application FormAsjsjsjsNo ratings yet

- The Following Rates Will Come in Force From 16/09/2015:: Bus Pass Scheme in DetailDocument13 pagesThe Following Rates Will Come in Force From 16/09/2015:: Bus Pass Scheme in DetailAsjsjsjsNo ratings yet

- Ch. Bansi Lal University, Bhiwani: Bus Pass Application FormDocument1 pageCh. Bansi Lal University, Bhiwani: Bus Pass Application FormAsjsjsjsNo ratings yet

- Application For Issue of Bus Passes To Physically ChallengedDocument6 pagesApplication For Issue of Bus Passes To Physically ChallengedAsjsjsjsNo ratings yet

- ContinueDocument2 pagesContinueAsjsjsjsNo ratings yet

- Route 10 Public Bus Timetable Casuarina To DarwinDocument2 pagesRoute 10 Public Bus Timetable Casuarina To DarwinAsjsjsjsNo ratings yet

- Overview of Transit VehiclesDocument3 pagesOverview of Transit VehiclesAsjsjsjsNo ratings yet

- Social Distancing Advisory by M Oh FWDocument2 pagesSocial Distancing Advisory by M Oh FWAsjsjsjsNo ratings yet

- CSCI 4717/5717 Computer Architecture Buses - Common CharacteristicsDocument9 pagesCSCI 4717/5717 Computer Architecture Buses - Common CharacteristicsAsjsjsjsNo ratings yet

- Bermuda Bus ScheduleDocument2 pagesBermuda Bus ScheduleAsjsjsjsNo ratings yet

- Hyderabad Region Contact Numbers of Cargo & Parcel Services: Sno Depot Name of The Bus Station Alotted To Alloted MobileDocument1 pageHyderabad Region Contact Numbers of Cargo & Parcel Services: Sno Depot Name of The Bus Station Alotted To Alloted MobileAsjsjsjsNo ratings yet

- IRS Tax Transcript Online Request: "Get Transcript by MAIL."Document3 pagesIRS Tax Transcript Online Request: "Get Transcript by MAIL."AsjsjsjsNo ratings yet

- AIS-052 (Revision 1) :2008 Code of Practice For Bus Body Design and ApprovalDocument162 pagesAIS-052 (Revision 1) :2008 Code of Practice For Bus Body Design and ApprovalAsjsjsjsNo ratings yet

- Route Direction To IITH PERMANENT Campus With Public Transport InfoDocument2 pagesRoute Direction To IITH PERMANENT Campus With Public Transport InfoAsjsjsjsNo ratings yet

- Unit 29 Airport: StructureDocument8 pagesUnit 29 Airport: StructureAsjsjsjsNo ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- Form PAR 101 Virginia Power of Attorney and Declaration of RepresentativeDocument4 pagesForm PAR 101 Virginia Power of Attorney and Declaration of RepresentativeAsjsjsjsNo ratings yet

- What Is A Tax Return Transcript?Document2 pagesWhat Is A Tax Return Transcript?AsjsjsjsNo ratings yet

- Request For Photocopy of Missouri Income Tax Return or Property Tax Credit ClaimDocument1 pageRequest For Photocopy of Missouri Income Tax Return or Property Tax Credit ClaimAsjsjsjsNo ratings yet

- Authorization For Release of Photocopies of Tax Returns And/or Tax InformationDocument2 pagesAuthorization For Release of Photocopies of Tax Returns And/or Tax InformationAsjsjsjsNo ratings yet

- Request For Copy of Tax Return or Tax Account Information/Transcript SC4506Document2 pagesRequest For Copy of Tax Return or Tax Account Information/Transcript SC4506AsjsjsjsNo ratings yet

- Calcutta TelephonesDocument3 pagesCalcutta TelephonessudipNo ratings yet

- Applied Economics: Module No. 5: Week 5: First QuarterDocument9 pagesApplied Economics: Module No. 5: Week 5: First QuarterhiNo ratings yet

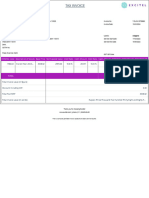

- publicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287Document1 pagepublicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287firoze pkNo ratings yet

- Interview PresentationDocument2 pagesInterview PresentationellyNo ratings yet

- Internship ReportDocument39 pagesInternship Reportjainshreyash42No ratings yet

- DocumentDocument3 pagesDocumentSSALI PETERNo ratings yet

- VinfastDocument2 pagesVinfastHà Thanh NguyễnNo ratings yet

- Barangay Appropriation OrdinanceDocument5 pagesBarangay Appropriation OrdinanceArman BentainNo ratings yet

- Excitel - ProcareDocument1 pageExcitel - Procareaviraj kalraNo ratings yet

- Order #2509903782 On Jun 18, 2022Document2 pagesOrder #2509903782 On Jun 18, 2022Xavior Esparza (R.)No ratings yet

- Introduction To Microeconomics: Professor Henry FarberDocument6 pagesIntroduction To Microeconomics: Professor Henry FarberNsimbi frankNo ratings yet

- Ajmer Vidyut Vitran Nigam LTDDocument1 pageAjmer Vidyut Vitran Nigam LTDgovt job postgyyNo ratings yet

- Hillsborough County Real Estate A0214340000 2020 Annual BillDocument1 pageHillsborough County Real Estate A0214340000 2020 Annual BillFaro farakNo ratings yet

- Quantitative Ability Handout: (Percentages, Profit and Loss - I)Document2 pagesQuantitative Ability Handout: (Percentages, Profit and Loss - I)Mark LucasNo ratings yet

- What Are Tariffs and Non TariffsDocument4 pagesWhat Are Tariffs and Non TariffsRonalie SustuedoNo ratings yet

- Nayatel BillDocument1 pageNayatel Billnr pakiNo ratings yet

- 3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065Document2 pages3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065AnilNo ratings yet

- IBE - 4 FinalDocument56 pagesIBE - 4 FinalMahima SinghNo ratings yet

- Your Vi Bill: Mr. Sarangapani KallyamoorthyDocument9 pagesYour Vi Bill: Mr. Sarangapani KallyamoorthySarangapani KaliyamoorthyNo ratings yet

- Taxation Challenges For Bangladesh: Sams Uddin AhmedDocument9 pagesTaxation Challenges For Bangladesh: Sams Uddin AhmedNusrat ShatyNo ratings yet

- DownloadDocument7 pagesDownloadRhen CarlonNo ratings yet

- MayaCredit SoA 2023MARDocument2 pagesMayaCredit SoA 2023MARJan SaysonNo ratings yet

- University of Management and Technology Quotation Master Paints 01-08-2023Document2 pagesUniversity of Management and Technology Quotation Master Paints 01-08-2023usman khanNo ratings yet

- GST Notes For Sem 4Document7 pagesGST Notes For Sem 4prakhar100% (2)

- Arakkonam Municipality - Draft Final ReportDocument249 pagesArakkonam Municipality - Draft Final ReporttitukuttyNo ratings yet

- Midterm Practice Questions SolutionsDocument5 pagesMidterm Practice Questions SolutionsRazeq AziziNo ratings yet

- Tolentino V Secretary of Finance DigestDocument2 pagesTolentino V Secretary of Finance DigestTimothy Joel CabreraNo ratings yet

- GSRTCDocument1 pageGSRTCvickysatiNo ratings yet

- Philippine Airlines - ReservationDocument7 pagesPhilippine Airlines - ReservationJohn Mark DosejoNo ratings yet

- My BookingDocument3 pagesMy Bookingshahid2opuNo ratings yet