Professional Documents

Culture Documents

Auab D2 S3

Auab D2 S3

Uploaded by

liamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auab D2 S3

Auab D2 S3

Uploaded by

liamCopyright:

Available Formats

Australian Accounting and Bookkeeping

Section 3 Prepare and Process Payroll

Conduct payroll preparation within designated

timelines in accordance with organisational

policy and procedures

The preparation of payroll must be completed within designated

timeline. Payroll must be calculated, submitted for approval, and lodged

so that employees receive their pay at the agreed time.Under most

circumstances the pay week, the period used to calculate wages,

finishes two to three days before the actual pay day. This allows

sufficient time for processing.

For example, if pay day is Thursday, the pay week finishes on Tuesday

so the payroll staff can process the pay on Wednesday before paying on

Thursday. This is particularly important for pays that are paid directly

into the employee’s bank account; actual bank to bank processing can

take 24 hours after the payroll file is uploaded to the organisation’s

bank. If the employees are paid cash or cheque they can be paid

immediately after processing is finished.

Payroll preparation starts with the collection and checking of employee time

sheets. In most cases, the employee’s supervisor or manager is responsible

for checking the time sheet. The time sheet is checked to see the correct

number of hours worked is entered, any special items such as sick or annual

leave claimed as appropriate, and any allowances or deductions such as

meal or travel allowance are legitimate.

Once the time sheets are authorised they are forwarded to the person

responsible for payroll processing. Each employee’s payroll is processed,

calculating the amount earned by establishing the gross pay, adding

allowances and processing deductions, and working out tax withholding

to arrive at each employee’s net pay.

Additional processing, such as superannuation guarantee, can be processed at

this stage. Superannuation guarantee is a mandated employer contribution to

an approved superannuation fund on behalf of an employee. The minimum

contribution is 9.5% of an employee’s ordinary time earnings.

Once the net pay has been established, the bank file can be created,

cheques written, or cash required analysed; depending on the method

used to pay employees.

Given the sensitivity of payroll preparation, and its importance in

maintaining good employer/employee relationships, many organisations

have a payroll policy and supporting procedures to ensure its completion

within designated time frames.

Learning Guide V1.0 © AAMC Training Group 21

Australian Accounting and Bookkeeping

Policies, procedures, and codes of practice

Companies all have standards or expectations with regard to the work

done by employees. These are generally documented in the form of Key

Performance Indicators (KPIs). Employees must know what work

standards are expected of them and should be involved in setting and

agreeing upon KPIs. KPIs are then used to measure and evaluate

employee performance. Performance reviews should then be utilised to

give employees formal feedback and to address any performance issues

that might occur.

Critical standards that need to be met by employees are honesty,

efficiency, effectiveness, accuracy, and high levels of customer service.

These standards are essential for an employee within the financial services

industry, as they provide the foundations upon which the business grows.

They are a part of the strategic and operational success of the business.

Thus, in order to work effectively and to work toward the achievement

of organisational goals, all employees must understand and implement

organisational procedures and policies related to workplace performance

appropriately.

Policy

A policy is a statement of agreed intent that clearly and unequivocally

describes an organisation’s views with respect to a particular matter. It

describes the principles that provide the direction for the organisation.

It is a set of principles or rules that provide a definite direction for an

organisation and embraces the general goals and acceptable procedures

in its area of influence. Policies assist in defining what must be done wen

particular events occur.

Policies are the rules that can be referred to as a means of maintaining

order, security, consistency, or practices for successfully furthering a goal or

mission. For example, an organisation might have a policy in place that deals

with suppliers when an error is made on invoices. Then, each time that

situation arose, staff members could refer to the policy rather than have to

make decisions based on the circumstances of the individual cases.

Policies are necessary so that people working in the organisation can have a

framework for actions that helps them perform their jobs in the way that is

expected by their employer. It alleviates the problem of people having to

discuss and resolve issues each time a situation arises. The policy provides

the decision-making process and the actions that can be applied in many

cases and as a consequence has efficiency benefits.

For every policy established, an organisation will need to create and

document supporting procedures.

Learning Guide V1.0 © AAMC Training Group 22

Australian Accounting and Bookkeeping

Procedure

A procedure is a clear step-by-step method for implementing an

organisation’s policy or responsibility. A procedure describes a logical

sequence of activities or processes that are to be followed to complete a

task or function in a correct and consistent manner. It can be a manner of

processing; a way of performing or effecting something or it can be a series

of specific steps to be taken to accomplish a given result or product.

Policies and procedures are usually compiled together to form a manual. A

Policy and Procedures Manual is a compilation of the written records of the

agreed policies and practices of an organisation. The manual should be

maintained in a loose leaf file system so that it can be updated and added

to as policies and practices are reviewed and amended. The manual should

be regularly reviewed and each policy and procedure should have a review

date. The manual should readily be available to all staff.

The accounts section of a business will have clearly documented

procedures outlining and detailing the steps and the specific instructions

that are required before an account payable invoice for example can be

cleared for payment.

Industry codes of practice

Industry codes of practice provide documented guidance and advise on

how to achieve predetermined minimum industry standards and

legislative compliance. They are usually developed in consultation with

representatives from industry, worker and employers, special interest

groups and government agencies. Whilst a code of practice is not law

and does not have the same legal enforcement as legislation, it should

be adhered to unless there is an alternative course of action that

achieved the same or better standards.

Company codes of practice

An organisation’s codes of practice will vary according to your particular

workplace. The code is a document that tells the reader what the

service/organisation undertakes to do. Codes reflect the beliefs, or

philosophy if the service/organisation. They tell the workers and clients

what the service values are and what actors need to be taken procedures

describe the steps that need to be taken to make the codes work.

Written codes of practice are a clear, concise set of guidelines outlining

how that service/organisation intends to operate. They tell employees

what management expects will happen in certain situations to support

the service’s mission/philosophy. The codes state what practices should

be implemented so that work is done efficiently and consistently.

Written codes should be available for all employees to access readily so

that if they are unsure of how to act, they can consult the code.

Learning Guide V1.0 © AAMC Training Group 23

Australian Accounting and Bookkeeping

Codes are like policies and are developed to help you in several ways:

• Hurried or spur-of-the-moment decisions are more likely to be avoided

• Actions are guided so employee stress is lessened

• Consistency in the way things are done by everyone on staff is increased

• Consistency in duties is carried on even though staff might leave

• Decisions can be made without consulting everyone else

Generally, they can help the staff team by:

• Empowering individuals who are able to make decisions with confidence

as they are based on written documentation

• Protecting staff who make decisions and act on established policies

• Helping teamwork and cooperation by collectively establishing common

goals, procedures and understanding

Good codes of practice that are practical, clear and relevant can support a

company to work efficiently and reflect the professional code of ethics.

Calculate, record and reconcile employee in

accordance with legislative requirements

In addition to normal wages or salary, employees receive special employee

entitlements such as leave. Employee entitlements vary, depending on

industry, but are usually set by an award or workplace agreement. Awards

and workplace agreements are underpinned by the National Employment

Standards (NES). Employee entitlements include:

Annual leave

In most cases, permanent employees receive four weeks annual leave

for each year of service. Organisations encourage employees to take

leave in the year it is accumulated, or as soon as possible thereafter.

This reduces the organisation’s leave liability (the amount of

accumulated annual leave owed to employees) and helps ensure the

employee’s continued health and wellbeing.

Under some awards and agreements, annual leave attracts a 17.5% annual

leave loading. If the employee receives annual leave loading, the tax table

used to calculate tax on earnings has different withholding amounts for

those who receive annual leave loading and those who do not.

Learning Guide V1.0 © AAMC Training Group 24

Australian Accounting and Bookkeeping

Long service leave

Long service leave is available to employees who have been employed

for a significant period. In general, employees who have been employed

for 10 years are entitled to two months long service leave, while those

employed for 15 years have accumulated 13 weeks.

Under some awards, pro-rata long service leave is owed to employees

who cease employment after more than seven years’ service.

Parental leave

Expectant mothers can claim up to 12 months unpaid leave commencing

six weeks before the due date. Expectant fathers can claim 12 months

unpaid leave from the actual birth date. Normally the expectant parent

must have been employed for a minimum of 12 months before they can

claim parental leave. Employees who claim parental leave are protected

from losing other entitlements while on parental leave. Some awards

and workplace agreements provide for paid parental leave.

The Australian Government introduced a paid parental leave scheme in

January 2011. Under the scheme employers are provided with funds to

make payments to eligible employees for a maximum of 18 weeks. This

scheme is in addition to other liabilities for parental leave under the

relevant award or agreement.

Sick leave

Awards and workplace agreements cater for sick leave for permanent

employees. The arrangements vary but typically cater for up to 10 days

per year. Unused sick leave generally can be accumulated. In some

cases, a number of non-continuous days can be claimed without a

doctor’s certificate.

Study leave

Study leave, paid or unpaid, can be granted to individual employees who

enrol in an approved program. Study leave is normally subject to an

agreement between the employer and employee.

Workers compensation

All workers are covered by workers compensation, a scheme that means

there is no loss of income for an injury sustained while at work.

Employers are generally required to be members of a complying workers

compensation scheme, although some government agencies are exempt

under the scheme and are self-insured.

Employee entitlements place an extra burden on the payroll processing

staff in extra recording and reporting.

Learning Guide V1.0 © AAMC Training Group 25

Australian Accounting and Bookkeeping

Annual leave and sick leave needs to be monitored, both in the

accumulation and claiming. In computerised systems sick and annual

leave entitlements are automatically incremented each pay period.

Manual systems are harder to maintain. Traditionally, leave entitlements

were granted on employment anniversaries but the expectation now is

for entitlements to be calculated each pay period.

One method of calculating sick or carer’s leave is to divide the number of

hours worked by 26. For example, if an employee works 38 hours per week

they will also accumulate 1.46 hours sick leave if they receive 10 days sick

leave per annum. This can be calculated and added to a sick leave accrual

account for the employee, or calculated when leave is taken, in most cases,

an accrual for each employee is the easiest to maintain.

Similarly, annual leave (assuming the employee receives four weeks

annual leave per year) can be calculated by dividing the hours worked

by 13. For example, for each 38 hours worked, 2.92 hours of annual

leave can be added to the leave accrual for the employee.

A spreadsheet is a good method for managing leave if a manual payroll

system is used. It is vital to maintain back-ups of any tool used to maintain

leave, especially if the accrual amount is not shown on each pay advice.

The Fair Work Ombudsman provides several recordkeeping templates on

its website.

An example of a template used to track annual leave, including leave accrual:

Leave accrual Details of leave taken

Leave taken Amount paid Leave

Hours

Date Amount Date balance

accrued From To

paid paid

12/05/15 2.92 140.16

19/05/15 2.92 143.08

26/05/15 2.92 20/05/15 25/5/15 875.00 26/05/15 108.00

2/06/15 2.92 110.92

9/06/15 2.92 113.84

(Adapted from www.fairwork.gov.au)

Recordkeeping

The ATO expects employers to keep the following records regarding

payments to employees:

• Tax file number declarations and withholding declarations

• Withholding variation notices

• Worker payment records

• PAYG payment summaries annual reports superannuation records

• Records of fringe benefits provided

Learning Guide V1.0 © AAMC Training Group 26

Australian Accounting and Bookkeeping

The Department of Families, Housing, Community Services, and Indigenous

Affairs expects employers to keep written records of amounts received and

paid to employees under the Paid Parental leave scheme. The Australian

Government Child Support Agency expects the employer to keep

appropriate records of child support payments deducted and remitted.

Legislative requirements

There are many aspects of legislative requirements that apply to

organisations in relation to payroll. Most organisations expect staff

involved in payroll functions to be conversant with such legislation. The

following concepts are legislations relating to payroll.

ATO regulations cover Australian Business Number (ABN),

employment declarations, and TFN declarations. The ABN is a unique 11

digit identifier which:

• Enables an organisation to claim Good and Services Tax (GST) credits

• Enables an organisation to claim fuel tax credits it qualifies for

• If not quoted to businesses an organisation deals with, may result in

amounts being withheld from payments under pay as you go (PAYG)

withholding

• Allows businesses to easily confirm details for ordering and invoicing

If an organisation has a GST turnover of $75000 or more (or $150000

or more for not-for-profit entities) it must register for GST and will need

an ABN to do this. If an organisation has a lower GST turnover

registration is optional.

Regulations relating to Business Activity Statement (BAS) agents

(anyone who provides a business activity statement service for a fee or

other reward) are required to comply with the Tax Practitioners Board

(TPB) including registration and adherence to the Code of Professional

Conduct. The Code of Professional Conduct is a legislated code that

sets out the professional and ethical standards required of registered tax

agents and BAS agents. It outlines the duties that agents owe to their

clients, the TPB and other agents. The Code consists of a list of 14 core

principles which are grouped into five categories:

Honesty and integrity

• You must act honestly and with integrity.

• You must comply with the taxation laws in the conduct of your personal

affairs.

• If you receive money or other property from or on behalf of a client and

you hold the money or other property on trust you must account to your

client for the money or other property.

Learning Guide V1.0 © AAMC Training Group 27

Australian Accounting and Bookkeeping

Independence

• You must act lawfully in the best interests of your client.

• You must have in place adequate arrangements to manage conflicts of

interest that may arise in relation to the activities that you might

undertake in the capacity of a registered tax agent or BAS agent.

Confidentiality

• Unless you have a legal duty to do so, you must not disclose any information

relating to a client’s affairs to a third party without client’s permission.

Competence

• You must ensure that a tax agent service you provide, or that is provided

on your behalf, is provided competently.

• You must maintain knowledge and skills relevant to the tax agent

services that you provide.

• You must take reasonable care in ascertaining a client’s state of affairs, to the

extent that ascertaining the state if those affairs is relevant to a statement you

are making or an activity you are undertaking on behalf of the client.

• You must take reasonable care to ensure that taxation laws are applied

correctly to the circumstances in relation to which you are providing

advice to a client.

Other responsibilities

• You must not knowingly obstruct the proper administration of the

taxation laws.

• You must advise your client of their rights and obligations under the taxation

laws that are materially related to the tax agent services you provide.

• You must maintain the professional indemnity insurance that the Board

requires you to maintain.

• You must respond to requests and directions from the Board in a timely,

responsible and reasonable manner.

Reconcile total payments for pay period, and

review and correct irregularities or refer them

to designated persons for resolution

Payments relating to payroll need to be checked and posted to the

accounting system.

The Chart of Accounts should include accounts related to employment,

such as wages and withholding liability.

Learning Guide V1.0 © AAMC Training Group 28

Australian Accounting and Bookkeeping

Simple Chart of Accounts:

Assets (1000-1999)

1000-Cash in Banks The Chart of Accounts shown

has child accounts under

1010-Petty Cash Fund

salaries and wages for different

1020-Accounts Receivable

areas within the organisation,

1030-Inventory allowing wage costs to be more

1040-Materials and Supplies closely monitored. Each

1210-Land organisation will have its own

1220-Buildings Chart of Accounts, designed to

1230-Tools and Equipment capture costs based on its own

1240-Vehicles requirements.

1250-Furniture and Fixtures

Liabilities (2000-2999)

2010-Accounts Payable

2020-GST Payable

2030-PAYG Payable

2110-Miscellaneous Accruals

Capital Accounts (3000-3999)

3010-Owner Equity

Sales (Revenue) Accounts (4000-4999)

4010-Retail Sales

4020-Wholesale Sales

4030-Sales-Service

Cost of Sales (5000-5999)

5010-Cost of Goods Sold

Expenses (6000-6999)

6010-Salaries and Wages

6011-Production Wages

6012-Administration Wages

6013-Sundry Wages

6014-Maintenance Wages

6020-Contract Labour

6030-Power

6040-Telephone

6050-Rent

6060-Office Supplies

6070-Postage

6080-Maintenance Expense

6090-Insurance

6100-Interest

6110-Depreciation

6120-Travel Expense

6130-Advertising

Posting payroll to the accounting system

Payroll payments can be posted to the Payroll Journal. A Payroll

Journal is a special journal that groups and records payroll transactions.

It keeps all payroll transactions in one place and saves time when

summarising payroll activity. It also means less frequent posting to the

General Ledger because only period totals need to be entered.

Learning Guide V1.0 © AAMC Training Group 29

Australian Accounting and Bookkeeping

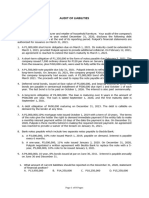

Payroll Journal

Payroll distribution to General Ledger Accounts

6011 6012 6013 6014 2030 1000

Employee Date Cheque

(Dr) (Dr) (Dr) (Dr) (Cr) (Cr)

B Smith 19/05/15 950.00 171.00 779.00 235987

R Brown 19/05/15 950.00 171.00 779.00 235688

P Green 19/05/15 550.00 61.00 489.00 235689

M White 19/05/15 250.00 400.00 104.00 546.00 235690

T Green 19/05/15 950.00 171.00 779.00 235691

R Jones 19/05/15 750.00 200.00 171.00 779.00 235692

19/05/15 3450.00 950.00 400.00 200.00 849.00 4151.00

Post Ref PJ-05-15 ok ok ok ok ok ok

The total wages can be reconciled against the amount credited to the PAYG payable account

and the cash at bank account. In this example, a cheque has been used to pay each employee

and the details recorded. The example applies equally for cash payments and direct credit to

bank account, except a single cheque or transaction will apply.

A posting reference shows the Payroll Journal has been summarised and posted to the General

Ledger. If an irregularity cannot be resolved it should be referred to the immediate supervisor or

other person with authority over payroll matters.

Obtain authorisation of payroll and individual pay advice in

accordance with organisational requirements

Payments can be made to employees by cash, cheque, or electronic funds transfer to the

employee’s bank account.

If payment is by a method other than cash, that is cheque or funds transfer, it must be agreed

before payment is made. Under some awards and agreements, employees who are paid by cheque

are given time during the working hours to cash or deposit the cheque.

Cash payroll, particular in large organisations, poses a serious security threat. Under these

circumstances, it is usual to outsource the preparation and delivery of pay packets to security

firms. Payment to employees can then be made from a secure environment, including an

armoured vehicle.

Cheques are becoming increasingly less common. Cheques provide a relatively secure method of

payment but are inconvenient and subject to bank charges and government stamp duty, making

them expensive. Employees do not like cheque payments because they have to take the cheque to

the bank and wait for the cheque to clear before they can draw on the cheque’s proceeds.

Learning Guide V1.0 © AAMC Training Group 30

Australian Accounting and Bookkeeping

Electronic funds transfer is now the most popular way to pay employees.

Electronic funds transfer is easy for the employer organisation to

manage, relatively inexpensive (depending on the organisation’s

arrangements with its bank), quick, and secure. Employees like

electronic transfer because their wages are available immediately after

the transfer is complete.

In some cases, there can be 24 hours delay between the organisation’s

bank processing the wages file supplied by the employer and the funds

being received by the employee’s bank. This depends on the bank used by

each, although banks have worked to reduce the problem. If both employer

and employee use the same bank, the transaction can be instantaneous.

Electronic funds transfer is heavily reliant on the bank’s computer and

communication systems, including the internet. Should either fail, it can

deny employees access to their funds.

Make arrangements for payments in accordance

with organisational and legislative requirements

Payroll should be authorised by the appropriate person in the

organisation before payment is made to employees in accordance with

organisational requirements. Authorising is necessary as it is with any

expense to maintain a clear audit trail.

An important facet of the payroll process is the production and issuing of

pay slips to employees. This can be incorporated in the authorisation

process; a person with the appropriate authority can check each pay slip,

verifying details before signing off (indicating the pay details are correct).

Under the Workplace Relations Act and the Workplace Relations

Regulations, employers must include the following information on an

employee’s pay slip:

• The name of the employer and employee

• The date (e.g. 5/04/15) and the period of payment (e.g. 22/03/15 to

4/04/15)

• The gross and net amounts of payment

• Any deductions made, including the amount and purpose of the

deduction and the name and number of the fund or account into which

the deductions were paid

• Any allowances, bonuses, incentive-based payments or other separately

identifiable entitlements paid

• For employees paid an hourly rate-the ordinary hourly rate of pay, number

of hours worked at that rate and the amount of payment at that rate

• For employees paid at an annual rate-the rate as at the latest date to

which the payment relates

Learning Guide V1.0 © AAMC Training Group 31

Australian Accounting and Bookkeeping

• Any overtime or penalty rates paid (e.g. weekend work), or loadings

(e.g. shift work)

• If employers are required to make superannuation contributions for the

benefit of the employee (excluding those made to defined benefits

superannuation funds):

– The amount of each superannuation contribution the employer makes or

is liable to make during the period to which the pay slip relates

– The name of the superannuation fund

Employers must issue a written payslip (either electronic or on paper) to

each employee within one day of the payment of wages. If electronic

pay slips are issued to employees, they must comply with the same

requirements as for paper pay slips. Pay slips issued for the purposes of

satisfying time and wages recordkeeping obligations must be kept for at

least seven years.

XYZ com ABN xxx xxx xxx

Pay slip

Employee:

Date:

Period: to

Ordinary rate: Salary:

Employer superannuation:

Fund: Amount:

Earnings and allowance:

description hours rate

Ordinary time

Overtime

Overtime 1 ½

Overtime 2

Shift or other loading

Bonus

Other payments

Gross payment:

Deductions

Taxation

Other deductions

Total deductions

Net payment

Produce, review and store payroll records in

accordance with organisational policy and

security procedures

One advantage of a computerised system over a manual payroll system

is the ability of a computerised system to generate reports that can be

used to summarise and check payroll functions. Employers are required

to keep accurate and complete payroll records for all their employees,

including time worked and wages paid, in addition to issuing pay slips to

their employees. Much of the information an employer is required to

keep is that provided on pay slips.

Learning Guide V1.0 © AAMC Training Group 32

Australian Accounting and Bookkeeping

Employee records must be in a form that is readily accessible to a Fair

Work Inspector. The records must be in a legible form and in English,

plain simple English is preferred. The records must not be altered unless

correcting a mistake and not be false or misleading to the employer’s

knowledge. Records must be kept for seven years.

Employee records should be treated in confidence. They can only be

accessed by the employer, the employee, or authorised payroll staff.

Employers are obligated to make copies of payroll records available to

an employee or former employee.

Fair Work Inspectors and other authorised inspectors (such as from a

trade union) can access employees records to determine if there has

been a contravention of relevant workplace legislation.

Under the Fair Work Act and Regulations the following records should be kept:

• General employment records

• Pay records

• Hours of work records

• Leave records

• Superannuation guarantee contribution records

• Individual flexibility arrangement records

• Guarantee of annual earnings records

• Termination records

• Transfer of business records

Where there has been a transfer of business, under the Act, the old

employer is required to transfer the records pertaining to a transferring

employee to the new employer.

Payroll records must be kept in a secure environment. Computer systems

used to store payroll should be password protected so only authorised

employees can access payroll records. Manual payroll or accounting

records should be stored in a secure cabinet. It is a good idea to keep the

payroll department separate (if possible) and locked if unattended.

Manual systems rely on information stored in journals to provide payroll

records. The employer accesses employee details, such as the tax file

number declaration forms, from the filing system. The employee file,

along with the relevant payroll journal, forms the basis of payroll

records in a manual system.

Computerised systems offer greater flexibility. Reports can be generated

providing details about certain aspects of payroll, such as PAYG liability,

SAG (superannuation guarantee) liability, leave taken, leave accrued

etc. These reports can be produced on demand.

Learning Guide V1.0 © AAMC Training Group 33

You might also like

- (2004) Supplier Management Handbook - James L. BossertDocument308 pages(2004) Supplier Management Handbook - James L. BossertPavel Collado100% (2)

- AC7108 Rev. F - Audit Criteria For Chemical ProcessingDocument74 pagesAC7108 Rev. F - Audit Criteria For Chemical ProcessingfdsbdfsbhdgndsnNo ratings yet

- Control ActivitiesDocument2 pagesControl ActivitiesKrystalle Marie Mag-asoNo ratings yet

- Procedural Manual PolicyDocument10 pagesProcedural Manual PolicyAARON JOHN TAHANLANGITNo ratings yet

- 3.3 Ifraz Mohammed - 20231449 - BABHRM611 - Section 2 - Develop Performance Management ProgrammeDocument11 pages3.3 Ifraz Mohammed - 20231449 - BABHRM611 - Section 2 - Develop Performance Management ProgrammeIfraz MohammadNo ratings yet

- Module 5 HRDocument23 pagesModule 5 HRmarlize viviersNo ratings yet

- Guide To Developing HR Policies and Procedures: Research Report Number 4489Document43 pagesGuide To Developing HR Policies and Procedures: Research Report Number 4489MD IMRAN RAJMOHMADNo ratings yet

- Topic 10 Policies and Procedures in Security ManagementDocument17 pagesTopic 10 Policies and Procedures in Security Managementgonzalo Bravo-Mejia BurneoNo ratings yet

- Policies and ProceduresDocument14 pagesPolicies and Proceduresarshana arunasalamNo ratings yet

- HR Audit-1Document24 pagesHR Audit-1Shreya VermaNo ratings yet

- Integrity Spotlight Policy Framework Folder 14.12.22Document6 pagesIntegrity Spotlight Policy Framework Folder 14.12.22AshNo ratings yet

- BSBMGT502 MANAGE PEOPLE PERFORMANCE Formative Assessment 2Document7 pagesBSBMGT502 MANAGE PEOPLE PERFORMANCE Formative Assessment 2Usman KhanNo ratings yet

- Strategic Management UNIT 2 NotesDocument23 pagesStrategic Management UNIT 2 NotesLucky SrivastavaNo ratings yet

- How To Write Policies and Procedures: Page - 1Document23 pagesHow To Write Policies and Procedures: Page - 1tarrteaNo ratings yet

- Accounting PolicyDocument19 pagesAccounting PolicySayali shenkarNo ratings yet

- My Love My Wife My EverythingDocument3 pagesMy Love My Wife My EverythingKatherine Key BullagayNo ratings yet

- BusinessLogic (Lesson4)Document3 pagesBusinessLogic (Lesson4)Micca CalingaNo ratings yet

- Policy & ProcedureDocument10 pagesPolicy & ProcedureaminlarghNo ratings yet

- Applying Method For Performance Review in Enhancing Employees' EffectivenessDocument6 pagesApplying Method For Performance Review in Enhancing Employees' EffectivenessCarla Jane ApolinarioNo ratings yet

- Accounts Payable Guide Improving Your Processes Tips For Leaders, Managers, Supervisors and Accounts Payable ClerksDocument26 pagesAccounts Payable Guide Improving Your Processes Tips For Leaders, Managers, Supervisors and Accounts Payable ClerksEwinetimNo ratings yet

- Policies, Processes, ProceduresDocument2 pagesPolicies, Processes, ProceduresAlex DcostaNo ratings yet

- What Are Policies and Procedures?: PolicyDocument5 pagesWhat Are Policies and Procedures?: PolicyA Home of GoodvibersNo ratings yet

- What Is An Employee HandbookDocument4 pagesWhat Is An Employee HandbookRazman RuzaimiNo ratings yet

- BSBCOM503 Assessment Task 3Document6 pagesBSBCOM503 Assessment Task 3Kathleen Kaye CastilloNo ratings yet

- EthicsDocument8 pagesEthicsAkera Norbert DiwanyNo ratings yet

- Product Checklist - IsO 45001Document2 pagesProduct Checklist - IsO 45001Muhammad FahimNo ratings yet

- Human Resource Management Assignment: Group 1 - EPGDIB HybridDocument24 pagesHuman Resource Management Assignment: Group 1 - EPGDIB HybridAnshu SharmaNo ratings yet

- Revision Notes V2Document23 pagesRevision Notes V2Vineela Srinidhi DantuNo ratings yet

- BSBHRM602 Manage Human Resources Strategic PlanningDocument35 pagesBSBHRM602 Manage Human Resources Strategic PlanningJoanne Navarro AlmeriaNo ratings yet

- BSBWHS605 - Handouts and NotesDocument51 pagesBSBWHS605 - Handouts and NotesAnaya Ranta100% (1)

- Management's Responsibility For Internal ControlDocument18 pagesManagement's Responsibility For Internal ControlVidya IntaniNo ratings yet

- Mohinder Singh Mcs Term PaperDocument19 pagesMohinder Singh Mcs Term PapersaggooNo ratings yet

- Administrative Manager Job DescriptionDocument4 pagesAdministrative Manager Job DescriptionVikas Baloda100% (1)

- BSBSMB406 Manage Small BusinessesDocument14 pagesBSBSMB406 Manage Small BusinessesIbsen Hanoj StockmannNo ratings yet

- Personnel Policies and Practices in Early ChildhoodDocument8 pagesPersonnel Policies and Practices in Early ChildhoodcarechildNo ratings yet

- Approaching The 2013 Framework ImplementationDocument4 pagesApproaching The 2013 Framework ImplementationYaqy RozazkiNo ratings yet

- Performance Management and The Employee ExperienceDocument12 pagesPerformance Management and The Employee Experiencepremier writersNo ratings yet

- ASSIGNMENT I Management Acc. Unit - 1Document5 pagesASSIGNMENT I Management Acc. Unit - 1nikita bajpaiNo ratings yet

- Assigment QMSADocument3 pagesAssigment QMSAuya lyaaNo ratings yet

- BSBMGT502 - Assessment 1 - ICM0788Document20 pagesBSBMGT502 - Assessment 1 - ICM0788Anirbit GhoshNo ratings yet

- Planning Unit 6 ODMDocument25 pagesPlanning Unit 6 ODMMark Vincent Z. PadillaNo ratings yet

- Lesson 1,1Document3 pagesLesson 1,1Yvonne Joyce B. DelimaNo ratings yet

- BSBOPS502 Task 1 - Kevin ConwayDocument11 pagesBSBOPS502 Task 1 - Kevin ConwayBui AnNo ratings yet

- Assessment 1 Part A - Case Study/Practical: Your TaskDocument7 pagesAssessment 1 Part A - Case Study/Practical: Your TaskChriseth CruzNo ratings yet

- Procedure Manual PresentationDocument7 pagesProcedure Manual Presentationsamah.fathi3No ratings yet

- Steps Forward Practice Manager Job DescriptionDocument3 pagesSteps Forward Practice Manager Job DescriptiondawnNo ratings yet

- Answers of Assignment Questions of Compensation ManagementDocument16 pagesAnswers of Assignment Questions of Compensation ManagementBaqirZarNo ratings yet

- BSBOPS502 Task 1 - Jacob Lloyd JonesDocument10 pagesBSBOPS502 Task 1 - Jacob Lloyd JonesBui AnNo ratings yet

- Poc Process MergedDocument5 pagesPoc Process MergedKumar SaurabhNo ratings yet

- STCM 01IntroductiontoManagementAccountingDocument7 pagesSTCM 01IntroductiontoManagementAccountingdin matanguihanNo ratings yet

- MC0076 Set 2Document7 pagesMC0076 Set 2Ashay SawantNo ratings yet

- BBA Introduction To Management Ppt5Document15 pagesBBA Introduction To Management Ppt5Maryam AleemNo ratings yet

- LM RTW PolicyManagementDocument1 pageLM RTW PolicyManagementarsalannasir2013_119No ratings yet

- 7 Advantages of Having Effective Workplace Health and Safety Policies and ProceduresDocument3 pages7 Advantages of Having Effective Workplace Health and Safety Policies and ProceduresDOTO SHINDAINo ratings yet

- Module 1 Definition Characteristics and GuidanceDocument28 pagesModule 1 Definition Characteristics and GuidanceJerma Dela CruzNo ratings yet

- Control ProcessDocument2 pagesControl Processraymart copiarNo ratings yet

- Activities and Assignment 1-Regina Gulo PachoDocument3 pagesActivities and Assignment 1-Regina Gulo PachoAlthea RoqueNo ratings yet

- HR PoliciesDocument11 pagesHR Policiessimply_cooolNo ratings yet

- Industrial Attachment Log-Book: University of ZimbabweDocument40 pagesIndustrial Attachment Log-Book: University of ZimbabwePhebieon Mukwenha100% (2)

- 10 Control and Quality ManagementDocument6 pages10 Control and Quality ManagementPrince BudhaNo ratings yet

- DR Lee Performance MaintenanceDocument12 pagesDR Lee Performance MaintenanceBruce QaziNo ratings yet

- Accounting and Bookkeeping: CPD CourseDocument4 pagesAccounting and Bookkeeping: CPD CourseliamNo ratings yet

- Section 4 Handle Payroll EnquiriesDocument6 pagesSection 4 Handle Payroll EnquiriesliamNo ratings yet

- Section 1 Establish Payroll RequirementsDocument4 pagesSection 1 Establish Payroll RequirementsliamNo ratings yet

- Section 2 Business Structures: Sole TraderDocument36 pagesSection 2 Business Structures: Sole TraderliamNo ratings yet

- Section 3 Government Authorities: Australian Taxation Office (ATO)Document23 pagesSection 3 Government Authorities: Australian Taxation Office (ATO)liamNo ratings yet

- Section 4 Forms and Lodgment: Activity StatementsDocument40 pagesSection 4 Forms and Lodgment: Activity StatementsliamNo ratings yet

- Section 1 Australian Government Structure: CommonwealthDocument2 pagesSection 1 Australian Government Structure: CommonwealthliamNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- Australian Business Number (ABN)Document70 pagesAustralian Business Number (ABN)liamNo ratings yet

- Australian Company Number (Acn) Australian Registered Body Number (Arbn)Document8 pagesAustralian Company Number (Acn) Australian Registered Body Number (Arbn)liamNo ratings yet

- CDO Sked - Weekend MAY. 2023bATCHDocument2 pagesCDO Sked - Weekend MAY. 2023bATCHAnna FaqingerNo ratings yet

- NAIC ORSA ManualDocument10 pagesNAIC ORSA ManualGagan SawhneyNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingRitik GuptaNo ratings yet

- Book - Transfer Journal EntriesDocument3 pagesBook - Transfer Journal Entriesrose gabonNo ratings yet

- Industry ProfileDocument22 pagesIndustry ProfileVishnu Vichu0% (1)

- Variable CostsDocument4 pagesVariable CostsMaria G. BernardinoNo ratings yet

- Constitution and Rules of Kay Park Bowling Club July 2013Document16 pagesConstitution and Rules of Kay Park Bowling Club July 2013api-237672089100% (1)

- CIA Application FormDocument1 pageCIA Application Formaliyah123No ratings yet

- Chapter 3 Risk Assement & Internal ControlDocument54 pagesChapter 3 Risk Assement & Internal ControlRohit Kumar SantukaNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module 2"Document68 pagesFundamentals of Accountancy, Business and Management 1: Module 2"Erica AlbaoNo ratings yet

- Jones Resume FinalDocument2 pagesJones Resume Finalapi-350296755No ratings yet

- MPRA - Paper - 93726 Wells FargoDocument30 pagesMPRA - Paper - 93726 Wells Fargomichaelasobrevega03No ratings yet

- Deno Research PaperDocument21 pagesDeno Research PaperBrenda OgeroNo ratings yet

- UOL 2091 Financial Reporting Lecture NotesDocument97 pagesUOL 2091 Financial Reporting Lecture NotesDương DươngNo ratings yet

- The ESOP Exit StrategyDocument11 pagesThe ESOP Exit StrategybipppNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- Work Place Writing Cover LetterDocument3 pagesWork Place Writing Cover Letterapi-316372263No ratings yet

- FA Exam - ESSENTIALS PDFDocument1 pageFA Exam - ESSENTIALS PDFShah SujitNo ratings yet

- The Four Dimensions of Public Financial ManagementDocument9 pagesThe Four Dimensions of Public Financial ManagementInternational Consortium on Governmental Financial Management100% (2)

- M Com 2019-20Document28 pagesM Com 2019-20GopalNo ratings yet

- Iath PrelimDocument7 pagesIath PrelimMara LacsamanaNo ratings yet

- OUR REF: MS/C7304/66E: LL Applications Should Submit A Copy of CV/Resume and Below Listed Documents To This EmailDocument2 pagesOUR REF: MS/C7304/66E: LL Applications Should Submit A Copy of CV/Resume and Below Listed Documents To This EmailscribsunilNo ratings yet

- Risk Assessment & Statistical Sampling in AuditDocument21 pagesRisk Assessment & Statistical Sampling in Auditaymen marzoukiNo ratings yet

- Research Paper Forensic AccountingDocument7 pagesResearch Paper Forensic Accountingcamn1m2e100% (1)

- BSBCOM603 - Assessment TasksDocument12 pagesBSBCOM603 - Assessment TasksAnaya Ranta0% (8)

- (NBAA) The National Board of Accountants and Auditors TanzaniaDocument2 pages(NBAA) The National Board of Accountants and Auditors TanzaniaBin SaadunNo ratings yet

- Client Acceptance and Continuance: Good Practice GuidanceDocument42 pagesClient Acceptance and Continuance: Good Practice GuidanceJoHn CarLoNo ratings yet

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet