Professional Documents

Culture Documents

Partnership Liquidation - Question#5

Uploaded by

Ivy BautistaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Liquidation - Question#5

Uploaded by

Ivy BautistaCopyright:

Available Formats

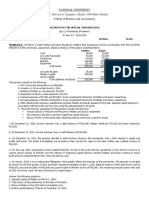

PARTNERSHIP LIQUIDATION

Q1. Larry. Marsha, and Natalie are partners in a company that is being liquidated. They

share profits and losses 55 percent, 20 percent, and 25 percent, respectively. When the

liquidation begins they have capital account balances of P108,000, P62,000, and

P56,000, respectively. The partnership just sold equipment with a historical cost and

accumulated depreciation of P25,000 and P18,000, respectively for P10,000. What is the

balance in Larry's capital account after the transaction is completed?

a. P106,350 c. P109,650

b. P108,000 d. P110,000

Answer: (c)

P108,000 + [P10,000 - (25,000 - P18,000)] (.55)

P108,000 + (P3,000) (.55)

P108,000 + (P1,650)

P109,650

Q2. Donald, Marion, and Jeff are liquidating their partnership. At the date the liquidation

begins Donald, Marion, and Jeff have capital account balances of P147,000, P260,000,

and P285,000, respectively and the partners share profits and losses 35%, 25%, and

40%, respectively. In addition, the partnership has a P28,000 Notes Payable to Donald

and a P15,000 Notes Receivable from Jeff. When the liquidation begins, what is the loss

absorption power with respect to Donald?

a. P 80,000 c. P420,000

b. P340,000 d. P500,000

Answer: (d)

(P147,000 + P28,000 ) / (.35)

(P175,000) / (.35)

P500,000

Partnership Liquidation | ©jipb162021

You might also like

- p2 PreweekDocument19 pagesp2 PreweekYaj Cruzada100% (1)

- Assignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachDocument5 pagesAssignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachCacjungoyNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Ansay, Allyson Charissa T - Activity 4Document14 pagesAnsay, Allyson Charissa T - Activity 4Allyson Charissa AnsayNo ratings yet

- Quiz-Chapter1 Partnership Formation and OperationsDocument2 pagesQuiz-Chapter1 Partnership Formation and Operationsalellie100% (1)

- Partnership DissolutionDocument19 pagesPartnership DissolutionRujean Salar Altejar100% (1)

- Advacc Preboard QuestionsDocument9 pagesAdvacc Preboard QuestionsJefferson ArayNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingGennia Mae MartinezNo ratings yet

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- Midterms Advanced Finac Acctg Set ADocument9 pagesMidterms Advanced Finac Acctg Set ALuisitoNo ratings yet

- Asynchronous 3Document35 pagesAsynchronous 3Mark Anthony CondaNo ratings yet

- Practical Accounting 2 - RMYCDocument10 pagesPractical Accounting 2 - RMYCZadharie Abby Gail BurataNo ratings yet

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsKc SevillaNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates and Trusts 29th Edition Pope Test BankDocument41 pagesPrentice Halls Federal Taxation 2016 Corporations Partnerships Estates and Trusts 29th Edition Pope Test Banksociablyrunning6y4vpe100% (22)

- Quiz AccountingDocument11 pagesQuiz Accountingsino ako100% (1)

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- Partnership DissolutionDocument5 pagesPartnership DissolutionJayhan PalmonesNo ratings yet

- Chapter c9Document45 pagesChapter c9bobNo ratings yet

- Self-Test Partnership and Corporate LiquidationDocument6 pagesSelf-Test Partnership and Corporate Liquidationxara mizpahNo ratings yet

- Partnership AcctgDocument14 pagesPartnership AcctgcessbrightNo ratings yet

- SecretDocument13 pagesSecretElla MyrrNo ratings yet

- Partnership Accounting Quiz Submissions: Standalone AssessmentDocument5 pagesPartnership Accounting Quiz Submissions: Standalone AssessmentChesca Alon100% (1)

- Multiple Choice Partnership and CorporationDocument14 pagesMultiple Choice Partnership and CorporationTrina Joy HomerezNo ratings yet

- Quiz 3 Dissolution AnswerDocument19 pagesQuiz 3 Dissolution AnswerCJ GranadaNo ratings yet

- P2 Question 2012Document18 pagesP2 Question 2012Jake ManansalaNo ratings yet

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Tax 1 Problem SolvingDocument4 pagesTax 1 Problem SolvingSheila Mae Araman100% (2)

- Partnership Problem SetDocument8 pagesPartnership Problem SetMary Rose ArguellesNo ratings yet

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaDocument9 pagesPamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaLeslie Mae Vargas ZafeNo ratings yet

- P2 Quizzer 2015Document12 pagesP2 Quizzer 2015Altair ColtraineNo ratings yet

- NCR Cup 2 Judges' Copy - Elimination RoundDocument17 pagesNCR Cup 2 Judges' Copy - Elimination RoundMich ClementeNo ratings yet

- 02Document3 pages02Jodel Castro100% (1)

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- Soal AKLDocument3 pagesSoal AKLErica Lesmana100% (1)

- AST Discussion 3 - PARTNERSHIP DISSOLUTIONDocument5 pagesAST Discussion 3 - PARTNERSHIP DISSOLUTIONCHRISTINE TABULOGNo ratings yet

- 1st Evals p2Document10 pages1st Evals p2Shiela MayNo ratings yet

- AFAR - Region 11Document24 pagesAFAR - Region 11Jessa BeloyNo ratings yet

- Accounting Volume 1 Canadian 9th Edition Horngren Test BankDocument99 pagesAccounting Volume 1 Canadian 9th Edition Horngren Test Bankbacksideanywheremrifn100% (27)

- Partnership ActivityDocument2 pagesPartnership ActivityRowena GayasNo ratings yet

- Xyz CT 2020Document2 pagesXyz CT 2020zhart1921No ratings yet

- CH 010Document2 pagesCH 010Joana TrinidadNo ratings yet

- Instructions D. Advanced Financial Accounting and Reporting AFAR.3101 Partnership DrillDocument1 pageInstructions D. Advanced Financial Accounting and Reporting AFAR.3101 Partnership Drillvane rondinaNo ratings yet

- AFAR.3101 Partnership (Drill) : D. Advanced Financial AccountingDocument1 pageAFAR.3101 Partnership (Drill) : D. Advanced Financial Accountingvane rondinaNo ratings yet

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Document10 pagesP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNo ratings yet

- Review On Partnership FormationDocument3 pagesReview On Partnership FormationPhilip Zamaico SerenioNo ratings yet

- Partnership ContinuationDocument3 pagesPartnership ContinuationRhoiz100% (2)

- Dissolution Problems DiscussionDocument9 pagesDissolution Problems Discussionlexfred55No ratings yet

- Lesson 3 Partnership DissolutionDocument80 pagesLesson 3 Partnership DissolutionmarkNo ratings yet

- Week 1 Formation Operation Dissolution 1 PDFDocument19 pagesWeek 1 Formation Operation Dissolution 1 PDFJuja FlorentinoNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Ac Far Quiz7Document4 pagesAc Far Quiz7Kristine Joy Cutillar100% (1)

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet