Professional Documents

Culture Documents

Synergy Benefits - Mathematical Problem For Valuation Exercise

Uploaded by

Jayash KaushalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Synergy Benefits - Mathematical Problem For Valuation Exercise

Uploaded by

Jayash KaushalCopyright:

Available Formats

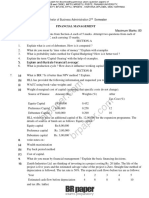

Calculation of Synergy Benefits for a M&A Deal

The following are excerpts from due diligence report for estimated financial positions as on 31. 3. 2021. in respect of an M&A

Deal in which both the Acquirer and the Target are manufacturing complementary FMCG household products with the same

raw material.

Please calculate monetary value of each line item of synergy benefits using a DCF model. Also please calculate the per share

Value of Synergy Benefits. You may assume numbers for additional information that you may require.

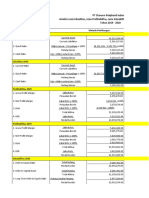

Sl.

No.

Identified Areas of Synergy Benefits Synergy / Compatibility UOM Acquirer Co. Target Co.

A. Capital

a. Equity Capital & Reserves Rs. 300 Mln. will reduce Rs. Mln. 1,000 600.00

Deployed after settlement of the deal.

b. Weighted average of Ke % 17 19.00

c. Long Term borrowed capital Collaterals are FA Rs. Mln. 2,500 900.00

d. Weighted average of LT Kd No change in requirement 12.0% 10.50%

e. Weighted average cost of % 0.12 0.10

Working Capital

B. Revenue Synergy - Higher Sales Rs. Mln 600

EBIDTA post consolidation 36%

C. Operational and Cost Synergies

2. Cash & Cash Equivalent

a. Average availability for FY 2016 To be maintained after deal Rs. Mln. 500 350.00

b. Annualised value of other Income Rs. Mln. 35 30.00

c. Income Yield 7.0% 9%

3. Net exposure to USD exchange rate Cash flow is even in terms

of

a. Year's Net Cash Flow Inflow - outflow USD. (-ve) 200 (+ve) 150

Mln.

b. Treasury operations Average strike Rates Self Consultant

c. Average Rates for transaction Avg. for FY 2016 - Rs. /USD 62 61.25

Outward 1

Avg. for FY 2016 - Inward 61 61.05

4. Procurement of the major Raw Material.

a. Total requirement in FY2016 MT 2,500 1,200.00

b. Average landed cost Rs. / MT 710 650.00

c. Stock holding period Plants are in same town Days 60 100.00

d. Credit Terms Days 60 75.00

5. Markets

a. Regions West, North North, East

b. Method of Distribution External Channel of Self stores + Distributors

Acquirer

takes care of 40% Turnover Distributors

c. Average cost of S&D on Net % 7 9.40

Revenue + Distributors' Margin

d. Addl. Investments required Volume to be handled 60% Rs. Mln 200

to handle Target's Prod. In Self

Stores. (Finance - Loan 75%)

Addl. Interest Cost p. a. 10%

e. Turnover Rs. Mln 11,250 5,640.00

f. Average period of receivables Days 45 55.00

6. Other elements of COGS Rs. Mln 5,000 1,840.00

COGS as percentage of Turnover 0 0.33

7. Leadership Manpower

a. Major Function Post acquisition the two No. 9 7.00

plants will function as

divisions

You might also like

- M&I Merger-Model-GuideDocument66 pagesM&I Merger-Model-GuideSai Allu100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- CMA Examination Sample QuestionsDocument9 pagesCMA Examination Sample QuestionsRamNo ratings yet

- 2GO Excel Calculation 1Document60 pages2GO Excel Calculation 1w_fibNo ratings yet

- The Buyout of AMC EntertainmentDocument5 pagesThe Buyout of AMC EntertainmentmosesNo ratings yet

- Answer Key Long Quiz Financial Statements Analysis and Cash FlowsDocument8 pagesAnswer Key Long Quiz Financial Statements Analysis and Cash FlowstanginamotalagaNo ratings yet

- Quiz - Quiz 2 Partnership Dissolution and Liquidation AnswersDocument15 pagesQuiz - Quiz 2 Partnership Dissolution and Liquidation AnswersKent Zirkai CidroNo ratings yet

- Financial Management QualiDocument6 pagesFinancial Management QualiJaime II LustadoNo ratings yet

- 'A' Level Accounting Study Pack Volume 1 PDFDocument376 pages'A' Level Accounting Study Pack Volume 1 PDFCephas Panguisa100% (2)

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsTshina Jill BranzuelaNo ratings yet

- Instalment/Consignment Sales: Partl: Theory of AccountsDocument5 pagesInstalment/Consignment Sales: Partl: Theory of AccountsFeliz Victoria CañezalNo ratings yet

- Yell FinalDocument10 pagesYell Finalbumz1234100% (2)

- Synergy Benefits - Mathematical Problem For Valuation Exercise 2023-24Document2 pagesSynergy Benefits - Mathematical Problem For Valuation Exercise 2023-24Jaydeep SheteNo ratings yet

- FM (2nd) May2019 PDFDocument2 pagesFM (2nd) May2019 PDFJohnNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisDhirendra Singh patwalNo ratings yet

- FM (2nd) May2016Document2 pagesFM (2nd) May2016JohnNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- GTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementDocument4 pagesGTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementAbhishek ChaturvediNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- 2820003Document5 pages2820003hetvi bhutNo ratings yet

- Rasio Metode Perhitungan Likuiditas 2020Document26 pagesRasio Metode Perhitungan Likuiditas 2020nurazirapfNo ratings yet

- DCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021Document7 pagesDCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021anandNo ratings yet

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezNo ratings yet

- MCQS On Financial ManagementDocument3 pagesMCQS On Financial ManagementAnonymous kwi5IqtWJNo ratings yet

- 2013MBA Sem II Financial Management - pdf2013Document3 pages2013MBA Sem II Financial Management - pdf2013Riya AgrawalNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- Prelim ExamDocument7 pagesPrelim ExamChristine MalayoNo ratings yet

- FINC 301 Assignment 2023 1Document8 pagesFINC 301 Assignment 2023 1kd5d26xw5rNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsDan Andrei BongoNo ratings yet

- BA 2802 - Principles of Finance Problems For Recitation #1Document3 pagesBA 2802 - Principles of Finance Problems For Recitation #1Eda Nur EvginNo ratings yet

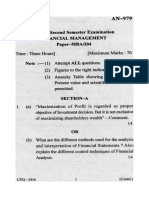

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- Post Mid Term AssignmentDocument4 pagesPost Mid Term AssignmentSRISHTI NARANGNo ratings yet

- Strategic Finance Mid-Term Examination 1Document6 pagesStrategic Finance Mid-Term Examination 1سردار عطا محمدNo ratings yet

- 1BSA Final ExamDocument11 pages1BSA Final ExamcamillaNo ratings yet

- Solutions Ias 36Document13 pagesSolutions Ias 36kashan.ahmed1985No ratings yet

- CFA pc1 2023-02Document5 pagesCFA pc1 2023-02Luiggi BorjasNo ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- Assignment Fin420 - Individual & Group EditDocument58 pagesAssignment Fin420 - Individual & Group EditHakim SantiagoNo ratings yet

- AutorickshawDocument3 pagesAutorickshawsuheal007860704No ratings yet

- Assignment # 2 MBA 1306: QuestionsDocument3 pagesAssignment # 2 MBA 1306: QuestionsZ KhanNo ratings yet

- Valuation of Goodwill Revision by CA CMA Santosh Kumar SIrDocument6 pagesValuation of Goodwill Revision by CA CMA Santosh Kumar SIrrabin067khatriNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- 4BSA MAS SET A No Answer 1 PDFDocument9 pages4BSA MAS SET A No Answer 1 PDFLayca Clarice BrimbuelaNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Bos 43771 QDocument6 pagesBos 43771 QSunil KumarNo ratings yet

- Answer Key ABM2Document6 pagesAnswer Key ABM2Elle Alorra RubenfieldNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Problemson CVPanalysisDocument11 pagesProblemson CVPanalysisMark RevarezNo ratings yet

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196No ratings yet

- MBA Corporate Finance Online Exam 05122020 025210pmDocument3 pagesMBA Corporate Finance Online Exam 05122020 025210pmminza siddiquiNo ratings yet

- Mme308 EndsemDocument2 pagesMme308 EndsemNavvay DhingraNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Application For H. O. Limits Branch: Corporate Credit DateDocument7 pagesApplication For H. O. Limits Branch: Corporate Credit DatehasanthakNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- Responsibility Acctg Transfer Pricing GP Analysis PDFDocument21 pagesResponsibility Acctg Transfer Pricing GP Analysis PDFma quenaNo ratings yet

- MS04Document34 pagesMS04Varun MandalNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoon LightNo ratings yet

- End Term - Corporate FinanceDocument3 pagesEnd Term - Corporate FinanceDEBAPRIYA SARKARNo ratings yet

- Tutorial 9 AnswersDocument5 pagesTutorial 9 AnswersPhụng KimNo ratings yet

- Problem StatementDocument5 pagesProblem StatementJayash KaushalNo ratings yet

- Unit - Iv: After Reading This Chapter, Students ShouldDocument37 pagesUnit - Iv: After Reading This Chapter, Students ShouldJayash KaushalNo ratings yet

- Plagiarism Scan Report: Plagiarised Unique Words CharactersDocument2 pagesPlagiarism Scan Report: Plagiarised Unique Words CharactersJayash KaushalNo ratings yet

- RelxoDocument141 pagesRelxoJayash KaushalNo ratings yet

- The Ultimate Guide To Synergies in M&A - Types, Sources, ModelDocument11 pagesThe Ultimate Guide To Synergies in M&A - Types, Sources, ModelJayash KaushalNo ratings yet

- What Are DerivativesDocument11 pagesWhat Are DerivativesJayash KaushalNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasJayash KaushalNo ratings yet

- Nel HydrogenDocument23 pagesNel HydrogenJayash KaushalNo ratings yet

- Group 6 - MRP (Research Findings)Document19 pagesGroup 6 - MRP (Research Findings)Jayash KaushalNo ratings yet

- ETF Expected Returns Annualized Standard DeviationDocument98 pagesETF Expected Returns Annualized Standard DeviationJayash KaushalNo ratings yet

- AccretionDilution AnalysisDocument14 pagesAccretionDilution AnalysisJayash KaushalNo ratings yet

- Consolidated Balance Sheet: Name Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 Dec 31, 2017Document9 pagesConsolidated Balance Sheet: Name Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 Dec 31, 2017Jayash KaushalNo ratings yet

- Top Down Ebit Tax Rate Nopat 6600: Net Sales 100,000Document2 pagesTop Down Ebit Tax Rate Nopat 6600: Net Sales 100,000Jayash KaushalNo ratings yet

- Option Chain ExcelDocument470 pagesOption Chain ExcelJayash KaushalNo ratings yet

- Brazil's Enigma: Sustaining Long-Term Growth: Presentation byDocument24 pagesBrazil's Enigma: Sustaining Long-Term Growth: Presentation byJayash KaushalNo ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Binomial TreesDocument25 pagesBinomial TreesJayash KaushalNo ratings yet

- FINAL Time-Table - MBA II Yr. Trim IV (2021-22)Document8 pagesFINAL Time-Table - MBA II Yr. Trim IV (2021-22)Jayash KaushalNo ratings yet

- Ias 12Document32 pagesIas 12Cat ValentineNo ratings yet

- S&P IndicesDocument17 pagesS&P Indicesmeditationinstitute.netNo ratings yet

- Finance MRP TopicsDocument3 pagesFinance MRP TopicsGaurav PatilNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingNirav TibraNo ratings yet

- Financial Management Chapter 4Document16 pagesFinancial Management Chapter 4Muhammad Syanizam100% (1)

- Ambee Pharmaceuticals Limited: First Quarter Financial Statement (Un-Audited)Document1 pageAmbee Pharmaceuticals Limited: First Quarter Financial Statement (Un-Audited)James BlackNo ratings yet

- 3 ProblemsDocument8 pages3 ProblemsHassan SheikhNo ratings yet

- Conceptual FinalDocument6 pagesConceptual FinalKelsey LorrinNo ratings yet

- Topic-1-B New Issue MarketDocument20 pagesTopic-1-B New Issue MarketTushar BhatiNo ratings yet

- Answers Post Test 01 Conceptual Framework 1Document3 pagesAnswers Post Test 01 Conceptual Framework 1Faith CastroNo ratings yet

- Quiz 1 2Document9 pagesQuiz 1 2Hồng ThơmNo ratings yet

- Capital Budgeting DecisionsDocument36 pagesCapital Budgeting DecisionsJC CABESONo ratings yet

- BAS-8 Accounting Policies Changes in Accounting Estimate and ErrorsDocument13 pagesBAS-8 Accounting Policies Changes in Accounting Estimate and ErrorsIttihadul islamNo ratings yet

- Page 1 of 10Document10 pagesPage 1 of 10Mercado JessicaNo ratings yet

- Chapter 4 - RoblesDocument18 pagesChapter 4 - RoblesYesha SibayanNo ratings yet

- Capital StructureDocument55 pagesCapital StructureShailaja BNo ratings yet

- Difference Between IFRS & The Company ActDocument7 pagesDifference Between IFRS & The Company ActAsadullah SherNo ratings yet

- Part 3 - AnswersDocument4 pagesPart 3 - AnswersFenladen AmbayNo ratings yet

- 2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedDocument3 pages2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedAmit KumarNo ratings yet

- Exercise Cost of CapitalDocument7 pagesExercise Cost of CapitalUmair Shekhani100% (2)

- CF Tutorial 8 - Solutions UpdatedDocument11 pagesCF Tutorial 8 - Solutions UpdatedchewNo ratings yet

- 200 500 Imo Board Meeting 20230215Document19 pages200 500 Imo Board Meeting 20230215Contra Value BetsNo ratings yet

- Advanced Accounting - Interactive Online Quiz Ch01Document4 pagesAdvanced Accounting - Interactive Online Quiz Ch01gilli1tr100% (1)

- DR DIsc - Platinum Equity - Avatar Growth - SirionLabsDocument1 pageDR DIsc - Platinum Equity - Avatar Growth - SirionLabsNeelima MaheshwariNo ratings yet

- Accounting Theory Chapter 6Document5 pagesAccounting Theory Chapter 6nabila IkaNo ratings yet