Professional Documents

Culture Documents

Assessment and Collection: Brihanmumbai Mahanagarpalika

Uploaded by

ganesh0 ratings0% found this document useful (0 votes)

41 views1 pageIGR MAHARASHTRA

Original Title

Circular_Transfer_of_Property

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIGR MAHARASHTRA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views1 pageAssessment and Collection: Brihanmumbai Mahanagarpalika

Uploaded by

ganeshIGR MAHARASHTRA

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

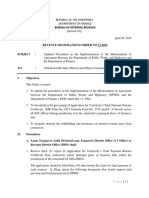

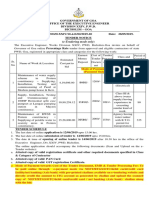

BRIHANMUMBAI MAHANAGARPALIKA

Assessment and Collection

AC/COMP/\ l;iO /2019-20

Sub:- Improving the process of Change of Name in

Property Tax records

To improve the Ease Of Doing Business, especially in 'Registering Property' indicator,

there is a need to re-engineer the process of Change of Name in Property Tax records. Once

data (Registration of Instrument of transfer) from SRO office is received online realtime in

MCGM Property Tax application, the said process of Change in name as per SRO data is

automated. Accordingly, the following instructions are issued.

Timeline for updating Property Tax records.

(A) Automated Process - Real time

• Under new process, the transferee would not be required to make an application to

Assessment & Collection department for Change of name in Property Tax records.

The Property Tax records would be updated automatically in real time on the same

day.

• Intimation regarding the updatlon would be sent to transferee of the property

through sms, email and by post.

. (B) Automated through Portal - 3 days

• In all other cases except the ones covered under (A) including the applications

received through the Citizen Porta(, the timeline- fo r updating name in the Property

Tax records is reduced to three(3) days, from 15 days. The necessary amendment

will be done in the notification issued under the Right to Services Act (RTS) and the

same will be published on Citizen Portal.

• URL of Citizen Portal - https ://ptaxportal.mcqm.qov.in/CitizenPortal

(C) If the flat is not assessed unitwise and assessment of society/building as a

whole is done by MCGM then in all such cases, cognizance of change will

be taken in respective Property account number. In future, whenever

society complies for unitwise billing, Property Tax bill for that particular flat

owner will be automatically gener~ted.

(D) Offline Non-automated Transfer process.

As per the RTS Act, 15 days time period is provided for this process, but in

view of (B) above, this process is discontinued.

For change in Property tax record there is no requirement of Property card. The change in name is being

done on the basis of Sale deed(Registered document).

During the period of change in Property Tax record, updation of Property card by SRO office will be

done simultaneously .

-S J-J4-\ ~ 202-0

Assessor and Collector

You might also like

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Tendernotice 1Document88 pagesTendernotice 1Gaurav AgarwalNo ratings yet

- Tendernotice 2Document52 pagesTendernotice 2erik flynnNo ratings yet

- DCW-TANGEDCO proceedings no191, dt.04.09.2023.Document4 pagesDCW-TANGEDCO proceedings no191, dt.04.09.2023.Karthikayani PalaniNo ratings yet

- Revised Concept Papere RegistrationDocument3 pagesRevised Concept Papere RegistrationayanNo ratings yet

- 2673120943822842160_70955_NoticeDocument3 pages2673120943822842160_70955_Noticevarun.vsconstructionNo ratings yet

- General Reform SummaryDocument10 pagesGeneral Reform SummaryRaghu RamNo ratings yet

- PO SPL Corrigendum-For-ExtensionDocument1 pagePO SPL Corrigendum-For-ExtensionRambabuNo ratings yet

- DRC-07 AdvisoryDocument4 pagesDRC-07 AdvisoryGaurav KapriNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Bakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Document14 pagesBakreswar Thermal Power Plant P.O. - BKTPP, District - Birbhum Pin - 731104, WB, India Telephone: 03462-220346/8336903916Shakthi VelNo ratings yet

- Bureau of Internal RevenueDocument5 pagesBureau of Internal RevenuegelskNo ratings yet

- NIET No. 16 of 2018-2019 WBSIDC LTDDocument52 pagesNIET No. 16 of 2018-2019 WBSIDC LTDgoutammandNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument19 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Ece 6018 Pli CBSDocument24 pagesEce 6018 Pli CBSNarayanaNo ratings yet

- E-Procurement FormetDocument2 pagesE-Procurement FormetMuhammad Zakir AttariNo ratings yet

- Indian Oil Corporation Limited Western Region Pipelines, Chaksu Technical Services DepartmentDocument2 pagesIndian Oil Corporation Limited Western Region Pipelines, Chaksu Technical Services Departmentpmcmbharat264No ratings yet

- Request For Quotation: Collective RFQ Number/ Purchase GroupDocument27 pagesRequest For Quotation: Collective RFQ Number/ Purchase GroupQCTS FaridabadNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Changes to confiscation and penalty provisions under GSTDocument16 pagesChanges to confiscation and penalty provisions under GSTamitshah2060No ratings yet

- Iobas ProcedureDocument2 pagesIobas ProcedurePraveen Keshri100% (1)

- CA Final IDT Amendments For May 2016Document11 pagesCA Final IDT Amendments For May 2016Venugopal RNo ratings yet

- New Functionalities Compilation Jan Mar 2022Document7 pagesNew Functionalities Compilation Jan Mar 2022AmanNo ratings yet

- साउथ ई न कोलफी ्स िलिमटेड South Eastern Coalfields LimitedDocument71 pagesसाउथ ई न कोलफी ्स िलिमटेड South Eastern Coalfields LimitedVipul SinghNo ratings yet

- E NITDocument7 pagesE NITpushpenderverma2002No ratings yet

- 3876 FDocument3 pages3876 FSushanta DasNo ratings yet

- LT Industrial Connection Online ApplicationsDocument5 pagesLT Industrial Connection Online ApplicationsdarrisvijayNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Citizen Grievance Redress ProcedureDocument2 pagesCitizen Grievance Redress ProcedureKollu PCNo ratings yet

- Government of Andhra Pradesh: Municipal Administration & Urban Development (M) DepartmentDocument5 pagesGovernment of Andhra Pradesh: Municipal Administration & Urban Development (M) DepartmentRaghu RamNo ratings yet

- AOM 2019-01 Brgy Look, LapinigDocument9 pagesAOM 2019-01 Brgy Look, LapinigKen BocsNo ratings yet

- Recent GST UpdatesDocument2 pagesRecent GST UpdatesGauri BudhirajaNo ratings yet

- DRAFT INSPECTION REPORT FINDINGSDocument7 pagesDRAFT INSPECTION REPORT FINDINGSmahavir singhNo ratings yet

- Municipal Corporation Bhilai Distt-Durg (C.G.) : Main Portal: Https://eproc - Cgstate.gov - inDocument8 pagesMunicipal Corporation Bhilai Distt-Durg (C.G.) : Main Portal: Https://eproc - Cgstate.gov - inNature TouchNo ratings yet

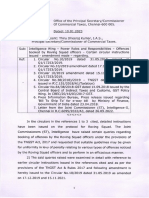

- Power Roles and Responsibilities - Offences Booked by Roving Squad OfficersDocument16 pagesPower Roles and Responsibilities - Offences Booked by Roving Squad OfficersAnandd BabunathNo ratings yet

- New Functionalities Made Available For Taxpayers On GST Portal (March, 2022)Document4 pagesNew Functionalities Made Available For Taxpayers On GST Portal (March, 2022)Shivakumar AmaresanNo ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- VivekDocument28 pagesVivekVivek SettipalliNo ratings yet

- AOM 2019-01 Brgy Lapinig Del Sur, LapinigDocument9 pagesAOM 2019-01 Brgy Lapinig Del Sur, LapinigKen BocsNo ratings yet

- ARCC - Renewal of ARCCDocument85 pagesARCC - Renewal of ARCCasombrado.cscdNo ratings yet

- Data Center April 2009Document11 pagesData Center April 2009El Trukitosac TrukinNo ratings yet

- Tender Ref. No. WCL-ba3650-pur-e134-2018-19: CIN No. U10100MH1975GOI01826Document25 pagesTender Ref. No. WCL-ba3650-pur-e134-2018-19: CIN No. U10100MH1975GOI01826Krystal MannNo ratings yet

- Tendernotice 1Document19 pagesTendernotice 1Gaurav AgarwalNo ratings yet

- Cmo 39 - 2008Document11 pagesCmo 39 - 2008Otis MelbournNo ratings yet

- Environmental permit fee payment instructionsDocument1 pageEnvironmental permit fee payment instructionsChelsie Barbonio OnoyaNo ratings yet

- Fully Electronic Refund ProcessDocument4 pagesFully Electronic Refund ProcessCA Sumit GargNo ratings yet

- Consent To Establish and Consent To OperateDocument18 pagesConsent To Establish and Consent To OperateMansi JainNo ratings yet

- Government of KeralaDocument3 pagesGovernment of KeralaVishnu ThavilNo ratings yet

- 0 - NIT SCANNED - MergedDocument74 pages0 - NIT SCANNED - MergedAnindyaMukherjeeNo ratings yet

- E-Invoice Under GSTDocument2 pagesE-Invoice Under GSTKumariNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- Period of Completi On (In Days) : D. Mode of Payment Towards Cost of The Tender Document, EMD & Tender Processing Fee: ToDocument3 pagesPeriod of Completi On (In Days) : D. Mode of Payment Towards Cost of The Tender Document, EMD & Tender Processing Fee: ToKishore A JhaNo ratings yet

- GST Amendment For June 2023 Part 3Document3 pagesGST Amendment For June 2023 Part 3rajbhanushali3981No ratings yet

- 1 Latest GSTR 9 and 9C TaxbykkDocument73 pages1 Latest GSTR 9 and 9C TaxbykkjitendraktNo ratings yet

- GST 7th Edition With CorrectionsDocument512 pagesGST 7th Edition With CorrectionsMemeswale BhaiyaaaNo ratings yet

- DRC-03 (4 ) Applicability and Procedure to Pay Additional TaxDocument3 pagesDRC-03 (4 ) Applicability and Procedure to Pay Additional Taxevertry27387No ratings yet

- EoI Drone SurveyDocument36 pagesEoI Drone SurveyVijay KumarNo ratings yet

- 37ae9553-eb20-42e2-9e40-c74926d41ff4 (1)Document17 pages37ae9553-eb20-42e2-9e40-c74926d41ff4 (1)YesBroker InNo ratings yet

- GST on E-commerceDocument45 pagesGST on E-commerceSai Kiran KudavalliNo ratings yet

- Louisiana Economic Forecast 2024-25 FinalDocument195 pagesLouisiana Economic Forecast 2024-25 FinalAmanda Johnson100% (2)

- GRM - Day 1.1Document279 pagesGRM - Day 1.1Tim KraftNo ratings yet

- Designing With Geosynthetics Robert M Koernerpdf CompressDocument818 pagesDesigning With Geosynthetics Robert M Koernerpdf CompressRamiro ChambiNo ratings yet

- 2019 USPS Postage Rate Guide: Effective January 27, 2019Document1 page2019 USPS Postage Rate Guide: Effective January 27, 2019NonoNo ratings yet

- Increasing The Innovative Activity of Tourist Enterprises Under The Development of The Digital EconomyDocument4 pagesIncreasing The Innovative Activity of Tourist Enterprises Under The Development of The Digital EconomyOpen Access JournalNo ratings yet

- Question and Suggested SolutionsDocument2 pagesQuestion and Suggested SolutionsMỹ Dung PhạmNo ratings yet

- Analytical Report On The Status of The China GHG Voluntary Emission Reduction ProgramDocument14 pagesAnalytical Report On The Status of The China GHG Voluntary Emission Reduction ProgramEnvironmental Defense Fund (Documents)No ratings yet

- Exercise - Week 7Document7 pagesExercise - Week 7Precious MarksNo ratings yet

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- C700 Oper - Manual, 22786867Document81 pagesC700 Oper - Manual, 22786867diego fernando salgado devia75% (4)

- Mera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Document2 pagesMera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Hur Hussain SyedNo ratings yet

- France La Banque PostaleDocument1 pageFrance La Banque PostaleDRISS TAZINo ratings yet

- Presentation on Puma Brand Life CycleDocument24 pagesPresentation on Puma Brand Life Cyclenicks1988No ratings yet

- DGQADocument2 pagesDGQASakethNo ratings yet

- Sample of A Project Proposal - Provision of Farm Inputs (Production of Palay, Corn, Mongo, Peanut and Camote)Document13 pagesSample of A Project Proposal - Provision of Farm Inputs (Production of Palay, Corn, Mongo, Peanut and Camote)rolandtrojas93% (182)

- SYAD Prefinal ExamsDocument2 pagesSYAD Prefinal ExamsBien Joshua Martinez PamintuanNo ratings yet

- APEDA Exporter Directory in RajasthanDocument21 pagesAPEDA Exporter Directory in RajasthanSandeep BhandariNo ratings yet

- HL Pay & Save-I Account 102022Document1 pageHL Pay & Save-I Account 102022naidaNo ratings yet

- How To Measure Employer Brands - The Development of A Comprehensive Measurement ScaleDocument23 pagesHow To Measure Employer Brands - The Development of A Comprehensive Measurement ScaletkNo ratings yet

- Social Science All in One (Preli)Document363 pagesSocial Science All in One (Preli)Safa AbcNo ratings yet

- Week 13 SolutionsDocument7 pagesWeek 13 SolutionsStanley RobertNo ratings yet

- Ninaad NandedkarDocument2 pagesNinaad NandedkarbelikehawkgamingNo ratings yet

- Accounting & Marketing Students ListDocument9 pagesAccounting & Marketing Students ListJustine Brylle DomantayNo ratings yet

- Oa Sba 1Document18 pagesOa Sba 1Darion JeromeNo ratings yet

- Sgs Ss Smls Pipe HNSSDDocument18 pagesSgs Ss Smls Pipe HNSSDNandha KumarNo ratings yet

- PIARB Pub - Strickland Vs Ernst and Young LLPDocument2 pagesPIARB Pub - Strickland Vs Ernst and Young LLPZSHAINFINITY ZSHANo ratings yet

- Identify Functional RequirementsDocument3 pagesIdentify Functional RequirementsEugene LingNo ratings yet

- Dhan Ki BaatDocument12 pagesDhan Ki Baattest hrmNo ratings yet

- Planning Reports and Proposals: 12/28/20 Chapter 11-1Document27 pagesPlanning Reports and Proposals: 12/28/20 Chapter 11-1H. U. KonainNo ratings yet

- Are Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustDocument3 pagesAre Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustRamprakash vishwakarmaNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)