Professional Documents

Culture Documents

NDCPS Trust Circular For NPS

NDCPS Trust Circular For NPS

Uploaded by

jvnrao0 ratings0% found this document useful (0 votes)

67 views2 pagesOriginal Title

NDCPS Trust Circular for NPS

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views2 pagesNDCPS Trust Circular For NPS

NDCPS Trust Circular For NPS

Uploaded by

jvnraoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

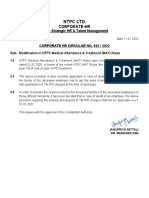

N7PC LTD. DEFINED CONTRIBUTION PENSION TRUST

Ref:01/F&A/DCPS/Circulars/M-21 Date: 15.09.2020

CIRCULAR NO: 08

Subject: Option to withdraw from the Scheme for joining National Pension System (NPS)

1.0 All Members are hereby informed that Board of Trustees of the Pension Trust in their 21*

meeting held on 15.06.2020 have approved amendments in the Trust Rules to allow Members

who are still in the service of the Company (NTPC Limited) to exercise one time irreversible

option to withdraw from the Scheme for joining National Pension System (NPS)-Corporate sector

model as employee of NTPC Limited.

2.0 NPS is a Defined Contribution Pension Scheme promoted by the Government of India and

regulated by the Pension Fund Regulatory and Development Authority (PFRDA) under PFRDA

Act, 2013. NPS is managed by the Board of Trustees of the NPS Trust and all the assets under the

NPS vests with the NPS Trust. Funds invested under NPS are managed by the Pension Funds

Managers appointed as per the rules and regulations issued by the PFRDA. Detailed circular for

introduction of NPS will be separately issued by the Company. Detailed information regarding

NPS scheme, intermediaries under NPS and role and responsibilities, applicable charges etc. can

be found on the PFRDA/NPS Trust web sites (www.pfrda.org.in / www.npstrust.org.in).

3.0 Itis also to be noted that from the date of notification for introduction of NPS in the Company,

no new Members shall be admitted into NTPC Defined Contribution Pension Scheme.

4.0 On withdrawal from Scheme for joining NPS, no further contribution shall be accepted for such

employees in the Trust. Employees joining NPS shall also have the option to transfer their

existing accumulated corpus in lump sum from the Trust to NPS. Transfer of existing corpus from

the Trust to NPS would not have any tax impact on the Members. Existing corpus of all the

Members of the Scheme is deposited under Group Superannuation Scheme of LIC and for

transfer to NPS; some exit load may be levied by LIC, which has to be borne by Employee. Trust

is trying for waiver of exit load by LIC and further developments in this regard shall be shared in

due course of time.

5.0 Employee exercising withdrawal option shall cease to be a Member of the Scheme from the date

of withdrawal of funds from the Trust and no provisions of the NTPC Ltd Defined Contribution

Pension Trust Deed/Rules shall be applicable to him/her. Pension benefits of such Members shall

be regulated as per the provision of National Pension System (NPS).

sell

Regd. Office : NTPC Bhawan, Core-7, Scope Complex, 7 Institutional Area, Lodhi Road, New Delhi-110003

6.0

7.0

8.0

9.0

Board of Trustees have also approved that in case of Members who have already separated from

the services of the Company but have not yet applied for settlement of their pension benefits

i.e. whose accumulated corpus is still lying with the Trust, may instead of taking pension annuity

as per the Rules, can opt for transfer of their contribution to NPS account or into his/her account

in the Superannuation Funds of their present employer, if any. As per the rules, in case of

separation on account of resignation (other than cases of resignation for joining any other CPSE)

and cases of termination, dismissals, removal etc. before 01.01.2017, only the amount of

employee's contribution plus interest accrued thereon shall be transferred. In case of separation

because of any reason on or after 01-01-2017, amount of both employee's and employer's

contribution along with interest accrued thereon, shall be transferred.

Member(s) opting for withdrawal of existing corpus may please note that existing corpus is

deposited with LIC of India and based on the option exercised by the Member(s), Trust would

take up with LIC for transfer of funds to NPS. However, there would be some time gap between

submission of option by a Member and processing of transfer request by LIC and actual transfer

of money. As per the rules of LIC, interest is credited at applicable rate till the date of settlement

of claim by LIC.

Although there is no cut-off date for submission of option for transfer of existing corpus and this

option can be exercised at any time, however, for timely credit of money in their NPS account,

interested Members must submit their option at the earliest and at least three months before

their due date of Superannuation.

This circular shall be effective from the date of issue of circular by NTPC Limited for introduction

of NPS Corporate Sector model in the Company. Interested Members may submit their

withdrawal option through ESS.

It is for information to all the Members of the Trust: 4)

ta

(Sandeep Aggarwal)

Secretary Trust

Distribution: All Members of the Trust through email/ESS notice board,

Chairman Trust and all members of the Board of Trustees

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 11bharat Charitra-11Document3 pages11bharat Charitra-11jvnraoNo ratings yet

- 9bharat Charitra-9Document3 pages9bharat Charitra-9jvnraoNo ratings yet

- 7bharat Charitra-7Document3 pages7bharat Charitra-7jvnraoNo ratings yet

- 1bharat Charitra-1Document3 pages1bharat Charitra-1jvnraoNo ratings yet

- PativrataDocument16 pagesPativratajvnraoNo ratings yet

- Yardhamaina ShaktuluDocument4 pagesYardhamaina ShaktulujvnraoNo ratings yet

- 6bharat Charitra-6Document3 pages6bharat Charitra-6jvnraoNo ratings yet

- Adhbhuta ChkitsaDocument8 pagesAdhbhuta ChkitsajvnraoNo ratings yet

- 3bharat Charitra-3Document3 pages3bharat Charitra-3jvnraoNo ratings yet

- SBA (S) 2512 Rev 4Document4 pagesSBA (S) 2512 Rev 4jvnraoNo ratings yet

- Kannada 1949 SeptDocument56 pagesKannada 1949 SeptjvnraoNo ratings yet

- UntitledDocument60 pagesUntitledjvnraoNo ratings yet

- Actual OPD Claim 2022-23Document1 pageActual OPD Claim 2022-23jvnraoNo ratings yet

- Donga SommuDocument5 pagesDonga SommujvnraoNo ratings yet

- .Trashed-1703386605-Invoice Pressure CookerDocument1 page.Trashed-1703386605-Invoice Pressure CookerjvnraoNo ratings yet

- CHRC922Document1 pageCHRC922jvnraoNo ratings yet

- Chandamama-Kannada-Oct 1949Document64 pagesChandamama-Kannada-Oct 1949jvnraoNo ratings yet

- .trashed-1684222721-NTPC Process Note Prepaired by Wallet4wealthDocument12 pages.trashed-1684222721-NTPC Process Note Prepaired by Wallet4wealthjvnraoNo ratings yet

- UntitledDocument60 pagesUntitledjvnraoNo ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- How To Prune Jade PlantDocument5 pagesHow To Prune Jade PlantjvnraoNo ratings yet

- Chandamama - Sept 1970Document55 pagesChandamama - Sept 1970jvnraoNo ratings yet

- DR Trust Oxymeter InvoiceDocument1 pageDR Trust Oxymeter InvoicejvnraoNo ratings yet

- Circular 266201993524Document1 pageCircular 266201993524jvnraoNo ratings yet

- Chandamama Aug1970Document50 pagesChandamama Aug1970jvnraoNo ratings yet

- Contact Details For Lic PensionDocument1 pageContact Details For Lic PensionjvnraoNo ratings yet

- Return of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistDocument5 pagesReturn of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistjvnraoNo ratings yet

- 429003800 పిన ని కూతురు సుజాత PDFDocument9 pages429003800 పిన ని కూతురు సుజాత PDFjvnrao50% (4)

- CHRC869Document3 pagesCHRC869jvnraoNo ratings yet

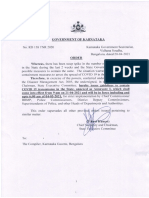

- Guidelines To Contain Covid 19 - Ktaka 20.04.2021Document10 pagesGuidelines To Contain Covid 19 - Ktaka 20.04.2021jvnraoNo ratings yet