Professional Documents

Culture Documents

Bonus Information FY 19-20 - v2 - tcm47-73104

Uploaded by

KaranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonus Information FY 19-20 - v2 - tcm47-73104

Uploaded by

KaranCopyright:

Available Formats

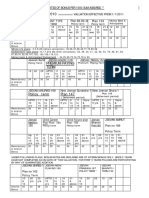

BONUS INFORMATION

Regular Bonus Terminal Bonus

Plan Name Declared Declared

Type Start Year

Bonus rate# Bonus rate **

Met 100 Gold Par Regular; Met 100 Platinum Par; Met Gold

Endowment Par; Met Platinum Endowment Par; Met Junior Par Compound 3.00% 10 0%

Endowment

Met Suvidha Par SP (Issued up to 31.5.2010) Compound 3.00% 10 30%

Met Suvidha Par 10P, 5P (Issued up to 31.5.2010) Compound 3.00% 10 0%

Met Suvidha Par RP (Issued up to 31.5.2010) Compound 3.00% 10 0%

Met Suvidha Par SP, 5P (Issued after 31.5.2010) Compound 2.50% 10 15%

Met Suvidha Par 10P, RP (Issued after 31.5.2010) Compound 2.50% 10 10%

Met Pension Par SP, RP, 3P, 5P Compound 4.00% 10 40%

Met Group Savings Plan - Term 10 Simple 1.45% 25%

At

Met Group Savings Plan - Term 15 Simple 1.60% NA

maturity

Met Group Savings Plan - Term 20 Simple 1.80% NA

Met Monthly Income Plan 5 pay Simple 2.60% At last NA

Met Monthly Income Plan 7 Pay Simple 1.70% income 10%

Met Monthly Income Plan 10 pay Simple 2.80% pay out NA

Met Monthly Income Plan 15 Pay Simple 3.30% NA

Met Deferred Monthly Income Plan Simple 1.95% 10 NA

Met Deferred Monthly Income Plan-7 Simple 1.20% 10 NA

Endowment Savings Plan – 5 Pay Simple 2.60% 10 NA

Endowment Savings Plan – 10 Pay Simple 2.40% 10 NA

Endowment Savings Plan – Regular Pay (Policy term <=14) Simple 2.40% 10 NA

Endowment Savings Plan – Regular Pay (Policy term >=15) Simple 2.30% 10 NA

MetLife Monthly Income Plan – 10 Pay (New) Simple 4.20% 10 NA

Endowment Savings Plan Plus - 5Pay - Up to Term 15 Simple 3.20% 10 NA

Endowment Savings Plan Plus - 5Pay - Above Term 15 Simple 2.75% 10 NA

Endowment Savings Plan Plus - 7Pay - Up to Term 15 Simple 2.70% 10 NA

Endowment Savings Plan Plus - 7Pay - Above Term 15 Simple 2.80% 10 NA

Endowment Savings Plan Plus - 10Pay - Up to Term 20 Simple 2.90% 10 NA

Endowment Savings Plan Plus - 10Pay - Above Term 20 Simple 2.90% 10 NA

Endowment Savings Plan Plus - RP - Up to Term 15 Simple 3.10% 10 NA

Endowment Savings Plan Plus - RP - Above Term 15 Simple 2.90% 10 NA

Bachat Yojana Simple 2.10% 10 NA

College Plan Up to Term 18 Simple 2.10% 10 NA

College Plan Up to Above 18 Simple 2.50% 10 NA

Bhavishya Plus Up to Term 18 Simple 2.10% 10 NA

Bhavishya Plus Above Term 18 Simple 2.50% 10 NA

Retirement Savings Plan-SP-Policy Term Upto 10 Simple 3.30% 10 NA

Retirement Savings Plan-SP-Policy Term Above 10 Simple 2.70% 10 NA

Retirement Savings Plan-RP-Policy Term Upto 20 Simple 1.90% 10 NA

Retirement Savings Plan-RP-Policy Term Above 20 Simple 2.00% 10 NA

Retirement Savings Plan-5-Pay Policy Term Upto 15 Simple 2.40% 10 NA

Retirement Savings Plan-5-Pay Policy Term 16-22 Simple 2.50% 10 NA

Retirement Savings Plan-5-Pay Policy Term Above 22 Simple 2.60% 10 NA

Retirement Savings Plan-10-Pay Policy Term Upto 15 Simple 2.00% 10 NA

Retirement Savings Plan-10-Pay Policy Term 16-22 Simple 2.10% 10 NA

Retirement Savings Plan-10-Pay Policy Term Above 22 Simple 2.20% 10 NA

Super Saver Plan (Accumulation Option)- 5Pay - Term 10 Simple 4.70% NA

Super Saver Plan (Accumulation Option)- 5Pay - Term 11 to

Simple 4.60% NA

Term 14

Super Saver Plan (Accumulation Option)- 5Pay - Above Term

Simple 4.40% NA

14

Super Saver Plan (Accumulation Option)- 7Pay - Term 10 to

Simple 3.75% minimum NA

Term 11

of (Policy

Super Saver Plan (Accumulation Option)- 7Pay - Term 12 to

Simple 3.70% term minus NA

Term 14

3 or 10)

Super Saver Plan (Accumulation Option)- 7Pay - Above Term

Simple 4.50% NA

14

Super Saver Plan (Accumulation Option)- 10Pay- Up to Term

Simple 3.70% NA

14

Super Saver Plan (Accumulation Option)- 10Pay - Term 15 to

Simple 4.30% NA

Term 19

Super Saver Plan (Accumulation Option)- 10Pay - Term 20 Simple 4.60% NA

Super Saver Plan (Accumulation Option)- 12Pay- Up to Term NA

Simple 3.90%

14

Super Saver Plan (Accumulation Option)- 12Pay - Above Term Simple NA

4.00%

14

Super Saver Plan (Accumulation Option)- 15Pay incl. 15 RP Simple 4.25% NA

Super Saver Plan (Liquidity Option)- 5Pay & 10Pay Simple 4.10% NA

Super Saver Plan (Liquidity Option)- 7Pay Simple 4.20% NA

Super Saver Plan (Liquidity Option)- 12Pay Simple 3.70% NA

For Met Ultimate Plan a one-time special bonus of 0.5% of SA for policies claiming (deaths/maturities/surrenders)

from premium paying or fully paid up status in FY 2020-21 has been declared.

# In case of compound reversionary bonus, the rates are expressed as a % of “Sum assured” plus “accrued bonus”

(i.e. bonus already credited to the policy till date). In case of Simple reversionary bonus, the rates are expressed as

% of “Sum assured” only.

** Terminal Bonus is expressed as % of “accrued reversionary bonus” only.

The above bonus rates have to be credited to all eligible policies (refer the respective policy terms & conditions) on

the policy anniversary falling during the FY 2020-21 (1st April 2020 to 31st March 2021, both dates inclusive),

provided the policy is in-force. It may also be noted that the same rates will be used for calculating the interim

bonus during the inter-valuation period (i.e. time period during the next financial year but before the bonus

declaration).

All other terms & conditions for the bonus eligibility shall remain same.

You might also like

- Assessment Form Tulungatung: Monitoring The Functionality of Barangay Council For The Protection of Children (BCPC)Document2 pagesAssessment Form Tulungatung: Monitoring The Functionality of Barangay Council For The Protection of Children (BCPC)Nald Cervas91% (11)

- Abdul Rahim Abdul Wahab - Employee Benefits - Saudi EOSB - Actuarial Val - IAS19 - 13 Dec 2016 - SendDocument98 pagesAbdul Rahim Abdul Wahab - Employee Benefits - Saudi EOSB - Actuarial Val - IAS19 - 13 Dec 2016 - SendSadiq1981No ratings yet

- 2018 TaxReturn PDFDocument139 pages2018 TaxReturn PDFGregory GoodNo ratings yet

- Payslip On DeputationDocument86 pagesPayslip On DeputationAnonymous pKsr5vNo ratings yet

- Taxation policies' effect on employee investment practicesDocument64 pagesTaxation policies' effect on employee investment practicesprashanthNo ratings yet

- MetLife bonus rates for 2019-20Document2 pagesMetLife bonus rates for 2019-20KaranNo ratings yet

- Bonus Rates-FY 2017-18 - tcm47-67139Document2 pagesBonus Rates-FY 2017-18 - tcm47-67139Lokesh singhNo ratings yet

- Bonus Rates-FY 2017-18 - tcm47-67139Document2 pagesBonus Rates-FY 2017-18 - tcm47-67139KaranNo ratings yet

- Bonus Rates FY 2016-17 - tcm47-63300-v0Document1 pageBonus Rates FY 2016-17 - tcm47-63300-v0Abhinav VermaNo ratings yet

- Agent Compensation Schedule - 16april2020 PDFDocument9 pagesAgent Compensation Schedule - 16april2020 PDFRajat GuptaNo ratings yet

- Growth & Guarantee Is Now Reality: Diamond Saving PlanDocument2 pagesGrowth & Guarantee Is Now Reality: Diamond Saving PlanMaulik PanchmatiaNo ratings yet

- Section 80 C and TaxationDocument3 pagesSection 80 C and TaxationdeepeshmahajanNo ratings yet

- Fixed deposit interest ratesDocument1 pageFixed deposit interest ratesP K MahatoNo ratings yet

- Time Value of MoneyDocument76 pagesTime Value of Moneyrhea agnesNo ratings yet

- Indicative Annualized Rates On Deposits W.E .F - 01 .01.2022 To 31 .03.2022Document4 pagesIndicative Annualized Rates On Deposits W.E .F - 01 .01.2022 To 31 .03.2022Afaq YousafNo ratings yet

- Amaia Payment SchemesDocument6 pagesAmaia Payment SchemesMhack ColisNo ratings yet

- Jeevan Utsav (Sridhar) 2023Document66 pagesJeevan Utsav (Sridhar) 2023VENUGOPAL VNo ratings yet

- Fixed Term Deposits Schemes-2Document7 pagesFixed Term Deposits Schemes-2Akshay KumarNo ratings yet

- A - PMLI - Group - Commission Chart-MergedDocument3 pagesA - PMLI - Group - Commission Chart-MergedVanshNo ratings yet

- Slides CurveDocument22 pagesSlides Curveqwsx098No ratings yet

- Time Value of Money in Excel - Workshop 1: Name: Name: Name: NameDocument16 pagesTime Value of Money in Excel - Workshop 1: Name: Name: Name: NameFranco GuaragnaNo ratings yet

- BCPC Functionality Form (LCPC Form 1-A)Document2 pagesBCPC Functionality Form (LCPC Form 1-A)Iinday AnrymNo ratings yet

- EduSave Plan Provides Education FundingDocument12 pagesEduSave Plan Provides Education Fundingsekar sNo ratings yet

- Indicative Profit Rates On Deposits Effective 1 April 2023: Savings AccountsDocument5 pagesIndicative Profit Rates On Deposits Effective 1 April 2023: Savings AccountsAtif QureshiNo ratings yet

- 1 Investment Options To Retirement MoneyDocument3 pages1 Investment Options To Retirement MoneyAMIT SHARMANo ratings yet

- Time Value of MoneyDocument59 pagesTime Value of MoneyjagrenuNo ratings yet

- GDS IncentivesDocument3 pagesGDS Incentivesaadarsh mishraNo ratings yet

- Workshop 2 - TVM-time Value of Money in ExcelDocument6 pagesWorkshop 2 - TVM-time Value of Money in ExcelAdriana MartinezNo ratings yet

- BCPC AssessmentDocument5 pagesBCPC AssessmentBarangay MabacanNo ratings yet

- Perhitungan FBI Dan LSR-1Document5 pagesPerhitungan FBI Dan LSR-1achmad saifudinNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Does Tax Saving Has To Be Systematic?: Income Tax Without Planning Tax With Planning SavingsDocument2 pagesDoes Tax Saving Has To Be Systematic?: Income Tax Without Planning Tax With Planning Savingschintan1806No ratings yet

- Savings & fixed deposit rates at a glanceDocument3 pagesSavings & fixed deposit rates at a glancesaiaviNo ratings yet

- Bonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFDocument5 pagesBonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFVipul KaushikNo ratings yet

- The Correct Answer Is: 4731Document21 pagesThe Correct Answer Is: 4731nishiNo ratings yet

- Introduction To Time Value of MoneyDocument70 pagesIntroduction To Time Value of Moneymubashir_mm4uNo ratings yet

- ReversionaryBonus PDFDocument4 pagesReversionaryBonus PDFPiyush BhartiNo ratings yet

- Tenure General Public FD Rate Senior Citizens FD RateDocument9 pagesTenure General Public FD Rate Senior Citizens FD Rateisha jsNo ratings yet

- Ida Terms Effective November 5 2016Document5 pagesIda Terms Effective November 5 2016dmahiuNo ratings yet

- Interest Rate: Head OfficeDocument19 pagesInterest Rate: Head Officeapi-19792705No ratings yet

- LCPC Form 1-ADocument2 pagesLCPC Form 1-ACasey Del Gallego Enrile100% (1)

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- BCPCDocument32 pagesBCPCDILG Magarao100% (4)

- Suitability Analysis80009870307Document2 pagesSuitability Analysis80009870307Amal S DasNo ratings yet

- So, What Are You Aiming For?: R CommisDocument1 pageSo, What Are You Aiming For?: R CommisRam PNo ratings yet

- USD Fixed Income Fund Fact SheetDocument20 pagesUSD Fixed Income Fund Fact SheetAfthon Ilman Huda Isyfi100% (1)

- Time Value of Money Using Excel Time Value of Money Using TI BA II PlusDocument21 pagesTime Value of Money Using Excel Time Value of Money Using TI BA II Plusautocrats 207No ratings yet

- Life Insurance CommisionDocument5 pagesLife Insurance CommisionpritipjainNo ratings yet

- (DP Period) : Bank Financing (Drawdown 30 Days After 1st 10% DP)Document4 pages(DP Period) : Bank Financing (Drawdown 30 Days After 1st 10% DP)Rose AnnNo ratings yet

- Saving Secure Account V6Document20 pagesSaving Secure Account V6Jei ChanNo ratings yet

- NRB Bank Bangladesh Deposit RateDocument2 pagesNRB Bank Bangladesh Deposit RateAlamin AlexNo ratings yet

- Problems of FinanceDocument67 pagesProblems of FinanceTariqul IslamNo ratings yet

- Commission ScheduleDocument9 pagesCommission ScheduleAnav MittalNo ratings yet

- Commission Rates To Agents & Credit To Do'sDocument5 pagesCommission Rates To Agents & Credit To Do'skammapurathan100% (2)

- Steps PDFDocument1 pageSteps PDFrmateo_caniyasNo ratings yet

- Calculate retirement corpus and annual savings requiredDocument26 pagesCalculate retirement corpus and annual savings requirednishiNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- LCPC Evaluation CriteriaDocument10 pagesLCPC Evaluation CriteriaPhong PhongNo ratings yet

- Your Money Mind: Setting Financial Goals to Manage Money BetterFrom EverandYour Money Mind: Setting Financial Goals to Manage Money BetterNo ratings yet

- The Insurance Industry in India and OverviewDocument15 pagesThe Insurance Industry in India and OverviewVijayKumar NishadNo ratings yet

- Income Tax Principles and Types in the PhilippinesDocument36 pagesIncome Tax Principles and Types in the PhilippinesPascua PeejayNo ratings yet

- Government Budget Is An Annual StatementDocument10 pagesGovernment Budget Is An Annual StatementYashika AsraniNo ratings yet

- Personal Asset Allocation Interfaces 2004Document16 pagesPersonal Asset Allocation Interfaces 2004Aaron MartinNo ratings yet

- Payslip TitleDocument1 pagePayslip TitleGuru MoorthiNo ratings yet

- A Strategy For Active Ageing: Alan WalkerDocument19 pagesA Strategy For Active Ageing: Alan WalkernegriRDNo ratings yet

- FMMA Vol 01 PDFDocument117 pagesFMMA Vol 01 PDFMuhammad Ahmad50% (2)

- Latest EPF & ESIC Amendments SessionDocument2 pagesLatest EPF & ESIC Amendments Sessionshankar_missionNo ratings yet

- Government of Telangana State Audit DepartmentDocument4 pagesGovernment of Telangana State Audit DepartmentkprNo ratings yet

- List of Tables in Sap HCMDocument26 pagesList of Tables in Sap HCMSamule PaulNo ratings yet

- All India Cantoment FedreationDocument5 pagesAll India Cantoment FedreationRavi SolankiNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- DCF Caveats in ValuationDocument23 pagesDCF Caveats in Valuationricoman1989No ratings yet

- Lecture 4-Time Value of Money-EDocument23 pagesLecture 4-Time Value of Money-ENam NguyenNo ratings yet

- Team 3 Group InsuranceDocument42 pagesTeam 3 Group InsuranceAnonymous Ua8mvPkNo ratings yet

- Land Officer role at IDFC BankDocument3 pagesLand Officer role at IDFC BankPooja Shah0% (1)

- Forms of Compensation IncomeDocument6 pagesForms of Compensation IncomeMariaHannahKristenRamirezNo ratings yet

- Retirement ConfidenceDocument4 pagesRetirement ConfidenceGERALDINE MENDOZANo ratings yet

- Pay and BenefitsDocument2 pagesPay and BenefitsMonica ValentinaNo ratings yet

- Subscriber Registration FormDocument148 pagesSubscriber Registration FormNitin SoniNo ratings yet

- PF GuidelineDocument2 pagesPF GuidelineRohan DobriyalNo ratings yet

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- Actuarial Report 2019Document9 pagesActuarial Report 2019FabioNo ratings yet

- Downloadfile 30 PDFDocument114 pagesDownloadfile 30 PDFYianniAnd Sophia0% (1)

- US Internal Revenue Service: I8615Document4 pagesUS Internal Revenue Service: I8615IRSNo ratings yet

- Chapter 10 - Types of Employees and Taxation of Compensation IncomeDocument3 pagesChapter 10 - Types of Employees and Taxation of Compensation IncomeDeviane CalabriaNo ratings yet

- EPF Death Claim Procedure for NomineeDocument7 pagesEPF Death Claim Procedure for NomineeSrinivasulu NatukulaNo ratings yet