Professional Documents

Culture Documents

Total Decreasing Adjustment

Uploaded by

MD. Mahbubur Rahman0 ratings0% found this document useful (0 votes)

32 views3 pagesOriginal Title

13-MUSHAK-9-1-B

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views3 pagesTotal Decreasing Adjustment

Uploaded by

MD. Mahbubur RahmanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

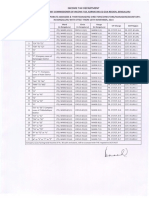

PART - 6: DECREASING ADJUSTMENTS (VAT)

Adjustment Details Note VAT Amount

Due to VAT Deducted at Source from the Supplies Delivered 29 - Subform

Advance Tax Paid at Import Stage 30 - Subform

Issuance of Credit Note 31 -

Any Other Adjustments (please specify below)

32 -

Total Decreasing Adjustment 33 -

PART - 7: NET TAX CALCULATION

Items Note Amount (Tax)

Net Payable VAT for the Tax Period (Section- 45) (9c-23b+28-33) 34 -

Net Payable VAT for the Tax Period after Adjustment with Closing Balance and balance of

35 -

form 18.6 [34-(52+56)]

Net Payable Supplementary Duty for the Tax Period (Before adjustment with Closing

36 -

Balance) [9b+38- (39+40)

Net Payable Supplementary Duty for the Tax Period after Adjusted with Closing Balance and

37 -

balance of form 18.6 [36-(53+57)]

Supplementary Duty Against Issuance of Debit Note 38 -

Supplementary Duty Against Issuance of Credit Note 39 -

Supplementary Duty Paid on Inputs Against Exports 40 -

Interest on Overdue VAT (Based on note 35) 41 -

Interest on Overdue SD (Based on note 37) 42 -

Fine/Penalty for Non-submission of Return 43 -

Other Fine/Penalty/Interest 44 -

Payable Excise Duty 45 -

Payable Development Surcharge 46 -

Payable ICT Development Surcharge 47 -

Payable Health Care Surcharge 48 -

Payable Environmental Protection Surcharge 49 -

Net Payable VAT for Treasury Deposit (35+41+43+44) 50 -

Net Payable SD for Treasury Deposit (37+42) 51 -

Closing Balance of Last Tax Period (VAT) 52 -

Closing Balance of Last Tax Period (SD) 53 -

PART - 8: ADJUSTMENT FOR OLD ACCOUNT CURRENT BALANCE

Items Note Amount (TK)

Remaining Balance (VAT) from Mushak-18.6, [Rule 118(5)] 54

Remaining Balance (SD) from Mushak-18.6, [Rule 118(5)] 55

Decreasing Adjustment for Note 54 (up to 10% of Note 34) 56

Decreasing Adjustment for Note 55 (up to 10% of Note 36) 57

PART - 9: ACCOUNTS CODE WISE PAYMENT SCHEDULE (TREASURY DEPOSIT)

Items Note Economic Code Amount (BDT)

VAT Deposit for the Current Tax Period 58 1/1133/Economic Code0311 - Subform

SD Deposit for the Current Tax Period 59 1/1133/Economic Code/0711-0721 - Subform

Excise Duty 60 1/1133/Economic Code/0601 - Subform

Development Surcharge 61 1/1103/Economic Code/2225 - Subform

ICT Development Surcharge 62 1/1103/Economic Code/2214 - Subform

Health Care Surcharge 63 1/1103/Economic Code/2212 - Subform

Environment Protection Surcharge 64 1/1103/Economic Code/2213 - Subform

PART - 10: CLOSING BALANCE

Item Note Amount (Tax)

Closing Balance (VAT) (58-50-67+Not Approved Amount of VAT in Refund Module (If

65 -

any))

Closing Balance (SD) [59-51-68+Not Approved Amount of SD in Refund Module (If any)]

66 -

PART - 11: REFUND

Items Note Yes No

I am interested to get refund of my Closing Balance Requested Amount for Refund 67 -

(VAT)

Requested Amount for Refund (SD) 68

PART - 12: DECLARATION

I hereby declare that all information provided in this Return Form are complete, true & accurate. In case of any untrue/incomplete statement, I may be subjected

to penal action under The Value Added Tax and Supplementary Duty Act, 2012 or any other applicable Act prevailing at present.

Name

Designation

Mobile number

National ID/Passport Number Signature

Signature [Not required for electronic

submission]

You might also like

- Government of The People's Republic of Bangladesh National Board of RevenueDocument6 pagesGovernment of The People's Republic of Bangladesh National Board of RevenueBazlur RahmanNo ratings yet

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinNo ratings yet

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinNo ratings yet

- Mushak-9.1 VAT Return On 19.NOV.2020 PDFDocument6 pagesMushak-9.1 VAT Return On 19.NOV.2020 PDFApexBD01No ratings yet

- Mushak-9.1 VAT Return On 17.DEC.2023Document7 pagesMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserNo ratings yet

- Mushak-9.1 VAT Return On 16.JUN.2022Document6 pagesMushak-9.1 VAT Return On 16.JUN.2022Noor TriftoNo ratings yet

- Mushak-9.1 VAT Return On 14.JUN.2022Document13 pagesMushak-9.1 VAT Return On 14.JUN.2022Kazi MahbubNo ratings yet

- Mushak-9.1 VAT Return On 08.AUG.2021Document6 pagesMushak-9.1 VAT Return On 08.AUG.2021Marjuk Rasel MormoNo ratings yet

- Mushak-9.1 VAT Return On 15.JAN.2024Document8 pagesMushak-9.1 VAT Return On 15.JAN.2024tacib.milkiNo ratings yet

- Mushak-9.1 VAT Return On 14.JAN.2022Document8 pagesMushak-9.1 VAT Return On 14.JAN.2022Md. Abu NaserNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- Mushak-9.1 VAT Return On 17.DEC.2023Document6 pagesMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserNo ratings yet

- Mushak-9.1 VAT Return On 14.MAR.2022Document18 pagesMushak-9.1 VAT Return On 14.MAR.2022Kazi MahbubNo ratings yet

- Mushak-9.1 VAT Return On 13.SEP.2021Document6 pagesMushak-9.1 VAT Return On 13.SEP.2021Md. Abu NaserNo ratings yet

- Ryat) /'./T: Part-6: Decreasing Adjustments VatamountDocument1 pageRyat) /'./T: Part-6: Decreasing Adjustments Vatamountmd alinawezNo ratings yet

- Cyprus Tax Facts 2024 RSM CyprusDocument76 pagesCyprus Tax Facts 2024 RSM Cyprusposhdoll.plNo ratings yet

- Astradigital Inc BIRForm 1702RT-page 2Document1 pageAstradigital Inc BIRForm 1702RT-page 2MARIA CRISTINA DE PAZNo ratings yet

- Mushak-9.1 VAT Return On 13.SEP.2021Document6 pagesMushak-9.1 VAT Return On 13.SEP.2021Aoronno Hasan Akib100% (1)

- Total Equity Non-Current Liabilities: Cfap 1: A A F RDocument1 pageTotal Equity Non-Current Liabilities: Cfap 1: A A F R.No ratings yet

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- 2022 Tax ComputationDocument7 pages2022 Tax ComputationGeo Mosaic Diaz (Jiyu)No ratings yet

- BIR Form 1702-RTDocument1 pageBIR Form 1702-RTGil DelenaNo ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- 9 8Document1 page9 8celson carelNo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- SampleDocument2 pagesSampleHarue LeeNo ratings yet

- 09 FMF - SSA & DC ParticipantsDocument67 pages09 FMF - SSA & DC ParticipantspalmkodokNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPHarsiddhi KotilaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPJuhi MarmatNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- Unit I: Income From Profits and Gains of Business or Profession'Document20 pagesUnit I: Income From Profits and Gains of Business or Profession'anuNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- SPS Chit Funds Private Limited Profit-Loss Fy2021-22Document1 pageSPS Chit Funds Private Limited Profit-Loss Fy2021-22Basker BillaNo ratings yet

- Capital Gain (Gross-Exemption) : Circle Zone Residential StatusDocument16 pagesCapital Gain (Gross-Exemption) : Circle Zone Residential StatusKhadimulHasanTarifNo ratings yet

- Book - Income Taxes - 7 (PGBP)Document45 pagesBook - Income Taxes - 7 (PGBP)Arjun ThawaniNo ratings yet

- Income Taxes: Practical Accounting 1 1Document2 pagesIncome Taxes: Practical Accounting 1 1Bryan ReyesNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Defined Benefit Plan-LectureDocument17 pagesDefined Benefit Plan-LectureDyen100% (1)

- ESTADOS fINANCIEROS SUPERMERCADOS DIADocument42 pagesESTADOS fINANCIEROS SUPERMERCADOS DIARichard NavarroNo ratings yet

- Company: Computation Type: Final Return Tin: Number of Months Accounting DateDocument13 pagesCompany: Computation Type: Final Return Tin: Number of Months Accounting DateHassan OmaryNo ratings yet

- 2316 For Eb Ss Deso Ss PDL SsDocument1 page2316 For Eb Ss Deso Ss PDL SsJesi Ray Almacen ZamoraNo ratings yet

- Sherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018Document15 pagesSherrod, Inc., Reported Pretax Accounting Income of $88 Million For 2018laale dijaanNo ratings yet

- Return of Income: For An Individual AssesseeDocument44 pagesReturn of Income: For An Individual AssesseeSammyNo ratings yet

- PDF 172945190200721Document1 pagePDF 172945190200721chanchal deviNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingDocument1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingPrashant GargNo ratings yet

- Class PaperDocument1 pageClass PaperPrashant GargNo ratings yet

- Psak 46Document15 pagesPsak 46api-3708783100% (1)

- Non GAAP Reconciliation Q3 2023Document9 pagesNon GAAP Reconciliation Q3 2023mayrandmandyNo ratings yet

- 2pg Itr SMIIDocument1 page2pg Itr SMIIRic Dela CruzNo ratings yet

- Annual DataDocument4 pagesAnnual DataJess BautistaNo ratings yet

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- PDF 534109970291221Document1 pagePDF 534109970291221tax advisorNo ratings yet

- Test 10 SolutionDocument2 pagesTest 10 Solutionls786580302No ratings yet

- Invoice 653Document1 pageInvoice 653MD. Mahbubur RahmanNo ratings yet

- Invoice 653Document1 pageInvoice 653MD. Mahbubur RahmanNo ratings yet

- Part - 2: Return Submission Data: Part - 1: Taxpayer'S InformationDocument2 pagesPart - 2: Return Submission Data: Part - 1: Taxpayer'S InformationMD. Mahbubur RahmanNo ratings yet

- Total Decreasing AdjustmentDocument3 pagesTotal Decreasing AdjustmentMD. Mahbubur RahmanNo ratings yet

- Part - 2: Return Submission Data: Part - 1: Taxpayer'S InformationDocument2 pagesPart - 2: Return Submission Data: Part - 1: Taxpayer'S InformationMD. Mahbubur RahmanNo ratings yet

- Invoice 653Document1 pageInvoice 653MD. Mahbubur RahmanNo ratings yet

- Part - 2: Return Submission Data: Part - 1: Taxpayer'S InformationDocument2 pagesPart - 2: Return Submission Data: Part - 1: Taxpayer'S InformationMD. Mahbubur RahmanNo ratings yet

- Demand Details: ProfileDocument2 pagesDemand Details: ProfileMukesh PadwalNo ratings yet

- Jurisdiction Details PDFDocument57 pagesJurisdiction Details PDFjigneshNo ratings yet

- I AnnexureDocument4 pagesI AnnexureRiSHI KeSH GawaINo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGDocument1 pageVAHAN 4.0 (Citizen Services) Onlineapp02 150 8013 GGmdneyaz9831No ratings yet

- Digest Cir v. Asalus CorpDocument2 pagesDigest Cir v. Asalus CorpJan Veah CaabayNo ratings yet

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceJosty NJNo ratings yet

- DL NewBusPermit-BACOORDocument2 pagesDL NewBusPermit-BACOOROlive Dago-oc100% (1)

- Principles of Taxation For Business and Investment Planning 2019 22nd Edition Jones Test BankDocument13 pagesPrinciples of Taxation For Business and Investment Planning 2019 22nd Edition Jones Test Bankavadavatvulgatem71u2100% (15)

- Impact of GST On Various SectorsDocument2 pagesImpact of GST On Various SectorsSwathi ReddyNo ratings yet

- Toshiba vs. CIR - G.R. No. 157594, March 09, 2010Document20 pagesToshiba vs. CIR - G.R. No. 157594, March 09, 2010Marian Dominique AuroraNo ratings yet

- Tax Cases April 28Document52 pagesTax Cases April 28Treborian TreborNo ratings yet

- 69679716181019595Document32 pages69679716181019595logicinsideNo ratings yet

- Swift Fin Mt103: Format DescriptionDocument10 pagesSwift Fin Mt103: Format DescriptionService Administratif100% (2)

- Kottayam, Kerala, India.: Revaluation / ScrutinyDocument2 pagesKottayam, Kerala, India.: Revaluation / ScrutinyBzl VargNo ratings yet

- 2023 18 10 13 23 04 Statement - 1697615584687Document28 pages2023 18 10 13 23 04 Statement - 1697615584687Rahul MunnaNo ratings yet

- 14-01-2022 شركة مدار لمواد البناء المحدودةDocument2 pages14-01-2022 شركة مدار لمواد البناء المحدودةmohammed asadNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- Assessment of Charitable Institution-A Comprehensive Case StudyDocument22 pagesAssessment of Charitable Institution-A Comprehensive Case StudyRachana P NNo ratings yet

- On GST 1Document56 pagesOn GST 1Gayathri Nathan100% (1)

- Tax On Corporations (Additional Exercises)Document2 pagesTax On Corporations (Additional Exercises)April PacanasNo ratings yet

- Description From Currency To Currency Recipient Receive Exchange Rate Amount DueDocument1 pageDescription From Currency To Currency Recipient Receive Exchange Rate Amount DueJOMBANG TIMOERNo ratings yet

- PDF Format Quotation Q B H 2122 167 1Document1 pagePDF Format Quotation Q B H 2122 167 1Gunjan PatelNo ratings yet

- Invoice OD121385510235609000Document1 pageInvoice OD121385510235609000Mohammed NazimNo ratings yet

- Argudo V Parea - 7071 Notice - CaguateDocument10 pagesArgudo V Parea - 7071 Notice - CaguateAlejandro RodriguezNo ratings yet

- Maria Filipinas S. Joson Principal IIDocument17 pagesMaria Filipinas S. Joson Principal IIAngela Maniego MendozaNo ratings yet

- Ramo 4 86 PDFDocument3 pagesRamo 4 86 PDFAmerigo VespucciNo ratings yet

- Self Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4Document3 pagesSelf Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4UmarNo ratings yet

- Cw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFDocument1 pageCw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFBBA SNUNo ratings yet

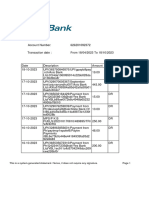

- City BankDocument2 pagesCity Banksabbithasan1No ratings yet

- Guide Relevant Life InsuranceDocument8 pagesGuide Relevant Life Insurancepderby1No ratings yet