Professional Documents

Culture Documents

Total Equity Non-Current Liabilities: Cfap 1: A A F R

Uploaded by

.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Equity Non-Current Liabilities: Cfap 1: A A F R

Uploaded by

.Copyright:

Available Formats

PRACTICE KIT

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 20: CONSOLIDATION CASH FLOWS

Total equity 1,112 1,122

Non-current liabilities

Long-term borrowings 20 64

Deferred tax 28 26

Retirement benefit obligation 100 96

Total non-current liabilities 148 186

Current liabilities:

Trade payables 115 180

Current tax payable 35 42

Short-term provisions 5 4

Total current liabilities 155 226

Total liabilities 303 412

Total equity and liabilities 1,415 1,534

WARRBURT GROUP

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR

ENDED 30 NOVEMBER 20X8

$

Revenue 910

Cost of sales (886)

Gross profit 24

Other income 7

Distribution costs (40)

Administrative expenses (35)

Finance costs (9)

Share of profit of associate 6

Loss before tax (47)

Income tax expense (29)

Loss for the year (76)

Other comprehensive income for the year (after tax, not reclassified to P/L)

Investment in equity instruments (IEI) 27

Gains on property revaluation 2

Remeasurement losses on defined benefit plan (4)

Other comprehensive income for the year (after tax) 25

Total comprehensive income for the year (51)

Profit/(loss) attributable to:

Owners of the parent (74)

Non-controlling interest (2)

(76)

Total comprehensive income attributable to:

Owners of the parent (49)

Non-controlling interest (2)

(51)

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 56 of 318

You might also like

- Institute of Chartered Accountants - Ghana (ICAG) Paper 3.1 Corporate Reporting Final Mock Exam 1Document20 pagesInstitute of Chartered Accountants - Ghana (ICAG) Paper 3.1 Corporate Reporting Final Mock Exam 1humphrey daimon100% (1)

- Pathfinder MAY 2016 ProfessionalDocument184 pagesPathfinder MAY 2016 ProfessionalALIU HADINo ratings yet

- Financial StatementsDocument92 pagesFinancial StatementsJaspreet KaurNo ratings yet

- Roche Holding LTD, Basel - Financial StatementsDocument15 pagesRoche Holding LTD, Basel - Financial StatementsItz MeeNo ratings yet

- B. Financial StatementsDocument4 pagesB. Financial StatementsReginald ValenciaNo ratings yet

- Consolidated Annual Accounts 2022Document67 pagesConsolidated Annual Accounts 2022heera lal thakurNo ratings yet

- Income Statement (In MLN.) : Roic - Ai - AfiDocument11 pagesIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNo ratings yet

- Danone 2020 Full Year Consolidated Financial Statements and Related NotesDocument62 pagesDanone 2020 Full Year Consolidated Financial Statements and Related NotesHager SalahNo ratings yet

- Probchp 07Document7 pagesProbchp 07irmaNo ratings yet

- ACCA SBR Mar-20 FightingDocument34 pagesACCA SBR Mar-20 FightingThu Lê HoàiNo ratings yet

- Eramet Annual Consolidated Financial Statements at 31december2020Document90 pagesEramet Annual Consolidated Financial Statements at 31december2020hyenadogNo ratings yet

- Statement of Cash Flows: AS 31 DEC 2015Document6 pagesStatement of Cash Flows: AS 31 DEC 2015Arif AmsyarNo ratings yet

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRANo ratings yet

- Plaquette Annuelle 31 Decembre 2022 EN VdefsDocument80 pagesPlaquette Annuelle 31 Decembre 2022 EN VdefsAbdcNo ratings yet

- Siemens Report4You FY2022Document64 pagesSiemens Report4You FY2022Vibhore KanoongoNo ratings yet

- InvestorPresentation-1H2016vFpinang CoalDocument20 pagesInvestorPresentation-1H2016vFpinang CoalHendry ChristiantoNo ratings yet

- 2023.12 Afklm Financial Statements and NotesDocument92 pages2023.12 Afklm Financial Statements and NotesCyrine JemaaNo ratings yet

- Far 202324 t2 Normal LVMH 2019 Eng FinancialstatementsDocument88 pagesFar 202324 t2 Normal LVMH 2019 Eng Financialstatementslingling9905No ratings yet

- Accounting: BasicsDocument18 pagesAccounting: Basicsdany2884bcNo ratings yet

- Corporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetDocument32 pagesCorporate Financial Reporting & Analysis: Preparing and Understanding Balance SheetMansi aggarwal 171050No ratings yet

- AstraZeneca AR 2021 Financial StatementsDocument77 pagesAstraZeneca AR 2021 Financial StatementsZoe SPNo ratings yet

- cpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020Document66 pagescpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020kjbewdjNo ratings yet

- Analysis of Financial StatementDocument8 pagesAnalysis of Financial StatementMuhammad IrfanNo ratings yet

- Analysing Financial Performance: Centre For Financial Management, BangaloreDocument24 pagesAnalysing Financial Performance: Centre For Financial Management, Bangalorepankaj9mayNo ratings yet

- Bab 1 GCG Delta Dunia AR 2019Document10 pagesBab 1 GCG Delta Dunia AR 2019Ditha LuvikaNo ratings yet

- ACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFDocument24 pagesACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFමිලන්No ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- Cash Flow Explanatory SheetDocument4 pagesCash Flow Explanatory SheetTony DarwishNo ratings yet

- CBSValuationChallenge InvestorsDocument60 pagesCBSValuationChallenge InvestorsVkNo ratings yet

- REVISION Qs FADocument12 pagesREVISION Qs FAhannah ispandiNo ratings yet

- Financial Statements of Great Eastern Shipping: YearsDocument15 pagesFinancial Statements of Great Eastern Shipping: YearsPriyankaNo ratings yet

- AR Ali 102Document1 pageAR Ali 102Lieder CLNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- 2020 LBG q1 Ims Excel Download v2Document16 pages2020 LBG q1 Ims Excel Download v2saxobobNo ratings yet

- Hilb, Rogal & Hamilton: Income StatementDocument3 pagesHilb, Rogal & Hamilton: Income Statementgunjan88No ratings yet

- Nvidia ExcelDocument8 pagesNvidia Excelbafsvideo4No ratings yet

- Consolidated Balance Sheet: Total AssetsDocument12 pagesConsolidated Balance Sheet: Total AssetsSaswata ChoudhuryNo ratings yet

- Module 2Document4 pagesModule 2Trúc LyNo ratings yet

- CFM Term Paper PresentationDocument34 pagesCFM Term Paper PresentationjavoleNo ratings yet

- Cipla FRA Assignment 2 Group 3Document7 pagesCipla FRA Assignment 2 Group 3xzeekNo ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- Exhibit 1: BALANCE SHEET of VIP Industries As at March 31Document2 pagesExhibit 1: BALANCE SHEET of VIP Industries As at March 31Neelu AggrawalNo ratings yet

- Chapter 12 - Example - 1Document2 pagesChapter 12 - Example - 1Haseeb AhmedNo ratings yet

- Cashflows From Operating Activities: Code Profit Before Tax 1Document21 pagesCashflows From Operating Activities: Code Profit Before Tax 1Lâm Ninh TùngNo ratings yet

- 20 03 12 Financial Statements of RWE AG 2019Document66 pages20 03 12 Financial Statements of RWE AG 2019HoangNo ratings yet

- MT - Examination Solution 2018 FSaDocument6 pagesMT - Examination Solution 2018 FSaRamrajNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Ford Motor Company and Subsidiaries Consolidated Income Statement (In Millions, Except Per Share Amounts)Document4 pagesFord Motor Company and Subsidiaries Consolidated Income Statement (In Millions, Except Per Share Amounts)Samy AbdullahNo ratings yet

- AFM Project Sec J Group 10Document32 pagesAFM Project Sec J Group 10J40Santhosh KrishnaNo ratings yet

- Long Hau LGH - Sonadezi Chau Duc SZC - Case Study Q7 ReviewDocument59 pagesLong Hau LGH - Sonadezi Chau Duc SZC - Case Study Q7 ReviewTrung Hung HoNo ratings yet

- Contoh FSDocument2 pagesContoh FSSamuel SubiyantoNo ratings yet

- Consolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial StatementsDocument5 pagesConsolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial Statementsria septiani putriNo ratings yet

- Financial Statement Analysis: Hong Kong Public Listed CompanyDocument14 pagesFinancial Statement Analysis: Hong Kong Public Listed CompanySalman SajidNo ratings yet

- Tutorial 3 Q ADocument12 pagesTutorial 3 Q ASwee Yi LeeNo ratings yet

- FBN Holdings PLC 9M 2021 Audited Financial StatementsDocument102 pagesFBN Holdings PLC 9M 2021 Audited Financial StatementsnkemoviaNo ratings yet

- Financial Numbers (A Comparison) (The Sector Vis-À-Vis The Selected Company)Document7 pagesFinancial Numbers (A Comparison) (The Sector Vis-À-Vis The Selected Company)Sanath NaimpallyNo ratings yet

- FCL Financial Statements 2015Document26 pagesFCL Financial Statements 2015adebo_yemiNo ratings yet

- Balance Sheet StructuresFrom EverandBalance Sheet StructuresAnthony N BirtsNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- Innogy (IGY:DE) : Investment RecommendationDocument22 pagesInnogy (IGY:DE) : Investment RecommendationVMMNo ratings yet

- SIM-42 B Oriental Bank of Commerce Stock StatementDocument4 pagesSIM-42 B Oriental Bank of Commerce Stock StatementkapilgsmNo ratings yet

- 9 Agents Confidential Info Ver.1Document1 page9 Agents Confidential Info Ver.1Jay TeeNo ratings yet

- Husky Brochure EnglishDocument26 pagesHusky Brochure EnglishPandega DewantoNo ratings yet

- Issue 97Document12 pagesIssue 97Sovannak OnNo ratings yet

- APC 210910042807607null 1262892960Document1 pageAPC 210910042807607null 1262892960ratnesh vaviaNo ratings yet

- Marketing Mangement: Pestle AnswersDocument3 pagesMarketing Mangement: Pestle AnswersSahithi Ammu LuNo ratings yet

- Sbi Life Midcap Fund PerformanceDocument1 pageSbi Life Midcap Fund PerformanceVishal Vijay SoniNo ratings yet

- Gpbs 2024 BrochureDocument8 pagesGpbs 2024 BrochurejayeshmananiNo ratings yet

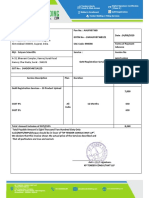

- JUL 23 Shiv Chamber BillDocument1 pageJUL 23 Shiv Chamber BillZubair SiddiquiNo ratings yet

- Satyam ScientificDocument1 pageSatyam ScientificHussain ShaikhNo ratings yet

- F - Jeevan Akshay VII Sales Brochure W4xH9 InchesDocument16 pagesF - Jeevan Akshay VII Sales Brochure W4xH9 InchesKing BNo ratings yet

- Chapter 6 Bsa 14Document6 pagesChapter 6 Bsa 14조형주No ratings yet

- Fall Macro 2016-3.tst PDFDocument7 pagesFall Macro 2016-3.tst PDFctyre34No ratings yet

- Agricultural MarketingDocument12 pagesAgricultural MarketingVikas SinghNo ratings yet

- "Navodaya Vidyalaya Samiti" PRE-BOARD Exam 2020-21 Class: Xii Subject: Accountancy (055) TIME: 3 Hours Max Marks: 80Document12 pages"Navodaya Vidyalaya Samiti" PRE-BOARD Exam 2020-21 Class: Xii Subject: Accountancy (055) TIME: 3 Hours Max Marks: 80hardikNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- Accounting Ratios Excel TemplateDocument4 pagesAccounting Ratios Excel TemplateMAZIN SALAHELDEENNo ratings yet

- PT 1 Transaction AnalysisDocument3 pagesPT 1 Transaction AnalysisJanela Venice SantosNo ratings yet

- Snapshot Q1 2023Document3 pagesSnapshot Q1 2023JIA WEI SIEWNo ratings yet

- Act130: Accounting For Special Transactions Assignment Topic: Corporate Liquidation Problem 1Document3 pagesAct130: Accounting For Special Transactions Assignment Topic: Corporate Liquidation Problem 1Aldrin ZolinaNo ratings yet

- Common Stock Valuation: Principles, Tables and Application: Financial Analysts JournalDocument21 pagesCommon Stock Valuation: Principles, Tables and Application: Financial Analysts JournalMuhammad NaeemNo ratings yet

- Taxing Petroleum Products - DK Srivastava Et Al - EPW - Feb 2021Document7 pagesTaxing Petroleum Products - DK Srivastava Et Al - EPW - Feb 2021Amiesha DhallNo ratings yet

- BPG - 5S-System (Fivess)Document24 pagesBPG - 5S-System (Fivess)Giö GdlNo ratings yet

- causelistALL2021 12 09Document114 pagescauselistALL2021 12 09Abhijeet KumarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961SUNYYRNo ratings yet

- Capital Budgeting 2Document4 pagesCapital Budgeting 2Nicole Daphne FigueroaNo ratings yet

- Marcelo Desouza: Travel ItineraryDocument2 pagesMarcelo Desouza: Travel ItineraryFátima GomesNo ratings yet

- Min ZoDocument3 pagesMin ZoaniclazarNo ratings yet

- Refuz La PlataDocument2 pagesRefuz La PlataAndra Alexandra AvădăneiNo ratings yet