Professional Documents

Culture Documents

Accounting fundamentals quiz answers

Uploaded by

Kanika BajajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting fundamentals quiz answers

Uploaded by

Kanika BajajCopyright:

Available Formats

1. The amount brought in by owner of the business should be credited to?

a) owners equity b) drawings (c) Cash (d) All of above

2. Which of the following transactions would have no impact on stockholders' equity?

(a) Purchase of the land from the proceeds of bank loan (b) Dividends to stock holders

(c) Net loss (d) Investment of cash by stockholders

3. Which of the following transactions occurs on daily basis in a large business

organization?

(a) Purchaser of equipment (b) Payroll (c) Credit sales

(d) Payment of suppliers

4. How much types a transaction has?

(a) One

(b) Two

(c) Three

(d) Four

5. Transactions are initially recorded in the?

(a) Book of Final Entry

(b) Accounting Equation

(c) T Accounts

(d) Book of Original Entry

6. Of the following account types, which would be increased by a debit?

(a) Liabilities and expenses

(b) Assets and equity

(c) Assets and expenses

(d) Equity and revenues

7. Sales made to Ahmed on credit should be debited to?

(a) Account Receivable

(b) Cash

(c) Account Receivable-Ahmed

(d) Sales

8. According to the rules of debit and credit for balance sheet accounts?

(a) Increase in assets, liabilities and owner equity recorded by debit

(b) Decrease in asset and liability are recorded by credit

(c) Increase in asset and owner’s equity are recorded by debit

(d) Decrease in liability and owner’s equity are recorded by debit

9. In which order does the Journal list transactions?

(a) Chronological (b) Decreasing

(c) Increasing (d) Alphabetical

10. All of the following are true regarding journal entries except?

(a) Journal entries show the effects of transactions

(b) Journal entries provide account balances

(c) The debited account titles are listed first

(d) Each journal entry should begin with a date

11. Which of the following accounts would be increased with a debit?

(a) Contributed Capital

(b) Retained Earnings

(c) Expenses

(d) Revenues

12. Which of the following account will be credited in the books of XYZ Co. Ltd, if the

business purchased a vehicle though cheque?

(a) Vehicle account

(b) Cash account

(c) Business account

(d) Bank account

13. The abbreviations for debit and credit (Dr. and Cr.) come from what language

words?

(a) Latin, debere and credere

(b) Latin, debtor and creditor

(c) Greek, debere and credere

(d) Greek, debtor and creditor

14. Which one of the following is used to record financial transactions in date wise

order?

(a) Account

(b) Voucher

(c) General Journal

(d) General Ledger

15. Accrued expenses are also called?

(a) Accrued liabilities

(b) Expenses incurred but not paid

(c) Both A & B

(d) None

16. Which one of the following is called book of original entry?

(a) General Journal

(b) General Ledger

(c) Trial Balance

(d) Receipt and Payment Account

17. Which of the following account/s will be affected under the rule of accrual

accounting, when furniture is purchased on cash?

(a) Only Cash Account

(b) Only Furniture Account

(c) Cash & Furniture Account

(d) Only Purchases Account

18. Purchased goods from Ahmed for cash should be credited to?

(a) Account Payable _ Ahmed

(b) Cash A/c

(c) Purchases A/c

(d) Account Receivable _ Ahmed

19. Credit terms of 1/10, n/30 mean that?

(a) Payment in full is due 10 days after date of the invoice

(b) If the invoice is paid within 10 days of its date, a 1% discount may be taken; otherwise the total

amount is due in 20 days

(c) Payment in full is due 30 days after date of the invoice

d) If the invoice is paid within 10 days of its date, a 1% discount may be taken; otherwise the total

amount is due in 30 days

20. Commission received is an example of?

(a) Real A/c (b) Personal A/c (c) Nominal A/c (d) None

You might also like

- Accounting MCQs With AnswersDocument77 pagesAccounting MCQs With AnswersAbhijeet AnandNo ratings yet

- Mcqs LedgerDocument10 pagesMcqs LedgerUsama SaadNo ratings yet

- Mcs QDocument52 pagesMcs QNabeel GondalNo ratings yet

- Accounting Multiple Choice Questions ExplainedDocument10 pagesAccounting Multiple Choice Questions ExplainedSarannya PillaiNo ratings yet

- MCQ FA (UNIT 1 and UNIT 2)Document13 pagesMCQ FA (UNIT 1 and UNIT 2)Udit SinghalNo ratings yet

- MCQs Financial AccountingDocument30 pagesMCQs Financial AccountingMehboob Ul-haq100% (1)

- Final McqsDocument43 pagesFinal McqsShoaib Kareem100% (4)

- Sem1 MCQ FinancialaccountDocument14 pagesSem1 MCQ FinancialaccountVemu SaiNo ratings yet

- Account MCQ PDFDocument93 pagesAccount MCQ PDFsunil kalura100% (1)

- Accountancy XIDocument8 pagesAccountancy XIGurmehar Kaur100% (1)

- Cma Inter MCQ Booklet Financial Accounting Paper 5Document175 pagesCma Inter MCQ Booklet Financial Accounting Paper 5DGGI BPL Group1No ratings yet

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersDocument24 pagesFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)

- Account's MCQDocument7 pagesAccount's MCQMohitTagotraNo ratings yet

- Class 11 MCQ Accountancy Unit 1Document10 pagesClass 11 MCQ Accountancy Unit 1MilanNo ratings yet

- Accounting Concepts MCQsDocument6 pagesAccounting Concepts MCQsUmar SulemanNo ratings yet

- FINANCIAL ACCOUNTS QUIZDocument6 pagesFINANCIAL ACCOUNTS QUIZAkanksha Garg100% (1)

- Exam 1 Review: Accounting Principles and Financial StatementsDocument16 pagesExam 1 Review: Accounting Principles and Financial StatementsAj201819No ratings yet

- Ratio Analysis McqsDocument10 pagesRatio Analysis McqsNirmal PrasadNo ratings yet

- NME Fundments of Accounting III & IV UnitDocument23 pagesNME Fundments of Accounting III & IV UnitSwathi LakshmiNo ratings yet

- Journal, Ledger MCQDocument7 pagesJournal, Ledger MCQSujan DangalNo ratings yet

- Xii Mcqs CH - 16 Cash FlowDocument6 pagesXii Mcqs CH - 16 Cash FlowJoanna GarciaNo ratings yet

- Unit 1: Indian Financial System: Multiple Choice QuestionsDocument31 pagesUnit 1: Indian Financial System: Multiple Choice QuestionsNisha PariharNo ratings yet

- Accounting Mcqs For PPSCDocument5 pagesAccounting Mcqs For PPSCizhar_buneriNo ratings yet

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument28 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- Financial Accounting MCQS For ExamDocument11 pagesFinancial Accounting MCQS For ExamMuhammad MidhatNo ratings yet

- MCQ-Financial Account-SEM VDocument52 pagesMCQ-Financial Account-SEM VVishnuNadarNo ratings yet

- Top Senior Auditor Solved MCQs Past PapersDocument12 pagesTop Senior Auditor Solved MCQs Past PapersAli100% (1)

- MCQs Financial Accounting BSCSDocument11 pagesMCQs Financial Accounting BSCSPervaiz Shahid100% (1)

- Accounts MCQDocument41 pagesAccounts MCQHaripriya VNo ratings yet

- 6-Cash Book Multiple Choice Questions With Answers PDFDocument14 pages6-Cash Book Multiple Choice Questions With Answers PDFHammadkhan Dj89No ratings yet

- Financial Accounting McqsDocument3 pagesFinancial Accounting McqsMurad AliNo ratings yet

- Xii Mcqs CH - 11 Redemption of DebenturesDocument4 pagesXii Mcqs CH - 11 Redemption of DebenturesJoanna GarciaNo ratings yet

- Corporate Accounting Solved Mcqs Set 15Document6 pagesCorporate Accounting Solved Mcqs Set 15Bhupendra Gocher0% (1)

- MCQDocument17 pagesMCQMilan Subhashchandra ShahNo ratings yet

- NILA TUITION CENTER - KUMBAKONAM ACCOUNTANCY ONE MARK TESTDocument9 pagesNILA TUITION CENTER - KUMBAKONAM ACCOUNTANCY ONE MARK TESTmageshwari mohanNo ratings yet

- REDEMPTION OF SHARES & DEBENTURES MCQsDocument7 pagesREDEMPTION OF SHARES & DEBENTURES MCQsChetan StoresNo ratings yet

- Sem5 MCQ MangACCDocument8 pagesSem5 MCQ MangACCShirowa ManishNo ratings yet

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsDocument9 pagesAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajNo ratings yet

- Mcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomeDocument6 pagesMcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomePradeep SethyNo ratings yet

- 80 Auditing Assurance MCQ'S: © Ca WorldDocument14 pages80 Auditing Assurance MCQ'S: © Ca WorldZain Butt50% (2)

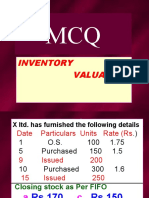

- MCQ Inventory Valuation LBSIMDocument49 pagesMCQ Inventory Valuation LBSIMSumit SharmaNo ratings yet

- Accounting Cycle McqsDocument7 pagesAccounting Cycle McqsasfandiyarNo ratings yet

- Multiple Choice Questions: Journal - The First Phase of Accounting CycleDocument4 pagesMultiple Choice Questions: Journal - The First Phase of Accounting CycleDohaa NadeemNo ratings yet

- Cost Sem 5 ObjectiveDocument16 pagesCost Sem 5 Objectivesimran Keswani0% (1)

- Accountancy Chapter on Retirement & Death of a Partner MCQsDocument7 pagesAccountancy Chapter on Retirement & Death of a Partner MCQsabiNo ratings yet

- All MCQs of Finnancial AccountingDocument13 pagesAll MCQs of Finnancial AccountingNoshair Ali100% (2)

- Special Purpose BooksDocument19 pagesSpecial Purpose BooksJasmine SainiNo ratings yet

- MCQ - Law 1 PDFDocument160 pagesMCQ - Law 1 PDFBharathNo ratings yet

- II B.Com Corporate Accounting Multiple Choice QuestionsDocument22 pagesII B.Com Corporate Accounting Multiple Choice QuestionsHaroon Akhtar0% (2)

- Accounting McqsDocument16 pagesAccounting McqsAsad RehmanNo ratings yet

- MCQsDocument3 pagesMCQsMalik ArshadNo ratings yet

- Trial Balance MCQs - Check Ledger AccountsDocument2 pagesTrial Balance MCQs - Check Ledger AccountsasfandiyarNo ratings yet

- Costing MCQDocument30 pagesCosting MCQkomalNo ratings yet

- NPO MCQ QuestionDocument5 pagesNPO MCQ QuestionBikash SahooNo ratings yet

- SET Journal EntryDocument5 pagesSET Journal EntryHifzaNo ratings yet

- Cash Book Quiz: Test Your Knowledge of Double Entry AccountingDocument5 pagesCash Book Quiz: Test Your Knowledge of Double Entry AccountingRabia BhattiNo ratings yet

- PT 2 Question Bank AccDocument7 pagesPT 2 Question Bank AccDeivanai K CSNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Liveloud SongsheetDocument20 pagesLiveloud SongsheetMhay Lee-VillanuevaNo ratings yet

- A) Formal PowerDocument2 pagesA) Formal PowerTejas RathodNo ratings yet

- Gift TaxDocument3 pagesGift TaxBiswas LitonNo ratings yet

- Unit 2 Export Policy Framework: 2.0 ObjectivesDocument11 pagesUnit 2 Export Policy Framework: 2.0 ObjectiveskajalNo ratings yet

- Bar Graph Unit MonthDocument2 pagesBar Graph Unit MonthsushantinhbiNo ratings yet

- BMC Public HealthDocument21 pagesBMC Public HealthDaniel JhonsonNo ratings yet

- Ople VS Torres FullDocument11 pagesOple VS Torres FullKDNo ratings yet

- Equatorial Realty v. Mayfair Theater ruling on ownership and fruitsDocument3 pagesEquatorial Realty v. Mayfair Theater ruling on ownership and fruitslinlin_17No ratings yet

- Live Learn Lab - UC San Diego, North Torrey Pines Living and Learning NeighborhoodDocument36 pagesLive Learn Lab - UC San Diego, North Torrey Pines Living and Learning NeighborhoodAbri VincentNo ratings yet

- Hurricanes Katrina and Rita BibliographyDocument20 pagesHurricanes Katrina and Rita Bibliographyamericana100% (2)

- Introduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedDocument56 pagesIntroduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedAbhay MalikNo ratings yet

- SPI Firefight Rules (1976)Document20 pagesSPI Firefight Rules (1976)Anonymous OUtcQZleTQNo ratings yet

- Business Plan Proposal: Willreen Bakery and CakeryDocument49 pagesBusiness Plan Proposal: Willreen Bakery and CakeryMonicah MuthokaNo ratings yet

- Palladio's Architectural Works and InfluenceDocument1 pagePalladio's Architectural Works and InfluencerebeccafroyNo ratings yet

- Chapter 3: An Introduction To Consolidated Financial StatementsDocument44 pagesChapter 3: An Introduction To Consolidated Financial StatementsMUHAMMAD ARIFNo ratings yet

- The Immortal v2Document2 pagesThe Immortal v2NihilisticWhimNo ratings yet

- GK Today 2016 Economy PDFDocument451 pagesGK Today 2016 Economy PDFAanand Rishabh DagaNo ratings yet

- LEA Responses To Human TraffickingDocument18 pagesLEA Responses To Human TraffickingJavier IbrahimovicNo ratings yet

- 3036 7838 1 PBDocument17 pages3036 7838 1 PBAmandaNo ratings yet

- CIVIL LAW Answers To The BAR As Arranged by Topics (Year 1990-2006)Document8 pagesCIVIL LAW Answers To The BAR As Arranged by Topics (Year 1990-2006)dot_rocks67% (3)

- Lopez (Bussiness Meeting)Document2 pagesLopez (Bussiness Meeting)Ella Marie LopezNo ratings yet

- Chapter 9 Answer KeyDocument34 pagesChapter 9 Answer KeyFirebirdGT50% (2)

- Linux Commands NetDocument5 pagesLinux Commands NetAditya KumarNo ratings yet

- CMC No. PRO13 PEACE AND SECURITY CAMPAIGN PLAN (M+K+K K) PDFDocument13 pagesCMC No. PRO13 PEACE AND SECURITY CAMPAIGN PLAN (M+K+K K) PDFDanielZamoraNo ratings yet

- Gensoc ReviewerDocument50 pagesGensoc ReviewerAdora AdoraNo ratings yet

- Q&A Accounting Sales and Purchase JournalsDocument16 pagesQ&A Accounting Sales and Purchase JournalsQand A BookkeepingNo ratings yet

- NATO Bombing of Yugoslavia (TEXT)Document4 pagesNATO Bombing of Yugoslavia (TEXT)ana milutinovicNo ratings yet

- Wars That Changed History 50 of The World's Greatest Conflicts by Spencer TuckerDocument626 pagesWars That Changed History 50 of The World's Greatest Conflicts by Spencer TuckerAMAR100% (1)

- Res Ipsa Loquitur Section 328 D 2d Restatement of Torts (Excerpt)Document2 pagesRes Ipsa Loquitur Section 328 D 2d Restatement of Torts (Excerpt)George Conk100% (1)

- Palawan State University, Puerto Princesa, PhilippinesDocument15 pagesPalawan State University, Puerto Princesa, PhilippinesreyNo ratings yet