Professional Documents

Culture Documents

Chapter - 10 International Business

Uploaded by

Aejaz MohamedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter - 10 International Business

Uploaded by

Aejaz MohamedCopyright:

Available Formats

CHAPTER - 10

INTERNATIONAL BUSINESS

• Introduction

In this lesson we are going to have overall idea of International Business i.e., how to

sell goods and services to other countries traders/users and how to buy goods and

services from traders of others countries. You are going to learn the formalities and

procedures involved in the process of international trade i.e., both imports and

exports.

• Meaning:

• The buying and selling of goods and services beyond the geographical limits of the

country is known as International Business.

• In other words trade between the countries is known as International business.

• It involves not only the international movements of goods and services, but also of

capital, personnel, technology and intellectual property like patents, trademarks,

knowhow and copyrights.

• If our country buys goods from some other country it is called IMPORT and if we sell

goods to some other country it is called Export Trade.

• Problems of International business: There are various complexities or problems involved in

the international business. The major problems faced are as follows:

1. Different currencies:

Every country has its own currency. So importer has to make payment in the currency of

exporter’s country.

2. Legal Formalities:

International business is subject to a large number of legal formalities and restrictions.

The government of every country exercises strict control over business with other

nations.

3. Distance Barriers:

Due to large distance between countries, it is difficult to establish quick and personal

contacts between traders from different countries.

4. Language Barrier:

Due to different languages in different countries, it becomes difficult for traders to

understand the terms and conditions of the contract.

5. Difference in Laws:

Material Downloaded From SUPERCOP 1/7

International business transactions are subject to laws, rule and regulations of

multiple countries.International business transactions are subject to laws, rule and

regulations of multiple countries.

6. Information Gap:

It is difficult to obtain accurate information about foreign markets and about the

financial position of foreign merchants.

7. Transport Problem:

Water and air transport are the important modes of transport used in international

business. Shipping is less costly but time consuming. On the other hand airways are

faster but the cost involved is very high.

IMPORT PROCEDURE

Trade Enquiry

Procurement of Import License

Obtaining Foreign Exchange

Placing order or Indent

Obtaining Letter of Credit

Arranging for Finance

Receipt of shipment Advice

Retirement of Import Documents

Arrival of Goods

Customs clearance and Release of goods

EXPORT PROCEDURE

Receipt of Enquiry and Sending Quotations

Receipt of Order or Indent

Assessing Importer’s Credit worthiness and securing a guarantee for payments.

Obtaining Export license

Obtaining Pre shipment Finance

Production or Procurement of Goods

Pre shipment Inspection

Excise Clearance

Obtaining certificate of Origin

Reservation of Shipping Space

Material Downloaded From SUPERCOP 2/7

Packing and forwarding

Insurance of Goods

Customs Clearance

Obtaining Mate’s Receipt

Payment of Freight and issuance of Bill of Lading

Preparation of Invoice and Securing Payment

Documents used in Export Transactions

Documents related to Goods Documents Related to Documents Related to

Shipment Payment

1. Export Invoice: 1. Mate’s Receipt: 1. Letter of Credit:

• It is issued by the exporter.• It is issued by the • It is guarantee issued by the

commanding officer of the importer’s Bank that it will

ship to the exporter after the honor payment up to a

• It provides information like

cargo is loaded on the ship. certain amount of export bills

quantity of goods sent, total

• It contains details like name to the bank of the exporter.

value of goods etc.

of the vessel, berth, date of

shipment, description of

packages, marks and

numbers etc.

• It is very important receipt

as shipping company issues

the bill of lading only after

getting this receipt.

2. Packing List: 2. Shipping Bill: 2. Bill of Exchange:

It indicates the number of • It is the main document on

• It is drawn by the exporter

cases or packs and the details the basis of which customs

on the importer.

of the goods contained in office grants permission for

• It contains instruction to

these packs the export.

the importer to pay a

• It contains details regarding

specified amount to a certain

goods to be exported,

person or the bearer of the

exporter’s name and address,

instrument.

Material Downloaded From SUPERCOP 3/7

etc.

3. Certificate of Origin: 3. Bill of Lading: 3.Bank Certificate of

• It specifies the country in • It is prepared by Shipping Payment:

which the goods are being company acknowledging the

• It certifies that necessary

produced. receipt of goods on board the

documents relating to the

• It helps to get tariff ship.

particular export have been

concessions. • It is a document of title of

presented to the importer for

• It is also required when goods and is freely

payment.

there is a ban on imports of transferable by endorsement

certain goods from selected and delivery.

countries • It contains an undertaking

to carry them to the port of

destination.

4. Certificate of 4 Airway Bill:

Inspection:

• It is prepared by the airline

• It ensures that only good company to acknowledge the

quality products are receipt of goods on board its

exported. aircraft.

• Export Inspection Council of • It is also a document of title

India is one such agency to the goods and is freely

transferable by the

endorsement and delivery.

5. Marine Insurance

Policy:

• It is an insurance contract.

• It is an agreement to

indemnify the insured against

any loss caused due to perils

of the sea in consideration of

payment called premium.

6. Cart Ticket:

It is prepared by the

exporter, which provides

details regarding export

Material Downloaded From SUPERCOP 4/7

cargo, like shipper’s name,

number of packages, shipping

bill number etc.

It is also known as a cart chit,

vehicle pass or gate pass.

• Documents Used In Import Transactions:

1. Trade Enquiry:

It is a written request by the importer to the exporter to provide information

regarding price, terms and conditions etc.

2. Proforma Invoice:

A proforma invoice is a document that contains detailed information regarding price,

quality, grade, grade, size etc.

3. Shipment Advice:

Shipment advice is a document that the exporter sends to the importer.

It informs that the shipment of goods has been made and details regarding it.

4. Bill of Entry:

It is a document prepared by the importer.

It shows the details of goods imported and is used by custom authorities for

determining import duty.

5. Sight Draft:

It is a type of Bill of Exchange.

Through this the exporter instructs the bank to hand over the relevant documents to

the importer only against payment

6. Usance Draft:

It is a type of Bill of Exchange.

Through this the exporter instructs the bank to hand over the relevant documents to

the importer only against Acceptance of Bill of Exchange.

7. Import General Manifest:

It contains details regarding imported goods.

On the basis of this Goods are unloaded from the carrier.

8. Dock Challan:

It is prepared by the importer or his C& F (Clearing and Forwarding agent)

IT specifies the amount of dock dues.

• WORLD TRADE ORGANISATION (WTO)

• It was established on 1st January 1995.

Material Downloaded From SUPERCOP 5/7

• IT was established to have a permanent institution to promote free and fair trade

amongst nations.

• Role of WTO

• Encouraging member countries to come forward to WTO for mitigating their

grievances

• Laying down a commonly accepted code of conduct in order to reduce trade

barriers.

• Acting as a dispute settlement body.

• Ensuring that all rules and regulations prescribed in the Act are duly followed by

the member countries for the settlement of their disputes

• Holding consultations with IMF and IBRD and its affiliated agencies to bring better

understanding and cooperation in global economic policy making

• Regularly supervising the operations of the revised Agreements and Ministerial

declarations relating to goods, services and Trade Related Intellectual Property

Rights (TRIPS).

• Short Answers type questions :

1. This certificate specifies the origin of goods exported. Name the document. (1)

Ans. Certificate of Origin

2. This document is issued by the commanding officer of the ship to the exporter

after the cargo is loaded on the ship. Identify the document. (1)

Ans. Mate’s Receipt.

3. This document is prepared by shipping company to acknowledge the receipt of

goods on ship and gives an undertaking to carry them to port of destination. Name

the document. (1)

Ans. Bill of lading.

4. This document is the most appropriate and secure method of payment to settle

international transactions. Name the document. (1)

Ans. Letter of Credit.

5. On the basis of this document, customs office grants permission for the export.

Identify the document. (1)

Ans. Shipping Bill

6. This document is prepared by the importer and it shows the details of goods

imported and is used by custom authorities to determine import duty. State the

name of the document. (1)

Ans. Bill of Entry.

7. On the basis of this document, imported goods are unloaded from the carrier.

Write the name of the document. (1)

Ans. Import general Manifest.

Material Downloaded From SUPERCOP 6/7

8. What is meant by Bill of Lading? Explain the contents. Of it. (3)

Ans. Meaning of Bill of Lading and its contents.

9. Explain the content and purpose of Bill of Entry.

Ans. Bill of entry (3)

Long Answer type Questions and Answers:

10. Describe the role of WTO.

Ans. Role of WTO (Refer WTO given earlier) (4)

11. Differentiate between

1) Sight and usance draft and Bill of lading and Airway Bill. (4)

Ans. In case of sight draft importer makes payment when relevant documents are

delivered. Whereas in case of usance draft importer accepts the bill of exchange

and makes payment on maturity of bill.

2) Bill of lading is issued by the shipping company when goods are loaded on the

ship.

Whereas the airway bill is issued by airline company when goods are loaded on the

aircraft.

12. What is meant by pre shipment finance? (4)

Ans. Meaning of Pre shipment finance. (Refer Pre shipment finance given earlier)

13. List the major countries with whom India trades

Ans. USA, UK, Belgium, Germany, Japan Swizerland, Hong Kong, UAE, China,

Singapore and Malaysia. (4)

14. Explain the meaning of the following documents used in connection with import

transactions: i) Trade Enquiry ii) Import License iii) Shipment advice Ans. (Refer

Import Documents) (5)

15. Trendz industries has received an export order of 5,000 kids jeans from walmart

store, USA. What procedure you will follow to execute this export order?

Ans. Export Procedure. (6)

• Gist of the Lesson:

Concept and Problems of International Trade

Export Import Procedure and documents

Role of WTO

Material Downloaded From SUPERCOP 7/7

You might also like

- Lender Robo-SigningDocument147 pagesLender Robo-SigningKevin Shirley100% (10)

- Bill of ExchangeDocument11 pagesBill of ExchangecreepyguyNo ratings yet

- Export ProcedureDocument42 pagesExport Procedurevenkataswamynath channa85% (13)

- Paychekplus Elite Visa Payroll CardDocument2 pagesPaychekplus Elite Visa Payroll CardTruexxBlood57% (7)

- Basics of Chartering: Negotiation - Compatibility - Decision MakingFrom EverandBasics of Chartering: Negotiation - Compatibility - Decision MakingNo ratings yet

- Letters of Credit and Documentary Collections: An Export and Import GuideFrom EverandLetters of Credit and Documentary Collections: An Export and Import GuideRating: 1 out of 5 stars1/5 (1)

- Documents Related To International TradeDocument6 pagesDocuments Related To International TradeMOHAMMED ALI CHOWDHURY100% (10)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsAejaz Mohamed81% (21)

- International Trade Procedures & DocumentationDocument36 pagesInternational Trade Procedures & Documentationimad100% (8)

- International BankingDocument46 pagesInternational BankingSandesh Bhat100% (1)

- Documentation For LogisticsDocument10 pagesDocumentation For LogisticsNick NikhilNo ratings yet

- Import Export Contract TermsDocument18 pagesImport Export Contract TermsNyi Htut95% (19)

- Case ParmalatDocument6 pagesCase ParmalatSrikant Sahu100% (1)

- Export DocumentationDocument14 pagesExport DocumentationSiya Macwan100% (1)

- Import Export DocumentationDocument12 pagesImport Export DocumentationBetelhem AregaNo ratings yet

- Export Import DoccumentationDocument25 pagesExport Import DoccumentationErik Treasuryvala0% (1)

- FM 2-0 - Intelligence (Final Draft) - Mar 2009 PDFDocument210 pagesFM 2-0 - Intelligence (Final Draft) - Mar 2009 PDFJuan Palomo (Pajarito)100% (1)

- EXIM PPT Group IDocument20 pagesEXIM PPT Group IShakeeb HashmiNo ratings yet

- Documentationprocessininternationalshipping 170708143239 PDFDocument15 pagesDocumentationprocessininternationalshipping 170708143239 PDFSunil SainiNo ratings yet

- Unit - V Export and Import Procedures and Documents: The Procedure of Export TradeDocument7 pagesUnit - V Export and Import Procedures and Documents: The Procedure of Export TradeT Sreenivasulu ReddyNo ratings yet

- Export Import ProcessDocument26 pagesExport Import ProcessM HarikrishnanNo ratings yet

- Export Trade: All You Need To KnowDocument4 pagesExport Trade: All You Need To KnowMOHAMMED DEMMUNo ratings yet

- Export TradeDocument3 pagesExport TradePushpa ANo ratings yet

- 1.A. Distinguish Between Export Order, Agreement & ContractDocument43 pages1.A. Distinguish Between Export Order, Agreement & Contractchanfa3851No ratings yet

- Customs Clearing Freight Forwarding ManagementDocument50 pagesCustoms Clearing Freight Forwarding Managementjalenechala20No ratings yet

- Processing of Export OrderDocument20 pagesProcessing of Export Orderkaran singlaNo ratings yet

- Basic Concepts of International Trade2Document28 pagesBasic Concepts of International Trade2TOMORI MUHAHHEDNo ratings yet

- ExportDocument42 pagesExportkanikaNo ratings yet

- Procedure For Export - ImportDocument23 pagesProcedure For Export - Importrajsafari2008No ratings yet

- Complete Export ProcessDocument15 pagesComplete Export ProcessasifanisNo ratings yet

- Difference Between Export Bill Collection and Export Bill Discounting.Document3 pagesDifference Between Export Bill Collection and Export Bill Discounting.lavanyakotaNo ratings yet

- Dont Delete We Will Copy (11-c) 4Document20 pagesDont Delete We Will Copy (11-c) 4Room CardNo ratings yet

- Dr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeDocument6 pagesDr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeatishmadanNo ratings yet

- Cash Against Documents (CAD) : Group 4Document17 pagesCash Against Documents (CAD) : Group 4Bùi Huy CườngNo ratings yet

- MNGT412 Letter of Credit 141403Document67 pagesMNGT412 Letter of Credit 141403Sales LinkedpharmaNo ratings yet

- Banking Project NewDocument77 pagesBanking Project NewMohit PaleshaNo ratings yet

- Documentary TransactionDocument16 pagesDocumentary TransactionJibran SakharkarNo ratings yet

- Packing and LabelingDocument19 pagesPacking and LabelingGeet SharmaNo ratings yet

- Retirement of Import DocumentsDocument18 pagesRetirement of Import Documentsvip_IITTM80% (5)

- Exame FinalDocument3 pagesExame Finaljesusalfonzoduarte95No ratings yet

- A Group Presentation On Exporting of Bangladeshi Ceramic IndustryDocument7 pagesA Group Presentation On Exporting of Bangladeshi Ceramic IndustryTanzir AhmedNo ratings yet

- L 10 External TradeDocument5 pagesL 10 External TradeDeveshi TewariNo ratings yet

- Understanding Import - Export EnvironmentDocument14 pagesUnderstanding Import - Export EnvironmentnigeNo ratings yet

- Export Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument12 pagesExport Documentation: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign Tradeimad100% (2)

- Session 1 - Int TradeDocument34 pagesSession 1 - Int Tradeybhattacharya9No ratings yet

- Name The Different Methods of Payment Acceptable InternationallyDocument3 pagesName The Different Methods of Payment Acceptable InternationallyConni ComalingNo ratings yet

- Export ProcedureDocument19 pagesExport ProcedureDenis SamuelNo ratings yet

- CH 7Document16 pagesCH 7ismail adanNo ratings yet

- Chapter 6 - Transportation Documents and Means of PaymentDocument16 pagesChapter 6 - Transportation Documents and Means of PaymentK59 Vo Doan Hoang AnhNo ratings yet

- Stage 2: Entering Into Export ContractDocument15 pagesStage 2: Entering Into Export ContractSatishNo ratings yet

- International Trade and Trade Service OperationDocument19 pagesInternational Trade and Trade Service OperationEmebet Tesema100% (2)

- Chaptre 4Document19 pagesChaptre 4Tariku AsmamawNo ratings yet

- Import DocumentDocument15 pagesImport DocumentkajaldwivediNo ratings yet

- External Trade: Team ADocument11 pagesExternal Trade: Team AKhan ShahRukhNo ratings yet

- Topic 4 - Export Marketing 2Document10 pagesTopic 4 - Export Marketing 2arrowphoto10943438andrewNo ratings yet

- Unit 2.2Document7 pagesUnit 2.2nguyenkhacthienphuong2001No ratings yet

- Stages in Implementing Export TransactionDocument19 pagesStages in Implementing Export TransactionGagan KauraNo ratings yet

- Chapter 5Document41 pagesChapter 5ngonh.nguyenhuyNo ratings yet

- (IT) IMPORTING FCL - Group 1Document40 pages(IT) IMPORTING FCL - Group 1Nguyên ThảoNo ratings yet

- Chapter-5 Transportation and DeliveryDocument39 pagesChapter-5 Transportation and DeliverySuraj SharmaNo ratings yet

- 6-International Procurement ProceduresDocument1 page6-International Procurement ProceduresmohammedNo ratings yet

- Processing of An Export OrderDocument7 pagesProcessing of An Export OrderSammir MalhotraNo ratings yet

- Patent Valuation: Improving Decision Making through AnalysisFrom EverandPatent Valuation: Improving Decision Making through AnalysisNo ratings yet

- Balance of Payment & Balance of TradeDocument11 pagesBalance of Payment & Balance of TradeAejaz MohamedNo ratings yet

- Balance of Payments: Presented by Shamroze SajidDocument18 pagesBalance of Payments: Presented by Shamroze SajidAejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 and 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 and 5 2021Aejaz Mohamed100% (2)

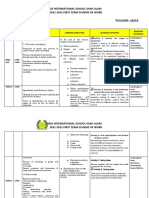

- Term 1 - Commerce F4 SOW 2021-2022Document6 pagesTerm 1 - Commerce F4 SOW 2021-2022Aejaz MohamedNo ratings yet

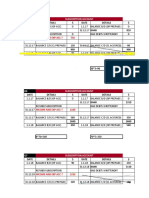

- Form 4 Paper 1 2020 Batch Term 3 19.3.21Document10 pagesForm 4 Paper 1 2020 Batch Term 3 19.3.21Aejaz MohamedNo ratings yet

- Chapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Document10 pagesChapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Aejaz MohamedNo ratings yet

- Chapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipDocument10 pagesChapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipAejaz MohamedNo ratings yet

- Commerce 3rd Term Exam Form 3 2020Document9 pagesCommerce 3rd Term Exam Form 3 2020Aejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 AND 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 AND 5 2021Aejaz MohamedNo ratings yet

- Commerce 3rd Term Exam 2020 Form 3 Answer KeyDocument9 pagesCommerce 3rd Term Exam 2020 Form 3 Answer KeyAejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Excel 2016 Basic Quick RefeDocument3 pagesExcel 2016 Basic Quick RefeAejaz MohamedNo ratings yet

- Chapter 6 Types of Leverages-1Document23 pagesChapter 6 Types of Leverages-1Aejaz MohamedNo ratings yet

- Clubs and Societies Questions 2020 BatchDocument13 pagesClubs and Societies Questions 2020 BatchAejaz MohamedNo ratings yet

- UntitledDocument455 pagesUntitled大叔談星股No ratings yet

- Ifsc H Dfco0 or Micr: Mandate Instruction FormDocument1 pageIfsc H Dfco0 or Micr: Mandate Instruction FormurvashiNo ratings yet

- Handbook Consumer Protection Inclusive Finance - FINALDocument96 pagesHandbook Consumer Protection Inclusive Finance - FINALSettler RoozbehNo ratings yet

- Depreciation, Depletion and ITC: 1 - Principles of AccountingDocument11 pagesDepreciation, Depletion and ITC: 1 - Principles of AccountingAthena Satria TumambingNo ratings yet

- Why Study Financial Markets and InstitutionsDocument75 pagesWhy Study Financial Markets and InstitutionsHoly BunkersNo ratings yet

- Working Capital Project - Oman Air BenchmarkingDocument29 pagesWorking Capital Project - Oman Air BenchmarkingAnonymous o1o3GuNo ratings yet

- FEDAI RulesDocument39 pagesFEDAI Rulesnaveen_ch522No ratings yet

- November 2020 PayslipDocument3 pagesNovember 2020 PayslipRose hillsNo ratings yet

- Sample: Business Plan Business NameDocument10 pagesSample: Business Plan Business NameDan688No ratings yet

- Fauji Fertilizer's Profit Increases 29%: April 30, 2013Document6 pagesFauji Fertilizer's Profit Increases 29%: April 30, 2013Sidra NaeemNo ratings yet

- Examiners Report 2013-2018 - Level BDocument13 pagesExaminers Report 2013-2018 - Level BZubair RafiqueNo ratings yet

- Computerized Accounting With TallyDocument42 pagesComputerized Accounting With Tallyanishjohna100% (1)

- Profit LossDocument2 pagesProfit Lossword04832No ratings yet

- The Relationship Between Risks and Company Performance Digi BerhadDocument24 pagesThe Relationship Between Risks and Company Performance Digi BerhadPutri FakhiraNo ratings yet

- Carding Vocabulary and Understanding Terms PDFDocument4 pagesCarding Vocabulary and Understanding Terms PDFcreative84No ratings yet

- Quiz 1 Matbis Revised Without Key AnswerDocument18 pagesQuiz 1 Matbis Revised Without Key AnswerNadya Estefania Brenaita SurbaktiNo ratings yet

- Pavlova, Valeriya 0050098500Document13 pagesPavlova, Valeriya 0050098500Andre Fernandes100% (1)

- Economics Chapter 14Document8 pagesEconomics Chapter 14Eman DhaifNo ratings yet

- State Bank of India: The Banker To Every IndianDocument4 pagesState Bank of India: The Banker To Every IndianSrinivas NandikantiNo ratings yet

- Steel Feasibility Study FinalDocument26 pagesSteel Feasibility Study FinalAman PeterNo ratings yet

- Restoration of Certificate of PracticeDocument1 pageRestoration of Certificate of PracticevishnuameyaNo ratings yet

- Tax Saving Devices: Presented by CA Mayur Makadia Partner M A Shah & Co. Chartered AccountantsDocument75 pagesTax Saving Devices: Presented by CA Mayur Makadia Partner M A Shah & Co. Chartered Accountantsmayur_sabNo ratings yet

- Audit ReportsDocument27 pagesAudit ReportsMa Lourdes T CahatianNo ratings yet

- Letter of Credit FormatDocument2 pagesLetter of Credit FormatfeteneNo ratings yet

- 3 - MAF603 - Efficient Market HypothesisDocument26 pages3 - MAF603 - Efficient Market HypothesisWan WanNo ratings yet