Professional Documents

Culture Documents

Coursebook Chapter 12 Answers

Uploaded by

Aejaz MohamedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coursebook Chapter 12 Answers

Uploaded by

Aejaz MohamedCopyright:

Available Formats

Cambridge IGCSE and O Level Accounting

Coursebook answers

Chapter 12

Answers to test yourself questions

Test yourself 12.1

1 Depreciation is an estimate of the loss in value of a non-current asset over its expected working

life.

2 Depreciation ensures that the cost of the non-current asset is spread over the years which

benefit from the use of that asset. This annual charge for depreciation means that the cost of

the asset is matched against the revenue of the business it helped to earn each year.

3 The four main causes of depreciation are physical deterioration, economic reasons, passage of

time and depletion.

Test yourself 12.2

1 The straight line method of depreciation charges the same amount of depreciation each year.

2 The reducing balance method of depreciation uses the same percentage rate each year, but it

is calculated on the net book value (the cost less the deprecation previously written off), so the

amount of depreciation each year reduces.

3 The revaluation method of depreciation is used where it is not practical, or it is difficult, to keep

detailed records of certain types of non-current assets.

1

Test yourself 12.3

1 a The total amount of depreciation up to 30 June 20–6 was 19 600.

b The net book value of the fixtures on 30 June 20–7 was 3 240.

2 The asset account shows the cost of the asset and the provision for depreciation account shows

the total depreciation written off. These must be considered together in order to see the net

book value of the asset.

Test yourself 12.4

1 Depreciation is a non-monetary expense because no money is paid or received. It is a loss in

value of a non-current asset not a reduction in the amount of money a business has.

2 The provision for depreciation of 16 000 represents the total deprecation written off up to the

end of 30 June 20–5. This will not appear in the income statement as it is not an expense for

the year ended 30 June 20–6. It will not appear as a figure in its own right in the statement of

financial position at 30 June 20–6: it is included in the accumulated depreciation to the date

of the statement which is the 16 000 at the start of the year plus the depreciation for the year

of 3 600.

Answers to exam-style questions

1 A

2 A

3 B

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

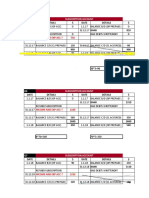

4 a

Elsa

Office equipment account

Date Details Fo. $ Date Details Fo. $

20–4 20–5

Apl 1 Balance b/d 2 500 Mar 31 Balance c/d 4 600

Aug 31 Bank/cash 1 200

Dec 1 Bank/cash 5 900 5 555

4 600 4 600

20–5

Apl 1 Balance b/d 4 600

Provision for depreciation of office equipment account

Date Details Fo. $ Date Details Fo. $

20–5 20–4

Mar 31 Balance c/d 1 450 Apl 1 Balance b/d 750

20–5

Mar 31 Income statement

555 5 (500 + 140 + 60) 5 700

1 450 1 450

20–5

2

Apl 1 Balance b/d 1 450

b

Elsa

Extract from Income statement for the year ended 31 March 20–5

Expenses $

Depreciation – office equipment 700

c

Elsa

Extract from Statement of financial position at 31 March 20–5

Non-current assets $ $ $

Cost Accumulated Net book

deprecation value

Office equipment 4 600 1 450 3 150

5 a Capital expenditure: premises, legal costs, motor vehicle, delivery costs

Revenue expenditure: fuel, insurance

b 10 000 × 20% × 2 years = 4 000

c i Debit disposal of motor vehicle account 10 000, credit motor vehicle account 10 000

ii Debit provision for depreciation of motor vehicle account 4 000, credit disposal of motor

vehicle account 4 000

iii Debit cash 5 600, credit disposal of motor vehicle account 5 600

© Cambridge University Press 2018

Cambridge IGCSE and O Level Accounting

6 a

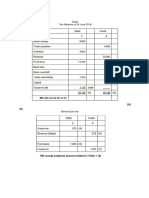

Tebogo

Income statement for the year ended 31 May 20–1

$ $ $

Fees received (37 130 + 1030) 38 160

Add Rent receivable (2 300 − 200 − 300) 1 800

Profit on disposal of office equipment

((2 200 + 1 560) − 3 650) 66 110

40 070

Less Office expenses 9 435

Rates 2 125

Wages (19 500 − 180 + 210) 19 530

Depreciation office equipment

(4 200 × 20% × 9/12) 6 6630 31 720

Profit for the year 68 350

b

Tebogo

Capital account

Date Details Fo. $ Date Details Fo. $

20–1 20–0

Mar 31 Drawings 9 000 Jun 1 Balance b/d 82 000

Balance c/d 81 350 20–1 3

68 350 May 31 Profit 68 350

90 350 90 350

20–1

Jun 1 Balance b/d 81 350

© Cambridge University Press 2018

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Accounting For Lawyers Exam OutlineDocument37 pagesAccounting For Lawyers Exam OutlineJesse Danoff100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsAejaz Mohamed81% (21)

- Accounting Cycle Exercise AnswerDocument9 pagesAccounting Cycle Exercise AnswerRaziel Jangas100% (1)

- Unit4 AuditingDocument37 pagesUnit4 Auditingdangthanhhd79100% (8)

- AC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With CommentsDocument74 pagesAC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With Comments전민건No ratings yet

- Balance of Payment & Balance of TradeDocument11 pagesBalance of Payment & Balance of TradeAejaz MohamedNo ratings yet

- Term 1 - Commerce F4 SOW 2021-2022Document6 pagesTerm 1 - Commerce F4 SOW 2021-2022Aejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 and 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 and 5 2021Aejaz Mohamed100% (2)

- Balance of Payments: Presented by Shamroze SajidDocument18 pagesBalance of Payments: Presented by Shamroze SajidAejaz MohamedNo ratings yet

- Chapter - 10 International BusinessDocument7 pagesChapter - 10 International BusinessAejaz MohamedNo ratings yet

- Commerce Revision Questions. PDF For FORM 4 AND 5 2021Document20 pagesCommerce Revision Questions. PDF For FORM 4 AND 5 2021Aejaz MohamedNo ratings yet

- Commerce 3rd Term Exam Form 3 2020Document9 pagesCommerce 3rd Term Exam Form 3 2020Aejaz MohamedNo ratings yet

- Form 4 Paper 1 2020 Batch Term 3 19.3.21Document10 pagesForm 4 Paper 1 2020 Batch Term 3 19.3.21Aejaz MohamedNo ratings yet

- Chapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipDocument10 pagesChapter - 2 Forms of Business Organisation: Meaning of Sole ProprietorshipAejaz MohamedNo ratings yet

- Clubs and Societies Questions 2020 BatchDocument13 pagesClubs and Societies Questions 2020 BatchAejaz MohamedNo ratings yet

- Chapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Document10 pagesChapter - 9 Internal Trade: Material Downloaded From SUPERCOP 1/10Aejaz MohamedNo ratings yet

- Commerce 3rd Term Exam 2020 Form 3 Answer KeyDocument9 pagesCommerce 3rd Term Exam 2020 Form 3 Answer KeyAejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- Chapter 6 Types of Leverages-1Document23 pagesChapter 6 Types of Leverages-1Aejaz MohamedNo ratings yet

- Excel 2016 Basic Quick RefeDocument3 pagesExcel 2016 Basic Quick RefeAejaz MohamedNo ratings yet

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Asignación Primer Taller ACCO-111Document15 pagesAsignación Primer Taller ACCO-111nerodriguez_1100% (1)

- Chapter 2 - Concept Questions and ExercisesDocument3 pagesChapter 2 - Concept Questions and Exercises20. Lê Phúc HoànNo ratings yet

- Chalmers 2008Document11 pagesChalmers 2008Apis Pus MeongNo ratings yet

- Bestbuy Financial AnalysisDocument11 pagesBestbuy Financial AnalysisGPA FOURNo ratings yet

- QSN 2 Fabm T AccountDocument3 pagesQSN 2 Fabm T AccountKisha Del mundoNo ratings yet

- Debit Credit: EGG SHERAN Corp. (Home Office) Unadjusted Trial Balance December 31,20x1Document6 pagesDebit Credit: EGG SHERAN Corp. (Home Office) Unadjusted Trial Balance December 31,20x1Riza Mae AlceNo ratings yet

- 4 Financial Statement AnalysisDocument28 pages4 Financial Statement Analysisrommel legaspi100% (2)

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- 2020 Cma P1 B SCFDocument37 pages2020 Cma P1 B SCFThasveer AvNo ratings yet

- Depreciation PPT NeewDocument13 pagesDepreciation PPT NeewSnehal GoleNo ratings yet

- Audit of Intangible AssetsDocument8 pagesAudit of Intangible AssetsHira IdaceiNo ratings yet

- Pas 16 (Property, Plant and Equipment) : Names: Jon Rigo Caruz Hosea Earl CollongDocument22 pagesPas 16 (Property, Plant and Equipment) : Names: Jon Rigo Caruz Hosea Earl CollongKaren Mae Oculam CerinoNo ratings yet

- ConsolidatedDocument7 pagesConsolidatedNatsu DragneelNo ratings yet

- Lecture 2 and 3 Revision Notes Balance Sheet What Is It?Document4 pagesLecture 2 and 3 Revision Notes Balance Sheet What Is It?Anisah HabibNo ratings yet

- Lembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Document9 pagesLembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Su MiniNo ratings yet

- Plant and Intangible AssetsDocument51 pagesPlant and Intangible AssetsMULATNo ratings yet

- Chapter Three - Plant AssetDocument23 pagesChapter Three - Plant AssetGizaw BelayNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document15 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)cindy100% (4)

- Chapter 17Document48 pagesChapter 17Shiv NarayanNo ratings yet

- TallyDocument6 pagesTallySayandip MondalNo ratings yet

- 2cp Ce 23Document12 pages2cp Ce 23rodrigoNo ratings yet

- Auditing Problems EmpleoDocument19 pagesAuditing Problems EmpleoGloria Bernal BonifacioNo ratings yet

- Management Buyout (Mbo)Document11 pagesManagement Buyout (Mbo)Louis Mourre Del RioNo ratings yet

- Income Tax Notes-IAS 12Document11 pagesIncome Tax Notes-IAS 12mehdi.jjh313No ratings yet