Professional Documents

Culture Documents

Accounting - Marking Scheme - Form 3 Secondary - 2016 Page 1 of 3

Uploaded by

waheeda17Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting - Marking Scheme - Form 3 Secondary - 2016 Page 1 of 3

Uploaded by

waheeda17Copyright:

Available Formats

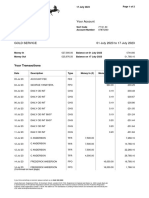

DIRECTORATE FOR QUALITY AND STANDARDS IN EDUCATION

Department of Curriculum Management

Educational Assessment Unit

Annual Examinations for Secondary Schools 2016

FORM 3 ACCOUNTING MARKING SCHEME

SECTION A

10 marks in total – 1 mark for each correct answer

1 (d); 2 (a); 3 (c); 4 (d); 5 (c); 6 (b); 7 (d); 8 (d); 9 (a); 10 (b)

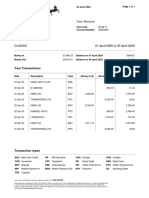

11. SECTION B

10 marks in total – 1 mark each correct answer.

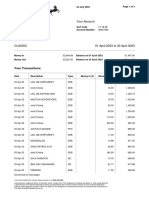

COLUMN A COLUMN B

0 A book showing how transactions will be recorded C Capital

A Net sales less cost of sales F Petty cash book

B Useful resources used by a firm E Working capital

The value of resources in a business provided by the

C H Drawings

owner

D People to whom the firm owes money 0 Journal

E Current assets less current liabilities J Cash book

The book where the payments of small amounts of

F G Ledger

money are recorded

G A set of accounts which are common in nature A Gross profit

H Assets taken by the owner for personal use I Business entity

The concept which requires us to separate business

I B Assets

transactions from personal transactions

J A book where all payments and receipts are recorded D Trade payables

SECTION C

10 marks – Each question carries 2 marks

12. The matching concept requires that expenses and revenues are recorded when they

occur (1), irrespective of the time when payments are made or received (1).

13. In the double entry system each transaction is recorded by two opposite (1) but equal

entries (1).

14. Book-keeping is the recording of transactions (1) while in accounting we try to interpret

the results for the managers and the owners (1).

15. The purchases day book contains a list of credit purchases (1) while the purchases

ledger contains the accounts of credit suppliers (1).

16. Capital expenditure is the expenditure to buy or upgrade non-current assets (1) while

revenue expenditure is the expenditure incurred in the daily operation of the firm with

the aim of earning revenue from such expenditure (1).

Accounting – Marking Scheme – Form 3 Secondary – 2016 Page 1 of 3

SECTION D [70 marks]

17. (a)

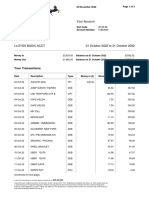

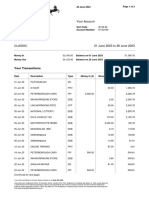

Cash Book

Discounts Discounts

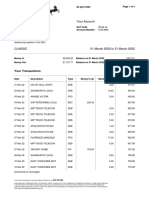

2016 Cash Bank 2016 Cash Bank

Allowed Received

Mar 1 Bal b/d 211 3,984 Mar 2 T Abela 4 76

Mar 4 C Pace 98 Mar 2 C Borg 13 247

Mar 6 Sales 49 Mar 2 D Calleja 22 418

Mar 9 R Spiteri 4 156 Mar 7 Insurance 65

Mar 9 J Tanti 16 624 Mar 12 Motor expenses 150

Mar 9 R Privitelli 13 507 Mar 21 Salaries 5,200

Mar 20 IRD 200 Mar 23 Rent 60

Mar 18 Sales 98 Mar 28 Electricity 400

Mar 28 Loan: BOV 500 Mar 31 Stationery 570

Mar 31 Bal c/d 793 Mar 31 Bal c/d 34

33 309 6,911 39 309 6,911

General Ledger

Discounts Allowed

2016 € 2016 €

Mar 31 Cash book (Total for the month) 33

Discounts Received

2016 € 2016 €

Mar 31 Cash book (Total for the month) 39

(33 marks – 1 mark for every correct ticked item)

(b) Cash discount is the discount allowed by suppliers to their customers for prompt payment (1) while trade discount is the discount

allowed by suppliers their customers for bulk purchasing and for loyalty (1). (2 marks)

Page 2 of 3 Accounting – Marking Scheme – Form 3 Secondary – 2016

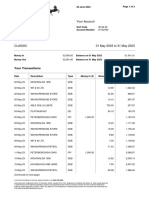

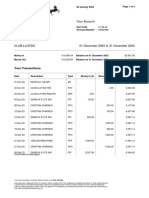

18. Albert Galea

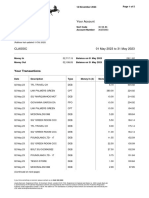

Income Statement for year ended 31 December 2015

€ €

Sales 120,000

Sales Returns (3,500)

116,500

Less Cost of Sales:

Opening Inventory 6,500

Purchases 80,000

86,500

Purchases Returns (4,000)

82,500

Closing Inventory (9,000) (73,500)

Gross Profit 43,000

Discounts Received 600

43,600

Less Expenses:

Rent 3,000

Wages 12,000

Motor expenses 1,200

Lighting and heating 2,600

Insurance 3,600

Discounts Allowed 800

Bank Loan Interest 4,000 (27,200)

Net Profit 16,400

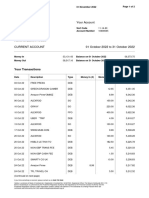

Statement of Financial Position as at 31 December 2015

Non-Current Assets € €

Furniture 8,000

Motor Vans 42,000

Equipment 20,000

70,000

Current Assets

Inventory 9,000

Trade Receivables 5,000

Bank 4,600

Cash 180 18,780

88,780

Capital

Balance 1 January 2015 30,680

Net Profit 16,400

47,080

Drawings (15,000)

32,080

Non-Current Liabilities

8% Bank Loan 50,000

Current Liabilities

Trade Payables 6,700

88,780

(35 marks – 1 mark for every correct ticked item)

Accounting – Marking Scheme – Form 3 Secondary – 2016 Page 3 of 3

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- My First Gujarati Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Gujarati words for Children, #17From EverandMy First Gujarati Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Gujarati words for Children, #17Rating: 5 out of 5 stars5/5 (1)

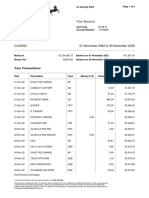

- Statement 2022 8Document4 pagesStatement 2022 8wconceptouNo ratings yet

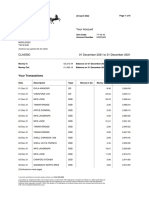

- Statement 2022 3Document4 pagesStatement 2022 3Dulo WegnerNo ratings yet

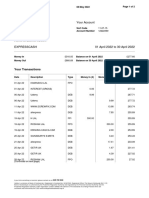

- Statement 2022 12Document4 pagesStatement 2022 12wconceptouNo ratings yet

- Statement 1Document3 pagesStatement 1idiagheosa66No ratings yet

- Statement 2022 9Document5 pagesStatement 2022 9wconceptouNo ratings yet

- 2021 August StatementDocument7 pages2021 August StatementJawad AhmedNo ratings yet

- Statement 2023 5Document5 pagesStatement 2023 5Next Media UKNo ratings yet

- 2018 1st S1 簿记与会计答案Document9 pages2018 1st S1 簿记与会计答案伍纹缌-NG WEN XINo ratings yet

- 2022 October StatementDocument2 pages2022 October StatementAlexandre RodriguesNo ratings yet

- Chapter 5Document18 pagesChapter 5winkko ucsmNo ratings yet

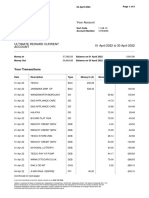

- Statement 2022 10Document4 pagesStatement 2022 10wconceptouNo ratings yet

- Statement 3Document4 pagesStatement 3idiagheosa66No ratings yet

- BK公式 PDFDocument23 pagesBK公式 PDFJia Yao TaiNo ratings yet

- Statement 2Document6 pagesStatement 2idiagheosa66No ratings yet

- Statement 2022 12Document3 pagesStatement 2022 12GustavoNo ratings yet

- PG - 5A Rosalez Co. Period 31 July 2017 Sales Journal Cash Receipt Journal Date Accounts Debited Termin Ref (D) Acc. Receivable Date (K) SalesDocument24 pagesPG - 5A Rosalez Co. Period 31 July 2017 Sales Journal Cash Receipt Journal Date Accounts Debited Termin Ref (D) Acc. Receivable Date (K) SalesNovia Stevani SipayungNo ratings yet

- 2019 November 18 December 18 StatementDocument2 pages2019 November 18 December 18 Statementjeffwork1976No ratings yet

- Cash Book - AnswersDocument6 pagesCash Book - AnswersJoshNo ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- AccountsA MTP Foundation Oct19Document10 pagesAccountsA MTP Foundation Oct19backuphpdv6No ratings yet

- Statement 2022 10Document3 pagesStatement 2022 10VijayNo ratings yet

- Bank1 2Document3 pagesBank1 2Harry TiwanaNo ratings yet

- 2020 April StatementDocument1 page2020 April StatementPOPESCU BERTHA-ANDREEANo ratings yet

- Sources and Recording of Data 1Document5 pagesSources and Recording of Data 1MachelMDotAlexanderNo ratings yet

- 2021 April StatementDocument5 pages2021 April StatementJawad AhmedNo ratings yet

- 2020 September StatementDocument7 pages2020 September StatementJawad AhmedNo ratings yet

- Statement 2023 7Document2 pagesStatement 2023 7Ardan DiazNo ratings yet

- Halifax StatementDocument4 pagesHalifax StatementSW ProjectNo ratings yet

- MohammadDocument2 pagesMohammadxfzm99mr8rNo ratings yet

- Statement 2022 11Document6 pagesStatement 2022 11wconceptouNo ratings yet

- Assignment Individual - Cuac111Document6 pagesAssignment Individual - Cuac111shiloh chipendoNo ratings yet

- Kunci Jawab Paket ADocument31 pagesKunci Jawab Paket ASilva Fitri AnjaniNo ratings yet

- Your AccountDocument6 pagesYour AccountJean FurtadoNo ratings yet

- Attachments 71b8d55c 2019 June Statement PDFDocument5 pagesAttachments 71b8d55c 2019 June Statement PDFMarianaNo ratings yet

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- 12 Months BankStatements..Document111 pages12 Months BankStatements..petersonahereza102No ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument11 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationMandrich AppadooNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- 8 Decemb StatmDocument2 pages8 Decemb StatmCaribay SeguraNo ratings yet

- S. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BDocument3 pagesS. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BALI ZAFAR� LIAQAT UnknownNo ratings yet

- DocumenteDocument5 pagesDocumentemaxim caldarasanNo ratings yet

- Statement 7 2022Document3 pagesStatement 7 2022GabrielNo ratings yet

- Exercises 20.4A Bad DebtsDocument1 pageExercises 20.4A Bad DebtsCarolnesa Dorie Tan Kar MeanNo ratings yet

- Statement 2023 1Document2 pagesStatement 2023 1GustavoNo ratings yet

- HjikDocument2 pagesHjikibraheemkhan034563No ratings yet

- May 2018 and 2017 SolutionsDocument43 pagesMay 2018 and 2017 SolutionsgNo ratings yet

- Cambridge International Examinations: Accounting 0452/22 March 2017Document13 pagesCambridge International Examinations: Accounting 0452/22 March 2017Mike ChindaNo ratings yet

- 2022 May StatementDocument2 pages2022 May Statementcretusebastian1983No ratings yet

- Halifax StatementDocument4 pagesHalifax StatementЮлия П100% (1)

- Bank 1Document2 pagesBank 1Harry TiwanaNo ratings yet

- 400 PDFDocument4 pages400 PDFmsavoooNo ratings yet

- 2022 September StatementDocument2 pages2022 September Statementcretusebastian1983No ratings yet

- 2019 April StatementDocument2 pages2019 April Statementkumar samyappanNo ratings yet

- 21072023, 010608 PDFDocument2 pages21072023, 010608 PDFCatalina-Elena100% (1)

- Summer ExamDocument17 pagesSummer Examoliverchukwudi97No ratings yet

- Buenaventura Problem 11 15Document12 pagesBuenaventura Problem 11 15Anonn67% (3)

- Statement 2023 5Document2 pagesStatement 2023 5Bamba correa BambaNo ratings yet

- Accounts Chapter-Wise Test 6 (Suggested Answers)Document3 pagesAccounts Chapter-Wise Test 6 (Suggested Answers)Shweta BhadauriaNo ratings yet

- Accounting A Level CIE J21 P34 INSDocument12 pagesAccounting A Level CIE J21 P34 INSwaheeda17No ratings yet

- Accounting Yr11 2018Document8 pagesAccounting Yr11 2018waheeda17No ratings yet

- 9706 International Accounting Standards (For Examination From 2023)Document58 pages9706 International Accounting Standards (For Examination From 2023)waheeda17No ratings yet

- Accounting A Level CIE J21 P34Document20 pagesAccounting A Level CIE J21 P34waheeda17No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/31waheeda17No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document24 pagesCambridge International AS & A Level: ACCOUNTING 9706/32waheeda17No ratings yet

- Work Access Permit: Prakash BoodenyDocument2 pagesWork Access Permit: Prakash BoodenyBoodeny PrakashNo ratings yet

- Work Access Permit: Prakash BoodenyDocument2 pagesWork Access Permit: Prakash BoodenyBoodeny PrakashNo ratings yet

- Syllabus: Cambridge International AS & A Level Accounting 9706Document40 pagesSyllabus: Cambridge International AS & A Level Accounting 9706Ammar FaisalNo ratings yet

- AccountStatement - 06 DEC 2022 - To - 06 JUN 2023Document7 pagesAccountStatement - 06 DEC 2022 - To - 06 JUN 2023hancyboxNo ratings yet

- Financial Statement Analysis ExamDocument21 pagesFinancial Statement Analysis ExamKheang Sophal100% (2)

- Studocu 12137811-1Document31 pagesStudocu 12137811-1kristinejoy pacalNo ratings yet

- Sde0003 enDocument6 pagesSde0003 enstgracoNo ratings yet

- Unclaimed Deposits in Dormant Accounts in UcbsDocument3 pagesUnclaimed Deposits in Dormant Accounts in UcbspraveenaNo ratings yet

- Assignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeDocument8 pagesAssignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeLeo ChristNo ratings yet

- Conceptual Map of The Mexican Financial SystemDocument2 pagesConceptual Map of The Mexican Financial SystemJuan BautistaNo ratings yet

- Echallan MH010490649202223 EDocument1 pageEchallan MH010490649202223 EPramod PawarNo ratings yet

- Complete POA SummaryDocument38 pagesComplete POA SummaryZara HazirahNo ratings yet

- Minggu 2 - Chapter 03 Interest and EquivalenceDocument38 pagesMinggu 2 - Chapter 03 Interest and EquivalenceAchmad Nabhan YamanNo ratings yet

- Impact of Basel III On Financial MarketsDocument4 pagesImpact of Basel III On Financial MarketsAnish JoshiNo ratings yet

- Hannah Knox An Architect Opened An Office On July 1Document1 pageHannah Knox An Architect Opened An Office On July 1Amit PandeyNo ratings yet

- Letter of Credit Bank Contracts Guarantees Trade Financing Export RefinanceDocument68 pagesLetter of Credit Bank Contracts Guarantees Trade Financing Export RefinanceMuhammad SaeedNo ratings yet

- Engineering Economy LectureDocument16 pagesEngineering Economy LectureEphraim RamosNo ratings yet

- Engr 305 - HW 3Document2 pagesEngr 305 - HW 3محمد خالدNo ratings yet

- Pubali July - 2019 - FinalDocument66 pagesPubali July - 2019 - Finalzannatul zoyaNo ratings yet

- The Venus ProjectDocument27 pagesThe Venus Projectapi-252242159100% (1)

- Brochure Derivatives Trading & StrategiesDocument14 pagesBrochure Derivatives Trading & StrategiesGokulesh DanapalNo ratings yet

- Manual-NTPC Travel CardDocument11 pagesManual-NTPC Travel Cardsiva prasadNo ratings yet

- Kota Fibres PresentationDocument16 pagesKota Fibres Presentationdaedric13No ratings yet

- IIM Bangalore Foreign Exchange MarketsDocument14 pagesIIM Bangalore Foreign Exchange MarketsGautam PatelNo ratings yet

- Sonic WhitepaperDocument9 pagesSonic Whitepapert.pentzekNo ratings yet

- Ethics CaseDocument38 pagesEthics Casemeochip21No ratings yet

- Consolidation Basic AAFRDocument25 pagesConsolidation Basic AAFRRana Ammar waheedNo ratings yet

- Chasebankusanationalassociation 489913 Wilmingtondelaware 19Document39 pagesChasebankusanationalassociation 489913 Wilmingtondelaware 19Efrain CabreraNo ratings yet

- Nike Case Study-ResponseDocument8 pagesNike Case Study-ResponseAnurag Sukhija100% (5)

- Lock Box in SAP ARDocument4 pagesLock Box in SAP ARNaveen KumarNo ratings yet

- BDO Investor Presentation Website 3Q19Document41 pagesBDO Investor Presentation Website 3Q19Engr. JDNo ratings yet

- Statement Jun 20 XXXXXXXX0037Document8 pagesStatement Jun 20 XXXXXXXX0037Harikrishna GoudNo ratings yet

- Problem Set 4 With Solution - AnnuityDocument14 pagesProblem Set 4 With Solution - AnnuityNoel So jrNo ratings yet