Professional Documents

Culture Documents

Final Qualifications For 18-19

Uploaded by

raj pandey0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

Final Qualifications for 18-19

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesFinal Qualifications For 18-19

Uploaded by

raj pandeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

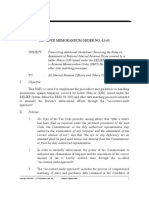

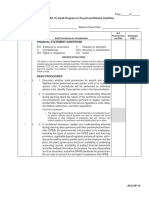

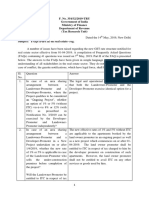

DISCLOSURES FOR GST AUDIT REPORT

S no Qualification type (heading) Observation/Qualifications

As per the information and explanation given to us and on the basis of

our examination of records of the taxpayer, the taxpayer has

maintained proper records of books and documents listed in Sec 35

read with Rule 56 to 58 of CGST Act, except Stock of goods wherein

memorandum stock statement is prepared. Partially maintained

Para 2 : List of Documents documents of supplies attracting payment of tax on reverse charge

1

not maintained mechanism along with relevant documents such as invoices, credit

notes, debit notes, refund vouchers, bill of supply etc. Partially some E-

way Bills and/or Delivery Challans were not prepared in some cases.

According to information and explanation given by the management

and in our opinion the same are not material. Cash Flow Statement is

not required to be prepared by the entity as per applicable laws.

Maintenance of books of accounts, GST related records and

preparation of financial statements are the responsibilities of the

entity’s management. Our responsibility is to express an opinion on

their GST related records based on our audit. We have conducted our

audit in accordance with the standard auditing principles generally

accepted in India. These standards require that we plan and perform

Para 5 : Observation/ the audit to obtain reasonable assurance about whether the GST

2 qualification in Form 9C related records and financial statements are free from material

Basis of GST Audit misstatement(s). The audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles

used and significant estimates by management as well as evaluating

the overall financial statements presentation. We believe that our

audit provides a reasonable basis for our opinion on Reconciliation

Statements in Form 9C.

The term “deemed supply” is not defined under GST Law. Section

7(1)(c) of the CGST Act provides that the activities specified in

Para 5 : Observation/ Schedule I is to be treated as a supply, when it is made without

qualification in Form 9C consideration. It has list out certain transactions / activities which is

3

Deemed Supply deemed as a supply in absence of consideration. The systems and

(Table 5D) processes adopted by the entity with a view to identifying such

transactions have been assessed. We have obtained management

representation letter regarding the same.

Para 5 : Observation/ As per the information and explanation given to us and on the basis of

qualification in Form 9C our examination of records of the taxpayer, reliance has been placed

Unbilled Revenue at on the audited financial statements and reconciliation provided by the

year end of financial management for determining the unbilled revenue and no separate

year (Table 5H) exercise is conducted to validate the same.

Para 5 : Observation/

As per the information and explanation given to us and on the basis of

qualification in Form 9C

our examination of records of the taxpayer, there is no adjustment

Adjustments in

warranted as per Sec 15 and rule thereunder on taxable value of

turnover u/s 15 and

outward supply reported in GSTR-9. The management is of the opinion

rule thereunder

that there is no material impact on GST liability.

(Table 5M)

Compiled by CA ANKIT SOMANI, Ajmer (98297-45560) fca.cs.ankitsomani@gmail.com Page 1

Para 5 : Observation/ Value of exempted, nil rated, non-GST and no supply turnover has

qualification in Form 9C been declared in Table 7B of GSTR 9C. The turnover reported is after

Value of Exempted, Nil adjustments of credit notes, debit notes and amendments. The total

Rated, Non-GST amount of Exempted, Nil Rated, Non-GST supplies and No-Supply

supplies, No-Supply turnover depends upon the management representation letter as

turnover (Table 7B) received from register person.

As per the information and explanation given to us, outward supplies

on which tax is to be paid by the recipient on reverse charge basis

If RCM is NOT paid even by a cannot be identified and disclosed by management and those charged

single amount by governance. Further, the taxpayer has not complied with tax

invoice rule 46(p) and the taxpayer has also not complied with ITC

reversal u/s 17 of CGST Act, wherever required.

Rule As per the information and explanation given to us and on the basis of

Para 5 : Observation/

54(3) our examination of records of the taxpayer, outward supplies on which

qualification in Form 9C

For GTA tax is to be paid by the recipient on reverse charge basis are disclosed

Reporting of RCM to be

supplier herewith. Further, the taxpayer has not/partially complied with tax

paid by the recipient

(GN, invoice rule 46(p), rule 54(3) and as per the assessee, he/it has also

(in Table 7D)

CFC) complied with ITC reversal u/s 17 of CGST Act, wherever required.

Para 5 : Observation/ GST rate wise details of taxable value and GST as applicable thereon,

qualification in Form 9C for outward supply are disclosed in Table 9 of GSTR 9C. The auditor

Rate-wise tax liability has relied on information as provided by management in absence of

on outward supplies availability of tax rate-wise ledgers in the books of accounts

(Table 9) maintained by the taxpayer.

The details of total tax payable for the period April, 2018 to March,

2019 as declared in GSTR 9 i.e. under the Annual Return is disclosed.

The calculation of interest cannot be done by management and those

charged with governance in view of complexities and non-clarity with

Para 5 : Observation/

regard to liability of interest as per Sec 50 of the CGST Act 2017,

qualification in Form 9C

whether to be computed on gross basis or on net basis to be decided

Reporting of payment

by the appropriate judicial authority. We have relied on the same and

of interest (Table 9L)

interest on gross basis is not quantified by the management. As per

the opinion of management interest should be paid according to net

liability is prudent interpretation of Sec 50 of CGST Act based on

amendment proposed in Sec 50 in Union Budget, 2019.

Para 5 : Observation/ As per the information available and based on the management

qualification in Form 9C representation, no penalty notices are received from the Tax

Reporting of penalty Authorities. Hence, our disclosure of penalty is based on above facts

(Table 9N) mentioned by the management.

ITC availed and reversal, if any, is being reported on the basis of

available records and information provided by the management. We

have test checked the ITC availed and payments made to taxpayer.

Para 5 : Observation/

Accordingly, the management is of the view that no ITC reversal arises

qualification in Form 9C

under the second proviso of 16(2) of CGST Act, 2017. As per the

ITC reversal and 180

information and explanation given to us and on the basis of our

days

examination of records of the taxpayer, our audit report is subject to

the above non-disclosure of correct and complete compliance of ITC

provisions by the taxpayer.

Para 5 : Observation/ As per the information and explanation given to us and on the basis of

qualification in Form 9C our examination of records of the taxpayer, the exempt turnover of

Compiled by CA ANKIT SOMANI, Ajmer (98297-45560) fca.cs.ankitsomani@gmail.com Page 2

Ineligible ITC and the taxpayer comprises of interest from bank, etc. The ITC availed is of

exempt turnover taxable turnover, thus reversal of ITC on proportionate basis is not

applicable as per rule 42 of the CGST Rules, 2017.

As per the information and explanation given to us and on the basis of

our examination of records of the taxpayer, there is some amount

Para 5 : Observation/ which is not appearing in GSTR 2A which has been claimed as credit

qualification in Form 9C and vice versa, as the case may be, also based on confirmation of

ITC as per GSTR-2A payment of such tax obtained by the management. Further, the

and GSTR-9C management is of the opinion that no liability of ITC reversal/excess

claim arises due to difference in information of ITC as per GSTR-2A and

GSTR-9, as the case may be.

During the year as per Books of Accounts and based on test-check for

the year 2017-18, liability of RCM u/s 9(4)/ 9(3) Rs. has been paid

Para 5 : Observation/ in the year 2018-19. The amount paid in 2018-19 was not shown in

qualification in Form 9C GSTR-9C based on the press release issued by CBEC. Accordingly, ITC

Reporting of RCM has been claimed on payment basis in the year of payment by the

taxpayer. Now, in FY 2018-19, such amount has been paid and credit

also has been availed.

As per the information and explanation given to us and on the basis of

Para 5 : Observation/ our examination of records, the taxpayer has not maintained complete

qualification in Form 9C record of inward supplies on which RCM is applicable u/s 9(3). Thus,

Reporting of RCM we are unable to comment on the liability of the taxpayer under

reverse charge for the year 2017-18.

As per the information and explanation given to us and on the basis of

Para 5 : Observation/

our examination of records of the taxpayer, we have received

qualification in Form 9C

management representation letter for obtaining details of expense

Expense head-wise ITC

head-wise ITC availed and taxable value in Table 14 of GSTR 9C. We

(Table 14)

have test-checked with books of accounts and reported the figures on

(in case filling this

which ITC is availed. The classification of various expenses under

table)

various expense head are taken from the audited financial statements.

For Accounting purchases other than capital goods, the taxpayer has

Para 5 : Observation/

followed Para 6-13 of AS-2 “Valuation on Inventories” where “Cost of

qualification in Form 9C

Purchases” includes only those taxes, which are not subsequently

Valuation on

recoverable by the enterprise form the taxing authorities.” Accordingly

Inventories

a separate ledger for ITC has been mentioned.

Para 5 : Observation/

The taxpayer has followed Para 17 of AS-10 (revised) “Property, Plant

qualification in Form 9C

& Equipment”, which provides that : “The cost of an item of property,

Accounting Treatment

plant and equipment comprises: (a) its purchase price, including

and disclosure of

import duties and non–refundable purchase taxes, after deducting

Capital Goods and ITC

trade discounts and rebates. (b) ….. (c) …..”

thereof

Para 5 : Observation/ The taxpayer has not included inward supplies for administrative use

qualification in Form 9C in the returns filed. However, details in respect of administrative

Misc. Inward Supplies Expenses involving inward supplies are not ascertainable as the

(other than taxable) not taxpayer has not maintained records in respect of the same and the

included in taxable same have not been included in the taxable value of inward supplies.

value of Inward Consequently, the taxpayer has not claimed ITC of the tax paid on such

Supplies inward supplies in the returns filed.

Compiled by CA ANKIT SOMANI, Ajmer (98297-45560) fca.cs.ankitsomani@gmail.com Page 3

You might also like

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- GST Audit PowerpointDocument62 pagesGST Audit PowerpointBiswakesh PatiNo ratings yet

- GST Audit Amendment Notes by Pankaj GargDocument12 pagesGST Audit Amendment Notes by Pankaj GargGopal Airan100% (2)

- Draft DisclosuresDocument11 pagesDraft DisclosuresCA Keshav MadaanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaGJ ELASHREEVALLINo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- 44627bos34430pmcp15 PDFDocument30 pages44627bos34430pmcp15 PDFVishav JindalNo ratings yet

- What Is GSTR-9C?: ReconciliationDocument7 pagesWhat Is GSTR-9C?: ReconciliationJatin ChoudaryNo ratings yet

- Auditors Report of BSNL Resultcomplete - 06Document25 pagesAuditors Report of BSNL Resultcomplete - 06g c agnihotriNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- Auditor Report - 2005Document9 pagesAuditor Report - 2005lohit3115No ratings yet

- 1 Tax Audit ConsolDocument199 pages1 Tax Audit Consolrishi Kr.No ratings yet

- Revenue Memorandum Order No. 42-03: October 23, 2003Document11 pagesRevenue Memorandum Order No. 42-03: October 23, 2003nathalie velasquezNo ratings yet

- Chapter - Tax Audit & Ethical CompliancesDocument106 pagesChapter - Tax Audit & Ethical CompliancessayanghoshNo ratings yet

- Standard Notes To Form No. 3CD (Revised 2019) CleanDocument8 pagesStandard Notes To Form No. 3CD (Revised 2019) CleanRahul LaddhaNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- Ifthekhae 3cbcd Ay 18-19Document14 pagesIfthekhae 3cbcd Ay 18-19Sneha ChavanNo ratings yet

- National Code: To Inform Yau of and CondudedDocument12 pagesNational Code: To Inform Yau of and CondudedKhush GosraniNo ratings yet

- Annex A - Audit Program - VAT Refund CY 2022Document5 pagesAnnex A - Audit Program - VAT Refund CY 2022Cha Gamboa De LeonNo ratings yet

- Tax Audit PresentationDocument12 pagesTax Audit PresentationChirag KarmadwalaNo ratings yet

- GST Audit Vis A Vis Annual ReturnDocument30 pagesGST Audit Vis A Vis Annual ReturnchariNo ratings yet

- TAX AUDIT PresentationDocument124 pagesTAX AUDIT PresentationCA Shivam Luthra100% (1)

- Ca Audit PDFDocument154 pagesCa Audit PDFsandesh1506No ratings yet

- Issue in Tax Audit and Documentation - Mulund Study Circle - CA Gautam M...Document61 pagesIssue in Tax Audit and Documentation - Mulund Study Circle - CA Gautam M...Neer MaruNo ratings yet

- Chapter 15 - Audit Under Fiscal LawsDocument3 pagesChapter 15 - Audit Under Fiscal LawsAswin NarayanNo ratings yet

- Fully Electronic Refund ProcessDocument4 pagesFully Electronic Refund ProcessCA Sumit GargNo ratings yet

- Taxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcessDocument3 pagesTaxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcesschetudaveNo ratings yet

- Rmo 43-90 PDFDocument5 pagesRmo 43-90 PDFRieland Cuevas67% (3)

- 2013 inDocument3 pages2013 inRahul KumarNo ratings yet

- Branch Auditor's Report: Raman Manoj& CoDocument25 pagesBranch Auditor's Report: Raman Manoj& CoDon bhaiNo ratings yet

- AssessmentDocument3 pagesAssessmentSWETCHCHA MISKANo ratings yet

- CWT RulesDocument2 pagesCWT RulesCherry Amor Venzon OngsonNo ratings yet

- Taxmann's Analysis - Changes Introduced in Guidance Note On Tax AuditDocument27 pagesTaxmann's Analysis - Changes Introduced in Guidance Note On Tax AuditS M SHEKAR AND CONo ratings yet

- Review Engagements Section General Review Standards: Scope and DefinitionsDocument7 pagesReview Engagements Section General Review Standards: Scope and DefinitionsFallon LoboNo ratings yet

- Delhi ITAT (Bar) Reports - December 2020Document23 pagesDelhi ITAT (Bar) Reports - December 2020PARVATI KUMARINo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- Fate of "Unjust Enrichment" Principle Under GSTDocument2 pagesFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyNo ratings yet

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocument12 pagesRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArNo ratings yet

- Audit Under Fiscal Laws E3Document87 pagesAudit Under Fiscal Laws E3Manogna PNo ratings yet

- Issues in Tax AuditDocument15 pagesIssues in Tax AuditChethan VenkateshNo ratings yet

- CIR vs. ISABELA CULTURAL CORPDocument2 pagesCIR vs. ISABELA CULTURAL CORPRenmarc JuangcoNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Form 3CD - Ajesh SoniDocument16 pagesForm 3CD - Ajesh SoniAditya AroraNo ratings yet

- Diff Between AS and TASDocument2 pagesDiff Between AS and TASashim1No ratings yet

- ALGP18 AP 10 RevisedDocument64 pagesALGP18 AP 10 RevisedAlexandra Denise PeraltaNo ratings yet

- Concurrent Audit Certificate 2017 PDFDocument3 pagesConcurrent Audit Certificate 2017 PDFSuresh SharmaNo ratings yet

- Types of AssessmentDocument9 pagesTypes of AssessmentRasel AshrafulNo ratings yet

- 07 Zcseza2021 Part1 IarDocument3 pages07 Zcseza2021 Part1 IarBaliv MozamNo ratings yet

- Disclosures Under ICDSDocument11 pagesDisclosures Under ICDScadrjainNo ratings yet

- 74824bos60500 cp15Document90 pages74824bos60500 cp15soni12c2004No ratings yet

- Eturns: After Studying This Chapter, You Will Be Able ToDocument70 pagesEturns: After Studying This Chapter, You Will Be Able ToChandan ganapathi HcNo ratings yet

- Path To Compliance NovDocument2 pagesPath To Compliance NovVishwanath HollaNo ratings yet

- Audit Report 18-19Document6 pagesAudit Report 18-19deepanshuca100No ratings yet

- Audit Program Compliance With Tax LawsDocument6 pagesAudit Program Compliance With Tax LawsVAL REYNAND ABADNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Tax Doctrines in Dimaampao CasesDocument3 pagesTax Doctrines in Dimaampao CasesDiane UyNo ratings yet

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaNo ratings yet

- GCRO - Top290 - PG - April2019 PDFDocument165 pagesGCRO - Top290 - PG - April2019 PDFMikee Baliguat TanNo ratings yet

- Chapter 9 Reply of Notices Under GSTDocument15 pagesChapter 9 Reply of Notices Under GSTDR. PREETI JINDALNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're Listeningraj pandeyNo ratings yet

- GST Case Study-JdaDocument7 pagesGST Case Study-Jdaraj pandeyNo ratings yet

- Section - 24 GST REGDocument1 pageSection - 24 GST REGraj pandeyNo ratings yet

- Stepbystep Approach Co Op Soc AuditDocument118 pagesStepbystep Approach Co Op Soc Auditraj pandeyNo ratings yet

- Impact of GST On Society RedevelopmentDocument23 pagesImpact of GST On Society Redevelopmentraj pandey100% (1)

- FAQ (II) Real Estate Sector 1405Document9 pagesFAQ (II) Real Estate Sector 1405raj pandeyNo ratings yet

- "Jurisprudence of Proviso": AUTHORED BY: - (09.08.2021)Document8 pages"Jurisprudence of Proviso": AUTHORED BY: - (09.08.2021)raj pandeyNo ratings yet

- Balance Sheet - ConsolidatedDocument239 pagesBalance Sheet - ConsolidatedAISHWARYA KUZHIKKATNo ratings yet

- Sahapat Daiso Holding 20201126034909Document46 pagesSahapat Daiso Holding 20201126034909Patara ChuparaNo ratings yet

- AUDITCISDocument2 pagesAUDITCISArebie Flores OcupanNo ratings yet

- Acc Project 2023-24 - For Students Accounting Ratio and Commparative & CommonsizeDocument18 pagesAcc Project 2023-24 - For Students Accounting Ratio and Commparative & Commonsizelegendyt949No ratings yet

- Module 1 ARS PCC - Intro To Management Acctg (ANSWERS)Document24 pagesModule 1 ARS PCC - Intro To Management Acctg (ANSWERS)James Bradley HuangNo ratings yet

- Government of Sierra Leone: OriginalDocument23 pagesGovernment of Sierra Leone: OriginalRaviNo ratings yet

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- English Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Document3 pagesEnglish Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Fioren KaunangNo ratings yet

- Conceptual Framework and Accounting Standards Instructional Materials - Presentation of Financial StatementsDocument9 pagesConceptual Framework and Accounting Standards Instructional Materials - Presentation of Financial StatementsMika MolinaNo ratings yet

- Philex Mining Corporation 2016 Consolidated Audited Financial StatementDocument97 pagesPhilex Mining Corporation 2016 Consolidated Audited Financial StatementRhean Jallorina GanadenNo ratings yet

- Analisis Laporan Keuangan Perusahaan Blue BirdDocument216 pagesAnalisis Laporan Keuangan Perusahaan Blue BirdDini KrisdianiNo ratings yet

- 104 2022 219 DTDocument23 pages104 2022 219 DTJason BramwellNo ratings yet

- FileDocument11 pagesFileRiza GallardoNo ratings yet

- Auditing and Assurance C11Document3 pagesAuditing and Assurance C11Paulo Timothy AguilaNo ratings yet

- At Last Minute by HerculesDocument19 pagesAt Last Minute by HerculesFranklin ValdezNo ratings yet

- Report On Financial Reporting PDFFFDocument38 pagesReport On Financial Reporting PDFFFMohit AroraNo ratings yet

- Theory - CASH FLOW ANALYSISDocument7 pagesTheory - CASH FLOW ANALYSISShahina KhanNo ratings yet

- LPKR Interim 30 Sep 2023Document175 pagesLPKR Interim 30 Sep 2023Hengkok SiholeNo ratings yet

- 06 Completing The Accounting CycleDocument26 pages06 Completing The Accounting CycleKristel Joy Eledia NietesNo ratings yet

- Accounting and ASC FrameworkDocument10 pagesAccounting and ASC FrameworkGwen Cabarse PansoyNo ratings yet

- Financial Reporting and Analysis Assignment MMS 03 Financial Statement 20230301 ParabDocument9 pagesFinancial Reporting and Analysis Assignment MMS 03 Financial Statement 20230301 ParabAdityaNo ratings yet

- Midterm Exam PFRSDocument7 pagesMidterm Exam PFRSRoldan AzueloNo ratings yet

- Audit of Cash and Marketable SecuritiesDocument21 pagesAudit of Cash and Marketable Securitiesዝምታ ተሻለNo ratings yet

- 3Q 2022 INDF Indofood+Sukses+Makmur+TbkDocument164 pages3Q 2022 INDF Indofood+Sukses+Makmur+TbkAdi Gesang PrayogaNo ratings yet

- AKRA - Annual Report - 2018-378-380Document3 pagesAKRA - Annual Report - 2018-378-380Ba babanaNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationhbuzdarNo ratings yet

- EXAMPLE ONE: Basic ConsolidationDocument24 pagesEXAMPLE ONE: Basic ConsolidationprasannaNo ratings yet

- Financial Statement Analysis LectureDocument71 pagesFinancial Statement Analysis Lecturephilippineball mapper100% (2)

- Annual Report 2018 KTM Industries AGDocument166 pagesAnnual Report 2018 KTM Industries AGSURYA FILMSNo ratings yet

- AFAR Quiz 4 and 5Document5 pagesAFAR Quiz 4 and 5Kyla DabalmatNo ratings yet