Professional Documents

Culture Documents

Analysis of Cash Flows at Dr. Reddy's

Uploaded by

Sarva ShivaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Cash Flows at Dr. Reddy's

Uploaded by

Sarva ShivaCopyright:

Available Formats

ANALYSIS

OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

EXECUTIVE SUMMARY

Cash flow analysis uses ratios that focus on cash flow and how solvent, liquid and

viable the company is. This study will focus on the application of the cash flow ratio

in evaluating the financial position of the Dr. Reddy’s Laboratories Ltd.

In 2001 Reddy’s completed its US initial public offering of $132.8 million, secured

by American Depositary Receipts. At that time the company also became listed on

the New York Stock Exchange. Funds raised from the initial public offering helped

Reddy’s move into international production and take over technology-based

companies.

To become a discovery ruled global pharmaceutical company with a core purpose of

helping people lead healthier lives.

Cash flow is the difference between the amount of cash flowing in and out a

company. Make sure to consistently include the different types of cash flows. It is

periodical statement as it covers a particular period of time, say month or year. It

shows moments of cash in between two balance sheet dates. It establishes the

relationship between net profit and changes in cash position of the firm. It does not

involve matching of cost against revenue.

It shows the sources and application of funds during particular period of time. Cash

flow analysis measures how much cash is generated and spent by the business during

a given period. It is the best measure of the company’s performance. Therefore, the

role played by cash flow statement in understanding the financial position of the

company is very much significant. Hence, we need to know how the cash flow helps

the organization in resolving its financial crisis. Therefore, the analysis of cash flow

statement is selected for the study.

The data can be collected and analyzed with the help of ratios, diagram and charts

which help in arriving to a conclusion.

K.L.E’s KF Patil Institute of Business Administration Page 1

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

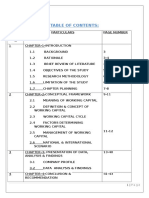

TABLE OF CONTENTS

SL. CHAPTERS TOPIC PAGE

NO NO

EXECUTIVE SUMMARY

1 CHAPTER – 1 INTRODUCTION TO THE STUDY

TITLE OF THE PROJECT

INDUSTRY PROFILE

2 CHAPTER – 2 COMPANY PROFILE

3 CHAPTER- 3 REVIEW OF LITERATURE

CASH FLOW CONCEPTUAL FRAME

WORK

4 CHAPTER – 4 DESIGN OF THE STUDY

5 CHAPTER – 5 DATA ANALYSIS AND

INTERPRETATION

6 CHAPTER – 6 CONCLUSION

FINDINGS

SUGGESTION

K.L.E’s KF Patil Institute of Business Administration Page 2

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 1

INTRODUCTION TO THE STUDY

TITLE OF THE STUDY

INDUSTRY PROFILE

K.L.E’s KF Patil Institute of Business Administration Page 3

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER 1

INTRODUCTION:

Cash play a very important role in the economic life of the business. In fact, what

blood is to human body, cash is to a business enterprise. Thus, it is very essential for a

business to maintain an adequate balance of cash. Cash is the basic input needed to

keep the operations of the business going on a continuing basis, it is also the final

output expected to be realized by selling the product manufactured by manufacturing

unit. Cash is both the beginning and the end of the business operations.

Cash flow statement deals with flow of cash which includes cash equivalence as well

as cash. This statement is additional information to the users of financial statements.

The statement shows the incoming and outgoing of cash. Thus, cash flow statement

may be defined as a summary of receipts and disbursements of cash for a period. It

also explains reasons for the changes in cash position of the firm. The management of

cash also assumes importance because it is difficult predict cash inflows and outflows

accurately and there is no perfect coincidence between the inflows and outflows of

cash giving rise to either cash outflows exceeding inflows or cash inflows exceeding

outflows. Cash flow statement is one important tool of cash management because it

throws light on cash inflows and outflows of a period.

Cash flow analysis uses ratios that focus on cash flow and how solvent, liquid and

viable the company is. This study will focus on the application of the cash flow ratio

in evaluating the financial position of the Dr. Reddy’s Laboratories Ltd.

TITLE OF THE PROJECT

“A STUDY ON ANALYSIS OF CASH FLOW STATEMENT OF DR.

REDDY’S LABORATORIES”

K.L.E’s KF Patil Institute of Business Administration Page 4

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

INDUSTRY PROFILE

Dr. Reddy's originally launched in 1984 producing active pharmaceutical ingredients.

In 1986, Reddy's started operations on branded formulations. Within a year Reddy's

had launched Norilet, the company's first recognized brand in India. Soon, Dr.

Reddy's obtained another success with Omez, its branded omeprazole ulcer and reflux

oesophagitis medication launched at half the price of other brands on the Indian

market at that time.

Within a year, Reddy's became the first Indian company to export the active

ingredients for pharmaceuticals to Europe. In 1987, Reddy's started to transform itself

from a supplier of pharmaceutical ingredients to other manufacturers into a

manufacturer of pharmaceutical products.

INTERNATIONAL EXPANSION:

The company's first international move took it to Russia in 1992. There, Dr. Reddy's

formed a joint venture with the country's biggest pharmaceuticals producer, Biomed.

They pulled out in 1995 amid accusations of scandal; involving "a significant material

loss due to the activities of Moscow's branch of Reddy's Labs with the help of

Biome’s chief executive”. eddy’s sold the joint venture to the Kremlin-friendly

Sistema group. In 1993, Reddy's entered into a joint venture in the Middle East and

created two formulation units there and in Russia. Reddy's exported bulk drugs to

these formulation units, which then converted them into finished products. In 1994,

Reddy's started targeting the US generic market by building state of art manufacturing

facility.

Reddy's path into new drug discovery involved targeting speciality generics products

in western markets to create a foundation for drug discovery. Development of

speciality generics was an important step for the company's growing interest in the

development of new chemical entities. The elements involved in creating a speciality

generic, such as innovation in the laboratory, developing the compound, and sending

the sales team to the market, are also stages in the development of a new specialty

drug. Starting with speciality generics allowed the company to gain experience with

those steps before moving on to creating brand-new drugs.

K.L.E’s KF Patil Institute of Business Administration Page 5

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

Reddy's also invested heavily in establishing R&D labs and is the only Indian

company to have significant R&D being undertaken overseas. Dr. Reddy's Research

Foundation was established in 1992 and in order to do research in the area of new

drug discovery. At first, the foundation's drug research strategy revolved around

searching for analogues. Focus has since changed to innovative R&D, hiring new

scientists, especially Indian students studying abroad on doctoral and post-doctoral

courses. In 2000, the Foundation set up an American laboratory in Atlanta, dedicated

to discovery and design of novel therapeutics. The laboratory is called Reddy US

Therapeutics Inc (RUSTI) and its main aim is the discovery of next-generation drugs

using genomics and proteomics. Reddy's research thrust focused on large niche areas

in western markets anti-cancer, anti-diabetes, cardiovascular and anti-infection drugs.

Reddy's international marketing successes were built on a strong manufacturing base

which itself was a result of inorganic growth through acquisition of international and

national facilities. Reddy's merged Cheminor Drug Limited (CDL) with the primary

aim of supplying active pharmaceutical ingredients to the technically demanding

markets of North America and Europe. This merger also gave Reddy's an entry into

the value-added generics business in the regulated markets of APIs. APIs in medicine

EXPANSION AND ACQUISITION:

By 1997, Reddy's made the transition from being an API and bulk drug supplier to

regulated markets like the USA and the UK, and a branded formulations supplier in

unregulated markets like India and Russia, into producing generics, by filing

an Abbreviated New Drug Application in the USA.

It strengthened its Indian manufacturing operations by acquiring American Remedies

Ltd. in 1999. This acquisition made Reddy’s the third largest pharmaceutical

company in India, after Ranbaxy and Glaxo (I) Ltd., with a full spectrum of

pharmaceutical products, which included bulk drugs, intermediates, finished dosages,

chemical synthesis, diagnostics and biotechnology.

Reddy’s started exploiting Para 4 filing as a strategy in bringing new drugs to the

market at a faster pace. In 1999 it submitted a Para 4 application for Omeprazole, the

K.L.E’s KF Patil Institute of Business Administration Page 6

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

drug that had been the cornerstone of its success in India. In December 2000, Reddy’s

had undertaken its first commercial launch of a generic product in the USA. and its

first product with market exclusivity was launched there in August 2001. The same

year, it also became the first non-Japanese pharmaceutical company from the Asia-

Pacific region to obtain a New York Stock Exchange listing, ground-breaking

achievements for the Indian pharmaceutical industry.

In 2001 Reddy’s became the first Indian company to launch the generic

drug, fluoxetine (a generic version of Eli Lilly and Company’s Prozac) with 180-day

market exclusivity in the USA. Prozac had sales in excess of $1 billion per year in the

late 1990s. Barr Laboratories of the U.S. obtained exclusivity for all of the approved

dosage forms (10 mg, 20 mg) except one (40 mg), which was obtained by Reddy’s.

Lilly had numerous other patents surrounding the drug compound and had already

enjoyed a long period of patent protection. The case to allow generic sales was heard

twice by the Federal Circuit Court, and Reddy’s won both hearings. Reddy’s

generated nearly $70 million in revenue during the initial six-month exclusivity

period. With such high returns at stake, Reddy’s was gambling on the success of the

litigation; failure to win the case could have cost them millions of dollars, depending

on the length of the trial.

The fluoxetine marketing success was followed by the American launch of Reddy's

house-branded ibuprofen tablets in 400, 600 and 800 mg strengths, in January

2003. Direct marketing under the Reddy’s brand name represented a significant step

in the company’s efforts to build a strong and sustainable US generic business. It was

the first step in building Reddy’s fully-fledged distribution network in the US market.

In 2015, Dr. Reddy's Laboratories bought the established brands of Belgian

drugmaker UCB SA in South Asia for 8 billion rupees ($128.38 million). [ Dr. Reddy's

Laboratories also signed a licensing pact with xenoPort for their experimental

treatment to treat plaque psoriasis. As per the agreement, Dr. Reddy’s will be granted

exclusive US rights to develop and commercialize XP23829 for all indications for an

upfront payment of $47.5 million.

K.L.E’s KF Patil Institute of Business Administration Page 7

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

AMERICAN IPO AND EXPANSION INTO EUROP:

In 2001 Reddy’s completed its US initial public offering of $132.8 million, secured

by American Depositary Receipts. At that time the company also became listed on

the New York Stock Exchange. Funds raised from the initial public offering helped

Reddy’s move into international production and take over technology-based

companies.

In 2002, Reddy’s started its European operations by acquiring two pharmaceutical

firms in the United Kingdom. The acquisition of BMS Laboratories and its wholly

owned subsidiary, Meridian UK, allowed Reddy’s to expand geographically into the

European market. In 2003 Reddy’s also invested $5.25 million (USD) in equity

capital into Bio Sciences Ltd.

Auriegene Discovery Technologies, a contract research company, was established as a

fully owned subsidiary of Reddy’s in 2002. Auriegene's objective was to gain

experience in drug discovery through contract research for other pharmaceutical

companies. Reddy’s entered into a venture investment agreement with ICICI Bank, an

established Indian banking company. Under the terms of the agreement, ICICI

Venture agreed to fund the development, registration and legal costs related to the

commercialization of ANDAs on a pre-determined basis. Upon commercialization of

these products, Dr. Reddy's pays ICICI Venture royalty on net sales for a period of 5

years.

GLOBAL EXPANSION

The company elected to expand globally, and acquired other entities. In March 2002,

Dr. Reddy’s acquired BMS Laboratories, Beverley, and its wholly owned subsidiary

Meridian Healthcare, for 14.81 million Euros. These companies deal in oral solids,

liquids and packaging, with manufacturing facilities in London and Beverley in the

UK. Recently, Dr. Reddy’s entered into an R&D and commercialization agreement

with Argenta Discovery Ltd., a private drug development company based in the UK,

for the treatment of chronic obstructive pulmonary disease (COPD).

K.L.E’s KF Patil Institute of Business Administration Page 8

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

Dr. Reddy’s entered into a 10-year agreement with Rheoscience A/S of Denmark for

the joint development and commercialization of Balaglitazone (DRF-2593), a

molecule for the treatment of type-2 diabetes. Rheoscience holds this product’s

marketing rights for the European Union and China, while the rights for the US and

the rest of the world will be held by Dr. Reddy’s. Dr. Reddy’s conducted clinical trials

of its cardiovascular drug RUS 3108 in Belfast, Northern Ireland, in 2005. The trials

were conducted to study the safety and the pharmacokinetic profiles of the drug,

which is intended for the treatment of atherosclerosis, a major cause of cardiovascular

disorders.

Dr. Reddy’s entered into a marketing agreement with Eurodrug Laboratories, a

pharmaceutical company based in Netherlands, for improving its product portfolio for

respiratory diseases. It introduced a second-generation xanthine bronchodilator,

Doxofylline, which is used for the treatment of asthma and COPD patients.

In 2004, Reddy’s acquired Triteness Therapeutics Inc; a US-based private

dermatology company. This acquisition gave Reddy’s access to proprietary products

and technologies in the dermatology sector.

Dr. Reddy’s Para 4 application strategy for generic business received a severe setback

when Reddy’s lost the patent challenge in the case of Pfizer’s

drug Norvasc (amlodipinemaleate), a drug indicated for the treatment

of hypertension and angina. The cost involved in patent litigation as well as the

unexpected loss of the patent challenge affected Reddy’s plans to start speciality

business in the US generic markets.

In March 2006, Dr. Reddy’s acquired Beta harm Arzneimittel GmbH from 3i for 480

million Euros. This is one of the largest-ever foreign acquisitions by an Indian

pharmaceutical company. Betapharm is Germany’s fourth-largest generics

pharmaceutical company, with a 3.5% market share, including 150 active

pharmaceutical ingredients.

Reddy’s has promoted India’s first integrated drug development company Pelican

Pharma Pvt Ltd together with ICICI ventures capital fund management company Ltd

and Citigroup Venture Capital International growth partnership Mauritius Ltd. The

K.L.E’s KF Patil Institute of Business Administration Page 9

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

combined entity will undertake clinical development and out-licensing of new

chemical entity assets.

Dr. Reddy's is presently licensed by Merck &Co. to sell an authorized generic version

of the popular drug simvastatin (Zocor) in the USA. Since Dr. Reddy's has a license

from Merck, it was not subject to the exclusivity period on generic simvastatin.

As of 2006, Dr. Reddy’s Laboratories exceeded $500 million USD in revenues,

flowing from their APIs, branded formulations and generics segments; the former two

segments account for almost 75% of revenues. Dr. Reddy's deals in and manages all

the processes, from the development of the API to the submission of finished dosage

dossiers to the regulatory agencies.

K.L.E’s KF Patil Institute of Business Administration Page 10

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 2

COMPANY PROFILE

K.L.E’s KF Patil Institute of Business Administration Page 11

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

DR.REDDY’S LABORATORIES – A PROFILE

Dr. Reddy's Laboratories is an Indian multinational pharmaceutical company based

in Hyderabad, Telangana, India. The company was founded by Anji Reddy, who

previously worked in the mentor institute Indian Drugs and Pharmaceuticals limited,

of Hyderabad, India. Dr. Reddy's manufactures and markets a wide range of

pharmaceuticals in India and overseas. The company has over 190 medications,60

active pharmaceutical ingredients(APIs) for drug manufacture, diagnostic kits, critical

care, and biotechnology products.

Dr. Reddy's Laboratories.

Type Public

Traded as NSE: DRREDDY

BSE: 500124

NYSE: RDY

Industry Pharmaceuticals

Founded 1984

Founders Kallam Anji Reddy

Headquarters Hyderabad, Telangana, India

Key people G. V. Prasad (CEO)

Kallam Satish Reddy (Chairman)

Revenue ₹15,697.80 crore (US$2.4 billion) (2016)[1]

Net income ₹2,151.40 crore (US$330 million) (2016)[1]

Total assets ₹20,010.40 crore (US$3.1 billion) (2016)

Total equity ₹82.80 crore (US$13 million) (2016)

Number of employees 20,373 (April 2015)

Website www.drreddys.com

K.L.E’s KF Patil Institute of Business Administration Page 12

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

ADDRESS OF THE COMPANY:

Dr.Reddy’s laboratories ltd.

Registered address

8-2-337, Road no 3, Banjara Hills, Hyderabad 500034,

India.

VISION:

To become a discovery ruled global pharmaceutical company with a core purpose of

helping people lead healthier lives.

MISSION:

To be INDIA’s first pharmaceutical that successfully takes its products from

discovery to commercial launch globally.

BOARD OF DIRECTORS:

NAME DESIGNATION

Mr. Satish Reddy Chairman

Mr. G.V Prasad Co-Chairman & CEO

Mr. Bharat Narotam Doshi Independent Director

Mr. Anupam Puri Independent Director

Dr. Omkar Goswami Independent Director

Mr. Hans Peter Hasler Independent Director

Ms. Kalpana Morparia Independent Director

Dr. Bruce LA Carter Independent Director

Dr. Ashok Ganguly Independent Director

Mr. Sridar Iyengar Independent Director

K.L.E’s KF Patil Institute of Business Administration Page 13

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

KEY PRODUCTS:

Ciprofloxacin Ranitidine HCI Losartan Potassium

Hydrochloride Form 2 Sparfloxacin

Clopidogrel

Ramipril Naproxen Nizatidine

Omeprazole

Terbinafine HCI Sodium Fexofenadine

Finasteride

Ibuprofen Naproxen Ranitidine

Sumatriptan

Sertaline Atorvastatin Hydrochloride Form 1

Hydrochloride Montelukast

AWARDS AND RECONGNITIONS

Best workplace in the Biotech/Pharmaceutical Industry – 2009.

Gold shield –ICAI Awards for Excellence in Financial Reporting.

Best CSR and Sustainability Practice 2008 – 9th International Conference on

corporate governance and sustainability.

HR Awards at world HRD congress

Awards from Public Relations Society of India.

RedituxTM – ‘’product of the year 2008’’

AIF- Annual spring Award to Dr. K. Anji Reddy.

K.L.E’s KF Patil Institute of Business Administration Page 14

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 3

REVIEW OF LITERATURE

CASH FLOW CONCEPTUAL FRAME WORK

K.L.E’s KF Patil Institute of Business Administration Page 15

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

INTRODUCTION LITERATURE

Cash management is a broad term that refers to the collection, concentration and

disbursement of cash. It encompasses a company’s level of liquidity, its management

of cash balance and its short-term investment strategies. In some ways, managing cash

flow is the most important job of business managers.

-Tim Keller, Marc Goodhearted, David Wessels. 2005: About the cash analysis we

can say that it is the lifeblood of any business. In an organization we can see many

activities to get the cash from sales, debtors, sale of assets, investments etc. like this

the company spend also the cash in some areas- payment of salaries, rent dividend,

interest etc. lastly we can say that cash flow reveals the inflow and outflow of cash

during a particular period.

Cash flow is the difference between the amount of cash flowing in and out a

company. Make sure to consistently include the different types of cash flows.

-Keck, T, E. Levengood, and A. Longfield. 1998: The value of the equity can be

calculated by subtracting any outstanding debts from the total of all discounted cash

flows.

-Aswath Damodaran 2001 Investment Valuation: Calculating cash flows after the

forecast period is much more difficult as uncertainty and therefore the risk factor,

rises with each additional year into the future. The continuing value, or terminal

value, is a solution that represents the cash flow after the forecast period.

-Kubr, Marches, Ilar, Kienhuis. 1998. Starting up. McKinley & company: The

role played by cash flow statement in understanding the financial position of the

company is very much significant. Hence we need to know how the cash flow helps

the organization in resolving its financial crisis. Therefore, the analysis of cash flow

statement is selected for the study.

K.L.E’s KF Patil Institute of Business Administration Page 16

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CASH FLOW STATEMENT- CONCEPTUAL FRAMEWORK

INTRODUCTION:

A statement which discloses the changes in position of cash and cash equivalents

between two periods .According to revised AS-3 issued by ICAI an organization

should prepare a cash flow statement and present it each period. Revised AS-3

DEALS with the provisions of information about changes in cash and cash

equivalents of an enterprise by means of cash flow statement.

MEANING:

Cash flow statement is a statement of changes in financial position of the firm on cash

basis.

It shows various sources (i.e. inflows) and applications (i.e. outflows) of cash during a

particular period and their net impact on the cash balance.

DEFINITIONS:

The institute of cost and works accountant of India defines cash flow statement as “a

statement setting out the flow cash under distinct heads of sources of funds and their

utilization to determine the requirements of cash during the given period and prepare

for its adequate provision”.

According to khan and Jain “cash flow statements are statements of changes in

financial position prepared on the bases of funds defined as cash or cash equivalents.

K.L.E’s KF Patil Institute of Business Administration Page 17

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CASH FLOW IMPORTANT TERMS

CASH AND CASH EQUIVALENTS:

As stated earlier, cash flow statement shows inflows and outflows of cash and cash

equivalents from various activities of an enterprise during a particular period. As per

AS-3, ‘Cash’ comprises cash in hand and demand deposits with banks, and ‘Cash

equivalents’ means short-term highly liquid investments that are readily convertible

into known amounts of cash and which are subject to an insignificant risk of changes

in value. An investment normally qualifies as cash equivalents only when it has a

short maturity, of say, three months or less from the date of acquisition. Investments

in shares are excluded from cash equivalents unless they are in substantial cash

equivalents. For example, preference shares of a company acquired shortly before

their specific redemption date provided there is only insignificant risk of failure of the

company to repay the amount at maturity. Similarly, short-term marketable securities

which can be readily converted into cash are treated as cash equivalents and is liquid

able immediately without considerable change in value.

CASH FLOWS:

‘Cash Flows’ implies movement of cash in and out due to some non-cash items.

Receipt of cash from a non-cash item is termed as cash inflow while cash payment in

respect of such items as cash outflow. For example, purchase of machinery by paying

cash is cash outflow while sale proceeds received from sale of machinery is cash

inflow. Other examples of cash flows include collection of cash from trade

receivables, payment to trade payables, payment to employees, receipt of dividend,

interest payments, etc. Cash management includes the investment of excess cash in

cash equivalent Hence, purchase of marketable securities or short-term investment

which constitutes cash equivalents is not considered while preparing cash flow

statement.

K.L.E’s KF Patil Institute of Business Administration Page 18

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

FEATURES OF CASH FLOW STATEMENTS

It is periodical statement as it covers a particular period of time, say month or

year.

It shows moments of cash in between two balance sheet dates.

It establishes the relationship between net profit and changes in cash position

of the firm.

It does not involve matching of cost against revenue.

It shows the sources and application of funds during particular period of time.

It records the changes in fixed assets as well as current assets.

It projected cash flow statement is referred to as cash budget.

It is an indicator of cash earning capacity of the firm.

It reflects clearly how financial position of firm changes over period of time

due to its operating activities, investing activities and financing activities.

CLASSIFICATION OF ACTIVITIES FOR THE PREPARATION OF CASH

FLOW STATEMENT

As per AS-3 these activities are to be classified into three categories.

Operating Activities

Investing Activities

Financing Activities.

So as to show separately the cash flow generated or used by in these activities. This

helps users of cash flow statement to assess the impact of these activities on the

financial position of an enterprise and also on its cash and cash equivalents.

K.L.E’s KF Patil Institute of Business Administration Page 19

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CASH FROM OPERATING ACTIVITIES:

Operating activities are the activities that constitute the primary or main activities of

an enterprise. For example, for a company manufacturing garments, operating

activities are procurement of raw material, incurrence of manufacturing expenses, sale

of garments, etc. These are the principal revenue generating activities (or the main

activities) of the enterprise and these activities are not investing or financing

activities. The amount of cash from operations’ indicates the internal solvency level

of the company, and is regarded as the key indicator of the extent to which the

operations of the enterprise have generated sufficient cash flows to maintain the

operating capability of the enterprise, paying dividends, making of new investments

and repaying of loans without recourse to external source of financing. Cash flows

from operating activities are primarily derived from the main activities of the

Enterprise. They generally result from the transactions and other events that enter

into the determination of net profit or loss. Examples of cash flows from operating

activities.

CASH INFLOWS FROM OPERATING ACTIVITIES

Cash receipts from sale of goods and the rendering of services.

Cash receipts from royalties fees, commissions, and other revenue.

Cash outflows from operating activities

Cash payments to suppliers of goods and services.

Cash payment to and on behalf of the employees.

Cash payment to an insurance enterprise for premium and claims, annuities

and other policy benefits.

Cash payments of income taxes unless they can be specifically identified with

financing and investing activities.

K.L.E’s KF Patil Institute of Business Administration Page 20

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CASH FROM INVESTING ACTIVITIES:

As per AS-3, investing activities are the acquisition and disposal of long-term assets

and other investments not included in cash equivalents. Investing activities relate to

purchase and sale of long-term assets or fixed assets such as machinery furniture, land

and building, etc. Transactions related to long-term investment are also investing

activities. Separate disclosure of cash flows from investing activities is important

because they represent the extent to which expenditures have been made for resources

intended to generate future income and cash flows. Examples of cash flows arising

from investing activities are:

CASH OUTFLOWS FROM INVESTING ACTIVITIES

Cash payments to acquire fixed assets including intangibles and capitalized

research and development.

Cash payments to acquire shares, warrants, or debt instruments of other

enterprises other than the instruments those held for trading purposes.

Cash advances and loans made to third party( other than advances and loans

made by financial enterprise where in it is operating activities).

CASH INFLOWS FROM INVESTING ACTIVITIES

Cash receipt from disposal of fixed assets including intangibles.

Cash receipt from the repayment of advances or loans made to third parties

(except in case of financial enterprise).

Cash receipt from disposal of shares, warrants, or debt instruments of other

enterprises except those held for trading purposes.

Interest received in cash from loan and advances.

Dividend received from investments in other enterprises.

.

K.L.E’s KF Patil Institute of Business Administration Page 21

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CASH FROM FINANCING ACTIVITIES:

As the name suggests, financing activities relate to long-term funds or capital of an

enterprise, e.g., cash proceeds from issue of equity shares, debentures, raising long-

term bank loans, repayment of bank loan, etc. As per AS-3, financing activities are

activities that result in changes in the size and composition of the owners’ capital

(including preference share capital in case of a company) and borrowings of the

enterprise. Separate disclosure of cash flows arising from financing activities is

important because it is useful in predicting claims on future cash flows by providers

of funds (both capital and borrowings) to the enterprise. Examples of financing

activities are:

CASH INFLOWS FROM FINANCING ACTIVITIES

Cash proceeds from issuing shares (equity and preference).

Cash proceeds from issuing debentures, loans, bonds, and other short/long

Term borrowings.

CASH OUTFLOWS FROM FINANCING ACTIVITIES

Cash repayments of amounts borrowed.

Interest paid on debentures and long term loans and advances.

Dividends paid on equity and preference capital.

K.L.E’s KF Patil Institute of Business Administration Page 22

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

RATIOS USED TO ANALYZE THE CASH FLOW STATEMENT

OPERATING CASHFLOW RATIO:

The operating cash flow ratio is a measure of how well current liabilities are

covered by the cash flow generated from a company's operations. The operating cash

flow ratio can gauge a company's liquidity in the short term. Using cash flow as

opposed to income is considered a cleaner, or more accurate, measure since earnings

can be manipulated.

Operating cash flow ratio = Net cash flow from operating activities

Net sales

ASSET EFFICIENCY RATIO:

Asset efficiency ratios are the key to analyzing how effectively and efficiency your

small business is managing its assets to produce sales. Asset efficiency ratios are also

called turnover ratios or management ratios. If you have too much invested in your

company's assets, your operating capital will be too high. If you don't have enough

invested in assets, you will lose sales and that will hurt your profitability, free cash

flow, and stock price.

Asset Efficiency Ratio = Net cash flow from operating activities

Total assets

CURRENT LIABLITY COVERAGE RATIO

To test for solvency, this is a simple ratio. The more accurate method is to subtract

the cash used to pay off dividends as it will give a truer picture of the operating cash

flows. This ratio gives you an idea about the company’s debt management practices.

E.g. a value of 4.3 means that the current cash flows can pay for 4.3x the current

liabilities. The higher the number the better. If it drops below 1, then CFO is unable

to pay the current liabilities. It’s also a better indicator of the company’s ability to

pay current liabilities than the current ratio or quick ratio. This ratio is used to

analyze the short term stability of a company. This ratio also includes the current

maturing portion of long term debt.

Current liability coverage ratio = Net cash flow from operating activities

Current liabilities

K.L.E’s KF Patil Institute of Business Administration Page 23

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

LONGTERM DEBT COVERAGE RATIO

The long-term debt coverage ratio indicates whether a company can repay its existing

liabilities and take on additional debt without jeopardizing its survival. It is efficiency

metric, meaning it shows investors how adeptly a company manages its resources.

The metric equals net profit plus any non-cash expenses divided by the principal

amount of long-term debt. Accountants add non-cash expenses back to net profit

because these charges reduce net income, yet the borrowing firm does not disburse

any funds. An example is depreciation, which enables a firm to allocate its fixed-asset

costs over several years.

Long term debt coverage ratio= Net cash flow from operating activities

Long term debt

INTREST COVERAGE RATIO

The interest coverage ratio is a debt ratio or profitability ratio used to determine how

easily a company can pay interest on outstanding debt. The interest coverage ratio

may be calculated by dividing a company's earning before interest and

tax(EBIT) during a given period by the amount a company must pay in interest on its

debts during the same period.

Cash interest coverage ratio= CFO+ Taxes paid+ interest paid

Interest paid

EXTERNAL FINANCING INDEX RATIO:

This ratio compares the cash flow from financing activities with cash from operation

to show how dependent the company is on financing. The higher the number, the

more dependent the business is on external money.

External financing index ratio = cash from financing

Net cash flow from operating

K.L.E’s KF Patil Institute of Business Administration Page 24

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

K.L.E’s KF Patil Institute of Business Administration Page 25

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 4

DESIGN OF THE STUDY

NEED OF THE STUDY

OBJECTIVES OF THE STUDY

METHODOLOGY OF THE STUDY

CHAPTERZATION

LIMITATIONS

K.L.E’s KF Patil Institute of Business Administration Page 26

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

NEED OF THE STUDY:

Cash flow analysis measures how much cash is generated and spent by the business

during a given period. It is the best measure of the company’s performance.

Therefore, the role played by cash flow statement in understanding the financial

position of the company is very much significant. Hence, we need to know how the

cash flow helps the organization in resolving its financial crisis. Therefore, the

analysis of cash flow statement is selected for the study.

OBJECTIVES OF THE STUDY:

Familiar with methodology for preparation of cash flow statement and different

components of cash flow statement.

To find out the liquidity position of the company.

To understand the types of transactions that result in cash flows from operating,

investing and financing activities.

K.L.E’s KF Patil Institute of Business Administration Page 27

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

METHODOLOGY OF THE STUDY:

Methodology is the general research strategy that outlines the way in which the

research is to be undertaken and among other things identifies the methods to be used

in it.

The data can be collected and analyzed with the help of ratios, diagram and charts

which help in arriving to a conclusion.

TYPE OF DATA USED:

This study is based entirely based on the secondary data.

SOURCES OF DATA COLLECTION:

The data collected is from the following sources:

Official website of Dr. Reddy’s Laboratories Ltd.

Annual reports of Dr. Reddy’s Laboratories Ltd.

Wikipedia.

PERIOD OF DATA USED:

The data collected and analyzed is for a period of past five years.

LIMITATIONS:

The information is collected from secondary data.

Only five years statements were taken into account for the study.

Time as a limited factor.

K.L.E’s KF Patil Institute of Business Administration Page 28

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 5

ANALYSIS AND INTERPRETATION OF DATA

K.L.E’s KF Patil Institute of Business Administration Page 29

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

DATA ANALYSIS:

Data analysis is the process of inspecting, cleaning, transforming, and modeling data

with a goal highlighting useful information, suggesting conclusion, and supporting

decision making. Data Analysis involves converting a series of recorded observations

into descriptive statements and inferences about relationships. The types of analysis

that can be conducted depend on the nature of the measurement instrument and the

data collected method.

DATA INTERPRETATION:

Data interpretation is the process of assigning meaning to collected information and

determining the conclusions, significance, and implication of findings. The

interpretation of data is an important factor. Interpretation needs skill, intelligence and

foresightedness. The inherent imitation of data analysis should be kept in mind while

interpreting them. The impact of factors such as price level changes, changes in

accounting policies, window dressing, etc., should also be kept in mind when

accounting to interpret data.

FOR ANALYZING THE CASH FLOW STATEMENT OF DR.

REDDY’S LABORATORIES LIMITED FOLLOWING RATIOS

ARE BEING USED:

Asset Efficiency Ratio

Current Liability Coverage Ratio

Operating Cash Flow Ratio

External Financing Index Ratio

Long Term Debt Coverage Ratio

Current Ratio

K.L.E’s KF Patil Institute of Business Administration Page 30

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE: - 4.1 NET OPERATING CASHFLOW FOR 5 YEARS

YEAR 2016 2015 2014 2013 2012

Op Cash flow before change in WC 27519 26559 34726 24384 21404

-

Change in WC 4435 -3906 20241 -17738 -3436

Cash generated from Operations 31954 22653 14485 6646 17968

Income tax paid, Net -3972 -4792 -5430 -3758 -3938

Net cash from Operating activities 27982 17861 9055 2888 14030

CF from Net operating (CFO) 27982 17861 9055 2888 14030

(Source: Annual Report - www.drreddys.com )

Interpretation:

Table 1 shows that net operating cash flow in the year 2017 is higher (i.e. Rupees

27982) is lower in the year 2014 (i.e. Rupees 2888). The trend is increasing year by

year except in the year 2014 and 2015.

K.L.E’s KF Patil Institute of Business Administration Page 31

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE:- 4.2 NET SALES FOR 5 YEARS

YEAR 2016 2015 2014 2013 2012

Gross Sales 100060 99703 95777 81462 66443

Excise duty and others. -842 -829 -820 -718 -405

Net Sales 99218 98874 94957 80744 66038

Net sales 99218 98874 94957 80744 66038

(Source: Annual Report -www.drreddys.com)

Interpretation:

Net sale of the company is highest in the year 2017 is Rupees 99218, and lowest in

the year 2013 was Rupees 66038. Net sales of the company is exhibiting an increasing

trend from 2013-2017.

K.L.E’s KF Patil Institute of Business Administration Page 32

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE: -4.3 TOTAL ASSETS FOR 5 YEARS

YEAR 2017 2016 2015 2014 2013

Noncurrent Assets 74627 60527 56003 53638 54169

Current Assets 100949 104033 89078 66253 49237

Total Assets 175576 164560 145081 119891 103406

(Source: Annual Report -www.drreddys.com

Interpretation:

Total assets of the company highest in the year 2017 was Rupees 175576, and lowest

in 2013 was Rupees 103406. Hence total assets of the company in the past 5 years

reflects an upward trend.

K.L.E’s KF Patil Institute of Business Administration Page 33

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE: - 4.4

COMPUTATION OF OPERATING CASHFLOW RATIO

YEAR 2016 2015 2014 2013 2012

CF from Net

Operating (CFO) 27928 17861 9055 2888 14030

Net Sales 99218 98874 94957 80744 66038

CFO/Net sales

Op CF Ratio 0.281481 0.180644 0.095359 0.035767 0.212453

(Source: Annual Report -www.drreddys.com)

Interpretation:

The operating cash flow ratio is highest in the year 2017 i.e. 0.281481, lowest in the

year 2014 i.e. .035757. From 2014 to 2015 operating cash flow ratio decreasing trend,

but in the year 2017 there is sudden increase to 0.281481.

K.L.E’s KF Patil Institute of Business Administration Page 34

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE:-4.5

COMPUTATION OF ASSET EFFICIANCY RATIO

YEAR 2017 2016 2015 2014 2013

CF from Net Operating

(CFO) 27928 17861 9055 2888 14030

Total Assets 175576 164560 145081 119891 103406

CFO/Total Assets

Asset Efficiency ratio 0.159065 0.108538 0.062413 0.024089 0.135679

(Source: Annual Report -www.drreddys.com)

Interpretation:

Asset efficiency ratio in the year 2013 is lowest i.e. .024089, and is highest in the

year 2017 i.e. .159065. Compared to 2013 there is increasing trend in 2014, 2016 and

2017 respectively.

K.L.E’s KF Patil Institute of Business Administration Page 35

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE:- 4.6

CURRENT LIABLITY COVERAGE RATIO

YEAR 2017 2016 2015 2014 2013

CF from Net

Operating (CFO) 27928 17861 9055 2888 14030

Dividend Paid 4076 3574 2979 2708 2216

Current Liabilities 47987 46986 41142 40731 30623

CFO - Dividend

Paid 23852 14287 6076 180 11814

CFO-Dividend Paid/Current Liability

Current Liability

Coverage Ratio 0.497051 0.304069 0.147684 0.004419 0.385788

Source: Annual Report -www.drreddys.com)

Interpretation:

Current liability coverage ratio is highest in the year 2017 i.e. 0.497051, lowest in the

year 2014 i.e. 0.004419.it depicts that current liability coverage ratio is increasing

from 2015 to 2017.

K.L.E’s KF Patil Institute of Business Administration Page 36

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE :– 4.7

COMPUTATION OF LONGTERM DEBT COVERAGE RATIO

YEAR 2017 2016 2015 2014 2013

CF from Net

Operating(CFO) 27928 17861 9055 2888 14030

Dividend Paid 4076 3574 2979 2708 2216

LT Debt 9944 9391 9015 63 5130

CFO-Dividend Paid 23852 14287 6076 180 11814

CFO-Dividend/LT Debt

LT Debt Coverage Ratio 2.398632 1.52135 0.673988 2.857143 2.302924

(Source: Annual Report -www.drreddys.com)

INTERPRETATION:

Long term debt coverage ratio is highest in the year 2017 i.e. 2.398632, lowset in the

year 2015 i.e. 0.673988. long term debt coverage ratio is fluctuating in past 5 years.

K.L.E’s KF Patil Institute of Business Administration Page 37

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE:-4.8 COMPUTATION OF CURRENT RATIO

YEAR 2017 2016 2015 2014 2013

Current Assets 100949 104033 89078 66253 49237

Current

Liability 47987 46986 41142 40731 30623

Current Assets/Current Liability

Current Ratio 2.103674 2.214128 2.165135 1.626599 1.607844

(Source: Annual Report -www.drreddys.com)

Interpretation:

As we know that ideal current ratio of any firm is 2:1, It we see the current ratio of

the company is incresed during the five years period. the current ratio of the

company is more than the ideal ratio this depicts that the company’s liquidity position

is sound. Its current assets are more than current liablities.

K.L.E’s KF Patil Institute of Business Administration Page 38

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE: -4.9

COMPUTATION OF EXTERNAL FINANCING INDEX RATIO

YEAR 2017 2016 2015 2014 2013

CF from Net Operating

(CFO) 27928 17861 9055 2888 14030

CF from Financing (CFF) -6937 1894 282 1518 -1949

CFF/CFO

-

EFI Ratio -0.24839 0.106041 0.031143 0.525623 0.13892

(Source: Annual Report -www.drreddys.com)

Interpretation:

External efficiency ratio is highset in the year 2013(i.e.0 .525623), lowest in the year

2015 (i.e. .031143). External efficiency ratio fluctuating year by year in past 5 years.

K.L.E’s KF Patil Institute of Business Administration Page 39

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE :-4.10 NET CASH FROM FINANCING ACTIVITIES

YEAR CF From Financing Activities

2017 -6937

2016 1894

2015 282

2014 1518

2013 -1949

(Source: Annual Report -www.drreddys.com)

Interpretation:

Cashflow from financing activties of the company in the year 2013 rupees -1949. In

the year 2014 it increases to rupees 1518, in the year 2014 it decreases to rupees 282.

In the year 2016 it increses to rupees 1894, in the year 2017 it decreses to -6937. This

shows that cash from financing activities of the company is nagative in the year 2017

and 2013.

K.L.E’s KF Patil Institute of Business Administration Page 40

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

TABLE:- 4.11 COMBINED RESULT OF ABOVE COMPUTED RATIOS

YEAR 2017 2016 2015 2014 2013

Operating Cash Flow Ratio 0.281481 0.180644 0.095359 0.035767 0.212453

Asset Efficiency Ratio 0.159065 0.108538 0.062413 0.024089 0.013568

Current Liability Coverage Ratio 0.497051 0.304069 0.147684 0.004419 0.385788

Long Term Debt Coverage Ratio 2.398632 1.52135 0.673988 2.857143 2.302924

Current Ratio 2.103674 2.214128 2.165135 1.626599 1.607844

External Financing Index Ratio -0.24839 0.106041 0.031143 0.525623 -0.13892

(Source: Annual Report -www.drreddys.com)

Interpretation:

The overall ratios of the company are showed in the chart and the company is

achieving growth year by year.

K.L.E’s KF Patil Institute of Business Administration Page 41

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CHAPTER – 6

CONCLUSION

FINDINGS

SUGGESTIONS

K.L.E’s KF Patil Institute of Business Administration Page 42

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

CONCLUSION

The present study on cash flow statements DR.REDDY’S LABORATORIES

LIMITED includes the analysis of cash flow ratios and such as current liability

coverage ratio, operating cash flow ratio, asset efficiency ratio, etc. which determine

the company’s financial position. It shows that Analysis of cash flow of the company

is achieving growth year by year. They are managing cash flow of the company in

very effective way.

K.L.E’s KF Patil Institute of Business Administration Page 43

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

FINDINGS:

The current ratio has shown increasing trend as 1.607844, 1.626599, 2.16513,

and 2.214128 during 2013, 2014, 2015 and 2016 respectively but in the year

2017 slight decrease to 2.103674.

Total assets of the company are increased from 2013 to 2017.

Net sales of the company is also in increasing trend from 2013 to 2017,

Rupees 103406, 119891, 145081, 164560and 175576.

Asset efficiency ratio is fluctuating year by year from 0.108535 to 0.281481 in

2016 and 2017.

Current liabilities coverage ratio is decreased in 2014 to .004419 and

remaining year it is increasing constantly.

Cash flow from financing activities is negative in 2017 and 2013, is Rupees -

6937 and -1949 respectively. In other years it is rupees

Operating cash flow ratio is fluctuating year by year from 2013 to 2017.

K.L.E’s KF Patil Institute of Business Administration Page 44

ANALYSIS OF CASH FLOW STATEMENT OF DR.REDDY’S LABOROTARIES

SUGGESTIONS

The company must lower the external financing index ratio to minimize the

dependency on external finance.

Current liability coverage ratio of the company below 1 for the past years. So

it is advised to increase the CLCR above 1.

The company has to use its assets to generate more cash flow.

Cash flow from net operating is increasing from past 5 years, except in the

year 2014.company should be planned in a way that it should increase on

yearly basis.

Long term debt coverage ratio is high in some of the year, higher the number

the more cash from operation is required to pay off debt. So it is advised to

maintain lower number of long term debt coverage ratio.

K.L.E’s KF Patil Institute of Business Administration Page 45

You might also like

- Cash Flow Analysis Dr Reddy'sDocument42 pagesCash Flow Analysis Dr Reddy'sSri KamalNo ratings yet

- Annualreport2005 06Document216 pagesAnnualreport2005 06Asif AminNo ratings yet

- A Project Report ON Ratio Analysis at Raddy'S LaboratoryDocument31 pagesA Project Report ON Ratio Analysis at Raddy'S LaboratoryKalpana Gunreddy100% (1)

- ESWAR FINAL PrintDocument37 pagesESWAR FINAL PrintvijaykrishnaNo ratings yet

- Project Report On Working CapitalDocument94 pagesProject Report On Working CapitalGourav Sharma67% (6)

- Financial Statement Analysis Project ReportDocument74 pagesFinancial Statement Analysis Project ReportnarendermbaNo ratings yet

- A Study On Financial Analysis Through Comparative Statements - With Special Reference To HPCLDocument7 pagesA Study On Financial Analysis Through Comparative Statements - With Special Reference To HPCLsubhaseduNo ratings yet

- Project Report On Study of Working Capital Management of Ranbaxy Lab LTDDocument91 pagesProject Report On Study of Working Capital Management of Ranbaxy Lab LTDPriyanka Sameer ShettiNo ratings yet

- Working Capital ManagementDocument53 pagesWorking Capital ManagementRIYA ROHILLANo ratings yet

- Table of Contents and Introduction to Working Capital ManagementDocument50 pagesTable of Contents and Introduction to Working Capital ManagementB Swaraj100% (1)

- Synopsis - Mahima Kumari - Mba-FinDocument10 pagesSynopsis - Mahima Kumari - Mba-Finyashkapoor12938No ratings yet

- Financial Statment Analysis - Project (21!06!2013)Document78 pagesFinancial Statment Analysis - Project (21!06!2013)narendermbaNo ratings yet

- Financial Analysis-At Eastern Cond PVT-LTD PDFDocument96 pagesFinancial Analysis-At Eastern Cond PVT-LTD PDFArpit CooldudeNo ratings yet

- Project Report On Study of Working Capital Management of Ranbaxy Lab LTD A Compa Rative Analysis Submitted ToDocument95 pagesProject Report On Study of Working Capital Management of Ranbaxy Lab LTD A Compa Rative Analysis Submitted ToNamneet SinghNo ratings yet

- Project Report On Capital StructureDocument94 pagesProject Report On Capital StructureGourav Sharma68% (47)

- Fm-Pharma Group ActivityDocument28 pagesFm-Pharma Group ActivityAnoop AnilNo ratings yet

- A Study On Funds Flow Analysis of Vital Pvt. LTD., TadaDocument5 pagesA Study On Funds Flow Analysis of Vital Pvt. LTD., TadaEditor IJTSRDNo ratings yet

- Sameer Final ProjectDocument67 pagesSameer Final ProjectZalwie JoeNo ratings yet

- Sandip Final ProjectDocument45 pagesSandip Final ProjectSangram PandaNo ratings yet

- Ratio AnalysisDocument48 pagesRatio AnalysisAadesh ShahNo ratings yet

- Ioc ProjectDocument91 pagesIoc ProjectzabimoqimNo ratings yet

- A Financial Ratio Analysis of Krishak Bharati Co-Operative LimitedDocument14 pagesA Financial Ratio Analysis of Krishak Bharati Co-Operative LimitedkrishnajiganNo ratings yet

- WCM Graph UpdatedDocument41 pagesWCM Graph UpdatedRahul SinghNo ratings yet

- The Purpose Is To Develop An Action Plan That Creates Such A Capital Structure That Will Upgradesand Standardize The Quality of Business AnalysisDocument9 pagesThe Purpose Is To Develop An Action Plan That Creates Such A Capital Structure That Will Upgradesand Standardize The Quality of Business AnalysisJay DabhiNo ratings yet

- Financial Analysis at Eastern Condiments PVT LTDDocument96 pagesFinancial Analysis at Eastern Condiments PVT LTDjjjajjaaa100% (4)

- Kse ProjectDocument116 pagesKse ProjectBasil Joseph100% (1)

- Financial Statement Analysis of Dr Reddy's LaboratoriesDocument11 pagesFinancial Statement Analysis of Dr Reddy's Laboratoriesmohammed khayyumNo ratings yet

- Chapter L FullDocument40 pagesChapter L FullŘømänţïc IĐïøť HãrïzNo ratings yet

- Project Report On Capital StructureDocument96 pagesProject Report On Capital StructurePrince Satish Reddy50% (2)

- Indian Drug Discovery CompaniesDocument33 pagesIndian Drug Discovery CompaniesPrasad BidweNo ratings yet

- FSA Report Sample 1Document47 pagesFSA Report Sample 1sudhanshu jeevtaniNo ratings yet

- Financial Statement Analysis (FIN AL)Document32 pagesFinancial Statement Analysis (FIN AL)Abdullah RashidNo ratings yet

- Measuring Financial Health of A Public Limited Company Using Z' Score Model - A Case StudyDocument18 pagesMeasuring Financial Health of A Public Limited Company Using Z' Score Model - A Case Studytrinanjan bhowalNo ratings yet

- Ratio Analysis 'Document67 pagesRatio Analysis 'boidapu kanakarajuNo ratings yet

- Capital Budgeting DR ReddyDocument55 pagesCapital Budgeting DR Reddynikhil thakur0% (1)

- Divyanshu Jain SynopsisDocument13 pagesDivyanshu Jain SynopsisHritik MurjaniNo ratings yet

- Project On Financial ManagementDocument8 pagesProject On Financial ManagementRahul ManwaniNo ratings yet

- Woring Capital ManagementDocument51 pagesWoring Capital ManagementRIYA ROHILLANo ratings yet

- IJRPR18248Document5 pagesIJRPR18248mudrankiagrawalNo ratings yet

- Capital Structure Report AnalysisDocument94 pagesCapital Structure Report AnalysisbhagathnagarNo ratings yet

- A Study On Financial Performance of PharmaceuticalDocument9 pagesA Study On Financial Performance of PharmaceuticalASWIN SNo ratings yet

- JisnaDocument45 pagesJisnaSarin SayalNo ratings yet

- Fore School of Management Corporate Finance Project Indian Oil CorporationDocument46 pagesFore School of Management Corporate Finance Project Indian Oil CorporationShishir JhaNo ratings yet

- Financial Performance of Indian Pharmaceutical IndustryDocument15 pagesFinancial Performance of Indian Pharmaceutical IndustryRupal MuduliNo ratings yet

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocument25 pagesFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415No ratings yet

- Financial Statement Analysis DR ReddyDocument84 pagesFinancial Statement Analysis DR Reddyarjunmba119624100% (1)

- Working Capital Management PROJECT REPORT MBADocument90 pagesWorking Capital Management PROJECT REPORT MBAvigneshNo ratings yet

- Investment BehaviourDocument46 pagesInvestment BehaviourR.SenthilNo ratings yet

- Ratio AnalysisDocument48 pagesRatio AnalysiskeerthiNo ratings yet

- An Empirical Study of Profitability Analysis of Selected Steel Companies in IndiaDocument17 pagesAn Empirical Study of Profitability Analysis of Selected Steel Companies in Indiamuktisolia17No ratings yet

- Working Capital On WIPRO & ITCDocument50 pagesWorking Capital On WIPRO & ITCMainak Bose75% (8)

- Project Report On Working Capital ManagementDocument53 pagesProject Report On Working Capital ManagementshailiNo ratings yet

- The Impact of Financial PlanningDocument8 pagesThe Impact of Financial PlanningabuadamsabbahNo ratings yet

- A Report On SypnosisDocument6 pagesA Report On SypnosisMd Isteaque HussainNo ratings yet

- Ratio AnalysisDocument53 pagesRatio Analysisravi kangneNo ratings yet

- Capital Budgeting DR Reddy PDFDocument55 pagesCapital Budgeting DR Reddy PDFIndia JobsNo ratings yet

- Dr. Reddy's Annual Report 2008-09Document204 pagesDr. Reddy's Annual Report 2008-09biswajitdNo ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Private Equity Investing in Emerging Markets: Opportunities for Value CreationFrom EverandPrivate Equity Investing in Emerging Markets: Opportunities for Value CreationNo ratings yet

- Global Mergers and Acquisitions: Combining Companies Across BordersFrom EverandGlobal Mergers and Acquisitions: Combining Companies Across BordersNo ratings yet

- KUMUDA D Report HRKR1Document52 pagesKUMUDA D Report HRKR1Sarva ShivaNo ratings yet

- Spoorthi BennurDocument58 pagesSpoorthi BennurSarva ShivaNo ratings yet

- Analyzing Corporation Bank's Financial PerformanceDocument61 pagesAnalyzing Corporation Bank's Financial PerformanceSarva ShivaNo ratings yet

- Grasim Industry Company ProfileDocument17 pagesGrasim Industry Company ProfileSarva ShivaNo ratings yet

- Indian Independence and Gandhi StudentDocument44 pagesIndian Independence and Gandhi StudentVaibhav BansalNo ratings yet

- Five Year Finance Summary of Grasim IndustriesDocument12 pagesFive Year Finance Summary of Grasim IndustriesSarva ShivaNo ratings yet

- CHAPTER - 2 Literature ReviewDocument12 pagesCHAPTER - 2 Literature ReviewSarva ShivaNo ratings yet

- Chapter-I: A Study On Cost Analysis With Special Reference To Raitara Sahakari Noolina Girani (N) HanumanamattiDocument57 pagesChapter-I: A Study On Cost Analysis With Special Reference To Raitara Sahakari Noolina Girani (N) HanumanamattiSarva ShivaNo ratings yet

- CHAPTER - 3 Conceptual FrameworkDocument14 pagesCHAPTER - 3 Conceptual FrameworkSarva ShivaNo ratings yet

- Powerpoint Chang2Document18 pagesPowerpoint Chang2okieriandiNo ratings yet

- CHAPTER - 5 Findings Suggesstion and ConclusionDocument4 pagesCHAPTER - 5 Findings Suggesstion and ConclusionSarva ShivaNo ratings yet

- CHAPTER - 2 Company Profile JaveedDocument25 pagesCHAPTER - 2 Company Profile JaveedSarva ShivaNo ratings yet

- Chapter - 1: Executive SummaryDocument7 pagesChapter - 1: Executive SummarySarva ShivaNo ratings yet

- Figures of Speech Power Point NewDocument36 pagesFigures of Speech Power Point NewEdlyn Asi LuceroNo ratings yet

- See The Chapter Planning From ThisDocument8 pagesSee The Chapter Planning From ThisSanjidaNo ratings yet

- Chapter - 1: A Study On Analysis of Financial Statement of Idbi Bank RanebennurDocument6 pagesChapter - 1: A Study On Analysis of Financial Statement of Idbi Bank RanebennurSarva ShivaNo ratings yet

- A Study On Ratio Analysis of Small Scale Industry With Special Reference To RSNG HanumanamattiDocument6 pagesA Study On Ratio Analysis of Small Scale Industry With Special Reference To RSNG HanumanamattiSarva ShivaNo ratings yet

- Chapter - 4 Data Analysis and Interpretation: Current RatioDocument15 pagesChapter - 4 Data Analysis and Interpretation: Current RatioSarva ShivaNo ratings yet

- Chapter - 1 A STUDY ON CASH MANAGEMENT AT KELVION COMPANYDocument12 pagesChapter - 1 A STUDY ON CASH MANAGEMENT AT KELVION COMPANYSarva ShivaNo ratings yet

- Small and Medium EnterprisesDocument6 pagesSmall and Medium EnterprisesSarva ShivaNo ratings yet

- Effective TrainingDocument48 pagesEffective TrainingSarva ShivaNo ratings yet

- Executive Summary: Customer Satisfaction Towards Hero Motocorp, A Case Study of RanebennurDocument51 pagesExecutive Summary: Customer Satisfaction Towards Hero Motocorp, A Case Study of RanebennurSarva ShivaNo ratings yet

- Chapter - 3 Research Desing: TitleDocument3 pagesChapter - 3 Research Desing: TitleSarva ShivaNo ratings yet

- Small and Medium EnterprisesDocument6 pagesSmall and Medium EnterprisesSarva ShivaNo ratings yet

- Chapter - 1Document5 pagesChapter - 1Sarva ShivaNo ratings yet

- Himalaya ProjectDocument91 pagesHimalaya ProjectSarva ShivaNo ratings yet

- Airtech Performance Affraisal Project AirtecDocument49 pagesAirtech Performance Affraisal Project AirtecSarva ShivaNo ratings yet

- Analysis of Cash Flows at Dr. Reddy'sDocument45 pagesAnalysis of Cash Flows at Dr. Reddy'sSarva ShivaNo ratings yet

- Customer Satisfaction Towards Himalaya Herbal ProductsDocument6 pagesCustomer Satisfaction Towards Himalaya Herbal ProductsSarva ShivaNo ratings yet

- Gopal B S Kle Work EDITS WORKSDocument52 pagesGopal B S Kle Work EDITS WORKSSarva ShivaNo ratings yet

- And J2EE Technologies.: Srinivasulu Boddu Mobile No: +91 9620173938Document4 pagesAnd J2EE Technologies.: Srinivasulu Boddu Mobile No: +91 9620173938raghuramthivariNo ratings yet

- A Project Report On Insurance As An Investment Tool With Regards To ULIP at ICICI LTDDocument96 pagesA Project Report On Insurance As An Investment Tool With Regards To ULIP at ICICI LTDBabasab Patil (Karrisatte)50% (2)

- Profit MaximisationDocument6 pagesProfit MaximisationAlexcorbinNo ratings yet

- BiiserDocument7 pagesBiiserFiras FurkanNo ratings yet

- Pay FixationDocument4 pagesPay FixationMayank PrakashNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- Florida LLC Operating Agreement TemplateDocument16 pagesFlorida LLC Operating Agreement TemplateCarol100% (2)

- Goquilay vs Sycip Partnership Property Sale Annulment CaseDocument1 pageGoquilay vs Sycip Partnership Property Sale Annulment CaseAlleine TupazNo ratings yet

- Lustan vs. CADocument1 pageLustan vs. CADave Jonathan MorenteNo ratings yet

- TAXATION Transcript Part 1 PDFDocument28 pagesTAXATION Transcript Part 1 PDFZyshan NainNo ratings yet

- Modular Programme Assignment Cover SheetDocument16 pagesModular Programme Assignment Cover SheetvitaNo ratings yet

- Pristine View 1Document28 pagesPristine View 1Michael Jordan80% (5)

- Entrepreneurship and Regional Competitiveness: The Role and Progression of PolicyDocument26 pagesEntrepreneurship and Regional Competitiveness: The Role and Progression of PolicyAnonymous q8vCvYNo ratings yet

- Value Driven Maintenance & Asset Management: Competing With Aging AssetsDocument5 pagesValue Driven Maintenance & Asset Management: Competing With Aging AssetsMILTON ANDRES ANGULO MORRISNo ratings yet

- I Want The Earth Plus 5 PercentDocument12 pagesI Want The Earth Plus 5 PercentLara Dubugras Campos100% (1)

- Acer Philippines. vs. CIRDocument27 pagesAcer Philippines. vs. CIRFarina R. SalvadorNo ratings yet

- SAP Cutover PlanDocument32,767 pagesSAP Cutover PlanMichelle FossNo ratings yet

- James Schulz, Petitioner, v. Commissioner of Internal Revenue, RespondentDocument4 pagesJames Schulz, Petitioner, v. Commissioner of Internal Revenue, RespondentMegan AglauaNo ratings yet

- Dividend Policy and Firm's Profitability: Evidence From Ethiopian Private Insurance CompaniesDocument6 pagesDividend Policy and Firm's Profitability: Evidence From Ethiopian Private Insurance Companieskefiyalew BNo ratings yet

- Audit Case StudiesDocument18 pagesAudit Case StudiesAanand ALNo ratings yet

- Corporate Governance in Asia: Eight Case Studies: Robert W. Mcgee Florida International UniversityDocument38 pagesCorporate Governance in Asia: Eight Case Studies: Robert W. Mcgee Florida International UniversitySasboomNo ratings yet

- Credit Management of Mercantile Bank LimitedDocument61 pagesCredit Management of Mercantile Bank LimitedMoyan Hossain100% (1)

- Bauxite Transfert PricingDocument21 pagesBauxite Transfert PricingEyock PierreNo ratings yet

- Options Trading (Advanced) ModuleDocument11 pagesOptions Trading (Advanced) ModuleavinashkakarlaNo ratings yet

- Final-Term-Paper-of-Ratio-Analysis-of-Bata-Shoes-FAR MAM PDFDocument22 pagesFinal-Term-Paper-of-Ratio-Analysis-of-Bata-Shoes-FAR MAM PDFafrina jui0% (1)

- Lisa Jardine, CP Snow, Two Culture RevisitedDocument118 pagesLisa Jardine, CP Snow, Two Culture RevisitedJose CornettNo ratings yet

- Soal Financial XLSX PDFDocument4 pagesSoal Financial XLSX PDFVeronichaNo ratings yet

- SiloDocument3 pagesSiloBilly ChandraNo ratings yet

- Grace Commission Report 1984 PDFDocument3 pagesGrace Commission Report 1984 PDFEmmanuel100% (1)

- SparcDocument80 pagesSparcPriyanka KumarNo ratings yet