Professional Documents

Culture Documents

Tax Assignment Titles Only

Tax Assignment Titles Only

Uploaded by

Talimur RahmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Assignment Titles Only

Tax Assignment Titles Only

Uploaded by

Talimur RahmanCopyright:

Available Formats

An evaluation of the taxation System in Bangladesh

Under these headings you will prepare your report on “An evaluation of the

taxation System in Bangladesh”.

Introduction

Tax (definition)

Tax Classifications

Purposes and effects

Tax incidence

Types of Taxes

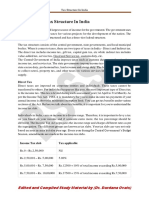

Bangladesh Income Tax Rates

Consumption tax

Types

Tax revenue Summary of Bangladesh

Tax Expenditure

Existing Tax Expenditure Measures in Bangladesh

Tax Expenditure Measures under Direct Taxes

Corporate Income Tax

Personal Income Tax

Tax Expenditure Measures in Indirect Taxes

Value–Added Tax

Tax Rebate for investment

Rate of Tax Rebate:

Types of investment qualified for the tax rebate are:

Tax Withholding Functions

Major Areas for Final Settlement of Tax Liability in Bangladesh

Tax Holiday

Who is entitled to a Tax Holiday?

Tax avoidance

Public opinion on tax avoidance

Taxes and economic growth

You might also like

- GPH Ispat BSRM SteelDocument28 pagesGPH Ispat BSRM SteelEnaiya IslamNo ratings yet

- Tax Term PaperDocument1 pageTax Term PaperEnaiya IslamNo ratings yet

- Plag Test-Mizanur Rahman - 51944012-07112023Document47 pagesPlag Test-Mizanur Rahman - 51944012-07112023mizanur2320No ratings yet

- Income Tax Planning in IndiaDocument61 pagesIncome Tax Planning in IndiaPRIYANKA LANDGENo ratings yet

- GST andDocument10 pagesGST andAbhishek DixitNo ratings yet

- SRM University: Bussiness TaxationDocument7 pagesSRM University: Bussiness TaxationabhaybittuNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- Taxation SystemDocument25 pagesTaxation SystemsathsihNo ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- JA-03 - Topic 2Document6 pagesJA-03 - Topic 2Kashif MalikNo ratings yet

- Tax ReformDocument5 pagesTax Reformakky.vns2004No ratings yet

- Tax Income, Sunk Cost and Opportunity Cost: Week 13Document46 pagesTax Income, Sunk Cost and Opportunity Cost: Week 13satryoyu811No ratings yet

- ICGAB New Tax Syllabus (Sep-19)Document9 pagesICGAB New Tax Syllabus (Sep-19)Aminul HaqNo ratings yet

- Value Added Tax Black Book 2 2332Document47 pagesValue Added Tax Black Book 2 2332sanket yelaweNo ratings yet

- 05 Corporate Tax Planning and ManagementDocument34 pages05 Corporate Tax Planning and ManagementHimanshu SharmaNo ratings yet

- Running Head: INCOME TAXDocument9 pagesRunning Head: INCOME TAXKashif MalikNo ratings yet

- Corporate Tax Planning and Management Module 1.Document46 pagesCorporate Tax Planning and Management Module 1.Viraja GuruNo ratings yet

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhapareNo ratings yet

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- 2 Scheme of Tax CalculationDocument72 pages2 Scheme of Tax CalculationvivekNo ratings yet

- Assignment 5: Legal Aspects of Business MS5210Document6 pagesAssignment 5: Legal Aspects of Business MS5210karanNo ratings yet

- Taxation ProjectDocument83 pagesTaxation ProjectManish JaiswalNo ratings yet

- UPSC Civil Services Examination: UPSC Notes (GS-III) Topic: Taxation in India (UPSC Economy Notes)Document4 pagesUPSC Civil Services Examination: UPSC Notes (GS-III) Topic: Taxation in India (UPSC Economy Notes)Kushal SharmaNo ratings yet

- Excise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Document6 pagesExcise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Tuhin DuttaNo ratings yet

- SHORT ANSWERS ChaurasiaDocument22 pagesSHORT ANSWERS ChaurasiaSatvik MishraNo ratings yet

- IFRS-Deferred Tax Balance Sheet ApproachDocument8 pagesIFRS-Deferred Tax Balance Sheet ApproachJitendra JawalekarNo ratings yet

- Presenting: Direct Tax - Trends in IndiaDocument27 pagesPresenting: Direct Tax - Trends in IndiatusharNo ratings yet

- Short Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Document22 pagesShort Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Satvik MishraNo ratings yet

- Module 04 Income Tax Compliance RevisedDocument25 pagesModule 04 Income Tax Compliance RevisedSly BlueNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- Corporate Tax PlanningDocument9 pagesCorporate Tax PlanningMd ChotaNo ratings yet

- Tax AuditDocument49 pagesTax AuditRebecca Mendes100% (1)

- TaxationDocument10 pagesTaxationIshika ChauhanNo ratings yet

- Assignment On Corporate Taxation in BangladeshDocument28 pagesAssignment On Corporate Taxation in BangladeshNazmulHasanNo ratings yet

- Module 04 - Income Tax ComplianceDocument21 pagesModule 04 - Income Tax ComplianceMark Emil BaritNo ratings yet

- Tax Compliance FinalDocument23 pagesTax Compliance FinalMahamood FaisalNo ratings yet

- Nmba FM 03: Tax Planning and Management Unit IDocument19 pagesNmba FM 03: Tax Planning and Management Unit IParul GargNo ratings yet

- Quizz Tax 1Document29 pagesQuizz Tax 1Dương Tú QuyênNo ratings yet

- Methods of Reducing Tax LiabilitiesDocument6 pagesMethods of Reducing Tax LiabilitiesAryan SharmaNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Withholding of TaxesDocument26 pagesWithholding of TaxesnalmatirajeshNo ratings yet

- Tax ProjectDocument9 pagesTax ProjectMaaz SiddiquiNo ratings yet

- Taxation System in BangladeshDocument4 pagesTaxation System in BangladeshRony RahmanNo ratings yet

- Advanced Financial Accounting - II CH 1-4Document24 pagesAdvanced Financial Accounting - II CH 1-4TAKELE NEDESANo ratings yet

- Taxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghDocument32 pagesTaxation: Presented By: Gaurav Yadav Rishabh Sharma Sandeep SinghjurdaNo ratings yet

- Annex 15Document20 pagesAnnex 15Mohamed BhathurudeenNo ratings yet

- Ethiopia D3S4 Income TaxesDocument19 pagesEthiopia D3S4 Income TaxesEshetie Mekonene AmareNo ratings yet

- Taxation Lecture - 2: Income TaxDocument26 pagesTaxation Lecture - 2: Income TaxAl SukranNo ratings yet

- AX Lanning: by Anup K SuchakDocument27 pagesAX Lanning: by Anup K SuchakanupsuchakNo ratings yet

- Corporate Tax Planning)Document368 pagesCorporate Tax Planning)Théotime Habineza100% (1)

- Tax Awarness SessionsDocument23 pagesTax Awarness Sessionsyara aliNo ratings yet

- 1) How Income Tax Works in India?: GST Is One of The Biggest Indirect Tax Reforms in The CountryDocument21 pages1) How Income Tax Works in India?: GST Is One of The Biggest Indirect Tax Reforms in The Countryaher unnatiNo ratings yet

- Taxation Term Paper TemplateDocument10 pagesTaxation Term Paper TemplateSANTIAGO CHESKAMAE OQUIANo ratings yet

- Tax Planning, Evasion, AvoidanceDocument16 pagesTax Planning, Evasion, AvoidanceDr. Nathan WafNo ratings yet

- Deferred Tax and Financial PerformanceDocument7 pagesDeferred Tax and Financial PerformanceOlanrewaju JoeNo ratings yet

- Taxation and ObjectivesDocument32 pagesTaxation and ObjectivesgeddadaarunNo ratings yet

- Direct Tax - The Boost For EconomyDocument10 pagesDirect Tax - The Boost For EconomySagar DhanakNo ratings yet

- Unit 4Document112 pagesUnit 4Vetri Velan100% (1)

- Self Assessments SchemeDocument10 pagesSelf Assessments SchemeRafae ShahidNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Objective of The Study: Assignment OnDocument10 pagesObjective of The Study: Assignment OnEnaiya IslamNo ratings yet

- Assignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Document9 pagesAssignment On: "Impact of Cost Accounting On Business Decision Making in Manufacturing Industries of Bangladesh''Enaiya IslamNo ratings yet

- Tariff Regime Chart FY 2000-01 To FY 2018 To 19Document1 pageTariff Regime Chart FY 2000-01 To FY 2018 To 19Enaiya IslamNo ratings yet

- "Vision Quest": Team NameDocument7 pages"Vision Quest": Team NameEnaiya IslamNo ratings yet

- 2017-2-10-157 AssignmentDocument17 pages2017-2-10-157 AssignmentEnaiya IslamNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- Doing Business Report in LondonDocument2 pagesDoing Business Report in LondonEnaiya IslamNo ratings yet

- Gen226 ASSIGNMENT 2 PinkyDocument5 pagesGen226 ASSIGNMENT 2 PinkyEnaiya IslamNo ratings yet

- Slide Fin201 GQH BSRMDocument22 pagesSlide Fin201 GQH BSRMEnaiya IslamNo ratings yet

- Assignment On Launching Aarong in Canada: Submitted ToDocument14 pagesAssignment On Launching Aarong in Canada: Submitted ToEnaiya IslamNo ratings yet

- ITB 301 SlideDocument17 pagesITB 301 SlideEnaiya IslamNo ratings yet

- Gen226 ASSIGNMENT 1 PDFDocument5 pagesGen226 ASSIGNMENT 1 PDFEnaiya IslamNo ratings yet

- Performance Evaluation of Square Textile Ltd. & Apex Spinning and Knitting Mills Ltd. Prepared ForDocument28 pagesPerformance Evaluation of Square Textile Ltd. & Apex Spinning and Knitting Mills Ltd. Prepared ForEnaiya IslamNo ratings yet

- MKT410 Term PaperDocument33 pagesMKT410 Term PaperEnaiya IslamNo ratings yet