Professional Documents

Culture Documents

Group 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing Decision

Uploaded by

Naurah Atika Dina0 ratings0% found this document useful (0 votes)

24 views1 pageOriginal Title

07 08 Group_7_Assignment_ABC

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageGroup 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing Decision

Uploaded by

Naurah Atika DinaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

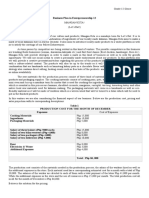

GROUP 7 CASE

VOLUME-BASED COSTING VS ACTIVITY-BASED COSTING

AND IMPACT ON PRICING DECISION

Honey Syrup Inc. produces 3 kinds of products: Honey Apple, Honey Orange, and Honey

Grape. The existing product cost calculation is as follows:

Honey Apple Honey Orange Honey Grape

Direct Raw Material Cost Rp 15.000.000 Rp 17.500.000 Rp 12.500.000

Direct Labor Costs 14.000.000 16.000.000 12.000.000

Factory Overhead Cost*):

4.000 DLH x Rp 3.000 12.000.000

6.000 DLH x Rp 3.000 18.000.000

3.000 DLH x Rp 3.000 9.000.000

Total costs Rp 41.000.000 Rp 51.500.000 Rp 33.500.000

Production 10.000 units 10.000 units 10.000

units

Cost per unit Rp 4.100 Rp 5.150 Rp 3.350

Competitor selling price per unit Rp 5.000 Rp 5.000 Rp 3.500

The following are FOH items:

Set up cost Rp 12.000.000

Inspection costs Rp 14.500.000

Material handling costs Rp 12.500.000

Total Rp 39.000.000

FOH activities are as follows:

Honey Apple Honey Orange Honey Grape

Setting up machine 1.000 x 400 x 600 x

Inspecting product 6.000 x 2.000 x 2.000 x

Handling materials 100x 300x 100x

Machine hours 4.000 6.000 3.000

Honey Syrup Inc.’s management curiously looks at the competitor selling price per unit,

especially for Honey Orange which is sold lower than Honey Syrup Inc.’s product cost.

Honey Syrup Inc.’s management assumes that competitor intentionally sells its product to

kill the company’s product

Required:

1. What costing approach is used by the company? Explain

2. Do you agree with management opinion that competitor sells its product lower than

the company’s product cost to kill the company’s product? Explain with supporting

calculation.

You might also like

- ACG2071 Managerial AccountingDocument31 pagesACG2071 Managerial Accountinganon_117931956No ratings yet

- Relevant Costing Sample ProblemsDocument29 pagesRelevant Costing Sample ProblemsAngela Padua100% (2)

- Managerial Accounting Case ProblemDocument14 pagesManagerial Accounting Case ProblemFrancis SarmientoNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Practice Ques - Incremental Analysis PDFDocument8 pagesPractice Ques - Incremental Analysis PDFDaksh AnejaNo ratings yet

- Assignment 2Document6 pagesAssignment 2Devesh MauryaNo ratings yet

- Financial Instruments Recognition and Measurement Group 1Document5 pagesFinancial Instruments Recognition and Measurement Group 1Naurah Atika DinaNo ratings yet

- Operational RiskDocument40 pagesOperational RiskNaurah Atika DinaNo ratings yet

- Wk1assgnclark ZuokemefaCDocument7 pagesWk1assgnclark ZuokemefaCClaudette Clark-ZuokemefaNo ratings yet

- 641124928137876risk Management PolicyDocument20 pages641124928137876risk Management PolicyNaurah Atika Dina100% (1)

- ADMC Practice Problems - Accounting For Decision Making and Control 10th EditionDocument17 pagesADMC Practice Problems - Accounting For Decision Making and Control 10th EditionDaveNo ratings yet

- ABC Costing Reveals Pricing IssuesDocument4 pagesABC Costing Reveals Pricing IssuesRaihan RaditiyaNo ratings yet

- Business PlanDocument3 pagesBusiness PlanGinette RubillarNo ratings yet

- Dodrio Doorknob Design CompanyDocument8 pagesDodrio Doorknob Design Companyloyd aradaNo ratings yet

- Jarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDocument5 pagesJarlsberg Cheese Company Has Developed A New Cheese Slicer Called Slim SlicerDeniseNo ratings yet

- Business Plan Guide (1)Document16 pagesBusiness Plan Guide (1)ninojamestagao2496No ratings yet

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocument2 pagesGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNo ratings yet

- CVP AnalysisDocument8 pagesCVP AnalysisEricka Mae AntiolaNo ratings yet

- Grup 7 (Multi Product and Activity Based CVP Analysis) - DikonversiDocument13 pagesGrup 7 (Multi Product and Activity Based CVP Analysis) - DikonversiRahimah ImNo ratings yet

- Case Study Chic SoapDocument3 pagesCase Study Chic SoapmohamedNo ratings yet

- Unit 6 Chapter 11Document5 pagesUnit 6 Chapter 11Kimberly A AlanizNo ratings yet

- BA Problems 2Document6 pagesBA Problems 2rassaNo ratings yet

- Chapter 10 5eDocument4 pagesChapter 10 5eym5c2324No ratings yet

- 23 Business Math Module 12Document14 pages23 Business Math Module 12Sweet MintNo ratings yet

- Ch04Hansen6e ABCDocument21 pagesCh04Hansen6e ABCTini SholihaniNo ratings yet

- Operations ManagementDocument4 pagesOperations ManagementFarel Abdia HarfyNo ratings yet

- Contribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is ADocument7 pagesContribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is AEVELYN ROSE MOGAONo ratings yet

- Study ProbesDocument48 pagesStudy ProbesRose VeeNo ratings yet

- Dee Hwa Liong Academy: Buying and SellingDocument21 pagesDee Hwa Liong Academy: Buying and SellingkelvinNo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Activity-Based Costing and Activity-Based ManagementDocument19 pagesActivity-Based Costing and Activity-Based ManagementMohammed Shalaby McflashNo ratings yet

- Dec MakDocument16 pagesDec MakGilbert TiongNo ratings yet

- Final for PDFDocument8 pagesFinal for PDFWaizin KyawNo ratings yet

- AssignmentDocument7 pagesAssignmentRoNo ratings yet

- Pricing SW1Document5 pagesPricing SW1DeniseNo ratings yet

- CHAPTER-4 Decision and Relevant InformationDocument69 pagesCHAPTER-4 Decision and Relevant InformationNahøm Abera AkNo ratings yet

- Break-Even Analysis Study CaseDocument5 pagesBreak-Even Analysis Study CaseCindhy ChamorroNo ratings yet

- Business EnglishDocument17 pagesBusiness EnglishDwi Octavelinasari Tarbiyah dan KeguruanNo ratings yet

- Variable Cost Analysis Using High-Low MethodDocument6 pagesVariable Cost Analysis Using High-Low MethodApoorva DhimarNo ratings yet

- Managerial Acctg Problems & Exercises in CVP AnalysisDocument4 pagesManagerial Acctg Problems & Exercises in CVP AnalysisJanelleNo ratings yet

- Exercises - Joint Cost AllocationDocument4 pagesExercises - Joint Cost AllocationJimbo Manalastas0% (1)

- Proposal Usaha Kain FlanelDocument4 pagesProposal Usaha Kain FlanelSri Intan MuhsinNo ratings yet

- Standard Costing and Variance AnalysisDocument14 pagesStandard Costing and Variance AnalysisSaad Khan YTNo ratings yet

- Managerial Accounting Case StudyDocument5 pagesManagerial Accounting Case Studymohammad Wildan khabibiNo ratings yet

- Incremental Analysis ProblemsDocument10 pagesIncremental Analysis ProblemsLiyana Chua0% (1)

- Accounting & Control: Cost ManagementDocument22 pagesAccounting & Control: Cost ManagementdewyNo ratings yet

- STNR DecisionsDocument10 pagesSTNR DecisionsHassan AdamNo ratings yet

- Latihans segmented reporting and absorption vs variable costingDocument3 pagesLatihans segmented reporting and absorption vs variable costingPrisilia AudilaNo ratings yet

- Chapter 5 - Relevant Information and Decision Making - StudentsDocument27 pagesChapter 5 - Relevant Information and Decision Making - StudentsDAN NGUYEN THENo ratings yet

- BUS 5110 Managerial Accounting Unit 4 WRDocument5 pagesBUS 5110 Managerial Accounting Unit 4 WRkuashask2No ratings yet

- Chapter 03 - How Securities Are TradedDocument7 pagesChapter 03 - How Securities Are TradedGoogle Play AccountNo ratings yet

- Decentralization and PricingDocument38 pagesDecentralization and PricingFidelina CastroNo ratings yet

- Group 1 Management AccountingDocument17 pagesGroup 1 Management AccountingZakyaNo ratings yet

- Final Key 2519Document2 pagesFinal Key 2519DanielchrsNo ratings yet

- Accounting Management MAY 2' 2019 Final Test: $405,000 / $225 1,800 Units Sold 1,800 + 400 2,200 UnitsDocument2 pagesAccounting Management MAY 2' 2019 Final Test: $405,000 / $225 1,800 Units Sold 1,800 + 400 2,200 UnitsDanielchrsNo ratings yet

- Basic Sales Mix The General Manager of LoDocument7 pagesBasic Sales Mix The General Manager of LoAndres MontenegroNo ratings yet

- Relevant Costs (Part 2) : F. M. KapepisoDocument21 pagesRelevant Costs (Part 2) : F. M. KapepisosimsonNo ratings yet

- Task PerformanceDocument3 pagesTask Performanceellie yapNo ratings yet

- Ms Comprehesive Exam Cart - October, 2015Document4 pagesMs Comprehesive Exam Cart - October, 2015Vel JuneNo ratings yet

- ABC Costing Reveals Losses from PURPLE and RED PensDocument5 pagesABC Costing Reveals Losses from PURPLE and RED PensbharathtgNo ratings yet

- Accounting & Control: Cost ManagementDocument38 pagesAccounting & Control: Cost ManagementMosha MochaNo ratings yet

- Seminar PresentationDocument11 pagesSeminar Presentationapi-328716222No ratings yet

- Accepted Manuscript: 10.1016/j.jfds.2015.03.001Document21 pagesAccepted Manuscript: 10.1016/j.jfds.2015.03.001Naurah Atika DinaNo ratings yet

- Soft System Methodology Implementation for Hotel Surya Palace Information SystemDocument14 pagesSoft System Methodology Implementation for Hotel Surya Palace Information SystemNaurah Atika DinaNo ratings yet

- Summary RM (Management Data)Document1 pageSummary RM (Management Data)Naurah Atika DinaNo ratings yet

- Accounting Information Audit and ControlDocument6 pagesAccounting Information Audit and ControlNaurah Atika DinaNo ratings yet

- Chapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingDocument6 pagesChapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingNaurah Atika DinaNo ratings yet

- Contoh Jurnal JAADocument13 pagesContoh Jurnal JAANaurah Atika DinaNo ratings yet

- Daftar Hadir Guru KB Aisyiyah Bungo TAnjungDocument2 pagesDaftar Hadir Guru KB Aisyiyah Bungo TAnjungNaurah Atika DinaNo ratings yet

- BASIC CONCEPTS OF INCOME TAXDocument4 pagesBASIC CONCEPTS OF INCOME TAXNaurah Atika DinaNo ratings yet

- Pink Flowers Cute Letter-WPS OfficeDocument1 pagePink Flowers Cute Letter-WPS OfficeNaurah Atika DinaNo ratings yet

- Smart Resume For Sales PositionDocument2 pagesSmart Resume For Sales PositionNaurah Atika DinaNo ratings yet

- Assignment of ApbnDocument7 pagesAssignment of ApbnNaurah Atika DinaNo ratings yet

- FlowchartDocument12 pagesFlowchartNaurah Atika DinaNo ratings yet

- Group 1 - Q & A Psak 72Document5 pagesGroup 1 - Q & A Psak 72Naurah Atika DinaNo ratings yet

- CHAPTER 4 N 3Document7 pagesCHAPTER 4 N 3Naurah Atika DinaNo ratings yet

- CA s1 Intl A 09 05 Cost BehaviourDocument2 pagesCA s1 Intl A 09 05 Cost BehaviourNaurah Atika DinaNo ratings yet

- Group Assignment of Fiscal Capacity in IndonesiaDocument8 pagesGroup Assignment of Fiscal Capacity in IndonesiaNaurah Atika DinaNo ratings yet

- Public Finance Soal No 2Document1 pagePublic Finance Soal No 2Naurah Atika DinaNo ratings yet

- Grass and Legume Types for Animal FeedDocument2 pagesGrass and Legume Types for Animal FeedNaurah Atika DinaNo ratings yet

- Job Order Costing Case StudyDocument1 pageJob Order Costing Case StudyNaurah Atika DinaNo ratings yet

- REPORT OF APBN FINANCIAL STATE AND LOCALDocument6 pagesREPORT OF APBN FINANCIAL STATE AND LOCALNaurah Atika DinaNo ratings yet

- Group 3 Case Cost of Goods Manufactured Statment and Income StatementDocument1 pageGroup 3 Case Cost of Goods Manufactured Statment and Income StatementNaurah Atika DinaNo ratings yet

- 11, 12, 13 Group - 10 - Assignment - Activity Process CostingDocument1 page11, 12, 13 Group - 10 - Assignment - Activity Process Costingdwi davisNo ratings yet

- Accounting For Manufacturing Cost Using Perpetual SystemDocument2 pagesAccounting For Manufacturing Cost Using Perpetual SystemNaurah Atika DinaNo ratings yet

- Group 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MDocument1 pageGroup 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MNaurah Atika DinaNo ratings yet

- Group 9 Case Functional and Activity Based Job Order CostingDocument1 pageGroup 9 Case Functional and Activity Based Job Order CostingNaurah Atika DinaNo ratings yet

- 05 06 Group 6 Assignment VBCDocument1 page05 06 Group 6 Assignment VBCNaurah Atika DinaNo ratings yet