Professional Documents

Culture Documents

Accounting For Manufacturing Cost Using Perpetual System

Uploaded by

Naurah Atika Dina0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

MANUFACTURING COST

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesAccounting For Manufacturing Cost Using Perpetual System

Uploaded by

Naurah Atika DinaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

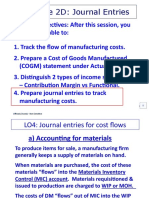

ACCOUNTING FOR MANUFACTURING COST USING PERPETUAL SYSTEM

ALTERNATIVE 1 (WIP recorded ALTERNATIVE 2 (WIP recorded as

as assets) expenses)

1. To record raw material Raw material inventory 1.000 Raw material inventory 1.000

purchase on cash Cash 1.000 Cash 1.000

2. To record direct raw Work In Process (WIP) WIP –DRMC 800

material usage Inventory 800 Raw Material Inventory 800

(DRMC) Raw material inventory 800

3. To record the direct Payroll 700 Payroll 700

labor cost payment Cash 700 Cash 700

4. To assign the DLC to WIP Inventory 700 WIP – DLC 700

product Payroll 700 Payroll 700

5. To record the applied WIP Inventory 500 WIP – FOH 500

FOH FOH 500 FOH – Applied 500

(assume that FOH Applied FOH = actual capacity x

rate Rp 10 per MH, FOH rate

and 50 actual = 50 MH x $ 10

machine hours /MH) = $ 500

FOH Rate = Budgeted

FOH / Normal

Capacity = 600 / 60

MH = $ 10 per MH

6. To record the actual FOH 550 FOH Control (actual) 550

FOH, assume that it Any credited accounts 550 Any credited accounts 550

was $ 550

7. To close the FOH FOH variance (UF) 50 FOH – Applied 500

account FOH 50 FOH variance (UF) 50

Applied FOH $ 500 FOH – Control 550

Actual FOH 550

FOH Variance (under-

Applied) – Unfavorable $ 50

8. To close the FOH Assuming that it is not

variance significant, the entry will be:

If FOH variance is COGS 50 COGS 50

significant, variance FOH variance 50 FOH variance 50

will be closed to WIP

Inventory, FG

inventory, and cost of

goods sold; if FOH

variance is not

significant, variance

can be closed directly

to cost of goods sold

9. To record units Finished Good Inventory 1.600 FG Inventory 1.600

completed WIP Inventory 1.600 WIP – DRMC 600

(assuming that WIP – DLC 525

ending WIP inventory WIP – FOH 475

consists of DRMC $

200, DLC $ 175, and

FOH $ 25.

10. To Record the ending No Entry WIP Inventory 400

WIP Inventory WIP – DRMC 200

WIP – DLC 175

WIP – FOH 25

11. Reversing entries No Entry WIP – DRMC 200

WIP – DLC 175

WIP – FOH 25

WIP Inventory 400

You might also like

- Cost AccDocument23 pagesCost AccAngel PulvinarNo ratings yet

- L6 Job Order Costing pt.2Document33 pagesL6 Job Order Costing pt.2TRISHA FATE CALANZANo ratings yet

- Factory Overhead Analysis and VariancesDocument13 pagesFactory Overhead Analysis and Variancesjgfjhf arwtrNo ratings yet

- Indirect Cost FOH Direct Material Material FOH Non Manufacturing Indirect /direct Material Indirect Cost FOH Direct Labor Indirect Cost FOH Cost FOH Cost FOH Indirect Cost FOH Indirect Labor FOHDocument6 pagesIndirect Cost FOH Direct Material Material FOH Non Manufacturing Indirect /direct Material Indirect Cost FOH Direct Labor Indirect Cost FOH Cost FOH Cost FOH Indirect Cost FOH Indirect Labor FOHHinza WaseemNo ratings yet

- Variance Actaul FOH - Applied FOHDocument12 pagesVariance Actaul FOH - Applied FOHHafiz NoumanNo ratings yet

- Per unit cost and types of FOHDocument8 pagesPer unit cost and types of FOHtayyabNo ratings yet

- Oracle Applications EBS - Accounting EntriesDocument43 pagesOracle Applications EBS - Accounting EntriesUdayraj SinghNo ratings yet

- T6 - InventoriesDocument21 pagesT6 - InventoriesJhonatan Perez VillanuevaNo ratings yet

- Absorption (Full Costing) Variable (Direct Costing)Document4 pagesAbsorption (Full Costing) Variable (Direct Costing)Leo Sandy Ambe CuisNo ratings yet

- Absorption Variable Costing1Document3 pagesAbsorption Variable Costing1Jasmine LimNo ratings yet

- Required:: 1. Calculate The Company's Predetermined Overhead RateDocument4 pagesRequired:: 1. Calculate The Company's Predetermined Overhead RateShannonNo ratings yet

- Total Ordering and Carrying Cost AnalysisDocument6 pagesTotal Ordering and Carrying Cost AnalysisHinza WaseemNo ratings yet

- Fifo and Lifo Periodic and Perpetual Inventory Information For P PDFDocument1 pageFifo and Lifo Periodic and Perpetual Inventory Information For P PDFAnbu jaromiaNo ratings yet

- Chapter 4 2020Document17 pagesChapter 4 2020JAEHYUK YOONNo ratings yet

- R23 Financial Reporting StandardsDocument30 pagesR23 Financial Reporting StandardsDiegoNo ratings yet

- Fs 21354165Document21 pagesFs 21354165xjammer100% (1)

- Chapter 4Document6 pagesChapter 4NGÂN ĐẶNG HOÀNGNo ratings yet

- Kelompok 8 (Raw)Document5 pagesKelompok 8 (Raw)RezaNo ratings yet

- Account for Government InventoryDocument19 pagesAccount for Government Inventoryanna paulaNo ratings yet

- JUST IN TIME AND BACKFLUSH COSTING With Illustrative ProblemDocument7 pagesJUST IN TIME AND BACKFLUSH COSTING With Illustrative Problemenzo0% (1)

- Lec 2D - Journal Entries-StudDocument21 pagesLec 2D - Journal Entries-StudNuurulNo ratings yet

- Week 2 - 3 COGS 30072023 062807pmDocument6 pagesWeek 2 - 3 COGS 30072023 062807pmabdulrazzaqmemon36No ratings yet

- Just in Time and Backflush Costing With Illustrative Problem Docx Compress 1Document7 pagesJust in Time and Backflush Costing With Illustrative Problem Docx Compress 1Danica Kaye MorcellosNo ratings yet

- DocDocument6 pagesDocBanana QNo ratings yet

- ACCY112 Tut 2Document15 pagesACCY112 Tut 2goh rainNo ratings yet

- Inventory Reporting Part 1Document1 pageInventory Reporting Part 1Ai ReenNo ratings yet

- Standard CostingDocument137 pagesStandard CostingMuhammad azeem100% (1)

- Accounting For Production LossesDocument6 pagesAccounting For Production LossesMary Ann NatividadNo ratings yet

- Factory Overhead VariancesDocument5 pagesFactory Overhead VariancesJACKILYN LAVIÑANo ratings yet

- Cfas Inventories QuizletDocument2 pagesCfas Inventories Quizletagm25No ratings yet

- Determination of Standard Costs Based On Equivalent ProductionDocument4 pagesDetermination of Standard Costs Based On Equivalent ProductionMeghan Kaye LiwenNo ratings yet

- Job Order CostingDocument33 pagesJob Order CostingChristian TanNo ratings yet

- Accounting for spoilage, reworks, and scrap materialsDocument4 pagesAccounting for spoilage, reworks, and scrap materialsGianJoshuaDayritNo ratings yet

- 3MA 03 Absortion and Variable CostingDocument3 pages3MA 03 Absortion and Variable CostingAbigail Regondola BonitaNo ratings yet

- Inventory 2Document4 pagesInventory 2Shuvo Taufiq AhmedNo ratings yet

- Activities KeyDocument7 pagesActivities KeyCassandra Dianne Ferolino MacadoNo ratings yet

- Jit and Backflush CostingDocument10 pagesJit and Backflush CostingMercine Rose SabandalNo ratings yet

- Marginal Costing - As LevelDocument2 pagesMarginal Costing - As LevelMUSTHARI KHANNo ratings yet

- 3 Absorption Vs Variable CostingDocument16 pages3 Absorption Vs Variable CostingXyril MañagoNo ratings yet

- Short-Term Assets: Appendix 1: LIFO - FIFO ConversionDocument10 pagesShort-Term Assets: Appendix 1: LIFO - FIFO ConversionSonali AgarwalNo ratings yet

- BFD Class NotesDocument20 pagesBFD Class NotesAnas KhanNo ratings yet

- Principle MaterialDocument35 pagesPrinciple MaterialHay JirenyaaNo ratings yet

- Overhead Variance - Additional Problems (Solution)Document4 pagesOverhead Variance - Additional Problems (Solution)Liza SoberanoNo ratings yet

- Class Assignment Excel Pertemuan 3 JOB COSTINGDocument6 pagesClass Assignment Excel Pertemuan 3 JOB COSTINGMarcia Gretchen LynneNo ratings yet

- Materials Procurement, Use and ControlDocument15 pagesMaterials Procurement, Use and ControlNah HamzaNo ratings yet

- Set up SAP MM configuration and master dataDocument13 pagesSet up SAP MM configuration and master dataSAP TrainingNo ratings yet

- Exercise 4 Point System in Overhead Rate ComputationDocument2 pagesExercise 4 Point System in Overhead Rate ComputationgloryfeilagoNo ratings yet

- Inventory: Source: Robert Morris Associates. Annual Statement Studies, Philadelphia, PA. 1992Document9 pagesInventory: Source: Robert Morris Associates. Annual Statement Studies, Philadelphia, PA. 1992Anonymous 0sMnAONo ratings yet

- Accounting 2 Chapter 6Document2 pagesAccounting 2 Chapter 6Rolando Drilo JrNo ratings yet

- Lecture Cost FlowDocument6 pagesLecture Cost FlowPASCUA RENALYN M.No ratings yet

- Fifo & LifoDocument9 pagesFifo & LifoTeodoraNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- Accounting for Materials SpoilageDocument39 pagesAccounting for Materials SpoilageAngela Miles DizonNo ratings yet

- Absorption and Variable CostingDocument1 pageAbsorption and Variable Costingqrrzyz7whgNo ratings yet

- Chapter5 JustinTimeandBackflushAccountingDocument21 pagesChapter5 JustinTimeandBackflushAccountingFaye Nepomuceno-Valencia0% (1)

- Chapter_7_Job_Order_Costing.pptxDocument28 pagesChapter_7_Job_Order_Costing.pptxlexfred55No ratings yet

- Operational RiskDocument40 pagesOperational RiskNaurah Atika DinaNo ratings yet

- Accepted Manuscript: 10.1016/j.jfds.2015.03.001Document21 pagesAccepted Manuscript: 10.1016/j.jfds.2015.03.001Naurah Atika DinaNo ratings yet

- Soft System Methodology Implementation for Hotel Surya Palace Information SystemDocument14 pagesSoft System Methodology Implementation for Hotel Surya Palace Information SystemNaurah Atika DinaNo ratings yet

- Summary RM (Management Data)Document1 pageSummary RM (Management Data)Naurah Atika DinaNo ratings yet

- 641124928137876risk Management PolicyDocument20 pages641124928137876risk Management PolicyNaurah Atika Dina100% (1)

- Accounting Information Audit and ControlDocument6 pagesAccounting Information Audit and ControlNaurah Atika DinaNo ratings yet

- Chapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingDocument6 pagesChapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingNaurah Atika DinaNo ratings yet

- Contoh Jurnal JAADocument13 pagesContoh Jurnal JAANaurah Atika DinaNo ratings yet

- Daftar Hadir Guru KB Aisyiyah Bungo TAnjungDocument2 pagesDaftar Hadir Guru KB Aisyiyah Bungo TAnjungNaurah Atika DinaNo ratings yet

- BASIC CONCEPTS OF INCOME TAXDocument4 pagesBASIC CONCEPTS OF INCOME TAXNaurah Atika DinaNo ratings yet

- Pink Flowers Cute Letter-WPS OfficeDocument1 pagePink Flowers Cute Letter-WPS OfficeNaurah Atika DinaNo ratings yet

- Smart Resume For Sales PositionDocument2 pagesSmart Resume For Sales PositionNaurah Atika DinaNo ratings yet

- Assignment of ApbnDocument7 pagesAssignment of ApbnNaurah Atika DinaNo ratings yet

- FlowchartDocument12 pagesFlowchartNaurah Atika DinaNo ratings yet

- Group 1 - Q & A Psak 72Document5 pagesGroup 1 - Q & A Psak 72Naurah Atika DinaNo ratings yet

- Financial Instruments Recognition and Measurement Group 1Document5 pagesFinancial Instruments Recognition and Measurement Group 1Naurah Atika DinaNo ratings yet

- CHAPTER 4 N 3Document7 pagesCHAPTER 4 N 3Naurah Atika DinaNo ratings yet

- CA s1 Intl A 09 05 Cost BehaviourDocument2 pagesCA s1 Intl A 09 05 Cost BehaviourNaurah Atika DinaNo ratings yet

- Group Assignment of Fiscal Capacity in IndonesiaDocument8 pagesGroup Assignment of Fiscal Capacity in IndonesiaNaurah Atika DinaNo ratings yet

- Public Finance Soal No 2Document1 pagePublic Finance Soal No 2Naurah Atika DinaNo ratings yet

- Grass and Legume Types for Animal FeedDocument2 pagesGrass and Legume Types for Animal FeedNaurah Atika DinaNo ratings yet

- Group 9 Case Functional and Activity Based Job Order CostingDocument1 pageGroup 9 Case Functional and Activity Based Job Order CostingNaurah Atika DinaNo ratings yet

- REPORT OF APBN FINANCIAL STATE AND LOCALDocument6 pagesREPORT OF APBN FINANCIAL STATE AND LOCALNaurah Atika DinaNo ratings yet

- Group 3 Case Cost of Goods Manufactured Statment and Income StatementDocument1 pageGroup 3 Case Cost of Goods Manufactured Statment and Income StatementNaurah Atika DinaNo ratings yet

- Job Order Costing Case StudyDocument1 pageJob Order Costing Case StudyNaurah Atika DinaNo ratings yet

- 11, 12, 13 Group - 10 - Assignment - Activity Process CostingDocument1 page11, 12, 13 Group - 10 - Assignment - Activity Process Costingdwi davisNo ratings yet

- Group 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MDocument1 pageGroup 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MNaurah Atika DinaNo ratings yet

- Group 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing DecisionDocument1 pageGroup 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing DecisionNaurah Atika DinaNo ratings yet

- 05 06 Group 6 Assignment VBCDocument1 page05 06 Group 6 Assignment VBCNaurah Atika DinaNo ratings yet

- Dupont Heir Sexually Abuses DaughterDocument3 pagesDupont Heir Sexually Abuses DaughterJuandelaCruzNo ratings yet

- "Fish" From Gourmet RhapsodyDocument4 pages"Fish" From Gourmet RhapsodySean MattioNo ratings yet

- 465 886 1 SMDocument8 pages465 886 1 SM17Annisa Muthmainnah067No ratings yet

- Constance Carroll Cosmetics) Final.1Document4 pagesConstance Carroll Cosmetics) Final.1api-26027438100% (1)

- VR-ForM-F06.10 (Hot Work Permit Request Form)Document1 pageVR-ForM-F06.10 (Hot Work Permit Request Form)imtz2013No ratings yet

- Brooks MT 3018Document16 pagesBrooks MT 3018Martin AndradeNo ratings yet

- 2requirements Permit PDFDocument1 page2requirements Permit PDFHazel CorralNo ratings yet

- Cronidur 30: Maximum Demand by Maximum Demand by Corrosive Stress WearDocument24 pagesCronidur 30: Maximum Demand by Maximum Demand by Corrosive Stress WearVlad PopescuNo ratings yet

- 4 ReactorsDocument58 pages4 ReactorsKiran ShresthaNo ratings yet

- 2009 IECC Residential Code Requirements Apr 14 Draft InspectorsDocument4 pages2009 IECC Residential Code Requirements Apr 14 Draft Inspectorsbcap-oceanNo ratings yet

- Facilitating Civic Engagement Through Consultation: Learning From Local Communities Through The NHI-Accountability Project in South AfricaDocument64 pagesFacilitating Civic Engagement Through Consultation: Learning From Local Communities Through The NHI-Accountability Project in South AfricaOxfamNo ratings yet

- What Is A PronounDocument9 pagesWhat Is A PronounFanera JefferyNo ratings yet

- RS9923 - Grade 12 Compulsory Subjects - Test Specification Chart and Model Questions - FinalDocument32 pagesRS9923 - Grade 12 Compulsory Subjects - Test Specification Chart and Model Questions - FinalPrince JaiswalNo ratings yet

- PEDH ReviewerDocument10 pagesPEDH ReviewerMaki Orejola de LeonNo ratings yet

- The QuestionnaireDocument3 pagesThe QuestionnaireMaximo C. Nayanga Jr.No ratings yet

- VBAC Parents Guide v2 April 2019Document110 pagesVBAC Parents Guide v2 April 2019The VBAC Link100% (4)

- Seven Appear in Court On Cocaine, P Charges After North Island Drug Raids - NZ HeraldDocument3 pagesSeven Appear in Court On Cocaine, P Charges After North Island Drug Raids - NZ HeraldVagamundos ArgentinosNo ratings yet

- Life Wealth Mastery EnglishDocument12 pagesLife Wealth Mastery EnglishD.j. Ralmm100% (1)

- Smart medical system monitors dementia patients' medicationDocument9 pagesSmart medical system monitors dementia patients' medicationKresnaNo ratings yet

- Subway 2009Document12 pagesSubway 2009sparklers_mNo ratings yet

- Diane Derzis Motion To Dismiss Complaint by The Alabama State Board of Health To Stop Her From Operating An Abortion Clinic Closed by The State.Document8 pagesDiane Derzis Motion To Dismiss Complaint by The Alabama State Board of Health To Stop Her From Operating An Abortion Clinic Closed by The State.Tom CiesielkaNo ratings yet

- Storage Tank: Data Sheet ForDocument2 pagesStorage Tank: Data Sheet ForAmanNo ratings yet

- Diseases That Cause HypoproteinemiaDocument12 pagesDiseases That Cause HypoproteinemiaRachel Marie M. GaniaNo ratings yet

- An Integrated Review of Evidence-Based Healthcare Design For Healing Environments Focusing On Longterm Care FacilitiesDocument16 pagesAn Integrated Review of Evidence-Based Healthcare Design For Healing Environments Focusing On Longterm Care FacilitiesAmira EsamNo ratings yet

- Chapter 5 Integumentary Study GuideDocument3 pagesChapter 5 Integumentary Study GuideSuperjunior8No ratings yet

- ASME B16.5 Flange Rating CalculatorDocument10 pagesASME B16.5 Flange Rating Calculatorfaizal100% (2)

- Public Stormwater Management With Green StreetsDocument90 pagesPublic Stormwater Management With Green StreetsPranay ManwarNo ratings yet

- Nikola Tesla Would Have Celebrated Christmas On January 7thDocument3 pagesNikola Tesla Would Have Celebrated Christmas On January 7thAnonymous DfeajF100% (1)

- AU440-36V-MH: DimensionsDocument2 pagesAU440-36V-MH: DimensionsJohnny FucahoriNo ratings yet

- Humic Substances As Electron Acceptor For Microbial RespirationDocument4 pagesHumic Substances As Electron Acceptor For Microbial RespirationNed FlandersNo ratings yet