Professional Documents

Culture Documents

Absorption and Variable Costing

Uploaded by

qrrzyz7whgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absorption and Variable Costing

Uploaded by

qrrzyz7whgCopyright:

Available Formats

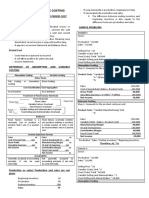

Absorption and Variable Costing Fixed selling and administrative expenses 40,000

Fixed manufacturing overhead 60,000

1. During the month of May, Royal Co. produces 10,000 units of Product X. Costs incurred by

Royal during May were as follows: Last period, 13,000 units were produced. In the current period, 15,000 units were produced.

In each period, 13,000 units were sold. What is the difference in reported income under

Direct materials ₱10,000

absorption and variable costing for the current period?

Direct labor 20,000

Variable manufacturing overhead 5,000 a. Variable costing income exceeded absorption costing income by ₱4,000.

Variable selling and general 3,000 b. Absorption costing income exceeded variable costing income by ₱8,000.

Fixed manufacturing overhead 9,000 C. Variable costing income exceeded absorption costing income by ₱6,000.

Fixed selling and general 4,000 d. Net income will equal between the two methods.

Total ₱51,000

4. What factor related to manufacturing costs causes the difference in net earnings

What are the unit costs under absorption and variable costing methods, respectively? computed using absorption costing and net earnings computed using variable costing?

a. ₱5.10 ; ₱3.80 c. ₱4.40 ; ₱3.50 a. absorption costing considers all costs in the determination of net earnings,

b. ₱3.80 ; ₱5.10 d. ₱3.50 ; ₱4.40 whereas variable costing considers only direct costs.

b. absorption costing ‘inventories’ all direct costs, but variable costing considers

2. The following information pertains to Ralph Corporation:

direct costs to be period costs.

Beginning inventory NONE c. absorption costing ‘ inventories’ all fixed manufacturing costs for the period in

Ending inventory 5,000 units ending finished goods inventory, but variable costing expenses all fixed costs.

Direct labor per unit ₱10 d. absorption costing allocates fixed manufacturing costs between costs of goods

Direct materials per unit 8 sold and inventories, and variable costing considers all fixed costs to be period costs.

Variable overhead per unit 2

5. Aki Company makes a single product that sells for ₱1,000 each. Data for 2023 operations

Fixed overhead per unit 5

follow:

Variable selling costs per unit 6

Fixed selling costs per unit 8 Units: Variable costs:

Beginning inventory 5 Direct materials ₱18,000

What is the value of ending inventory under variable costing method and absorption costing

Production 60 Direct labor 12,000

method?

Ending inventory 15 Factory overhead 6,000

a. ₱155,000 ; ₱125,000 c. ₱100,000 ; ₱155,000 Selling and administrative 1,000

b. ₱125,000 ; ₱100,000 d. ₱195,000 ; ₱100,000 Fixed costs:

Factory overhead ₱15,000

3. Consider the following: Selling and administrative 2,000

Sales price, per unit ₱18 per unit 1. Determine inventory cost per unit under Absorption costing and Variable costing

Standard absorption cost rate 12 per unit 2. Determine the total cost of ending inventory under Absorption and Variable costing.

Standard variable cost rate 8 per unit 3. Prepare income statement under Absorption costing and Variable costing.

Variable selling expense rate 2 per unit 4. How much is the difference in profit between the two costing method?

You might also like

- Module 4 Absorption and Variable Costing WA PDFDocument8 pagesModule 4 Absorption and Variable Costing WA PDFMadielyn Santarin MirandaNo ratings yet

- MAS.106 Variable Costing and Absorption CostingDocument3 pagesMAS.106 Variable Costing and Absorption CostingJerrizza RamirezNo ratings yet

- MAS Final Preboard QuestionsDocument12 pagesMAS Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- 04 Variable and Absorption CostingDocument8 pages04 Variable and Absorption CostingJunZon VelascoNo ratings yet

- Final CostDocument8 pagesFinal CostPaul Mark DizonNo ratings yet

- Mas 9404 Product CostingDocument11 pagesMas 9404 Product CostingEpfie SanchesNo ratings yet

- CH 8 Practice HomeworkDocument11 pagesCH 8 Practice HomeworkNCT100% (1)

- Study Abroad Consultant in PanchkulaDocument17 pagesStudy Abroad Consultant in Panchkulashubham mehtaNo ratings yet

- Indo Africa Indianparticipants-09Document870 pagesIndo Africa Indianparticipants-09Guruprasad T JathanNo ratings yet

- Ret Ro Gam Er Iss Ue 168 2017Document116 pagesRet Ro Gam Er Iss Ue 168 2017Albanidis X. Kostas100% (1)

- Job Hazard Analysis Site InspectionDocument12 pagesJob Hazard Analysis Site InspectionNonsoufo eze100% (1)

- Absorption and Variable Costing ReviewDocument13 pagesAbsorption and Variable Costing ReviewRodelLabor100% (1)

- For Print Exercises Variable and Absorption CostingDocument2 pagesFor Print Exercises Variable and Absorption CostingAngelica Sumatra0% (1)

- 03 MAS - Var. & Absorption CostingDocument6 pages03 MAS - Var. & Absorption CostingManwol JangNo ratings yet

- Midterm Exam - Bsais 2BDocument6 pagesMidterm Exam - Bsais 2BMarilou DomingoNo ratings yet

- Mas-03: Absorption & Variable CostingDocument4 pagesMas-03: Absorption & Variable CostingClint AbenojaNo ratings yet

- Chapter 7Document12 pagesChapter 7Camille GarciaNo ratings yet

- Contribution Approach 2Document16 pagesContribution Approach 2kualler80% (5)

- Chapter 4Document8 pagesChapter 4Châu Ánh ViNo ratings yet

- Absorption Costing and Variable Costing QuizDocument3 pagesAbsorption Costing and Variable Costing QuizKeir GaspanNo ratings yet

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- QUIZ 1 Absorption CostingDocument1 pageQUIZ 1 Absorption CostingJohn Carlo CruzNo ratings yet

- COT 1 - (Science 7) - Cell To Biosphere 4as Semi-Detailed LPDocument10 pagesCOT 1 - (Science 7) - Cell To Biosphere 4as Semi-Detailed LPARLENE AGUNOD100% (1)

- 3 - Absorption and Variable CostingDocument3 pages3 - Absorption and Variable CostingPrince Jeffrey FernandoNo ratings yet

- Activity Chapter 5 1Document11 pagesActivity Chapter 5 1Rocelle MalinaoNo ratings yet

- MAS 04 Absorption CostingDocument6 pagesMAS 04 Absorption CostingJoelyn Grace MontajesNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- COS 103 - Variable Costing ExercisesDocument2 pagesCOS 103 - Variable Costing ExercisesAivie Pangilinan100% (1)

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- CH 05Document3 pagesCH 05Gus JooNo ratings yet

- 3MA 03 Absortion and Variable CostingDocument3 pages3MA 03 Absortion and Variable CostingAbigail Regondola BonitaNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- SAMPLESKCQISJAXSDocument7 pagesSAMPLESKCQISJAXSShaira Mae E. PacisNo ratings yet

- ACC2052 T 3 SGDocument23 pagesACC2052 T 3 SGNitinNo ratings yet

- Quiz 2Document4 pagesQuiz 2Kathleen CusipagNo ratings yet

- Chapter 7Document4 pagesChapter 7Mixx MineNo ratings yet

- Absorption (Full Costing) Variable (Direct Costing)Document4 pagesAbsorption (Full Costing) Variable (Direct Costing)Leo Sandy Ambe CuisNo ratings yet

- Examples FMA - 5Document10 pagesExamples FMA - 5DaddyNo ratings yet

- Absorption Costing GclassDocument4 pagesAbsorption Costing GclassDoromal, Jerome A.No ratings yet

- CostconDocument33 pagesCostconDanica VillaganteNo ratings yet

- Process CostingDocument6 pagesProcess Costingbae joohyun0% (2)

- Akmen Soal Review Uas PDFDocument8 pagesAkmen Soal Review Uas PDFvionaNo ratings yet

- SIM - Variable and Absorption Costing - 0Document5 pagesSIM - Variable and Absorption Costing - 0lilienesieraNo ratings yet

- Overview of Absorption and Variable CostingDocument5 pagesOverview of Absorption and Variable CostingJarrelaine SerranoNo ratings yet

- Standard Costing and Variance AnalysisDocument14 pagesStandard Costing and Variance AnalysisSaad Khan YTNo ratings yet

- Soal Kelas Lab IxDocument3 pagesSoal Kelas Lab IxSarah Dzuriyati SamiyahNo ratings yet

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- Costman Variable CostingDocument2 pagesCostman Variable CostingJeremi BernardoNo ratings yet

- Absorption and Variable CostingDocument3 pagesAbsorption and Variable CostingDhona Mae FidelNo ratings yet

- Absorption Costing & Variable CostingDocument20 pagesAbsorption Costing & Variable Costingsaidkhatib368No ratings yet

- 93 - Final PB MASDocument12 pages93 - Final PB MASEliny CruzNo ratings yet

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- Absorption and Marginal Costing With Answers 2Document6 pagesAbsorption and Marginal Costing With Answers 2Hassaan ImranNo ratings yet

- Variable CostingDocument10 pagesVariable Costingrodell pabloNo ratings yet

- Variable Costing ReviewerDocument3 pagesVariable Costing Reviewerdaniellejueco1228No ratings yet

- Product Costing QUIZ 7 CopiesDocument2 pagesProduct Costing QUIZ 7 Copiesqrrzyz7whgNo ratings yet

- Drill Prelim To FinalsDocument7 pagesDrill Prelim To FinalsMila Casandra CastañedaNo ratings yet

- Cost & MGT II CH 1Document13 pagesCost & MGT II CH 1fikruhope533No ratings yet

- Costing - Oar - Absorptional - MCQ'SDocument7 pagesCosting - Oar - Absorptional - MCQ'SMusthari KhanNo ratings yet

- Absorption Costing vs. Variable CostingDocument8 pagesAbsorption Costing vs. Variable CostingShaira GampongNo ratings yet

- Elaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Document2 pagesElaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Meghan Kaye LiwenNo ratings yet

- Lecture 3 Costing and Costing TechniquesDocument43 pagesLecture 3 Costing and Costing TechniquesehsanNo ratings yet

- Variable CostingDocument7 pagesVariable CostingRainie LopezNo ratings yet

- Quiz Regulatory Framework and Legal Issues in BusinessDocument8 pagesQuiz Regulatory Framework and Legal Issues in Businessqrrzyz7whgNo ratings yet

- Lesson 3 - Lending IndustryDocument15 pagesLesson 3 - Lending Industryqrrzyz7whgNo ratings yet

- Time Value of MoneyDocument40 pagesTime Value of Moneyqrrzyz7whgNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingqrrzyz7whgNo ratings yet

- Academic and Occupational English Needs of Tourism and Hotel Management Students Oral Communication Skills in FocusDocument136 pagesAcademic and Occupational English Needs of Tourism and Hotel Management Students Oral Communication Skills in FocusYeneneh WubetuNo ratings yet

- Aceleradores Serie 6900Document2 pagesAceleradores Serie 6900jdavis5548No ratings yet

- Effects of Adiabatic Flame Temperature On Flames CharacteristicDocument12 pagesEffects of Adiabatic Flame Temperature On Flames CharacteristicAhmed YasiryNo ratings yet

- Introduction Manual: 30000mah Type-C Power BankDocument33 pagesIntroduction Manual: 30000mah Type-C Power BankIreneusz SzymanskiNo ratings yet

- Sumande - Field Work No.8 - Azimuth Traverse Using Theodolite and TapeDocument10 pagesSumande - Field Work No.8 - Azimuth Traverse Using Theodolite and TapeCedrix SumandeNo ratings yet

- Ryan PrintDocument24 pagesRyan PrintALJHON SABINONo ratings yet

- "Universal Asynchronous Receiver and Transmitter" (UART) : A Project Report OnDocument24 pages"Universal Asynchronous Receiver and Transmitter" (UART) : A Project Report Ondasari himajaNo ratings yet

- Aviation Industry Review Subtain FileDocument11 pagesAviation Industry Review Subtain Filesahab gNo ratings yet

- Mobile Wireless Communications 1St Edition Schwartz Solutions Manual Full Chapter PDFDocument22 pagesMobile Wireless Communications 1St Edition Schwartz Solutions Manual Full Chapter PDFelysiarorym2ek100% (9)

- Chap9 PDFDocument50 pagesChap9 PDFpramani90No ratings yet

- User Manual HP Officejet 8210Document95 pagesUser Manual HP Officejet 8210ponidiNo ratings yet

- Polycab Pricelist 21-01-2019Document5 pagesPolycab Pricelist 21-01-2019KULDEEP TRIPATHINo ratings yet

- 01-Thermal Integrity Profiler PDI USF TIPDocument2 pages01-Thermal Integrity Profiler PDI USF TIPAlexandru PoenaruNo ratings yet

- Quick Guide System 1200 - Monitoring Using Sets of AnglesDocument3 pagesQuick Guide System 1200 - Monitoring Using Sets of AnglesariyarathneNo ratings yet

- VHDL PaperDocument32 pagesVHDL PaperSajid JanjuaNo ratings yet

- A Model Estimating Bike Lane DemandDocument9 pagesA Model Estimating Bike Lane DemandachiruddinNo ratings yet

- Articulo en Jurnal Nature of MedicineDocument13 pagesArticulo en Jurnal Nature of MedicineIngeniería Alpa TelecomunicacionesNo ratings yet

- Forest Botany For Forestry StudentsDocument39 pagesForest Botany For Forestry StudentsMadan ThapaNo ratings yet

- Ncs University System Department of Health Sciences: Discipline (MLT-04) (VIROLOGY &MYCOLOGY)Document5 pagesNcs University System Department of Health Sciences: Discipline (MLT-04) (VIROLOGY &MYCOLOGY)Habib UllahNo ratings yet

- W3-W4 Eng10 WHLPDocument7 pagesW3-W4 Eng10 WHLPSanta Esmeralda GuevaraNo ratings yet

- Annotated BibliographyDocument4 pagesAnnotated Bibliographychrismason1No ratings yet

- WWW - Universityquestions.in: Question BankDocument11 pagesWWW - Universityquestions.in: Question BankgokulchandruNo ratings yet

- ASV Program Guide v3.0Document53 pagesASV Program Guide v3.0Mithun LomateNo ratings yet

- Acalypha Indica and Curcuma Longa Plant Extracts Mediated ZNS Nanoparticles PDFDocument9 pagesAcalypha Indica and Curcuma Longa Plant Extracts Mediated ZNS Nanoparticles PDFRabeea NasirNo ratings yet

- PRP ConsentDocument4 pagesPRP ConsentEking InNo ratings yet