Professional Documents

Culture Documents

BASIC CONCEPTS OF INCOME TAX

Uploaded by

Naurah Atika DinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BASIC CONCEPTS OF INCOME TAX

Uploaded by

Naurah Atika DinaCopyright:

Available Formats

BASIC CONCEPT OF INCOME TAX

1. Definition of Income Tax

Income Tax is a tax imposed on income received by the taxpayer.

2. Definition of Tax Subject

The tax subject is the person intended by law to be introduced to tax.

Included in the domestic tax subject are:

a. Private person.

1) Indonesian (without limitation of residence / domicile).

2) Have income.

3) Individual entrepreneurs / companies.

4) Employees.

5) Professional / expert.

b. Un divided inheritance.

1) Is a unit, replacing the rightful (heirs).

2) Still have to pay taxes even though inheritance has not been shared with those who are entitled.

c. Body subject.

1) A group of people from or a collection of capital as a whole either doing business or not doing

business.

2) PT, CV, Firm, Cooperative, Pension Fund, Association of Foundations, Mass Organizations, Social

and Political Organizations, Institutions, etc.

d. Permanent form of business.

1) Form of business used by foreign tax subjects who run a business or conduct activities in Indonesia.

2) In the form of management activities, company branches, representative offices, office buildings,

factories, workshops, warehouses, spaces for promotion / sales, mining, drilling, agriculture,

construction projects, service provision, people or entities acting as agents whose position is not free,

insurance agents or employees, computers for e-commerce.

Included in the foreign tax subject are:

a. An individual who does not reside / reside in Indonesia not more than 183 days in a period of 12

months and an entity that is not established / domiciled in Indonesia.

b. Who runs a business / conducts activities through a permanent establishment in Indonesia.

c. Who can receive / earn income from Indonesia not from running a business or carrying out

activities through a permanent establishment in Indonesia.

3. Domestic Subjective Tax Liability START

a. When a Personal Person is born, is or intends to reside in Indonesia.

b. When the body is established or domiciled in Indonesia.

c. At the time of the emergence of an undivided inheritance.

4. Domestic Subjective Tax Obligations END

a. When the individual dies or leaves Indonesia for ever.

b. When the body is dissolved or no longer domiciled in Indonesia.

c. When the inheritance has been distributed.

5. Not Including Tax Subjects

a. Foreign country representative body.

b. Diplomatic, and consular representative officials or other officials from foreign countries and

persons seconded to those who work and live with them.

c. International Organizations established by Decree of the Minister of Finance.

d. Officials representing international organizations established by Decree of the Minister of Finance.

6. Definition of Income Tax Objects

The object of income tax is any additional economic ability that is received or obtained by the

Taxpayer, both from Indonesia and from outside Indonesia, which can be used for consumption or to

increase the Taxpayer's wealth in the name and in any form.

Excluding tax objects

Based on Law No. 36 of 2008 concerning Income Tax, which does not include tax objects according to

article 4 paragraph 3, among others:

1. Assistance or donations including zakat received by the amil zakat body or charity charity institution

which is formed or authorized by the government and the recipients of the zakat that are entitled and

the hybrid property received by the blood family in a straight lineage one degree and by the religious

body or educational body or a social entity or small businessman including cooperatives established

by the Minister of Finance, as long as there is no relationship with business, work, ownership, or

control between the parties concerned;

2. Inheritance;

3. Assets including cash deposits received by the agency in lieu of shares or as a substitute for equity

participation;

4. Substitution or compensation in respect of work or services received or in the form of nature and /

or enjoyment of a Taxpayer or government;

5. Payments from insurance companies to individuals related to health insurance, accident insurance,

life insurance, dual-purpose insurance, and scholarship insurance:

6. Individuals or parts of profits received or obtained by limited liability companies as domestic

taxpayers, cooperatives, BUM or BUMD from capital participation in a business entity established and

domiciled in Indonesia, with the following conditions:

- Individuals derived from retained earnings; and

- For limited liability companies, BUMN and BUMD that receive dividends, share ownership in the

entity that provides dividends is at least 25% (twenty-five percent) of the total paid-in capital and

must have an active business outside of the ownership of the shares. If the dividend received is

greater than 25% (twenty five percent), then it is not included in the tax object.

1. Fees received or obtained by pension funds whose establishment has been approved by the

Minister of Finance, both those paid by employers and employees;

2. Income from capital invested by pension funds in certain fields determined by the Minister of

Finance Decree;

3. The share of profits received or obtained by members of a limited partnership whose capital is not

divided into shares, alliances, associations, firms, and partners;

4. Bond interest received or obtained by a mutual company and for the first 5 (five) years since the

establishment of the company or the granting of a business license;

5. Income received or obtained by venture capital companies.

7. Tax Objects Received Final Income Tax

Based on Law No. 36 of 2008 concerning Income Tax, objects subject to final tax according to article 4

paragraph 2 include:

a. Deposit rates and other savings.

b. Income from stock transactions and other securities on the stock exchange.

c. Income from the transfer of assets in the form of land and or buildings.

d. Other certain income, the tax imposition is regulated by Government Regulation.

8. Basic Tax Imposition

Basis of Tax Imposition is the value in the form of money which is used as the basis for calculating the

tax owed. For domestic taxpayers and permanent establishments which are the basis of the tax

imposition is taxable income. While for foreign taxpayers is Gross Income.

The amount of the DPP includes:

a. Corporate Taxpayer = Net Income

b. Prbadi Taxpayer = Net Income - PTKP

How to Calculate Taxable Income

a. Using Bookkeeping

1) Taxable Income (Personal Taxpayer):

= Net Income - PTKP

= (Net Income - Costs allowed by the Income Tax Act) - PTKP

2) Taxable Income (Obligatory Agency):

= Net income

= Net Income - Costs that are allowed by the Income Tax Act

b. Using Norms for Calculating Net Income

c. Taxpayers may use Norms for Calculating Net Income

is an Individual Taxpayer who meets the following conditions:

1) Gross circulation is less than Rp. 4,800,000,000.00 per year.

2) Submitting an application within the first three months of the financial year.

3) Organizing records.

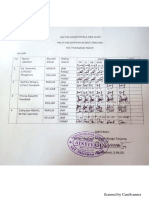

9. PTKP (Non-Taxable Income)

In calculating the taxable income of a domestic person, he is given a reduction in the form of non-

taxable income. The amount of PTKP is set as follows:

No. Information for a year

1. Personal Taxpayer's Self Rp. 36,000,000.00

2. Additional taxpayers who marry Rp. 3,000,000.00

3. Additional for a wife whose income is combined with husband's income. Rp. 36,000,000.00

4. Additional for each blood-blooded descendant member in a straight lineage and a fully adopted

adopted child, a maximum of 3 people for each family. Rp. 3,000,000.00

10. Taxable Income

Taxable Income is the basis used to calculate the amount of tax payable which is based on the

company's financial statements after a fiscal correction is carried out in order to obtain net fiscal

income. Whereas for personal taxpayers to find out taxable income must be reduced between net

income and PTKP.

Information:

The tariff used can follow:

a. General Tariff

Tariff based on Article 17 of Law No. 0. 36 of 2008.

b. Special Rates

Tariffs are based on government regulations for certain income.

11. Income Tax Rates

a. For Individual Taxpayers in the country:

Tax Rate of Taxable Income Tax

Up to IDR 50,000,000.00 5%

Above IDR 50,000,000.00 up to IDR 250,000,000.00 15%

Above IDR 250,000,000.00 up to IDR 500,000,000.00 25%

Above IDR 500,000,000.00 30%

10% Dividend Rate

Do not have a NPWP (for Article 21 PPh) 20% higher than it should be

Do not have a NPWP to collect / deduct (for Article 23 Income Tax) 100% higher than it should be

Fiscal payments for those who have a Free NPWP.

b. Domestic Corporate Taxpayers and Permanent Establishments

Year of Tax Rate

In 2009 28%

From 2010 and then 25%

PT, whose 40% shares are traded on the stock exchange 5% lower than they should

Gross circulation up to Rp 50,000,000,000.00 Reduction of 50% of what should be

12. Income Merger / Separation

1. Merging Income

Income or loss for a woman who has been married at the beginning of the tax year or at the beginning

of the portion of the tax year is considered as her husband's income or loss, and is taxed as a whole.

The merger is not carried out in the event that the wife's income is obtained from work as an

employee who has been taxed by the employer, provided that:

1. The income of the wife is solely obtained from one employer.

2. The wife's income comes from a job that has nothing to do with the business or independent work

of the husband or other family members.

2. Separation of Income

In the event that the husband and wife have lived separately based on the judge's decision, the

calculation of taxable income and taxation is carried out individually. If the husband and wife hold a

written agreement on property and income or if the wife wishes to exercise her own taxation rights

and obligations, the tax calculation is carried out based on the sum of the husband and wife's net

income and each bear a tax burden proportional to the amount of net income.

Example:

Tax calculation for husband and wife who have written income separation agreements or if the wife

wishes to exercise her own taxation rights and obligations are as follows:

Ramdan entered into a written income separation agreement with his wife. Ramdan earns an income

of Rp 100,000,000.00 and his wife works as an employee with an income of Rp 50,000,000. Besides

being an employee, Ramdan's wife runs a beauty salon business with an income of Rp 10,000,000.00.

The imposition of income tax for husband and wife is calculated based on the amount of income of

Rp. 250,000,000.00

For example, the tax owed on the amount of income is Rp. 27,550,000.00 so for each husband and

wife the tax imposition is calculated as follows:

Suami: IDR 100,000,000.00 x IDR 27,550,000.00 = IDR 11,020,000.00 IDR 250,000,000.00

Wife: Rp. 150,000,000.00 x Rp. 27,550,000.00 = Rp. 16,530,000.00 Rp. 250,000,000.00

1. Earnings of Young Children

The income of an immature child, regardless of the source of his income and whatever the nature of

his work, is combined with the income of his parents in the same tax year. What is meant by

"immature child" is a child who is not yet 18 years old and has never been married. If a child is not an

adult, whose parents have separated, received or earned income, the tax is combined with the

income of the father or mother based on the actual situation.

13. Special Relationship

Special relationships are deemed absent if:

1. Ownership Relationship (Article 18 of the PPh Jo Law SE-04 / PJ.7 / 1993 Jo SE-18.Pj.53 / 1995)

Inclusion of direct or indirect capital of 25% or more in other taxpayers.

The relationship between compulsory applicants and the inclusion of 25% or more in two or more

taxpayers.

Relations between two taxpayers or more whose capital is 25% or more owned by the same party.

2. Mastery Relations:

That is the relationship between taxpayers who control other taxpayers, or two taxpayers or more

are under the same control either directly or indirectly, either mastery through management or

through the use of technology.

Mastery through management for example: Mr. X is the President Director of PT Alfa and also

serves as Director of Security at PT Beta. In this case between PT Alfa and PT Beta there is a special

relationship

Mastery through the use of technology, for example: PT A companies that produce beverages using

a formula created by PT B. In this case between PT A and PT B there is a special relationship

because there is control through the use of technology by PT B against PT A.

3, Blood Relations or Marriage

Special relationship because there is a family relationship, both in blood and in a fine in the straight

line and / or sideways one degree.

Straight degrees one degree are: father, mother and child.

Sideways one degree, namely: siblings (biological, father or mother).

The agenda is straight one degree: in-laws with son-in-law or parents with stepchildren.

Fingers aside one degree: brother-in-law.

If between husband and wife is made an agreement to separate property in income, then there is a

special relationship between husband and wife.

You might also like

- Lesson Income TaxDocument8 pagesLesson Income TaxEfren Lester ReyesNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- TAXATION - Taxation of Individuals, Partnerships and Co-Ownerships, Estates and Trusts, and CorporationsDocument13 pagesTAXATION - Taxation of Individuals, Partnerships and Co-Ownerships, Estates and Trusts, and CorporationsJohn Mahatma Agripa100% (2)

- Income TaxDocument51 pagesIncome TaxInternet 223No ratings yet

- The Philippines Income TaxDocument8 pagesThe Philippines Income TaxmendozaivanrichmondNo ratings yet

- Returns and Payment of TaxDocument14 pagesReturns and Payment of TaxJanna Grace Dela CruzNo ratings yet

- Module 1: Income Tax PrinciplesDocument18 pagesModule 1: Income Tax PrinciplesJun MagallonNo ratings yet

- PTX - AssignmentDocument15 pagesPTX - AssignmentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Residential Status of An IndividualDocument11 pagesResidential Status of An IndividualRevathy PrasannanNo ratings yet

- Income TaxationDocument3 pagesIncome Taxationm.bagnas.488669No ratings yet

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Faq ITDocument9 pagesFaq ITManu GuptaNo ratings yet

- Income and Business TaxationDocument44 pagesIncome and Business TaxationBeverly EroyNo ratings yet

- Hari Income Tax Department - Do CXDocument12 pagesHari Income Tax Department - Do CXNelluri Surendhar ChowdaryNo ratings yet

- Indirect Taxes Are Levied On The Production or Consumption of Goods andDocument10 pagesIndirect Taxes Are Levied On The Production or Consumption of Goods andPARTH NAIKNo ratings yet

- Corporation PT 2Document21 pagesCorporation PT 2Danica ConcepcionNo ratings yet

- Tax Unit 2Document63 pagesTax Unit 2sunaina aliNo ratings yet

- Income and Business TaxationDocument21 pagesIncome and Business TaxationFrance Jacob B. EscopeteNo ratings yet

- Income Tax Concept ExplainedDocument16 pagesIncome Tax Concept ExplainedPARTH NAIKNo ratings yet

- Concepts of Taxation and Income TaxationDocument10 pagesConcepts of Taxation and Income TaxationPinks D'CarlosNo ratings yet

- Income Tax FaqDocument11 pagesIncome Tax FaqNasir AhmedNo ratings yet

- B - Individual Taxation: PhilippinesDocument4 pagesB - Individual Taxation: PhilippinesJasper Allen B. Barrientos100% (1)

- Income Tax NotesDocument28 pagesIncome Tax NotesEL Filibusterisimo Paul CatayloNo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- Business Taxation Notes B.com Part 2 Income Tax Sales TaxDocument79 pagesBusiness Taxation Notes B.com Part 2 Income Tax Sales TaxMehwish Akram 48No ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Thailand's Corporate Income Tax OverviewDocument13 pagesThailand's Corporate Income Tax Overviewhasanarif0257No ratings yet

- 6,6 Taxation of Income of PersonsDocument29 pages6,6 Taxation of Income of Personsjoseph mbuguaNo ratings yet

- Basic ConceptsDocument35 pagesBasic Concepts3208 A PallaviNo ratings yet

- Taxation System in IndiaDocument30 pagesTaxation System in IndiaSwapnil Pisal-DeshmukhNo ratings yet

- Alana - Self-Assessment Module 3Document3 pagesAlana - Self-Assessment Module 3kate trishaNo ratings yet

- LLB Tax NavDocument31 pagesLLB Tax Navamit HCSNo ratings yet

- income taxDocument32 pagesincome taxAeiaNo ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- Indonesian Tax CertificateDocument5 pagesIndonesian Tax CertificatehalimNo ratings yet

- Income and Tax AuthorityDocument21 pagesIncome and Tax AuthorityRatul HaqueNo ratings yet

- Income TaxDocument11 pagesIncome Taxvikas_thNo ratings yet

- Corporate Tax PlanningDocument8 pagesCorporate Tax PlanningTumie Lets0% (1)

- FABM2 Module 09 (Q2-W3-5)Document9 pagesFABM2 Module 09 (Q2-W3-5)Christian Zebua50% (4)

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Taxation of Income in NepalDocument24 pagesTaxation of Income in NepalSophiya PrabinNo ratings yet

- Subject and Object of TaxationDocument12 pagesSubject and Object of TaxationCahyani PrastutiNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- Reviewer Strat TaxDocument11 pagesReviewer Strat Taxregine bacabagNo ratings yet

- Non Taxable IncomeDocument4 pagesNon Taxable IncomeSesshomaruHimuraNo ratings yet

- 2.6 The Scheme of Income Tax Law: An OverviewDocument3 pages2.6 The Scheme of Income Tax Law: An OverviewjohnNo ratings yet

- Taxation of CorporationsDocument26 pagesTaxation of CorporationsjolinaNo ratings yet

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresNo ratings yet

- Fundamental Concepts of Individual Income TaxationDocument43 pagesFundamental Concepts of Individual Income TaxationLawrence Ting100% (1)

- Companies Income Tax and Other Taxes As at Feb 2023Document10 pagesCompanies Income Tax and Other Taxes As at Feb 2023BaneNo ratings yet

- Taxation Topic 3Document29 pagesTaxation Topic 3Philip Gwadenya100% (2)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Operational RiskDocument40 pagesOperational RiskNaurah Atika DinaNo ratings yet

- Accepted Manuscript: 10.1016/j.jfds.2015.03.001Document21 pagesAccepted Manuscript: 10.1016/j.jfds.2015.03.001Naurah Atika DinaNo ratings yet

- Soft System Methodology Implementation for Hotel Surya Palace Information SystemDocument14 pagesSoft System Methodology Implementation for Hotel Surya Palace Information SystemNaurah Atika DinaNo ratings yet

- Summary RM (Management Data)Document1 pageSummary RM (Management Data)Naurah Atika DinaNo ratings yet

- 641124928137876risk Management PolicyDocument20 pages641124928137876risk Management PolicyNaurah Atika Dina100% (1)

- Accounting Information Audit and ControlDocument6 pagesAccounting Information Audit and ControlNaurah Atika DinaNo ratings yet

- Chapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingDocument6 pagesChapter 7 - Measurement Application: Section 7.2: Current Value Accounting 7.2.1 Two Versions of Current Value AccountingNaurah Atika DinaNo ratings yet

- Contoh Jurnal JAADocument13 pagesContoh Jurnal JAANaurah Atika DinaNo ratings yet

- Daftar Hadir Guru KB Aisyiyah Bungo TAnjungDocument2 pagesDaftar Hadir Guru KB Aisyiyah Bungo TAnjungNaurah Atika DinaNo ratings yet

- Grass and Legume Types for Animal FeedDocument2 pagesGrass and Legume Types for Animal FeedNaurah Atika DinaNo ratings yet

- Pink Flowers Cute Letter-WPS OfficeDocument1 pagePink Flowers Cute Letter-WPS OfficeNaurah Atika DinaNo ratings yet

- Smart Resume For Sales PositionDocument2 pagesSmart Resume For Sales PositionNaurah Atika DinaNo ratings yet

- Public Finance Soal No 2Document1 pagePublic Finance Soal No 2Naurah Atika DinaNo ratings yet

- FlowchartDocument12 pagesFlowchartNaurah Atika DinaNo ratings yet

- Group 1 - Q & A Psak 72Document5 pagesGroup 1 - Q & A Psak 72Naurah Atika DinaNo ratings yet

- Financial Instruments Recognition and Measurement Group 1Document5 pagesFinancial Instruments Recognition and Measurement Group 1Naurah Atika DinaNo ratings yet

- CHAPTER 4 N 3Document7 pagesCHAPTER 4 N 3Naurah Atika DinaNo ratings yet

- Accounting For Manufacturing Cost Using Perpetual SystemDocument2 pagesAccounting For Manufacturing Cost Using Perpetual SystemNaurah Atika DinaNo ratings yet

- Assignment of ApbnDocument7 pagesAssignment of ApbnNaurah Atika DinaNo ratings yet

- CA s1 Intl A 09 05 Cost BehaviourDocument2 pagesCA s1 Intl A 09 05 Cost BehaviourNaurah Atika DinaNo ratings yet

- REPORT OF APBN FINANCIAL STATE AND LOCALDocument6 pagesREPORT OF APBN FINANCIAL STATE AND LOCALNaurah Atika DinaNo ratings yet

- Group 9 Case Functional and Activity Based Job Order CostingDocument1 pageGroup 9 Case Functional and Activity Based Job Order CostingNaurah Atika DinaNo ratings yet

- Group Assignment of Fiscal Capacity in IndonesiaDocument8 pagesGroup Assignment of Fiscal Capacity in IndonesiaNaurah Atika DinaNo ratings yet

- Group 3 Case Cost of Goods Manufactured Statment and Income StatementDocument1 pageGroup 3 Case Cost of Goods Manufactured Statment and Income StatementNaurah Atika DinaNo ratings yet

- Job Order Costing Case StudyDocument1 pageJob Order Costing Case StudyNaurah Atika DinaNo ratings yet

- 11, 12, 13 Group - 10 - Assignment - Activity Process CostingDocument1 page11, 12, 13 Group - 10 - Assignment - Activity Process Costingdwi davisNo ratings yet

- Group 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MDocument1 pageGroup 1 Case Direct Raw Material Costs: Type of Jati Wood Quantities Purchased Weight Purchase Price Per MNaurah Atika DinaNo ratings yet

- Group 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing DecisionDocument1 pageGroup 7 Case: Volume-Based Costing Vs Activity-Based Costing and Impact On Pricing DecisionNaurah Atika DinaNo ratings yet

- 05 06 Group 6 Assignment VBCDocument1 page05 06 Group 6 Assignment VBCNaurah Atika DinaNo ratings yet

- IBM Informix 4GL V7.50 - Quick Start GuideDocument2 pagesIBM Informix 4GL V7.50 - Quick Start GuideMohamed AfeilalNo ratings yet

- US03CPHY22 UNIT - 3 Feedback in AmplifiersDocument23 pagesUS03CPHY22 UNIT - 3 Feedback in AmplifiersDr Sathiya SNo ratings yet

- Noise - LightroomDocument2 pagesNoise - LightroomLauraNo ratings yet

- RBS LogDocument1,351 pagesRBS Logsalman7467No ratings yet

- GAD Project ProposalDocument2 pagesGAD Project ProposalMa. Danessa T. BulingitNo ratings yet

- Lecture PLCDocument30 pagesLecture PLCProsenjit Chatterjee100% (1)

- Trident Limited PPT On EngineeringDocument22 pagesTrident Limited PPT On EngineeringShafali PrabhakarNo ratings yet

- TaxDocument9 pagesTaxRossette AnaNo ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Install Fresh & Hot Air AttenuatorsDocument3 pagesInstall Fresh & Hot Air Attenuatorsmazumdar_satyajitNo ratings yet

- Citibank'S Epay: Online Credit Card Payment. From Any BankDocument2 pagesCitibank'S Epay: Online Credit Card Payment. From Any BankHamsa KiranNo ratings yet

- Opportunities For Enhanced Lean Construction Management Using Internet of Things StandardsDocument12 pagesOpportunities For Enhanced Lean Construction Management Using Internet of Things StandardsBrahian Roman CabreraNo ratings yet

- Ee Room VentilationDocument7 pagesEe Room VentilationNiong DavidNo ratings yet

- Install and update ENC permits and chartsDocument2 pagesInstall and update ENC permits and chartsPanagiotis MouzenidisNo ratings yet

- Business-to-Business Marketing & Channel StrategyDocument8 pagesBusiness-to-Business Marketing & Channel Strategysuljo atlagicNo ratings yet

- Section 1 Quiz: Reduced Maintenance Real-World Modeling Both ( ) NoneDocument50 pagesSection 1 Quiz: Reduced Maintenance Real-World Modeling Both ( ) NoneNikolay100% (2)

- Unit 15 AssignmentDocument13 pagesUnit 15 Assignmentapi-339083063100% (4)

- Software Requirements Specification For MPAYMENT ParisDocument4 pagesSoftware Requirements Specification For MPAYMENT ParisbeckokoNo ratings yet

- Valencia v. Sandiganbayan DIGESTDocument2 pagesValencia v. Sandiganbayan DIGESTkathrynmaydevezaNo ratings yet

- NTP Dummy ConfigDocument1 pageNTP Dummy Configastir1234No ratings yet

- Modern Particle Characterization Techniques Image AnalysisDocument46 pagesModern Particle Characterization Techniques Image AnalysisSONWALYOGESHNo ratings yet

- Martial Law Experience of a Filipino GrandmotherDocument2 pagesMartial Law Experience of a Filipino GrandmotherarellanokristelleNo ratings yet

- RESIDENT NMC - Declaration - Form - Revised - 2020-2021Document6 pagesRESIDENT NMC - Declaration - Form - Revised - 2020-2021Riya TapadiaNo ratings yet

- Premobilisation Grader InspectionDocument1 pagePremobilisation Grader InspectionArjun SatheesanNo ratings yet

- Digest of CIR v. Arnoldus Carpentry (G.R. No. 71122)Document2 pagesDigest of CIR v. Arnoldus Carpentry (G.R. No. 71122)Rafael PangilinanNo ratings yet

- Order in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedDocument10 pagesOrder in Respect of Application Filed by Munjal M Jaykrishna Family Trust Under Regulation 11 of Takeover Regulations, 2011 For Acquisition of Shares in AksharChem (India) LimitedShyam SunderNo ratings yet

- EVIDENCE DIGESTS RULE 129 sEC. 4 TO Rule 130 Section 41Document48 pagesEVIDENCE DIGESTS RULE 129 sEC. 4 TO Rule 130 Section 41Pat RañolaNo ratings yet

- XML Programming With SQL/XML and Xquery: Facto Standard For Retrieving and ExchangingDocument24 pagesXML Programming With SQL/XML and Xquery: Facto Standard For Retrieving and ExchangingdkovacevNo ratings yet

- Inorganic Growth Strategies: Mergers, Acquisitions, RestructuringDocument15 pagesInorganic Growth Strategies: Mergers, Acquisitions, RestructuringHenil DudhiaNo ratings yet

- PSY290 Presentation 2Document3 pagesPSY290 Presentation 2kacaribuantonNo ratings yet