Professional Documents

Culture Documents

Shareholders' Funds Reserves and Surplus

Uploaded by

Balaji GaneshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shareholders' Funds Reserves and Surplus

Uploaded by

Balaji GaneshCopyright:

Available Formats

Exhibit 1

DRL Limited

Balance Sheet as on …

Particulars 31.03.2012 31.03.2013

EQUITY AND LIABILITIES

Shareholders’ funds

Share capital (170,000 shares of 5 each) 850

Reserves and surplus

Share Premium 1850

General Reserves 1800

Balance in Profit and Loss Account 4200 7850 8700

Non current liabilities

Long term Loans from banks (12%) 3000

8% bonds

10%, Debentures 5000 8000

Current liabilities

Accounts payables 4650

Commission payable to directors 200

Dividend payable 325

Interest accrued but not due (debentures) 125

Interest accrued but not due (bonds)

Factory Wages payable 800

Provision for tax (2011-12) 2200

Provision for tax (2012-13) 8300

Total 25000

ASSETS

Non-Current Assets

Fixed Assets

Machinery 4000

Accumulated Depreciation 800 3200

Building (Factory) 6000

Accumulated Depreciation 1200 4800

Building (HO)

Accumulated Depreciation

Vehicle (Honda City Car used by Directors) 800

Accumulated Depreciation 160 640

Land

Patents (relating to manufacturing) 600

Accumulated amortization 300 300 8940

Other Non-current assets

Capital work-in-progress 535

Investments in subsidiaries 250

Investment in non-subsidiary companies 150

Current assets

Inventories

- Raw Materials 1700

- Work-in-progress 2600

- Finished goods 3350 7650

Accounts receivables 2200

- Provision for doubtful debts 110 2090

Cash and bank balances 460

Advance income tax (2011-12) 2500

Advance income tax (2012-13)

Prepaid wages

Advance excise duty 325

Prepaid Rent (head office) 300

Prepaid insurance (factory) 600 13925

Preliminary expenses not written off 1200

Total 25000

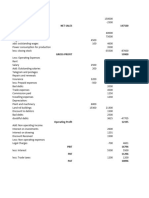

Income Statement for the year ending 31.3.2013

Particulars Details Amount

Gross Turnover 72250

Excise Duty (gst) pass through trans 1650

Net Turnover 70600

Other Revenues

Dividend income 20

Profit on sale of investments in non-subsidiary cos 30

Commission received 450 500

Total Revenues 71100

Cost of Goods Sold

Raw Material Consumed

Opening Stock of R. M. 1700

Add: Purchase of P. M. 24000

Less: Abnormal Loss 260

Less: Closing Stock of R. M. 2400

Raw Material Consumed 23040

Add: Conversion Costs

Power & Fuel 1600

Wages & Salaries (manufacturing) 3000

Depreciation - Machinery 400

Depreciation - Factory building 1200

Amortization - Patents 150

Insurance (Factory) 2100

Total Conversion Costs 8450

Add: Opening Stock of Work-in-progress 2600

Less: Closing Stock of Work-in-progress 1800

Cost of Goods Manufactured 32290

Add: Opening stock of Finished Goods 3350

Add: Direct purchase of Finished Goods 16000

Less: Closing Stock of Finished Goods -4200

Cost of Goods Sold 47440

Less: Selling and Distribution Expenses

Selling & Advertisement 1800

Cash discount 350

Provision for doubtful debts 230

Less: Interest and Finance Charges

Interest on Debentures 500

Interest on bank loan 360

Interest on bonds 10

Bank charges 50

Less: General and Administrative Expenses

Depreciation - Head office building 5

Depreciation - Vehicles 40

Abnormal loss of inventory 260

Loss on sale of Car 100

Directors - Salary 1800

Directors- Commission 500

Rent 4200

Write off of Preliminary expenses 200

Total Expenses 7105

Profit before tax 57845

Less: Income Tax 13255

Current year 2400

Previous year 100 2500

Profit after tax 10755

Add: Balance of P & L b/f from Previous year

Amount available for appropriations

APPROPRIATIONS

General Reserve

Dividend

Balance carried to Balance Sheet

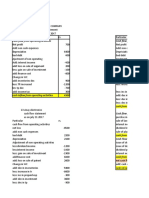

Cash Flow Statement for the year ending 31.03.2013

Particulars Detail Amount

Cash from Operating Activities

Profit before tax 57,845

Add: Non-Cash Expenses

Depreciation - Machinery

Depreciation - Factory building

Amortization - Patents

Provision for doubtful debts

Depreciation - Head office building

Depreciation - Vehicles

Write off of Preliminary expenses 0

Adj: Item belonging to other heads

Dividend income

Profit on sale of investments in non-subsidiary cos

Interest on Debentures

Interest on bank loan

Interest on bonds

Loss on sale of Car

-

CFO before working capital changes 57,845

Adjustment for changes in Working Capital

Accounts payables

Commission payable to directors

Factory wages

Inventory - Raw Materials

Inventory - WIP

Inventory - Finished Goods

Accounts Receivable

Advance excise duty

Prepaid Rent (head office)

Prepaid insurance (factory) -

Income Tax Paid -

Income Tax Refund

Cash flow from Operating Activities 57,845

Cash from Investing Activities

Sale of Vehicle

Sale of investment in non-subsidiary companies

Investment in subsidiary companies

Dividend received

Capital work-in-progress

Cash flow from Investing Activities 0

Cash from Financing Activities

Proceeds from issue of shares

Share issue expenses

Dividend paid

Interest paid on debentures

Interest paid on bank loans

Cash used in Financing Activities 0

Total cash flow during the year 57845

Opening balance of cash and cash equivalent 460

Closing balance of cash and cash equivalent 58305

You might also like

- Stanley Black & Decker IncDocument6 pagesStanley Black & Decker IncNitesh RajNo ratings yet

- Top 20 Corporate Finance Interview Questions (With Answers) PDFDocument19 pagesTop 20 Corporate Finance Interview Questions (With Answers) PDFDipak MahalikNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Illustration Sample Chart of AccountsDocument3 pagesIllustration Sample Chart of AccountsJulie R. UgsodNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- List of Standard Reports in Oracle EBSDocument17 pagesList of Standard Reports in Oracle EBSJilani Shaik100% (1)

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- Automobiles July 2021Document28 pagesAutomobiles July 2021Mayur DhurveNo ratings yet

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- FUNDAMENTAL ANALYSIS NotesDocument8 pagesFUNDAMENTAL ANALYSIS NotesBalaji GaneshNo ratings yet

- Tally Vol-1 - April #SKCreative2018Document34 pagesTally Vol-1 - April #SKCreative2018SK CreativeNo ratings yet

- 80D Medical ClaimDocument2 pages80D Medical ClaimPratik Rajkumar LakhotiaNo ratings yet

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahDocument28 pagesRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- Shareholders' Funds Reserves and SurplusDocument10 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- DRL Complete SolutionDocument3 pagesDRL Complete SolutionAnonymous aOj6NKBNo ratings yet

- PFS - LO1 LTD Company Accounts - Questions 2021Document5 pagesPFS - LO1 LTD Company Accounts - Questions 2021Ludmila DorojanNo ratings yet

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Document9 pagesAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNo ratings yet

- Group 2Document8 pagesGroup 2Gaurav SinghNo ratings yet

- Financial Statement ExerciseDocument7 pagesFinancial Statement ExerciseĐạt PhạmNo ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Orkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesDocument7 pagesOrkshop Nswers: Bank A Bank B Assets Liabilities Assets LiabilitiesOmar SrourNo ratings yet

- SAPL Cash FlowDocument11 pagesSAPL Cash FlowDibyendu Dey ChakrabortyNo ratings yet

- Particulars Amt: Trading, Profit and Loss A/CDocument5 pagesParticulars Amt: Trading, Profit and Loss A/CKave MathiNo ratings yet

- Exercises On Formation of Final Accounts: Particulars Amount AmountDocument4 pagesExercises On Formation of Final Accounts: Particulars Amount AmountNeelu AggrawalNo ratings yet

- Name of Company:-Madhura EnterprisesDocument39 pagesName of Company:-Madhura EnterprisesTaur VishalNo ratings yet

- Cash Flow and RatiosDocument8 pagesCash Flow and RatiosAnindya BasuNo ratings yet

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDocument4 pagesPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- Cash Flow Assignment 1Document9 pagesCash Flow Assignment 1Ramakrishna J RNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Consolidation (Study Hub)Document4 pagesConsolidation (Study Hub)HammadNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Q8 Motswala LimitedDocument2 pagesQ8 Motswala Limitedamosmalusi5No ratings yet

- Assets Liabilities and Owners EquityDocument9 pagesAssets Liabilities and Owners EquityNouman MujahidNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Final AccountsDocument36 pagesFinal AccountsHammadNo ratings yet

- Prepare Income Statement and Balance Sheet: Equity Sahreholders FundDocument14 pagesPrepare Income Statement and Balance Sheet: Equity Sahreholders FundPoonamNo ratings yet

- Mock Exam 2 Suggested SolutionsDocument10 pagesMock Exam 2 Suggested SolutionsAna-Maria GhNo ratings yet

- Corporate Final Accounts With AdjustmentsDocument6 pagesCorporate Final Accounts With AdjustmentsNeelu AggrawalNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Mid Sem Paper SolutionDocument2 pagesMid Sem Paper Solutionwww.tejashrai1072000No ratings yet

- Fin Q2Document6 pagesFin Q2Pulkit SethiaNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentMedha SinghNo ratings yet

- ECOR 3800 - Assignment 2 SolutionsDocument8 pagesECOR 3800 - Assignment 2 SolutionsJason ChenNo ratings yet

- Paper Financial ManagementDocument8 pagesPaper Financial ManagementAbul Ala Daniyal QaziNo ratings yet

- Membership Fees 147000 Sponsorship During Tourn 113600: Revenues AssetsDocument4 pagesMembership Fees 147000 Sponsorship During Tourn 113600: Revenues AssetsJAY BHAVIN SHETH (B14EE014)No ratings yet

- FS With AdjustmentsDocument25 pagesFS With AdjustmentsBlack NightNo ratings yet

- PGDM (2021-23) Exercise On Final AccountsDocument9 pagesPGDM (2021-23) Exercise On Final Accountspriyanshu guptaNo ratings yet

- Illustration Ratio AnalysisDocument6 pagesIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- Ribbon N Bows Inc. Income Statement For The Period June 30 Particulars Amount Amount Cost of Goods SoldDocument4 pagesRibbon N Bows Inc. Income Statement For The Period June 30 Particulars Amount Amount Cost of Goods Soldrani rinoNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- Final Accounts - 2 Solved ProblemsDocument6 pagesFinal Accounts - 2 Solved ProblemsrijaNo ratings yet

- Worked Example Financial StatementDocument2 pagesWorked Example Financial StatementNayaz EmamaulleeNo ratings yet

- Mock Solutions - MMDocument24 pagesMock Solutions - MMNitish YadavNo ratings yet

- Exercises On Formation of Final Accounts: Particulars Amount AmountDocument4 pagesExercises On Formation of Final Accounts: Particulars Amount AmountNeelu AggrawalNo ratings yet

- Excel Task 2Document4 pagesExcel Task 2michael songaNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Format Excel For BS IS and CFSDocument9 pagesFormat Excel For BS IS and CFSNishant WasadNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Practice f7Document9 pagesPractice f7Sarmad Sadiq E4 42No ratings yet

- 2021 Seminar Paper Marking SchemeDocument12 pages2021 Seminar Paper Marking Schemesayuru423geenethNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Revenue From Operations Non-Current AssetsDocument13 pagesRevenue From Operations Non-Current AssetsNishantNo ratings yet

- ExamDocument4 pagesExammohammad maabrehNo ratings yet

- Workbook Questions Incomplete RecordsDocument7 pagesWorkbook Questions Incomplete RecordsgunasekarasugeethaNo ratings yet

- QM-1a 2018 End Term SolutionDocument6 pagesQM-1a 2018 End Term SolutionBalaji GaneshNo ratings yet

- 1 Year Pgp/Fabm/Phd Participants Inter-Act-I-On 2 July 2021Document2 pages1 Year Pgp/Fabm/Phd Participants Inter-Act-I-On 2 July 2021Balaji GaneshNo ratings yet

- QM-1a 2018 End Term SolutionDocument6 pagesQM-1a 2018 End Term SolutionBalaji GaneshNo ratings yet

- 1 QuestionsDocument18 pages1 QuestionsharshaNo ratings yet

- Assets Liabilities Revenues ExpensesDocument3 pagesAssets Liabilities Revenues ExpensesBalaji GaneshNo ratings yet

- Term1 Qm1a End-TermDocument11 pagesTerm1 Qm1a End-TermBalaji GaneshNo ratings yet

- Accounts Receivable Commission Received OB 2200 72000 450Document2 pagesAccounts Receivable Commission Received OB 2200 72000 450Balaji GaneshNo ratings yet

- QM 1 A Quiz 1 - Answer KeyDocument4 pagesQM 1 A Quiz 1 - Answer KeyBalaji GaneshNo ratings yet

- Income Statement: RevenueDocument5 pagesIncome Statement: RevenueBalaji GaneshNo ratings yet

- Score Card: Balaji Ganesh S Male 21 Mar 1998Document2 pagesScore Card: Balaji Ganesh S Male 21 Mar 1998Balaji GaneshNo ratings yet

- FSI - Club Run Submission: DisclaimersDocument2 pagesFSI - Club Run Submission: DisclaimersBalaji GaneshNo ratings yet

- 1993 - Book - Probability - by WWW - LearnEngineering.inDocument1 page1993 - Book - Probability - by WWW - LearnEngineering.inBalaji GaneshNo ratings yet

- Applications 2021-22: Name: Balaji Ganesh Roll No: PGPGC202100311 Mobile Number: 9042348926 Email: P21balajis@iima - Ac.inDocument2 pagesApplications 2021-22: Name: Balaji Ganesh Roll No: PGPGC202100311 Mobile Number: 9042348926 Email: P21balajis@iima - Ac.inBalaji GaneshNo ratings yet

- Group 2 Contracts and Finality of Signature Coys of Kensington Automobiles Limited V Tiziana PuglieseDocument7 pagesGroup 2 Contracts and Finality of Signature Coys of Kensington Automobiles Limited V Tiziana PuglieseBalaji GaneshNo ratings yet

- C4 W1 Final AssessmentDocument4 pagesC4 W1 Final AssessmentBalaji GaneshNo ratings yet

- Application Form 2021: Personal DetailsDocument2 pagesApplication Form 2021: Personal DetailsBalaji GaneshNo ratings yet

- Group 3 Entire Agreement Clauses - The Inntrepreneur Pub Company and PeekayDocument4 pagesGroup 3 Entire Agreement Clauses - The Inntrepreneur Pub Company and PeekayBalaji GaneshNo ratings yet

- Group 1 Contracts, Putting Communications in Context Wells V DevaniDocument6 pagesGroup 1 Contracts, Putting Communications in Context Wells V DevaniBalaji GaneshNo ratings yet

- Instructions:: Round 1 - Application FormDocument2 pagesInstructions:: Round 1 - Application FormBalaji GaneshNo ratings yet

- Fare Details: ?eradicate Corruption - Build A New India?Document3 pagesFare Details: ?eradicate Corruption - Build A New India?veereshNo ratings yet

- PGP-1 Application 2021-22: The Consult ClubDocument5 pagesPGP-1 Application 2021-22: The Consult ClubBalaji GaneshNo ratings yet

- Balaji Ganesh Reume NewDocument3 pagesBalaji Ganesh Reume NewBalaji GaneshNo ratings yet

- Quiz 8 - BTX 113Document3 pagesQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- Accounting Cycle Requirement 1: Journal Entries T-AccountsDocument5 pagesAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloNo ratings yet

- ACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationDocument9 pagesACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationRaju Raj RajNo ratings yet

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDocument4 pagesGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshNo ratings yet

- A131 Tutorial 1 QDocument9 pagesA131 Tutorial 1 QJu RaizahNo ratings yet

- Tutorial 7 - Budgeting and Budgetary Control QuestionsDocument3 pagesTutorial 7 - Budgeting and Budgetary Control QuestionsJing ZeNo ratings yet

- Internship ReportDocument18 pagesInternship ReportSofonias MenberuNo ratings yet

- Vivifi India Finance PVT LTDDocument11 pagesVivifi India Finance PVT LTDMohd lrfanNo ratings yet

- Colgate AR 2020.indd - PDFDocument100 pagesColgate AR 2020.indd - PDFali khanNo ratings yet

- Lecture 12 Equity Analysis and ValuationDocument31 pagesLecture 12 Equity Analysis and ValuationKhushbooNo ratings yet

- Motex AssignmentDocument13 pagesMotex Assignmentmotuma dugasaNo ratings yet

- Corporate Liquidation Problem SolvingDocument21 pagesCorporate Liquidation Problem SolvingRujean Salar AltejarNo ratings yet

- BOI-business Guide 2017-20170222 - 44021Document146 pagesBOI-business Guide 2017-20170222 - 44021Kamon Eak AungkhasirikunNo ratings yet

- Public Private PartnershipsDocument4 pagesPublic Private PartnershipsshahriarsadighiNo ratings yet

- Account StatementDocument3 pagesAccount StatementSaeed AnwarNo ratings yet

- 2011-2012 Proposed Budget City of Bridgeport ConnecticutDocument427 pages2011-2012 Proposed Budget City of Bridgeport ConnecticutBridgeportCTNo ratings yet

- ExcelDocument55 pagesExcelJashNo ratings yet

- Dividend Policy of A Firm PDFDocument28 pagesDividend Policy of A Firm PDFpaisa321No ratings yet

- Internship ReportDocument22 pagesInternship ReportBadari Nadh100% (1)

- 2 Major Types of AccountsDocument18 pages2 Major Types of AccountsLUKE ADAM CAYETANONo ratings yet

- Langston Ronald - 1238 - ScannedDocument17 pagesLangston Ronald - 1238 - ScannedZach EdwardsNo ratings yet

- JSW Steel LTD PDFDocument4 pagesJSW Steel LTD PDFTanveer NNo ratings yet

- Issue of Debentures Redemption of Debentures UnderwrtingDocument47 pagesIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantNo ratings yet